Hamilton, Bermuda, November 27, 2024 -

Golden Ocean Group Limited (NASDAQ/OSE: GOGL) (the “Company” or

“Golden Ocean”), the world's largest listed owner of large size dry

bulk vessels, today announced its unaudited results for the quarter

ended September 30, 2024.

Highlights

- Net income of $56.3 million and

earnings per share of $0.28 (basic) for the third quarter of 2024,

compared to net income of $62.5 million and earnings per share of

$0.31 (basic) for the second quarter of 2024.

- Adjusted EBITDA of $124.4

million for the third quarter of 2024, compared to $120.3 million

for the second quarter of 2024.

- Adjusted net income of $66.7

million for the third quarter of 2024, compared to $63.4 million

for the second quarter of 2024.

- Reported TCE rates for

Capesize and Panamax vessels of $28,295 per day and $16,361 per

day, respectively, and $23,726 per day for the entire fleet in the

third quarter of 2024.

- Entered into agreements to sell one

Newcastlemax vessel and one Panamax vessel for a total net

consideration of $56.8 million.

- Announced the renewal of its share

buy-back program for an additional 12 months.

- Entered into a $150 million

facility to refinance six Newcastlemax vessels, at highly

attractive terms.

- Estimated TCE rates, inclusive of

charter coverage calculated on a load-to-discharge basis, are

approximately:

- $26,300 per day for 82% of Capesize

available days and $14,600 per day for 83% of Panamax available

days for the fourth quarter of 2024.

- $21,060 per day for 27% of Capesize

available days and $17,500 per day for 15% of Panamax available

days for the first quarter of 2025.

- Announced a cash dividend of $0.30

per share for the third quarter of 2024, which is payable on or

about December 18, 2024, to shareholders of record on December 9,

2024. Shareholders holding the Company’s shares through Euronext

VPS may receive this cash dividend later, on or about December 20,

2024.

Peder Simonsen, Interim Chief Executive Officer

and Chief Financial Officer, commented:

"Golden Ocean delivered strong performance with

achieved market rates significantly above the indexes for the third

quarter. This is attributable to our modern, fuel-efficient fleet,

strong commercial capabilities, and industry leading low

cash-break-even. We continue to execute on our strategy of

divesting older and less efficient tonnage at attractive

valuations. The macro and geopolitical environment creates

volatility in the financial markets and freight market impacting

sentiment, despite healthy trading volumes across all commodities.

Looking ahead, the freight market is expected to benefit with

tonne-mile growth, with the strong iron ore and bauxite exports out

of Brazil and Guinea to Asia being the main driver. Combined with a

healthy vessel supply outlook we remain optimistic for the years to

come. With a modern fleet and strong balance sheet, Golden Ocean is

well positioned to generate strong cash flow and attractive returns

to our shareholders.”

The Board of DirectorsGolden Ocean Group

LimitedHamilton, BermudaNovember 27, 2024

Questions should be directed to:

Peder Simonsen: Interim Chief Executive Officer

and Chief Financial Officer, Golden Ocean Management AS+47 22 01 73

40

The full report is available in the link below.

Forward-Looking Statements

Matters discussed in this earnings report may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995, or the PSLRA, provides safe harbor

protections for forward-looking statements in order to encourage

companies to provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts.

The Company is taking advantage of the safe

harbor provisions of the PSLRA and is including this cautionary

statement in connection therewith. This document and any other

written or oral statements made by the Company or on its behalf may

include forward-looking statements, which reflect the Company's

current views with respect to future events and financial

performance. This earnings report includes assumptions,

expectations, projections, intentions and beliefs about future

events. These statements are intended as "forward-looking

statements." The Company cautions that assumptions, expectations,

projections, intentions and beliefs about future events may and

often do vary from actual results and the differences can be

material. When used in this document, the words “believe,”

“expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,”

“projects,” “likely,” “will,” “would,” “could” and similar

expressions or phrases may identify forward-looking statements.

The forward-looking statements in this report

are based upon various assumptions, many of which are based, in

turn, upon further assumptions, including without limitation,

management's examination of historical operating trends, data

contained in the Company's records and other data available from

third parties. Although the Company believes that these assumptions

were reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond the Company's

control, the Company cannot assure you that it will achieve or

accomplish these expectations, beliefs or projections. As a result,

you are cautioned not to rely on any forward-looking

statements.

