FuelCell Energy, Inc. (NASDAQ: FCEL) today reported financial

results for its third quarter ended July 31, 2024.

“In the third quarter, our team achieved solid performance and

continued cost management, while advancing our Powerhouse

strategy,” said Mr. Jason Few, President and Chief Executive

Officer. “We continue to build upon and expand our prospective

customer relationships at home and around the world, ranging from

interest in our new solid oxide fuel cell and electrolysis

platforms, to repowering projects in Korea, such as with Gyeonggi

Green Energy Co., Ltd.’s Hwaseong Balan Industrial Complex where we

are supplying 42 upgraded fuel cell modules over the next couple of

years. With our recent wins, backlog grew meaningfully in the

quarter. We also see meaningful potential to capture the rapidly

increasing time-to-power opportunity as grids are challenged by AI

data center growth.”

“While we execute on our current opportunity set, we are also

focused on building our sales pipeline,” added Mr. Few. “We believe

we are positioned to capitalize on market opportunities, ranging

from built-in fuel diversity which supports biogas applications and

hydrogen blending, similar to our work with Ameresco in Sacramento,

CA, to the growing power and absorption or electrical cooling needs

of edge data centers. Our goal is to generate steady, predictable

results now while keeping our focus on future growth.”

Consolidated Financial Metrics

|

|

|

Three Months Ended July 31, |

|

|

|

|

(Amounts in thousands) |

|

2024 |

|

|

|

2023 |

|

|

Change |

|

|

|

Total revenues |

|

$23,695 |

|

|

|

$25,510 |

|

|

(7 |

%) |

|

|

|

Gross

loss |

|

(6,202 |

) |

|

|

(8,215 |

) |

|

(25 |

%) |

|

|

|

Loss

from operations |

|

(33,617 |

) |

|

|

(41,395 |

) |

|

(19 |

%) |

|

|

|

Net

loss |

|

(35,123 |

) |

|

|

(23,601 |

) |

|

49 |

% |

|

|

|

Net

loss attributable to common stockholders |

|

(33,460 |

) |

|

|

(25,079 |

) |

|

33 |

% |

|

|

|

Net

loss per basic and diluted share |

|

(0.07 |

) |

|

|

(0.06 |

) |

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA * |

|

(24,379 |

) |

|

|

(34,772 |

) |

|

(30 |

%) |

|

|

|

Adjusted EBITDA * |

|

($20,134 |

) |

|

|

($31,606 |

) |

|

(36 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* A

reconciliation of EBITDA, Adjusted EBITDA and any other non-GAAP

measures is contained in the appendix to this press release. |

| |

Third Quarter of Fiscal 2024 Results

(All comparisons are between third quarter of fiscal 2024 and

third quarter of fiscal 2023 unless otherwise noted)

Third quarter revenue of $23.7 million represents a decrease of

7% from the comparable prior year quarter.

- Product revenues were $0.3 million during the

three months ended July 31, 2024, and there were no product

revenues in the comparable prior year period. The product revenues

during the three months ended July 31, 2024 were recognized under

the Company’s new sales contract with Ameresco, Inc., which was

entered into during the second quarter of fiscal 2024.

- Service agreements revenues decreased to $1.4

million from $9.8 million. The decrease in service agreements

revenues during the three months ended July 31, 2024 was primarily

driven by the fact that there were no module exchanges during the

quarter. Service agreements revenues recognized during the third

quarter of fiscal 2023 were primarily driven by module exchanges at

the plants owned by Korea Southern Power Company in Korea.

- Generation revenues increased 22% to $13.4

million from $11.0 million, primarily driven by revenue generated

by the Toyota and Derby projects, all of which began operations in

the first quarter of fiscal 2024.

- Advanced Technologies contract revenues

increased to $8.6 million from $4.7 million. Advanced Technologies

contract revenues recognized under our Joint Development Agreement

with ExxonMobil Technology and Engineering Company (“EMTEC”) were

approximately $1.8 million, revenues arising from the purchase

order received from Esso Nederland B.V. (“Esso”), an affiliate of

EMTEC and Exxon Mobil Corporation, related to the Rotterdam project

were approximately $3.5 million and revenue recognized under

government contracts and other contracts were approximately $3.3

million for the three months ended July 31, 2024. This compares to

Advanced Technologies contract revenues recognized under our Joint

Development Agreement with EMTEC of approximately $2.8 million and

revenue recognized under government contracts and other contracts

of approximately $1.9 million the three months ended July 31,

2023.

