HIGHLIGHTS

- Continued solid profitability in 2024 despite volumes under

pressure (-1.3% vs. 2023): 2024 revenue of €3,456 million, down

-11.5% compared to 2023 on a reported basis and at constant scope

and exchange rates1, with adjusted EBITDA2 of €842.5 million (2023:

€1,108.0 million) and adjusted EBITDA margin of 24.4% (2023:

28.4%).

- Confirmed recovery in activity in Q4: organic volume

growth and adjusted EBITDA up +4.3% to €201.2 million (2023: €192.9

million) with a 24.5% margin (2023: 23.3%).

- Robust balance sheet: net debt ratio on 31 December 2024

at 2.1x last 12-month adjusted EBITDA compared to 2.3x on 30

September 2024 (1.2x at 31 December 2023); liquidity3 of €953

million at 31 December 2024.

- Proposal for the payment of a dividend of €1.70 per

share4 for the 2024 financial year.

- Ongoing decarbonization actions: in 2024, reduction in

Scope 1 & 2 CO2 emissions5 by -9.4% vs. 2023 (-23.7% vs.

2019)6, in line with our 2030 target validated by the SBTi

initiative.

- 2025, return to solid free cash flow generation: 2025

objectives of generating adjusted EBITDA close to 2024 and more

than doubling free cash flow generation (around €200 million)

compared to 2024 in a still uncertain market environment.

- Organization of a Capital Markets Day in September

during which the Group will present its new mid-term roadmap

(strategy, financial and CSR targets and capital allocation

policy).

Regulatory News:

Verallia (Paris:VRLA):

"Following an exceptional year in 2023, Verallia successfully

adapted to the uncertainties of 2024, marked by ongoing destocking

effects that weighed on demand recovery. The Group continues to

demonstrate robust profitability, underpinned by solid

fundamentals. We have maintained stringent cost and investment

management while advancing our strategic initiatives, including the

inauguration of the first 100% electric furnace in Cognac and the

completion of a new acquisition in Italy. In the face of a still

uncertain market environment, our priority for 2025 will be cash

generation, with strict cost control and the continued positive

impact of the Performance Improvement Plan (PAP)", commented

Patrice Lucas, Chief Executive Officer of Verallia.

REVENUE

Revenue breakdown by region

in millions of euros

2024

2023

% change

Of which organic

growth7

Southern and Western Europe

2,268.6

2,527.2

-10.2%

-12.7 %

Northern and Eastern Europe

759.2

979.8

-22.5%

-21.6 %

Latin America

428.3

396.8

+7.9%

+21.1% (-0.5% excluding

Argentina)

Group Total

3,456.1

3,903.8

-11.5%

-11.5% (-14.0% excluding

Argentina)

In 2024, the group generated revenue of €3,456.1 million,

down -11.5% on a reported basis compared to last year. In Q4

2024 alone, revenue amounted to €820.9 million, down -1.0% on a

reported basis compared to Q4 2023.

Foreign exchange effect amounted to -1.6%, or € (61.1)

million in 2024 and +18.1%, or +€149.9 million in Q4 2024. It is

mainly linked to the depreciation of the Argentine peso in 2024

(even if its impact is much lower than in 2023), and to a lesser

extent to that of the Brazilian real.

Scope effect, related to the acquisition of Vidrala's

glass activities in Italy in July 2024 as well as the acquisition

of cullet processing centers in Iberia in Q4 2023, contributed

€61.1 million or +1.6% in 2024. In Q4, this contribution amounted

to €23.3 million, or +2.8%.

At constant scope and exchange rates, 2024 revenue decreased

by -11.5% (-14.0% excluding Argentina), and revenue in Q4 2024

by -21.9% (significant impact of the devaluation of the Argentine

peso in Q4 2023) and -9.1% excluding Argentina. As anticipated in

July, demand was subdued at Group level for the year 2024. Beer

volumes are improving, benefiting from the gradual end of

destocking and a fairly low basis of comparison for the year 2023.

Spirits posted the largest decline in volume. The other segments

posted a slight year-on-year decline despite a rebound in the

second half of the year.

In Q4 2024, as in Q3, volumes grew organically, driven by good

momentum in still wines, beer and food jars.

2024 revenue was also affected by lower selling prices in

Europe, with H1 price negotiations fully impacting H2. Mix

contribution was slightly negative for the year, with a

normalization observed in the second half.

By geographical area:

- In Southern and Western Europe,

revenue was down -10.2% on a reported basis and -12.7% at constant

exchange rates and scope for the full year 2024, primarily due to

lower selling prices. Sales volumes remain stable, bolstered by the

significant contribution from Italy, which benefits from the

strategic acquisition of Vidrala Italia (Corsico site) in July

2024. On a like-for-like basis, the beer segment is growing again

after a disappointing 2023. Other segments experienced moderate

declines, but showed improved momentum in Q4 for still wines and

spirits.

- In Northern and Eastern Europe,

revenue decreased by -22.5% on a reported basis and by -21.6% at

constant exchange rates and scope in 2024. Activity slowed down

significantly. The most challenging segments are spirits in the

United Kingdom and beer in Germany. Food jar volumes are on the

rise again in Q4 2024. Situation in Ukraine remains uncertain;

Verallia's top priority continues to be the safety of its teams and

serving its local customers.

- In Latin America, revenue grew by

+7.9% on a reported basis and by +21.1% at constant exchange rates

and scope in 2024. The beer segment was the most dynamic throughout

the year and in Q4, driven by a very active Brazilian market and

the full-year impact of the new furnace at our Jacutinga site.

Additionally, still wines experienced positive trends across all

countries in the region, more than offsetting the decline in

sparkling wine volumes.

