UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of September 2024

Commission

File Number 001-40517

BON

NATURAL LIFE LIMITED

(Translation

of registrant’s name into English)

C601,

Gazelle Valley, No.69 Jinye Road

Xi’an

Hi-Tech Zone, Xi’an, China

People’s

Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: Form 20-F ☒ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Bon

Natural Life Limited Announces Interim 2024 Results

Bon

Natural Life Limited (“we,” “us,” or “the Company”), a bio-ingredient solutions provider in the natural,

health and personal care industries engaged in the research and development, manufacturing and sales of functional active ingredients

extracted from natural herb plants which are widely used by manufacturer customers in the functional food, personal care, cosmetic and

pharmaceutical industries, today announced its unaudited financial results for the six months ended March 31, 2024.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

report contains forward-looking statements. All statements contained in this report other than statements of historical fact, including

statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for

future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,”

“continue,” “anticipate,” “intend,” “expect,” and similar expressions are intended to

identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections

about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term

and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number of risks,

uncertainties and assumptions, including those described in the “Risk Factors” section. Moreover, we operate in a very competitive

and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor

can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties

and assumptions, the future events and trends discussed in this report may not occur and actual results could differ materially and adversely

from those anticipated or implied in the forward-looking statements.

2024

Interim Results Highlights

| |

● |

Revenue

- Total revenues were $10,183,553 for the six months ended March 31, 2024, a decrease of $3,966,414, or 28.0% as compared to

$14,149,967 in the same period of 2023. |

| |

|

|

| |

● |

Income

from operations – Income from operations for the six months ended March 31, 2024 was $84,505, a decrease

of $2,900,729 or 97.2% as compared to $2,985,234 in the same period of 2023. |

| |

|

|

| |

● |

Net

loss attributable to Bon Natural Life Limited - Net loss attributed to Bon Natural Life Limited for the six months

ended March 31, 2024 was $10,519 as compared to a net income attributable to BON Natural Life Limited of $2,119,760 in the same period

of 2023. |

| |

|

|

| |

● |

(Loss)

Earnings per share – Loss per share was $0.00 for the six months ended March 31, 2024 as compared to a basic earnings per

share of $0.24 and a diluted earnings per share of $0.24 in the same period of 2023. |

COVID-19

Impact

In

December 2022, the Chinese government lifted all the COVID-19 related restriction. As of the date of this report, the daily life in China

is back to its normal state. However, the impact of COVID-19 pandemic still depends on the future developments that cannot be accurately

predicted at this time. A resurgence could cause city lockdown, negatively affect the execution of customer contracts, the collection

of customer payments, or disrupt our supply chain, and the continued uncertainties associated with COVID 19 may cause our revenue and

cash flows to underperform in the next 12 months from the date our unaudited condensed consolidated interim financial statements for

the six months ended March 31, 2024 are released. The extent of the future impact of the COVID-19 pandemic on our business and results

of operations is still uncertain.

Comparison

of Interim Financial Results for the six months ended March 31, 2024 and 2023

The

following table summarizes the results of our operations during the six months ended March 31, 2024 and 2023, respectively, and provides

information regarding the dollar and percentage increase or (decrease) during such periods.

| | |

For the Six Months Ended March 31, | |

| | |

2024 | | |

2023 | | |

Variance | |

| | |

Amount | | |

% of revenue | | |

Amount | | |

% of revenue | | |

Amount | | |

% | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| REVENUE | |

| 10,183,553 | | |

| 100.0 | % | |

| 14,149,967 | | |

| 100.0 | % | |

| (3,966,414 | ) | |

| (28.0 | )% |

| COST OF REVENUE | |

| (7,215,116 | ) | |

| (70.9 | )% | |

| (9,432,619 | ) | |

| (66.7 | )% | |

| (2,217,503 | ) | |

| (23.5 | )% |

| GROSS PROFIT | |

| 2,968,437 | | |

| 29.1 | % | |

| 4,717,348 | | |

| 33.3 | % | |

| (1,748,911 | ) | |

| (37.1 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Selling expenses | |

| (103,096 | ) | |

| (1.0 | )% | |

| (136,164 | ) | |

| (1.0 | )% | |

| (33,068 | ) | |

| (24.3 | )% |

| General and administrative expenses | |

| (1,890,452 | ) | |

| (18.6 | )% | |

| (1,465,955 | ) | |

| (10.4 | )% | |

| 424,497 | | |

| 29.0 | % |

| Research and development expenses | |

| (890,384 | ) | |

| (8.7 | )% | |

| (129,995 | ) | |

| (0.9 | )% | |

| (760,389 | ) | |

| 584.9 | % |

| Total operating expenses | |

| (2,883,932 | ) | |

| (28.3 | )% | |

| (1,732,114 | ) | |

| (12.3 | )% | |

| 1,151,818 | | |

| 66.5 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (LOSS) INCOME FROM OPERATIONS | |

| 84,505 | | |

| 0.8 | % | |

| 2,985,234 | | |

| 21.0 | % | |

| (2,900,729 | ) | |

| (97.2 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (143,586 | ) | |

| (1.4 | )% | |

| (169,825 | ) | |

| (1.2 | )% | |

| (26,239 | ) | |

| (15.5 | )% |

| Other income (expenses), net | |

| 108,017 | | |

| 1.1 | % | |

| (202,676 | ) | |

| (1.4 | )% | |

| 249,786 | | |

| 123.2 | % |

| Total other expenses, net | |

| (35,569 | ) | |

| (0.3 | )% | |

| (372,501 | ) | |

| (2.6 | )% | |

| (276,025 | ) | |

| (74.1 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME BEFORE INCOME TAX PROVISION | |

