AMC Networks Inc. ("AMC Networks" or the "Company") (NASDAQ: AMCX)

today reported financial results for the second quarter ended

June 30, 2024.

Chief Executive Officer Kristin

Dolan said: "AMC Networks continues to find opportunities

in a strategic plan built around programming, partnerships and

profitability. Key to our plan is the creation and curation of

celebrated films and series, and making them available to audiences

everywhere, including through an exciting new branded content

licensing agreement with Netflix. In the first half of 2024, we’ve

made significant progress against our strategic priority of

generating strong free cash flow, and we’re well on our way to

achieving our free cash flow guidance for the full year."

Operational Highlights:

-

Expanded our longstanding relationship with Netflix by striking an

innovative deal to strategically curate and window prior seasons of

15 AMC branded shows on their platform, launching on August

19th.

-

Entered into a new licensing partnership with Sky, making Sky the

new home of The Walking Dead Universe in the UK.

-

Continued participation in new and innovative internet-delivered

skinny bundles including the inclusion of our AMC, We TV, BBCA, BBC

News, Sundance and IFC networks in Optimum's new Entertainment TV

package available on Optimum Stream.

-

Successfully implemented price increases for two of our targeted

streaming services: Acorn TV and HIDIVE with an insignificant

impact to churn due to highly-engaged, brand-loyal subscriber

bases.

-

AMC Reality, a branded offering on ITVX, the UK’s largest AVOD

platform, launched May 30th joining AMC Stories which launched on

ITVX on April 8th.

-

Greenlit the third series in the expanding Anne Rice Immortal

Universe, a drama for AMC and AMC+ focused on a secretive society

called The Talamasca, slated for a 2025 premiere.

-

Announced a new series from AMC Studios for AMC and AMC+, set

inside the bubble of Silicon Valley, from writer and showrunner

Jonathan Glatzer of Succession, Bad Sisters, and Better Call Saul

fame.

Financial Highlights – Second Quarter

Ended June 30, 2024:

-

Net cash provided by operating activities of $104 million; Free

Cash Flow(1) of $95 million.

-

Operating income of $11 million included impairment and other

charges of $97 million in the second quarter; Adjusted Operating

Income(1) of $153 million, with a margin of 24%.

-

Net revenues of $626 million decreased 8% from the prior year.

Excluding $20 million of revenues in the prior year related to the

return of rights from Hulu, $19 million of revenues in the prior

year related to 25/7 Media (which we divested on December 29, 2023)

and $13 million of revenues in the current period related to a

one-time adjustment payment at AMCNI, net revenues decreased 4%.

-

Streaming revenues of $150 million increased 9% from the prior

year.

-

Diluted EPS of $(0.66); Adjusted EPS(1) of $1.24.

|

Dollars in thousands, except per share amounts |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

Change |

|

|

|

2024 |

|

|

2023 |

|

Change |

|

|

Net Revenues |

|

$ |

625,934 |

|

|

$ |

678,628 |

|

(7.8 |

)% |

|

$ |

1,222,395 |

|

$ |

1,396,075 |

|

(12.4 |

)% |

|

Operating Income |

|

$ |

10,788 |

|

|

$ |

105,701 |

|

(89.8 |

)% |

|

$ |

120,966 |

|

$ |

279,005 |

|

(56.6 |

)% |

|

Adjusted Operating Income |

|

$ |

152,807 |

|

|

$ |

176,777 |

|

(13.6 |

)% |

|

$ |

301,931 |

|

$ |

392,540 |

|

(23.1 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings (Loss) Per Share |

|

$ |

(0.66 |

) |

|

$ |

1.60 |

|

n/m |

|

$ |

0.37 |

|

$ |

3.97 |

|

n/m |

|

Adjusted Earnings Per Share |

|

$ |

1.24 |

|

|

$ |

2.02 |

|

(38.6 |

)% |

|

$ |

2.40 |

|

$ |

4.64 |

|

(48.3 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

104,403 |

|

|

$ |

157,566 |

|

(33.7 |

)% |

|

$ |

255,272 |

|

$ |

25,047 |

|

n/m |

|

Free Cash Flow |

|

$ |

95,165 |

|

|

$ |

147,614 |

|

(35.5 |

)% |

|

$ |

239,314 |

|

$ |

3,597 |

|

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See page 5 of this earnings release for a

discussion of non-GAAP financial measures used in this release.

This discussion includes the definition of Adjusted Operating

Income, Adjusted EPS and Free Cash Flow.

