TIDMSPA

RNS Number : 9349V

1Spatial Plc

26 July 2018

THIS ANNOUNCEMENT IS NOT FOR RELEASE, DISTRIBUTION OR

PUBLICATION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO,

OR WITHIN AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA,

NEW ZEALAND OR THE UNITED STATES OR IN TO ANY OTHER JURISDICTION

WHERE SUCH AN ANNOUNCEMENT WOULD BE UNLAWFUL. FURTHER, THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND SHALL NOT

CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY,

SUBSCRIBE FOR OR OTHERWISE ACQUIRE ANY SHARES OR OTHER SECURITIES

OF 1SPATIAL PLC IN ANY JURISDICTION IN WHICH ANY SUCH OFFER OR

SOLICITATION WOULD BE UNLAWFUL.

CAPITALISED TERMS USED IN THIS ANNOUNCEMENT SHALL HAVE THE SAME

MEANING AS IN THE ANNOUNCEMENT HEADED 'LAUNCH OF PLACING VIA

ACCELERATED BOOKBUILD' RELEASED EARLIER TODAY.

26 July 2018

1SPATIAL PLC

("1Spatial", the "Company" or the "Group")

Result of Placing

Further to the announcements earlier today of the proposed

fundraising of up to GBP8 million (net of expenses) and subsequent

close of the accelerated bookbuild, 1Spatial plc, the global

geospatial software and solutions company, is pleased to confirm

the result of the Placing.

HIGHLIGHTS

- Placing has raised GBP8 million (net of expenses) for 1Spatial

and was significantly oversubscribed, with strong support from

existing shareholders and new institutional investors

- Conducted at a Placing Price equivalent to 3.75 pence (37.5

pence as adjusted following completion of the Share Consolidation);

an effective discount of 6.25 per cent. to 1Spatial's closing

mid-market price of 4 pence on 25 July 2018, prior to the

announcement of the Placing

- Contract win, announced earlier today, for the Company to

provide data management solutions to a UK infrastructure provider

represents an encouraging step forward for 1Spatial in a key

sector

- Placing underpins 1Spatial's recent important progress, with

the first phase of the Company's turnaround now complete and with

an established strong financial and operation platform from which

to capitalise on a robust pipeline of opportunities for growth

- Proceeds of the Placing will be invested in customer

acquisition, including repayment of the Company's overdraft

facility, further development of the Company's technology and for

working capital purposes generally

Nplus1 Singer Advisory LLP ("N+1 Singer") acted as sole book

runner in respect of the Placing and is nominated adviser and

broker to the Company.

Andy Roberts, Non-Executive Chairman of 1Spatial, commented:

"The Board are delighted with the ongoing support shown by

existing investors and to welcome new high quality institutional

shareholders at this exciting time in the Company's development.

With a strengthened balance sheet, 1Spatial can now focus on

further development of its software development and capitalising on

our robust pipeline of opportunities for growth."

22,666,675 Placing Shares have been placed with investors at a

price of 37.5 pence per Placing Share. The Placing is conditional

on, inter alia, the passing of the Resolution to be proposed at a

General Meeting expected to be held at the offices of N+1 Singer, 1

Bartholomew Lane, London EC2N 2AX at 10 a.m. on 20 August 2018.

Following completion of the Share Consolidation, the Ordinary

Shares will trade under the new ISIN GB00BFZ45C84.

A circular, setting out further details of the Placing and the

Share Consolidation and including a notice convening the General

Meeting (the "Circular"), is expected to be sent to Shareholders

and be available on the Company's website in the coming few days.

An announcement confirming publication of the Circular will be

released in due course.

Application will be made for the New Ordinary Shares to be

admitted to trading on AIM, with dealings expected to commence at 8

a.m. on on 21 August 2018. Following completion of the Share

Consolidation and issue of the Placing Shares, the Company will

have a total of 99,031,889 Ordinary Shares in issue, including

319,635 Ordinary Shares held in treasury. Accordingly, the total

issued share capital with voting rights following Admission will be

98,712,254.

