Etango-8 Project Scoping Study

August 05 2020 - 7:00AM

Bannerman Resources Limited (ASX:BMN, OTCQB:BNNLF, NSX:BMN)

(

Bannerman or

the Company) is

pleased to advise of the completion of a Scoping Study for an 8Mtpa

development of its flagship Etango Uranium Project in Namibia

(

Etango-8 Project).

KEY OUTCOMES

- Primary outcome of recent scaling evaluation work on

Etango; provides an alternate, streamlined development model to the

20Mtpa development assessed to DFS level in 2015

- Demonstrates the strong technical and economic

viability of conventional open pit mining and heap leach processing

of the world class Etango deposit at 8Mtpa throughput

- Life-of-mine (LOM) production of 51.1 Mlbs U3O8 (48.5 –

53.7 Mlbs) with annual average production of 3.5 Mlbs U3O8 (3.4 –

3.7 Mlbs)

- Forecast pre-production capital expenditure of US$254M

(US$241 – 267M), delivering an attractive upfront capital intensity

of approx. US$71/lb average annual U3O8 production

- Life-of-mine of approx. 14 years (114.1 Mt plant feed

at 232 ppm U3O8)

- Average final product cash operating cost

(ex-royalties) of US$37/lb U3O8 (US$36 – 39/lb)

- Attractive projected economics at forecast US$65/lb

U3O8 realised price:° Ungeared, real,

post-tax NPV8% of US$212M (US$201 –

223M)° Post-tax internal rate of return (IRR)

of 21.2% (20.1 – 22.3%) and payback of 3.6

years° Forecast net project cashflow

(post-capex, post-tax) of US$604M (US$574 – 634M)

- Further upside potential

from:° Future life extension and/or scale-up

expansion° Additional processing efficiency

and cost opportunities

- Vast body of previous technical work enables

fast-tracking of feasibility studies; all resource drilling,

geotechnical, metallurgical and environmental work already

complete

- Heap leach process route has also been comprehensively

de-risked via operation of the Etango Heap Leach Demonstration

Plant

- Bannerman Board has approved commencement of a

Pre-Feasibility Study (PFS) with completion targeted for Q2

2021

- Long-term scalability of Etango Project (up to 20Mtpa)

confirmed by previous definitive level studies; provides strong

optionality and leverage to upside-case uranium

market

|

|

Commenting on the Etango-8 Scoping Study results,

Bannerman Chief Executive Officer, Brandon Munro,

said:

“Last year we commenced a review of various

project scaling opportunities that might exist for the Etango

Project. This Etango-8 Scoping Study represents the

successful culmination of that work.

“Developing the world-class Etango Project at an

initial 8Mtpa throughput offers significant advantages. It

sharply reduces the upfront capital and funding hurdle compared to

that associated with the original 20Mtpa Etango development

evaluated in the DFS in 2012, and the DFS Optimisation Study in

2015. It also enables us to predominantly mine shallower,

higher-grade ore, which significantly reduces stripping and lifts

the average feed grade to the processing facility. The

combined result is that the upfront capital intensity of the Etango

Project per pound of annual production capacity has fallen

materially whilst maintaining robust project economics.

“The Etango-8 Project is expected to deliver

over 3.5Mlbs U3O8 per annum over an initial operating life of more

than 14 years. This may be a reduced scale compared with the

original Etango, but it is still a world-class uranium project and

amongst the largest development projects in the sector. With

a post-tax IRR north of 20%, the Etango-8 Project delivers

attractive projected investment returns on a lower initial capital,

funding and development risk profile.

“Importantly, while the Etango-8 Project

provides a reduced scale of production entry, it does so without

removing the option of subsequent expansion, including to the

originally envisaged 20Mtpa Etango scale. In short, the

scalability of the world class Etango resource remains robust even

with a more modular approach to development of the project.

“We are now proceeding to undertake a PFS on the

Etango-8 Project. This process will benefit significantly

from the fact that the Etango Project has already been the subject

of a definitive level of feasibility study, at a larger scale, in

recent years. As a result, we are targeting completion of a

comprehensive PFS in Q2 2021.”

The full announcement, including cautionary statement, is

available here.

This ASX release was authorised on behalf of the

Bannerman Board by:

Brandon Munro, Chief Executive Officer

CONTACT DETAILS:

Brandon MunroChief Executive Officer+61 8 9381

1436bmunro@bannermanresources.com.au

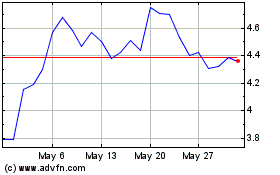

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Jan 2025 to Feb 2025

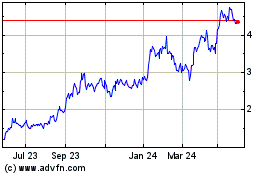

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Feb 2024 to Feb 2025