Segment Results:(dollars in

thousands)

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

Net Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Operations |

|

$ |

538,291 |

|

|

$ |

581,819 |

|

|

(7.5 |

)% |

|

$ |

1,062,517 |

|

|

$ |

1,193,673 |

|

|

(11.0 |

)% |

|

International |

|

|

90,095 |

|

|

|

99,304 |

|

|

(9.3 |

)% |

|

|

165,700 |

|

|

|

207,376 |

|

|

(20.1 |

)% |

|

Inter-segment Eliminations |

|

|

(2,452 |

) |

|

|

(2,495 |

) |

|

1.7 |

% |

|

|

(5,822 |

) |

|

|

(4,974 |

) |

|

(17.0 |

)% |

|

Total Net Revenues |

|

$ |

625,934 |

|

|

$ |

678,628 |

|

|

(7.8 |

)% |

|

$ |

1,222,395 |

|

|

$ |

1,396,075 |

|

|

(12.4 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Operations |

|

$ |

102,735 |

|

|

$ |

162,530 |

|

|

(36.8 |

)% |

|

$ |

244,752 |

|

|

$ |

362,018 |

|

|

(32.4 |

)% |

|

International |

|

|

(43,795 |

) |

|

|

(11,705 |

) |

|

(274.2 |

)% |

|

|

(35,186 |

) |

|

|

2,437 |

|

|

n/m |

|

Corporate / Inter-segment Eliminations |

|

|

(48,152 |

) |

|

|

(45,124 |

) |

|

(6.7 |

)% |

|

|

(88,600 |

) |

|

|

(85,450 |

) |

|

(3.7 |

)% |

|

Total Operating Income |

|

$ |

10,788 |

|

|

$ |

105,701 |

|

|

(89.8 |

)% |

|

$ |

120,966 |

|

|

$ |

279,005 |

|

|

(56.6 |

)% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Operating Income (Loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Domestic Operations |

|

$ |

155,348 |

|

|

$ |

184,806 |

|

|

(15.9 |

)% |

|

$ |

317,667 |

|

|

$ |

404,194 |

|

|

(21.4 |

)% |

|

International |

|

|

29,265 |

|

|

|

19,186 |

|

|

52.5 |

% |

|

|

42,665 |

|

|

|

40,323 |

|

|

5.8 |

% |

|

Corporate / Inter-segment Eliminations |

|

|

(31,806 |

) |

|

|

(27,215 |

) |

|

(16.9 |

)% |

|

|

(58,401 |

) |

|

|

(51,977 |

) |

|

(12.4 |

)% |

|

Total Adjusted Operating Income |

|

$ |

152,807 |

|

|

$ |

176,777 |

|

|

(13.6 |

)% |

|

$ |

301,931 |

|

|

$ |

392,540 |

|

|

(23.1 |

)% |

|

|

Domestic Operations

Second Quarter Results:

-

Domestic Operations revenues decreased 7% from the prior year to

$538 million.

-

Subscription revenues decreased 3% to $323 million, primarily due

to declines in the linear subscriber universe, partially offset by

an increase in streaming revenues.

-

Streaming revenues increased 9% to $150 million driven by

year-over-year subscriber growth and price increases.

-

Streaming subscribers increased 5% to 11.6 million as compared to

11.0 million subscribers as of June 30, 2023.

-

Affiliate revenues decreased 12% to $172 million, primarily due to

basic subscriber declines.

-

Content licensing revenues decreased 18% to $67 million due to the

availability of deliveries in the period. The prior period included

$20 million of revenues related to the return of rights from Hulu

that resulted in the acceleration of revenue previously anticipated

to be recognized in 2024. Excluding prior period revenues

associated with the return of rights from Hulu, content licensing

revenues increased 10%.

-

Advertising revenues decreased 11% to $149 million due to linear

ratings declines and a challenging ad market, partly offset by

digital and advanced advertising revenue growth.

-

Operating income of $103 million included a long-lived asset

impairment charge related to our BBCA joint venture of $29

million.

-

Adjusted Operating Income decreased 16% to $155 million, with a

margin of 29%. The decrease in Adjusted Operating Income was

primarily driven by a decrease in revenues, partly offset by

continued cost management measures.

International

In 2024, the Company updated the name of its

previously titled "International and Other" operating segment to

"International" following the divestiture of the 25/7 Media

business on December 29, 2023, which was the sole component of the

operating segment that comprised “Other.” This update does not

constitute a change in segment reporting, but rather an update in

name only. Prior period segment information contained in this

release includes the results of the 25/7 Media business through the

date of divestiture.

Second Quarter Results:

-

International revenues decreased 9% from the prior year to $90

million. The prior period included $19 million of content licensing

and other revenues related to 25/7 Media, which we divested on

December 29, 2023. Additionally, current period advertising revenue

included $13 million of revenue related to a one-time adjustment

payment. Excluding revenues related to 25/7 Media and the one-time

adjustment payment, International revenues decreased 4%.

-

Subscription revenues decreased 13% to $50 million, primarily due

to the non-renewal of an AMCNI distribution agreement in the UK

that occurred in the fourth quarter of 2023.

