Hermès International: 2022 Full Year Results

HERMES2022 Full Year

Results

Sales

momentum and

particularly robust

results in 2022

Revenue amounted to €11.6 billion (+29% at

current exchange rates and +23% at constant exchange rates)

Recurring operating income reached €4.7 billion (+33%)Net profit

amounted to €3.4 billion (+38%)

Paris, 17th February 2023

The group’s consolidated revenue amounted to

€11,602 million in 2022, up 29% at current exchange rates and 23%

at constant exchange rates compared to 2021. Recurring operating

income amounted to €4,697 million, i.e. 40.5% of sales. Net profit

(group share) reached €3,367 million, representing net

profitability of 29%.

In the fourth quarter 2022, the great sales

momentum recorded at the end of September continued, with sales

reaching €2,991 million, an increase of 26% at current exchanges

rates and 23% at constant exchange rates.

Axel Dumas, Executive Chairman of Hermès, said:

“In 2022, Hermès had an exceptional year thanks notably to the good

performance of its international markets. This success reinforces

our approach as an artisanal and highly integrated company, mainly

in France: a design house that offers objects conceived to be

functional, with an assertive style and uncompromising quality. The

year underpins the relevance of our responsible and sustainable

model.”

Over the last three years, Hermès created 4,300

jobs, including 2,900 in France, and reinforced its operating

investments by €1.5 billion, including c. 60% in France.

Sales by geographical area at the end of

December(at constant exchange rates unless otherwise

indicated)

At the end of December, sales growth was

remarkable across geographical areas. Sales increased considerably

both in group stores (+23% at constant exchange rates) and in

wholesale activities (+26%), which benefited from the recovery in

travel retail. Hermès continued to develop its exclusive

distribution network, while online sales pursued their upward trend

worldwide.

- Asia excluding Japan (+22%)

remained very dynamic throughout the geographical area. Sales

performance in Greater China was sustained. In October, a fourth

store opened in the Qiantan district in Shanghai, Mainland China,

and Hermès inaugurated a store in Pangyo, in South Korea. Several

stores reopened after renovation and extension work, such as the

Hyundai Coex store in Seoul in December and the Hong Kong

international airport store in November.

- Japan (+20%) recorded a steady,

sustained increase in sales. In November, the Takashimaya store in

Nagoya reopened after renovation and extension in a new location,

and the Hermès in the Making exhibition showcased the house’s

know-how in Kyoto.

- The Americas (+32%) saw an

exceptional year in 2022. After the April opening of a new store in

Austin, a new maison was inaugurated at 706 Madison Avenue in New

York in September. This store offers clients an unprecedented

experience of the creativity of Hermès and confirms the house’s

attachment to the sustainability of objects with a whole floor

dedicated to repairs. In Mexico, the store in Guadalajara reopened

in October after renovation.

- Europe excluding France (+18%)

recorded sustained growth, thanks to the loyalty of local clients

and the resumption of tourist traffic. The Paseo de Gracia store in

Barcelona was inaugurated in November, after being renovated and

extended.

- France (+27%) improved strongly,

with an acceleration at year-end thanks to high demand from both

national and international clients. The store in Strasbourg

reopened in November, after renovation and extension, in a new

location in the city’s historical centre.

Sales by business line at the end of

December(at constant exchange rates unless otherwise

indicated)

At the end of December 2022, all the business

lines confirmed their high levels of sales, with Ready-to-Wear and

Accessories, Watches and Other Hermès business lines posting a

remarkable increase, reflecting the huge desirability of the

house.

The Leather Goods and Saddlery business line

(+16%) performed particularly well, benefitting from very sustained

demand and a favourable comparison basis in the 4th quarter. The

growth in production capacities continued with five site projects.

These new capacities will reinforce the nine centres of expertise

located across the national territory, with their production units,

workshops and training centres. In 2023, Hermès will open two new

leather goods workshops: one in Louviers (Normandie) and the other

one in la Sormonne (Ardennes). The projects for new workshops sites

in Riom (Puy-de-Dôme), L’Isle-d’Espagnac (Charente) and Loupes

(Gironde) are ongoing. Hermès continues to reinforce its local

anchoring in France in regions with strong manufacturing know-how,

while also developing employment and training.