Gross loss for the third quarter of fiscal 2024 totaled $(6.2)

million, compared to a gross loss of $(8.2) million in the

comparable prior year quarter. The reduction in gross loss for the

third quarter of fiscal 2024 was, in part, a result of favorable

margins for Advanced Technologies of $1.9 million and Generation of

$1.1 million, partially offset by higher gross losses for product

of $(1.0) million. Service gross margin remained consistent quarter

over quarter.

Operating expenses for the third quarter of fiscal 2024

decreased to $27.4 million from $33.2 million in the third quarter

of fiscal 2023. Selling and administrative expenses decreased to

$14.6 million during the third quarter of fiscal 2024 from $17.6

million during the third quarter of fiscal 2023. The decrease in

selling and administrative expenses is a result of lower legal,

consulting and shareholder relations expenses and lower

compensation expense. Research and development expenses decreased

to $12.8 million during the third quarter of fiscal 2024 compared

to $15.6 million in the third quarter of fiscal 2023. The decrease

in research and development expenses reflects the previously

announced decrease in spending on the Company’s ongoing commercial

development efforts related to our solid oxide power generation and

electrolysis platforms and carbon separation and carbon recovery

solutions compared to the comparable prior year period as well as a

shift in engineering resource allocation toward supporting the

increase in funded Advanced Technologies activities.

Net loss was $(35.1) million in the third quarter of fiscal

2024, compared to net loss of $(23.6) million in the third quarter

of fiscal 2023. The net loss in the prior-year third quarter

included the benefit of a gain on extinguishment of finance

obligations and debt of $15.3 million.

Adjusted EBITDA totaled $(20.1) million in the third quarter of

fiscal 2024, compared to Adjusted EBITDA of $(31.6) million in the

third quarter of fiscal 2023. Please see the discussion of non-GAAP

financial measures, including Adjusted EBITDA, in the appendix at

the end of this release.

The net loss per share attributable to common stockholders in

the third quarter of fiscal 2024 was $(0.07), compared to $(0.06)

in the third quarter of fiscal 2023. The net loss per common share

in the third quarter of fiscal 2024 was a result of the higher net

loss offset by the benefit of the higher number of weighted average

shares outstanding due to share issuances since July 31, 2023. The

net loss per share attributable to common stockholders in the third

quarter of fiscal 2024 included the one-time benefit of a gain on

extinguishment of finance obligations and debt of approximately

$0.04.

Cash, Restricted Cash and Short-Term

Investments

Cash and cash equivalents, restricted cash and cash equivalents,

and short-term investments totaled $326.0 million as of July 31,

2024, compared to $403.3 million as of October 31, 2023. Of the

$326.0 million total as of July 31, 2024, unrestricted cash and

cash equivalents totaled $159.3 million, short-term investments

totaled $107.8 million and restricted cash and cash equivalents

totaled $58.8 million. Of the $403.3 million total as of October

31, 2023, unrestricted cash and cash equivalents totaled $250.0

million, short-term investments totaled $103.8 million, and

restricted cash and cash equivalents totaled $49.6 million.

Short-term investments represent the amortized cost of U.S.

Treasury Securities outstanding as of July 31, 2024 and October 31,

2023 as part of the Company’s cash management optimization effort,

all of which are expected to be held to maturity.

“We are taking proactive steps to help preserve balance sheet

strength while continuing to execute on our growth objectives and

position our platforms to capitalize on the energy transition and

the growing distributed power generation opportunity,” said Mr.

Michael Bishop, Executive Vice President, Chief Financial Officer

and Treasurer. “We remain focused on lowering our quarterly

spending and cash burn, while also pursuing financing to support

commercial opportunities including our Korea repowering

activities.”

During the three months ended July 31, 2024, approximately 95.2

million shares of the Company’s common stock were sold under the

Company’s Amended Open Market Sale Agreement at an average sale

price of $0.71 per share, resulting in gross proceeds of

approximately $67.3 million before deducting sales commissions and

fees, and net proceeds to the Company of approximately $65.9

million after deducting sales commissions and fees totaling

approximately $1.4 million.