-

Content licensing and other revenues decreased 86% to $3 million

due to the sale of our interest in 25/7 Media in December

2023.

-

Advertising revenues increased 84% to $38 million due to a $13

million one-time adjustment payment and new streaming offerings in

the UK. Excluding the one-time adjustment payment, advertising

revenues increased 18%.

-

Operating loss of $44 million included a goodwill impairment change

of $68 million related to AMCNI.

-

Adjusted Operating Income increased 53% to $29 million. The

increase in Adjusted Operating Income was primarily driven by the

one-time adjustment payment. 25/7 Media generated $1 million of AOI

in the second quarter of 2023. Excluding AOI related to the

one-time adjustment payment, International AOI was $16 million,

with a margin of 21%.

Other Matters

Open Market Repurchases of 4.25% Senior Notes

due 2029

In June 2024, the Company repurchased $15

million principal amount of its 4.25% senior notes due 2029 on the

open market, at a discount of $4.9 million, and retired the

repurchased notes.

4.25% Convertible Senior Notes due 2029

On June 21, 2024, the Company completed an

offering of $143.75 million principal amount of its 4.25%

convertible senior notes due 2029 (the "Convertible Notes"). The

Convertible Notes may be converted at an initial conversion rate of

78.5083 shares of Class A Common Stock per $1,000 principal amount

of Convertible Notes (equivalent to an initial conversion price of

approximately $12.74 per share).

Impairment and Other Charges

Impairment and other charges of $97 million for

the quarter ended June 30, 2024 primarily consisted of a $68

million goodwill impairment charge at AMCNI and $29 million of

long-lived asset impairment charges at BBCA.

During the second quarter of 2024, we determined

that the decline in our stock price was an indicator of potential

impairment of goodwill. Accordingly, we performed quantitative

assessments for all of our reporting units and concluded that the

fair value of the AMCNI reporting unit declined to less than its

carrying amount. As a result, we recognized an impairment charge of

$68 million, which is included in Impairment and other charges in

the condensed consolidated statements of income (loss).

Additionally, the Company performed a recoverability test and

determined that the carrying amount of the BBCA asset group

exceeded its fair value, therefore an impairment charge of $29

million was recorded for identifiable intangible assets and other

long-lived assets, which is included in Impairment and other

charges in the condensed consolidated statement of income (loss)

within the Domestic Operations operating segment.

Stock Repurchase Program & Outstanding

Shares

As previously disclosed, the Company's Board of

Directors has authorized a program to repurchase up to $1.5 billion

of the Company’s outstanding shares of common stock. The Stock

Repurchase Program has no pre-established end date and may be

suspended or discontinued at any time. During the quarter ended

June 30, 2024, the Company did not repurchase any shares. As

of June 30, 2024, the Company had $135 million of

authorization remaining for repurchase under the Stock Repurchase

Program.

As of August 2, 2024, the Company had

32,613,713 shares of Class A Common Stock and 11,484,408 shares of

Class B Common Stock outstanding.

Please see the Company’s Quarterly Report on

Form 10-Q for the period ended June 30, 2024, which will be

filed later today, for further details regarding the above

matters.

Description of Non-GAAP

Measures

Internally, the Company uses net revenues,

Adjusted Operating Income (Loss), and Free Cash Flow measures as

the most important indicators of its business performance and

evaluates management’s effectiveness with specific reference to

these indicators.

The Company defines Adjusted Operating Income

(Loss), which is a non-GAAP financial measure, as operating income

(loss) before share-based compensation expense or benefit,

depreciation and amortization, impairment and other charges

(including gains or losses on sales or dispositions of businesses),

restructuring and other related charges, cloud computing

amortization, and including the Company’s proportionate share of

adjusted operating income (loss) from majority-owned equity method

investees. From time to time, we may exclude the impact of certain

events, gains, losses, or other charges (such as significant legal

settlements) from AOI that affect our operating performance.

Because it is based upon operating income (loss), Adjusted

Operating Income (Loss) also excludes interest expense (including

cash interest expense) and other non-operating income and expense

items. The Company believes that the exclusion of share-based

compensation expense or benefit allows investors to better track

the performance of the various operating units of the business

without regard to the effect of the settlement of an obligation

that is not expected to be made in cash.

The Company believes that Adjusted Operating

Income (Loss) is an appropriate measure for evaluating the

operating performance of the business segments and the Company on a

consolidated basis. Adjusted Operating Income (Loss) and similar

measures with similar titles are common performance measures used

by investors, analysts, and peers to compare performance in the

industry. Adjusted Operating Income (Loss) should be viewed as a

supplement to and not a substitute for operating income (loss), net

income (loss), and other measures of performance presented in

accordance with U.S. generally accepted accounting principles

("GAAP"). Since Adjusted Operating Income (Loss) is not a measure

of performance calculated in accordance with GAAP, this measure may

not be comparable to similar measures with similar titles used by

other companies. For a reconciliation of operating income (loss) to

Adjusted Operating Income (Loss), please see pages 8-9 of this

release.