The Ready-to-Wear and Accessories division

(+36%) pursued its strong growth, thanks to the success of the

ready-to-wear, fashion accessories and footwear collections. The

men’s and women’s spring-summer 2023 collections, mixing casual,

sophisticated, bold and light spirits, were respectively presented

in June and October. Demand was also strong for fashion accessories

and footwear, with models that express the abundance of the house’s

know-how.

The Silk and Textiles business line (+20%)

achieved a splendid performance, supported by the growth in

production capacities and the success of the collections,

especially through the exploration of exceptional materials and

artisanal know-how, such as hand-weaving and leather work.

Perfume and Beauty business line (+15%) gained

from the successful launches of new creations, such as Terre

d’Hermès Eau Givrée, the Eau de parfum H24, and the Colognes with

Eau de basilic pourpre. Two years after its creation, the Hermès

Beauty business line continues its strong growth, thanks to the

limited editions of Rouge Hermès and the launch of Hermès Plein

Air, the new chapter for complexion.

The Watches business line (+46%) confirmed its

outstanding performance, displaying singular creativity and unique

style nurtured by all the other métiers of the house, as well as

exceptional watch-making know-how. In November 2022, the Arceau Le

temps voyageur watch won two awards at the Grand Prix d’Horlogerie

de Genève (Geneva Watchmaking Grand Prix). The new Hermès H08 men’s

watch confirmed its success, alongside the house’s classic

models.

The Other Hermès business lines (+30%), which

include Jewellery and Homeware, continued on their upward trend,

highlighting the full creative strength and singularity of the

house. The seventh haute bijouterie collection, called Les jeux de

l’ombre, was presented in Paris this summer and in New York this

autumn.

Particularly

robust

results

Recurring operating income increased by 33% to

€4,697 million compared to €3,530 million in 2021. Thanks to the

leverage effect generated by the strong sales growth and the

exceptional performance of the collections, annual recurring

operating profitability reached its highest level ever at 40.5%, up

from 39.3% in 2021.

Consolidated net profit (group share) amounted

to €3,367 million (29% of sales), an increase of 38% from €2,445

million in 2021.

Operational investments represented €518 million

and adjusted free cash flow reached €3,405 million.

After distribution of the ordinary dividend

(€837 million) and inclusion of share redemptions (€116 million for

104,269 shares outside the liquidity contract), the restated net

cash position increased by €2,672 million to €9,742 million

compared to €7,070 million as at 31 December 2021.

A responsible, sustainable

model

The group pursued its dynamic recruitment,

adding some 2,100 new hires to the workforce this year. At the end

of December 2022, the group employed 19,700 people, including

12,400 in France. True to its commitment as a responsible employer

and in recognition of the employees’ contribution to the

performance and success of the group, Hermès will pay an

exceptional bonus of €4,000 in 2023, to all the employees

worldwide.

Hermès strengthened its commitments in the

fields of education and knowledge transmission with the launch of

the École des artisans de la vente in April and the rollout of the

École Hermès des savoir-faire, opening a new Apprentice Training

Centre at the Ardennes regional hub of expertise. The group has

made another five-year commitment in an amount of €61 million for

the actions of the Fondation d’Entreprise Hermès.

In line with the house’s commitments for the

fight against climate change, Hermès pursued its actions in line

with the emissions reduction targets validated by the Science Based

Target initiative (SBTi). Hermès aims to reduce emissions by 50.4%

on scope 1 and 2 in absolute value and by 58.1% in intensity on

scope 3, over the 2018-2030 period. The house already offsets 100%

of scope 1&2 emissions, and most of transport-related

emissions, thanks to high environmental and societal value

programmes. Regarding the protection of biodiversity and resources,

the house also introduced a demanding responsible construction

standard that integrates sustainability issues across the life

cycle of real-estate projects. It was certified in November 2022 by

an independent third party, as being more demanding that the main

global standards.

