Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) (the

“Company” or “Consolidated”), a top 10 fiber provider in the U.S.,

today reported results for first quarter 2024.

First Quarter 2024 Results

- Revenue totaled $274.7 million

- Overall consumer revenue was $114.8 million

- Consumer fiber broadband revenue was $41.6 million

- Total consumer broadband net adds were 6,338

- Consumer broadband revenue was $79.9 million

- Commercial data services revenue was $54.7 million

- Carrier data-transport revenue was $31.0 million

- Net loss was ($47.2 million). Adjusted EBITDA was $88.4

million

- Total committed capital expenditures were $83.7 million

Cost of services and products and selling, general and

administrative expenses collectively decreased $15.8 million versus

the prior year largely due to decreased USF contributions, lower

video programming costs, a reduction in salaries driven by certain

cost savings initiatives, and lower access expense.

Net interest expense was $42.5 million, an increase of $8.6

million versus the prior year, primarily as a result of higher

interest rates on the term loan, in addition to decreased interest

income due to lower cash holdings in the current quarter. At Mar.

31, 2024, the Company had 73% of its total outstanding debt at a

fixed rate through September 2026. As of Mar. 31, 2024, the

weighted average cost of debt was 7.14%.

Net loss in the first quarter of 2024 was ($47.2 million)

compared to net loss of ($47.7 million) in the first quarter of

2023. Net loss per share was ($0.41) in the first quarter of 2024

as compared to net loss per share of ($0.42) in the first quarter

of 2023. Adjusted diluted net income (loss) per share excludes

certain items as outlined in the table provided in this release.

Adjusted diluted net loss per share was ($0.27) compared to ($0.28)

in the first quarter of 2023.

Capital Expenditures

Total committed capital expenditures were $83.7 million, driven

by 10,783 new fiber passings, first quarter fiber adds, and reflect

the usage of existing inventory for install and build activity.

Capital Structure

On Mar. 21, 2024, the Company, as borrower, entered into an $80

million term loan agreement (“Term Loan Agreement”) with

Searchlight CVL AGG, L.P. as lender. The Term Loan Agreement

provides the Company with the ability to borrow on the loan in the

event either the aggregate amount of available loans to be drawn

under the Company’s revolving credit facility is less than $25.0

million or drawing under the Company’s revolving credit facility

would trigger the financial maintenance covenant thereunder and the

Company would not be in compliance with such covenant on a pro

forma basis, subject to the satisfaction of certain other customary

conditions.

As of Mar. 31, 2024, the Company maintained liquidity with cash

and short-term investments of approximately $7 million, as well as

$111 million of available borrowing capacity under the Company’s

revolving credit facility and $80 million undrawn under its Term

Loan Agreement, in each case, subject to certain covenants. The net

debt leverage ratio for the trailing 12 months ended Mar. 31, 2024,

was 6.76x.

Washington Asset Sale

On May 1, 2024, Consolidated completed the sale of its

Washington assets.

Pending Transaction

As previously announced on Oct. 16, 2023, Consolidated entered

into an agreement to be acquired by affiliates of Searchlight

Capital Partners, L.P. and British Columbia Investment Management

Corporation in an all-cash transaction with an enterprise value of

approximately $3.1 billion, including the assumption of debt. On

Jan. 31, 2024, at a special meeting of shareholders, approximately

75% of shares held by disinterested shareholders voted to approve

the proposal to adopt the merger agreement and approve the pending

transaction. The transaction will result in Consolidated becoming a

private company and is expected to close by the first quarter of

2025, subject to customary closing conditions, including receipt of

regulatory approvals. The transaction is not subject to a financing

condition. Following the closing of the transaction, shares of

Consolidated common stock will no longer be traded or listed on any

public securities exchange.

In light of the transaction, Consolidated will not host an

earnings conference call.

About Consolidated Communications

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) is

dedicated to moving people, businesses and communities forward by

delivering the most reliable fiber communications solutions.

Consumers, businesses and wireless and wireline carriers depend on

Consolidated for a wide range of high-speed internet, data, phone,

security, cloud and wholesale carrier solutions. With a network

spanning over 61,000 fiber route miles, Consolidated is a top 10

U.S. fiber provider, turning technology into solutions that are

backed by exceptional customer support. Learn more at

consolidated.com.