| 48,936 | | |

| 0.5 | % | |

| 2,612,733 | | |

| 18.4 | % | |

| (2,563,797 | ) | |

| (98.1 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| (90,734 | ) | |

| (0.9 | )% | |

| (510,077 | ) | |

| (3.6 | )% | |

| (419,343 | ) | |

| (82.2 | )% |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NET (LOSS) INCOME | |

| (41,798 | ) | |

| (0.4 | )% | |

| 2,102,656 | | |

| 14.8 | % | |

| (2,144,454 | ) | |

| (102.0 | )% |

Revenues

We

currently produce our products for our customers in three broad product categories: fragrance compounds, health supplemental (powder

drinks) and bioactive food ingredients.

Total

revenues were $10,183,553 in the six months ended March 31, 2024, a decrease of $3,966,414 or approximately 28.0% as compared to $14,149,967

in the same period of 2023. Specifically, the decrease in revenues was primarily attributable to (i) an overall decrease in sales volume

of fragrance compound and health supplemental powder drinks by 87.0% and 52.0%, respectively, due to the decline in customer and

market demand; (ii) we sold our products to 81 and 94 customers in the six months ended March 31, 2024 and 2023, respectively,

representing a decrease of 13.8%. In terms of purchase order size, the average purchase order by our customers decreased

by 16.0% from approximately $150,000 per customer in the six months ended March 31, 2023 to approximately $126,000 per customer

in the six months ended March 31, 2024. For the six months ended March 31, 2024, two customers accounted for 58.2% and 20.0% of

the Company’s total revenue, respectively. For the six months ended March 31, 2023, three customers accounted for 43.3%, 32.9%

and 14.2% of the Company’s total revenue, respectively; (iii) offset by a 3.3% negative impact from foreign currency fluctuation

when average exchange rate used in converting RMB into USD changed from US$1 to RMB 6.9761 in the six months ended March 31, 2023 to

US$1 to RMB 7.2064 in the same period of 2024.

The

following table summarizes the breakdown of revenues by categories for the periods indicated.

| | |

Revenues | |

| | |

For the Six Months Ended March 31, | |

| | |

2024 | | |

2023 | | |

Change | | |

Change | |

| | |

Amount | | |

% | | |

Amount | | |

% | | |

Amount | | |

% | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Fragrance compounds | |

$ | 866,192 | | |

| 8.5 | % | |

$ | 6,810,374 | | |

| 48.1 | % | |

$ | (5,944,182 | ) | |

| (87.3 | )% |

| Health supplements (powder drinks) | |

| 2,126,147 | | |

| 20.9 | % | |

| 4,583,272 | | |

| 32.4 | % | |

| (2,457,125 | ) | |

| (53.6 | )% |

| Bioactive food ingredients | |

| 7,192,214 | | |

| 70.6 | % | |

| 2,756,321 | | |

| 19.5 | % | |

| 4,434,893 | | |

| 160.9 | % |

| Total Revenue | |

$ | 10,183,553 | | |

| 100.0 | % | |

$ | 14,149,967 | | |

| 100.0 | % | |

$ | (3,966,414 | ) | |

| (28.0 | )% |

Revenues

from sales of our fragrance compound products

Our

fragrance compound products primarily include natural compounds extracted from plants for cosmetic applications, such as sclareolide

and ambroxide, a sustainable replacement to ambergris, a secretion by sperm whales.

Revenues

from sales of our fragrance compound products decreased by 87.3% or $5,944,182 to $866,192 in the six months ended March 31, 2024 from

$6,810,374 in the same period of 2023. This decrease was attributable to the following: (i) an 87.0% decrease in sales volume

from 20,093 kilograms sold in the six months ended March 31, 2023 to 2,604 kilograms sold in the same period of 2024, mainly attributed

to the decline in market demand and our strategic shift in sales strategy to focusing on our bioactive food ingredients

segment; and (ii) a 3.3% negative impact from foreign currency fluctuation when average exchange rate used in converting RMB into USD

changed from US$1 to RMB 6.976 in the six months ended March 31, 2023 to US$1 to RMB 7.2064 in the same period of 2024.

Revenues

from sales of our health supplement (powder drinks) products

Our

health supplement (powder drinks) products primarily include Prebiotics series with benefits such as intestine rejuvenation and probiotic

proliferation acceleration.

Revenues

from sales of health supplement (powder drinks) products decreased by 53.6% or $2,457,125 to $2,126,147 in the six months ended March

31, 2024 from $4,583,272 in the same period of 2023. This decrease was attributable to the following: (i) a decrease of 52.0% in sales

volume from 195,035 cases sold in the six months ended March 31, 2023 to 93,569 cases sold in the same period of 2024, mainly

attributed to the decline in market demand; and (ii) a 3.3% negative impact from foreign currency fluctuation when average exchange rate

used in converting RMB into USD changed from US$1 to RMB 6.976 in the six months ended March 31, 2023 to US$1 to RMB 7.2064 in the same

period of 2024.

Revenues

from sales of our bioactive food ingredient products

Our

bioactive food ingredient products primarily include fruit juice concentrates and extracts for a variety of health benefits that can’t

be sufficiently sourced from daily dietary intakes, such as fruit concentrates, apple polyphenol, rich in anti-oxidant and derived from

apple, milk thistle extracts with benefits to protect liver and lower blood sugar, and phloretin, an anti-oxidant with skin discoloration

effect extracted from leaves and roots of apple, pear and other fruits.