In 2022, Hermès again saw an improvement in

non-financial ratings reflecting the strength of the CSR

commitments and the reinforced transparency. MSCI published a

greatly improved “AA” rating (versus BBB in 2020 and then A in

2021). Sustainalytics ranked the house as the best company in

Textiles and Clothing (number 1 out of 191 companies) and in the

Luxury Goods sector (number 1 out of 102 companies), with the

highest “Negligible Risk” classification. Moody’s ESG Solutions

ranked Hermès in 5th position in the Luxury Goods and Cosmetics

sector, thus consolidating the group’s position in the CAC40 ESG

index. Finally, Hermès joined the CDP’s A-list, making the house

one the world’s 330 top-performing companies in environmental

matters.

Proposed dividend

At the General Meeting to be held on 20th April

2023, a dividend proposal of €13.00 per share will be made. The

€3.50 interim dividend, paid on 22nd February 2023, will be

deducted from the dividend approved by the General Meeting.

Outlook

In the medium-term, despite the economic,

geopolitical and monetary uncertainties around the world, the group

confirms an ambitious goal for revenue growth at constant exchange

rates.

The group has moved into 2023 with confidence,

thanks to the highly integrated artisanal model, the balanced

distribution network, the creativity of collections and the loyalty

of clients.

Thanks to its unique business model, Hermès is

pursuing its long-term development strategy based on creativity,

maintaining control over know-how and singular communication.

Inspiration of the creation at Hermès,

Astonishment is the theme of the year. The ability to be surprised

is a constant source of innovation and dynamism for the house,

which will continue to accompany clients with enthusiasm and

creativity across 2023.

The press release and the presentation of the

2022 results are available on the group’s website:

https://finance.hermes.com

At the Supervisory Board meeting on 16th February

2023, Executive Management presented the audited financial

statements for 2022. The audit procedures have been completed and

the audit report is under preparation. The complete consolidated

financial statements will be available by 31st March 2023 at the

following address https://finance.hermes.com and on the AMF

website: www.amf-france.org

Upcoming events:

- 14th April 2023: Q1 2023 revenue

publication

- 20th April 2023: General Meeting of

shareholders

- 28th July 2023: Publication of H1

2023 results

2022

KEY FIGURES

|

In millions of euros |

2022 |

2021 |

| |

|

|

|

Revenue |

11,602 |

8,982 |

|

Growth at current exchange rates vs. n-1 |

29.2% |

40.6% |

|

Growth at constant exchange rates vs. n-1 (1) |

23.4% |

41.8% |

|

|

|

|

|

Recurring operating

income (2) |

4,697 |

3,530 |

|

As a % of revenue |

40.5% |

39.3% |

|

|

|

|

|

Operating income |

4,697 |

3,530 |

|

As a % of revenue |

40.5% |

39.3% |

|

|

|

|

|

Net profit – Group share |

3,367 |

2,445 |

|

As a % of revenue |

29.0% |

27.2% |

|

|

|

|

|

Operating cash flows |

4,111 |

3,060 |

|

|

|

|

|

Investments (excluding financial investments) |

518 |

532 |

|

|

|

|

|

Adjusted free cash flow (3) |

3,405 |

2,661 |

|

|

|

|

|

Equity – Group share |

12,440 |

9,400 |

|

|

|

|

|

Net cash position (4) |

9,223 |

6,695 |

|

|

|

|

|

Restated net cash position (5) |

9,742 |

7,070 |

|

|

|

|

|

Workforce (number of employees) |

19,686 |

17,595 |

(1) Growth at constant exchange

rates is calculated by applying the average exchange rates of the

previous period to the current period’s revenue, for each

currency.

(2) Recurring operating income

is one of the main performance indicators monitored by the group’s

General Management. It corresponds to the operating income

excluding non-recurring items having a significant impact likely to

affect the understanding of the group’s economic performance.

