Blackboxstocks Files Form S-4 for Evtec Acquisition

May 16 2024 - 8:00AM

Blackboxstocks Inc. (NASDAQ: BLBX), (“Blackbox” or the “Company”),

a financial technology and social media hybrid platform offering

real-time proprietary analytics for stock and options traders of

all levels, announced that it filed its Form S-4 on May 13, 2024,

for its acquisition of Evtec Aluminium Ltd. and today reported its

financial results for the first quarter ended March 31, 2024.

The filing of the S-4 was a significant

milestone in the Company’s planned acquisition of Evtec Aluminium

Ltd. Pending SEC and Nasdaq approval, the Company expects to

consummate the merger as soon as possible.

First Quarter Financial and Operating

Highlights:

- Total

revenue for the first quarter of 2024 was $649,420 as compared to

$859,004 for the same period in 2023.

-

Average member count of 2,944 was 17.2% lower than the first

quarter of 2023 but approximately equal to the fourth quarter of

2023.

-

Operating expenses decreased by 51% to $1,155,428 in the first

quarter of 2024 compared to $2,358,177 for the same period in 2023.

Stock based compensation declined from $768,126 in the first

quarter of 2023 to $114,666 in the first quarter of 2024.

-

Operating loss decreased by 56% to $863,966 for the first quarter

of 2024 as compared to $1,946,804 in the first quarter of

2023.

- Filed

a Registration Statement on Form S-4 including an Information

Statement/Prospectus regarding the acquisition of Evtec Aluminium

Limited on May 13, 2024

Gust Kepler, Chief Executive Officer, commented,

“The significant reduction in our operating loss for the first

quarter reflects the stabilization of our membership over the past

several quarters within the core business as well as lower

operating expenses.

-

We have completed development for our new portfolio alert product

StockNanny, which we are planning to launch in June of this

year.

-

We acquired 13% of Evtec Automotive Ltd., the sister company to

Evtec Aluminium in Q2 2023, which we may seek to acquire following

the acquisition of the Evtec Aluminium Ltd. as part of a larger

roll-up strategy.

-

The acquisition of Evtec Aluminium Ltd. has taken longer than

expected, however we are pleased to announce that we have an S-4

filed and are working diligently to complete this

transaction.”

Gust Kepler continued, “Despite 2023 being a

challenging year for our company, we have pivoted swiftly to

implement multiple strategic and operational initiatives for 2024

and I am confident that our stockholders will be well rewarded for

their faith in our company.”

Summary financial data is presented in the

tables below. Please see the Company’s Quarterly Report on Form

10-Q filed with the Securities and Exchange Commission on May 15,

2024, for additional information.

About Blackboxstocks, Inc.

Blackboxstocks, Inc. is a financial technology

and social media hybrid platform offering real-time proprietary

analytics and news for stock and options traders of all levels. Our

web-based software employs “predictive technology” enhanced by

artificial intelligence to find volatility and unusual market

activity that may result in the rapid change in the price of a

stock or option. Blackbox continuously scans the NASDAQ, New York

Stock Exchange, CBOE, and all other options markets, analyzing over

10,000 stocks and up to 1,500,000 options contracts multiple times

per second. We provide our users with a fully interactive social

media platform that is integrated into our dashboard, enabling our

users to exchange information and ideas quickly and efficiently

through a common network. We recently introduced a live audio/video

feature that allows our members to broadcast on their own channels

to share trade strategies and market insight within the Blackbox

community. Blackbox is a SaaS company with a growing base of users

that spans over 40 countries; current subscription fees are $99.97

per month or $959.00 annually. For more information, go

to: https://blackboxstocks.com

Safe Harbor Statement

Our prospects here at Blackbox stocks are

subject to uncertainties and risks. This press release contains

forward-looking statements that involve substantial uncertainties

and risks. These forward-looking statements are based upon our

current expectations, estimates and projections about our business,

and reflect our beliefs and assumptions based upon information

available to us at the date of this press release. In some cases,

you can identify these statements by words such as “if,” “may,”

“might,” “will,” “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” “continue,” and

other similar terms. These forward-looking statements include,

among other things, plans for proposed operations, descriptions of

our strategies, our product and market development plans, and other

objectives, expectations and intentions, the trends we anticipate

in our business and the markets in which we operate, and the

competitive nature and anticipated growth of those markets. We

caution readers that forward-looking statements are predictions

based on our current expectations about future events. These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and assumptions that are

difficult to predict. Our actual results, performance or

achievements could differ materially from those expressed or

implied by the forward-looking statements as a result of a number

of factors including, but not limited to, the risks and

uncertainties discussed in our other filings with the Securities

Exchange Commission. We undertake no obligation to revise or update

any forward-looking statement for any reason.

Disclosure of Non-GAAP Financial

Measures

We report our financial results in accordance

with accounting principles generally accepted in the United States

of America (“GAAP”). However, management believes the presentation

of certain non-GAAP financial measures provides useful information

to management and investors regarding financial and business trends

relating to the Company’s financial condition and results of

operations, and that when GAAP financial measures are viewed in

conjunction with the non-GAAP financial measures, investors are

provided with a more meaningful understanding of the Company’s

ongoing operating performance. In addition, these non-GAAP

financial measures are among the primary indicators management uses

as a basis for evaluating performance. For all non-GAAP financial

measures in this release, we have provided corresponding GAAP

financial measures for comparative purposes in the report.

