TIDMMTVW

RNS Number : 3252F

Mountview Estates PLC

07 July 2023

7 July 2023

Mountview Estates P.L.C.

Publication of 2023 Annual Report and Accounts

&

Notice of 2023 Annual General Meeting

Mountview Estates P.L.C. (the "Company") announces that the

Annual Report and Accounts for the year ended 31 March 2023 ("2023

ARA") together with the 2023 Notice of Annual General Meeting (the

"2023 AGM") has been sent to shareholders and is available to

download from the Company's website www.mountviewplc.co.uk .

Copies of these documents, together with the Form of Proxy for

the Annual General Meeting, will be made available for inspection

on the National Storage Mechanism at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism in

accordance with the Financial Conduct Authority's ("FCA") Listing

Rule 9.6.1R.

AGM arrangements

The Company's 2023 AGM will be held at the offices of Norton

Rose Fulbright LLP, 3 More London Riverside, London DE1 2AQ on

Wednesday, 9 August 2023 at 11.00 am. Any specific measures in

place for the 2023 AGM will be published prior to the meeting on

the Company's website: www.mountviewplc.co.uk .

Voting

The Board urges all shareholders to exercise their vote and

submit their proxy as soon as possible. All shareholders are

encouraged to appoint the chairman of the meeting as their proxy

even if they intend to attend in person. This is to ensure their

vote is counted even if they (or any other proxy appointed) are not

able to attend in person on the day of the 2023 AGM. Results of

voting will be published as soon as practicable following the

conclusion of the meeting.

Engagement with shareholders is important to the Company and

arrangements have been made so that shareholders can participate in

the 2023 AGM by submitting questions or matters of concern in

connection with the business of the 2023 AGM in advance. Any

specific questions on the business of the 2023 AGM and on the

resolutions can be submitted by email to

reception@mountviewplc.co.uk or by writing to the Company

Secretary, Mountview House, 151 High Street, Southgate, London N14

6EW. The Board encourages questions to be submitted as soon as

possible and no later than 28 July 2023 and the Board will provide

responses to relevant questions by way of a written Q&A posted

on the Company's website as soon as practicable in advance of the

AGM, and no later than 4 August 2023. The Notice of 2023 AGM

explains the arrangements for submitting questions.

Preliminary results announcement

The Board announces that in the release of its preliminary

unaudited results for the financial year ended 31 March 2023 on 15

June 2023 it was stated the profit before tax (in millions) had

decreased by 6.3% when in fact the decrease was 6.0%. This has been

corrected in the 2023 ARA.

In compliance with paragraph 6.3.5 of the Disclosure Guidance

and Transparency Rules, the information in respect of Principal

Risks, Related Party Transactions and the Statement of Directors'

Responsibilities, contained in the Appendix, is extracted from the

2023 Annual Report and Accounts and should be read in conjunction

with the Company's preliminary results announcement of 15 June 2023

which can be viewed on the Company's website at

www.mountviewplc.co.uk.

The ESEF format of the 2023 ARA will be submitted to the FCA's

National Storage Mechanism in due course and will be available in

compliance with paragraph 4.1.14R and paragraph 6.3.5R of the FCA's

Disclosure Guidance and Transparency Rules.

Enquiries:

For further information on the Company, visit:

www.mountviewplc.co.uk

SPARK Advisory Partners Limited (Financial Adviser)

www.sparkadvisorypartners.com

Mark Brady 020 3368 3550

APPIX

PRINCIPAL RISKS AND UNCERTAINTIES

Making effective decisions to realise our strategic and

operational aims is underpinned by our risk management processes

that embrace monitoring of currently identified risks, scanning for

emerging risks and then once identified assessing those risks and

our response to them within our context and the challenges placed

on us by the external environment. The Audit and Risk Committee

maintains our risk matrix which classifies risks broadly between

those for active and regular monitoring and those for reporting on

by exception and reports on them to the Board (Risk Matrix). The

Risk Matrix also includes risks where the impact would be high, but

probability is deemed low and it is these risks in particular that

we consider when assessing longer term resilience and viability. In

particular in the recent years, and as described in our annual

reports from 2020 to 2022, the risk management processes were

tested by Covid-19. This year, following a Board discussion, we

have taken the view that we can move Covid-19 risks from the active

monitoring status to one of being ready to react in the event of a

recurrence of a new strain of Covid or other pandemic. Accordingly

in this annual report the notes describing our operational response

to Covid-19, and many other references to Covid-19 have been

removed - though remain accessible from our earlier annual

reports.