Revenues

from sales of our bioactive food ingredient products increased by 160.9% or $4,434,893 to $7,191,214 in the six months ended March 31,

2024 from $2,756,321 in the same period of 2023. The increase was mainly attributable to the following: (i) a 2.4% increase in

sales volume from 55,104 kilograms in the six months ended March 31, 2023 to 56,444 kilograms in the same period of 2024 due to strong

customer demand and our sales effort to promote sales of milk thistle extracts with benefits to protect liver and lower blood sugar;

(ii) the increase is offset by a 3.3% negative impact from foreign currency fluctuation when average exchange rate used in converting

RMB into USD changed from US$1 to RMB 6.976 in the six months ended March 31, 2023 to US$1 to RMB 7.2064 in the same period of 2024.

Cost

of Revenues

Our

cost of revenues primarily consists of inventory costs (raw materials, labor, packaging cost, depreciation and amortization, freight

costs and overhead) and business tax. Cost of revenues generally changes as our production costs change, which are affected by factors

including the market price of raw materials, or labor productivity, and as the customer and product mix changes.

Our

cost of revenues decreased by $2,217,503 or 23.5%, to $7,215,116 in the six months ended March 31, 2024 from $9,432,619 in the same period

of 2023. The decrease in our cost of revenues was mainly attributable to the following: (i) sale volume of our fragrance compound products

and health supplemental powder drinks decreased by 87.0% and 52.0%, respectively, in the six months ended March 31, 2024 compared to

the same period of 2023 due to the decline in market demand and our sales effort to promote sales of milk thistle extracts with benefits

to protect liver, which lead to the increase in sales for the bioactive food ingredients; and (ii) a 3.3% negative impact from

foreign currency fluctuation when average exchange rate used in converting RMB into USD changed from US$1 to RMB 6.976 in the six months

ended March 31, 2023 to US$1 to RMB 7.2064 in the same period of 2024.

| | |

For the Six Months Ended March 31, | |

| | |

2024 | | |

2023 | | |

Change | |

| | |

Amount | | |

Amount | | |

Amount | | |

% | |

| | |

| | |

| | |

| | |

| |

| Cost of revenues – Fragrance compound products | |

$ | 607,500 | | |

| 4,785,695 | | |

$ | (4,178,195 | ) | |

| (87.3 | )% |

| Cost of revenues – Health supplement (powder drinks) | |

| 1,471,617 | | |

| 3,168,714 | | |

| (1,697,097 | ) | |

| (53.6 | )% |

| Cost of revenues – Bioactive food ingredients | |

| 5,135,999 | | |

| 1,478,210 | | |

| (3,657,789 | ) | |

| 247.4 | % |

| Total cost of revenues | |

$ | 7,215,116 | | |

| 9,432,619 | | |

$ | (2,217,503 | ) | |

| (23.5 | )% |

Cost

of Revenues from sales of our fragrance compound products

The

87.3 % decrease in cost of revenues for our fragrance compound products from $4,785,695 in the six months ended March 31, 2023 to $607,500

in the same period of 2024 was mainly attributable to the following: (i) a decrease of 87.3% in sales volume from 20,093 kilograms

sold in the six months ended March 31, 2023 to 2,604 kilograms sold in the same period of 2024, mainly attributed to the decline

in market demand and our strategic shift in sales strategy on focusing our bioactive food ingredients segment; and (ii) a 2.0% decrease

in weighted average unit cost from $238.2 in the six months ended March 31, 2023 to $233.3 in the same period of 2024.

Cost

of Revenues from sales of our health supplement (powder drinks) products

The

53.6% decrease in cost of revenues for our health supplement (powder drinks) products from $3,168,714 in the six months ended March 31,

2023 to $1,471,617 in the same period of 2024 was mainly attributable to the following: (i) a decrease of 52.0% in sales volume

from 195,035 cases sold in the six months ended March 31, 2023 to 93,569 cases sold in the same period of 2024, mainly attributed

to the decline in market demand; and (ii) a decrease of 3.2% in weighted average unit cost for this product category from $16.3 in the

six months ended March 31, 2023 to $15.7 in the same period of 2024.

Cost

of Revenues from sales of our bioactive food ingredient products

The

247.4% increase in cost of revenues for our bioactive food ingredient products from $1,478,210 in the six months ended March 31, 2023

to $5,135,999 in the same period of 2024 was mainly attributable to the following: (i) an increase of 15.2% in weighted average

unit cost of our bioactive ingredient products as a result of increased in raw materials purchase price, which was affected by the change

in product mix for the six months ended March 31, 2024; and (ii) a 2.4% increase in sales volume from 55,104 kilograms in the

six months ended March 31, 2023 to 56,444 kilograms in the same period of 2024 due to strong customer demand and our sales effort

to promote sales of milk thistle extracts with benefits to protect liver and lower blood sugar.

