0001437925false00014379252023-06-282023-06-28iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): June 28, 2023

GOLDEN MATRIX GROUP, INC. |

(Exact name of registrant as specified in its charter) |

Nevada | | 001-41326 | | 46-1814729 |

(State or other jurisdiction of incorporation or organization) | | (Commission file number) | | (IRS Employer Identification No.) |

3651 Lindell Road, Suite D131

Las Vegas, NV 89103

(Address of principal executive offices)(zip code)

Registrant’s telephone number, including area code: (702) 318-7548

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.00001 Par Value Per Share | | GMGI | | The NASDAQ Stock Market LLC (The NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 | Entry into a Material Definitive Agreement. |

As previously disclosed in the Current Report on Form 8-K filed by Golden Matrix Group, Inc. (the “Company”, “Golden Matrix”, “we” and “us”) with the Securities and Exchange Commission on January 12, 2023 (the “January 2023 Current Report”), we entered into a Sale and Purchase Agreement of Share Capital (the “Original Purchase Agreement”) with Aleksandar Milovanovic, Zoran Milosevic and Snezana Bozovic (collectively, the “Sellers”), the owners of Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia; Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro; Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta; and Meridian Gaming (Cy) Ltd, a company formed and registered in the republic of Cyprus (collectively, the “Meridian Companies”). Pursuant to the Original Purchase Agreement, we agreed to acquire 100% of the Meridian Companies (the “Purchase”).

Subsequent to the parties’ entry into the Original Purchase Agreement, the parties continued to discuss the consideration payable by the Company to the Sellers, the breakdown between cash and equity of such consideration, and the timing for the payment of such consideration, and the number of closings, and after such discussions, the parties determined to amend and restate the Original Purchase Agreement, to adjust such consideration breakdown, the timing of payments in connection therewith, the number of closings, to extend certain required deadlines set forth in the Original Purchase Agreement, and make various other changes to the Original Purchase Agreement.

In connection therewith, on June 28, 2023, we entered an Amended and Restated Sale and Purchase Agreement of Share Capital dated June 27, 2023, with the Sellers (the “A&R Purchase Agreement”). The A&R Purchase Agreement amended the Original Purchase Agreement, to among other things:

| 1. | Remove the provisions of the Original Purchase Agreement which provided for two closings—the acquisition is now contemplated to close in one closing; |

| | |

| 2. | Reduce the closing cash payment from $50 million to $30 million; |

| | |

| 3. | Reduce the agreed upon price per share of the common stock to be delivered as part of the acquisition to $3.00 per share (compared to $3.50 under the Original Purchase Agreement), and to increase the number of shares issuable to the Sellers at the closing to 82,141,857 shares of common stock (the “Closing Shares”)(previously 56,999,000 shares of common stock); |

| | |

| 4. | Increase the amount of the contingent post-closing equity consideration to 5,000,000 shares of common stock (the “Post-Closing Shares”)(previously 4,285,714 shares of common stock) and decrease the amount of the contingent post-closing cash consideration to $5 million (previously $10 million), which shall be paid and issued to the Sellers within five business days following the sixth month anniversary of the closing if (and only if) the Sellers and their affiliates are not then in default in any of their material obligations, covenants or representations under the A&R Purchase Agreement; |

| 5. | Provide for $20 million of the purchase price to be payable to the Sellers as additional non-contingent post-closing consideration, of which $10 million is due within 12 months of closing and $10 million is due within 18 months of closing; |

| | |

| 6. | Increase the amount of the promissory notes payable to the Sellers to $15 million (from $10 million), and provide for such amounts to be due in 24 months (compared to nine months); |

| | |

| 7. | Re-confirm certain representations and warranties made by the parties in the Original Purchase Agreement, as of the date of the parties’ entry into the A&R Purchase Agreement; |

| | |

| 8. | Extend the required closing date from June 30, 2023 to December 31, 2023, which such closing date cannot occur prior to August 10, 2023; |

| | |

| 9. | Extend the date that certain shareholder agreements and restricted covenant agreements are required to be entered into with certain minority shareholders of the subsidiaries of the Meridian Companies to 60 days following the execution date of the A&R Agreement, instead of 45 days following the date the parties entered into the Original Purchase Agreement; |

| | |

| 10. | Extend the date that the Company is required to have a binding commitment for the cash due at closing of the A&R Agreement from May 31, 2023 to August 31, 2023, and reduce the required amount of financing from $50 million to $30 million (unless otherwise agreed by the parties); and |

| | |

| 11. | Reduce the amount of default interest which would be payable to the Sellers in the event of any event of default under the promissory notes from 18% to 12%. |

The parties are committed to closing the transactions contemplated by the purchase agreement, as amended, are working towards preparing the required proxy statement filing, financial statements and related disclosures, and expect the acquisition to close during the third or fourth quarters of calendar 2023.