(3) Adjusted free cash flow

corresponds to the sum of operating cash flows and change in

working capital requirement, less operating investments and

repayment of lease liabilities, as per IFRS cash flow

statement.

(4) The

net cash position includes cash and cash equivalents on the asset

side of the balance sheet, less bank overdrafts presented within

the short-term borrowings and financial liabilities on the

liability side of the balance sheet. It does not include lease

liabilities recognised in accordance with IFRS 16.

(5) The

restated net cash position corresponds to the net cash position,

plus cash investments that do not meet IFRS criteria for cash

equivalents as a result of their original maturity of more than

three months, minus borrowings and financial liabilities.

INFORMATION BY GEOGRAPHICAL ZONE

(a)

|

|

|

As of Dec.

31st |

Evolution /2021 |

| In millions of

Euros |

|

2022 |

2021 |

Published |

At constant exchange rates |

| France |

|

1,064 |

838 |

26.9 % |

26.9 % |

| Europe (excl.

France) |

|

1,536 |

1,303 |

17.9 % |

18.4 % |

| Total

Europe |

|

2,600 |

2,141 |

21.5 % |

21.8 % |

| Japan |

|

1,101 |

977 |

12.7 % |

19.7 % |

| Asia-Pacific

(excl. Japan) |

|

5,556 |

4,251 |

30.7 % |

21.9 % |

| Total

Asia |

|

6,657 |

5,227 |

27.4 % |

21.5 % |

| Americas |

|

2,138 |

1,458 |

46.6 % |

31.6 % |

| Other |

|

207 |

156 |

32.5 % |

31.5 % |

|

TOTAL |

|

11,602 |

8,982 |

29.2 % |

23.4 % |

|

|

|

4th quarter |

Evolution /2021 |

| In millions of

Euros |

|

2022 |

2021 |

Published |

At constant exchange rates |

| France |

|

311 |

251 |

23.9 % |

23.9 % |

| Europe (excl.

France) |

|

413 |

398 |

3.8 % |

4.8 % |

| Total

Europe |

|

724 |

649 |

11.6 % |

12.2 % |

| Japan |

|

279 |

267 |

4.6 % |

15.7 % |

| Asia-Pacific

(excl. Japan) |

|

1,314 |

1,025 |

28.3 % |

24.7 % |

| Total

Asia |

|

1,593 |

1,292 |

23.4 % |

22.8 % |

| Americas |

|

620 |

397 |

56.0 % |

40.8 % |

| Other |

|

54 |

42 |

28.8 % |

27.7 % |

|

TOTAL |

|

2,991 |

2,380 |

25.7 % |

22.9 % |

(a) Sales by destination.

INFORMATION BY SECTOR

|

|

|

As of Dec.

