0001718224false--01-01falseQ220230.001200000000000.002500000006246118639611886422589000000.000.000.0000046994900017182242023-01-022023-07-020001718224btbd:NextGenIceIncMemberbtbd:LoanModificationAndExtensionAgreementMember2023-01-022023-07-020001718224btbd:NextGenIceIncMemberbtbd:LoanModificationAndExtensionAgreementMember2023-07-020001718224btbd:NextGenIceIncMember2023-07-020001718224btbd:VBGAssetsMember2023-07-020001718224btbd:PIEAssetsMember2023-07-020001718224btbd:KeeganAssetsMember2023-07-020001718224btbd:KeeganAssetsMember2023-01-022023-07-020001718224btbd:CorporateOfficeSpaceMember2023-01-022023-07-020001718224btbd:VBGAssetsMember2023-01-022023-07-020001718224btbd:PIEAssetsMember2023-01-022023-07-020001718224btbd:LandLeaseMember2023-01-022023-07-020001718224btbd:LandLeaseMember2023-07-020001718224btbd:TwoThousandNinteenIncentivePlanMember2023-01-022023-07-020001718224btbd:TwoThousandNinteenIncentivePlanMember2022-01-032022-07-030001718224btbd:TwoThousandNinteenIncentivePlanMember2022-04-022022-07-030001718224btbd:TwoThousandNinteenIncentivePlanMember2023-04-032023-07-0200017182242023-02-2700017182242023-02-012023-02-270001718224btbd:TwoThousandNinteenIncentivePlanMember2023-07-0200017182242022-01-032023-01-010001718224btbd:JuneTwentyEightTwoThousandTwentyOneMemberus-gaap:LongTermDebtMemberbtbd:ShareholdersMember2023-01-010001718224btbd:JuneTwentyEightTwoThousandTwentyOneMemberus-gaap:LongTermDebtMemberbtbd:ShareholdersMember2023-07-020001718224btbd:AprilTwentyNineTwoThousandTwentyMemberus-gaap:LongTermDebtMember2023-01-010001718224btbd:AprilTwentyNineTwoThousandTwentyMemberus-gaap:LongTermDebtMember2023-07-0200017182242022-01-022022-07-0300017182242023-04-022023-07-0200017182242022-01-012022-12-310001718224btbd:TradenamesMember2023-07-020001718224us-gaap:TrademarksMember2023-01-022023-07-020001718224btbd:CovenantNotToCompeteMember2023-01-022023-07-020001718224us-gaap:TrademarksMember2023-07-020001718224btbd:CovenantNotToCompeteMember2023-07-020001718224btbd:NGICorporationMember2023-01-022023-07-020001718224btbd:NGICorporationMember2023-07-020001718224btbd:NGICorporationMember2022-02-012022-02-120001718224btbd:BaggersDaveMember2023-01-022023-07-020001718224btbd:BaggersDaveMember2023-03-272023-06-250001718224btbd:BaggersDaveMember2023-07-020001718224btbd:NobleRomansIncMember2023-07-020001718224btbd:FASBMember2022-12-012023-01-010001718224us-gaap:TreasuryStockCommonMember2023-04-032023-07-020001718224us-gaap:RetainedEarningsMember2023-04-032023-07-020001718224us-gaap:AdditionalPaidInCapitalMember2023-04-032023-07-020001718224us-gaap:CommonStockMember2023-04-032023-07-0200017182242023-04-020001718224us-gaap:TreasuryStockCommonMember2023-04-020001718224us-gaap:RetainedEarningsMember2023-04-020001718224us-gaap:AdditionalPaidInCapitalMember2023-04-020001718224us-gaap:CommonStockMember2023-04-020001718224us-gaap:TreasuryStockCommonMember2023-07-020001718224us-gaap:RetainedEarningsMember2023-07-020001718224us-gaap:AdditionalPaidInCapitalMember2023-07-020001718224us-gaap:CommonStockMember2023-07-020001718224us-gaap:TreasuryStockCommonMember2023-01-022023-07-020001718224us-gaap:RetainedEarningsMember2023-01-022023-07-020001718224us-gaap:AdditionalPaidInCapitalMember2023-01-022023-07-020001718224us-gaap:CommonStockMember2023-01-022023-07-020001718224us-gaap:TreasuryStockCommonMember2023-01-010001718224us-gaap:RetainedEarningsMember2023-01-010001718224us-gaap:AdditionalPaidInCapitalMember2023-01-010001718224us-gaap:CommonStockMember2023-01-010001718224us-gaap:TreasuryStockCommonMember2022-04-042022-07-030001718224us-gaap:RetainedEarningsMember2022-04-042022-07-030001718224us-gaap:AdditionalPaidInCapitalMember2022-04-042022-07-030001718224us-gaap:CommonStockMember2022-04-042022-07-0300017182242022-04-030001718224us-gaap:TreasuryStockCommonMember2022-04-030001718224us-gaap:RetainedEarningsMember2022-04-030001718224us-gaap:AdditionalPaidInCapitalMember2022-04-030001718224us-gaap:CommonStockMember2022-04-0300017182242022-07-030001718224us-gaap:TreasuryStockCommonMember2022-07-030001718224us-gaap:RetainedEarningsMember2022-07-030001718224us-gaap:AdditionalPaidInCapitalMember2022-07-030001718224us-gaap:CommonStockMember2022-07-030001718224us-gaap:TreasuryStockCommonMember2022-01-032022-07-030001718224us-gaap:RetainedEarningsMember2022-01-032022-07-030001718224us-gaap:AdditionalPaidInCapitalMember2022-01-032022-07-030001718224us-gaap:CommonStockMember2022-01-032022-07-0300017182242022-01-020001718224us-gaap:TreasuryStockCommonMember2022-01-020001718224us-gaap:RetainedEarningsMember2022-01-020001718224us-gaap:AdditionalPaidInCapitalMember2022-01-020001718224us-gaap:CommonStockMember2022-01-0200017182242022-04-042022-07-0300017182242023-04-032023-07-0200017182242022-01-032022-07-0300017182242023-01-0100017182242023-07-0200017182242023-08-16iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:purebtbd:integerutr:sqft

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the quarterly period ended: July 2, 2023 |

|

or |

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

Commission File Number: 333-233233

BT BRANDS, INC. | |

(Exact name of registrant as specified in its charter) |

Wyoming | | 90-1495764 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

405 Main Avenue West, Suite 2D, West Fargo, ND | | 58078 |

(Address of principal executive offices) | | (Zip Code) |

(307) 274-3055

(Registrant’s telephone number, including area code)

NONE

(Former name former address and former fiscal year if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

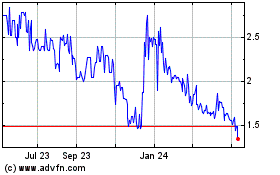

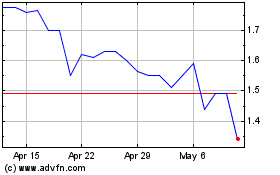

Common stock, $0.002 per share | | BTBD | | The NASDAQ Stock Market LLC |

Warrant to Purchase Common Stock | | BTBDW | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

Non-accelerated Filer | ☒ | Smaller reporting company | ☒ |

| | Emerging Growth Company | ☒ |

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether any error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

At August 16, 2023, there were 6,246,118 shares of common stock outstanding.

CAUTIONARY STATEMENT REGARDING RISKS

AND UNCERTAINTIES THAT MAY AFFECT FUTURE RESULTS

Forward-Looking Information

This quarterly report contains forward-looking statements about the business, financial condition and prospects of BT Brands, Inc. and its wholly-owned subsidiaries (together, the “Company”). Forward-looking statements, as that term is defined in the Private Securities Litigation Reform Act of 1995, can be identified by the use of forward-looking terminology such as “believes,” “projects,” “expects,” “may,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” “would,” “anticipates,” “potential,” “confident,” “optimistic” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy, objectives, estimates, guidance, expectations, and future plans. Forward-looking statements can also be identified by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties.