Use of Non-GAAP Financial Measures

This press release includes disclosures regarding “EBITDA,”

“adjusted EBITDA,” “Net debt leverage ratio,” and “adjusted diluted

net income (loss) per share,” all of which are non-GAAP financial

measures. Accordingly, they should not be construed as alternatives

to net cash from operating or investing activities, cash and cash

equivalents, cash flows from operations, net income or net income

per share as defined by GAAP and are not, on their own, necessarily

indicative of cash available to fund cash needs as determined in

accordance with GAAP. In addition, not all companies use identical

calculations, and the non-GAAP financial measures may not be

comparable to other similarly titled measures of other companies. A

reconciliation of these non-GAAP financial measures to the most

directly comparable financial measures presented in accordance with

GAAP is included in the tables that follow.

Adjusted EBITDA is comprised of EBITDA, adjusted for certain

items as permitted or required by the lenders under our credit

agreement in place at the end of each quarter in the periods

presented. The tables that follow include an explanation of how

adjusted EBITDA is calculated for each of the periods presented

with the reconciliation to net income (loss). EBITDA is defined as

net income (loss) before interest expense, income taxes,

depreciation and amortization on a historical basis.

We present adjusted EBITDA for several reasons. Management

believes adjusted EBITDA is useful as a means to evaluate our

ability to fund our estimated uses of cash (including interest on

our debt). In addition, we have presented adjusted EBITDA to

investors in the past because it is frequently used by investors,

securities analysts and other interested parties in the evaluation

of companies in our industry, and management believes presenting it

here provides a measure of consistency in our financial reporting.

Adjusted EBITDA, referred to as Available Cash in our credit

agreement, is also a component of the restrictive covenants and

financial ratios contained in our credit agreement that requires us

to maintain compliance with these covenants and limit certain

activities, such as our ability to incur debt. The definitions in

these covenants and ratios are based on Adjusted EBITDA after

giving effect to specified charges. In addition, Adjusted EBITDA

provides our board of directors with meaningful information, with

other data, assumptions and considerations, to measure our ability

to service and repay debt. We present the related “Net debt

leverage ratio” principally to help investors understand how we

measure leverage and facilitate comparisons by investors, security

analysts and others. Total net debt is defined as the current and

long-term portions of debt and finance lease obligations less cash,

cash equivalents and short-term investments, deferred debt issuance

costs and discounts on debt. Our Net debt leverage ratio differs in

certain respects from the similar ratio used in our credit

agreement or against comparable measures of certain other companies

in our industry. These measures differ in certain respects from the

ratios used in our senior notes indenture.

These non-GAAP financial measures have certain shortcomings. In

particular, Adjusted EBITDA does not represent the residual cash

flows available for discretionary expenditures, since items such as

debt repayment and interest payments are not deducted from such

measure. In addition, the Net debt leverage ratio is subject to the

risk that we may not be able to use the cash on the balance sheet

to reduce our debt on a dollar-for-dollar basis. Management

believes this ratio is useful as a means to evaluate our ability to

incur additional indebtedness in the future.

We present the non-GAAP measure “adjusted diluted net income

(loss) per share” because our net income (loss) and net income

(loss) per share are regularly affected by items that occur at

irregular intervals or are non-cash items. We believe that

disclosing these measures assists investors, securities analysts

and other interested parties in evaluating both our company over

time and the relative performance of the companies in our

industry.

Forward-Looking Statements

Certain statements in this press release, including those

relating to the current expectations, plans, strategies, and the

timeline for consummating the take private transaction with

Searchlight Capital Partners, L.P. and British Columbia Investment

Management Corporation by the first quarter of 2025, are

forward-looking statements and are made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements reflect, among other things, our

current expectations, plans, strategies and anticipated financial

results. There are a number of risks, uncertainties and conditions

that may cause our actual results to differ materially from those

expressed or implied by these forward-looking statements,

including: significant competition in all parts of our business and

among our customer channels; our ability to adapt to rapid

technological changes; shifts in our product mix that may result in

a decline in operating profitability; continued receipt of support

from various funds established under federal and state laws;

disruptions in our networks and infrastructure and any related

service delays or disruptions could cause us to lose customers and

incur additional expenses; cyber-attacks may lead to unauthorized

access to confidential customer, personnel and business information

that could adversely affect our business; our operations require

substantial capital expenditures and our business, financial

condition, results of operations and liquidity may be impacted if

funds for capital expenditures are not available when needed; our

ability to obtain and maintain necessary rights-of-way for our

networks; our ability to obtain necessary hardware, software and

operational support from third-party vendors; substantial video

content costs continue to rise; our ability to enter into new

collective bargaining agreements or renew existing agreements; our

ability to attract and/or retain certain key management and other

personnel in the future; risks associated with acquisitions and the

realization of anticipated benefits from such acquisitions;