31st |

Evolution /2021 |

| In millions of

Euros |

|

2022 |

2021 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

4,963 |

4,091 |

21.3 % |

15.6 % |

| Ready-to-wear

and Accessories (2) |

|

3,152 |

2,219 |

42.0 % |

35.8 % |

| Silk and

Textiles |

|

842 |

669 |

25.8 % |

20.3 % |

| Other Hermès

sectors (3) |

|

1,371 |

1,001 |

37.0 % |

29.6 % |

| Perfume and

Beauty |

|

448 |

385 |

16.4 % |

15.0 % |

| Watches |

|

519 |

337 |

54.2 % |

45.9 % |

| Other products

(4) |

|

306 |

279 |

9.6 % |

7.6 % |

|

TOTAL |

|

11,602 |

8,982 |

29.2 % |

23.4 % |

|

|

|

4th quarter |

Evolution /2021 |

| In millions of

Euros |

|

2022 |

2021 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

1,300 |

1,015 |

28.1 % |

25.3 % |

| Ready-to-wear

and Accessories (2) |

|

775 |

585 |

32.5 % |

29.7 % |

| Silk and

Textiles |

|

263 |

237 |

11.2 % |

8.7 % |

| Other Hermès

sectors (3) |

|

348 |

265 |

31.0 % |

27.4 % |

| Perfume and

Beauty |

|

105 |

97 |

7.8 % |

7.4 % |

| Watches |

|

118 |

95 |

24.3 % |

21.4 % |

| Other products

(4) |

|

82 |

86 |

(4.3) % |

(5.5) % |

|

TOTAL |

|

2,991 |

2,380 |

25.7 % |

22.9 % |

(1) The “Leather Goods and Saddlery” business

line includes bags, riding, memory holders and small leather

goods.(2) The “Ready-to-wear and Accessories” business line

includes Hermès Ready-to-wear for men and women, belts, costume

jewellery, gloves, hats and shoes.(3) The “Other Hermès business

lines” include Jewellery and Hermès home products (Art of Living

and Hermès Tableware).(4) The “Other products” include the

production activities carried out on behalf of non-group brands

(textile printing, tanning…), as well as John Lobb, Saint-Louis and

Puiforcat.

2022 quarterly

revenue

|

|

|

Q1 |

Q2 |

Q3 |

Q4 |

2022 |

| Revenue (in

€M) |

|

2,765 |

2,710 |

3,136 |

2,991 |

11,602 |

| Growth at

current exchange rates |

|

32.7% |

26.0% |

32.5% |

25.7% |

29.2% |

| Growth at

constant exchange rates |

|

27.1% |

19.5% |

24.3% |

22.9% |

23.4% |

--------------------------------------------------------------------------------

Extra-financial performances

|

RESPONSIBLE EMPLOYER2,100 Jobs

created |

DIVERSITY AND INCLUSION6.4%Direct

disability employment rate |

GENDER EQUALITY60%Women managers

group |

|

LONG-TERM RELATIONSHIPS 20

years Average age of supplier

relationships(Top50) |

PARTNERS SUPPORT24

daysAverage payment terms for suppliers in

France |

LOCAL

SUPPLIERS66%Of purchases come

from France (Top50) |

|

CLIMATE1.5°CCarbon

trajectory commitment validated by SBTi |

ENERGY TRANSITION100%Green

electricity in France |

DURABILITY202,000Repairs in

workshops |

|

TRANSPARENCY AWARDS#1SBF

120, all categories |

SOCIAL

RESPONSIBILITY€61mBudget allocated to the

Fondation d’entreprise Hermès |

PARTNERSHIPS€5.2mPurchases

from socially supported organisations |

APPENDIX – EXTRACT FROM CONSOLIDATED ACCOUNTS

Financial statements of the year, including

notes to the consolidated accounts, will be available at the end of

March 2023 on the website https://finance.hermes.com, together with

the other chapters of the Annual Financial Report.

CONSOLIDATED INCOME STATEMENT

|

In millions of euros |

2022 |

2021 |

|

Revenue |

11 602 |

8 982 |

|

Cost of sales |

(3 389) |

(2 580) |

|

Gross margin |

8 213 |

6 402 |

|

Sales and administrative expenses |

(2 680) |

(2 137) |

|

Other income and expenses |

(836) |

(734) |

|

Recurring operating income |

4 697 |

3 530 |

|

Other non-recurring income and expenses |

- |

- |

|

Operating income |

4 697 |

3 530 |

|

Net financial income |

(62) |

(96) |

|

Net income before tax |

4 635 |

3 435 |

|

Income tax |

(1 305) |

(1 015) |

|

Net income from associates |

50 |

34 |

|

CONSOLIDATED NET INCOME |

3 380 |

2 454 |

|

Non-controlling interests |

(13) |

(8) |

|

NET INCOME ATTRIBUTABLE TO OWNERS OF THE

PARENT |

3 367 |

2 445 |

|

Basic earnings per share (in euros) |

32,20 |

23,37 |

|

Diluted earnings per share (in euros) |

32,09 |

23,30 |

CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

|

In millions of euros |

2022 |

2021 |

|

Consolidated net income |

3 380 |

2 454 |

|

Changes in foreign currency adjustments 1 |

126 |

141 |

|

Hedges of future cash flows in foreign currencies 1 2 |

129 |

(110) |

|

|

23 |

(87) |

- recycling through profit or loss

|

106 |

(23) |

|

Assets at fair value 2 |

333 |

87 |

|

Employee benefit obligations: change in value linked to actuarial

gains and losses 2 |

41 |

9 |

|

Net comprehensive income |

4 009 |

2 582 |

- attributable to owners of the

parent

|

3 996 |

2 573 |

- attributable to non-controlling

interests

|

14 |

9 |

(1) Transferable through profit or loss.(2) Net of

tax.