ADJUSTED EBITDA

Breakdown of adjusted EBITDA by region

in millions of euros

2024

2023

Southern and Western Europe

Adjusted EBITDA8

547.8

725.2

Adjusted EBITDA margin

24.1%

28.7%

Northern and Eastern Europe

Adjusted EBITDA8

147.3

244.2

Adjusted EBITDA margin

19.4%

24.9%

Latin America

Adjusted EBITDA8

147.4

138.5

Adjusted EBITDA margin

34.4%

34.9%

Group Total

Adjusted EBITDA8

842.5

1,108.0

Adjusted EBITDA margin

24.4%

28.4%

Adjusted EBITDA was €842 million in 2024, representing an

adjusted EBITDA margin of 24.4% (2023: 28.4%). In Q4, adjusted

EBITDA was €201 million with a margin of 24.5% (24.3% in the first

9 months of the year).

Unfavorable foreign exchange effect reached €(19) million in

2024 (+€44 million in Q4 2024), primarily due to the

depreciation of the Argentine peso and the Brazilian real.

Scope effect is positive and largely linked to the

six-month consolidation of Vidrala Italia, acquired in July

2024.

Activity declined over the year, impacting adjusted

EBITDA by €(165) million (despite a positive contribution of +€34

million in Q4). This year-on-year decrease is primarily linked to

inventory variation effects, as the positive impact of inventory

increases seen in 2023 did not recur.

The contribution of the inflation spread9 was negative by

€(165) million for the year (€(200) million excluding

Argentina), impacted by a carry-over effect on the sales prices

adjusted in 2023 and by the price reductions applied during the

year. Spread remains negative in Q4 at €(90) million (€(64) million

excluding Argentina).

The net reduction in cash production costs (PAP) again

strongly contributed to the improvement in EBITDA by €64 million

(or 2.8% of cash production costs), above the 2% target set by the

Group.

By geographic region, 2024 adjusted EBITDA break down as

follows:

- In Southern and Western Europe,

adjusted EBITDA reached €548 million for the year (vs. €725 million

in 2023) and a margin of 24.1% compared to 28.7% in 2023. The

negative impact on the region's adjusted EBITDA is due to the

combined effect of lower volumes and the absence in 2024 of the

positive inventory increase effect seen in 2023. Lower selling

prices also weighed on the region's margin, with a negative

inflation spread not offset by the PAP. However, the consolidation

of Vidrala Italia over the last six months contributed to volume

stability during the period.

- Northern and Eastern Europe posted

adjusted EBITDA of €147 million (vs. €244 million in 2023),

bringing its margin to 19.4%, compared to 24.9% in 2023. Activity

was down due to lower volumes and the negative spread was not

offset by cost-cutting actions.

- In Latin America, adjusted EBITDA

grew in 2024 to €147 million (vs. €139 million in 2023), posting a

solid margin of 34.4% compared to 34.9% in 2023. Activity was

positive, driven by dynamic volumes, particularly in Brazil, and

the cost reduction plan (PAP) also contributed.

The decrease in net profit to €239 million (EPS10: €2.01

per share) is mainly due to the decrease in adjusted EBITDA and, to

a lesser extent, to the increase in financial expenses. Like every

year, 2024 net profit includes a charge of €44 million and €0.37

per share (net of tax), which was recorded at the time of the

acquisition of Saint-Gobain's packaging business in 2015 and will

expire in 2027. Excluding this charge, net profit would be €283

million and €2.38 per share. This charge was €45 million and

€0.38 per share in 2023.

Booked capital expenditure reached €323 million (i.e.

9.4% of total revenue), compared to €418 million in 2023. These

investments consist of €206 million in recurring capex (vs. €234

million in 2023) and €117 million in strategic capex (vs. €184

million in 2023) mainly corresponding to investments related to

the construction of the new furnaces in Campo Bom in Brazil and

Pescia in Italy, the Cognac electric furnace in France, as well as

investments related to CO2 emission reductions.

Operating cash flow11 was down to €399 million compared

to €582 million in 2023. The reduction in capital expenditure

failed to fully offset the decline in adjusted EBITDA and the

increase in working capital (including the strong cash outflows at

the beginning of the year related to investments booked at the end

of 2023).

Free cash flow12 amounted to €82.6 million, down compared

to 2023 but steadily improving over the quarters thanks to strict

expense control.

ROBUST BALANCE SHEET

At the end of December 2024, Verallia's net financial debt

amounted to €1,797 million, up €433 million compared to 2023,

mainly due to the acquisition of Vidrala Italia in July 2024.

The net debt ratio thus amounted to 2.1x 2024 adjusted

EBITDA, compared with 2.3x at the end of September 2024 and

1.2x at the end of December 2023.

In November 2024, Verallia successfully issued new Euro senior

bonds for a total amount of €600.0 million with an 8-year maturity

and a fixed annual coupon of 3.875%. These bonds are rated BBB- by

S&P, in line with Verallia's long-term ratings (Baa3/BBB-

stable outlook at Moody's/S&P). The proceeds were allocated to

(i) the full repayment of the €250.0 million loan implemented to

acquire Vidrala Italia, (ii) the partial early repayment of €350.0

million of the term loan implemented in April 2023 and (iii) the

financing of the Group's general corporate purposes.

In December 2024, Verallia set up a revolving credit facility

(RCF) with an initial principal amount of €250 million, undrawn as

of December 31, 2024. This RCF has a 3-year maturity and two 1-year

extension options.

As a result, the Group had liquidity13 of €953 million as

of December 31, 2024 and had no significant debt maturing before

2028.

START-UP OF THE 100% ELECTRIC FURNACE IN COGNAC, A WORLD

FIRST IN THE FOOD GLASS PACKAGING INDUSTRY

Verallia inaugurated the 100% electric furnace in Cognac on

September 10, 2024. This furnace, with a capacity of 180 tons per

day, is a world first in the glass packaging industry.

