Positive Resolution of Section 232 Trade Investigation

July 15 2019 - 7:00AM

Bannerman Resources Limited (ASX:BMN, NSX:BMN) (“Bannerman” or “the

Company”) is pleased to advise that the section 232 trade

investigation into uranium imports into the United States has been

resolved with a clear and positive decision by President Trump.

HIGHLIGHTS

- Positive section 232 decision announced on 12 July.

- President Trump decided to take no trade action, rejecting

quota requiring US utilities to procure 25% of uranium from

domestic US sources.

- Highly positive outcome for uranium sector and non-US uranium

companies, as it alleviates concerns that a quota, tariff or other

trade action would be imposed.

- Certainty generated by section 232 resolution is expected to

increase uranium market activity, which has been suppressed since

January 2018.

- New US Nuclear Fuel Working Group established as part of s232

decision. ° Lays the foundation for further

positive outcomes as the Working Group is directed to “reinvigorate

the entire nuclear fuel supply chain”.

- Bannerman’s Etango Project well positioned to benefit

° Advanced project with world-class scale leveraged to

increases in uranium price ° Namibia ideal

jurisdiction for uranium development as geo-political risk and need

for supply diversity becomes more acute.

On 12 July 2019, President Trump announced the

completion of the section 232 trade investigation undertaken by the

United States Department of Commerce. This trade

investigation was initiated under section 232 of the Trade

Expansion Act after two US uranium producers petitioned the

Department of Commerce in January 2018, seeking an order that US

nuclear utilities be required to purchase 25% of their uranium from

US domestic production.

President Trump decided to take no trade action,

which has lifted concerns that a quota, tariff or other trade

action would be imposed under the broad power delegated to the

President under section 232. Instead, President Trump has

initiated a review of the domestic nuclear supply chain (uranium

production, conversion, enrichment and fabrication) in the context

of the 2017 White House initiative to revive, revitalise and expand

the nuclear energy sector.

Since January 2018 the breadth of potential

outcomes, including the potential to adversely affect term

contracting arrangements, had created uncertainty that has resulted

in most utility procurement programs being suspended or sharply

curtailed. Other market activity was also substantially

reduced in the immediate lead-up to a decision, resulting in low

spot volumes.

Bannerman regards this no trade action outcome

as highly positive for the uranium sector, given that global

uranium market activity is now expected to return towards more

normalised levels. Moreover, this outcome is particularly

positive for non-US uranium companies as it maintains open market

access to the US uranium market. Given the partial

hiatus in a number of uranium market operations, the Company

expects enhanced activity from utilities, traders, producer-buyers

and speculators during the remainder of calendar 2019. In

particular, Cameco has confirmed its intention to recommence spot

purchasing during 2019 in order to meet term contract delivery

obligations that it must fill after placing its McArthur River mine

onto care and maintenance in July 2018.

Although President Trump did not agree that

uranium imports threaten to impair the national security of the

United States, he acknowledged that the United States uranium

industry faces significant challenges in producing uranium

domestically and that this is an issue of national security

(because, for instance, the US Navy must use domestically produced

uranium for its maritime nuclear power). Accordingly, to

address concerns regarding the production of domestic uranium and

ensure a comprehensive review of the domestic nuclear supply chain,

the President directed that a Nuclear Fuel Working Group be

established. The Working Group will include the Secretary of

State, Secretary of Energy and Secretary of Defence, amongst other

key officials, and will develop recommendations for reviving and

expanding domestic nuclear fuel production (that is, uranium,

conversion, enrichment and fuel fabrication). Within 90 days

the Working Group must submit a report to the President making

recommendations to further enable domestic nuclear fuel

production.

Recommendations from the Working Group are

likely to produce positive outcomes for the uranium market as a

whole, given the section 232 powers to impose trade actions are now

ended and the Working Group is enabled to find more holistic

solutions to the challenges facing the US nuclear energy

sector. The US nuclear fleet represents a quarter of current

uranium demand globally, so any steps the US government takes to

revitalise and expand this sector is positive for uranium suppliers

internationally.

Further, the section 232 process and associated

publicity has raised awareness of the importance of supply

diversity and geopolitical factors in the uranium sector.

These geopolitical factors are likely to be further examined by the

Working Group, which is directed to “reinvigorate the entire

nuclear supply chain, consistent with United States’ national

security and non-proliferation goals”. African projects in

jurisdictions without fixed geo-political allegiances are well

positioned for the resulting interest from both US and non-US

uranium consumers seeking to reduce supply risk.

Bannerman’s Chief Executive Officer, Mr Brandon

Munro, said, “We welcome the strong and decisive resolution of the

section 232 trade investigation, which has been a distraction to

the uranium sector for 18 months. This no trade action

outcome maintains open access to the US uranium market and is

particularly positive for non-US uranium companies. With a renewed

focus on supply diversity and geo-political risk, Bannerman is

particularly well positioned with its Etango Project situated in

Namibia, a premier uranium development jurisdiction with good

bi-lateral relations with all major uranium consumption markets,

including the US, China, Russia and France. Bannerman is set

to benefit from renewed uranium market activity, with an advanced

project of world-class scale in a premier jurisdiction and robust

cash balance.”

For further

information please contact:

|

Brandon MunroChief Executive OfficerPerth, Western

AustraliaTel: +61 (8) 9381

1436info@bannermanresources.com.au |

Robert DaltonCompany SecretaryPerth, Western

AustraliaTel: +61 (8) 9381 1436info@bannermanresources.com.au |

Michael Vaughan (Media)Fivemark PartnersPerth,

Western AustraliaTel: +61 422 602

720michael.vaughan@fivemark.com.au |

|

|

|

About Bannerman - Bannerman Resources Limited is

an ASX and NSX listed exploration and development company with

uranium interests in Namibia, a southern African country which is a

premier uranium mining jurisdiction. Bannerman’s principal

asset is its 95%-owned Etango Project situated near Rio Tinto’s

Rössing uranium mine, Paladin’s Langer Heinrich uranium mine and

CGNPC’s Husab uranium mine. A definitive feasibility study has

confirmed the viability of a large open pit and heap leach

operation at one of the world’s largest undeveloped uranium

deposits. From 2015 to 2017, Bannerman conducted a large scale heap

leach demonstration program to provide further assurance to

financing parties, generate process information for the detailed

engineering design phase and build and enhance internal capability.

More information is available on Bannerman’s website at

www.bannermanresources.com. |

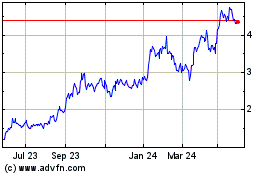

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Jan 2025 to Feb 2025

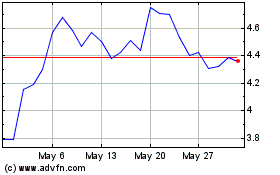

Bannerman Energy (ASX:BMN)

Historical Stock Chart

From Feb 2024 to Feb 2025