increasing attention to, and evolving expectations for,

environmental, social and governance initiatives; unfavorable

changes in financial markets could affect pension plan investments;

weak economic conditions; the risk that the proposed transaction

may not be completed in a timely manner or at all; the possibility

that any or all of the various conditions to the consummation of

the proposed transaction may not be satisfied or waived, including

the failure to receive any required regulatory approvals from any

applicable governmental entities (or any conditions, limitations or

restrictions placed on such approvals); the occurrence of any

event, change or other circumstance that could give rise to the

termination of the definitive transaction agreement relating to the

proposed transaction, including in circumstances which would

require the Company to pay a termination fee; the effect of the

announcement or pendency of the proposed transaction on the

Company’s ability to attract, motivate or retain key executives and

employees, its ability to maintain relationships with its

customers, suppliers and other business counterparties, or its

operating results and business generally; risks related to the

proposed transaction diverting management’s attention from the

Company’s ongoing business operations; the amount of costs, fees

and expenses related to the proposed transaction; the risk that the

Company’s stock price may decline significantly if the proposed

transaction is not consummated; the risk of shareholder litigation

in connection with the proposed transaction, including resulting

expense or delay; and the other risk factors described in Part I,

Item 1A of Risk Factors in our Annual Report on Form 10-K for the

year ended December 31, 2023 and the other risk factors identified

from time to time in the Company’s other filings with the SEC.

Filings with the SEC are available on the SEC’s website at

http://www.sec.gov. Many of these circumstances are beyond our

ability to control or predict. Moreover, forward-looking statements

necessarily involve assumptions on our part. These forward-looking

statements generally are identified by the words “believe,”

“expect,” “anticipate,” “estimate,” “project,” “intend,” “plan,”

“should,” “may,” “will,” “would,” “will be,” “will continue” or

similar expressions. All forward-looking statements attributable to

us or persons acting on our behalf are expressly qualified in their

entirety by the cautionary statements that appear throughout this

press release. Furthermore, undue reliance should not be placed on

forward-looking statements, which are based on the information

currently available to us and speak only as of the date they are

made. Except as required under federal securities laws or the rules

and regulations of the Securities and Exchange Commission, we

disclaim any intention or obligation to update or revise publicly

any forward-looking statements.

Tag: [Consolidated-Communications-Earnings]

Consolidated Communications Holdings, Inc. Condensed

Consolidated Balance Sheets (Dollars in thousands, except share

and per share amounts) (Unaudited)

March 31,

December 31,

2024

2023

ASSETS Current assets: Cash and cash equivalents $

7,363

$

4,765

Accounts receivable, net

109,353

121,194

Income tax receivable

3,070

2,880

Prepaid expenses and other current assets

62,738

56,843

Assets held for sale

70,971

70,473

Total current assets

253,495

256,155

Property, plant and equipment, net

2,461,004

2,449,009

Investments

8,648

8,887

Goodwill

814,624

814,624

Customer relationships, net

14,543

18,616

Other intangible assets

10,557

10,557

Other assets

79,371

70,578

Total assets $

3,642,242

$

3,628,426

LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS'

EQUITY Current liabilities: Accounts payable $

20,529

$

60,073

Advance billings and customer deposits

48,579

44,478

Accrued compensation

47,901

58,151

Accrued interest

36,275

18,694

Accrued expense

96,750

114,022

Current portion of long-term debt and finance lease obligations

19,234

18,425

Liabilities held for sale

3,147

3,402

Total current liabilities

272,415

317,245

Long-term debt and finance lease obligations

2,234,667

2,134,916

Deferred income taxes

201,047

210,648

Pension and other post-retirement obligations

136,460

137,616

Other long-term liabilities

46,298

48,637

Total liabilities

2,890,887

2,849,062

Series A Preferred Stock, par value $0.01 per share;

10,000,000 shares authorized, 434,266 shares outstanding as of

March 31, 2024 and December 31, 2023, respectively; liquidation

preference of $532,643 and $520,957 as of March 31, 2024 and

December 31, 2023, respectively

384,277

372,590

Shareholders' equity: Common stock, par value $0.01 per

share; 150,000,000 shares authorized, 118,429,666 and 116,172,568

shares outstanding as of March 31, 2024 and December 31, 2023,

respectively

1,184

1,162

Additional paid-in capital

671,241

681,757

Accumulated deficit

(297,876

)