While the Company believes the expectations reflected in forward-looking statements are reasonable, there can be no assurances that such expectations will prove to be accurate. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. You should evaluate all forward-looking statements made in this report in the context of the factors that could cause outcomes to differ materially from our expectations. These factors include, but are not limited to:

| · | capital requirements and the availability of capital to fund our growth; |

| · | difficulties executing our growth strategy, including completing profitable acquisitions; |

| · | the impact of public health matters; |

| · | the risks of acquiring an existing restaurant business, including identifying a suitable target, completing comprehensive due diligence, the impact on our financial condition of any debt we may incur in acquiring the target, the ability to integrate the target’s operations with our existing operations, our ability to retain management and key employees of the target, among other factors relevant to acquisitions; |

| · | challenges related to hiring and retaining store employees at competitive wage rates; |

| · | our failure to prevent food safety and foodborne illness incidents; |

| · | shortages or interruptions in the supply or delivery of food products; |

| · | our dependence on a small number of suppliers and a single distribution company; |

| · | negative publicity relating to any one of our restaurants; |

| · | competition from other restaurant chains with significantly greater resources than we have; |

| · | changes in economic conditions, including the effects on consumer confidence and discretionary spending; |

| · | changes in consumer tastes and nutritional and dietary trends; |

| · | our inability to manage our growth; |

| · | our inability to maintain an adequate level of cash flow or access to capital to grow; |

| · | changes in management, loss of key personnel, and difficulty hiring and retaining skilled personnel; |

| · | labor shortages and increased labor costs; |

| · | our vulnerability to increased food, commodity, and energy costs; |

| · | the impact of governmental laws and regulations; |

| · | failure to obtain and maintain required licenses and permits to comply with food control regulations; |

| · | changes in economic conditions and adverse weather, and other unforeseen conditions, in regions where our restaurants are located; |

| · | inadequately protecting our intellectual property; |

| · | breaches of security of confidential consumer information; and |

| · | other factors discussed in the Company’s Annual Report on Form 10-K under “Business” and “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” |

We caution you that the factors referenced above may not contain all the important factors to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences we anticipate or affect us or our operations in the ways we expect. The forward-looking statements included in this report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as required by law. If we update one or more forward-looking statements, no inference should be made that we will make additional updates regarding those or other forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

From time to time, oral or written forward-looking statements are also included in our reports on Forms 10-K, 10-Q, and 8-K, our Schedule 14A, our press releases and other materials released to the public. Although we believe that at the time made, the expectations reflected in all of these forward-looking statements are and will be reasonable, any or all of the forward-looking statements may prove to be incorrect. This may occur due to inaccurate assumptions or due to known or unknown risks and uncertainties. Many factors discussed in this Quarterly Report on Form 10-Q, certain of which are beyond our control, will be important in determining our future performance. Consequently, actual results may differ materially from those anticipated from forward-looking statements. In light of these and other uncertainties, you should not regard the inclusion of a forward-looking statement in this Quarterly Report on Form 10-Q or other public communications that we might make as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent periodic reports filed with the Securities and Exchange Commission.

TABLE OF CONTENTS

PART I FINANCIAL INFORMATION

BT BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| | Unaudited | | | | |

| | July 2, 2023 | | | January 1, 2023 | |

ASSETS | | | | | | |

CURRENT ASSETS | | | | | | |

Cash and cash equivalents | | $ | 5,704,879 | | | $ | 2,150,578 | |

Marketable securities | | | 1,233,796 | | | | 5,994,295 | |

Receivables | | | 35,412 | | | | 76,948 | |

Inventory | | | 191,206 | | | | 158,351 | |

Prepaid expenses and other current assets | | | 58,140 | | | | 37,397 | |

Assets held for sale | | | 258,751 | | | | 446,524 | |

Total current assets | | | 7,482,184 | | | | 8,864,093 | |

| | | | | | | | |

PROPERTY, EQUIPMENT AND LEASEHOLD IMPROVEMENTS, NET | | | 3,276,683 | | | | 3,294,644 | |

OPERATING LEASES RIGHT-OF-USE ASSETS | | | 1,890,044 | | | | 2,004,673 | |

INVESTMENTS | | | 1,224,837 | | | | 1,369,186 | |

DEFERRED INCOME TAXES | | | 143,000 | | | | 61,000 | |

GOODWILL | | | 671,220 | | | | 671,220 | |

INTANGIBLE ASSETS, NET | | | 411,713 | | | | 453,978 | |

OTHER ASSETS, NET | | | 50,052 | | | | 50,903 | |

Total assets | | | | | | | | |

| | $ | 15,149,733 | | | $ | 16,769,697 | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | | | |

CURRENT LIABILITIES | | | | | | | | |

Accounts payable | | $ | 639,226 | | | $ | 448,605 | |

Broker margin loan | | | - | | | | 791,370 | |

Current maturities of long-term debt | | | 164,866 | | | | 167,616 | |

Current operating lease obligations | | | 286,114 | | | | 193,430 | |

Accrued expenses | | | 451,891 | | | | 532,520 | |

Total current liabilities | | | 1,542,097 | | | | 2,133,541 | |

| | | | | | | | |

LONG-TERM DEBT, LESS CURRENT PORTION | | | 2,374,705 | | | | 2,658,477 | |

NONCURRENT OPERATING LEASE OBLIGATIONS | | | 1,628,754 | | | | 1,825,057 | |

Total liabilities | | | 5,545,556 | | | | 6,617,075 | |

| | | | | | | | |

COMMITMENTS AND CONTINGENCIES | | | | | | | | |

| | | | | | | | |

SHAREHOLDERS' EQUITY | | | | | | | | |

Preferred stock, $0.001 par value, 2,000,000 shares authorized, | | | | | | | | |

no shares outstanding at July 2, 2023 and January 1, 2023 | | | - | | | | - | |

Common stock, $0.002 par value, 50,000,000 authorized, 6,246,118 | | | | | | | | |

issued and outstanding at July 2, 2023 and 6,396,118 issued | | | | | | | | |

and outstanding at January 1, 2023, respectively | | | 12,492 | | | | 12,792 | |

Less cost of 215,000 and 65,000 common shares held in Treasury | | | | | | | | |

at July 2, 2023 and January 1, 2023, respectively | | | (356,807 | ) | | | (106,882 | ) |

Additional paid-in capital | | | 11,486,535 | | | | 11,409,235 | |

Accumulated deficit | | | (1,538,043 | ) | | | (1,162,523 | ) |

| | | | | | | | |

Total shareholders' equity | | | 9,604,177 | | | | 10,152,622 | |

| | | | | | | | |

Total liabilities and shareholders' equity | | $ | 15,149,733 | | | $ | 16,769,697 | |

See Notes to Consolidated Condensed Financial Statements

BT BRANDS, INC. AND SUBSIDIARIES |

CONSOLIDATED STATEMENTS OF OPERATIONS |

(Unaudited) |

|

| | 26 Weeks Ended | | | 26 Weeks Ended, | | | 13 Weeks Ended, | | | 13 Weeks Ended, | |

| | July 2, 2023 | | | July 3, 2022 | | | July 2, 2023 | | | July 3, 2023 | |

SALES | | $ | 7,070,763 | | | $ | 5,598,076 | | | $ | 3,999,965 | | | $ | 3,524,881 | |

| | | | | | | | | | | | | | | | |

COSTS AND EXPENSES | | | | | | | | | | | | | | | | |

Restaurant operating expenses | | | | | | | | | | | | | | | | |

Food and paper costs | | | 2,898,498 | | | | 2,032,956 | | | | 1,608,175 | | | | 1,311,373 | |

Labor costs | | | 2,615,136 | | | | 1,786,828 | | | | 1,412,376 | | | | 1,179,118 | |

Occupancy costs | | | 505,861 | | | | 435,920 | | | | 148,736 | | | | 261,282 | |

Other operating expenses | | | 394,243 | | | | 332,181 | | | | 198,629 | | | | 212,314 | |

Depreciation and amortization expenses | | | 356,027 | | | | 178,701 | | | | 192,520 | | | | 109,286 | |

General and administrative expenses | | | 944,992 | | | | 746,717 | | | | 519,077 | | | | 455,656 | |

Gain on sale of assets | | | (313,688 | ) | | | - | | | | - | | | | - | |

Total costs and expenses | | | 7,401,069 | | | | 5,513,303 | | | | 4,079,513 | | | | 3,529,029 | |

Income (loss) from operations | | | (330,306 | ) | | | 84,773 | | | | (79,548 | ) | | | (4,148 | ) |

| | | | | | | | | | | | | | | | |

UNREALIZED GAIN (LOSS) ON MARKETABLE SECURITIES | | | (23,064 | ) | | | (80,238 | ) | | | (92,919 | ) | | | (80,238 | ) |