It produces flint glass bottles and has now made its first

deliveries.

This furnace will make it possible, thanks to a 60% reduction in

its CO2 emissions, to contribute to the industrial decarbonization

of Verallia France. With this investment, Verallia takes on a

leadership role in the supply chain, with the aim of decarbonizing

the glass industry.

ACQUISITION OF THE GLASS ACTIVITIES OF THE VIDRALA GROUP IN

ITALY

On February 28, 2024, Verallia entered into an agreement to

acquire Vidrala's glass business in Italy.

Verallia completed the acquisition of all the subsidiary's

shares on July 4, 2024 after the approval of the Competition

Authorities, for a price of €142.5 million (€230 million in

enterprise value).

The acquisition of Vidrala Italia was financed through a term

loan agreement with a three-year maturity, totaling €250.0 million.

The full amount was made available to the company on July 1, 2024.

The latter was fully refinanced on November 7, 2024, with a new

€600 million bond issuance, maturing in 8 years.

Equipped with two recently renovated furnaces, the Corsico-based

plant benefits from modern production facilities and enjoys a

strong positioning, particularly in the beer, food and spirits

markets. This acquisition allows the Group to expand its industrial

footprint in the strategic Italian market and to develop its glass

packaging offering for beverages and food products for the benefit

of all its customers.

SUSTAINABLE DEVELOPMENT INDICATORS

Scope 1 and 2 CO2 emissions amounted to 2,357 kt CO2 for the

year 2024, a decrease of -9.4% compared to 2023 emissions of

2,603 kt CO2 (i.e. -23.7% vs. 2019). Verallia is therefore in line

with its trajectory of reducing its "Scope 1 and 214 CO2 emissions

by 46% in absolute terms by 2030 (reference year 2019)15. Scope

1 and 2 emissions intensity has also decreased this year from

0.47 tCO2/TPG16 in 2023 at 0.44 tCO2/TPG16 in 2024.

In addition, our cullet utilization rate15 reached 56.7% in

2024, up 2.6 points compared to 2023 (54.1%).

As part of the deployment of its decarbonization strategy, the

Group started up its first 100% electric furnace in Cognac (France)

in March, with a confirmed 60% reduction in CO2 emissions compared

to a traditional furnace. In 2025, we will continue to implement

our CSR roadmap with the start-up of our first hybrid furnace in

Zaragoza (Spain).

2024 DIVIDEND

Verallia’s Board of Directors decided during their meeting on 19

February 2025 to propose the payment of a €1.70 cash dividend per

share for the 2024 financial year. This amount will be subject to

the approval of the Annual General Shareholders' Meeting which will

take place on 25 April 2025.

OUTLOOK 2025

The year 2025 begins in an uncertain environment, marked by

continued subdued European consumption and an upsurge in

geopolitical and trade tensions that could affect our customers'

exports.

We expect demand in Europe to increase very slightly, as seen in

recent quarters, and to remain strong in Latin America.

In this context, Verallia has set itself the following

objectives:

- achieve an adjusted EBITDA in 2025 close to that of 2024 by

offsetting the negative impact of the carry-over effect of 2024

price reductions through continued cost control and a renewed

positive impact of the PAP

- more than double its free cash flow generation (around €200

million).

Verallia is planning to present its strategy and the Group's

mid-term outlook as well as its capital allocation policy during a

Capital Markets Day (CMD) in September 2025.

UNSOLICITED PROPOSAL RECEIVED FOR THE ACQUISITION OF THE

GROUP'S STAKE IN ITS ARGENTINIAN SUBSIDIARY

The Group has received an unsolicited proposal to acquire its

59.9% stake in the Argentinian company Rayen-Cura, which generated

sales of €144 million17 in 2024 and operates an industrial site

with two furnaces. Verallia is currently reviewing this proposal,

which will only be pursued if it fully values the Group's

Argentinian activities.

FOLLOW-UP TO THE PRESS RELEASE OF BW GESTÃO DE INVESTIMENTOS

LTDA ("BWGI")18 AND SET UP OF AN AD HOC COMMITTEE

On February 3, 2025, BWGI issued a press release confirming that

it is reviewing a potential takeover bid for Verallia shares

(without delisting)19. As of today, this intention has not been

confirmed.

In order to monitor the work of the Company's Board of Directors

in the context of this project and pending the submission of a

proposal including the detailed terms of the offer, the Board met

on February 4 and set up an ad hoc committee from among its

members, composed exclusively of independent members of the Board

of Directors within the meaning of the Afep-Medef corporate

governance Code, namely:

- Ms. Marie-José Donsion in her capacity as President of the said

ad hoc committee,

- Mr. Didier Debrosse, and

- Mr. Pierre Vareille.

The ad hoc committee will be in charge of (i) proposing to the

Board of Directors the appointment of an independent expert, (ii)

monitoring the works of the independent expert that will be

appointed by the Board of Directors, and (iii) issuing a

recommendation to the Board of Directors regarding the interest for

all of the Company’s stakeholders of the offer that may be

submitted by BWGI.

The Board of Directors, during its meeting on February 19, 2025,

decided, in this context and on the recommendation of the ad hoc

committee, to approve the appointment of Cabinet Ledouble to act as

independent expert.20

A shareholder of Verallia since its IPO in 2019, BWGI,

controlled by Brazil’s Moreira Salles family, is Verallia's

reference shareholder, holding 28.8% of the share capital and 27.9%

of the voting rights to date.

The Verallia Group consolidated financial statements for the

financial year ended 31 December 2024 were approved by the Board of

Directors on 19 February 2025. The consolidated financial

statements have been audited by the Statutory Auditors.

