Bitcoin Market Leverage and Coinbase Premium: What Recent Data Reveals

December 21 2024 - 6:30AM

NEWSBTC

As Bitcoin currently faces a downturn and now seeing a recovery

suggesting a preparation for its next bull run, market participants

appears to be analyzing trends in exchange leverage and liquidity.

Particularly, CryptoQuant has pointed out that leverage ratios on

centralized exchanges have become a focal point, offering insights

into the potential risks and opportunities shaping the crypto

market. The platform’s recent data highlights the importance of

assessing these ratios to gauge the financial stability of

exchanges and the impact on trading dynamics. Related Reading: As

Bitcoin Reclaims $100,000, Warning Signs Emerge from Long-Term

Investors Leverage Trends And Exchange Stability A detailed

analysis revealed that Binance maintains strong reserves relative

to its open interest, signaling a strong ability to manage market

volatility. In contrast, smaller exchanges like Gate.io and Bybit

exhibit higher leverage ratios, raising questions about their

capacity to withstand liquidity crunches. According to CryptoQuant,

monitoring these metrics has become even more “critical” in light

of past events, such as the collapse of FTX in November 2024, which

was triggered by insufficient reserves against high open interest.

CryptoQuant’s latest findings further highlight the varying

leverage strategies employed by major cryptocurrency exchanges.

Binance emerged as a leader in maintaining a stable leverage ratio

while expanding its Bitcoin open interest from $4.45 billion in

December 2023 to $11.64 billion in December 2024. Despite this

growth, Binance’s Bitcoin, Ethereum, and USDT reserves have

consistently exceeded its open interest, ensuring liquidity and

stability even during volatile market conditions. The exchange’s

leverage ratio, which rose modestly from 12.8 to 13.5 over the past

year, remains the lowest among its peers. Conversely, exchanges

like Gate.io, Bybit, and Deribit exhibit significantly higher

leverage ratios of 106, 86, and 32, respectively. CryptoQuant

wrote: These figures show their Bitcoin open interest exceeds or

approaches their reserves, with similar patterns observed for

Ethereum. Coinbase Premium: A Key Indicator For Bitcoin Traders

Beyond leverage ratios, another crucial metric shaping Bitcoin

market sentiment is the Coinbase Premium. This indicator, which

tracks the price difference between Bitcoin on Coinbase and other

exchanges, is a barometer for institutional demand and market

trends. A CryptoQuant analyst named BQYoutube suggested that

traders adopt a cautious approach based on Coinbase Premium

signals: When the premium is negative, it may be wise to stay on

the sidelines. Related Reading: Bitcoin Rally Loses Momentum: Could

A Drop To $75,000 Signal The Final Correction? However, a positive

premium often signals the return of strong demand, offering a

strategic entry point for traders looking to ride major market

trends. According to the latest data, this metric currently sits on

the negative side, suggesting to stay on the sidelines. BQYoutube

added: You might miss few small trends with this approach but at

least you can ride all the big trends and avoid losses in dips or

downtrends. Featured image created with DALL-E, Chart from

TradingVie

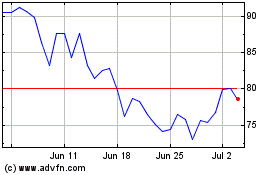

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

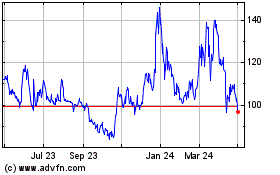

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024