The representations, warranties and covenants of each party set forth in the A&R Purchase Agreement have been made only for the purposes of, and were and are solely for the benefit of the parties to, the A&R Purchase Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between the parties to the A&R Purchase Agreement instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time, and investors should not rely on them as statements of fact. In addition, such representations and warranties (i) will only survive consummation of the Purchase as specifically set forth therein and (ii) were made only as of the date of the A&R Purchase Agreement or such other date as is specified in the A&R Purchase Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the A&R Purchase Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the A&R Purchase Agreement is included with this filing only to provide investors with information regarding the terms of the A&R Purchase Agreement, and not to provide investors with any factual information regarding the Company, their respective affiliates or their respective businesses. The A&R Purchase Agreement should not be read alone, but should instead be read in conjunction with the other information regarding the Company, the Meridian Companies and the Sellers, their respective affiliates or their respective businesses, the A&R Purchase Agreement and the Purchase, that will be contained in, or incorporated by reference into, the Proxy Statement the Company plans to file subsequent to the date hereof to seek shareholder approval for the Purchase, as well as in the Form 10-K, Form 10-Q and other filings that the Company makes hereafter with the Securities and Exchange Commission (“SEC”).

* * * * *

The foregoing description of the A&R Purchase Agreement and Promissory Notes, is not complete and is subject to, and qualified in its entirety by reference to the Purchase Agreement and form of Promissory Note, attached as Exhibits 2.2 and 10.1 hereto, which are incorporated in this Item 1.01 by reference in their entirety.

Additional information regarding the terms of the Purchase, and the terms of the A&R Purchase Agreement, which were not amended versus the Original Purchase Agreement, are discussed in the January 2023 Form 8-K.

Item 3.02. | Unregistered Sales of Equity Securities. |

The offer of, and the issuance of, the Closing Shares, Post-Closing Shares, the shares of Series C Voting Preferred Stock issuable pursuant to the A&R Purchase Agreement and upon conversion thereof (a total of 1,000 shares of Series C Voting Preferred Stock is required to be issued at the closing of the Purchase, which are convertible into 1,000 shares of common stock, as discussed in greater detail in the January 2023 Form 8-K)(collectively, the “Purchase Shares”) is intended to be exempt from registration pursuant to Section 4(a)(2) and/or Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), since the foregoing issuances will not involve a public offering, the recipients have confirmed that they are “accredited investors”, and the recipients will acquire the securities for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof. The securities were offered without any general solicitation by us or our representatives. The securities will be subject to transfer restrictions, and the certificates evidencing the securities will contain an appropriate legend stating that such securities have not been registered under the Securities Act and may not be offered or sold absent registration or pursuant to an exemption therefrom.

As described above, the issuance of the Purchase Shares will cause substantial dilution to existing stockholders. To the extent issued in full, the maximum number of Purchase Shares issuable pursuant to the Purchase Agreement (without taking into account any post-closing equity awards contemplated by the A&R Purchase Agreement) will total 87,142,857 shares of common stock (when including 1,000 shares of common stock issuable upon conversion of the Series C Voting Preferred Stock pursuant to its terms).

Item 7.01. | Regulation FD Disclosure. |

On June 30, 2023, the Company published a press release announcing the entry into the A&R Purchase Agreement and the related transactions. A copy of the press release is included herewith as Exhibit 99.1 and the information in the press release is incorporated by reference into this Item 7.01.

The information responsive to Item 7.01 of this Form 8-K and Exhibit 99.1 attached, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

Exhibit Number | | Description of Exhibit |

2.1#£ | | Sale and Purchase Agreement of Share Capital dated January 11, 2023 by and between Golden Matrix Group, Inc., as purchaser and the shareholders of: Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia, Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro, Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta, and Meridian Gaming (Cy) Ltd, a company formed and registered in the Republic of Cyprus, as sellers (filed as Exhibit 2.1 to the Current Report on Form 8-K filed by Golden Matrix Group, Inc. with the Securities and Exchange Commission on January 12, 2023 (File No. 001-41326), and incorporated by reference herein) |