INTEREST AND OTHER INCOME | | | 90,810 | | | | 9,473 | | | | 1,761 | | | | 9,473 | |

INTEREST EXPENSE | | | (49,909 | ) | | | (54,461 | ) | | | (24,376 | ) | | | (26,190 | ) |

EQUITY IN NET LOSS OF AFFILIATE | | | (145,050 | ) | | | (14,172 | ) | | | (90,651 | ) | | | (14,172 | ) |

LOSS BEFORE TAXES | | | (457,520 | ) | | | (54,625 | ) | | | (285,734 | ) | | | (115,275 | ) |

INCOME TAX BENEFIT | | | 82,000 | | | | 5,000 | | | | 52,000 | | | | 23,000 | |

NET LOSS | | $ | (375,520 | ) | | $ | (49,625 | ) | | $ | (233,734 | ) | | $ | (92,275 | ) |

NET LOSS PER COMMON SHARE - Basic and Diluted | | $ | (0.06 | ) | | $ | (0.01 | ) | | $ | (0.04 | ) | | $ | (0.01 | ) |

| | | | | | | | | | | | | | | | |

WEIGHTED AVERAGE SHARES USED IN COMPUTING PER COMMON SHARE AMOUNTS - Basic and Diluted | | | 6,261,631 | | | | 6,458,276 | | | | 6,246,114 | | | | 6,461,118 | |

See Notes to Consolidated Condensed Financial Statements

BT BRANDS, INC. AND SUBSIDIARIES |

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY |

(Unaudited) |

| | | | | | | | | | | | | | | | | | |

For the 26-week periods- | | | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Treasury | | | | |

| | Shares | | | Amount | | | Capital | | | (Deficit) | | | Stock | | | Total | |

Balances, January 1, 2023 | | | 6,396,118 | | | $ | 12,792 | | | $ | 11,409,235 | | | $ | (1,162,523 | ) | | $ | (106,882 | ) | | $ | 10,152,622 | |

Stock-based compensation | | | - | | | | - | | | | 77,300 | | | | - | | | | - | | | | 77,300 | |

Treasury stock purchase | | | (150,000 | ) | | | (300 | ) | | | | | | | - | | | | (249,925 | ) | | | (250,225 | ) |

Net loss | | | - | | | | - | | | | - | | | | (375,520 | ) | | | - | | | | (375,520 | ) |

Balances, July 2, 2023 | | | 6,246,118 | | | $ | 12,492 | | | $ | 11,486,535 | | | $ | (1,538,043 | ) | | $ | (356,807 | ) | | $ | 9,604,177 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Balances, January 2, 2022 | | | 6,447,506 | | | $ | 12,895 | | | $ | 11,215,696 | | | $ | (600,238 | ) | | $ | - | | | $ | 10,628,353 | |

Stock-based compensation | | | - | | | | - | | | | 73,400 | | | | - | | | | - | | | | 73,400 | |

Shares issued in exercise of warrants | | | 13,612 | | | | 27 | | | | 74,839 | | | | - | | | | - | | | | 74,866 | |

Net loss | | | - | | | | - | | | | - | | | | (49,625 | ) | | | - | | | | (49,625 | ) |

Balances, July 3, 2022 | | | 6,461,118 | | | $ | 12,922 | | | $ | 11,363,935 | | | $ | (649,863 | ) | | $ | - | | | $ | 10,726,994 | |

For the 13-week periods- | | | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Treasury | | | | |

| | Shares | | | Amount | | | Capital | | | (Deficit) | | | Stock | | | Total | |

Balances, April 2, 2023 | | | 6,246,118 | | | $ | 12,492 | | | $ | 11,445,135 | | | $ | (1,304,309 | ) | | $ | (356,807 | ) | | $ | 9,796,511 | |

Stock-based compensation | | | - | | | | - | | | | 41,400 | | | | - | | | | - | | | | 41,400 | |

Net loss | | | - | | | | - | | | | - | | | | (233,734 | ) | | | - | | | | (233,734 | ) |

Balances, July 2, 2023 | | | 6,246,118 | | | $ | 12,492 | | | $ | 11,486,535 | | | $ | (1,538,043 | ) | | $ | (356,807 | ) | | $ | 9,604,177 | |

| | | | | Common Stock | | | Additional Paid-in | | | Accumulated | | | Treasury | | | | |

| | Shares | | | Amount | | | Capital | | | (Deficit) | | | Stock | | | Total | |

| | | | | | | | | | | | | | | | | | |

Balances, April 3, 2022 | | | 6,461,118 | | | $ | 12,922 | | | $ | 11,324,035 | | | $ | (557,588 | ) | | $ | - | | | $ | 10,779,369 | |

Stock-based compensation | | | - | | | | - | | | | 39,900 | | | | - | | | | - | | | | 39,900 | |

Net loss | | | - | | | | - | | | | - | | | | (92,275 | ) | | | - | | | | (92,275 | ) |

Balances, July 3, 2022 | | | 6,461,118 | | | $ | 12,922 | | | $ | 11,363,935 | | | $ | (649,863 | ) | | $ | - | | | $ | 10,726,994 | |

See Notes to Consolidated Condensed Financial Statements

BT BRANDS, INC. AND SUBSIDIARIES |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

(Unaudited) |

| | 26 Weeks ended, | |

| | July 2, 2023 | | | July 3, 2022 | |

CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

Net loss | | $ | (375,520 | ) | | $ | (49,625 | ) |

Adjustments to reconcile net loss to net cash | | | | | | | | |

provided (used) by operating activities- | | | | | | | | |

Depreciation and amortization | | | 356,027 | | | | 178,701 | |

Amortization of debt issuance premium included in interest expense | | | 2,700 | | | | 2,700 | |

Deferred taxes | | | (82,000 | ) | | | (67,490 | ) |

Stock-based compensation | | | 77,300 | | | | 73,400 | |

Unrealized loss on marketable securities | | | 23,064 | | | | 80,238 | |

Investment gains | | | (29,178 | ) | | | - | |

Loss on equity method investment | | | 145,050 | | | | 14,172 | |

Gain on sale of assets | | | (313,688 | ) | | | - | |

Non-cash operating lease expense | | | 10,309 | | | | - | |

Property tax liability settlement | | | (181,339 | ) | | | - | |

Changes in operating assets and liabilities, net of acquisitions - | | | | | | | | |

Receivables | | | 41,536 | | | | 36,183 | |

Inventory | | | (32,855 | ) | | | (33,833 | ) |

Prepaid expenses and other current assets | | | (20,743 | ) | | | (26,274 | ) |

Accounts payable | | | 166,879 | | | | 206,284 | |

Accrued expenses | | | 100,710 | | | | 284,700 | |

Income taxes payable | | | - | | | | (201,088 | ) |

Net cash provided (used) by operating activities | | | (111,747 | ) | | | 498,068 | |

| | | | | | | | |

CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

Acquisition of net assets of Keegan's Seafood Grille | | | - | | | | (1,150,000 | ) |

Acquisition of net assets of Pie In The Sky Coffee and Bakery | | | - | | | | (1,159,600 | )) |

Investment in Bagger Dave's Burger Tavern, Inc. | | | - | | | | (1,260,000 | ) |

Proceeds from sale of assets | | | 496,000 | | | | - | |

Purchase of property and equipment | | | (265,747 | ) | | | (159,491 | ) |

Investment in related company | | | - | | | | (229,000 | ) |

Purchase of marketable securities | | | (1,091,736 | ) | | | (607,988 | ) |

Proceeds from the sale of marketable securities | | | 5,858,348 | | | | - | |

Other assets | | | - | | | | (12,500 | ) |

Net cash provided by (used) in investing activities | | | 4,996,865 | | | | (4,578,579 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

Repayment of broker margin loan | | | (791,370 | ) | | | - | |

Principal payment on long-term debt | | | (289,222 | ) | | | (84,035 | ) |

Proceeds from exercise of common stock warrants | | | - | | | | 74,866 | |

Purchase of treasury shares | | | (250,225 | ) | | | - | |

Net cash used in financing activities | | | (1,330,817 | ) | | | (9,169 | ) |

| | | | | | | | |

CHANGE IN CASH and CASH EQUIVALENTS | | | 3,554,301 | | | | (4,089,680 | ) |

| | | | | | | | |

CASH and CASH EQUIVALVENTS, BEGINNING OF PERIOD | | | 2,150,578 | | | | 12,385,632 | |

| | | | | | | - | |

CASH AND CASH EQUIVALENTS, END OF PERIOD | | $ | 5,704,879 | | | $ | 8,295,952 | |

| | | | | | | | |

SUPPLEMENTAL DISCLOSURES | | | | | | | | |

Cash paid for interest | | $ | 47,209 | | | $ | 51,761 | |

Cash paid for income taxes | | $ | - | | | $ | 209,088 | |

Purchase of property and equipment included in accounts payable | | $ | 23,742 | | | $ | - | |

See Notes to Consolidated Financial Statements

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements include the accounts of BT Brands, Inc., and its subsidiaries (the “Company,” “we,” “our,” “us,” or “BT Brands”) and have been prepared in accordance with the U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. All intercompany accounts and transactions have been eliminated in consolidation and have been prepared on a basis consistent in all material respects with the accounting policies for the fiscal year ending January 1, 2023. In our opinion, all adjustments, which are normal and recurring in nature, necessary for a fair presentation of our financial position and results of operation have been included. Operating results for interim periods are not necessarily indicative of the results that may be expected for a full fiscal year.