The Company defines Free Cash Flow, which is a

non-GAAP financial measure, as net cash provided by operating

activities less capital expenditures, all of which are reported in

our Consolidated Statement of Cash Flows. The Company believes the

most comparable GAAP financial measure of its liquidity is net cash

provided by operating activities. The Company believes that Free

Cash Flow is useful as an indicator of its overall liquidity, as

the amount of Free Cash Flow generated in any period is

representative of cash that is available for debt repayment,

investment, and other discretionary and non-discretionary cash

uses. The Company also believes that Free Cash Flow is one of

several benchmarks used by analysts and investors who follow the

industry for comparison of its liquidity with other companies in

the industry, although the Company’s measure of Free Cash Flow may

not be directly comparable to similar measures reported by other

companies. For a reconciliation of net cash provided by operating

activities to Free Cash Flow, please see page 11 of this

release.

The Company defines Adjusted Earnings per

Diluted Share (“Adjusted EPS”), which is a non-GAAP financial

measure, as earnings per diluted share excluding the following

items: amortization of acquisition-related intangible assets;

impairment and other charges (including gains or losses on sales or

dispositions of businesses); non-cash impairments of goodwill,

intangible and fixed assets; restructuring and other related

charges; and the impact associated with the modification of debt

arrangements, including gains and losses related to the

extinguishment of debt; as well as the impact of taxes on the

aforementioned items. The Company believes the most comparable GAAP

financial measure is earnings per diluted share. The Company

believes that Adjusted EPS is one of several benchmarks used by

analysts and investors who follow the industry for comparison of

its performance with other companies in the industry, although the

Company’s measure of Adjusted EPS may not be directly comparable to

similar measures reported by other companies. For a reconciliation

of earnings per diluted share to Adjusted EPS, please see pages

12-13 of this release.

Forward-Looking Statements

This earnings release may contain statements

that constitute forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements are based on management's current expectations and are

subject to uncertainty and changes in circumstances. Investors are

cautioned that any such forward-looking statements are not

guarantees of future performance or results and involve risks and

uncertainties and that actual results or developments may differ

materially from those in the forward-looking statements as a result

of various factors, including financial community and rating agency

perceptions of the Company and its business, operations, financial

condition and the industries in which it operates and the factors

described in the Company’s filings with the Securities and Exchange

Commission, including the sections entitled "Risk Factors" and

"Management’s Discussion and Analysis of Financial Condition and

Results of Operations" contained therein. The Company disclaims any

obligation to update any forward-looking statements contained

herein.

Conference Call Information

AMC Networks will host a conference call today

at 8:30 a.m. ET to discuss its second quarter 2024 results. To

listen to the call, please visit investors.amcnetworks.com.

About AMC Networks Inc.

AMC Networks (Nasdaq: AMCX) is home to many of

the greatest stories and characters in TV and film and the premier

destination for passionate and engaged fan communities around the

world. The company creates and curates celebrated series and films

across distinct brands and makes them available to audiences

everywhere. Its portfolio includes targeted streaming services

AMC+, Acorn TV, Shudder, Sundance Now, ALLBLK and HIDIVE; cable

networks AMC, BBC AMERICA (operated through a joint venture with

BBC Studios, which includes U.S. distribution and sales

responsibilities for BBC News), IFC, SundanceTV and We TV; and film

distribution labels IFC Films and RLJE Films. The company also

operates AMC Studios, its in-house studio, production and

distribution operation behind acclaimed and fan-favorite original

franchises including The Walking Dead Universe and the Anne Rice

Immortal Universe; and AMC Networks International, its

international programming business.

Contacts

|

Investor Relations |

|

|

Corporate Communications |

|

Nicholas Seibert |

|

|

Jim Maiella |

|

nicholas.seibert@amcnetworks.com |

|

|

jim.maiella@amcnetworks.com |

|

|

|

|

|

|

|

|

AMC NETWORKS INC.CONSOLIDATED STATEMENTS

OF INCOME (LOSS) (Dollars in thousands, except per

share amounts)(unaudited) |

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues, net |

|

$ |

625,934 |

|

|

$ |

678,628 |

|

|

$ |

1,222,395 |

|

|

$ |

1,396,075 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Technical and operating (excluding depreciation and