Backlog

|

|

As of July 31, |

|

|

|

(Amounts in thousands) |

|

2024 |

|

|

2023 |

|

Change |

|

Product |

$136,708 |

|

$ |

26 |

|

$136,682 |

|

|

Service |

|

178,387 |

|

|

136,621 |

|

|

41,766 |

|

|

Generation |

|

839,532 |

|

|

915,062 |

|

|

(75,530 |

) |

|

Advanced Technologies |

|

42,480 |

|

|

11,552 |

|

|

30,928 |

|

|

Total Backlog |

$1,197,107 |

|

$ |

1,063,261 |

|

$133,846 |

|

|

|

As of July 31, 2024, backlog increased by approximately 12.6% to

$1.20 billion, compared to $1.06 billion as of July 31, 2023,

primarily as a result of the long-term service agreement with

Gyeonggi Green Energy Co., Ltd. (the “GGE Agreement”) entered into

during the third quarter of fiscal 2024. Backlog for the GGE

Agreement was allocated between Product backlog of $126.0 million

and service backlog of $33.6 million. Product backlog will be

recognized as revenue over time as the Company completes

commissioning of the replacement modules. Commissioning of the

first six 1.4-MW replacement fuel cell modules is expected to be

completed in the fall of calendar year 2024, with an additional 30

1.4-MW replacement fuel cell modules expected to be commissioned

throughout the course of calendar year 2025, and the remaining six

1.4-MW replacement fuel cell modules expected to be commissioned in

the first half of calendar year 2026. Service backlog will be

recognized as revenue as the Company performs service at the GGE

site over the term of the GGE Agreement.

Backlog represents definitive agreements executed by the Company

and our customers. Projects for which we have an executed power

purchase agreement (“PPA”) or hydrogen power purchase agreement

(“HPPA”) are included in generation backlog, which represents

future revenue under long-term PPAs and HPPAs. The Company’s

ability to recognize revenue in the future under a PPA or HPPA is

subject to the Company’s completion of construction of the project

covered by such PPA or HPPA. Should the Company not complete the

construction of the project covered by a PPA or HPPA, it will forgo

future revenues with respect to the project and may incur penalties

and/or impairment charges related to the project. Projects sold to

customers (and not retained by the Company) are included in product

sales and service agreements backlog, and the related generation

backlog is removed upon sale. Together, the service and generation

portion of backlog had a weighted average term of approximately 17

years as of July 31, 2024, with weighting based on the dollar

amount of backlog and utility service contracts of up to 20 years

in duration at inception.

Conference Call Information

FuelCell Energy will host a conference call today beginning at

10:00 a.m. ET to discuss third quarter results for fiscal year 2024

as well as key business highlights. Participants can access the

live call via webcast on the Company website or by telephone as

follows:

- The live webcast of the call and supporting slide presentation

will be available at www.fuelcellenergy.com. To listen to the call,

select “Investors” on the home page located under the “Our Company”

pull-down menu, proceed to the “Events & Presentations” page

and then click on the “Webcast” link listed under the September 5th

earnings call event, or click here.

- Alternatively, participants can dial 888-330-3181 and state

FuelCell Energy or the conference ID number 1099808.

The replay of the conference call will be available via webcast

on the Company’s Investors’ page

at www.fuelcellenergy.com approximately two hours after

the conclusion of the call.

Cautionary Language

This news release contains forward-looking statements within the

meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 regarding future events or our future

