TIDMSRES

RNS Number : 1886B

Sunrise Resources Plc

31 May 2023

31 May 2023

SUNRISE RESOURCES PLC

("Sunrise" or the "Company")

HALF-YEARLY REPORT 2023

Sunrise Resources plc, is pleased to announce its unaudited

interim results for the six months ended 31 March 2023, a copy of

which is also available on the Company's website,

www.sunriseresourcesplc.com.

Operational Highlights

CS Pozzolan-Perlite Project, Nevada

Ø Discussions continue with interested parties for the

development of the project.

Ø Interest in natural pozzolan accelerating in 2023 driven by

legislative pressures on the cement industry to decarbonise and a

growing acceptance that fly ash supplies in the US are not

sustainable.

Ø Cement Distribution Consultants commissioned to produce a

detailed market study on cement and pozzolans in California and

Nevada to provide the Company with additional market intelligence

and to identify additional partnership opportunities.

Ø Projections to 2030 indicate the combined market for cement

and pozzolans will grow from 12.6 million tons to 15.1 million tons

in the key California markets with growth to be met by increasing

production and inter-state imports of pozzolan including 2.4

million tons of natural pozzolan.

Ø CS Project is shovel ready; Company has a first mover

advantage.

Hazen Pozzolan Project, Nevada

Ø Collaborative arrangement with an existing processor of

natural pozzolan for mining and test grinding of a bulk sample of

the Company's Hazen natural pozzolan deposit in northern

Nevada.

Ø Test mining completed successfully, pozzolan is free

digging.

Ø Laboratory tests on bulk sample reported to be

satisfactory.

Ø Unusually severe winter storms have limited the availability

of silo space for the test grind which is still awaited.

Pioche Sepiolite Project, Nevada

Ø Project continues to be advanced by Tolsa, the world's largest

producer of sepiolite.

Ø Trenching programme confirmed multiple beds of sepiolite and

generated several mini-bulk samples, now under evaluation in

Spain.

Ø 31 additional mining claims staked to more than double the

size of the Pioche Project.

Ø Resource definition drilling scheduled for June 2023.

Ø Detailed site topographic survey in progress to better define

drill sites.

Ø Tolsa has made the US$50,000 interim payment, can purchase the

project for US$1.25m by 28 December 2023 and Sunrise will retain a

3% gross revenue royalty on all claims.

Reese Ridge Base Metal and Gold Project, Nevada

Ø New project located on the south side of the prospective

Humboldt Structural Zone.

Ø Numerous gossans and alteration zones at surface with grab

samples up to 15.8% zinc, 3.3% copper, 0.37g/t gold and 51g/t

silver in separate samples with multiple pathfinder elements,

including arsenic and thallium.

Ø Satellite imagery shows large alteration areas associated with

this mineralisation.

Ø Significant low resistivity target identified below the

surface mineralisation from past geothermal energy exploration

programme.

Ø Project prospective for a number of different styles of

mineralisation including carbonate replacement

lead-zinc-copper-silver and Carlin-style gold deposits.

Financial Results Summary

Group loss for the six months ended 31 March 2023 of GBP145,911

comprising:

-- Income includes GBP32,344 for granting option rights to

Tolsa, GBP4,043 from lease and GBP380 interest receivable.

-- Less administration costs of GBP180,426 and expensed

pre-licence exploration costs GBP2,252.

Project expenditure of GBP39,012 was capitalised.

Funding during the period

In November 2022, the Company issued a two-year zero-coupon

convertible security of GBP200,000 to Toward Net Zero LLC ("TNZ")

and in addition GBP80,000 (before expenses) was raised via a share

placing, both as part of a funding package of up to GBP480,000 with

TNZ.

Shares to the value of GBP20,116 were issued in January 2023 in

satisfaction of a portion of outstanding directors' fees.

On 31 March 2023, the Company held GBP180,896 in cash and cash

equivalents and listed investments with a current value of

GBP15,341.

The Company relies upon periodic capital fundraisings until such

time as cashflow can be derived either from the sale of assets or

future operations.