An analysts’ conference call will be held at 9.00am (CET)

on Thursday, 20 February 2025 via an audio webcast service (live

and replay) and the earnings presentation will be available on

www.verallia.com.

FINANCIAL CALENDAR

- 2 April 2025: Beginning of the quiet period.

- 23 April 2025: Q1 2025 financial results - Press release after

market close and conference call/presentation the next day at

9.00am CET.

- 25 April 2025: Annual General Shareholders’ Meeting.

- 8 July 2025: Beginning of the quiet period.

- 29 July 2025: H1 2025 financial results - Press release after

market close and conference call/presentation the next day at

9.00am CET.

- September 2025: Capital markets day.

- 1 October 2025: Beginning of the quiet period.

- 22 October 2025: Q3 2025 financial results - Press release

after market close and conference call/presentation the following

day at 9.00am CET.

About Verallia

At Verallia, our purpose is to re-imagine glass for a

sustainable future. We want to redefine how glass is produced,

reused and recycled, to make it the world’s most sustainable

packaging material. We work together with our customers, suppliers

and other partners across the value chain to develop new,

beneficial and sustainable solutions for all.

With almost 11,000 employees and 35 glass production facilities

in 12 countries, we are the European leader and world's

third-largest producer of glass packaging for beverages and food

products. We offer innovative, customised and environmentally

friendly solutions to over 10,000 businesses worldwide. Verallia

produced more than 16 billion glass bottles and jars and recorded

revenue of €3.5 billion in 2024.

Verallia's CSR strategy has been awarded the Ecovadis Platinum

Medal, placing the Group in the top 1% of companies assessed by

Ecovadis. Our CO2 emissions reduction target of -46% on scopes 1

and 2 between 2019 and 2030 has been validated by SBTi (Science

Based Targets Initiative). It is in line with the trajectory of

limiting global warming to 1.5° C set by the Paris Agreement.

Verallia is listed on compartment A of the regulated market of

Euronext Paris (Ticker: VRLA – ISIN: FR0013447729) and trades on

the following indices: CAC SBT 1.5°, STOXX600, SBF 120, CAC Mid 60,

CAC Mid & Small and CAC All-Tradable.

Disclaimer

Certain information included in this press release is not

historical data but forward-looking statements. These

forward-looking statements are based on estimates, forecasts and

assumptions including, but not limited to, assumptions about

Verallia's present and future strategy and the economic environment

in which Verallia operates. They involve known and unknown risks,

uncertainties and other factors, which may cause Verallia's actual

results and performance to differ materially from those expressed

or implied in such forward-looking statements. These risks and

uncertainties include those detailed and identified in Chapter 4

"Risk Factors" of the universal registration document filed with

the Autorité des marchés financiers ("AMF") and available on the

Company’s website (www.verallia.com) and that of the AMF

(www.amf-france.org). These forward-looking statements and

information are not guarantees of future performance. This press

release includes summarized information only and does not purport

to be exhaustive.

This press release does not contain, nor does it constitute, an

offer of securities or a solicitation to invest in securities in

France, the United States, or any other jurisdiction.

Protection of personal data

You may unsubscribe from the distribution list of our press

releases at any time by sending your request to the following email

address: investors@verallia.com. Press releases will still be

available via the website

https://www.verallia.com/en/investors/.

Verallia SA, as data controller, processes personal data for the

purpose of implementing and managing its internal and external

communication. This processing is based on legitimate interests.

The data collected (last name, first name, professional contact

details, profiles, relationship history) is essential for this

processing and is used by the relevant departments of the Verallia

Group and, where applicable, its subcontractors. Verallia SA

transfers personal data to its service providers located outside

the European Union, who are responsible for providing and managing

technical solutions related to the aforementioned processing.

Verallia SA ensures that the appropriate guarantees are obtained in

order to supervise these data transfers outside of the European

Union. Under the conditions defined by the applicable regulations

for the protection of personal data, you may access and obtain a

copy of the data concerning you, object to the processing of this

data and request for it to be rectified or erased. You also have a

right to restrict the processing of your data. To exercise any of

these rights, please contact the Group Financial Communication

Department at investors@verallia.com. If, after having contacted

us, you believe that your rights have not been respected or that

the processing does not comply with data protection regulations,

you may submit a complaint to the CNIL (Commission nationale de

l'informatique et des libertés — France’s regulatory body).

APPENDIX - Key figures

in millions of euros

2024

2023

Revenue

3,456.1

3,903.8

Reported growth

-11.5 %

+16.5%

Organic growth

-11.5 %

+21.4%

of which Southern and Western Europe

2,268.6

2 527.2

of which Northern and Eastern Europe

759.2

979.8

of which Latin America

428.3

396.8

Cost of sales

(2,739.4)

(2,853.5)

Selling, general and administrative

expenses

(168.7)

(212.4)

Acquisition-related items

(75.6)

(71.3)

Other operating income and expenses

(13.1)

(5.2)

Operating profit/(loss)

459.2

761.3

Financial income/(expense)

(135.3)

(119.0)

Profit (loss) before tax

324.0

642.4

Income tax

(84.5)

(167.4)

Share of net profit (loss) of

associates

(0.9)

0.3

Net profit/(loss)21

238.6

475.3

Net profit/(loss) excluding PPA

282.6

520.2

Net profit/(loss) attributable to the

shareholders of the company 21

235.7

470.0

Net profit/(loss) attributable to the

shareholders of the company excluding PPA

279.7

514.9

Earnings per share

€2.01

€4.02

Earnings per share excluding

PPA

€2.38

€4.40

Adjusted EBITDA22

842.5

1,108.0

Group margin

24.4%

28.4%

of which Southern and Western Europe

547.8

725.2

Southern and Western Europe margin

24.1%

28.7%

of which Northern and Eastern Europe

147.3

244.2

Northern and Eastern Europe margin

19.4%

24.9%

of which Latin America

147.4

138.5

Latin America margin

34.4%

34.9%

Net debt at end of period

1,797.4

1,364.5

Last 12 months adjusted EBITDA

842.5

1,108.0

Net debt/last 12 months adjusted

EBITDA

2.1x

1.2x

Total capex23

323.4

418.0

Cash conversion24

61.6%

62.3%

Change in operating working capital

(120.2)