(262,380

)

Accumulated other comprehensive loss, net

(15,691

)

(21,872

)

Noncontrolling interest

8,220

8,107

Total shareholders' equity

367,078

406,774

Total liabilities, mezzanine equity and shareholders' equity $

3,642,242

$

3,628,426

Consolidated Communications Holdings, Inc. Condensed

Consolidated Statements of Operations (Dollars in thousands,

except per share amounts) (Unaudited)

Three Months

Ended March 31,

2024

2023

Net revenues $

274,675

$

276,126

Operating expenses: Cost of services and products

113,459

131,938

Selling, general and administrative expenses

83,955

81,284

Transaction costs

2,925

—

Loss on disposal of assets

—

3,304

Depreciation and amortization

80,633

77,699

Loss from operations

(6,297

)

(18,099

)

Other income (expense): Interest expense, net of interest income

(42,451

)

(33,860

)

Other, net

1,593

2,758

Loss before income taxes

(47,155

)

(49,201

)

Income tax benefit

(11,772

)

(12,240

)

Net loss

(35,383

)

(36,961

)

Less: dividends on Series A preferred stock

11,687

10,587

Less: net income attributable to noncontrolling interest

113

143

Net loss attributable to common shareholders $

(47,183

)

$

(47,691

)

Net loss per basic and diluted common shares attributable to

common shareholders $

(0.41

)

$

(0.42

)

Consolidated Communications Holdings, Inc. Condensed

Consolidated Statements of Cash Flows (Dollars in thousands)

(Unaudited)

Three Months Ended March

31,

2024

2023

OPERATING ACTIVITIES Net loss $

(35,383

)

$

(36,961

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

80,633

77,699

Deferred income tax expense (benefit)

(11,791

)

5,604

Pension and post-retirement contributions in excess of expense

(1,702

)

(2,861

)

Non-cash, stock-based compensation

1,681

799

Amortization of deferred financing costs and discounts

1,957

1,847

Loss on disposal of assets

—

3,304

Other adjustments, net

(1,283

)

(418

)

Changes in operating assets and liabilities, net

(28,442

)

6,073

Net cash provided by operating activities

5,670

55,086

INVESTING ACTIVITIES Purchase of property, plant and equipment, net

(98,032

)

(130,826

)

Proceeds from sale of assets

76

292

Proceeds from sale and maturity of investments

714

1,623

Net cash used in investing activities

(97,242

)

(128,911

)

FINANCING ACTIVITIES Proceeds from issuance of long-term debt

100,000

—

Payment of finance lease obligations

(4,837

)

(3,114

)

Payment of financing costs

(504

)

—

Share repurchases for minimum tax withholding

(489

)

(1,036

)

Net cash provided by (used in) financing activities

94,170

(4,150

)

Net change in cash and cash equivalents

2,598

(77,975

)

Cash and cash equivalents at beginning of period

4,765

325,852

Cash and cash equivalents at end of period $

7,363

$

247,877

Consolidated Communications Holdings, Inc. Consolidated

Revenue by Category (Dollars in thousands) (Unaudited)

Three Months Ended March 31,

2024

2023

Consumer: Broadband (Data and VoIP) $

79,882

$

67,961

Voice services

28,336

32,263

Video services

6,626

9,594

114,844

109,818

Commercial: Data services (includes VoIP)

54,681

53,134

Voice services

30,711

32,631

Other

8,964

9,756

94,356

95,521

Carrier: Data and transport services

31,048

32,923

Voice services

3,794

4,367

Other

235

350

35,077

37,640

Subsidies

6,806

7,036

Network access

22,468

24,444

Other products and services

1,124

1,667

Total operating revenue $

274,675

$

276,126

Consolidated Communications Holdings, Inc. Consolidated

Revenue Trend by Category (Dollars in thousands) (Unaudited)

Three Months Ended Q1 2024 Q4

2023 Q3 2023 Q2 2023 Q1 2023 Consumer:

Broadband (Data and VoIP) $

79,882

$

76,458

$

75,089

$

71,339

$

67,961

Voice services

28,336

29,935

31,616

31,352

32,263

Video services

6,626

7,460

8,541

9,362

9,594

114,844

113,853

115,246

112,053

109,818

Commercial: Data services (includes VoIP)

