FOMC Decision Will Push Bitcoin Up Or Down? The $30,000 Question

March 21 2023 - 2:17PM

NEWSBTC

As the next Federal Open Market Committee (FOMC) meeting approaches

on March 22, Bitcoin (BTC) trades at $28,000, just below its

nearest resistance level. The cryptocurrency is consolidating at a

critical zone, indicating the potential for continuing its current

trend or a possible pullback to $25,000. Tomorrow’s FOMC is priced

at an 80% chance of an interest rate hike of 25 basis points (bps).

According to a recent post by the crypto-trading firm QCP Capital,

the consensus has shifted to what analysts suggested last week of

no hike decision by the FOMC or a surprise cut. In the latter

scenario, QCP Capital believes a rate cut may cause more market

panic and lead to a decline in the global financial sector. This

may seem counterintuitive, as lower interest rates are generally

favorable for the markets and can stimulate borrowing and

investment. However, a decision not to hike rates or to cut them

unexpectedly could signal to investors that the Federal Reserve

(Fed) is concerned about the state of the economy and may be

anticipating a downturn, causing investors to sell off their

investments, leading to a decline in the crypto market and the

delay of the next bull cycle for Bitcoin. Related Reading: Can

Ethereum Fall Below $1,500? Here Are Factors That Could Drive It

Crucial Turning Point For Bitcoin QCP Capital sees the next

FOMC meeting as a critical point for the markets that could

significantly impact the price action of the cryptocurrency

industry and the Nasdaq index, which tracks tech companies.

According to the trading firm, the recent rally in Bitcoin’s price

has been due in part to the large injection of liquidity into the

markets by the Federal Reserve, which has helped to boost prices.

However, the firm believes that the “lack of resolve” among Fed

policymakers is an even more important factor driving the current

rally. Suppose the Federal Reserve were to adjust its monetary

policy to align with market expectations. In that case, it could

result in more gains in equities and the cryptocurrency market,

enabling Bitcoin to continue its uptrend and surpass the $30,000

mark, which will significantly confirm the bull market cycle.

Weekly Breakout Confirmed For BTC According to Adrian Zdunczyk, a

Technical crypto analyst, Bitcoin has signaled a bullish long-term

pattern, confirming a weekly breakout for the most prominent

cryptocurrency in the market, suggesting Bitcoin’s price is likely

to continue rising over the long term. This trend could allow BTC

to reclaim the 200-day mean average, used to forecast long-term

trends, which has preceded powerful rallies for the crypto from

cycle lows. According to Zdunczyk, reclaiming the 50-week and

200-week moving averages could hint that the current trend is a

strong bullish signal, indicating a high probability of further

price increases in the near term. Breaking through these resistance

levels suggests that bulls have taken control of the market,

increasing Bitcoin’s price, potentially up to the $30,000 mark. For

the analyst, Bitcoin’s price will create a range between $25,800

and $28,700, based on the average volatility of the crypto price

movement. This suggests the price will likely stay within this

range based on historical patterns. Any “violent” break” outside of

this price range could result in a trend reversal or continuation,

according to Adrian Zdunczyk. As Bitcoin approaches the

$30,000 level, the upcoming FOMC meeting could increase volatility

in the market. However, the new bull trend appears to be confirmed

after an 82% rally from the cycle low, surpassing the next

resistance level. This could represent the end of the crypto

winter, despite the possibility of future corrections in the BTC

price. Related Reading: Shiba Inu Whales On Buying Spree, But SHIB

Needs To Conquer This Price Bitcoin is trading at $28,200, gaining

a profit of 1.8% in the last 24 hours. Feature image from Unsplash,

chart from TradingView.com

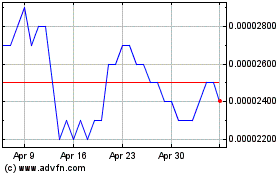

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024