Using our Risk Matrix we have carried out a robust assessment of

the principal risks facing the Company, including those that would

threaten its business model, future performance or solvency. The

following list of risks does not comprise all of the risks the

Company or Group may face, and they are not presented in order of

importance.

1. TRADING STOCK - REGULATED TENANCIES

RISK

Reduced opportunity to replace asset sales of vacant properties

due to the reducing number of regulated tenancies available for

purchase.

MITIGATION

The Group has developed clear criteria that are applied when

considering asset purchases. Using these, the Group has performed

excellently in a difficult market replacing this class of assets in

the year ended 31 March 2023, with substantial purchasing again

during the year. The 'Analysis of Acquisitions' is on page 8 of the

2023 ARA.

2. MARKET

RISK

Weak macro-economic conditions triggered by external events

including for example the after effects of Brexit, the war in

Ukraine and the cost of living crisis driven by rising inflation

and interest rates.

MITIGATION

The Group's exposure is weighted towards the stronger London and

South East markets and this geographical area has over the long

term consistently been an above-average performer.

3. FINANCIAL

RISK

Reduced availability of financing options resulting in inability

to meet business plans.

MITIGATION

The Group monitors its bank accounts and loans closely to

maintain sufficient capacity. We review our loan facilities

regularly. The Group is conservatively geared and operates well

within financial covenants. Financial Key Performance indicators

are on page 10. Details of the Group's current facilities are set

out in Note 18 on page 78 of the 2023 ARA.

4. DIVIDS

RISK

The Group seeks to provide shareholders with good returns on

their investment. This aim could be put at risk if the Group was

unable to sustain the level of dividends for any reason.

MITIGATION

We carefully monitor our strategy and our results in order to

identify any risk to dividend levels. The Group maintains a strong

balance sheet. With appropriate banking facilities, we are able to

maintain our trading stock by taking advantage of purchasing

opportunities when they occur.

5. PEOPLE

RISK

Capacity to maintain strategy is compromised due to inability to

attract and retain suitably experienced employees.

MITIGATION

Mountview employs a relatively small workforce which enables

personal interaction at all levels. The Company has a stringent

recruitment process to ensure we employ appropriately skilled

staff. We carry out regular appraisals and offer employees

opportunities for training and development courses. The Company has

a good record of long-term service, a great number of our employees

have worked for the Group for over 10 years. Details of employees

and diversity are set out in Notes 9 and 10 of the Directors'

Report in the 2023 ARA.

6. REGULATORY

RISK

Risk of not meeting new or changed regulatory requirements and

obligations that affect the Group's business activities and could

lead to fines or penalties.

MITIGATION

The Group engages in close working relationships with

appropriate authorities and advisers to ensure it meets its

obligations.

7. OPERATIONS AND PROPERTY MAINTENANCE

RISK

Legal action against the Group for failure to meet its

obligations under property management and safety legislation.

MITIGATION

In addition to its own regular inspections, the Group engages

professional external companies to undertake health and safety, gas

and electrical checks, fire risk assessments, etc to ensure we meet

our commitments as employers and landlords. Our staff receive

regular training to ensure their skills are kept up to date. Our

Compliance Officer monitors our performance against existing

regulations and tracks and prepares for new requirements as they

are published.

8. CLIMATE

RISK

The impact on the Group of climate related matters. For example,

changing regulations or physical risks following changing weather

patterns, including extreme weather events, that could lead to

increased wear and tear or other property damage and transition

risks, for example following regulatory changes.

MITIGATION

The regular inspections noted above provide the Group with

opportunities to identify properties that may be at risk which

would be considered for more frequent inspections. Due diligence

for purchases aims to identify properties with higher than normal

inherent risks for flooding or other water risks. We explain more

fully on pages 17 to 25 of the 2023 ARA in our notes on TCFD how we

approach and handle climate related risks.

EMERGING RISK

As well as monitoring the incidence of currently identified

risks we also look for emerging trends in operations that could

become active risks. In addition, we carry out horizon scanning

through our network of stakeholders, notably our advisers, and also

by reviewing published emerging risk reports. Where emergent risks

arise and are concluded to be relevant to Mountview's business then

when considering which risks, including climate risks, to include

in our framework we use the TRAP (Terminate; Reduce; Accept; Pass

on) model to guide our approach.