The accompanying Condensed Consolidated Balance Sheet, as of July 2, 2023, does not include all the disclosures required by GAAP. Accordingly, these interim condensed consolidated financial statements should be read in conjunction with the consolidated financial statements as of January 1, 2023, and the related notes thereto included in the Company’s Form 10-K for the fiscal year ended January 1, 2023.

Use of Estimates

The preparation of condensed consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates, and the differences could be material.

The Company

BT Brands, Inc. (the “Company”) was incorporated as Hartmax of NY Inc. on January 19, 2016. Effective July 30, 2018, the Company acquired 100% of BTND, LLC.

We operate restaurants in the eastern two-thirds of the United States. As of July 2, 2023, including our 41.2% owned Bagger Dave’s business, we operated eighteen restaurants comprising the following:

| · | Eight Burger Time fast-food restaurants and one Dairy Queen franchise located in the North Central region of the United States, collectively (“BTND”); |

| · | Bagger Dave’s Burger Tavern, Inc, a 41.2% owned affiliate, operates six Bagger Dave’s restaurants in Michigan, Ohio, and Indiana (“Bagger Dave’s”); |

| · | Keegan’s Seafood Grille in Indian Rocks Beach, Florida (“Keegan’s”); |

| · | Pie In The Sky Coffee and Bakery in Woods Hole, Massachusetts (“PIE”). |

| · | Village Bier Garten is a German-themed restaurant, bar, and entertainment venue in Cocoa, Florida (“VBG”). |

Our Dairy Queen store is operated under a franchise agreement with International Dairy Queen. We pay royalty and advertising payments to the franchisor as required by the franchise agreement.

Fiscal Year Period

Our fiscal year is a 52/53-week year, ending on Sunday, closest to December 31. Most years consist of four 13-week accounting periods comprising the 52-week year. All references to years in this report refer to the 13-week periods in the respective fiscal year periods. The fiscal year 2023 is 52 weeks ending December 31, 2023.

Cash and Cash Equivalents

For purposes of reporting cash and cash flows, cash and cash equivalents includes money market funds and is net of outstanding checks and includes amounts on deposit at banks and deposits in transit and excludes transfers out in transit and includes brokerage account money market funds which are not insured deposits.

Fair Value of Financial Instruments

The Company’s accounting for fair value measurements of assets and liabilities, including available-for-sale securities, is that they are recognized or disclosed at fair value in the statements on a recurring or nonrecurring basis, adhere to the Financial Accounting Standards Board (FASB) fair value hierarchy that prioritizes the input to valuation techniques used to measure fair value.

The hierarchy prioritizes unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to measurements involving significant unobservable inputs (Level 3 measurements).

The three levels of the fair value hierarchy are as follows:

| · | Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company can access at the measurement date. |

| | |

| · | Level 2 inputs are inputs other than quoted prices included in Level 1 inputs that are observable for the asset or liability, either directly or indirectly, for substantially the entire term of the asset or liability. |

| | |

| · | Level 3 Inputs are unobservable inputs for the asset or liability. |

The level in the fair value hierarchy within which a fair measurement in its entirety falls is based on the lowest level input that is significant to fair value measurement in its entirety.

The carrying values of cash, receivables, accounts payable and other financial working capital items approximate fair value due to the short maturity nature of these instruments.

On July 2, 2023, the cost of marketable securities includes a bond fund at a cost of $416,570 and common stocks at a cost of $978,040 for a total cost of $1,394,610 prior to a mark-to-market reduction of $160,814. At January 1, 2023, the fair value of Level 1 investments included common stocks of $713,900 and a corporate bond exchange-traded fund (ETF) of $316,000, a total carrying value of $1,029,900, net of an unrealized mark-to-market loss of $86,422. These investments are reflected in the accompanying financial statements at July 2, 2023, at the level-one quoted market price in an active market of $1,233,796.

Investments

Noncurrent investments at July 2, 2023, include our net equity method investment of $920,837 in Bagger Dave’s and our $304,000 total investment in NGI Corporation. (NGI). In 2020, the Company received equity ownership in NGI as consideration for a loan to NGI. Upon repayment of the loan to NGI, $75,000 was attributed by us to the value of the equity received, which was reflected as additional interest income in 2020. The fair value determined in 2020 continues to be reflected as the value of the investment. On February 12, 2022, we invested $229,000 in Series A1 8% Cumulative Convertible Preferred Stock of NGI, including a five-year warrant to purchase 34,697 common shares of NGI at $1.65 per share. See also Note 8.

Bagger Dave’s common stock is traded on the OTC Pink Sheets market and files quarterly and annual financial reports with OTCMarkets, Inc. under the Alternative Reporting Standard. The listing with OTC Markets does not require the information to be audited. For the thirteen weeks ended June 25, 2023, Bagger Dave’s had sales of $1,966,644 and a net loss of $230,844 and for the 26 weeks in 2023 Bagger Dave's sales were approximately $3,981,000 and the year to date loss was $352,000. For the 26-week period, our 41.2% equity share in the loss was approximately $145,050 and is included in the accompanying statement of operations.

Investments also includes 1,421,647 shares of Noble Roman's, Inc. with a cost and market value of approximately $300,000 representing approximately 6.4% ownership of Noble Roman's. During the third quarter the company was unsuccessful in its effect to have its CEO, Gary Copperud elected to the Noble Roman's board of directors.

Receivables

Receivables consist mainly of estimated rebates due from a primary vendor.

Inventory

Inventory consists of food, beverages and supplies and is stated at a lower of cost (first-in, first-out method) or net realizable value.

Property and Equipment

Property and equipment are stated at cost. Depreciation is computed using the straight-line method over the estimated useful lives, ranging from three to thirty years.

The Company reviews long-lived assets to determine if the carrying value of these assets is recoverable based on estimated cash flows. Assets are evaluated at the lowest level, for which cash flows can be identified at the restaurant level. In determining future cash flows, estimates are made by the Company for future operating results of each restaurant. If such assets are considered impaired, the impairment to be recognized is measured by the amount by which the carrying value of the assets exceeds the fair value of the assets.

Land, building and equipment, operating right of use assets and certain other assets, including definite-lived intangible assets, are reviewed regularly for impairment and whenever events or circumstances indicate that the carrying amount of an asset may not be recoverable. Recoverability is measured by comparison of the carrying amount of the assets to the future undiscounted net cash flow expected to be generated and is determined at the restaurant level. If an asset is determined to be impaired, the recognized impairment is measured by the amount by which the carrying amount of the asset exceeds the fair value.

Impairment and Disposal of Long-Lived Assets

We closed the Burger Time store in West St. Paul in 2022 and the Richmond, Indiana, store in 2018. The West St. Paul location sale was completed in February of 2023 for a gain of $313,688. The Richmond location is currently offered for sale. We believe the Richmond property will be sold at or above its current carrying value. In the second quarter of 2023, we completed the disposition of the St. Louis property in lieu of unpaid property taxes resulting in an elimination of approximately $180,000 of previously accrued property taxes which is reflected as a reduction of occupancy costs.

Income Taxes

We provide for income taxes under (Accounting Standards Codification (ASC), 740), Accounting for Income Taxes. ASC 740 uses an asset and liability approach in accounting for income taxes. Deferred tax asset and liability account balances are determined based on differences between the financial reporting and tax bases of assets and liabilities. They are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company provides a valuation allowance, if necessary, to reduce deferred tax assets to their estimated realizable value. The deferred tax assets are reviewed periodically for recoverability, and valuation allowances are adjusted as necessary. As of July 2, 2023, the Company estimates a current tax provision at the statutory rate of approximately 27.5%

The Company has no accrued interest or penalties relating to income tax obligations. The Company has no federal or state examinations in progress, nor has it had any federal or state tax examinations since its inception. All periods since inception remain open for inspection.

Per Common Share Amounts

Net income per common share is computed by dividing net income or loss by the weighted average number of shares of common stock outstanding during the period. Diluted net income per share is calculated by dividing net income by the weighted average number of shares of common stock and potentially outstanding shares of common stock during each period. Common stock equivalents are excluded from the computation of diluted per-share amounts if their effect is anti-dilutive. There were no dilutive shares for the periods ending in 2023 and 2022.