54,681

54,473

53,870

53,230

53,134

Voice services

30,711

31,217

31,825

32,236

32,631

Other

8,964

10,521

9,228

10,378

9,756

94,356

96,211

94,923

95,844

95,521

Carrier: Data and transport services

31,048

31,713

31,388

31,224

32,923

Voice services

3,794

2,868

4,090

4,263

4,367

Other

235

243

262

313

350

35,077

34,824

35,740

35,800

37,640

Subsidies

6,806

6,902

6,878

7,072

7,036

Network access

22,468

22,217

20,842

22,747

24,444

Other products and services

1,124

1,171

10,025

1,646

1,667

Total operating revenue $

274,675

$

275,178

$

283,654

$

275,162

$

276,126

Consolidated Communications Holdings, Inc. Reconciliation

of Net Loss to Adjusted EBITDA (Dollars in thousands)

(Unaudited)

Three Months Ended March

31,

2024

2023

Net loss $

(35,383

)

$

(36,961

)

Add (subtract): Income tax benefit

(11,772

)

(12,240

)

Interest expense, net

42,451

33,860

Depreciation and amortization

80,633

77,699

EBITDA

75,929

62,358

Adjustments to EBITDA (1): Other, net (2)

10,727

10,030

Pension/OPEB benefit

62

(1,141

)

Loss on disposal of assets

—

3,304

Non-cash compensation (3)

1,681

799

Adjusted EBITDA $

88,399

$

75,350

Notes: (1) These adjustments reflect those

required or permitted by the lenders under our credit agreement.

(2) Other, net includes income attributable to noncontrolling

interests, transaction and non-recurring related costs, and certain

miscellaneous items. (3) Represents compensation expenses in

connection with our Restricted Share Plan, which because of the

non-cash nature of the expenses are excluded from adjusted EBITDA.

Consolidated Communications Holdings, Inc. Reconciliation

of Loss Attributable to Common Shareholders to Adjusted Loss and

Calculation of Adjusted Diluted Net Loss Per Common Share

(Dollars in thousands, except per share amounts) (Unaudited)

Three Months Ended March 31,

2024

2023

Net loss $

(35,383

)

$

(36,961

)

Less: dividends on Series A preferred stock

11,687

10,587

Less: net income attributable to noncontrolling interest

113

143

Net loss attributable to common shareholders

(47,183

)

(47,691

)

Adjustments to net loss attributable to common shareholders:

Dividends on Series A preferred stock

11,687

10,587

Transaction and severance related costs, net of tax

3,191

2,648

Loss on disposition of assets, net of tax

—

2,441

Non-cash interest expense for swaps, net of tax

—

(338

)

Non-cash stock compensation, net of tax

1,241

590

Adjusted net loss $

(31,064

)

$

(31,763

)

Weighted average number of common shares outstanding

114,134

112,939

Adjusted diluted net loss per common share $

(0.27

)

$

(0.28

)

Notes: Calculations above assume a 26.1% effective

tax rate for each of the three months ended March 31, 2024 and

2023.

Consolidated Communications Holdings, Inc.

Reconciliation of Total Net Debt to LTM Adjusted EBITDA

Ratio (Dollars in thousands) (Unaudited)

March

31,

2024

Long-term debt and finance lease obligations: Term loans, net of

discount $6,585 $

993,290

6.50% Senior secured notes due 2028

750,000

5.00% Senior secured notes due 2028

400,000

Revolving loan

100,000

Finance leases

38,347

Total debt as of March 31, 2024

2,281,637

Less: deferred debt issuance costs

(27,736

)

Less: cash, cash equivalents and short-term investments

(7,363

)

Total net debt as of March 31, 2024 $

2,246,538

Adjusted EBITDA for the 12 months ended March 31, 2024 $

332,248

Total Net Debt to last 12 months Adjusted EBITDA 6.76x

Consolidated Communications Holdings, Inc. Key Operating

Metrics (Unaudited)

2023

FY 2022 Q1 Q2 Q3 Q4 FY

Q1 2024 Passings Total Fiber

Gig+ Capable Passings (1)(2)(3)

1,008,660

1,062,518

1,119,956

1,187,076

1,236,208

1,236,208

1,246,991

Total DSL/Copper Passings (2)(3)

1,617,077

1,564,889

1,509,875

1,447,539

1,401,535

1,401,535

1,392,698

Total Passings (1)(2)(3)