Gross

Profit

| | |

For the Six Months Ended March 31, | |

| | |

2024 | | |

2023 | | |

Change | |

| | |

Amount | | |

Amount | | |

Amount | | |

% | |

| | |

| | |

| | |

| | |

| |

| Gross Profit – Fragrance compound products | |

$ | 258,692 | | |

$ | 2,024,679 | | |

$ | (1,765,987 | ) | |

| (87.2 | )% |

| Gross Profit – Health supplement (powder drinks) | |

| 654,530 | | |

| 1,414,558 | | |

| (760,028 | ) | |

| (53.7 | )% |

| Gross Profit – Bioactive food ingredients | |

| 2,055,215 | | |

| 1,278,111 | | |

| 777,104 | | |

| 60.8 | % |

| Total Gross Profit | |

$ | 2,968,437 | | |

$ | 4,717,348 | | |

$ | (1,748,911 | ) | |

| (37.1 | )% |

| Gross Profit Margin | |

| 29.1 | % | |

| 33.3 | % | |

| | | |

| (4.2 | )% |

Our

gross profit in the six months ended March 31, 2024 decreased by $1,748,911 or 37.1%, to $2,968,437 from $4,717,348

in the same period of 2023. Our gross margin also decreased by 4.2% from 33.3% in the six months ended March 31, 2023 to 29.1%

in the same period of 2024. The decrease in gross profit was mainly due to (i) an overall decrease of 1.9% in sales volume of all

products due to decline in market demand and change in sales strategy as discussed above; (ii) a decrease of overall cost by 23.5% due

to our decrease in sales from higher cost products; and (iii) a 3.3% negative impact from foreign currency fluctuation when average

exchange rate used in converting RMB into USD changed from US$1 to RMB 6.976 in the six months ended March 31, 2023 to US$1 to RMB 7.2064

in the same period of 2024.

Gross

profit from sales of our fragrance compound products

Gross

profit of our fragrance compound products decreased by $1,765,987 or 87.2% from $2,024,679 in the six months ended March 31, 2023 to

$258,692 in the same period of 2024. The decrease was primarily attributable to (i) an 87.0% decrease in sales volume from 20,093

kilograms sold in the six months ended March 31, 2023 to 2,604 kilograms sold in the same period of 2024 as discussed above; (ii) a 2.0%

decrease in weighted average unit cost from $238.2 in the six months ended March 31, 2023 to $233.3 in the same period of 2024; and (iii)

by a 3.3% negative impact from foreign currency fluctuation when average exchange rate used in converting RMB into USD changed from US$1

to RMB 6.976 in the six months ended March 31, 2023 to US$1 to RMB 7.2064 in the same period of 2024. As a result of the above, gross

margin for our fragrance compound products remained relatively the same from 29.7% in the six months ended March 31, 2023, to 29.9% in

the same period of 2024.

Gross

profit from sales of our health supplement (powder drinks) products

Gross

profit of our health supplement (powder drinks) products decreased by $760,028 or 53.7% from $1,414,558 in the six months ended March

31, 2023, to $654,530 in the same period of 2024. The decrease was primarily attributable to: (i) a decrease of 52.0% in sales

volume from 195,035 cases sold in the six months ended March 31, 2023 to 93,569 cases sold in the same period of 2024 as discussed

above; (ii) weighted average unit cost for this product category decreased by 3.2%; and (iii) a 3.3% negative impact from foreign

currency fluctuation when average exchange rate used in converting RMB into USD changed from US$1 to RMB 6.976 in the six months ended

March 31, 2023 to US$1 to RMB 7.2064 in the same period of 2024.

Gross

profit from sales of our bioactive food ingredient products

Gross

profit of our bioactive food ingredient products increased by $777,104 or 60.8%, from $1,278,111 in the six months ended March 31, 2023,

to $2,055,215 in the same period of 2024. This increase was primarily due to (i) a 2.4% increase in sales volume from 55,104 kilograms

in the six months ended March 31, 2023 to 56,444 kilograms in the same period of 2024 as discussed above; (ii) a 3.3% negative impact

from foreign currency fluctuation when average exchange rate used in converting RMB into USD changed from US$1 to RMB 6.976 in the six

months ended March 31, 2023 to US$1 to RMB 7.2064 in the same period of 2024; and (iii) the increase is offset by an increase

of 15.2% in weighted average unit cost of our bioactive ingredient products as a result of increase purchase price as affected by the

change in product mix.

Selling

expenses

| | |

For the Six Months Ended March 31, | | |

Change | |

| (in US dollars, except percentage) | |

2024 | | |

2023 | | |

Amount | | |

% | |

| Selling Expenses | |

| 103,096 | | |

| 136,164 | | |

$ | (33,068 | ) | |

| (24.3 | )% |

| as a percentage of revenues | |

| 1.0 | % | |

| 1.0 | % | |

| | | |

| | |

Selling

expenses decreased by $33,068, or 24.3%, from $136,164 in the six months ended March 31, 2023, to $103,096 in the same period of 2024.

The decrease was mainly due to (i) a 21.6% decrease in staff payroll from $57,305 in the six months ended March 31, 2023

to $44,944 compared to the same period of 2024, as we decreased our sales efforts and decreased our staff headcount from 11 in

the six months ended March 31, 2023 to 8 compared to the same period of 2024; (ii) a 62.4% decrease in shipping and handling expenses

from $42,491 in the six months ended March 31, 2023 to $15,965 compared to the same period of 2024, due to the decrease in our sales

volume.