Goodwill, Other Intangible Assets and Other Assets

Goodwill is not amortized. Goodwill is tested for impairment at least annually. The cost of other intangible assets is amortized over the expected useful life. Other assets include the allocated fair value of the acquired Dairy Queen franchise agreement related to our location in Ham Lake, Minnesota, which is amortized over an estimated useful life of 14 years.

NOTE 2 – INTANGIBLE ASSETS

At July 2, 2023, the value of Intangible Assets are as follows:

| | Estimated Useful Life (Years) | | | Original Cost | | | Accumulated Amortization | | | Net Carrying Value | |

Covenants not to Compete | | | 3 | | | $ | 98,000 | | | $ | (41,110 | ) | | $ | 56,890 | |

Trademarks | | | 15 | | | | 393,000 | | | | (38,177 | ) | | | 354,823 | |

| | | | | | $ | 491,000 | | | $ | (79,287 | ) | | $ | 411,713 | |

Tradename assets are being amortized over 15 years at $26,000 in amortization expense per year. The total amortization of intangible assets, including the covenants not to compete, will approximate $58,900 in 2023 and 2024, $40,500 in 2025, $26,200 per year thereafter for the following six years and approximately $7,500 in 2037.

Total amortization expense for the 2023 13-week period was $14,718, and for the 26-week period ended July 2, 2023 was $42,265

NOTE 3 – PROPERTY AND EQUIPMENT

Property and equipment consisted of the following:

| | July 2, 2023 | | | January 1, 2023 | |

Land | | $ | 435,239 | | | $ | 485,239 | |

Equipment | | | 3,842,834 | | | | 3,893,274 | |

Buildings and leasehold improvements | | | 2,421,521 | | | | 2,402,157 | |

| | | | | | | | |

Total property and equipment | | | 6,699,594 | | | | 6,780,670 | |

Accumulated depreciation | | | (3,164,160 | ) | | | (3,039,500 | ) |

Less - property held for sale | | | (258,751 | ) | | | (446,526 | ) |

Net property and equipment | | $ | 3,276,683 | | | $ | 3,294,644 | |

Depreciation expense for the 13-week periods in 2023 and 2022 was $192,520 and $109,286, respectively; for the 26-week periods in 2023 and 2022 was $312,911 and $177,676, respectively.

NOTE 4 - ACCRUED EXPENSES

Accrued expenses consisted of the following at:

| | July 2, 2023 | | | January 1, 2023 | |

Accrued real estate taxes | | $ | 29,747 | | | $ | 202,436 | |

Accrued bonus compensation | | | 67,472 | | | | 59,139 | |

Accrued payroll and payroll taxes | | | 199,674 | | | | 156,245 | |

Accrued sales taxes payable | | | 125,921 | | | | 70,270 | |

Accrued vacation pay | | | 17,663 | | | | 17,663 | |

Accrued gift card liability | | | 11,414 | | | | 25,965 | |

Other accrued expenses | | | - | | | | 802 | |

| | $ | 451,891 | | | $ | 532,520 | |

NOTE 5 - LONG TERM DEBT

Our long-term debt is as follows:

| | July 2, 2023 | | | January 1, 2023 | |

| | | | | | |

Three notes payable to a bank dated June 28, 2021, due in monthly installments totaling $22,213, including principal and interest at a fixed rate of 3.45% through June 28, 2031. Beginning in July 2031, the interest rate will be equal to the greater of the “prime rate” plus .75%, or 3.45%. These notes mature on June 28, 2036. The notes are secured by mortgages covering ten BTND operating locations. BT Brands, Inc. and a shareholder of the Company guarantee the notes. | | $ | 2,578,011 | | | $ | 2,864,484 | |

| | | | | | | | |

Minnesota Small Business Emergency Loan dated April 29, 2020, payable in monthly installments of $458.33 beginning December 15, 2020, including principal and interest at 0%. This note is secured by the personal guarantee of a shareholder of the Company. Pursuant to the terms of the loan, $13,750 of the loan was forgiven on June 22, 2022 | | | 458 | | | | 3,208 | |

Total | | | 2,578,469 | | | | 2,867,692 | |

Less - unamortized debt issuance costs | | | (38,899 | ) | | | (41,599 | ) |

Current maturities | | | (164,866 | ) | | | (167,616 | ) |

| | $ | 2,374,705 | | | $ | 2,658,477 | |

NOTE 6 - STOCK-BASED COMPENSATION

In 2019, we adopted the BT Brands, Inc 2019 Incentive Plan (the “Plan”), under which the Company may grant stock options, stock appreciation rights, restricted stock, restricted stock units, performance shares, performance stock units, and other stock and cash awards to eligible participants. As of July 2, 2023, there were 529,750 shares available for grant under the Plan.

Compensation expense equal to the fair value of the options at the grant date is recognized in general and administrative expense over the applicable service period. Total equity-based compensation expense through the second quarter of 2023 was $77,300 and $73,400 through the second quarter of 2022, and $41,300 and $9,500, respectively, related to the Contingent Share Award described below. Based on current estimates, we project that approximately $180,000 in stock-based compensation expense for current grants will be recognized over the next three years at approximately $60,000 per year.

As outlined in each agreement, stock options granted to employees and directors vest over four years in annual installments. Options expire ten years from the date of the grant. Compensation expense equal to the fair value of the options at the grant date is recognized in general and administrative expense over the applicable service period.

We utilize the Black-Scholes option pricing model when determining the compensation cost associated with stock options issued using the following significant assumptions:

| · | Stock price – Published trading market values of the Company’s common stock as of the grant date. |

| · | Exercise price – The stated exercise price of the stock option. |

| · | Expected life – The simplified method |

| · | Expected dividend – The rate of dividends expected to be paid over the term of the stock option. |

| · · | Volatility – Estimated volatility. Risk-free interest rate – The daily United States Treasury yield curve rate corresponding to the expected life of the award |

Information regarding our stock options is summarized below:

| | Number of Options | | | Weighted Average Exercise Price | | | Weighted Average Remaining Term (In Years) | | | Aggregate Intrinsic Value | |

Options outstanding at January 1, 2023 | | | 220,250 | | | $ | 2.74 | | | | 9.0 | | | $ | 0 | |

Granted | | | 0 | | | | 0 | | | | | | | | | |

Exercised | | | 0 | | | | 0 | | | | | | | | | |

Canceled, forfeited, or expired | | | 0 | | | | 0 | | | | | | | | | |

Options outstanding at July 2, 2023 | | | 220,250 | | | $ | 2.74 | | | | 8.5 | | | $ | 0 | |

Options exercisable at July 2, 2023 | | | 94,950 | | | $ | 3.18 | | | | 8.5 | | | $ | 0 | |

On February 27, 2023, the Company finalized a Contingent Incentive Share Award with senior executives. The Contingent Share Awards provides that so long as the Company’s publicly traded warrants are outstanding, senior management of the Company will be deemed to earn an aggregate award of 250,000 shares of common stock as an award upon the Company’s share price reaching $8.50 per share for 20 consecutive trading days, provided, however, participants must be employed by the Company at the time the Incentive Shares are earned. The estimated fair value of the plan is $1.00 per share, and $250,000 of compensation expense will be recognized over the remaining 2.1 years available under the Plan and $41,300 of stock-based compensation was recognized for this Agreement for the 26-week period of 2023. We utilized a lattice model when determining the fair value of the Contingent Incentive Share Awards. Assumptions utilized in the model include a risk-free rate of 4.4% and volatility of 63%.

NOTE 7 – LEASES

With the acquisition of Keegan’s net assets, we entered into a lease for approximately 2,800 square feet of restaurant space. The 131-month Keegan’s lease provides for an initial rent of $5,000 per month with an annual escalation equal to the greater of 3% or the Consumer Price Index. The lease is being accounted for as an operating lease. At the inception of the lease, we recorded an operating lease obligation and a right-of-use asset of $624,000. The present value discounted at 4% of the remaining lease obligation of $539,919 is reflected as a liability in the accompanying financial statements.

Keegan’s lease does not provide an implicit interest rate; we used our incremental borrowing rate of 4% to determine the present value. The incremental borrowing rate represents an estimate of the interest rate we would incur at lease commencement to borrow an amount equal to the lease payments on a collateralized basis over the lease term. Variable lease costs consist primarily of property taxes, insurance, certain utility expenses, and sales tax.

Upon acquiring PIE assets, we leased approximately 3,500 square feet of restaurant and bakery production space. The terms of the 60-month lease provide for an initial rent of $10,000 per month with an annual escalation of after 24 months of 5%. The PIE lease includes three five-year renewal option periods. The PIE lease is accounted for as an operating lease. At the inception of the lease, we recorded an operating lease obligation and a right-of-use asset of $1,055,000. The present value discounted at 5% of the remaining lease obligation of $951,227 is reflected as a liability in the accompanying financial statements.