TRANSACTION STATISTICS

Placing Price 37.5p

Number of Existing Ordinary Shares 763,652,144

Number of Existing Ordinary Shares held in

treasury 3,196,356

Conversion ratio of Existing Ordinary Shares 10 Existing Ordinary

to Consolidated Ordinary Shares Shares to one Consolidated

Ordinary Share

Nominal value of an Ordinary Share following 10 pence

the Share Consolidation

Number of Ordinary Shares in issue immediately

following the Share Consolidation and prior

to the issue of the Placing Shares 76,365,214

Number of Ordinary Shares held in treasury

immediately following the Share Consolidation

and prior to the issue of the Placing Shares 319,635

Number of Placing Shares being issued by the

Company pursuant to the Placing 22,666,675

Number of Ordinary Shares in issue following

Admission 99,031,889

Number of Ordinary Shares carrying voting rights

in issue following Admission 98,712,254

Percentage of the existing issued ordinary

share capital (as adjusted, following the Share

Consolidation) of the Company being placed

pursuant to the Placing 29.68%

New ISIN of the Ordinary Shares following the GB00BFZ45C84

Share Consolidation

Total proceeds of the Placing GBP8.5 million

Estimated expenses of the Placing GBP0.5 million

Estimated net proceeds of the Placing receivable GBP8.0 million

by the Company

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2018(1)

Publication of the Circular and Forms of Proxy by no later than

3 August

Latest time and date for receipt of Forms

of Proxy 10 a.m. on 16 August

General Meeting 10 a.m. on 20 August

Record Date in respect of the Share Consolidation 6 p.m. on 20 August

Admission and dealings in the New Ordinary

Shares expected to commence on AIM 8 a.m. on 21 August

Where applicable, expected date for CREST

accounts to be credited in respect of New

Ordinary Shares in uncertificated form 21 August

Where applicable, expected date for despatch

of definitive share certificates for New Ordinary by no later than

Shares in certificated form 4 September

Notes:

1. Each of the above dates and times are subject to change at

the absolute discretion of the Company. In the event of the

adjustment of any of the above dates or times, details of the new

dates and times will be notified via an RNS and, where appropriate,

to Shareholders.

ENQUIRIES:

1Spatial plc

Claire Milverton / Andy Roberts 01223 420 414

N+1 Singer

Shaun Dobson / Lauren Kettle 020 7496 3060

FTI Consulting

Dwight Burden / Alex Le May 020 3727 1000

LEI Code: 213800VG7OZYQES6PN67

About 1Spatial

1Spatial is a software solutions provider and global leader in

managing geospatial data. We work with our clients to deliver real

value by making data current, complete and consistent through the

use of automated processes - ensuring that decisions are always

based on the highest quality information available.

Our unique, rules-based approach delivers enterprise-scale,

cross-platform, automation to all stages of the data lifecycle. It

builds confidence in the data while reducing the time and cost of

stewardship. Our global clients include national mapping and land

management agencies, utilities, transportation organisations,

government departments, emergency services, defence and census

bureaus.

A leader in our field, we have a wealth of experience and a

record of continual innovation and development. We partner with

some of the leading technology vendors including, Esri and

Oracle.

For more information visit www.1spatial.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ROIEAKXKAENPEFF

(END) Dow Jones Newswires

July 26, 2018 12:12 ET (16:12 GMT)

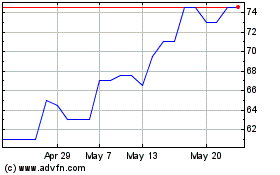

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

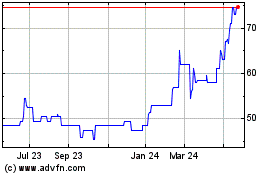

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025