General

and administrative expenses

| | |

For the Six Months Ended March 31, | | |

Change | |

| (in US dollars, except percentage) | |

2024 | | |

2023 | | |

Amount | | |

% | |

| General and Administrative Expenses | |

$ | 1,890,452 | | |

| 1,465,955 | | |

| 424,497 | | |

| 29.0 | % |

| as a percentage of revenues | |

| 18.6 | % | |

| 10.4 | % | |

| | | |

| | |

General

and administrative expenses increased by $424,497, or 29.0%, from $1,465,955 in the six months ended March 31, 2023, to $1,890,452 in

the same period of 2024, mainly attributable to (i) a 59.6% or $485,534 increase in professional service and consulting

fees to $1,300,608 in the six months ended March 31, 2024 from $815,074 in the same period of 2023; and (ii) the increase

was offset by the decrease in staff payroll from $297,624 in the six months ended March 31, 2023 to $220,236 compared to

the same period of 2024.

Research

and development (“R&D”) expenses

| | |

For the Six Months Ended March 31, | | |

Change | |

| (in US dollars, except percentage) | |

2024 | | |

2023 | | |

Amount | | |

% | |

| Research and Development Expenses | |

$ | 890,384 | | |

$ | 129,995 | | |

$ | 760,389 | | |

| 584.9 | % |

| as a percentage of revenues | |

| 8.7 | % | |

| 0.9 | % | |

| | | |

| | |

Research

and development expenses increased by $760,389, or approximately 584.9%, from $129,995 in the six months ended March 31, 2023, to $890,384

in the same period of 2024. The increase was mainly due (i) a 33.1%, or $17,428 increase in staff payroll from $52,585

in the six months ended March 31, 2023 to $70,013 in the same period of 2024; and (ii) a 1,643.0%, or $743,619 increase

in outsourcing R&D activities to external consulting firms from $45,260 in the six months ended March 31, 2023 to $788,879

in the same period of 2024. The increase in staff payroll and outsourcing R&D activities were mainly attributed to our

effort to invest in research for new products. The increase was offset by the decrease in R&D material and inspection fees, which

decreased by 92.5%, or $21,584 from $23,341 in the six months ended March 31, 2023 to $1,757 in the same period of 2024, mainly

attributed to our change of R&D plan from in-house development to outsourcing.

Other

income (expenses)

Other

income (expenses) primarily includes interest income generated from our bank deposits, interest expenses incurred on our borrowings from

various banks and financial institutions, government subsidy income, rental income, income from technology transfer, unrealized foreign

currency exchange gain due to our export sales, and investment income of short-term investment.

| | |

For the six months ended March 31, | | |

Change | |

| (in US dollars, except percentage) | |

2024 | | |

2023 | | |

Amount | | |

% | |

| Interest expense, net | |

| (143,586 | ) | |

| (169,825 | ) | |

| (26,239 | ) | |

| (15.5 | )% |

| Foreign currency exchange (loss) gain | |

| (2,747 | ) | |

| 8,452 | | |

| (11,199 | ) | |

| (132.5 | )% |

| Other income, net | |

| | | |

| | | |

| | | |

| | |

| -Government grants | |

| 61,081 | | |

| 11,916 | | |

| 49,165 | | |

| 412.6 | % |

| - Other income (expenses) | |

| 49,683 | | |

| (223,043 | ) | |

| 272,726 | | |

| 122.3 | % |

Interest

expense, net, decreased by $26,239 or approximately 15.5% in the six months ended March 31, 2024 as compared to 2023. The decrease

was mainly attributable to decreased average loan balances in long-term loan that we carried during the six months ended March 31,

2024 compared to the same period of 2023.

Government

subsidies received totaled $11,916 in the six months ended March 31, 2023 comparing to $61,081 in the six months ended March 31, 2024,

representing an increase of 412.6%. We recognize government subsidies as other operating income when they are received because they are

not subject to any past or future conditions, there are no performance conditions or conditions of use, and they are not subject to future

refunds.

Other income for the six months ended March 31,

2024 were $49,683 comparing to other expenses of $223,043 for the six months ended March 31, 2023. We recgonized a one-time tax related

charges of $252,682 in the six months ended March 31, 2023, which was nil for the six months ended March 31, 2024.

The

overall changes in our other income (expenses) reflected the above major factors.

Provision

for Income Taxes

Our

provision for income taxes was $90,734 in the six months ended March 31, 2024, a decrease of $419,343 or 82.2% from $510,077 in the same

period of 2023 mainly due to our decreased taxable income.

Net

(loss) income

As

a result of the foregoing, we had a net income of $2,102,656 in the six months ended March 31, 2023 compared to a net loss of

$41,798 in the same period of 2024.

Cash

Flow

As

of March 31, 2024, we had cash on hand of $717,879. The following table sets forth a summary of our cash flows for the periods

indicated:

| | |

For the Six Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Net cash used in operating activities | |

$ | (1,884,173 | ) | |

$ | (2,177,992 | ) |

| Net cash used in investing activities | |

| (693 | ) | |

| (18,101 | ) |

| Net cash provided by financing activities | |

| 2,511,853 | | |

| 1,914,916 | |

| Effect of exchange rate change on cash | |

| (21,858 | ) | |

| (17,412 | ) |

| Net increase (decrease) in cash | |

| 605,128 | | |

| (298,589 | ) |

| Cash, beginning of period | |

| 112,751 | | |

| 840,861 | |

| Cash, end of period | |

$ | 717,879 | | |

$ | 542,272 | |

Cash

flows from operating activities

Net

cash used in operating activities during the six months ended March 31, 2024 was $1,884,173, primarily attributable to net loss

of $41,798 for the six months ended March 31, 2024, non-cash charges of depreciation and amortization of $686,038, stock based compensation

of $1,009,836, an increase of $3,464,205 in accounts receivable due to increased sales orders in months in March

2024, and an increase in inventory of $498,736 due to an increase of the raw materials stockpile in order to prepare for an

anticipated increase in production to fulfill sales orders from customers.