2,625,737

2,627,407

2,629,831

2,634,615

2,637,743

2,637,743

2,639,689

% Fiber Gig+ Coverage/Total Passings

38

%

40

%

43

%

45

%

47

%

47

%

47

%

Consumer Broadband Connections

Fiber Gig+ Capable

122,872

135,209

153,860

175,748

195,195

195,195

213,997

DSL/Copper

244,586

234,653

222,969

210,473

198,024

198,024

185,560

Total Consumer Broadband Connections

367,458

369,862

376,829

386,221

393,219

393,219

399,557

Consumer Broadband Net Adds

Total Fiber Gig+ Capable Net Adds (5)

40,075

12,337

18,651

21,888

19,447

72,323

18,802

DSL/Copper Net Adds (5)

(39,351

)

(9,933

)

(11,684

)

(12,496

)

(12,449

)

(46,562

)

(12,464

)

Total Consumer Broadband Net Adds (5)

724

2,404

6,967

9,392

6,998

25,761

6,338

Consumer Broadband Penetration

% Fiber Gig+ Capable (on fiber passings)

12.2

%

12.7

%

13.7

%

14.8

%

15.8

%

15.8

%

17.2

%

DSL/Copper (on DSL/copper passings)

15.1

%

15.0

%

14.8

%

14.5

%

14.1

%

14.1

%

13.3

%

Total Consumer Broadband Penetration %

14.0

%

14.1

%

14.3

%

14.7

%

14.9

%

14.9

%

15.1

%

Consumer Average Revenue Per Unit

(ARPU) Fiber Gig+ Capable $

65.42

$

67.51

$

68.29

$

68.78

$

68.14

$

66.90

$

67.96

DSL/Copper $

53.36

$

53.21

$

55.88

$

57.18

$

56.27

$

55.83

$

59.69

Churn Fiber Consumer Broadband

Churn (5)

1.1

%

1.0

%

1.3

%

1.3

%

1.2

%

1.2

%

1.1

%

DSL/Copper Consumer Broadband Churn (5)

1.6

%

1.5

%

1.7

%

2.0

%

2.0

%

1.8

%

2.0

%

Consumer Broadband Revenue

($ in thousands) Fiber Broadband

Revenue (4) $

82,034

$

26,136

$

29,613

$

34,004

$

37,916

$

127,668

$

41,613

Copper and Other Broadband Revenue

190,112

41,825

41,726

41,085

38,542

163,179

38,268

Total Consumer Broadband Revenue $

272,146

$

67,961

$

71,339

$

75,089

$

76,458

$

290,847

$

79,882

Consumer Voice Connections

276,779

267,509

258,680

249,081

239,587

239,587

229,523

Video Connections

35,039

32,426

28,934

26,158

21,900

21,900

17,620

Fiber route network miles (long-haul, metro and FttP)

57,865

57,569

58,836

59,915

60,438

60,438

61,366

On-net buildings

14,427

14,520

14,735

14,928

15,105

15,105

15,254

Notes: (1) In Q1 2021, the Company launched a

multi-year fiber build plan to upgrade 1.6 million passings or 70%

of our service area to fiber Gig+ capable services. During the

quarter ended March 31, 2024, an additional 10,783 passings were

upgraded to FttP and total fiber passings were 1,246,991 or 47% of

the Company's service area. (2) Passings counts are estimates of

single family units, multi-dwelling units, and multi-tenant units

within consumer, small business and enterprise. These counts are

based upon the information available at this time and are subject

to updates as additional information becomes available. (3) When a

passing is both fiber and DSL/Copper capable it is counted as a

fiber passing. (4) Fiber broadband revenue includes revenue from

our Kansas City operations, which was sold in the fourth quarter of

2022, of approximately $1.8 million for the year ended December 31,

2022. Amounts have not been adjusted to reflect the sale. (5)

Consumer Broadband net adds and churn for the year ended December

31, 2022 have been normalized to reflect the divestitures of our

Kansas City and Ohio operations, which were sold in 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506543676/en/

Investor and Media Contacts

Philip Kranz, Investor Relations +1 217-238-8480

Philip.kranz@consolidated.com

Jennifer Spaude, Media Relations +1 507-386-3765

Jennifer.spaude@consolidated.com

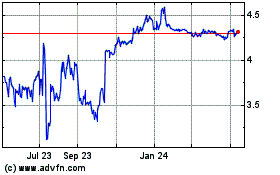

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Oct 2024 to Nov 2024

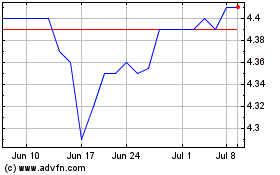

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Nov 2023 to Nov 2024