financial performance that involve certain contingencies and

uncertainties, including those discussed in our Annual Report on

Form 10-K for the fiscal year ended October 31, 2023 in the section

entitled "Management's Discussion and Analysis of Financial

Condition and Results of Operations”. The forward-looking

statements include, without limitation, statements with respect to

the Company’s anticipated financial results and statements

regarding the Company’s plans and expectations regarding the

continuing development, commercialization and financing of its

current and future fuel cell technologies, the expected timing of

completion of the Company’s ongoing projects, the Company’s

business plans and strategies, the Company’s capacity expansion,

the capabilities of the Company’s products, the sales pipeline for

the Company’s products, and the markets in which the Company

expects to operate. Projected and estimated numbers contained

herein are not forecasts and may not reflect actual results. These

forward-looking statements are not guarantees of future

performance, and all forward-looking statements are subject to

risks and uncertainties that could cause actual results to differ

materially from those projected. Factors that could cause such a

difference include, without limitation: general risks associated

with product development and manufacturing; general economic

conditions; changes in interest rates, which may impact project

financing; supply chain disruptions; changes in the utility

regulatory environment; changes in the utility industry and the

markets for distributed generation, distributed hydrogen, and fuel

cell power plants configured for carbon capture or carbon

separation; potential volatility of commodity prices that may

adversely affect our projects; availability of government subsidies

and economic incentives for alternative energy technologies; our

ability to remain in compliance with U.S. federal and state and

foreign government laws and regulations; our ability to regain and

maintain compliance with the listing rules of The Nasdaq Stock

Market; our ability to implement a reverse stock split and the

impacts of a reverse stock split, if implemented; rapid

technological change; competition; the risk that our bid awards

will not convert to contracts or that our contracts will not

convert to revenue; market acceptance of our products; changes in

accounting policies or practices adopted voluntarily or as required

by accounting principles generally accepted in the United States;

factors affecting our liquidity position and financial condition;

government appropriations; the ability of the government and third

parties to terminate their development contracts at any time; the

ability of the government to exercise “march-in” rights with

respect to certain of our patents; our ability to successfully

market and sell our products internationally; our ability to

develop new products to achieve our long-term revenue targets; our

ability to implement our strategy; our ability to reduce our

levelized cost of energy and deliver on our cost reduction strategy

generally; our ability to protect our intellectual property;

litigation and other proceedings; the risk that commercialization

of our new products will not occur when anticipated or, if it does,

that we will not have adequate capacity to satisfy demand; our need

for and the availability of additional financing; our ability to

generate positive cash flow from operations; our ability to service

our long-term debt; our ability to increase the output and

longevity of our platforms and to meet the performance requirements

of our contracts; our ability to expand our customer base and

maintain relationships with our largest customers and strategic

business allies; and concerns with, threats of, or the consequences

of, pandemics, contagious diseases or health epidemics, including

the novel coronavirus, and resulting supply chain disruptions,

shifts in clean energy demand, impacts to our customers’ capital

budgets and investment plans, and impacts on the demand for our

products, as well as other risks set forth in the Company’s filings

with the Securities and Exchange Commission, including the

Company’s Annual Report on Form 10-K for the fiscal year ended

October 31, 2023 and the Company’s Quarterly Report on Form 10-Q

for the fiscal quarter ended July 31, 2024. The forward-looking

statements contained herein speak only as of the date of this press

release. The Company expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

such statement contained herein to reflect any change in the

Company’s expectations or any change in events, conditions or

circumstances on which any such statement is based.

About FuelCell Energy

FuelCell Energy, Inc. (NASDAQ: FCEL): FuelCell Energy is a

global leader in delivering environmentally responsible distributed

baseload energy platform solutions through our proprietary fuel

cell technology. FuelCell Energy is focused on advancing

sustainable clean energy technologies that address some of the

world’s most critical challenges around energy access, security,

resilience, reliability, affordability, safety and environmental

stewardship. As a leading global manufacturer of proprietary fuel

cell technology platforms, FuelCell Energy is uniquely positioned

to serve customers worldwide with sustainable products and

solutions for industrial and commercial businesses, utilities,

governments, municipalities, and communities.

SureSource, SureSource 1500, SureSource 3000, SureSource 4000,

SureSource Recovery, SureSource Capture, SureSource Hydrogen,

SureSource Storage, SureSource Service, SureSource Capital,

FuelCell Energy, and FuelCell Energy logo are all trademarks of

FuelCell Energy, Inc.

