Another Bitcoin Metric Turns Bullish With Price At $23,000 And Forecasts More Profits

February 08 2023 - 3:00PM

NEWSBTC

Bitcoin has been moving sideways during this week as bullish

momentum fades under the pressure of macroeconomic uncertainty. The

cryptocurrency has been recording significant profits since the

beginning of 2023, flipping market sentiment from fear to optimism

as it reconquers previously lost ground. Related Reading: AI Token

The Graph (GRT) Sees Correction, But How High Can The Price Go? As

of this writing, Bitcoin (BTC) trades at $23,000 with sideways

movement across the board. Other cryptocurrencies in the top 10 by

market cap are seeing better performance, with Polygon (MATIC),

Ethereum (ETH), and Cardano (ADA) still trading in the green over

the same period. Bitcoin Long-Term Fundamentals Hint At Further

Profits As Bitcoin pierced through the critical resistance at

$24,000, fundamental metrics point towards extending the current

bullish trend. According to a report from Bitfinex Alpha, the

Realized Profit/Loss Ratio (RPLR) for BTC turned bullish for the

first time since April 2022. The RPLR is used to gauge the

buyer/seller dynamics. At its current levels, the indicator points

to two critical facts: Bitcoin investors are taking profits, and

there is enough buying pressure in the crypto market to counter

sellers. The report noted: “this generally signifies that sellers

with unrealized losses have been exhausted, and a healthier inflow

of demand exists to absorb profit taking”. Hence, this indicator is

sending a bullish sign for a longer timeframe investor. As seen in

the chart below, a spike in this metric above zero has preceded

periods of extended appreciation, such as the February to March and

the August to November bull runs from 2021. At that time, Bitcoin

recovered from a significant crash before it resumed its bullish

momentum and re-entered price discovery. Bottom In, Bears On Their

Way Out As the report noted, this is not the first time Bitcoin has

bottomed following a spike in its RPLR. In 2019, when the metric

hit 0.2, the cryptocurrency crashed to a multi-year low of $3,600,

then moved to a long consolidation period before rallying to a new

all-time high. Related Reading: This Little-Known Crypto Erupts

1,300% In Last 24 Hours – Find Out Here The report claims that the

BTC’s price could see similar price action throughout 2023, with

long consolidation followed by more rallies. These bull runs often

see Bitcoin trading 20x or 10x from its low. Bitfinex noted: The

RPLR again recently bottomed around 0.18, its lowest since 2011,

and Bitcoin was trading in the $16,000s in November 2022. Bulls

will be hoping for history to once again rhyme, and that the

world’s largest cryptocurrency by market cap can post another

exponential rally from lows over the next three or so years. A 10x

rally from recent lows would see Bitcoin hitting around $160,000.

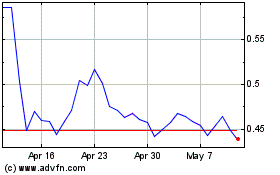

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

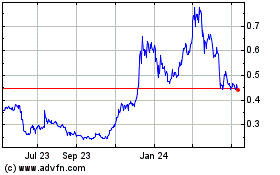

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024