We refer to the term “EBITDA” in various places

of our financial discussion. EBITDA is defined by us as net income

(loss) from continuing operations before interest expense, income

tax, depreciation and amortization expense and certain non-cash

expenses including stock-based compensation. EBITDA is not a

measure of operating performance under GAAP and therefore should

not be considered in isolation nor construed as an alternative to

operating profit, net income (loss) or cash flows from operating,

investing or financing activities, each as determined in accordance

with GAAP. Also, EBITDA should not be considered as a measure of

liquidity. Moreover, since EBITDA is not a measurement determined

in accordance with GAAP, and thus is susceptible to varying

interpretations and calculations, EBITDA, as presented, may not be

comparable to similarly titled measures presented by other

companies.

Contacts:

Investors@blackboxstocks.com

PCG AdvisoryJeff Ramsonjramson@pcgadvisory.com

-Tables Follow-

|

Blackboxstocks Inc. |

|

|

Summary Balance Sheet Data |

|

|

As of March 31, 2024 and December 31 2023 |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

|

March 31, 2024 |

|

December 31, 2023 |

|

|

Assets |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Cash |

|

$ |

114,968 |

|

|

$ |

472,697 |

|

| |

Receivables |

|

|

16,194 |

|

|

|

493,212 |

|

| |

Other current assets |

|

|

103,275 |

|

|

|

41,580 |

|

| |

Total current assets |

|

$ |

234,437 |

|

|

$ |

1,007,489 |

|

| |

|

|

|

|

|

|

| |

Property and equipment, net |

$ |

377,418 |

|

|

$ |

396,651 |

|

| |

Investments |

|

|

8,424,000 |

|

|

|

8,424,000 |

|

|

Total assets |

|

$ |

9,035,855 |

|

|

$ |

9,828,140 |

|

| |

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

| |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

| |

Accounts payable |

|

$ |

879,996 |

|

|

$ |

842,404 |

|

| |

Unearned subscriptions |

|

$ |

1,135,571 |

|

|

$ |

1,295,514 |

|

| |

Other current liabilities |

|

$ |

161,633 |

|

|

$ |

66,431 |

|

| |

Note payable, current portion |

$ |

29,094 |

|

|

$ |

28,064 |

|

| |

Total current liabilities |

|

$ |

2,206,294 |

|

|

$ |

2,232,413 |

|

| |

|

|

|

|

|

|

|

Long term liabilities: |

|

|

|

|

|

| |

Note payable, net of current portion |

$ |

3,291 |

|

|

$ |

11,550 |

|

| |

Lease liability right of use, long term |

$ |

278,555 |

|

|

$ |

287,417 |

|

| |

Total long term liabilities |

|

$ |

281,846 |

|

|

$ |

298,967 |

|

| |

|

|

|

|

|

|

|

Total stockholders' equity |

|

$ |

6,547,715 |

|

|

$ |

7,296,760 |

|

| |

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

9,035,855 |

|

|

$ |

9,828,140 |

|

| |

|

|

|

|

|

|

|

Blackboxstocks Inc. |

|

Summary Statements of Operations |

|

For the Three Months Ended March 31, 2024 and

2023 |

|

|

| |

|

|

| |

For the three months ended |

| |

March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

Revenue |

$ |

649,420 |

|

|

$ |

859,004 |

|

|

Cost of revenue |

|

357,958 |

|

|

|

447,631 |

|

|

Gross margin |

$ |

291,462 |

|

|

$ |

411,373 |

|

|

Operating expenses: |

|

1,155,428 |

|

|

|

2,358,177 |

|

|

Operating loss |

$ |

(863,966 |

) |

|

$ |

(1,946,804 |

) |

|

Other income |

|

(255 |

) |

|

|

(46,436 |

) |

|

Net loss |

$ |

(863,711 |

) |

|

$ |

(1,900,368 |

) |

| |

|

|

| |

|

|

|

Adjusted EBITDA |

$ |

(740,927 |

) |

|

$ |

(1,168,160 |

) |

| |

|

|

|

Adjusted EBITDA Calculation |

|

|

|

Net loss |

$ |

(863,711 |

) |

|

$ |

(1,900,368 |

) |

|

Adjustments: |

|

|

|

Depreciation and amortization expense |

|

8,373 |

|

|

|

10,518 |

|

|

Interest and financing expense |

|

93 |

|

|

|

165 |

|

|

Investment income |

|

(348 |

) |

|

|

(46,601 |

) |

|

Stock based compensation |

|

114,666 |

|

|

|

768,126 |

|

|

Total adjustments |

$ |

122,784 |

|

|

$ |

732,208 |

|

|

Adjusted EBITDA |

$ |

(740,927 |

) |

|

$ |

(1,168,160 |

) |

| |

|

|

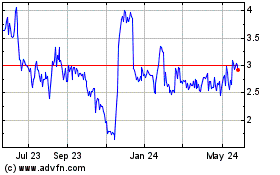

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Jun 2024 to Jul 2024

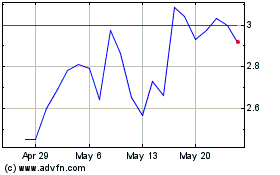

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Jul 2023 to Jul 2024