Contact:FuelCell Energy,

Inc.ir@fce.com203.205.2491

|

FUELCELL ENERGY, INC.Consolidated Balance

Sheets(Unaudited)(Amounts in thousands, except

share and per share amounts) |

| |

|

|

|

|

|

|

|

|

July 31,2024 |

|

|

October 31,2023 |

|

ASSETS |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents, unrestricted |

$ |

159,347 |

|

|

$ |

|

249,952 |

|

|

Restricted cash and cash equivalents – short-term |

|

9,686 |

|

|

|

|

5,159 |

|

|

Investments – short-term |

|

107,817 |

|

|

|

|

103,760 |

|

|

Accounts receivable, net |

|

11,161 |

|

|

|

|

3,809 |

|

|

Unbilled receivables |

|

30,169 |

|

|

|

|

16,296 |

|

|

Inventories |

|

129,349 |

|

|

|

|

84,456 |

|

|

Other current assets |

|

12,439 |

|

|

|

|

12,881 |

|

|

Total current assets |

|

459,968 |

|

|

|

|

476,313 |

|

| |

|

|

|

|

|

| Restricted cash and cash

equivalents – long-term |

|

49,148 |

|

|

|

|

44,465 |

|

| Inventories – long-term |

|

2,743 |

|

|

|

|

7,329 |

|

| Project assets, net |

|

248,790 |

|

|

|

|

258,066 |

|

| Property, plant and equipment,

net |

|

121,382 |

|

|

|

|

89,668 |

|

| Operating lease right-of-use

assets, net |

|

7,884 |

|

|

|

|

8,352 |

|

| Goodwill |

|

4,075 |

|

|

|

|

4,075 |

|

| Intangible assets, net |

|

15,104 |

|

|

|

|

16,076 |

|

| Other assets |

|

39,816 |

|

|

|

|

51,176 |

|

|

Total assets (1) |

$ |

948,910 |

|

|

$ |

|

955,520 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Current portion of long-term debt |

$ |

12,232 |

|

|

$ |

|

10,067 |

|

|

Current portion of operating lease liabilities |

|

760 |

|

|

|

|

599 |

|

|

Accounts payable |

|

16,928 |

|

|

|

|

26,518 |

|

|

Accrued liabilities |

|

25,970 |

|

|

|

|

26,313 |

|

|

Deferred revenue |

|

10,649 |

|

|

|

|

2,406 |

|

|

Total current liabilities |

|

66,539 |

|

|

|

|

65,903 |

|

| |

|

|

|

|

|

| Long-term deferred

revenue |

|

1,979 |

|

|

|

|

732 |

|

| Long-term operating lease

liabilities |

|

8,708 |

|

|

|

|

8,992 |

|

| Long-term debt and other

liabilities |

|

126,720 |

|

|

|

|

119,588 |

|

|

Total liabilities (1) |

|

203,946 |

|

|

|

|

195,215 |

|

|

|

|

|

|

|

|

| Redeemable Series B preferred

stock (liquidation preference of $64,020 as of July 31, 2024 and

October 31, 2023) |

|

59,857 |

|

|

|

|

59,857 |

|

| Total equity: |

|

|

|

|

|

|

Stockholders’ equity:Common stock ($0.0001 par value);