CONSOLIDATED BALANCE SHEET

ASSETS

|

In millions of euros |

31/12/2022 |

31/12/2021 |

|

Goodwill |

- |

42 |

|

Intangible assets |

213 |

258 |

|

Right-of-use assets |

1 582 |

1 517 |

|

Property, plant and equipment |

2 007 |

1 881 |

|

Investment property |

8 |

9 |

|

Financial assets |

1 109 |

617 |

|

Investments in associates |

54 |

51 |

|

Loans and deposits |

65 |

59 |

|

Deferred tax assets |

555 |

546 |

|

Other non-current assets |

39 |

22 |

|

Non-current assets |

5 630 |

5 002 |

|

Inventories and work-in-progress |

1 779 |

1 449 |

|

Trade and other receivables |

383 |

333 |

|

Current tax receivables |

19 |

58 |

|

Other current assets |

263 |

257 |

|

Financial derivatives |

160 |

53 |

|

Cash and cash equivalents |

9 225 |

6 696 |

|

Current assets |

11 828 |

8 845 |

|

TOTAL ASSETS |

17 459 |

13 847 |

LIABILITIES

|

In millions of euros |

31/12/2022 |

31/12/2021 |

|

Share capital |

54 |

54 |

|

Share premium |

50 |

50 |

|

Treasury shares |

(674) |

(551) |

|

Reserves |

8 795 |

7 142 |

|

Foreign currency adjustments |

303 |

178 |

|

Revaluation adjustments |

546 |

83 |

|

Net income attributable to owners of the parent |

3 367 |

2 445 |

|

Equity attributable to owners of the parent |

12 440 |

9 400 |

|

Non-controlling interests |

16 |

12 |

|

Equity |

12 457 |

9 412 |

|

Borrowings and financial liabilities due in more than one year |

35 |

24 |

|

Lease liabilities due in more than one year |

1 629 |

1 529 |

|

Non-current provisions |

30 |

26 |

|

Post-employment and other employee benefit obligations due in more

than one year |

181 |

220 |

|

Deferred tax liabilities |

20 |

15 |

|

Other non-current liabilities |

103 |

45 |

|

Non-current liabilities |

1 998 |

1 860 |

|

Borrowings and financial liabilities due in less than one year |

2 |

1 |

|

Lease liabilities due in less than one year |

268 |

248 |

|

Current provisions |

133 |

115 |

|

Post-employment and other employee benefit obligations due in less

than one year |

15 |

40 |

|

Trade and other payables |

777 |

535 |

|

Financial derivatives |

74 |

122 |

|

Current tax liabilities |

496 |

347 |

|

Other current liabilities |

1 239 |

1 168 |

|

Current liabilities |

3 004 |

2 575 |

|

TOTAL EQUITY AND LIABILITIES |

17 459 |

13 847 |

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

|

In millions of euros |

Number of shares |

Share capital |

Share premium |

Treasury shares |

Consolidated reserves and net income attributable to owners

of the parent |

Actuarial gains and losses |

Foreign currency adjustments |

Revaluation adjustments |

|

|

|

|

Financial investments |

Hedges of future cash flows in foreign

currencies |

Equity attributable to owners of the parent |

Non-controlling interests |

Equity |

|

As at 1 January

2021 |

105 569 412 |

54 |

50 |

(464) |

7 732 |

(135) |

38 |

100 |

5 |

7 380 |

11 |

7 391 |

|

Net income |

- |

- |

- |

- |

2 445 |

- |

- |

- |

- |

2 445 |

8 |

2 454 |

|

Other comprehensive income |

- |

- |

- |

- |

- |

9 |

141 |

87 |

(110) |

127 |

0 |

128 |

|

Comprehensive income |

- |

- |

- |

- |

2 445 |

9 |

141 |

87 |

(110) |

2 573 |

9 |

2 582 |

|

Change in share capital and share premiums |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase or sale of treasury shares |

