Consolidated Communications Shareholders Approve Proposed Transaction with Searchlight and BCI

January 31 2024 - 4:17PM

Business Wire

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) (the

“Company” or “Consolidated”), a top 10 fiber provider in the U.S.,

today announced that, based on the preliminary vote count provided

by its proxy solicitor following the Company’s special meeting of

shareholders (the “Special Meeting”) held earlier today,

Consolidated shareholders have voted overwhelmingly to approve the

proposed acquisition of the Company by affiliates of Searchlight

Capital Partners, L.P. (“Searchlight”) and British Columbia

Investment Management Corporation (“BCI”) (the “Proposed

Transaction”). Approximately 75% of disinterested shareholders

voted to approve the proposal to adopt the merger agreement and

approve the Proposed Transaction. Consolidated will file final,

certified voting results on a Form 8-K with the U.S. Securities and

Exchange Commission as soon as practicable.

“Today’s vote by Consolidated shareholders is a clear

endorsement that they recognize the value-maximizing nature of this

transaction,” said Robert J. Currey, the Chairman of the

Consolidated Communications Board and the Special Committee Chair.

“With the financial flexibility and access to capital this

transaction provides, we will be well positioned to bring broadband

services to underserved and unserved communities across rural

America. We look forward to continuing to deliver for our

stakeholders, including our customers and our employees, for many

years to come.”

The Proposed Transaction is expected to close by the first

quarter of 2025, subject to customary closing conditions, including

receipt of regulatory approvals. The Proposed Transaction is not

subject to a financing condition. Following the closing of the

Proposed Transaction, shares of Consolidated Communications common

stock will no longer be traded or listed on any public securities

exchange.

Advisors

Rothschild & Co is acting as financial advisor to the

special committee and Cravath, Swaine & Moore LLP is acting as

its legal counsel. Latham & Watkins LLP is providing legal

counsel to Consolidated Communications.

About Consolidated Communications

Consolidated Communications Holdings, Inc. (Nasdaq: CNSL) is

dedicated to moving people, businesses and communities forward by

delivering the most reliable fiber communications solutions.

Consumers, businesses and wireless and wireline carriers depend on

Consolidated for a wide range of high-speed internet, data, phone,

security, cloud and wholesale carrier solutions. With a network

spanning nearly 60,000 fiber route miles, Consolidated is a top 10

U.S. fiber provider, turning technology into solutions that are

backed by exceptional customer support.

Forward-Looking Statements

Certain statements in this communication are forward-looking

statements and are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995. These

forward-looking statements reflect, among other things, the

Company’s current expectations, plans, strategies and anticipated

financial results.

There are a number of risks, uncertainties and conditions that

may cause the Company’s actual results to differ materially from

those expressed or implied by these forward-looking statements,

including: (i) the risk that the Proposed Transaction may not be

completed in a timely manner or at all; (ii) the possibility that

any or all of the various conditions to the consummation of the

Proposed Transaction may not be satisfied or waived, including the

failure to receive any required regulatory approvals from any

applicable governmental entities (or any conditions, limitations or

restrictions placed on such approvals); (iii) the possibility that

competing offers or acquisition proposals for the Company will be

made; (iv) the occurrence of any event, change or other

circumstance that could give rise to the termination of the

definitive transaction agreement relating to the Proposed

Transaction, including in circumstances which would require the

Company to pay a termination fee; (v) the effect of the

announcement or pendency of the Proposed Transaction on the

Company’s ability to attract, motivate or retain key executives and

employees, its ability to maintain relationships with its

customers, suppliers and other business counterparties, or its

operating results and business generally; (vi) risks related to the

Proposed Transaction diverting management’s attention from the

Company’s ongoing business operations; (vii) the amount of costs,

fees and expenses related to the Proposed Transaction; (viii) the

risk that the Company’s stock price may decline significantly if

the Proposed Transaction is not consummated; (ix) the risk of

shareholder litigation in connection with the Proposed Transaction,

including resulting expense or delay; and (x) (A) the risk factors

described in Part I, Item 1A of Risk Factors in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2022 and

(B) the other risk factors identified from time to time in the

Company’s other filings with the SEC. Filings with the SEC are

available on the SEC’s website at http://www.sec.gov.

Many of these circumstances are beyond the Company’s ability to

control or predict. These forward-looking statements necessarily

involve assumptions on the Company's part. These forward-looking

statements generally are identified by the words “believe,”

“expect,” “anticipate,” “intend,” “plan,” “should,” “may,” “will,”

“would” or similar expressions. All forward-looking statements

attributable to the Company or persons acting on the Company’s

behalf are expressly qualified in their entirety by the cautionary

statements that appear throughout this communication. Furthermore,

undue reliance should not be placed on forward-looking statements,

which are based on the information currently available to the

Company and speak only as of the date they are made. The Company

disclaims any intention or obligation to update or revise publicly

any forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240131885867/en/

Philip Kranz, Investor Relations +1 217-238-8480

Philip.kranz@consolidated.com

Jennifer Spaude, Media Relations +1 507-386-3765

Jennifer.spaude@consolidated.com

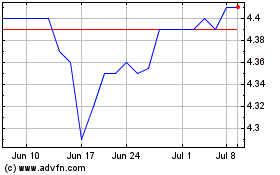

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Oct 2024 to Nov 2024

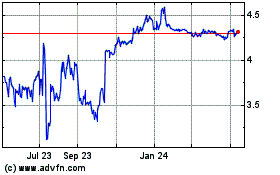

Consolidated Communicati... (NASDAQ:CNSL)

Historical Stock Chart

From Nov 2023 to Nov 2024