Net

cash used in operating activities during the six months ended March 31, 2023 was $2,177,992, primarily attributable to net income of

$2,102,656 for the six months ended March 31, 2023, our taxes payable increased by $386,510 primarily due to the increase in income and

VAT in the six months ended March 2023, an increase of $2,198,450 in accounts receivable due to increased sales in the six months

ended March 31, 2023, an increase in inventory of $124,601 due to increase of the raw materials stockpile in order to prepare for anticipated

increase in production to fulfill increased sales orders from customers, and an increase of $3,335,205 in accrued expenses and

other current liabilities.

Cash

flows from investing activities

Net

cash used in investing activities during the six months ended March 31, 2024 was $693 which was attributable to purchase

of property and equipment in the amount of $693.

Net

cash used in investing activities during the six months ended March 31, 2023 was $18,101 which was primarily attributable to purchase

of property and equipment in the amount of $15,131.

Cash

flows from financing activities

Net

cash provided by financing activities during the six months ended March 31, 2024 was $2,511,853 and primarily includes

proceeds from short-term loans of $3,619,267, proceeds from long-term loans of $854,514, repayment of short-term loans

of $1,534,052 and repayment of long-term loans of $508,629.

Net

cash provided by financing activities during the six months ended March 31, 2023 was $1,914,916 and primarily includes

net proceeds from issuance of Ordinary Shares in an initial public offering of $2,200,000, proceeds from short-term loans of $259,767,

repayment of long-term loans of $437,412, repayment of short-term loans of $79,165 and principal payment from capital lease of $27,236.

During

the six months ended March 31, 2024, we experienced a net increase in cash of $605,128 compared to a net decrease in cash of $298,589

in the six months ended March 31, 2023.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date:

September 27, 2024 |

Bon

Natural Life Limited |

| |

|

|

| |

By: |

/s/

Yongwei Hu |

| |

|

Yongwei

Hu |

| |

|

Chairman

and Chief Executive Officer |

EXHIBIT

INDEX

Exhibit

99.1

BON

NATURAL LIFE LIMITED AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

| | |

As of

| |

| | |

| March

31, 2024 | | |

| September 30, 2023 | |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash | |

$ | 717,879 | | |

$ | 112,751 | |

| Short-term investments | |

| - | | |

| 65 | |

| Accounts receivable, net | |

| 8,108,271 | | |

| 4,602,466 | |

| Inventories, net | |

| 1,437,180 | | |

| 987,287 | |

| Advance to suppliers, net | |

| 15,414,883 | | |

| 15,117,191 | |

| Acquisition deposit | |

| 1,000,000 | | |

| 1,000,000 | |

| Prepaid expenses and other current assets | |

| 1,583,606 | | |

| 2,363,704 | |

| TOTAL CURRENT ASSETS | |

| 28,261,819 | | |

| 24,183,464 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 20,613,211 | | |

| 21,064,043 | |

| Intangible assets, net | |

| 992,544 | | |

| 995,227 | |

| Right-of-use lease assets, net | |

| 199,679 | | |

| 312,067 | |

| Deferred tax assets, net | |

| 12,672 | | |

| 1,335 | |

| TOTAL ASSETS | |

$ | 50,079,925 | | |

$ | 46,556,136 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Short-term loans | |

$ | 4,617,414 | | |

$ | 2,509,890 | |

| Current portion of long-term loans | |

| 473,111 | | |

| 419,610 | |

| Accounts payable | |

| 1,284,816 | | |

| 1,404,937 | |

| Due to related parties | |

| 188,640 | | |

| 83,380 | |

| Taxes payable | |

| 2,523,163 | | |

| 2,718,687 | |

| Deferred revenue | |

| 497,937 | | |

| 106,514 | |

| Accrued expenses and other current liabilities | |

| 1,797,826 | | |

| 2,140,900 | |

| Operating lease liability, current | |

| 202,552 | | |

| 227,297 | |

| TOTAL CURRENT LIABILITIES | |

| 11,585,459 | | |

| 9,611,215 | |

| | |

| | | |

| | |

| Long-term loans | |

| 1,176,624 | | |

| 871,368 | |

| Operating lease liability, noncurrent | |

| - | | |

| 91,720 | |

| TOTAL LIABILITIES | |

$ | 12,762,083 | | |

$ | 10,574,303 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| EQUITY | |

| | | |

| | |

| Ordinary shares, $0.0001 par value, 500,000,000 shares authorized, 14,138,662 and 11,738,662 shares issued and outstanding as of March 31, 2024 and September 30, 2023, respectively | |

| 1,414 | | |

| 1,174 | |

| Additional paid in capital | |

| 19,097,652 | | |

| 18,088,056 | |

| Statutory reserve | |

| 2,372,871 | | |

| 2,372,871 | |

| Retained earnings | |

| 18,693,477 | | |

| 18,703,996 | |

| Accumulated other comprehensive income | |

| (3,470,975 | ) | |

| (3,681,445 | ) |

| TOTAL BON NATURAL LIFE LIMITED SHAREHOLDERS’ EQUITY | |

| 36,694,439 | | |

| 35,484,652 | |

| Non-controlling interest | |

| 623,403 | | |

| 497,181 | |

| TOTAL SHAREHOLDERS’ EQUITY | |

| 37,317,842 | | |

| 35,981,833 | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 50,079,925 | | |