2.2*#£ | | Amended and Restated Sale and Purchase Agreement of Share Capital dated June 27, 2023 by and between Golden Matrix Group, Inc., as purchaser and the shareholders of: Meridian Tech Društvo Sa Ograničenom Odgovornošću Beograd, a private limited company formed and registered in and under the laws of the Republic of Serbia, Društvo Sa Ograničenom Odgovornošću “Meridianbet” Društvo Za Proizvodnju, Promet Roba I Usluga, Export Import Podgorica, a private limited company formed and registered in and under the laws of Montenegro, Meridian Gaming Holdings Ltd., a company formed and registered in the Republic of Malta, and Meridian Gaming (Cy) Ltd, a company formed and registered in the Republic of Cyprus, as sellers |

3.1 | | Form of Certificate of Designation of Golden Matrix Group, Inc. Establishing the Designation, Preferences, Limitations and Relative Rights of Its Series C Preferred Stock (not yet effective) (filed as Exhibit 3.1 to the Current Report on Form 8-K filed by Golden Matrix Group, Inc. with the Securities and Exchange Commission on January 12, 2023 (File No. 001-41326), and incorporated by reference herein) |

10.1* | | Form of Promissory Note (June 27, 2023 Amended and Restated Sale and Purchase Agreement)(not yet effective) |

99.1** | | Press Release dated June 30, 2023 |

104 | | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

* Filed herewith.

** Furnished herewith.

# Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2)(ii) of Regulation S-K. A copy of any omitted schedule or Exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however that Golden Matrix Group, Inc. may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or Exhibit so furnished.

£ Certain personal information which would constitute an unwarranted invasion of personal privacy has been redacted from this exhibit pursuant to Item 601(a)(6) of Regulation S-K.

FORWARD-LOOKING STATEMENTS

Certain statements made in this Current Report on Form 8-K and in Exhibit 99.1 furnished herewith, contain forward-looking information within the meaning of applicable securities laws, including within the meaning of the Private Securities Litigation Reform Act of 1995 (“forward-looking statements”). Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements.

Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation, the ability of the parties to close the Purchase Agreement on the terms set forth in, and pursuant to the required timing set forth in, the Purchase Agreement, if at all; the occurrence of any event, change or other circumstances that could give rise to the right of one or all of the Company or the Sellers (collectively, the “Purchase Agreement Parties”) to terminate the Purchase Agreement; the effect of such termination, including breakup and other fees potentially payable in connection therewith; the outcome of any legal proceedings that may be instituted against Purchase Agreement Parties or their respective directors or officers; the ability to obtain regulatory and other approvals and meet other closing conditions to the Purchase Agreement on a timely basis or at all, including the risk that regulatory and other approvals required for the Purchase Agreement are not obtained on a timely basis or at all, or are obtained subject to conditions that are not anticipated or the expected benefits of the transaction; the ability of the Company to obtain the funding required to complete such acquisition, the terms of such funding, potential dilution caused thereby and/or covenants agreed to in connection therewith; the ability to obtain approval by the Company’s shareholders on the expected schedule of the transactions contemplated by the Purchase Agreement; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Purchase Agreement; the ability of the Company to retain and hire key personnel; the diversion of management’s attention from ongoing business operations; the expected synergistic relationships and cost savings from the transactions contemplated by the Purchase Agreement; uncertainty as to the long-term value of the common stock of the Company following the closing of the Purchase Agreement; the business, economic and political conditions in the markets in which Purchase Agreement Parties operate; the effect on the Company and its operations of the ongoing Ukraine/Russia conflict, increased interest rates, recessions and increased inflation; the need for additional financing, the terms of such financing and the availability of such financing; the ability of the Company and/or its subsidiaries to obtain additional gaming licenses; the ability of the Company to manage growth; the Company’s ability to complete acquisitions and the available funding for such acquisitions; disruptions caused by acquisitions; dilution caused by fund raising, the conversion of outstanding preferred stock and/or acquisitions; the Company’s ability to maintain the listing of its common stock on the Nasdaq Capital Market; the Company’s expectations for future growth, revenues, and profitability; the Company’s expectations regarding future plans and timing thereof; the Company’s reliance on its management; the fact that the Company’s chief executive officer has voting control over the Company and the fact that the Sellers will obtain voting control over the Company following the completion of the Purchase; related party relationships; the potential effect of economic downturns, recessions, increases in interest rates and inflation, and market conditions, decreases in discretionary spending and therefore demand for our products and services, and increases in the cost of capital, related thereto, among other affects thereof, on the Company’s operations and prospects; the Company’s ability to protect proprietary information; the ability of the Company to compete in its market; the Company’s lack of effective internal controls; dilution caused by efforts to obtain additional financing; the effect of current and future regulation, the Company’s ability to comply with regulations and potential penalties in the event it fails to comply with such regulations and changes in the enforcement and interpretation of existing laws and regulations and the adoption of new laws and regulations that may unfavorably impact our business; the risks associated with gaming fraud, user cheating and cyber-attacks; risks associated with systems failures and failures of technology and infrastructure on which the Company’s programs rely; foreign exchange and currency risks; the outcome of contingencies, including legal proceedings in the normal course of business; the ability to compete against existing and new competitors; the ability to manage expenses associated with sales and marketing and necessary general and administrative and technology investments; and general consumer sentiment and economic conditions that may affect levels of discretionary customer purchases of the Company’s products, including potential recessions and global economic slowdowns. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this communication and the press release furnished herewith, are reasonable, we provide no assurance that these plans, intentions or expectations will be achieved.

Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication and the press release furnished herewith, are described in the Company’s publicly filed reports, including, but not limited to, under the “Special Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended October 31, 2022 and the Company’s Quarterly Report on Form 10-Q for the quarter ended April 30, 2023. These reports are available at www.sec.gov.

The Company cautions that the foregoing list of important factors is not complete, and does not undertake to update any forward-looking statements except as required by applicable law. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on behalf of any Purchase Agreement Parties are expressly qualified in their entirety by the cautionary statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on the Company’s future results. The forward-looking statements included in this communication and the press release furnished herewith, are made only as of the date hereof. The Company cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, the Company undertakes no obligation to update these statements after the date of this communication, except as required by law, and takes no obligation to update or correct information prepared by third parties that is not paid for by the Company. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Additional Information and Where to Find It

This communication and the press release furnished herewith, do not constitute a solicitation of any vote, proxy or approval in connection with the Purchase Agreement or related transactions. In connection with the transactions contemplated by the Purchase Agreement, the Company plans to file with the Securities and Exchange Commission (SEC) a proxy statement to seek shareholder approval for the Purchase Agreement and the issuance of shares of common stock in connection therewith, which, when finalized, will be sent to the shareholders of the Company seeking their approval of the respective transaction-related proposals, as well as other documents regarding the proposed transactions. This communication and the press release furnished herewith, are not a substitute for any proxy statement or other document the Company may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTIONS CONTEMPLATED BY THE PURCHASE AGREEMENT, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE PURCHASE AGREEMENT AND THE PROPOSED PURCHASE TRANSACTION.

Investors and security holders may obtain copies of these documents free of charge through the website maintained by the SEC at www.sec.gov or from the Company at its website, https://goldenmatrix.com/investors-overview. Documents filed with the SEC by the Company will be available free of charge on the “Investors,” “SEC Filings” page of our website at https://goldenmatrix.com/investors-overview/sec-filings/ or, alternatively, by directing a request by mail, email or telephone to the Company at 3651 Lindell Road, Suite D131, Las Vegas, NV 89103; ir@goldenmatrix.com; or (702) 318-7548, respectively.

Participants in the Solicitation

The Company and certain of its respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the respective shareholders of the Company in respect of the transactions contemplated by the Purchase Agreement under the rules of the SEC. Information about the Company’s directors and executive officers and their ownership of the Company is available in the Company’s Annual Report on Form 10-K for the year ended October 31, 2022, as filed with the Securities and Exchange Commission on January 30, 2023.

The Sellers, the Meridian Companies, and their respective directors, managers, and executive officers may also be deemed to be participants in the solicitation of proxies from the Company’s shareholders in connection with the Purchase Agreement. A list of the names of such parties and information regarding their interests in the Purchase Agreement will be included in the proxy statement for the Purchase Agreement when available.

Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC regarding the Purchase Agreement when they become available. Investors should read the proxy statement carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the Company using the sources indicated above.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Purchase Agreement and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

| GOLDEN MATRIX GROUP, INC. | |

| | |

Date: June 30, 2023 | By: | /s/ Anthony Brian Goodman | |

| | Anthony Brian Goodman | |

| | Chief Executive Officer | |

nullnullnull

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

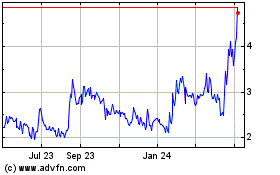

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From Apr 2024 to May 2024

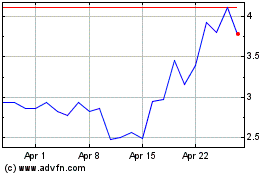

Golden Matrix (NASDAQ:GMGI)

Historical Stock Chart

From May 2023 to May 2024