In addition to these important factors and

matters discussed elsewhere herein, important factors that, in the

Company’s view, could cause actual results to differ materially

from those discussed in the forward-looking statements, include

among other things: general market trends in the dry bulk industry,

which is cyclical and volatile, including fluctuations in charter

hire rates and vessel values; a decrease in the market value of the

Company’s vessels; changes in supply and demand in the dry bulk

shipping industry, including the market for the Company’s vessels

and the number of newbuildings under construction; delays or

defaults in the construction of the Company’s newbuilding could

increase the Company’s expenses and diminish the Company’s net

income and cash flows; an oversupply of dry bulk vessels, which may

depress charter rates and profitability; the Company’s future

operating or financial results; the Company’s continued borrowing

availability under the Company’s debt agreements and compliance

with the covenants contained therein; the Company’s ability to

procure or have access to financing, the Company’s liquidity and

the adequacy of cash flows for the Company’s operations; the

failure of the Company’s contract counterparties to meet their

obligations, including changes in credit risk with respect to the

Company’s counterparties on contracts; the loss of a large customer

or significant business relationship; the strength of world

economies; the volatility of prevailing spot market and

charter-hire charter rates, which may negatively affect the

Company’s earnings; the Company’s ability to successfully employ

the Company’s dry bulk vessels and replace the Company’s operating

leases on favorable terms, or at all; changes in the Company’s

operating expenses and voyage costs, including bunker prices, fuel

prices (including increased costs for low sulfur fuel), drydocking,

crewing and insurance costs; the adequacy of the Company’s

insurance to cover the Company’s losses, including in the case of a

vessel collision; vessel breakdowns and instances of offhire; the

Company’s ability to fund future capital expenditures and

investments in the construction, acquisition and refurbishment of

the Company’s vessels (including the amount and nature thereof and

the timing of completion of vessels under construction, the

delivery and commencement of operation dates, expected downtime and

lost revenue); risks associated with any future vessel construction

or the purchase of second-hand vessels; effects of new products and

new technology in the Company’s industry, including the potential

for technological innovation to reduce the value of the Company’s

vessels and charter income derived therefrom; the impact of an

interruption or failure of the Company’s information technology and

communications systems, including the impact of cybersecurity

threats and data security breaches, upon the Company’s ability to

operate; potential liability from safety, environmental,

governmental and other requirements and potential significant

additional expenditures (by the Company and the Company’s

customers) related to complying with such regulations; changes in

governmental rules and regulations or actions taken by regulatory

authorities and the impact of government inquiries and

investigations; the arrest of the Company’s vessels by maritime

claimants; government requisition of the Company’s vessels during a

period of war or emergency; the Company’s compliance with complex

laws, regulations, including environmental laws and regulations and

the U.S. Foreign Corrupt Practices Act of 1977; potential

difference in interests between or among certain members of the

Board of Directors, executive officers, senior management and

shareholders; the Company’s ability to attract, retain and motivate

key employees; work stoppages or other labor disruptions by the

Company’s employees or the employees of other companies in related

industries; potential exposure or loss from investment in

derivative instruments; stability of Europe and the Euro or the

inability of countries to refinance their debts; inflationary

pressures and the central bank policies intended to combat overall

inflation and rising interest rates and foreign exchange rates;

fluctuations in currencies; the impact that any discontinuance,

modification or other reform or the establishment of alternative

reference rates have on the Company's floating interest rate debt

instruments; acts of piracy on ocean-going vessels, public health

threats, terrorist attacks and international hostilities and

political instability; potential physical disruption of shipping

routes due to accidents, climate-related (acute and chronic),

political instability, terrorist attacks, piracy, international

sanctions or international hostilities, including the developments

in the Ukraine region and in the Middle East, including the

conflicts in Israel and Gaza, and the Houthi attacks in the Red

Sea; general domestic and international political and geopolitical

conditions or events, including any further changes in U.S. trade

policy that could trigger retaliatory actions by affected

countries; the impact of adverse weather and natural disasters; the

impact of increasing scrutiny and changing expectations from

investors, lenders and other market participants with respect to

the Company’s Environmental, Social and Governance policies;

changes in seaborne and other transportation; the length and

severity of epidemics and pandemics and governmental responses

thereto and the impact on the demand for seaborne transportation in

the dry bulk sector; impacts of supply chain disruptions and market

volatility surrounding impacts of the Russian-Ukrainian conflict

and the developments in the Middle East; fluctuations in the

contributions of the Company’s joint ventures to the Company’s

profits and losses; the potential for shareholders to not be able

to bring a suit against us or enforce a judgement obtained against

us in the United States; the Company’s treatment as a “passive

foreign investment company” by U.S. tax authorities; being required

to pay taxes on U.S. source income; the Company’s operations being

subject to economic substance requirements; the Company potentially

becoming subject to corporate income tax in Bermuda in the future;

the volatility of the stock price for the Company’s common shares,

from which investors could incur substantial losses, and the future

sale of the Company’s common shares, which could cause the market

price of the Company’s common shares to decline; and other

important factors described from time to time in the reports filed

by the Company with the U.S. Securities and Exchange Commission,

including the Company's most recently filed Annual Report on Form

20-F for the year ended December 31, 2023.

The Company cautions readers of this report not

to place undue reliance on these forward-looking statements, which

speak only as of their dates. Except to the extent required by

applicable law or regulation, the Company undertakes no obligation

to release publicly any revisions to these forward-looking

statements to reflect events or circumstances after the date of

this report or to reflect the occurrence of unanticipated events.

These forward-looking statements are not guarantees of the

Company’s future performance, and actual results and future

developments may vary materially from those projected in the

forward-looking statements.

This information is subject to the disclosure

requirements pursuant to section 5-12 of the Norwegian Securities

Trading Act.

- GOGL - 3rd Quarter 2024 Results

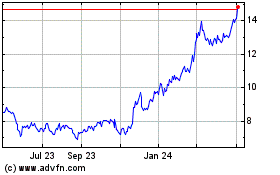

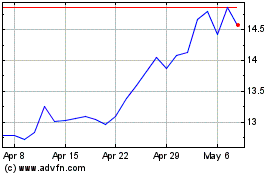

Golden Ocean (NASDAQ:GOGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Golden Ocean (NASDAQ:GOGL)

Historical Stock Chart

From Dec 2023 to Dec 2024