Further information:

Sunrise Resources plc Tel: +44 (0)1625 838 884

Patrick Cheetham, Executive

Chairman

Tel: +44 (0)207 628 3396

Beaumont Cornish Limited

Nominated Adviser

James Biddle/Roland Cornish

Tel: +44 (0)207 469 0930

Peterhouse Capital Limited

Broker

Lucy Williams/Duncan Vasey

CAUTIONARY NOTICE

The news release may contain certain statements and expressions

of belief, expectation or opinion which are forward looking

statements, and which relate, inter alia, to the Company's proposed

strategy, plans and objectives or to the expectations or intentions

of the Company's directors. Such forward-looking statements involve

known and unknown risks, uncertainties and other important factors

beyond the control of the Company that could cause the actual

performance or achievements of the Company to be materially

different from such forward-looking statements. Accordingly, you

should not rely on any forward-looking statements and save as

required by the AIM Rules for Companies or by law, the Company does

not accept any obligation to disseminate any updates or revisions

to such forward-looking statements.

MARKET ABUSE REGULATION (MAR) DISCLOSURE

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 which forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Chairman's Statement

I am pleased to present the Company's unaudited financial

results for the six months' period ended 31 March 2023.

In the period under review we have continued and extended our

efforts to secure the future development of our flagship CS

Pozzolan-Perlite project in Nevada, USA. Our experience, and that

of others in the pozzolan business, is that cement companies are

incredibly conservative and slow to act. However, the evidence from

the 2023 NPA Symposium, where attendance levels were up 300%, is

that 2023 may prove to be a pivotal year as the cement companies

react to the realities of climate change legislation. I encourage

shareholders to read the recent RNS Reach announcement in which

some key points from the NPA Symposium are discussed.

Portland cement is responsible for 8% of the global man-made

carbon dioxide emissions and Net-zero CO(2) targets are therefore a

major challenge for the cement and concrete industries. In the US,

these targets are enshrined in Federal and State legislation and

industry-body commitments and are increasingly driven by cement and

concrete customers and specifiers. One of the Implementation

Priorities in US President Biden's November 2021 Executive Order

"Implementation of the $1.2 trillion Infrastructure Investment and

Jobs Act" is "building infrastructure that is resilient and that

helps combat the crisis of climate change". The Inflation Reduction

Act of 2022 includes a $5.8 billion financial package for

decarbonisation of heavy industries like steel and cement.

California has the largest economy of all the US States and

southern California is a major target market for the CS Project. In

September 2021 California's Carbon Cap-and-Trade scheme was signed

into legislation and directly targets greenhouse gas emissions

associated with the cement industry. These legislative changes are

driving strong interest in natural pozzolan which can replace up to

30% of Portland cement in cement and concrete mixes and be a major

contributor to net-zero strategies.

The CS Project is shovel ready. We are in a favourable position

to take advantage of these projections and the increasing interest

in natural pozzolan. This interest is coming not just from the

cement companies, but also from the established fly ash

distributers who see the writing on the wall for fly ash and the

opportunities both for the production of fly ash/pozzolan mixes to

extend remaining fly ash supplies, and the rise of blended cements

with a substantially reduced carbon footprint.

Our focus in the reporting period at the CS Project has been on

the markets for pozzolan rather than perlite as this is the larger

business opportunity, having the better potential to attract

external funding, and recognising that our perlite deposits can

also be utilised as natural pozzolan.

Our Hazen Pozzolan Project is a much earlier stage project, but

has a favourable location close to rail and the cement markets of

northern California. This has attracted the attention of an

existing producer of natural pozzolan already serving this market

and we have agreed a collaborative programme to test mine and grind

a bulk sample of Hazen pozzolan. The mining exercise completed

successfully, demonstrated that the Hazen pozzolan is free digging

and so cheap to mine and we await the results of the test grind

which has been delayed by a particularly difficult winter which has

prevented silo space from becoming available.

In order to provide additional market intelligence and identify

additional partnership opportunities we have commissioned a

detailed, granular, study of the markets for cements and pozzolans

in California and Nevada with independent Cement Distribution

Consultants ("CDC"). CDC has also provided us with its projections

on the US and individual State markets to 2030. This assumes that

ordinary Portland cement production will remain steady whilst

increasing demand for cement and concrete will be met by blended

cements using natural and other pozzolans. These projections

identify a US wide shortfall by 2030 of 18.8 million tons of

pozzolan, 2.7 million tons in California alone. In California this

shortfall is predicted to be met by increased consumption of

natural pozzolan from other states.