(108.3)

Operating cash flow25

398.9

581.7

Free cash flow26

82.6

365.3

Strategic capex27

117.2

183.6

Recurring capex28

206.2

234.4

New presentation of the bridges (Argentina impact)

The group has, up until H1 2024, presented its financial bridges

including the impact of Argentina under each heading as represented

below in the column "Group analysis".

Due to Argentina's economic situation (hyper-inflation and sharp

currency devaluation) and in order to present the group's

performance more clearly, we outline below a second version (since

Q3 2024) of the bridges isolating in a separate section the net

impact of Argentina on changes in revenue and adjusted EBITDA from

one period to the next ("Analysis excluding Argentina" column).

This new presentation makes it easier to understand Verallia's

performance in terms of volume, price/mix, spread, etc.

Change in revenue by type in millions of euros in Q4

In millions of euros

Group analysis

Analysis excluding

Argentina29

Q4 2023 revenue

829.2

Volumes

-11.6

+18.3

Price / Mix

-169.9

-94.4

Foreign exchange impact

+149.9

-11.1

Scope effect

+23.3

+23.3

Argentina

+55.6

Q4 2024 revenue

820.9

Change in revenue by type in millions of euros during 2024

In millions of euros

Group analysis

Analysis excluding

Argentina29

2023 revenue

3,903.8

Volumes

-173.2

-166.7

Price / Mix

-274.5

-366.3

Foreign exchange impact

-61.1

-32.4

Scope effect

+61.1

+61.1

Argentina

+56.7

2024 revenue

3,456.1

Change in adjusted EBITDA by type in millions of euros in Q4

In millions of euros

Group analysis

Analysis excluding

Argentina30

Q4 2023 Adjusted EBITDA

192.9

Activity contribution

+34.0

+35.6

Price-mix /Cost spread

-90.3

-63.7

Net productivity

+14.9

+17.2

Foreign exchange impact

+43.6

-4.5

Other

+6.0

+6.3

Argentina

+17.4

Q4 2024 Adjusted EBITDA

201.2

Change in adjusted EBITDA by type in millions of euros during

2024

In millions of euros

Group analysis

Analysis excluding

Argentina30

2023 Adjusted EBITDA

1,108.0

Activity contribution

-164.9

-165.7

Price-mix /Cost spread

-165.1

-200.4

Net productivity

+64.3

+61.9

Foreign exchange impact

-19.3

-10.8

Other

+19.6

+38.1

Argentina

+11.4

2024 Adjusted EBITDA

842.5

Change in last 12 months adjusted EBITDA since 2017

[Graphic omitted]

Key figures for the fourth quarter

in millions of euros

Q4 2024

Q4 2023

Revenue

820.9

829,2

Reported growth

-1.0%

-0.6%

Organic growth

-21.9%

(-9.1% excluding Argentina)

+18.1%

(+1.6% excluding Argentina)

Adjusted EBITDA

201.2

192.9

Adjusted EBITDA margin

24.5%

23.3 %

Reconciliation of operating profit/(loss) to adjusted EBITDA

in millions of euros

2024

2023

Operating profit/(loss)

459.2

761.3

Depreciation and amortisation31

356.6

326.7

Restructuring costs

14.1

3.4

IAS 29 Hyperinflation (Argentina)32

(4.4)

5.8

Management share ownership plan and

associated costs

2.5

6.2

Company acquisition costs and

earn-outs

3.5

0.7

Other

11.0

3.9

Adjusted EBITDA

842.5

1,108.0

Adjusted EBITDA and cash conversion are alternative performance

indicators within the meaning of AMF position n°2015-12.

Adjusted EBITDA and cash conversion are not standardized

accounting aggregates that meet a single definition generally

accepted by IFRS. They should not be considered as a substitute for

operating income, cash flows from operating activities that are

measures defined by IFRS or a liquidity measure. Other issuers may

calculate adjusted EBITDA and cash conversion differently from the

Group's definition.

IAS 29: Hyperinflation in Argentina

Since 2018, the Group has been applying IAS 29 in Argentina. The

application of this standard requires the revaluation of non-cash

assets and liabilities and the income statement to reflect changes

in purchasing power in the local currency. These remeasurements may

lead to a gain or loss on the net money position included in the

financial result.

In addition, the financial assets of the Argentine subsidiary

are translated into euros at the closing exchange rate of the

relevant period.

In 2024, the net impact on revenue was €14.3 million. The

impact of hyperinflation is excluded from consolidated adjusted

EBITDA as presented in the "Operating income to adjusted EBITDA

transition table".

Financial structure

In millions of euros

Nominal or max. drawable

amount

Nominal rate

Final maturity

December 31, 2024

Sustainability-Linked Bond

May 202133

500

1.625 %

May 2028

503.6

Sustainability-Linked Bond

November 202133

500

1.875 %

Nov. 2031

495.5

Bond November 202433

600

3.875 %

Nov. 2032

595.6

Term Loan B – TLB33

200

Euribor +1.50%

Apr. 2028

201.9

Revolving credit facility – RCF

2023

550

Euribor +1.00%

Apr. 2029 + one-year

extension

-

Revolving credit facility – RCF 2027

250

Euribor +0.80%

Dec. 2027 + 2x one-year

extension

-

Negotiable commercial paper (Neu CP)33

500

317.3

Other debt34

153.6

Total debt

2,267.4

Cash and cash equivalents

(470.0)

Net debt

1,797.4

As of 31/12/2024, total financial debts35 amounted to €2,254.8

million, compared to €2,380.2 million as of 30/09/2024 and €1,838.7

million as of 31/12/2023.