The PIE lease did not provide an implicit interest rate; we used our estimated incremental borrowing rate of 5% to determine the present value of future lease payments. The incremental borrowing rate represents an estimate of the interest rate we would incur at lease commencement to borrow an amount equal to the lease payments on a collateralized basis over the lease term. Variable lease costs consist primarily of property taxes, insurance, certain utility expenses, and sales tax.

With the acquisition of assets of Village Bier Garten, we entered into a five-year lease with the seller for approximately 3,000 square feet of restaurant space and access to an additional 3,000 square feet of shared entertainment and seating area. The terms of the triple-net 60-month provide for an initial rent of $8,200 per month with an annual escalation of 3%. The VBG lease includes three five-year renewal option periods. The VBG lease does not provide an implicit interest rate; we used our estimated incremental borrowing rate of 4.5% to determine the present value of future lease payments. The incremental borrowing rate represents an estimate of the interest rate we would incur at lease commencement to borrow an amount equal to the lease payments on a collateralized basis over the lease term. Variable lease costs consist primarily of property taxes, insurance, certain utility expenses, and sales tax.

The VBG lease is accounted for as an operating lease. At the inception of the lease, we recorded an operating lease obligation and a right-of-use asset of $469,949. The present value, discounted at 4.5% of the remaining lease obligation of $423,722, is reflected as a liability in the accompanying financial statements.

Following is a schedule of the approximate minimum future lease payments on the operating leases as of July 2, 2023:

| | Total | |

Remainder 2023 | | $ | 141,576 | |

2024 | | | 289,076 | |

2025 | | | 297,745 | |

2026 | | | 306,674 | |

2027 | | | 268,437 | |

2028 and thereafter | | | 1,039,438 | |

Total future minimum lease payments | | | 2,342,966 | |

Less - interest | | | (428,098 | ) |

| | $ | 1,914,868 | |

The Company is a party to a month-to-month land lease agreement for one of its Burger Time locations. The net book value of the building on this land is approximately $18,500. The monthly lease payment is $1,800 plus the cost of property taxes.

The weighted average remaining lease term is approximately 5.6 years.

The Company also pays monthly rent, under month-to-month arrangements, for corporate and administrative office spaces in West Fargo, North Dakota, and Minnetonka, Minnesota, for a combined monthly rent of approximately $2,200.

The total operating lease expense for the 26-week and 13-week period in 2023 was $223,589 and $97,887 respectively Cash paid for leases during the 26-week period in 2023 totaled $141,426, and variable expenses for leased properties were approximately $28,500.

NOTE 8 - RELATED PARTY TRANSACTION

NGI Corporation

Our CEO and CFO also serve as Chairman and CFO, respectively, of NGI Corporation (NGI). BT Brands owns 330,418 common shares and holds warrants to purchase 358,000 common shares at $1.00, expiring March 31, 2028, and 34,697 warrants to purchase additional shares at $1.65 of NGI. We received 179,000 shares of common stock in NGI as consideration for modifying a note that was subsequently paid. The common stock and warrants received in the note modification transaction were recorded at a value determined by BT Brands of $75,000. The investment in NGI does not have a readily determinable market value. Therefore, it is carried at a cost determined by BT Brands.

NOTE 9 – CONTINGENCIES

In the course of its business, the Company may be a party to claims and legal or regulatory actions arising from its business. However, we are unaware of any significant asserted or potential claims that could impact our financial position.

RESULTS OF OPERATION

The following discussion of the financial condition, results of operations, liquidity and capital resources of BT Brands, Inc. and its wholly-owned subsidiaries (together, the “Company”) should be read in conjunction with the Company’s condensed consolidated financial statements and accompanying notes included under Part I, Item 1 of this quarterly report on Form 10-Q, as well as with the audited consolidated financial statements and accompanying notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations included in the Company’s annual report on Form 10-K for the year ended January 1, 2023.

Introduction

As of July 2, 2023, including our partially owned Bagger Dave’s business, we owned and operated eighteen restaurants comprising the following:

| · | Eight Burger Time fast-food restaurants and one Dairy Queen franchise (“BTND”); |

| · | Village Bier Garten is a German-themed restaurant, bar, and entertainment venue in Cocoa, Florida (“VBG”): |

| · | Keegan’s Seafood Grille in Indian Rocks Beach, Florida (“Keegan’s”); |

| · | Pie In The Sky Coffee and Bakery in Woods Hole, Massachusetts (“PIE”). |

| · | Unconsolidated affiliate Bagger Dave’s Burger Tavern, Inc, 41.2% owned, operates six Bagger Dave’s restaurants in Michigan, Ohio, and Indiana (“BD”). |

Burger Time opened its first restaurant in Fargo, North Dakota, in 1987. Burger Time restaurants feature grilled hamburgers and other affordable foods such as chicken sandwiches, pulled pork sandwiches, sides, and soft drinks. Burger Time’s operating principles include (i) offering bigger burgers and more value for the money; (ii) offering a limited menu to permit attention to quality and speed of preparation; (iii) providing fast service by way of single and double drive-thru designs and a point-of-sale system that expedites the ordering and preparation process, and (iv) great tasting and quality food made fresh to order at a fair price. Our primary strategy is to serve the drive-thru and take-out segment of the quick-service restaurant industry.

The average customer transaction price at our Burger Time restaurants increased by approximately 20% in fiscal 2023 compared to 2022 and currently is about $15.60. This recent increase is principally the result of menu price increases implemented in 2022. Many factors influence our sales trends. Our business environment is challenging as competition is intense.

We operate through a central management organization that provides continuity across our restaurant base by utilizing the efficiencies of a central management team.

Notable Recent Events

Our recent acquisitions have allowed us to diversify our operations into new restaurant segments and new geographic regions, reducing our dependency on the financial performance of our Burger Time restaurants. During the 2022 fiscal year, we acquired three operating restaurants and a 41.2% ownership interest in BD, an operator of six casual restaurants. We expect to consider new acquisition opportunities in the future.

Material Trends and Uncertainties

Industry trends have a direct impact on our business. Current trends include difficulties attracting food service workers and rapid inflation in the cost of input items. Recent trends also include the rapidly changing area of technology and food delivery. The major companies in the restaurant industry have rapidly adopted and developed smartphone and mobile delivery applications, aggressively expanded drive-through operations, and developed loyalty programs and database marketing supported by a robust technology platform. We expect these trends to continue as restaurants aggressively compete for customers. Competitors will continue to discount prices through aggressive promotions.

Food costs have increased over the last two years, and we expect to see some moderating inflationary pressure during the remainder of 2023. Beef and egg costs have trended down slightly in 2023. Given the competitive nature of the restaurant industry, it may be challenging to raise menu prices to cover cost increases fully. As a result, future margin improvements may be difficult to achieve. Margin improvement will be achieved through operational enhancements, equipment advances, and increased volumes offsetting food cost increases.

Labor is a critical factor in operating our stores. Securing staff to run our locations at full capacity has become more challenging in most areas where we operate our restaurants. The current labor market has resulted in higher wages as the competition for employees intensifies, not only in the restaurant industry but in practically all retail and service industries. To succeed, we must identify, develop and retain quality employees.

Result of operations for the 13 weeks ending July 2, 2023, compared to the 13 weeks ending July 3, 2022.

The following table sets forth, for the periods indicated, our Consolidated Statements of Operations expressed as a percentage of total revenues. The percentages may not reconcile because of rounding.

| | 13 weeks ended, July 2, 2023 | | | 13 weeks ended, July 3, 2022 | |

| | Amount | | | % | | | Amount | | | % | |

SALES | | $ | 3,999,965 | | | | 100.0 | % | | $ | 3,524,881 | | | | 100.0 | % |

COSTS AND EXPENSES | | | | | | | | | | | | | | | | |

Restaurant operating expenses | | | | | | | | | | | | | | | | |

Food and paper costs | | | 1,608,175 | | | | 40.2 | | | | 1,311,373 | | | | 37.2 | |

Labor costs | | | 1,412,376 | | | | 35.3 | | | | 1,179,118 | | | | 33.5 | |

Occupancy costs | | | 148,736 | | | | 3.7 | | | | 261,282 | | | | 7.4 | |

Other operating expenses | | | 198,629 | | | | 5.0 | | | | 212,314 | | | | 6.0 | |

Depreciation and amortization | | | 192,520 | | | | 4.8 | | | | 109,286 | | | | 3.1 | |

General and administrative | | | 519,077 | | | | 13.0 | | | | 455,656 | | | | 12.9 | |

Total costs and expenses | | | 4,079,513 | | | | 102.0 | | | | 3,529,029 | | | | 100.1 | |

