- Revenue of €278 million, up 25% at constant exchange rates

(+17% like-for-like)

- Operating profitability more than doubles with EBITDA

reaching €23 million (+107%) or 8.3% of revenue

- Net income multiplied by 7 to €11 million

- Record cash position of €118 million, supported by strong

operating cash flow generation of €40 million

Regulatory News:

Claranova (Paris:CLA):

The condensed interim consolidated financial

statements for the half-year period ended December 31, 2020 were

approved by the Board of Directors on March 31, 2021. The limited

review procedures for the interim financial statements have been

completed, and the limited review report will be issued after the

verification of the half-year financial report is completed.

“More than any year to date, 2020 marked a pivotal milestone in

the economy’s digital transformation. Our diversified market

position in the B2C1 segment, based largely on a freemium

business model2 allowed us to fully benefit from the

economy’s rapid digital development within a health context we have

been experiencing already for one year.

In this context, Claranova achieved record performances in H1

2020-2021 with continuing strong revenue growth, up 25%3 to

€278 million, but above all a very significant improvement in

operating profitability with EBITDA4 of €23 million.

Operating profitability more than doubled in relation to last

year’s first half, already exceeding the total annual amount of

EBITDA achieved by Claranova over the entire 2019-2020 fiscal year.

Similarly, the Group’s net profitability5 grew by a multiple

of seven to reach the historic level of €11 million. These

performances are the result of work accomplished over the last few

years to strengthen our positions in high-potential digital

segments and build resilient business models for each of our

divisions.

Our growth potential remains considerable. We are more than ever

confident in our ability to maintain this trend of profitable

growth and reaffirm our goal to achieve annual revenue of €700

million and an EBITDA margin above 10% by 2023."

Pierre Cesarini, Chairman and CEO of Claranova Group

Claranova remained on track with strong and balanced growth in

H1 2020-2021 (July-December 2020), with revenue of €278 million

(+25% at constant exchange rates) accompanied by a sharp

improvement in profitability. EBITDA, the main operating

performance indicator, more than doubled in the first half (+107%),

in line with guidance issued when revenue was published on February

10, 2021. Operating profitability reached €23 million6, increasing

the EBITDA margin to 8.3%, up from 4.8% one year earlier.

This significant rise in EBITDA achieved by each of Claranova’s

divisions highlights:

- the potential profitability of the personalized e-commerce

businesses (PlanetArt) during a period of limited marketing

investments;

- the successful transition from a software publishing business

model (Avanquest) into a higher margin proprietary software

subscription-based model (SaaS7);

- the significant reduction in the operating losses of the IoT

businesses (myDevices).

In line with the improvement in EBITDA, Net Income increased

sevenfold in H1 2020-2021 to reach €11 million. This first half

also confirmed the Group’s strong cash flow generation with a net

inflow from operating activities of €40 million. On that basis,

Claranova’s gross cash position increased 29% in relation to

December 31, 2019 to a record level of €118 million, resulting in

net cash (cash net of financial debts) of €47 million.

Change in the Group’s main operating performance indicators:

In € million

H1 2020-2021

H1 2019-2020

Change

Revenue

278

234

19%

EBITDA

23

11

107%

EBITDA as a % of Revenue

8.3%

4.8%

+3.5 pts

Recurring Operating Income

21

10

114%

Net Income

11

1

603%

Cash flow from operating

activities

40

37

7%

Closing cash position

118

91

29%

PlanetArt: a solid first half, highlighting the potential

profitability of the personalized e-commerce businesses

With €234 million in revenue and €19 million in EBITDA,

PlanetArt continued to deliver robust growth (+32% at constant

exchange rates), accompanied by a very sharp rise in operating

profitability in the first half of 91%. This positive trend for

EBITDA is the result of an ever-increasing demand in the markets

addressed by PlanetArt which continues to strengthen its

competitive position worldwide, year after year. It also reflects

the more limited marketing investments during the year-end holiday

period where the traditional pressure on the supply chain was

reinforced by the public health situation. This in turn further

boosted online consumption from which PlanetArt fully

benefited.

This first half also confirmed the good integration of the

Personal Creations businesses acquired in August 2019 (under

Chapter 11). Personal Creations posted double-digit growth with a

structurally improved profitability profile in the first half of

the year8,9. FreePrints Gifts application experienced a very

successful launch in the United States: with over 700,000 downloads

since its launch at the start of the year, and an average score of

4.8/510 stars, FreePrints Gifts is off to a promising start. Its

ramp-up will allow us to further monetize of our global FreePrints

installed based with strong margins associated to FreePrints Gifts

products.