Our partner on the Pioche Sepiolite Project, our third key

project, is Tolsa, the world's largest producer of sepiolite. Tolsa

continues to make progress with testwork ongoing in Spain on bulk

samples extracted during last years' trenching programme. Planning

is also well underway for drill testing this summer of the

extensive sepiolite beds now known to exist as Tolsa moves towards

its decision to purchase the Pioche project by year end. This has

potential to provide a significant injection of funds into the

Company and, moreover, we will retain a gross revenue royalty which

has potential to provide a significant cash flow in future

years.

We were pleased to see Golden Metal Resources plc ("GMR") make

its recent IPO debut on AIM. We hold royalty interests on two of

the four projects held by GMR in Nevada and we look forward to

their further exploration of these projects. Cash flow from

royalties commands a higher valuation than cash flow from equity

participation as royalty cash flow is risk free and unrelated to

profitability.

In the longer term we see the potential to build up a valuable

portfolio of mining royalties from the sale of other projects held

by the Company. We continue to add to our project interests where

opportunities are presented at low cost, and in the reporting

period we staked claims at the Reese Ridge Project where we have

found high values of base metals in gossans at surface and where

there is a compelling target for drill testing.

The Company's projects were recently reviewed and valued by our

broker, Peterhouse, in a recently published research note which

highlights a substantial undervaluation of the Company by the

market. It also identifies a number of triggers for further value

appreciation. This research note can be accessed via our

website.

I would like to thank shareholders for their patient support,

and we look forward to bringing you further news from our key

projects this summer.

Patrick Cheetham

Executive Chairman

31 May 2023

Consolidated Income Statement

for the six months to 31 March 2023

Six months Six months Twelve months

to 31 March to 31 March to

2023 2022 30 September

Unaudited Unaudited 2022

Audited

GBP GBP GBP

------------------------------------ -------------- -------------- ----------------

Pre-licence exploration costs (2,252) (4,133) (5,638)

Impairment of deferred exploration

assets - - (194,247)

Administration costs (180,426) (160,623) (291,860)

Other income 36,387 11,422 13,474

------------------------------------ -------------- -------------- ----------------

Operating loss (146,291) (153,334) (478,271)

Interest receivable 380 11 48

Loss before income tax (145,911) (153,323) (478,223)

Income tax - - -

Loss for the period attributable

to equity

holders of the parent (145,911) (153,323) (478,233)

==================================== ============== ============== ================

Loss per share - basic and fully

diluted (pence) (Note 2) (0.004) (0.004) (0.013)

==================================== ============== ============== ================

Consolidated Statement of Comprehensive Income

for the six months to 31 March 2023

Six months Six months Twelve months

to 31 March to 31 March to 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

-------------------------------------- -------------- -------------- ------------------

Loss for the period (145,911) (153,323) (478,223)

-------------------------------------- -------------- -------------- ------------------

Other comprehensive income:

Items that could be reclassified

subsequently to the income

statement:

Foreign exchange translation

differences on foreign currency

net investments in subsidiaries (246,823) 61,117 441,434

Items that will not be reclassified

to the Income Statement:

Changes in the fair value

of equity investments (3,119) (14,282) (22,962)

(249,942) (14,282) 418,472

Total comprehensive loss for

the period attributable to

equity holders of the parent (395,853) (106,488) (59,751)

====================================== ============== ============== ==================

Consolidated Statement of Financial Position

as at 31 March 2023

As at As at As at

31 March 31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

-------------------------------- ------------ ------------ ---------------

Non-current assets

Intangible assets 2,292,959 2,228,941 2,503,812

Right of use assets 7,749 11,603 11,147

Other investments 15,341 49,553 20,075

2,316,049 2,290,097 2,535,034

-------------------------------- ------------ ------------ ---------------

Current assets

Receivables 151,325 147,358 167,425

Cash and cash equivalents 180,896 183,923 96,126

-------------------------------- ------------ ------------ ---------------

332,221 331,281 263,551

Current liabilities

Trade and other payables (54,930) (103,178) (104,936)

Lease liability (2,587) (1,171) (2,839)

--------------------------------

Net current assets 274,704 226,932 155,776

-------------------------------- ------------ ------------ ---------------

Non-Current liabilities

Lease liability - (3,632) (2,874)

Share subscription loan (200,000)

Provisions for liabilities and

charges (29,129) (24,458) (32,079)

-------------------------------- ------------ ------------ ---------------

(229,129) (28,090) (34,953)