amortization) |

|

|

280,727 |

|

|

|

321,961 |

|

|

|

552,303 |

|

|

|

648,690 |

|

|

Selling, general and administrative |

|

|

208,176 |

|

|

|

194,298 |

|

|

|

397,057 |

|

|

|

379,904 |

|

|

Depreciation and amortization |

|

|

26,493 |

|

|

|

25,745 |

|

|

|

52,319 |

|

|

|

51,620 |

|

|

Impairment and other charges |

|

|

96,819 |

|

|

|

24,882 |

|

|

|

96,819 |

|

|

|

24,882 |

|

|

Restructuring and other related charges |

|

|

2,931 |

|

|

|

6,041 |

|

|

|

2,931 |

|

|

|

11,974 |

|

|

Total operating expenses |

|

|

615,146 |

|

|

|

572,927 |

|

|

|

1,101,429 |

|

|

|

1,117,070 |

|

|

Operating income |

|

|

10,788 |

|

|

|

105,701 |

|

|

|

120,966 |

|

|

|

279,005 |

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(43,216 |

) |

|

|

(38,930 |

) |

|

|

(76,057 |

) |

|

|

(76,547 |

) |

|

Interest income |

|

|

9,292 |

|

|

|

7,342 |

|

|

|

18,177 |

|

|

|

15,258 |

|

|

Gain on extinguishment of debt, net |

|

|

247 |

|

|

|

— |

|

|

|

247 |

|

|

|

— |

|

|

Miscellaneous, net |

|

|

1,493 |

|

|

|

10,140 |

|

|

|

(3,697 |

) |

|

|

14,729 |

|

|

Total other expense |

|

|

(32,184 |

) |

|

|

(21,448 |

) |

|

|

(61,330 |

) |

|

|

(46,560 |

) |

| Income (loss) from operations before income taxes |

|

|

(21,396 |

) |

|

|

84,253 |

|

|

|

59,636 |

|

|

|

232,445 |

|

|

Income tax expense |

|

|

(10,893 |

) |

|

|

(22,155 |

) |

|

|

(34,542 |

) |

|

|

(59,054 |

) |

|

Net income (loss) including noncontrolling interests |

|

|

(32,289 |

) |

|

|

62,098 |

|

|

|

25,094 |

|

|

|

173,391 |

|

|

Net (income) loss attributable to noncontrolling interests |

|

|

3,055 |

|

|

|

8,141 |

|

|

|

(8,525 |

) |

|

|

458 |

|

|

Net income (loss) attributable to AMC Networks' stockholders |

|

$ |

(29,234 |

) |

|

$ |

70,239 |

|

|

$ |

16,569 |

|

|

$ |

173,849 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss)

per share attributable to AMC Networks' stockholders: |

|

|

|

|

|

Basic |

|

$ |

(0.66 |

) |

|

$ |

1.60 |

|

|

$ |

0.37 |

|

|

$ |

3.98 |

|

|

Diluted |

|

$ |

(0.66 |

) |

|

$ |

1.60 |

|

|

$ |

0.37 |

|

|

$ |

3.97 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average common shares: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