Consolidated statement of income

in millions of euros

2024

2023

Revenue

3,456.1

3,903.8

Cost of sales

(2,739.4)

(2,853.5)

Selling, general and administrative

expenses

(168.7)

(212.4)

Acquisition-related items

(75.6)

(71.3)

Other operating income and expenses

(13.1)

(5.2)

Operating profit/(loss)

459.2

761.3

Financial income/(expense)

(135.3)

(119.0)

Profit (loss) before tax

324.0

642.4

Income tax

(84.5)

(167.4)

Share of net profit (loss) of

associates

(0.9)

0.3

Net profit/(loss) 36

238.6

475.3

Attributable to shareholders of the

Company

235.7

470.0

Attributable to non-controlling

interests

2.9

5.3

Net profit/(loss) excluding PPA

282.6

520.2

Attributable to shareholders of the

Company

279.7

514.9

Attributable to non-controlling

interests

2.9

5.3

Basic earnings per share (in

euros)

2.01

4.02

Basic earnings per share excluding PPA

(in euros)

2.38

4.40

Diluted earnings per share (in

euros)

2.00

4.01

Diluted earnings per share excluding

PPA (in euros)

2.37

4.39

Consolidated balance sheet

in millions of euros

31 Dec. 2024

31 Dec. 2023

ASSETS

Goodwill

733.5

687.8

Other intangible assets

390.9

416.2

Property, plant and equipment

1,956.7

1,795.6

Investments in associates

6.4

6.7

Deferred tax

21.0

33.6

Other non-current assets

49.4

57.8

Non-current assets

3,157.9

2,997.7

Current portion of non-current and

financial assets

7.5

1.4

Inventories

727.0

711.5

Trade receivables

175.3

144.3

Current tax receivables

23.1

15.1

Other current assets

114.3

115.7

Cash and cash equivalents

470.0

474.6

Current assets

1,517.2

1,462.6

Total assets

4,675.1

4,460.3

LIABILITIES

Share capital

408.3

413.3

Consolidated reserves

588.5

494.6

Equity attributable to

shareholders

996.8

907.9

Non-controlling interests

70.2

50.6

Equity

1,067.0

958.5

Non-current financial liabilities and

derivatives

1,885.5

1,610.5

Provisions for pensions and other employee

benefits

90.1

88.9

Deferred tax

162.6

141.9

Provisions and other non-current financial

liabilities

30.4

45.5

Non-current liabilities

2,168.6

1,886.8

Current financial liabilities and

derivatives

393.8

249.2

Current portion of provisions and other

non-current financial liabilities

48.6

49.8

Trade payables

590.6

627.1

Current tax liabilities

7.9

66.3

Other current liabilities

398.6

622.6

Current liabilities

1,439.5

1,615.0

Total equity and liabilities

4,675.1

4,460.3

Consolidated cash flow statement

in millions of euros

2024

2023

Net profit/(loss)

238.6

475.3

Depreciation, amortisation and impairment

of assets

356.6

326.7

Interest expense on financial

liabilities

74.0

53.2

Change in inventories

20.9

(191.8)

Change in trade receivables, trade

payables & other receivables & payables

(67.2)

92.7

Current tax expense

88.1

176.8

Cash tax paid

(148.1)

(131.4)

Changes in deferred taxes and

provisions

(26.0)

0.2

Other

50.7

56.2

Net cash flow from (used in) operating

activities

587.6

857.9

Acquisition of property, plant and

equipment and intangible assets

(323.4)

(418.0)

Increase (decrease) in debt on fixed

assets

(75.0)

(1.5)

Acquisitions of subsidiaries, net of cash

acquired

(137.8)

(35.5)

Other

(4.2)

(4.6)

Net cash flow from (used in) investing

activities

(540.4)

(459.6)

Capital increase (decrease)

18.1

18.6

Dividends paid

(251.9)

(163.8)

Increase (decrease) in own shares

(1.0)

(41.7)

Transactions with shareholders of the

parent company

(234.8)

(186.9)

Transactions with non-controlling

interests

(3.1)

(3.1)

Increase (decrease) in bank overdrafts and

other short-term borrowings

142.2

34.5

Increase in long-term debt

889.3

569.7

Decrease in long-term debt

(761.4)

(565.0)

Financial interest paid

(68.9)

(51.2)

Change in gross debt

201.2

(12.0)

Net cash flow from (used in) financing

activities

(36.7)

(202.0)

Increase (decrease) in cash and cash

equivalents

10.5

196.3

Impact of changes in foreign exchange

rates on cash and cash equivalents

(15.1)

(52.6)

Opening cash and cash

equivalents

474.6

330.8

Closing cash and cash

equivalents

470.0

474.6

Mid-Term Objectives (2022-24) (announced in 2021)

2022-2023-2024

Assumptions

Situation as of end

2024

Organic sales growth37

+4-6% CAGR

From ca half volume and half

price/mix

Moderate inflation in raw

material and energy costs after 2022

+18.4% CAGR

Adjusted EBITDA margin

28% - 30% in 2024

Positive price/cost spread

Net PAP > 2% of production

cash cost (i.e. > 35m per annum)

24.4% in 2024

(2023: 28.4%)

Cumulative Free

Cash-Flow38

ca €900m over 3 years

Recurring and strategic capex @

ca 10% of sales, including CO2-related capex and 3 new furnaces by

2024

€812 million in total since

2022

Earnings per share (excl.