1,000,000,000 shares authorized as of July 31, 2024 and October 31,

2023; 553,840,943 and 450,626,862 shares issued and outstanding as

of July 31, 2024 and October 31, 2023, respectively |

|

55 |

|

|

|

|

45 |

|

|

Additional paid-in capital |

|

2,277,417 |

|

|

|

|

2,199,661 |

|

|

Accumulated deficit |

|

(1,600,134 |

) |

|

|

|

(1,515,541 |

) |

|

Accumulated other comprehensive loss |

|

(1,576 |

) |

|

|

|

(1,672 |

) |

|

Treasury stock, Common, at cost (376,340 and 246,468 shares as of

July 31, 2024 and October 31, 2023, respectively) |

|

(1,198 |

) |

|

|

|

(1,078 |

) |

|

Deferred compensation |

|

1,198 |

|

|

|

|

1,078 |

|

|

Total stockholders’ equity |

|

675,762 |

|

|

|

|

682,493 |

|

|

Noncontrolling interests |

|

9,345 |

|

|

|

|

17,955 |

|

|

Total equity |

|

685,107 |

|

|

|

|

700,448 |

|

| Total liabilities, redeemable

Series B preferred stock and total equity |

$ |

948,910 |

|

|

$ |

|

955,520 |

|

| |

|

(1) As of July 31, 2024 and October 31, 2023, the combined

assets of the variable interest entities (“VIEs”) were $318,698 and

$235,290, respectively, that can only be used to settle obligations

of the VIEs. These assets include cash of $4,239, accounts

receivable of $726, unbilled accounts receivable of $8,403,

operating lease right of use assets of $1,667, other current assets

of $137,326, restricted cash and cash equivalents of $625, project

assets of $161,964 and other assets of $3,749 as of July 31, 2024,

and cash of $4,797, unbilled accounts receivable of $1,876,

operating lease right of use assets of $1,680, other current assets

of $50,713, restricted cash and cash equivalents of $526, project

assets of $170,444, derivative asset of $4,127 and other assets of

$1,125 as of October 31, 2023. The combined liabilities of the VIEs

as of July 31, 2024 include short-term operating lease liabilities

of $203, accounts payable of $184,900, accrued liabilities of $497,

deferred revenue of $132, long-term operating lease liability of

$2,146, and other non-current liabilities of $2,725 and, as of

October 31, 2023, include short-term operating lease liabilities of

$203, accounts payable of $165,824, long-term operating lease

liability of $2,159 and other non-current liabilities of $187. |

| |

|

FUELCELL ENERGY, INC.Consolidated

Statements of Operations and Comprehensive

Loss(Unaudited)(Amounts in thousands, except share

and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

Product |

|

$ |

250 |

|

|

|

$ |

- |

|

|

Service |

|

|

1,411 |

|

|

|

|

9,841 |

|

|

Generation |

|

|

13,402 |

|

|

|

|

10,982 |

|

|

Advanced Technologies |

|

|

8,632 |

|

|

|

|

4,687 |

|

|

Total revenues |

|

|

23,695 |

|

|

|

|

25,510 |

|

| Costs of

revenues: |

|

|

|

|

|

|

|

|

Product |

|

|

4,181 |

|

|

|

|

2,910 |

|

|

Service |

|

|

1,146 |

|

|

|

|

9,575 |

|

|

Generation |

|

|

18,761 |

|

|

|

|

17,483 |

|

|

Advanced Technologies |

|

|

5,809 |

|

|

|

|

3,757 |

|

|

Total costs of revenues |

|

|

29,897 |

|

|

|

|

33,725 |

|

| Gross

loss |

|

|

(6,202 |

) |

|

|

|

(8,215 |

) |

|

Operating expenses: |

|

|

|

|

|

|

|

|

Administrative and selling expenses |

|

|

14,599 |

|

|

|

|

17,560 |

|

|

Research and development expenses |

|

|

12,816 |

|

|

|

|

15,620 |

|

|

Total costs and expenses |

|

|

27,415 |

|

|

|

|

33,180 |

|

| Loss

from operations |

|

|

(33,617 |

) |

|

|

|

(41,395 |

) |

|

Interest expense |

|

|

(2,555 |

) |

|

|

|

(1,912 |

) |

|

Interest income |

|

|

3,269 |

|

|

|

|

3,966 |

|

|

Gain on early extinguishment of finance obligations and debt,

net |

|

|

- |

|

|

|

|

15,337 |

|

|

Other (expense) income, net |

|

|

(2,218 |

) |

|

|

|

403 |

|

| Loss

before provision for income taxes |

|

|

(35,121 |

) |

|

|

|

(23,601 |

) |

|

Provision for income taxes |

|

|

(2 |

) |

|

|

|

- |

|

| Net

loss |

|

|

(35,123 |

) |

|

|

|

(23,601 |

) |

|

Net (loss) income attributable to noncontrolling interest |

|

|

(2,463 |

) |

|

|

|

678 |

|

| Net loss attributable to

FuelCell Energy, Inc. |

|

|

(32,660 |

) |

|

|

|

(24,279 |

) |

|

Series B preferred stock dividends |

|

|

(800 |

) |

|

|

|

(800 |

) |

| Net loss

attributable to common stockholders |

|

$ |

(33,460 |

) |

|

|

$ |

(25,079 |

) |

| Loss per

share basic and diluted: |

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders |

|

$ |

(0.07 |

) |

|

|

$ |

(0.06 |

) |

|

Basic and diluted weighted average shares outstanding |

|

|

503,183,725 |

|

|

|

|

415,867,594 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FUELCELL ENERGY, INC.Consolidated