- |

- |

- |

(88) |

(69) |

- |

- |

- |

- |

(157) |

- |

(157) |

|

Share-based payments |

- |

- |

- |

- |

59 |

- |

- |

- |

- |

59 |

- |

59 |

|

Dividends paid |

- |

- |

- |

- |

(485) |

- |

- |

- |

- |

(485) |

(5) |

(490) |

|

Other |

- |

- |

- |

- |

30 |

- |

- |

- |

- |

30 |

(2) |

28 |

|

As at 31 December

2021 |

105 569 412 |

54 |

50 |

(551) |

9 712 |

(125) |

178 |

188 |

(105) |

9 400 |

12 |

9 412 |

|

Net income |

- |

- |

- |

- |

3 367 |

- |

- |

- |

- |

3 367 |

13 |

3 380 |

|

Other comprehensive income |

- |

- |

- |

- |

- |

41 |

125 |

333 |

129 |

628 |

1 |

630 |

|

Comprehensive income |

- |

- |

- |

- |

3 367 |

41 |

125 |

333 |

129 |

3 996 |

14 |

4 009 |

|

Change in share capital and share premiums |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Purchase or sale of treasury shares |

- |

- |

- |

(123) |

2 |

- |

- |

- |

- |

(121) |

- |

(121) |

|

Share-based payments |

- |

- |

- |

- |

55 |

- |

- |

- |

- |

55 |

- |

55 |

|

Dividends paid |

- |

- |

- |

- |

(845) |

- |

- |

- |

- |

(845) |

(8) |

(852) |

|

Other |

- |

- |

- |

- |

(44) |

- |

- |

- |

- |

(44) |

(2) |

(46) |

|

AS AT 31 DECEMBER 2022 |

105 569 412 |

54 |

50 |

(674) |

12 247 |

(85) |

303 |

521 |

25 |

12 440 |

16 |

12 457 |

CONSOLIDATED STATEMENT OF CASH FLOWS

|

In millions of euros |

2022 |

2021 |

|

CASH FLOWS RELATED TO OPERATING ACTIVITIES |

|

|

|

Net income attributable to owners of the parent |

3 367 |

2 445 |

|

Depreciation and amortisation of fixed assets |

341 |

312 |

|

Depreciation of right-of-use assets |

266 |

251 |

|

Impairment losses |

123 |

65 |

|

Mark-to-Market financial instruments |

- |

(1) |

|

Foreign exchange gains/(losses) on fair value adjustments |

12 |

(46) |

|

Change in provisions |

12 |

28 |

|

Net income from associates |

(50) |

(34) |

|

Net income attributable to non-controlling interests |

13 |

8 |

|

Capital gains or losses on disposals and impact of changes in scope

of consolidation |

(1) |

(4) |

|

Deferred tax expense |

(16) |

(15) |

|

Accrued expenses and income related to share-based payments |

55 |

59 |

|

Dividend income |

(11) |

(10) |

|

Other |

(0) |

(0) |

|

Operating cash flows |

4 111 |

3 060 |

|

Change in working capital requirements |

73 |

346 |

|

Change in net cash position

related to operating activities (A) |

4 184 |

3 405 |

|

CASH FLOWS RELATED TO INVESTING ACTIVITIES |

|

|

|

Operating investments |

(518) |

(532) |

|

Acquisitions of consolidated shares |

(1) |

- |

|

Acquisitions of other financial assets |

(165) |

(198) |

|

Disposals of operating assets |

1 |

3 |

|

Disposals of consolidated shares and impact of losses of

control |

0 |

- |

|

Disposals of other financial assets |

5 |

6 |

|

Change in payables and receivables related to investing

activities |

32 |

6 |

|

Dividends received |

67 |

47 |

|

Change in net cash position

related to investing activities (B) |

(579) |

(669) |

|

CASH FLOWS RELATED TO FINANCING ACTIVITIES |

|

|

|

Dividends paid |