PPA)39

ca €3 in 2024

Average cost of financing

(pre-tax) @ ca 2%

Effective tax rate @ ca 27%

€2.38 in 2024

(2023: 4.40€)

Shareholder return

policy

DPS growth > 10% +

Accretive share buy-backs

Net income growth > 10% per

annum

Investment grade trajectory (Net

debt ratio < 2x)

Dividends: CAGR +17% 40

Share buyback: €50 million

GLOSSARY

Activity: corresponds to the sum of the change in volumes

plus or minus the change in inventories.

Organic growth: corresponds to revenue growth at constant

scope and exchange rates. Revenue growth at constant exchange rates

is calculated by applying the same exchange rates to the financial

indicators presented for the two periods being compared (by

applying the exchange rates of the previous period to the financial

indicators for the current period).

Adjusted EBITDA: this is a non-IFRS financial measure. It

is an indicator for monitoring the underlying performance of

businesses adjusted for certain expenses and/or income which are

non-recurring or liable to distort the Company’s performance.

Adjusted EBITDA is calculated on the basis of operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plans,

subsidiary disposal-related effects and subsidiary contingencies,

site closure costs, and other items.

Capex: short for “capital expenditure”, this corresponds

to purchases of property, plant and equipment and intangible assets

necessary to maintain the value of an asset and/or adapt to market

demand and to environmental, health and safety requirements, or to

increase the Group’s capacity. The acquisition of securities is

excluded from this category.

Recurring capex: recurring capex corresponds to purchases

of property, plant and equipment and intangible assets necessary to

maintain the value of an asset and/or adapt to market demand and to

environmental, health and safety requirements. It mainly includes

furnace renovations and maintenance of IS machines.

Strategic capex: strategic capex corresponds to purchases

of strategic assets that significantly enhance the Group’s capacity

or its scope (for example, the acquisition of plants or similar

facilities, greenfield or brownfield investments), including the

building of additional new furnaces. Since 2021 it has also

included investments associated with implementing the plan to

reduce CO2 emissions.

Cash conversion: refers to the ratio between cash flow

and adjusted EBITDA. Cash flow refers to adjusted EBITDA less

capex.

Free cash flow: defined as operating cash flow - other

operating impacts - interest paid & other financing costs -

taxes paid.

The Southern and Western Europe segment comprises

production sites located in France, Spain, Portugal and Italy. It

is also designated by its acronym “SWE”.

The Northern and Eastern Europe segment comprises

production sites located in Germany, the United Kingdom, Russia,

Ukraine and Poland. It is also designated by its acronym “NEE”.

The Latin America segment comprises production sites

located in Brazil, Argentina and Chile and, since January 1, 2023,

Verallia’s operations in the USA.

Liquidity: calculated as available cash + undrawn

revolving credit facilities – outstanding negotiable commercial

paper (Neu CP).

Amortisation of intangible assets acquired through business

combinations: corresponds to the amortisation of customer

relationships recognised upon acquisition.

Net debt ratio (leverage): is calculated as net debt

divided by adjusted EBITDA for the last 12 months.

Net financial debt: includes all financial liabilities

and derivatives on current and non-current financial liabilities,

minus the amount of cash and cash equivalents.

Earnings per share (EPS): net profit/(loss) attributable

to Group ordinary shareholders divided by the weighted average

number of ordinary shares outstanding excluding treasury shares

over the period.

1 Revenue growth at constant scope and exchange rates. Revenue

growth at constant exchange rates is calculated by applying the

same exchange rates to the financial indicators presented for the

two periods being compared (by applying the exchange rates of the

previous period to the financial indicators for the current

period). Growth in revenue at constant scope and exchange rates

excluding Argentina was -14.0% in 2024 compared with 2023.

2 Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plan costs,

disposal-related effects and subsidiary contingencies, site closure

costs, and other items.

3 Calculated as available cash + undrawn revolving credit

facilities – outstanding commercial paper (Neu CP).

4 Subject to approval of the Annual General Meeting of

Shareholders to be held on April 25, 2025.

5 Scope 1 “direct emissions” = CO2 emissions within the physical

perimeter of the plant, in other words, carbonated raw materials,

heavy and domestic fuel oil, and natural gas (melting and

non-melting activities). Scope 2 “indirect emissions” = emissions

related to electricity consumption required for the operation of

the plant.

6 CO2 emissions are expressed on a like-for-like basis and

exclude, for reasons of comparability with respect to the 2019

starting point, the contribution of Allied Glass / Verallia UK and

Vidrala Italia / Verallia Corsico.

7 Revenue growth at constant scope and exchange rates. Revenue

growth at constant exchange rates is calculated by applying the

same exchange rates to the financial indicators presented for the

two periods being compared (by applying the exchange rates of the

previous period to the financial indicators for the current

period). Growth in revenue at constant scope and exchange rates

excluding Argentina was -14.0% in 2024 compared with 2023.

8 Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plan costs,

disposal-related effects and subsidiary contingencies, site closure

costs, and other items.

9 The spread corresponds to the difference between (i) the

increase in selling prices and the mix applied by the Group after

passing any increase in production costs onto these selling prices

and (ii) the increase in production costs. The spread is positive

when the increase in selling prices applied by the Group is greater

than the increase in its production costs. The increase in

production costs is recorded by the Group at constant production

volumes, before industrial variance and taking into consideration

the impact of the Performance Action Plan (PAP).

10 Net profit/(loss) attributable to Group ordinary shareholders

divided by the weighted average number of ordinary shares

outstanding excluding treasury shares over the period.

11 Cash flow from operations represents adjusted EBITDA less

Capex, plus the change in operating working capital including

changes in payables to fixed asset suppliers.