Statements of Operations and Comprehensive

Loss(Unaudited)(Amounts in thousands, except share

and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

Product |

|

$ |

250 |

|

|

|

$ |

9,095 |

|

|

Service |

|

|

4,397 |

|

|

|

|

49,913 |

|

|

Generation |

|

|

38,013 |

|

|

|

|

28,979 |

|

|

Advanced Technologies |

|

|

20,146 |

|

|

|

|

12,945 |

|

|

Total revenues |

|

|

62,806 |

|

|

|

|

100,932 |

|

|

|

| Costs of

revenues: |

|

|

|

|

|

|

|

|

Product |

|

|

9,510 |

|

|

|

|

7,425 |

|

|

Service |

|

|

4,301 |

|

|

|

|

40,633 |

|

|

Generation |

|

|

61,079 |

|

|

|

|

51,166 |

|

|

Advanced Technologies |

|

|

12,917 |

|

|

|

|

10,779 |

|

|

Total costs of revenues |

|

|

87,807 |

|

|

|

|

110,003 |

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

loss |

|

|

(25,001 |

) |

|

|

|

(9,071 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Administrative and selling expenses |

|

|

48,659 |

|

|

|

|

47,637 |

|

|

Research and development expenses |

|

|

43,796 |

|

|

|

|

43,000 |

|

|

Total costs and expenses |

|

|

92,455 |

|

|

|

|

90,637 |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss

from operations |

|

|

(117,456 |

) |

|

|

|

(99,708 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(7,168 |

) |

|

|

|

(4,926 |

) |

|

Interest income |

|

|

10,726 |

|

|

|

|

11,064 |

|

|

Gain on early extinguishment of finance obligations and debt,

net |

|

|

- |

|

|

|

|

15,337 |

|

|

Other (expense) income, net |

|

|

(3,278 |

) |

|

|

|

216 |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss

before provision for income taxes |

|

|

(117,176 |

) |

|

|

|

(78,017 |

) |

|

Provision for income taxes |

|

|

(2 |

) |

|

|

|

(581 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

|

(117,178 |

) |

|

|

|

(78,598 |

) |

|

Net loss attributable to noncontrolling interest |

|

|

(32,585 |

) |

|

|

|

(1,394 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to

FuelCell Energy, Inc. |

|

|

(84,593 |

) |

|

|

|

(77,204 |

) |

|

Series B preferred stock dividends |

|

|

(2,400 |

) |

|

|

|

(2,400 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Net loss

attributable to common stockholders |

|

$ |

(86,993 |

) |

|

|

$ |

(79,604 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Loss per

share basic and diluted: |

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders |

|

$ |

(0.19 |

) |

|

|

$ |

(0.19 |

) |

|

Basic and diluted weighted average shares outstanding |

|

|

469,387,264 |

|

|

|

|

409,361,826 |

|

|

|

|

|

|

|

|

|

|

|

|

Appendix

Non-GAAP Financial Measures

Financial results are presented in accordance

with accounting principles generally accepted in the United States

(“GAAP”). Management also uses non-GAAP measures to analyze

and make operating decisions on the business. Earnings before

interest, taxes, depreciation and amortization (“EBITDA”) and

Adjusted EBITDA are non-GAAP measures of operations and operating

performance by the Company.

These supplemental non-GAAP measures are

provided to assist readers in assessing operating performance.

Management believes EBITDA and Adjusted EBITDA are useful in

assessing performance and highlighting trends on an overall basis.

Management also believes these measures are used by companies in

the fuel cell sector and by securities analysts and investors when

comparing the results of the Company with those of other companies.

EBITDA differs from the most comparable GAAP measure, net loss

attributable to the Company, primarily because it does not include

finance expense, income taxes and depreciation of property, plant

and equipment and project assets. Adjusted EBITDA adjusts EBITDA

for stock-based compensation, restructuring charges, non-cash

(gain) loss on derivative instruments and other unusual items,

which are considered either non-cash or non-recurring.