44,466 |

|

|

|

43,842 |

|

|

|

44,267 |

|

|

|

43,702 |

|

|

Diluted |

|

|

44,466 |

|

|

|

43,900 |

|

|

|

45,443 |

|

|

|

43,835 |

|

|

|

|

AMC NETWORKS INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in

thousands)(Unaudited) |

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

|

|

Domestic Operations |

|

International |

|

Corporate / Inter-segment Eliminations |

|

Consolidated |

|

Operating income (loss) |

|

$ |

102,735 |

|

$ |

(43,795 |

) |

|

$ |

(48,152 |

) |

|

$ |

10,788 |

|

Share-based compensation expenses |

|

|

2,748 |

|

|

905 |

|

|

|

4,804 |

|

|

|

8,457 |

|

Depreciation and amortization |

|

|

10,800 |

|

|

4,151 |

|

|

|

11,542 |

|

|

|

26,493 |

|

Restructuring and other related charges |

|

|

2,931 |

|

|

— |

|

|

|

— |

|

|

|

2,931 |

|

Impairment and other charges |

|

|

28,815 |

|

|

68,004 |

|

|

|

— |

|

|

|

96,819 |

|

Cloud computing amortization |

|

|

3,283 |

|

|

— |

|

|

|

— |

|

|

|

3,283 |

|

Majority owned equity investees AOI |

|

|

4,036 |

|

|

— |

|

|

|

— |

|

|

|

4,036 |

| Adjusted operating

income (loss) |

|

$ |

155,348 |

|

$ |

29,265 |

|

|

$ |

(31,806 |

) |

|

$ |

152,807 |

| |

|

Three Months Ended June 30, 2023 |

| |

|

Domestic Operations |

|

International |

|

Corporate / Inter-segment Eliminations |

|

Consolidated |

|

Operating income (loss) |

|

$ |

162,530 |

|

$ |

(11,705 |

) |

|

$ |

(45,124 |

) |

|

$ |

105,701 |

|

Share-based compensation expenses |

|

|

2,192 |

|

|

846 |

|

|

|

4,610 |

|

|

|

7,648 |

|

Depreciation and amortization |

|

|

11,663 |

|

|

4,902 |

|

|

|

9,180 |

|

|

|

25,745 |

|

Restructuring and other related charges |

|

|

3,905 |

|

|

261 |

|

|

|

1,875 |

|

|

|

6,041 |

|

Impairment and other charges |

|

|

— |

|

|

24,882 |

|

|

|

— |

|

|

|

24,882 |

|

Cloud computing amortization |

|

|

5 |

|

|

— |

|

|

|

2,244 |

|

|

|

2,249 |

|

Majority owned equity investees AOI |

|

|

4,511 |

|

|

— |

|

|

|

— |

|

|

|

4,511 |

| Adjusted operating

income (loss) |

|

$ |

184,806 |

|

$ |

19,186 |

|

|

$ |

(27,215 |

) |

|

$ |

176,777 |

|

|

|

AMC NETWORKS INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in

thousands)(Unaudited) |

|

|

| |

|

Six Months Ended June 30, 2024 |

| |

|

Domestic Operations |

|

International |

|

Corporate / Inter-segment Eliminations |

|

Consolidated |

|

Operating income (loss) |

|

$ |

244,752 |

|

$ |

(35,186 |

) |

|

$ |

(88,600 |

) |

|

$ |

120,966 |

|

Share-based compensation expenses |

|

|

5,978 |

|

|

1,671 |

|

|

|

6,883 |

|

|

|

14,532 |

|

Depreciation and amortization |

|

|

20,827 |

|

|

8,176 |

|

|

|

23,316 |

|

|

|

52,319 |

|

Restructuring and other related charges |

|

|

2,931 |

|

|

— |

|

|

|

— |

|

|

|

2,931 |

|

Impairment and other charges |

|

|

28,815 |

|

|

68,004 |

|

|

|

— |

|

|

|

96,819 |

|

Cloud computing amortization |

|

|

6,831 |

|

|

— |

|

|

|

— |

|

|

|

6,831 |

|

Majority owned equity investees AOI |

|

|

7,533 |

|

|

— |

|

|

|

— |

|

|

|

7,533 |

| Adjusted operating

income (loss) |

|

$ |

317,667 |

|

$ |

42,665 |

|

|

$ |

(58,401 |

) |

|

$ |

301,931 |

| |

|

Six Months Ended June 30, 2023 |

| |

|

Domestic Operations |

|

International |

|

Corporate / Inter-segment Eliminations |

|

Consolidated |

|

Operating income (loss) |

|

$ |

362,018 |

|

$ |

2,437 |

|

$ |

(85,450 |

) |

|

$ |

279,005 |

|

Share-based compensation expenses |

|

|

6,639 |

|

|

1,685 |

|

|

4,969 |

|

|

|

13,293 |

|

Depreciation and amortization |

|

|

23,517 |

|

|

9,673 |

|

|

18,430 |

|

|

|

51,620 |

|

Restructuring and other related charges |

|

|

4,723 |

|

|

1,646 |

|

|

5,605 |

|

|

|

11,974 |

|

Impairment and other charges |

|

|

— |

|

|

24,882 |

|

|

— |

|

|

|

24,882 |

|

Cloud computing amortization |

|

|

10 |

|

|

— |

|

|

4,469 |

|

|

|

4,479 |

|

Majority owned equity investees AOI |

|

|

7,287 |

|

|

— |

|

|

— |

|

|

|

7,287 |

| Adjusted operating

income (loss) |

|

$ |

404,194 |

|

$ |

40,323 |

|

$ |

(51,977 |

) |

|

$ |

392,540 |

|

|

|

AMC NETWORKS INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in

thousands)(Unaudited) |

|

|

|

Capitalization |

June 30, 2024 |

|

|

Cash and cash equivalents |

$ |

802,553 |

|

|

|

|

|

|

Credit facility debt (a) |

$ |

416,875 |

|

|

Senior notes (a) |

|

2,003,760 |

|

|

Total debt |

$ |

2,420,635 |

|

| |

|

|

|

Net debt |

$ |

1,618,082 |

|

|

|

|

|

|

Finance leases |

|

16,766 |

|

|

Net debt and finance leases |

$ |

1,634,848 |

|

| |

|

|

| |

Twelve Months Ended June 30, 2024 |

|

| Operating Income (GAAP) |

$ |

230,373 |

|

|

Share-based compensation expense |

|

26,904 |

|

|

Depreciation and amortization |

|

108,101 |

|

|

Restructuring and other related charges |

|

18,744 |

|

|

Impairment and other charges |

|

168,626 |

|

|

Cloud computing amortization |

|

12,895 |

|

|

Majority owned equity investees |

|

13,852 |

|

| Adjusted Operating Income

(Non-GAAP) |

$ |

579,495 |

|

| |

|

|

|

Leverage ratio (b) |

|

2.8 |

x |

|

|

|

|

|

(a) Represents the

aggregate principal amount of the debt.(b) Represents net debt and

finance leases divided by Adjusted Operating Income for the twelve

months ended June 30, 2024. This ratio differs from the

calculation contained in the Company's credit facility. No

adjustments have been made for consolidated entities that are not

100% owned.

