Blackboxstocks Inc. (NASDAQ: BLBX), (“Blackbox” or the

“Company”), a financial technology and social media hybrid platform

offering real-time proprietary analytics for stock and options

traders of all levels, today announced the Company’s financial

results for the second quarter and six months ended June 30,

2023.

Second Quarter Financial and Operating Highlights:

- Total revenue for the second quarter of 2023 was $737,398 as

compared to $1,399,315 for the same period in 2022. Revenue for the

six months ended June 30, 2023 was $1,596,402 as compared to

$2,671,801 for the prior year period.

- The average member count for the second quarter of 2023 was

3,937 compared to 5,482 for the second quarter of 2022 and 3,555

for the first quarter of 2023. Average member count for the six

months ended June 30, 2023 was 3,756 as compared to 5,954 for the

prior year period

- Operating expenses net of stock-based compensation decreased by

$606,385 in the second quarter of 2023 to $1,336,090 as compared to

$1,942,472 for the same period in 2022.

- Adjusted EBITDA was $(1,014,988) and $(1,036,737) for the three

months ended June 30, 2023 and 2022, respectively. Adjusted EBITDA

for the six months ended June 30, 2023 and 2022 was $2,183,145 and

$1,930,583, respectively.

Gust Kepler, Chief Executive Officer, commented, “We are

encouraged by the stabilization of the member base for our core

product, which is attributable to a reduction in our churn rate.

Recent changes to our marketing team are expected to have a

positive impact on our growth trajectory. We have also

significantly reduced our operating expenses as we prepare for the

launch of StockNanny, which we expect to release later this year.

StockNanny is a mobile application for the self-directed investor,

a market demographic that is exponentially larger than the

day-trader segment we currently serve. In addition to StockNanny,

our marketing initiatives that leverage our technology through

licensing agreements with financial institutions, offers a

potential new revenue stream that is much less costly to operate

than our current B2C model.

“In addition, we have made significant progress with our merger

with Evtec Group Limited and believe this will provide maximum

value for our stakeholders in parallel to our continued operations

of Blackbox when it is completed.”

Robert Winspear, Chief Financial Officer, added, “We believe

that our sustainable expense reductions will enable us to focus on

our new product and marketing initiatives as we continue to pursue

our planned acquisition of Evtec Group Limited and certain of its

related entities.”

Summary financial data is presented in the tables below. Please

see the Company’s quarterly report on Form 10-Q filed with the

Securities and Exchange Commission on August 14, 2023 for

additional information.

About Blackboxstocks, Inc.

Blackboxstocks, Inc. is a financial technology and social media

hybrid platform offering real-time proprietary analytics and news

for stock and options traders of all levels. Our web-based software

employs “predictive technology” enhanced by artificial intelligence

to find volatility and unusual market activity that may result in

the rapid change in the price of a stock or option. Blackbox

continuously scans the NASDAQ, New York Stock Exchange, CBOE, and

all other options markets, analyzing over 10,000 stocks and up to

1,500,000 options contracts multiple times per second. We provide

our users with a fully interactive social media platform that is

integrated into our dashboard, enabling our users to exchange

information and ideas quickly and efficiently through a common

network. We recently introduced a live audio/video feature that

allows our members to broadcast on their own channels to share

trade strategies and market insight within the Blackbox community.

Blackbox is a SaaS company with a growing base of users that spans

42 countries; current subscription fees are $99.97 per month or

$959.00 annually. For more information, go to:

https://blackboxstocks.com

Safe Harbor Statement

Our prospects here at Blackbox stocks are subject to

uncertainties and risks. This press release contains

forward-looking statements that involve substantial uncertainties

and risks. These forward-looking statements are based upon our

current expectations, estimates and projections about our business,

and reflect our beliefs and assumptions based upon information

available to us at the date of this press release. In some cases,

you can identify these statements by words such as “if,” “may,”

“might,” “will, “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” “continue,” and

other similar terms. These forward-looking statements include,

among other things, plans for proposed operations, descriptions of

our strategies, our product and market development plans, and other

objectives, expectations and intentions, the trends we anticipate

in our business and the markets in which we operate, and the

competitive nature and anticipated growth of those markets. We

caution readers that forward-looking statements are predictions

based on our current expectations about future events. These

forward-looking statements are not guarantees of future performance

and are subject to risks, uncertainties and assumptions that are

difficult to predict. Our actual results, performance or

achievements could differ materially from those expressed or

implied by the forward-looking statements as a result of a number

of factors including, but not limited to, the risks and

uncertainties discussed in our other filings with the Securities

Exchange Commission. We undertake no obligation to revise or update

any forward-looking statement for any reason.