Change in PlanetArt’s main operating performance indicators:

In € million

H1 2020-2021

H1 2019-2020

Change

Revenue

234

186

26%

EBITDA

19

10

91%

EBITDA as a % of Revenue

8.3%

5.4%

+ 2.8 pts

Avanquest: profitability of businesses reinforced by focusing

on proprietary software publishing and subscription sales

Avanquest, Claranova’s software publishing business, is

continuing to shift its focus to a higher margin proprietary

software subscription-based business model (SaaS) which has

contributed to a significant improvement in EBITDA from €4 million

to €5 million, an increase of 31%.

This transition continues to limit revenue growth in the first

half, which registered a marginal decrease of 4% at constant

exchange rates (-9% at actual exchange rates). The momentum for the

subscription-based sales of proprietary software, and notably PDF

document management (Soda PDF) and photo editing tools (InPixio),

both with double-digit growth in H1, offset in part the planned

decrease by Avanquest’s non-strategic businesses which include

physical software sales, non-proprietary software sales and sales

by channel partner networks which are now internalized.

The EBITDA margin rose significantly from 8.0% as a percentage

of revenue in last year’s first half to 11.5%. With recurring sales

now accounting for 56% of revenue compared to 42% in the prior

year's first half, the profitability of the publishing software

business will continue to improve as this percentage increases.

Change in Avanquest’s main operating performance indicators in

2019-2020:

In € million

H1 2020-2021

H1 2019-2020

Change

Revenue

42

46

-9%

EBITDA

5

4

31%

EBITDA as a % of Revenue

11.5%

8.0%

+ 3.5 pts

myDevices: business remains resilient even as the pandemic

slows the pace of the rollout

Revenue from Claranova’s IoT businesses remained stable at €2

million, up 4% at constant exchange rates, within a context of

slower deployment observed since the beginning of the pandemic in

myDevices’ main industry sectors (hospitality services, catering,

hospitals, offices, etc.). Waiting for rollout to resume, losses

registered in the first half were contained with myDevices’ EBITDA

representing a loss of €1.0 million, up from a €3 million loss in

last year’s first half.

The positive business momentum prior to the health crisis should

gradually resume as the situation gradually returns to normal and

activity recovers as expected in the main industries covered by the

myDevices solutions, especially as this crisis has emphasized the

importance of IoT to the indispensable digitalization of use cases

in those segments.

Change in myDevices’ main operating performance indicators in

2019-2020:

In € million

H1 2020-2021

H1 2019-2020

Change

Revenue

2

2

-3%

EBITDA

(1)

(3)

-62%

EBITDA as a % of Revenue

-46.5%

-118.1%

+ 71.6 pts

A new record for cash (€118 million), boosted by operating

cash flow generation (€40 million)

Claranova ended H1 2020-2021 with a closing cash position of

€118 million as of December 31, 2020, i.e. a €35 million increase

compared to June 30, 2020. This increase was bolstered by net

inflows from operating activities of €40 million which included €23

million from operations and €21 million from changes in working

capital requirements, reflecting the growth of PlanetArt (organic

and external), the seasonal nature of these businesses (significant

activity during year-end festivities generating an exceptional peak

in cash flow at the end of December) and the business model (B2C

distribution which naturally generates negative working capital

requirements). Net cash flows used in investing activities and from

financing activities remained limited representing an outflow of €4

million and an inflow of €3 million respectively.

In € million

H1 2020-2021

H1 2019-2020

Cash flow from operations before changes

in working capital

23

9

Change in working capital requirements

21

34

Taxes and net interest paid

(4)

(6)

Net cash flow from/(used in) operating

activities

40

37

Net cash flow from/(used in) investing

activities

(4)

(32)

Net cash flow from/(used in) financing

activities

3

10

Increase (decrease) in cash

38

14

Opening cash position

83

75

Net foreign exchange difference

(3)

2

Closing cash position

118

91

A financial position that remains very solid with positive

net cash position of €47 million

Claranova’s financial position remains particularly sound with

cash position of €118 million and financial debt of €71 million

(excluding the impact IFRS 16 on the recognition of leases),

resulting in net cash of €47 million as at December 31, 2020.