$ | 46,556,136 | |

BON

NATURAL LIFE LIMITED AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(UNAUDITED)

| | |

For the six months ended March 31, | |

| | |

2024 | | |

2023 | |

| REVENUE | |

$ | 10,183,553 | | |

$ | 14,149,967 | |

| COST OF REVENUE | |

| (7,215,116 | ) | |

| (9,432,619 | ) |

| GROSS PROFIT | |

| 2,968,437 | | |

| 4,717,348 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Selling expenses | |

| (103,096 | ) | |

| (136,164 | ) |

| General and administrative expenses | |

| (1,890,452 | ) | |

| (1,465,955 | ) |

| Research and development expenses | |

| (890,384 | ) | |

| (129,995 | ) |

| Total operating expenses | |

| (2,883,932 | ) | |

| (1,732,114 | ) |

| | |

| | | |

| | |

| INCOME FROM OPERATIONS | |

| 84,505 | | |

| 2,985,234 | |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSES) | |

| | | |

| | |

| Interest income | |

| 161 | | |

| 8,732 | |

| Interest expense | |

| (143,747 | ) | |

| (178,557 | ) |

| Unrealized foreign transaction exchange loss (gain) | |

| (2,747 | ) | |

| 8,452 | |

| Government subsidies | |

| 61,081 | | |

| 11,916 | |

| Income from short-term investments | |

| - | | |

| - | |

| Other income (expenses) | |

| 49,683 | | |

| (223,044 | ) |

| Total other expenses, net | |

| (35,569 | ) | |

| (372,501 | ) |

| | |

| | | |

| | |

| INCOME BEFORE INCOME TAX PROVISION | |

| 48,936 | | |

| 2,612,733 | |

| | |

| | | |

| | |

| INCOME TAX PROVISION | |

| (90,734 | ) | |

| (510,077 | ) |

| | |

| | | |

| | |

| NET (LOSS) INCOME | |

| (41,798 | ) | |

| 2,102,656 | |

| Less: net loss attributable to non-controlling interest | |

| (31,279 | ) | |

| (17,104 | ) |

| NET (LOSS) INCOME ATTRIBUTABLE TO BON NATURAL LIFE LIMITED | |

$ | (10,519 | ) | |

$ | 2,119,760 | |

| | |

| | | |

| | |

| NET (LOSS) INCOME | |

$ | (41,798 | ) | |

$ | 2,102,656 | |

| | |

| | | |

| | |

| OTHER COMPREHENSIVE INCOME | |

| | | |

| | |

| Total foreign currency translation adjustment | |

| 367,971 | | |

| 1,071,621 | |

| TOTAL COMPREHENSIVE INCOME | |

| 326,173 | | |

| 3,174,277 | |

| Less: comprehensive loss attributable to non-controlling interest | |

| 126,222 | | |

| (17,104 | ) |

| COMPREHENSIVE INCOME ATTRIBUTABLE TO BON NATURAL LIFE LIMITED | |

$ | 199,951 | | |

$ | 3,191,381 | |

| | |

| | | |

| | |

(LOSS) EARNINGS PER SHARE ATTRIBUTABLE TO BON NATURAL LIFE LIMITED | |

| | | |

| | |

| Basic | |

$ | (0.00 | ) | |

$ | 0.24 | |

| Diluted | |

$ | (0.00 | ) | |

$ | 0.24 | |

| | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING | |

| | | |

| | |

| Basic | |

| 12,857,018 | | |

| 8,918,309 | |

| Diluted | |

| 12,857,018 | | |

| 8,979,243 | |

BON

NATURAL LIFE LIMITED AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR

THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(UNAUDITED)

| | |

Common

shares | | |

Additional

paid-in | | |

Statutory | | |

Retained | | |

Accumulated

other

comprehensive | | |

Total

shareholders’ | | |

Non- controlling | | |

Total | |

| | |

Shares | | |

Amount | | |

capital | | |

reserve | | |

earnings | | |

loss | | |

equity | | |

interest | | |

equity | |

| Balance

at September 30, 2022 | |

| 8,396,226 | | |

$ | 840 | | |

$ | 15,711,450 | | |

$ | 1,804,116 | | |

$ | 14,676,769 | | |

$ | (2,631,171 | ) | |

$ | 29,562,004 | | |

$ | 530,492 | | |

$ | 30,092,496 | |

| Issuance

of ordinary shares in a private placement, net | |

| 2,750,000 | | |

| 275 | | |

| 2,199,725 | | |

| | | |

| | | |

| | | |

| 2,200,000 | | |

| | | |

| 2,220,000 | |

| Share-based

compensation | |

| | | |

| | | |

| 35,000 | | |

| | | |

| | | |

| | | |

| 35,000 | | |

| | | |

| 35,000 | |

| Net

income | |

| | | |

| | | |

| | | |

| | | |

| 2,119,760 | | |

| | | |

| 2,119,760 | | |

| (17,104 | ) | |

| 2,102,656 | |

| Foreign

currency translation adjustment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,071,621 | | |