|

|

|

|

|

AMC NETWORKS INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in thousands)

(Unaudited) |

|

|

|

Free Cash Flow (1) |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net cash provided by operating activities |

|

$ |

104,403 |

|

|

$ |

157,566 |

|

|

$ |

255,272 |

|

|

$ |

25,047 |

|

|

Less: capital expenditures |

|

|

(9,238 |

) |

|

|

(9,952 |

) |

|

|

(15,958 |

) |

|

|

(21,450 |

) |

|

Free Cash Flow |

|

$ |

95,165 |

|

|

$ |

147,614 |

|

|

$ |

239,314 |

|

|

$ |

3,597 |

|

|

Supplemental Cash Flow Information |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Restructuring initiatives (2) |

|

$ |

(3,282 |

) |

|

$ |

(31,620 |

) |

|

$ |

(8,103 |

) |

|

$ |

(88,506 |

) |

|

Distributions to noncontrolling interests |

|

|

(15,352 |

) |

|

|

(15,585 |

) |

|

|

(16,520 |

) |

|

|

(27,087 |

) |

| |

|

|

|

|

|

|

|

|

(1) Free Cash Flow

includes the impact of certain cash receipts or payments (such as

restructuring initiatives, significant legal settlements, and

programming write-offs) that affect period-to-period

comparability.

2) Restructuring

initiatives includes cash payments of $0.9 million and $2.2 million

for content impairments and other exit costs for the three and six

months ended June 30, 2024, respectively, and $2.4 million and $5.9

million for severance and employee-related costs for the three and

six months ended June 30, 2024, respectively. Restructuring

initiatives includes cash payments of $11.2 million and $52.2

million for content impairments and other exit costs for the three

and six months ended June 30, 2023, respectively, and $20.4 million

and $36.3 million for severance and employee-related costs for the

three and six months ended June 30, 2023, respectively.

|

|

|

AMC NETWORKS INC.SUPPLEMENTAL FINANCIAL DATA

(Dollars in thousands, except per share amounts)

(Unaudited) |

|

Adjusted Earnings Per Share |

| |

|

Three Months Ended June 30, 2024 |

| |

|

Income (loss) from operations before income taxes |

|

Income tax (expense) benefit |

|

Net (income) loss attributable to noncontrolling interests |

|

Net income (loss) attributable to AMC Networks' stockholders |

|

Diluted EPS attributable to AMC Networks' stockholders |

|

Reported Results (GAAP) |

|

$ |

(21,396 |

) |

|

$ |

(10,893 |

) |

|

$ |

3,055 |

|

|

$ |

(29,234 |

) |

|

$ |

(0.66 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

|

9,608 |

|

|

|

(2,460 |

) |

|

|

(962 |

) |

|

|

6,186 |

|

|

|

0.14 |

|

|

Restructuring and other related charges |

|

|

2,931 |

|

|

|

(784 |

) |

|

|

— |

|

|

|

2,147 |

|

|

|

0.05 |

|

|

Impairment and other charges |

|

|

96,819 |

|

|

|

(3,801 |

) |

|

|

(14,616 |

) |

|

|

78,402 |

|

|

|

1.76 |

|

|

Gain on extinguishment of debt, net |

|

|

(247 |

) |

|

|

66 |

|

|

|

— |

|

|

|

(181 |

) |

|

|

— |

|

|

Dilutive income and share basis difference - GAAP vs.

Adjusted(1) |

|

|

153 |

|

|

|

(37 |

) |

|

|

— |

|

|

|

116 |

|

|

|

(0.05 |

) |

|

Adjusted Results (Non-GAAP) |

|

$ |

87,868 |

|

|

$ |

(17,909 |

) |

|

$ |

(12,523 |

) |

|

$ |

57,436 |

|

|

$ |

1.24 |

|

|

|

(1) For the

reconciliation of Adjusted EPS to GAAP EPS, the item “Dilutive

income and share basis difference - GAAP vs. Adjusted” represents

the impact of the adjustments from a net loss to net income

position, which required an adjustment for the interest expense

associated with the convertible debt and a change in the dilutive

shares outstanding to reflect additional dilutive shares associated

with restricted stock units and convertible debt that were

considered anti-dilutive on a GAAP basis.