While management believes that these non-GAAP

financial measures provide useful supplemental information to

investors, there are limitations associated with the use of these

measures. The measures are not prepared in accordance with GAAP and

may not be directly comparable to similarly titled measures of

other companies due to potential differences in the exact method of

calculation. The Company’s non-GAAP financial measures are not

meant to be considered in isolation or as a substitute for

comparable GAAP financial measures and should be read only in

conjunction with the Company’s consolidated financial statements

prepared in accordance with GAAP.

The following table calculates EBITDA and

Adjusted EBITDA and reconciles these figures to the GAAP financial

statement measure Net loss.

|

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

| (Amounts

in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

2023 |

|

|

Net loss |

$ |

(35,123 |

) |

|

$ |

(23,601 |

) |

|

|

(117,178 |

) |

|

$ |

(78,598 |

) |

|

Depreciation and amortization (1) |

|

9,238 |

|

|

|

6,623 |

|

|

|

27,389 |

|

|

|

18,659 |

|

|

Provision for income taxes |

|

2 |

|

|

|

- |

|

|

|

2 |

|

|

|

581 |

|

| Other

(income) expense, net (2) |

|

2,218 |

|

|

|

(403 |

) |

|

|

3,278 |

|

|

|

(216 |

) |

| Gain on

extinguishment of finance obligations and debt, net (4) |

|

- |

|

|

|

(15,337 |

) |

|

|

- |

|

|

|

(15,337 |

) |

| Interest

income |

|

(3,269 |

) |

|

|

(3,966 |

) |

|

|

(10,726 |

) |

|

|

(11,064 |

) |

| Interest

expense |

|

2,555 |

|

|

|

1,912 |

|

|

|

7,168 |

|

|

|

4,926 |

|

|

EBITDA |

$ |

(24,379 |

) |

|

$ |

(34,772 |

) |

|

$ |

(90,067 |

) |

|

$ |

(81,049 |

) |

|

Stock-based compensation expense |

|

3,350 |

|

|

|

3,166 |

|

|

|

9,227 |

|

|

|

8,997 |

|

|

Unrealized loss on natural gas contract derivative assets (3) |

|

895 |

|

|

|

- |

|

|

|

5,072 |

|

|

|

- |

|

|

Adjusted EBITDA |

$ |

(20,134 |

) |

|

$ |

(31,606 |

) |

|

$ |

(75,768 |

) |

|

$ |

(72,052 |

) |

| |

| (1) Includes

depreciation and amortization on our Generation portfolio of $7.3

million and $21.3 million for the three and nine months ended July

31, 2024, respectively, and $5.4 million and $14.9 million for the

three and nine months ended July 31, 2023, respectively.(2) Other

(income) expense, net includes gains and losses from transactions

denominated in foreign currencies, interest rate swap income earned

from investments and other items incurred periodically, which are

not the result of the Company’s normal business operations.(3) The

Company recorded a mark-to-market net loss of $0.9 million and $5.1

million for the three and nine months ended July 31, 2024,

respectively, related to natural gas purchase contracts. There was

no comparable loss in the prior year as the Company changed its

designation in the fourth quarter of fiscal year 2023 and in the

second quarter of fiscal year 2024, as a result of net settling

certain natural gas purchases under previous normal purchase normal

sale contract designations, which resulted in a change to

mark-to-market accounting. There were no mark-to-market gains or

losses for the three and nine months ended July 31, 2023. These

losses are classified as Generation cost of sales.(4) The gain on

extinguishment of finance obligations and debt, net was $15.3

million for the three and nine months ended July 31, 2023 and

represents a one-time gain on the payoff of certain finance

obligations of the Company to PNC Energy Capital, LLC, which payoff

occurred in conjunction with a new project financing facility

entered into in May 2023. |

| |

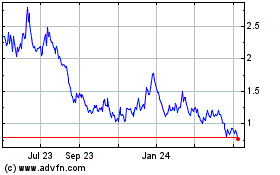

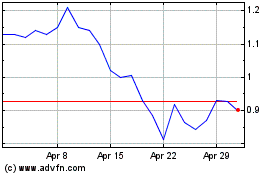

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Jan 2025 to Feb 2025

FuelCell Energy (NASDAQ:FCEL)

Historical Stock Chart

From Feb 2024 to Feb 2025