(852) |

(490) |

|

Repayment of lease liabilities |

(261) |

(212) |

|

Treasury share buybacks net of disposals |

(123) |

(158) |

|

Borrowing subscriptions |

- |

- |

|

Repayment of borrowings |

(0) |

(8) |

|

Change in net cash position

related to financing activities (C) |

(1 237) |

(869) |

|

Foreign currency translation adjustment (D) |

159 |

110 |

|

CHANGE IN NET CASH POSITION

(A) + (B) + (C) + (D) |

2 528 |

1 978 |

|

Net cash position at the beginning of the period |

6 695 |

4 717 |

|

Net cash position at the end of the period |

9 223 |

6 695 |

|

CHANGE IN NET CASH POSITION |

2 528 |

1 978 |

REMINDER

2022

HALF YEAR KEY FIGURES

|

In millions of euros |

H1 2022 |

H1 2021 |

| |

|

|

|

Revenue |

5,475 |

4,235 |

|

Growth at current exchange rates vs. n-1 |

29.3,% |

70.2 % |

|

Growth at constant exchange rates vs. n-1 (1) |

23.2,% |

76.7 % |

|

|

|

|

|

Recurring operating

income (2) |

2,304 |

1,722 |

|

As a % of revenue |

42.1,% |

40.7 % |

|

|

|

|

|

Operating income |

2,304 |

1,722 |

|

As a % of revenue |

42.1,% |

40.7 % |

|

|

|

|

|

Net profit – Group share |

1,641 |

1,174 |

|

As a % of revenue |

30.0,% |

27.7 % |

|

|

|

|

|

Operating cash flows |

2,001 |

1,487 |

|

|

|

|

|

Investments (excluding financial investments) |

190 |

214 |

|

|

|

|

|

Adjusted free cash flow (3) |

1,421 |

1,236 |

|

|

|

|

|

Equity – Group share |

10,259 |

8,024 |

|

|

|

|

|

Net cash position (4) |

7,280 |

5,326 |

|

|

|

|

|

Restated net cash position (5) |

7,685 |

5,521 |

|

|

|

|

|

Workforce (number of employees) |

18,428 |

16,966 |

(6) Growth at constant exchange

rates is calculated by applying the average exchange rates of the

previous period to the current period’s revenue, for each

currency.

(7) Recurring operating income

is one of the main performance indicators monitored by the group’s

General Management. It corresponds to the operating income

excluding non-recurring items having a significant impact likely to

affect the understanding of the group’s economic performance.

(8) Adjusted free cash flow

corresponds to the sum of operating cash flows and change in

working capital requirement, less operating investments and

repayment of lease liabilities, as per IFRS cash flow

statement.

(9) The

net cash position includes cash and cash equivalents on the asset

side of the balance sheet, less bank overdrafts presented within

the short-term borrowings and financial liabilities on the

liability side of the balance sheet. It does not include lease

liabilities recognised in accordance with IFRS 16.

(10) The

restated net cash position corresponds to the net cash position,

plus cash investments that do not meet IFRS criteria for cash

equivalents as a result of their original maturity of more than

three months, minus borrowings and financial liabilities.

- hermes_20230217_pr_2022fullyearresults_va

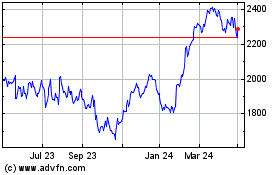

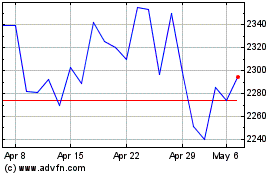

Hermes (EU:RMS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Hermes (EU:RMS)

Historical Stock Chart

From Mar 2024 to Mar 2025