Disclosure of Non-GAAP Financial Measures

We report our financial results in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”). However, management believes the presentation of certain

non-GAAP financial measures provides useful information to

management and investors regarding financial and business trends

relating to the Company’s financial condition and results of

operations, and that when GAAP financial measures are viewed in

conjunction with the non-GAAP financial measures, investors are

provided with a more meaningful understanding of the Company’s

ongoing operating performance. In addition, these non-GAAP

financial measures are among the primary indicators management uses

as a basis for evaluating performance. For all non-GAAP financial

measures in this release, we have provided corresponding GAAP

financial measures for comparative purposes in the report.

We refer to the term “EBITDA” in various places of our financial

discussion. EBITDA is defined by us as net income (loss) from

continuing operations before interest expense, income tax,

depreciation and amortization expense and certain non-cash expenses

including stock-based compensation. EBITDA is not a measure of

operating performance under GAAP and therefore should not be

considered in isolation nor construed as an alternative to

operating profit, net income (loss) or cash flows from operating,

investing or financing activities, each as determined in accordance

with GAAP. Also, EBITDA should not be considered as a measure of

liquidity. Moreover, since EBITDA is not a measurement determined

in accordance with GAAP, and thus is susceptible to varying

interpretations and calculations, EBITDA, as presented, may not be

comparable to similarly titled measures presented by other

companies.

-Tables Follow-

Blackboxstocks Inc. Summary Balance Sheet Data As

of June 30, 2023 and December 31, 2022 (Unaudited)

June 30, 2023

December 31, 2022

Assets Cash

$

272,564

$

425,578

Marketable securities

673,174

3,216,280

Other current assets

450,144

265,197

Total current assets

$

1,395,882

$

3,907,055

Property and equipment, net

374,809

428,726

Investment

8,424,000

-

Total assets

$

10,194,691

$

4,335,781

Liabilities and Stockholders' Equity Current

liabilities: Accounts payable

$

750,097

$

730,099

Unearned subscriptions

$

720,516

$

1,022,428

Other current liabilities

$

68,984

$

71,615

Note payable, current portion

$

28,877

$

28,733

Total current liabilities

$

1,568,474

$

1,852,875

Long term liabilities: Note payable, net of current portion

$

25,139

$

39,614

Lease liability right of use, long term

$

232,667

$

265,639

Total long term liabilities

$

257,806

$

305,253

Total stockholders' equity

$

8,368,411

$

2,177,653

Total liabilities and stockholders' equity

$

10,194,691

$

4,335,781

Blackboxstocks Inc. Summary Statements of Operations

For the Three and Six Months Ended June 30,2023 and 2022

(Unaudited) For the three months ended For the six

months ended June June

2023

2022

2023

2022

Revenue

$

737,398

$

1,399,315

$

1,596,402

$

2,671,801

Cost of revenue

426,975

499,427

874,606

1,079,389

Gross margin

$

310,423

$

899,888

$

721,796

$

1,592,412

Operating expenses:

1,741,722

2,068,654

4,099,899

3,782,332

Operating loss

$

(1,431,299

)

$

(1,168,766

)

$

(3,378,103

)

$

(2,189,920

)

Other income (expense)

(6,805

)

147,333

(53,241

)

368,622

Net loss

$

(1,424,494

)

$

(1,316,099

)

$

(3,324,862

)

$

(2,558,542

)

Adjusted EBITDA

$

(1,014,988

)

$

(1,036,737

)

$

(2,183,145

)

$

(1,930,583

)

Adjusted EBITDA Calculation Net loss

$

(1,424,494

)

$

(1,316,099

)

$

(3,324,862

)

$

(2,558,542

)

Adjustments: Depreciation and amortization expense

10,679

5,850

21,197

11,125

Interest and financing expense

147

42,266

312

84,823

Investment (income) loss

(6,952

)

105,067

(53,553

)

283,799

Stock based compensation

405,632

126,179

1,173,761

248,212

Total adjustments

$

409,506

$

279,362

$

1,141,717

$

627,959

Adjusted EBITDA

$

(1,014,988

)

$

(1,036,737

)

$

(2,183,145

)

$

(1,930,583

)

Tags: SOFTWARE-APPLICATION TECHNOLOGY

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230814647250/en/

Investors@blackboxstocks.com

PCG Advisory Stephanie Prince (646) 863-6341

sprince@pcgadvisory.com

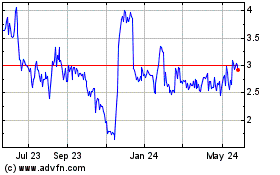

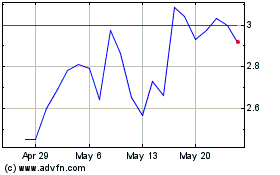

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Jun 2024 to Jul 2024

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Jul 2023 to Jul 2024