-------------------------------- ------------ ------------ ---------------

Net assets 2,361,624 2,488,939 2,655,857

================================ ============ ============ ===============

Equity

Called up share capital 3,933,675 3,711,086 3,833,559

Share premium account 5,680,316 5,683,695 5,680,316

Share warrant reserve 39,136 39,015 40,101

Fair value reserve 7,021 18,820 10,140

Foreign currency reserve 157,280 23,786 404,103

Accumulated losses (7,455,804) (6,987,463) (7,312,362)

-------------------------------- ------------ ------------ ---------------

Equity attributable to owners

of the parent 2,361,624 2,488,939 2,655,857

================================ ============ ============ ===============

Consolidated Statement of Changes in Equity

Share Share Fair Foreign

Share premium warrant value currency Accumulated

capital account reserve reserve reserve losses Total

GBP GBP GBP GBP GBP GBP GBP

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

At 30 September 2021 3,701,805 5,675,616 40,164 33,102 (37,331) (6,835,289) 2,578,067

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Loss for the period - - - - - (153,323) (153,323)

Change in fair value - - - (14,282) - - (14,282)

Exchange differences - - - - 61,117 - 61,117

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Total comprehensive

loss for the period - - - (14,282) 61,117 (153,323) (106,488)

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Share issue 9,281 8,079 - - - - 17,360

Share based payments expense - - - - - - -

Transfer of expired warrants - - (1,150) - - 1,150 -

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

At 31 March 2022 3,711,086 5,683,695 39,014 18,820 23,786 (6,987,462) 2,488,939

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Loss for the period - - - - - (324,900) (324,900)

Change in fair value - - - (8,680) - - (8,680)

Exchange differences - - - - 380,317 - 380,317

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Total comprehensive -

loss for the period - - - (8,680) 380,317 (324,900) 46,737

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Share issue 122,473 (3,379) - - - - 119,094

Share based payments expense - - 1,087 - - - 1,087

Transfer of expired warrants - - - - - - -

At 30 September 2022 3,833,559 5,680,316 40,101 10,140 404,103 (7,312,362) 2,655,857

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Loss for the period - - - - - (145,911) (145,911)

Change in fair value - - - (3,119) - - (3,119)

Exchange differences - - - - (246,823) - (246,823)

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Total comprehensive

loss for the period - - - (3,119) (246,823) (145,911) (395,853)

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Share issue 100,116 - - - - - 100,116

Share based payments expense - - 1,504 - - - 1,504

Transfer of expired warrants - - (2,469) - - 2,469 -

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

At 31 March 2023 3,933,675 5,680,316 39,136 7,021 157,280 (7,455,804) 2,361,624

----------------------------- ---------- ---------- ---------- ---------- ----------- -------------- ----------

Consolidated Statement of Cash Flows

for the six months to 31 March 2023

Six months Six months Twelve months

to 31 March to 31 March to 30 September

2023 2022 2022

Unaudited Unaudited Audited

GBP GBP GBP

---------------------------------------------- ------------- ------------- -----------------

Operating activity

Operating Loss (146,291) (153,323) (478,271)

Depreciation/interest charge 2,286 2,285 5,595

Share based payment charge 1,504 - 1,087

Shares issued in lieu of net wages 20,116 16,685 31,279

Shares issued via exercise of warrants - 675 -

Impairment of deferred exploration

asset - - 194,247

Reclamation provision - (2,950) -

(Increase)/decrease in receivables 16,098 (16,553) (36,620)

Increase/(decrease) in trade and other

payables (50,007) 2,317 4,075

Net cash outflow from operating activity (156,294) (150,864) (278,608)

---------------------------------------------- ------------- ------------- -----------------

Investing activity

Interest received 380 11 48

Receipts from disposal of equity investments - - 23,263

Project development expenditures (39,012) (37,145) (137,490)

Net cash outflow from investing activity (38,632) (39,571) (114,179)

---------------------------------------------- ------------- ------------- -----------------

Financing activity

Issue of share capital (net of expenses) 80,000 - 104,500

Issue of shares via exercise of warrants - 675 675

Share subscription loan 200,000

Lease payments (2,587) (2,437) (2,874)

Net cash inflow from financing activity 277,413 1,762 102,301

---------------------------------------------- ------------- ------------- -----------------