In € million

12/31/2020

06/30/2020

Bank debt

20

18

Bonds

48

48

Other financial liabilities

2

3

Accrued interest

1

0

Total financial liabilities11

71

69

Available unpledged cash

118

83

Net debt

(47)

(14)

Financial calendar: May 11, 2021: Q3

2020-2021 revenue

The presentation of H1 2020-2021 results may be

consulted at the Company’s website:

https://www.claranova.com/investisseurs/publications-financieres/

The Company anticipates the publication of the

half-yearly financial report the week of April 12, 2021 after the

finalization of the limited review procedures by the auditors.

About Claranova:

Claranova is a high-growth international technology group with a

long-term vision and resilient business models operating in high

potential markets. As the leader in personalized e-commerce

(PlanetArt), Claranova provides added value through technological

expertise in software publishing (Avanquest) and the Internet of

Things (myDevices). These three business divisions share a common

mission to simplify access to new technologies through solutions

combining innovation and ease of use. Based on these strengths,

Claranova has maintained an average annual rate of growth for the

past three years of more than 45% and in FY 2019-2020 had revenue

of €409 million.

For more information on Claranova group:

https://www.claranova.com or

https://twitter.com/claranova_group

CODES Ticker : CLA ISIN : FR0013426004

Disclaimer: All statements other than statements of

historical fact included in this press release about future events

are subject to (i) change without notice and (ii) factors beyond

the Company’s control. Forward-looking statements are subject to

inherent risks and uncertainties beyond the Company’s control that

could cause the Company’s actual results or performance to be

materially different from the expected results or performance

expressed or implied by such forward-looking statements.

Appendices

Appendix 1: Consolidated Income Statement

In € million

H1 2020-2021

H1 2019-2020

Net revenue

277.8

234.3

Raw materials and purchases of goods

(91.0)

(73.5)

Other purchases and external expenses

(119.1)

(113.1)

Taxes, duties and similar payments

(0.4)

(0.3)

Employee expenses

(32.4)

(26.8)

Depreciation, amortization and provisions

(net of reversals)

(4.1)

(3.0)

Other recurring operating income and

expenses

(10.1)

(7.9)

Recurring Operating Income

20.8

9.7

Other operating income and expenses

(3.3)

(3.0)

Operating income

17.5

6.8

Net financial income (expense)

(3.5)

(2.3)

Tax expense

(3.5)

(2.9)

Net Income

10.5

1.5

Net income attributable to owners of

the parent

8.5

1.2

Appendix 2: Earnings per share

(In €)

H1 2020-2021

H1 2019-2020

Number of shares outstanding12 (in

units)

39,486,529

39,200,753

Number of shares outstanding after

potential dilution (in units)

39,905,818

39,905,820

Net income per share

€ 0.27

€ 0.04

Net income per share after potential

dilution

€ 0.26

€ 0.04

Adjusted net income per share

€ 0.36

€ 0.11

Adjusted net income per share after

potential dilution

€ 0.36

€ 0.11

Net income per share attributable to

the parent

€ 0.21

€ 0.03

Net income per share attributable to the

parent after potential dilution

€ 0.21

€ 0.03

Adjusted net income per share attributable

to the parent

€ 0.31

€ 0.10

Adjusted net income attributable to the

parent after dilution

€ 0.30

€ 0.10

Appendix 3: Calculation of EBITDA and Adjusted net

income

EBITDA and Adjusted net income are non-GAAP measures and should

be viewed as additional information. They do not replace Group IFRS

aggregates. Claranova’s Management considers these measures to be

relevant indicators of the Group’s operating and financial

performance. It presents them for information purposes, as they

enable most non-operating and non-recurring items to be excluded

from the measurement of business performance.

The transition from Recurring Operating Income to EBITDA is as

follows:

In € million

H1 2020-2021

H1 2019-2020

Recurring Operating Income

20.8

9.7

Impact of IFRS 16 on leases expenses

(1.8)

(1.6)

Share-based payments, including social

security expenses

0.0

0.0

Depreciation, amortization and

provisions

4.1

3.0

EBITDA

23.1

11.2

The reconciliation of Net Income to Adjusted Net income is as

follows:

In € million

H1 2020-2021

H1 2019-2020

Net Income

10.5

1.5

IFRS 16 impact on Net income

0.2

0.2

Share-based payments, including social

security expenses

0.0

0.0

Fair value remeasurement of financial

instruments

0.1

(0.3)

Other operating income and expenses

3.3

3.0

Adjusted net income

14.2

4.3

Appendix 4: Simplified Statement of Financial

Position

Claranova’s total assets increased from €210 million to €244

million between June 30, 2020 and December 31, 2020. This increase

reflects mainly the significant growth in cash and cash equivalents

of €35 million generated by the Group’s operations in the first

half in relation to June 30, 2020.