THE OVERALL RISK ENVIRONMENT

Given Mountview's business model and financial strength, while

any risks materialising could well have a negative impact on short

term performance, and lead to inconvenience, none are significant

enough to threaten the continued existence of the Group. We are

confident that we can meet our strategic and operational goals and

in particular are in a strong position to take advantage of

purchasing opportunities as they arise. Where the likelihood

of a risk materialising becomes high and imminent, we factor

accommodating the risk, into our operational plans to be activated

once the impact is clear. This is the case with the Climate

Transition risk related to tightening EPC requirements where our

teams are monitoring progress of the legislation. Other risks are

considered to be broadly unchanged from 2022 with moderate

assessments for both probability of occurrence and impact. Other

These principal risks were part of the Group's assessment of long

term viability, details of which are set out in the viability

statement on page 13 of the 2023 ARA.

RELATED PARTY TRANSACTIONS

The following is extracted from the 2023 ARA

1. During the financial year there were no key management

personnel emoluments, other than remuneration.

2. (a) Mountview Estates P.L.C. provides general management and

administration services to Ossian Investors Limited and Sinclair

Estates Limited, companies of which Mr D.M. Sinclair is a Director.

Fees of GBP28,612 (2022: GBP27,762) were charged for these

services.

(b) Transactions between the Group and its subsidiaries, which

are related parties, have been eliminated on consolidation and have

not been disclosed in this note.

(c) The only key management are the Directors.

(d) As at 31 March 2023 the Group owed Mr D.M. Sinclair GBP8,616

(2022: GBP9,788) in relation to an informal loan.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The following statement is extracted from the 2023 ARA

The Directors are responsible for preparing the Annual Report,

the Directors' Remuneration Report and the Group and Company

financial statements in accordance with applicable law and

regulations.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law, the Directors

are required to prepare the Group financial statements in

accordance with UK adopted international accounting standards and

applicable UK law.

The Directors have elected to prepare the Company financial

statements in accordance with United Kingdom Generally Accepted

Accounting Practice (UK GAAP) including FRS 102 and applicable

law.

Under company law, the Directors must not approve the financial

statements unless they are satisfied that they give a true and fair

view of the state of affairs of the Group and Company and of their

profit or loss for that period. In preparing these financial

statements, the Directors are required to:

-- select suitable accounting policies and then apply them

consistently;

-- make judgements and estimates that are reasonable and

prudent;

-- present information, including accounting policies, in a

manner that provides relevant, reliable, comparable and

understandable information;

-- in respect of Group financial statements, state whether UK

adopted international accounting standards in conformity with the

requirements of the Companies Act 2006, have been followed, subject

to any material departures disclosed and explained in the Financial

Statements;

-- in respect of the Company financial statements state whether

applicable UK accounting standards in conformity with the

requirements of the Companies Act 2006, have been followed, subject

to any material departures disclosed and explained in those

statements; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and the

Company will continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

its financial statements comply with the Companies Act 2006. They

have general responsibility for taking such steps as are reasonably

open to them to safeguard the assets of the Group and to prevent

and detect fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and financial information included on the

Company's website. Legislation in the UK governing the preparation

and dissemination of financial statements may differ from

legislation in other jurisdictions.

Each of the Directors, (as set out on page 26 of the 2023 ARA)

as at the date of this Report, confirms to the best of their

knowledge that:

-- The Financial Statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit of the

Group and the Company.

-- The strategic report includes a fair review of the

development and performance of the business and the position of the

Group and the Company, together with a description of the principal

risks and uncertainties that they face.

-- The annual report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Group's performance,

business model and strategy.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSEAAXXEDKDEEA

(END) Dow Jones Newswires

July 07, 2023 02:00 ET (06:00 GMT)

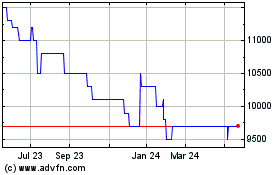

Mountview Estates (AQSE:MTVW.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

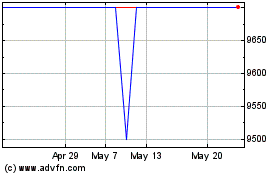

Mountview Estates (AQSE:MTVW.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024