12 Defined as operating cash flow - other operating impacts -

interest paid & other financing costs - taxes paid.

13 Calculated as available cash + undrawn revolving credit

facilities – outstanding commercial paper (Neu CP).

14 Scope 1 “direct emissions” = CO2 emissions within the

physical perimeter of the plant, in other words, carbonated raw

materials, heavy and domestic fuel oil, and natural gas (melting

and non-melting activities). Scope 2 “indirect emissions” =

emissions related to electricity consumption required for the

operation of the plant.

15 Cullet = recycled glass; CO2 emissions are expressed on a

like-for-like basis and exclude, for reasons of comparability with

respect to the 2019 starting point, the contribution of Allied

Glass / Verallia UK and Vidrala Italia / Verallia Corsico.

16 TPG: Tonne of Packed Glass.

17 The turnover here is calculated on the basis of the Argentine

peso/euro conversion using the closing rate of 2024.

18 BWGI, whose controlling shareholder is Brasil Warrant

Administração de Bens e Empresas S.A., acts as the management

company of Kaon V, a sub-fund of Kaon Investment Fund ICAV and a

direct shareholder of Verallia.

19 See press release dated February 3, 2025 issued by BWGI.

20 It is specified that BWGI, represented by Mr. João Salles,

and BWSA, represented by Mrs. Marcia Freitas, did not participate

in the relevant deliberation and vote, and Mr. Guilherme Bottura

did not participate in the relevant deliberation.

21 Net profit and net profit attributable to the shareholders of

the company for 2024 includes an amortisation expense for customer

relationships, recognised upon the acquisition of Saint-Gobain's

packaging business in 2015, of €44 million or €0.37 per share (net

of taxes). If this expense had not been taken into account, net

profit would be €283 million or €2.38 per share. This expense was

€45 million or €0.38 per share in 2023.

22 Adjusted EBITDA is calculated based on operating profit

adjusted for depreciation, amortisation and impairment,

restructuring costs, acquisition and M&A costs,

hyperinflationary effects, management share ownership plan costs,

disposal-related effects and subsidiary contingencies, site closure

costs, and other items.

23 Capex (capital expenditure) corresponds to purchases of

property, plant and equipment and intangible assets necessary to

maintain the value of an asset and/or adapt to market demand and to

environmental, health and safety requirements, or to increase the

Group’s capacity. The acquisition of securities is excluded from

this category.

24 Cash conversion is defined as adjusted EBITDA less capex,

divided by adjusted EBITDA.

25 Operating cash flow corresponds to adjusted EBITDA less

capex, plus changes in operating working capital requirements

including changes in payables to fixed asset suppliers.

26 Defined as operating cash flow - other operating impacts -

interest paid & other financing costs - taxes paid.

27 Strategic capex corresponds to purchases of strategic assets

that significantly enhance the Group’s capacity or its scope (for

example, the acquisition of plants or similar facilities,

greenfield or brownfield investments), including the building of

additional new furnaces. Since 2021, they have also included

investments associated with implementing the plan to reduce CO2

emissions.

28 Recurring capex corresponds to purchases of property, plant

and equipment and intangible assets necessary to maintain the value

of an asset and/or adapt to market demand and to environmental,

health and safety requirements. They mainly include furnace

renovations and maintenance of IS machines.

29 The column "Analysis excluding Argentina" presents all the

data in the bridge excluding Argentina, its net impact over the

period being reported in the "Argentina" row only.

30 The column "Analysis excluding Argentina" presents all the

data in the bridge excluding Argentina, its net impact over the

period being reported in the "Argentina" row only.

31 Includes depreciation and amortisation of intangible assets

and property, plant and equipment, amortisation of intangible

assets acquired through business combinations, and impairment of

property, plant and equipment.

32 The Group has applied IAS 29 (Hyperinflation) since 2018.

33 Including accrued interest.

34 o/w IFRS16 leasing (€75.0m).

35 Total debt of €2,267.4m includes €12.5m of financing

derivatives, thus a total financial debt of €2,254.8m€.

36 Net profit for 2024 includes an amortisation expense for

customer relationships, recognised upon the acquisition of

Saint-Gobain's packaging business in 2015, of €44 million or €0.37

per share (net of taxes). If this expense had not been taken into

account, net profit would be €283 million or €2.38 per share. This

expense was €45 million or €0.38 per share in 2023.

37 At constant FX and excluding changes in perimeter.

38 Defined as the Operating Cash Flow - Other operating impact -

Interest paid & other financing costs – Cash Tax.

39 Earnings excl. amortization expense for customer relations

(PPA) recognized upon the acquisition from Saint-Gobain, of ca 0.38

/ share (net of taxes).

40 At its meeting held on February 19, 2025, Verallia's Board of

Directors decided to propose the payment of a dividend of €1.70 per

share in cash for the 2024 financial year. This amount will be

subject to the approval of the Annual General Meeting of

Shareholders to be held on April 25, 2025.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219853613/en/

Press Benoit Grange | +33 (0)6 14 45 09 26 Tristan

Roquet-Montégon | +33 (0)6 37 00 52 57

verallia@brunswickgroup.com

Sara Natij & Laurie Dambrine verallia@comfluence.fr | +33

(0)7 68 68 83 22

Investor relations David Placet |

david.placet@verallia.com Michele Degani |

michele.degani@verallia.com

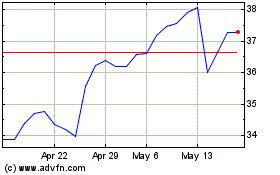

VERALLIA (EU:VRLA)

Historical Stock Chart

From Jan 2025 to Feb 2025

VERALLIA (EU:VRLA)

Historical Stock Chart

From Feb 2024 to Feb 2025