Income (loss) from operations | | | (79,548 | ) | | | (2.0 | ) | | | (4,148 | ) | | | (0.1 | ) |

UNREALIZED GAIN ON MARKETABLE SECURITIES | | | (92,920 | ) | | | (2.3 | ) | | | (80,238 | ) | | | (2.3 | ) |

INTEREST AND OTHER INCOME | | | 1,761 | | | | 0 | | | | 9,473 | | | | .3 | |

INTEREST EXPENSE | | | (24,376 | ) | | | (0.6 | ) | | | (26,190 | ) | | | (.7 | ) |

EQUITY IN AFFILIATE LOSS | | | (90,651 | ) | | | (2.3 | ) | | | (14,172 | ) | | | (.4 | ) |

INCOME TAX BENEFIT | | | 52,000 | | | | 1.3 | | | | 23,000 | | | | .6 | |

NET (LOSS) | | $ | (233,734 | ) | | | (5.8 | )% | | $ | (92,275 | ) | | | (2.6 | )% |

Net Revenues:

Net sales for the second quarter of 2023 increased $475,084 or 13.5% to $3,999,965 from $3,524,881 in 2022. The sales increase resulted from acquiring three restaurants in 2022, contributing $2,025,000 in revenue during the quarter. Sales also reflect the closing of the West St Paul Burger Time location in the fourth quarter of 2022.

For BTND locations open at quarter-end, second-quarter restaurant sales ranged from a low of $113,000 to a high of $333,000. The average sales for each Burger Time unit open at quarter-end were approximately $225,000 in 2023, an increase of approximately 2.94% from $219,000 in 2022.

Restaurant Operating Costs:

During 2023, restaurant operating costs (which refer to all the costs associated with operating our restaurants but do not include general and administrative expenses and depreciation and amortization and the gain on the sale of property and equipment) increased to 84.2% in restaurant sales in 2023 from 84.1% in 2022. For all of our locations, we continued to see price inflation on input costs, including food and labor, and the matters discussed in the “Cost of Sales,” “Labor Costs,” and “Occupancy and Other Operating Costs” sections below.

The impact of cost increases and the addition of three non-BTND restaurants during the year may be detailed as follows:

Restaurant operating costs for the period ended July 3, 2022 | | $ | 2,964,087 | |

Increase in food and paper costs | | | 296,802 | |

Increase in labor costs | | | 233,258 | |

Decrease in occupancy and operating cost | | | (126,231 | ) |

Restaurant operating costs for the periods ended July 2, 2023 | | $ | 3,367,916 | |

Costs of Sales - food and paper:

Cost of sales - food and paper - for 2023 increased to 40.2% of restaurant sales from 37.2% of restaurant sales in 2022. For all of our locations, we continued to see price inflation on input costs, including food costs, where ground beef costs are approximately 40% higher compared to the second quarter of 2022. The increase also results from including Keegan’s, which operates at a higher food cost than our remaining stores. This overall increase is offset by results from PIE which, because of its coffee-focused menu, has significantly lower food and paper costs than BTND, Keegan’s and Village Bier Garten.

Labor Costs:

In 2023, labor and benefits cost increased to 35.3% of restaurant sales from 33.5% in 2022. The increase is the net result of higher BTND activity in 2023 and higher wages because of labor shortages in some of our markets, contributing to an unfavorable utilization of the fixed portion of labor costs. PIE and Keegan’s businesses run at higher labor costs than BTND. We benefit from minimal turnover in unit restaurant management. Payroll costs are semi-variable, meaning that they do not decrease proportionally to decreases in revenue; thus, they increase as a percentage of restaurant sales when there is a decrease in restaurant sales.

Occupancy and Other Operating Costs:

For 2023, occupancy and other costs decreased to 8.7% of sales or $347,365 compared to $473,596, or 13.4% of restaurant sales in 2022, principally because of a reversal in previously accrued property taxes related to a property in St. Louis, Missouri. The property was deeded to the taxing authority in lieu of payment and any further liability. These costs were also impacted by three new leased restaurant locations added in 2022, which operate at a higher occupancy cost than our BTND locations, where we own most of the real estate.

Depreciation and Amortization Costs:

For 2023, depreciation and amortization costs increased by $83,234 to $192,520 (4.8% of sales) from $109,286 (3.1% of sales) in 2022. Depreciation and amortization costs increased principally due to the purchase of three restaurants during 2022 for approximately $2.4 million and capital additions in the last two years, including major parking lot repairs and significant replacement of HVAC equipment at several locations. These capital additions offset the decrease in depreciation and amortization resulting from a significant amount of our equipment reaching a fully depreciated status.

General and Administrative Costs

General and administrative costs in 2023 increased 0.1% of sales, or $63,421, to $519,077 (13.0%) from $455,656 (12.9% of sales) in 2022. The dollar amount increase was due to our acquiring three businesses during 2022 and the ongoing costs of operating as a public company, including administrative salaries and audit expenses.

Income (loss) from Operations:

The loss from operations was $79,548 in 2023 compared to a loss of $4,148 in 2022. The change in income from operations in 2023 compared to 2022 was primarily due to the decline in BTND sales and poor margins at Keegan’s, together with other matters discussed in the “Net Revenues,” “General and Administrative Costs,” and “Restaurant Operating Costs,” sections above.

Interest expense:

In 2023, our interest expense decreased by $1,814 to $24,376 (0.6% of restaurant sales) from $26,190 (1.4% of restaurant sales) in 2022. The decrease in the percentage of sales is due to the sales from the newly acquired businesses in 2022. The actual dollar value only decreased slightly.

Interest, Dividends and Other Income:

Interest and dividend income was $1,761 in 2023, resulting from income earned on the Company’s available cash balance.

Net Income (loss):

The net loss was $285,734 in 2023, compared to a net loss of $115,275 in 2022. The change in 2023 from 2022 was primarily attributable to the matters discussed in the “Net Revenues,” “Restaurant Operating Costs,” “General and Administrative Costs,” and “Other Income” sections.

Result of operations for the 26 weeks ending July 2, 2023, compared to the 26 weeks ending July 3, 2022.

The following table sets forth, for the periods indicated, our Consolidated Statements of Operations expressed as a percentage of total revenues. The percentages may not add because of rounding.

| | 26 weeks ended, July 2, 2023 | | | 26 weeks ended, July 3, 2022 | |

| | Amount | | | % | | | Amount | | | % | |

SALES | | $ | 7,070,763 | | | | 100.0 | % | | $ | 5,598,076 | | | | 100.0 | % |

COSTS AND EXPENSES | | | | | | | | | | | | | | | | |

Restaurant operating expenses | | | | | | | | | | | | | | | | |

Food and paper costs | | | 2,898,498 | | | | 41.0 | | | | 2,032,956 | | | | 36.3 | |

Labor costs | | | 2,615,136 | | | | 37.0 | | | | 1,786,828 | | | | 31.9 | |

Occupancy costs | | | 505,861 | | | | 7.2 | | | | 435,920 | | | | 7.8 | |

Other operating expenses | | | 394,243 | | | | 5.6 | | | | 332,181 | | | | 5.9 | |

Depreciation and amortization | | | 356,027 | | | | 5.0 | | | | 178,701 | | | | 3.2 | |

Gain on sale of assets held for sale | | | (313,688 | ) | | | (4.4 | ) | | | - | | | | - | |

General and administrative | | | 944,992 | | | | 13.4 | | | | 746,717 | | | | 13.3 | |

Total costs and expenses | | | 7,401,069 | | | | 104.7 | | | | 5,513,303 | | | | 98.5 | |

Income (loss) from operations | | | (330,406 | ) | | | (4.7 | ) | | | 84,773 | | | | 1.5 | |

UNREALIZED LOSS ON MARKETABLE SECURITIES | | | (23,064 | ) | | | (.3 | ) | | | (80,238 | ) | | | (1.7 | ) |

INTEREST AND OTHER INCOME | | | 90,809 | | | | 1.3 | | | | 9,473 | | | | .2 | |

INTEREST EXPENSE | | | (49,909 | ) | | | (.7 | ) | | | (54,461 | ) | | | (1.0 | ) |

EQUITY IN AFFILIATE LOSS | | | (145,050 | ) | | | (2.1 | ) | | | (14,172 | ) | | | - | |

INCOME TAX (EXPENSE) BENEFIT | | | 82,000 | | | | 1.2 | | | | 5,000 | | | | .1 | |

NET (LOSS) | | $ | (375,520 | ) | | | (5.3 | )% | | $ | (49,625 | ) | | | (0.9 | )% |

Net Revenues:

Net sales for 26-week period representing the first half of fiscal 2023 increased $1,472,687 or 26.3% to $7,070,763 from $5,598,076 in fiscal 2022. The increase in sales was principally the result of a favorable impact in the 26 weeks of three acquired restaurants which contributed for a partial period in 2022 and contributed a total of approximately $3.7 million in 2023 offset by a decline in sales at BTND of $164,000 excluding the West St. Paul location closed date in 2022.