| 1,071,621 | | |

| | | |

| 1,071,621 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

at March 31, 2023 | |

| 11,146,226 | | |

$ | 1,115 | | |

$ | 17,946,175 | | |

$ | 1,804,116 | | |

$ | 16,796,529 | | |

$ | (1,559,550 | ) | |

$ | 34,988,384 | | |

$ | 513,387 | | |

$ | 35,501,771 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

at September 30, 2023 | |

| 11,738,662 | | |

$ | 1,174 | | |

$ | 18,088,056 | | |

$ | 2,372,871 | | |

$ | 18,703,996 | | |

$ | (3,681,445 | ) | |

$ | 35,484,652 | | |

$ | 497,181 | | |

$ | 35,981,833 | |

| Share-based

compensation | |

| 2,400,000 | | |

| 240 | | |

| 1,009,596 | | |

| | | |

| | | |

| | | |

| 1,009,836 | | |

| | | |

| 1,009,836 | |

| Net

loss | |

| | | |

| | | |

| | | |

| | | |

| (10,519 | ) | |

| | | |

| (10,519 | ) | |

| (31,279 | ) | |

| (41,798 | ) |

| Foreign

currency translation adjustment | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 210,470 | | |

| 210,470 | | |

| 157,501 | | |

| 367,971 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

at March 31, 2024 | |

| 14,138,662 | | |

$ | 1,414 | | |

$ | 19,097,652 | | |

$ | 2,372,871 | | |

$ | 18,693,477 | | |

$ | (3,470,975 | ) | |

$ | 36,694,439 | | |

$ | 623,403 | | |

$ | 37,317,842 | |

BON

NATURAL LIFE LIMITED AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

For the six months ended March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities | |

| | | |

| | |

| Net (loss) income | |

$ | (41,798 | ) | |

$ | 2,102,656 | |

| Adjustments to reconcile net income to cash provided by operating activities | |

| | | |

| | |

| Allowance for doubtful accounts | |

| 21,441 | | |

| - | |

| Depreciation and amortization | |

| 686,038 | | |

| 282,888 | |

| Inventory reserve | |

| 58,349 | | |

| 105,314 | |

| Deferred income tax | |

| (11,345 | ) | |

| (25,749 | ) |

| Amortization of operating lease right-of-use assets | |

| 115,882 | | |

| 114,179 | |

Share-based compensation | |

| 1,009,836 | | |

| 35,000 | |

| Unrealized foreign currency exchange loss (gain) | |

| 2,747 | | |

| (8,452 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (3,464,205 | ) | |

| (2,198,450 | ) |

| Inventories | |

| (498,736 | ) | |

| (124,601 | ) |

| Advance to suppliers, net | |

| (160,908 | ) | |

| (3,353,433 | ) |

| Prepaid expenses and other current assets | |

| 801,781 | | |

| (3,595,458 | ) |

| Accounts payable | |

| (135,111 | ) | |

| 100,386 | |

| Operating lease liabilities | |

| (120,040 | ) | |

| (115,170 | ) |

| Taxes payable | |

| (224,459 | ) | |

| 386,510 | |

| Deferred revenue | |

| 391,057 | | |

| 781,183 | |

| Accrued expenses and other current liabilities | |

| (314,702 | ) | |

| 3,335,205 | |

| Net cash used in operating activities | |

| (1,884,173 | ) | |

| (2,177,992 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (693 | ) | |

| (15,131 | ) |

| Capital expenditures on construction-in-progress | |

| - | | |

| (2,970 | ) |

| Net cash used in investing activities | |

| (693 | ) | |

| (18,101 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | |

| Net proceeds from issuance of ordinary shares | |

| - | | |

| 2,200,000 | |

| Proceeds from short-term loans | |

| 3,619,267 | | |

| 259,767 | |

| Proceeds from long-term loans | |

| 854,514 | | |

| - | |

| Repayment of short-term loans | |

| (1,534,052 | ) | |

| (79,165 | ) |

| Repayment of long-term loans | |

| (508,629 | ) | |

| (437,412 | ) |

| Proceeds from (repayment of) borrowings from related parties | |

| 80,752 | | |

| (1,038 | ) |

| Repayment of capital lease | |

| - | | |

| (27,236 | ) |

| Net cash provided by financing activities | |

| 2,511,853 | | |

| 1,914,916 | |

| | |

| | | |

| | |

| Effect of changes of foreign exchange rates on cash | |

| (21,858 | ) | |

| (17,412 | ) |

| Net increase (decrease) in cash | |

| 605,128 | | |

| (298,589 | ) |

| Cash, beginning of period | |

| 112,751 | | |

| 840,861 | |

| Cash, end of period | |

$ | 717,879 | | |

$ | 542,272 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information | |

| | | |

| | |

| Cash paid for interest expense | |

$ | 143,747 | | |

$ | 178,557 | |

| Cash paid for income tax | |

$ | - | | |

$ | 500,251 | |

| Supplemental disclosure of non-cash investing and financing activities | |

| | | |

| | |

| Amortization of share-based compensation for initial public offering services | |

$ | 24,000 | | |

$ | 35,000 | |

| Right-of-use assets obtained in exchange for operating lease obligations | |

$ | - | | |

$ | 458,181 | |

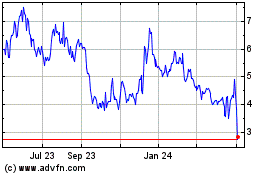

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From Jan 2025 to Feb 2025

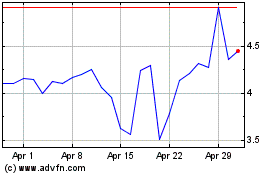

Bon Natural Life (NASDAQ:BON)

Historical Stock Chart

From Feb 2024 to Feb 2025