Net increase/(decrease) in cash and

cash equivalents 82,487 (189,760) (290,486)

Cash and cash equivalents at start

of period 96,126 371,740 371,740

Exchange differences 2,283 1,943 14,872

Cash and cash equivalents at end

of period 180,896 183,923 96,126

============================================== ============= ============= =================

Notes to the Interim Statement

1. Basis of preparation

The consolidated interim financial information has been prepared

in accordance with the accounting policies that are expected to be

adopted in the Group's full financial statements for the year

ending 30 September 2023 which are not expected to be significantly

different to those set out in Note 1 of the Group's audited

financial statements for the year ended 30 September 2022. These

are based on the recognition and measurement requirements of

applicable law and UK adopted International Accounting Standards.

The financial information has not been prepared (and is not

required to be prepared) in accordance with IAS 34. The accounting

policies have been applied consistently throughout the Group for

the purposes of preparation of this financial information.

The financial information in this statement relating to the six

months ended 31 March 2023 and the six months ended 31 March 2022

has neither been audited nor reviewed by the Independent Auditor

pursuant to guidance issued by the Auditing Practices Board. The

financial information presented for the year ended 30 September

2022 does not constitute the full statutory accounts for that

period. The Annual Report and Financial Statements for the year

ended 30 September 2022 have been filed with the Registrar of

Companies. The Independent Auditor's Report on the Annual Report

and Financial Statements for the year ended 30 September 2022 was

unqualified, although it did draw attention to matters by way of

emphasis in relation to going concern.

The directors prepare annual budgets and cash flow projections

for a 15-month period. These projections include the proceeds of

future fundraising necessary within the period to meet the

Company's and the Group's planned discretionary project

expenditures and to maintain the Company and the Group as a going

concern. Although the Company has been successful in raising

finance in the past, there is no assurance that it will obtain

adequate finance in the future. These factors represent a material

uncertainty related to events or conditions which may cast

significant doubt on the entity's ability to continue as a going

concern and, therefore, that it may be unable to realise its assets

and discharge its liabilities in the normal course of business.

However, the directors have a reasonable expectation that they will

secure additional funding when required to continue meeting

corporate overheads and exploration costs for the foreseeable

future and therefore believe that the going concern basis is

appropriate for the preparation of the financial statements.

2. Loss per share

Loss per share has been calculated on the attributable loss for

the period and the weighted average number of shares in issue

during the period.

Six months Six months Twelve months

to 31 March to 31 March to 30 September

2023 2022 2022

Unaudited Unaudited Audited

---------------------------- ---------------- ---------------- ------------------

Loss for the period (GBP) (145,911) (153,323) (478,223)

Weighted average shares

in issue (No.) 3,894,814,406 3,705,826,898 3,734,454,207

Basic and diluted loss per

share (pence) (0.004) (0.004) (0.013)

============================ ================ ================ ==================

The loss attributable to ordinary shareholders and weighted

average number of shares for the purpose of calculating the diluted

earnings per share are identical to those used for the basic

earnings per share. This is because the exercise of share warrants

would have the effect of reducing the loss per share and is

therefore not dilutive under the terms of IAS33.

3. Share capital

During the six months to 31 March 2023 the following share

issues took place:

An issue of 80,000,000 Ordinary Shares of 0.1p at 0.1p per share

for a total consideration of GBP80,000, as part of a share placing

with Toward Net Zero LLC (30 November 2022).

An issue of 20,116,000 Ordinary Shares of 0.1p at 0.1p per share

to three directors, for a total consideration of GBP20,116, in

satisfaction of a portion of outstanding directors' fees (17

January 2023).

The total number of Ordinary Shares in issue on 31 March 2023

was 3,933,675,087 (30 September 2022: 3,833,559,087).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SDEFSFEDSELI

(END) Dow Jones Newswires

May 31, 2023 06:46 ET (10:46 GMT)

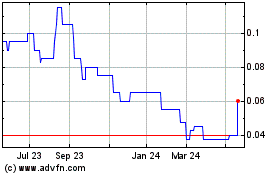

Sunrise Resources (AQSE:SRES.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

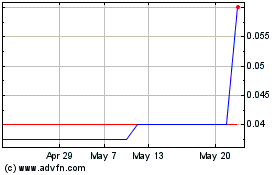

Sunrise Resources (AQSE:SRES.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024