Burger Time unit sales for the 26 weeks ranged from a low of approximately $207,000 to a high of approximately $587,000. Average sales for each Burger Time unit were approximately $398,000 in 2023, a decline from approximately $404,200 in the same 26-week period in 2022. The sales decline in the first half of 2023 resulted from a return to pre-covid customer purchasing patterns as competitive dining options returned to normal, labor challenges resulting in some contraction of hours, and poorer weather conditions relative to the year-earlier period.

Costs of Sales - food and paper:

Cost of sales - food and paper for the first half of fiscal 2023 increased to 41.0% from 36.3% of restaurant sales in the same period in 2022. This increase resulted from increased food costs overall; for example, the price of eggs increased tremendously in 2023.

Restaurant Operating Costs:

Restaurant operating costs, which are associated with operations, not including general and administrative expenses, and depreciation and amortization, increased as a percentage of restaurant sales to 90.7% in 2023 from 82.0% in fiscal 2022. This increase was due to the increase in sales activity from new locations and its impact, as further discussed in the "Cost of Sales," "Labor Costs," and "Occupancy and Other Operating Costs" sections below.

Labor Costs:

For the first half of fiscal 2023, labor and benefits cost increased to 37.0% of restaurant sales from 31.9% in fiscal 2022. Shortages in staffing levels combined with higher hourly wage rates at all locations increased the overall labor percentage. The hiring markets have become more challenging in terms of filling open positions. Payroll costs are semi-variable, meaning they do not decrease proportionally to decreases in revenue. Thus, they increase as a percentage of restaurant sales when there is a decrease.

Occupancy and Other Operating Expenses:

For the first 26 weeks of fiscal 2023, occupancy and other expenses decreased to 12.8% of sales from 13.7% in 2022 principally because of a reversal in previously accused property taxes related to a property in St. Louis, Missouri. Many of these costs are fixed, and the percentage reflects lower maintenance costs offset by higher lease occupancy costs at our new locations

Depreciation and Amortization Expense:

Depreciation and amortization expenses in the first half of fiscal 2023 increased by $177,326 to $356,027 (5.0% of sales) from $178,701 (3.2% of sales) in the first half of fiscal 2022 and are the result of the purchase of three new restaurants and capital additions at several of our locations.

General and Administrative Costs:

General and administrative costs increased 26.6% or $198,275 to $944,992, from $746,717 (13.3% of sales) in the first half of fiscal 2022 due to acquiring these businesses during 2022 and the ongoing costs of operating as a public company.

Income from Operations:

Operating loss was $330,306 in the first half of fiscal 2023 compared to income of $84,773 in the first half of fiscal 2022. The change in income from operations in the first half of fiscal 2023 compared to fiscal 2022 was due primarily to the increase in general and administrative expenses, which included higher costs associated with the transition to a public company near the end of 2021, including the "Net Revenues" and "Restaurant Operating Costs" sections above.

Restaurant-level EBITDA:

To supplement the consolidated financial statements, which are prepared and presented in accordance with GAAP, we use restaurant-level EBITDA (earnings before interest, taxes, depreciation, and amortization), which is not a measure defined by GAAP. This non-GAAP operating measure is useful to both management and investors because it represents one means of gauging the overall profitability of our recurring and controllable core restaurant operations. However, this measure is not indicative of our overall results, nor does restaurant-level profit accrue directly to the benefit of stockholders, primarily due to the exclusion of corporate-level expenses. Accordingly, restaurant-level EBITDA should not be considered a substitute for or superior to operating income, which is calculated in accordance with GAAP, and the reconciliations to operating income set forth below should be carefully evaluated.

We define restaurant-level EBITDA as operating income before pre-opening costs if any, general and administrative costs, depreciation, and amortization. General and administrative expenses are excluded as they are generally unrelated to restaurant-specific costs. Depreciation and amortization are excluded because they are not ongoing controllable cash expenses and are unrelated to ongoing operations’ health.

| | 26 Weeks ended, | |

| | July 2, 2023 | | | July 3, 2022 | |

Revenues | | $ | 7,070,763 | | | $ | 5,598,076 | |

Reconciliation: | | | | | | | | |

Income (loss) from operations | | | (330,306 | ) | | | 84,773 | |

Depreciation and amortization | | | 356,027 | | | | 178,701 | |

General and administrative, corporate-level expenses | | | 944,992 | | | | 746,717 | |

Restaurant-level EBITDA | | $ | 970,713 | | | $ | 1,010,191 | |

Restaurant-level EBITDA margin | | | 13.7 | % | | | 18.0 | % |

Liquidity and Capital Resources

For the 26 weeks ending July 2, 2023, the Company earned an after-tax loss of $375,520 due to poorer-than-expected results at the Company’s two Florida locations and generally lower-than-expected sales in the second quarter combined with the equity in the loss of the unconsolidated Bagger Dave’s business of $145,050. At July 2, 2023, the Company had $5,704,879 in cash and cash equivalents and a working capital of $5,940,087.

Our primary requirements for liquidity are to fund our working capital needs, capital expenditures, and general corporate needs, as well as to invest in or acquire businesses that are synergistic with our business. Our operations do not require significant working capital, and, like many restaurant companies, we may operate with negative working capital. Our primary liquidity and cash flow sources are operating cash flows and cash on hand. We use this to service debt, maintain our stores to operate efficiently, and increase our working capital. Our working capital position benefits from the fact that we collect cash from sales from our customers at the point of purchase or within a few days from our credit card processor. Generally, payments to our vendors are not due for thirty days.

Summary of Cash Flows

Cash Flows Provided (used) by Operating Activities

The 2023 26-week period resulted in cash flow used of $111,747 compared to cash flow from operations of $498,068 in the prior year. The winter months have historically been seasonally the slowest part of the Company’s business, and the first quarter of 2023 was impacted by harsh winter weather.

Cash Flows Provided by Investing Activities

In the 26-week period, cash from investing activities was $4,996,865, primarily the result of proceeds at maturity of $5 million in Treasury Bills held at the end of 2022 and proceeds from the sale of the West St. Paul location in 2022. The Company continues to focus on identifying potential acquisition opportunities.

Cash Flows Used in Financing Activities

A significant portion of the Company’s cash flow is allocated to service the Company’s debt and purchase of Treasury shares.

Contractual Obligations

As of July 2, 2023, we had approximately $2.6 million in contractual obligations relating to amounts due under mortgages on the real property on which stores are situated. Our monthly required payment is approximately $32,000 and $2,343,000 of future lease payments requiring a total minimum monthly payment of approximately $25,000.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures designed to ensure that information required to be disclosed by us in the reports filed under the Securities Exchange Act is recorded, processed, summarized, and reported within the periods specified by the SEC’s rules and forms. Disclosure controls are also designed to ensure that this information is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure. In designing and evaluating the disclosure controls and procedures, management recognizes that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

As of July 2, 2023, our Chief Executive Officer and Chief Financial Officer evaluated the effectiveness of our disclosure controls and procedures under Rule 13a-15(b) promulgated under the Exchange Act. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of July 2, 2023, our disclosure controls and procedures were not effective at a reasonable assurance as of the end of the period covered by this report because we lack the necessary corporate accounting resources to maintain adequate segregation of duties. We did not perform an effective risk assessment or monitor internal controls over financial reporting. Management is developing and implementing a series of accounting systems, procedure changes, and internal controls intended to provide adequate controls over financial reporting.

Changes in internal control over financial reporting

There have been no significant changes in our internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rules 13a-15 or 15d-15 under the Securities Exchange Act of 1934 that occurred during our most recent fiscal quarter that has materially affected or is reasonably likely to materially affect, our internal control over financial reporting.

PART II—OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

There are no pending legal proceedings to which the Company is a party or as to which any of its property is subject, and no such proceedings are known to the Company to be threatened or contemplated against it.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934, as amended, and are not required to provide the information required under this item.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

Since the date on which the Company filed its annual report on Form 10-K and through the date of this quarterly report, the Company did not sell any securities.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5. OTHER INFORMATION

None

ITEM 6. EXHIBITS.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| BT BRANDS, INC. | |

| | | |

Date: August 16, 2023 | By: | /s/ Kenneth Brimmer | |

| Name: | Kenneth Brimmer | |

| Title: | Chief Operating Officer and Principal Financial Officer | |