Group balance sheet highlights:

In € million

12/31/2020

06/30/2019

Goodwill

62.5

61.7

Right-of-use lease assets

8.5

9.8

Other non-current assets

23.2

22.2

Current assets (excl. Cash and cash

equivalents)

31.5

33.5

Cash and cash equivalents

118.1

82.8

Total assets

243.7

210.0

Equity

73.2

62.3

Financial liabilities

71.4

68.9

Lease liabilities

9.0

10.1

Other non-current liabilities

3.1

3.1

Other-current liabilities

87.1

65.6

Total equity and liabilities

243.7

210.0

Appendix 5: IFRS 16 impact on leases

On January 13, 2016, the IASB

published IFRS 16 on the recognition of leases, replacing IAS 17.

The Group transitioned to IFRS 16 on July 1, 2019, using the

simplified retrospective method. The impacts on the Income

Statement, the Statement of Financial Position and the Statement of

Cash Flows are presented below. Further information on the impacts

of application of IFRS 16 on the Group financial statements can be

found in Note 16 to the 2020-2021 Half-year Financial

Report.

In € million

H1 2020-2021

H1 2019-2020

Cancellation of lease expenses

1.8

1.6

Amortization of right-of-use assets

(1.6)

(1.4)

Interest on lease liabilities

(0.4)

(0.3)

Impact on Net Income

(0.2)

(0.2)

Non-current lease assets

8.5

9.8

Impact on total assets

8.5

9.8

Non-current lease liabilities

5.9

7.2

Current lease liabilities

3.2

3.0

Impact on total liabilities

9.1

10.1

Impact on closing cash

0.0

0.0

1 B2C or Business-to-Consumer refers to the process where

businesses sell products and services directly to individual

consumers. 2 A penetration pricing strategy that involves proposing

a free product to customers who are then charged for complementary

products, services and features. 3CHange at constant exchange rates

4EBITDA (Earnings before interest, taxes, depreciation and

amortization) is a non-GAAP aggregate used to measure the operating

performance of the businesses. It is equal to Recurring Operating

Income before depreciation, amortization and share-based payments

including related social security expenses and the IFRS 16 impact

on the recognition of leases. Details on the calculation of EBITDA

are presented in the Appendix to this presentation. 5 In terms of

Net Income. 6 The increase in EBITDA does not take into account the

aid received from the US federal government through the Covid-19

relief Paycheck Protection Program (PPP), pending final guidance by

the US authorities concerning the conditions governing its

conversion into grants in favor of the Group’s two US subsidiaries.

The conversion of this aid into a grant would positively impact the

Group’s EBITDA by nearly US$5 million. 7 Software as a Service. 8

Because Personal Creations was integrated in August 2019,

like-for-like growth is calculated at constant exchange rates on a

comparable basis of five months (August to December). 9 The

profitability of the Personal Creations businesses corresponds to

the contribution margin or before fixed costs, where the Personal

Creations businesses have already been fully merged with

PlanetArt’s other businesses and are supported by a shared

logistics, IT and marketing platform. 10 Source: AppFigures, number

of downloads and average score obtained since the app’s launch on

iOS and Android. 11 Excluding lease liabilities resulting from the

adoption of IFRS 16. 12 The number of outstanding shares was

restated in H1 2018-2019 and H1 2017-2018 to take into account the

one-for-ten reverse stock split in H1 2019-2020.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210331005784/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 65

ir@claranova.com

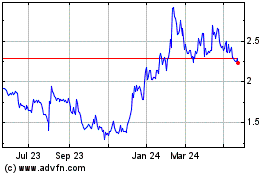

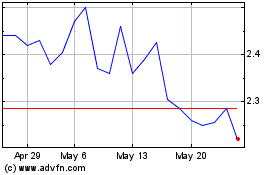

Claranova (EU:CLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Claranova (EU:CLA)

Historical Stock Chart

From Dec 2023 to Dec 2024