| |

| |

|

Three Months Ended June 30, 2023 |

| |

|

Income from operations before income taxes |

|

Income tax expense |

|

Net (income) loss attributable to noncontrolling interests |

|

Net income attributable to AMC Networks' stockholders |

|

Diluted EPS attributable to AMC Networks' stockholders |

|

Reported Results (GAAP) |

|

$ |

84,253 |

|

$ |

(22,155 |

) |

|

$ |

8,141 |

|

|

$ |

70,239 |

|

$ |

1.60 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

|

10,469 |

|

|

(2,104 |

) |

|

|

(1,704 |

) |

|

|

6,661 |

|

|

0.15 |

|

Restructuring and other related charges |

|

|

6,041 |

|

|

(1,433 |

) |

|

|

(90 |

) |

|

|

4,518 |

|

|

0.11 |

|

Impairment and other charges |

|

|

24,882 |

|

|

(2,175 |

) |

|

|

(15,949 |

) |

|

|

6,758 |

|

|

0.15 |

|

Gain on extinguishment of debt, net |

|

|

605 |

|

|

(147 |

) |

|

|

— |

|

|

|

458 |

|

|

0.01 |

|

Adjusted Results (Non-GAAP) |

|

$ |

126,250 |

|

$ |

(28,014 |

) |

|

$ |

(9,602 |

) |

|

$ |

88,634 |

|

$ |

2.02 |

|

|

|

AMC NETWORKS INC.SUPPLEMENTAL FINANCIAL

DATA (Dollars in thousands, except per share

amounts) (Unaudited) |

|

|

|

Adjusted Earnings Per Share |

| |

|

Six Months Ended June 30, 2024 |

| |

|

Income (loss) from operations before income taxes |

|

Income tax (expense) benefit |

|

Net (income) loss attributable to noncontrolling interests |

|

Net income (loss) attributable to AMC Networks' stockholders |

|

Diluted EPS attributable to AMC Networks' stockholders |

|

Reported Results (GAAP) (1) |

|

$ |

59,789 |

|

|

$ |

(34,579 |

) |

|

$ |

(8,525 |

) |

|

$ |

16,685 |

|

|

$ |

0.37 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

|

18,164 |

|

|

|

(4,333 |

) |

|

|

(1,924 |

) |

|

|

11,907 |

|

|

|

0.26 |

|

Restructuring and other related charges |

|

|

2,931 |

|

|

|

(784 |

) |

|

|

— |

|

|

|

2,147 |

|

|

|

0.05 |

|

Impairment and other charges |

|

|

96,819 |

|

|

|

(3,801 |

) |

|

|

(14,616 |

) |

|

|

78,402 |

|

|

|

1.72 |

|

Gain on extinguishment of debt, net |

|

|

(247 |

) |

|

|

66 |

|

|

|

— |

|

|

|

(181 |

) |

|

|

— |

|

Adjusted Results (Non-GAAP) |

|

$ |

177,456 |

|

|

$ |

(43,431 |

) |

|

$ |

(25,065 |

) |

|

$ |

108,960 |

|

|

$ |

2.40 |

|

|

(1) Includes the required adjustment for

interest expense associated with the convertible debt.

| |

|

Six Months Ended June 30, 2023 |

| |

|

Income from operations before income taxes |

|

Income tax expense |

|

Net (income) loss attributable to noncontrolling interests |

|

Net income attributable to AMC Networks' stockholders |

|

Diluted EPS attributable to AMC Networks' stockholders |

|

Reported Results (GAAP) |

|

$ |

232,445 |

|

$ |

(59,054 |

) |

|

$ |

458 |

|

|

$ |

173,849 |

|

$ |

3.97 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquisition-related intangible assets |

|

|

20,887 |

|

|

(4,175 |

) |

|

|

(3,409 |

) |

|

|

13,303 |

|

|

0.30 |

|

Restructuring and other related charges |

|

|

11,974 |

|

|

(2,777 |

) |

|

|

(204 |

) |

|

|

8,993 |

|

|

0.21 |

|

Impairment and other charges |

|

|

24,882 |

|

|

(2,175 |

) |

|

|

(15,949 |

) |

|

|

6,758 |

|

|

0.15 |

|

Gain on extinguishment of debt, net |

|

|

605 |

|

|

(147 |

) |

|

|

— |

|

|

|

458 |

|

|

0.01 |

|

Adjusted Results (Non-GAAP) |

|

$ |

290,793 |

|

$ |

(68,328 |

) |

|

$ |

(19,104 |

) |

|

$ |

203,361 |

|

$ |

4.64 |

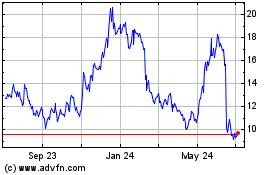

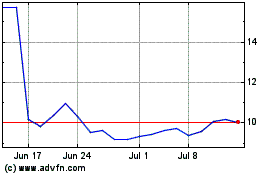

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Dec 2024 to Jan 2025

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Jan 2024 to Jan 2025