TIDMFDM

RNS Number : 0022U

FDM Group (Holdings) plc

28 July 2022

FDM Group (Holdings) plc

Interim Results

FDM Group (Holdings) plc ("the Company") and its subsidiaries

(together "the Group" or "FDM"), today announces its Interim

Results for the for the six months ended 30 June 2022.

30 June 30 June 2021 % change

2022

Revenue GBP152.8m GBP131.3m +16%

---------- ------------- ---------

Adjusted operating profit(1) GBP25.1m GBP22.3m +13%

---------- ------------- ---------

Profit before tax GBP22.2m GBP20.5m +8%

---------- ------------- ---------

Adjusted profit before tax(1) GBP25.0m GBP22.0m +14%

---------- ------------- ---------

Basic earnings per share 15.6p 14.3p +9%

---------- ------------- ---------

Adjusted basic earnings per share(1) 17.6p 15.6p +13%

---------- ------------- ---------

Cash flows generated from operations GBP16.8m GBP19.4m -13%

---------- ------------- ---------

Cash conversion(2) 75.3% 93.3% -19%

---------- ------------- ---------

Adjusted cash conversion(1) 66.9% 86.9% -23%

---------- ------------- ---------

Interim dividend per share 17.0p 15.0p +13%

---------- ------------- ---------

Cash position at period end GBP40.0m GBP44.7m -11%

---------- ------------- ---------

-- Good operational and financial progress delivered in the

first half, with momentum continuing to date.

-- Consistently high levels of demand for our Consultants across

all our regions, resulting in record levels of activity for the

Group.

-- North America, in both USA and Canada, performing increasingly strongly.

-- APAC operations approaching 1,000 Consultants assigned to

clients, notwithstanding complex conditions in Hong Kong and

mainland China.

-- UK and EMEA both performing well.

-- Growth in Returners and Ex-Forces Consultant streams during the first half.

-- Group Consultants assigned to clients at week 26(3) were up

22% from a year previous at 4,703 (30 June 2021: 3,841) and up 17%

since the 2021 year-end (31 December: 4,033).

-- Consultant utilisation rate(4) for the six months to 30 June 2022 was 97.6% (2021: 96.9%).

-- Training completions in the first half were up 55% to 1,584 (2021: 1,025) .

-- The Group had 911 in training at 30 June 2022 ( 30 June 2021: 569 ).

-- 30 new clients secured globally during the first six months

of 2022 (2021: 37) of which 20 were outside the financial services

sector; progress in the government, pharmaceutical, healthcare,

life sciences and telecommunications sectors.

-- Nascent business streams with Apprentices and Services gaining momentum.

-- Strong balance sheet, with GBP40.0 million cash at 30 June 2022 (2021: GBP44.7 million).

-- Cash conversion of 75.3% during the first six months of 2022

(2021: 93.3%), adjusted cash conversion(1) of 66.9% (2021: 86.9%)

reflecting increasing levels of activity and revenue during the

final months of the half year. Debtor days remain within our target

parameters.

-- On 27 July 2022, the Board declared an interim dividend of

17.0 pence per ordinary share (2021: 15.0 pence), which will be

payable on 30 September 2022 to shareholders on the register on 26

August 2022.

-- The Group is well placed to achieve the Board's expectations

for the full year and to deliver long-term growth.

(1) The adjusted operating profit and adjusted profit before tax

are calculated before Performance Share Plan expense (including

social security costs) of GBP2.8 million (2021: GBP1.5 million ).

The adjusted basic earnings per share is calculated before the

impact of Performance Share Plan expense (including social security

costs and associated deferred tax). The adjusted cash conversion is

calculated by dividing cash flow generated from operations by

adjusted operating profit.

(2) Cash conversion is calculated by dividing cash flows

generated from operations by operating profit.

(3) Week 26 in 2022 commenced on 27 June 2022 (2021: week 26

commenced on 28 June 2021).

(4) Utilisation rate is calculated as the ratio of cost of

utilised Consultants to the total Consultant payroll cost.

Rod Flavell, Chief Executive Officer, said:

"The Group delivered a good performance during the first half of

2022, with strong trading in all of our operating regions and high

levels of client demand, resulting in record levels of activity.

First half training completions were a record high and recruitment

continues to be strong. The performance delivered from both our

Canadian and USA businesses was pleasing and I am hopeful that we

can build from this stronger base.

Given the high levels of demand, we continue with our plan of

accelerating and enhancing investment in recruitment of both

Consultants and internal staff, and in our other complementary

development programmes. Our Group-wide spend on paid training this

year will exceed GBP20 million (year ending 31 December 2021:

GBP12.5 million) and this investment will help to underpin our

ambitious targets for the remainder of this year and into the

following years.

While mindful of wider macro-economic uncertainties, the Board

is confident that the Group is well placed to achieve its

expectations for the full year and to deliver long-term,

sustainable growth."

Enquiries

For further information:

FDM Rod Flavell - CEO 0203 056 8240

Mike McLaren - CFO 0203 056 8240

Nick Oborne

(financial public relations) 07850 127526

Forward-looking statements

This Interim Report contains statements which constitute

"forward-looking statements". Although the Group believes that the

expectations reflected in these forward-looking statements are

reasonable at the time they are made, it can give no assurance that

these expectations will prove to be correct. Because these

statements involve risks and uncertainties, actual results may

differ materially from those expressed or implied by these

forward-looking statements. Subject to any requirement under the

Disclosure Guidance and Transparency Rules or other applicable

legislation, regulation or rules, the Group does not undertake any

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise.

Shareholders and/ or prospective shareholders should not place

undue reliance on forward-looking statements, which speak only as

of the date of this Interim Report.

We are FDM

FDM Group (Holdings) plc ("the Company") and its subsidiaries

(together "the Group" or "FDM") form a global professional services

provider with a focus on IT. Our mission is to bring people and

technology together, creating and inspiring exciting careers that

shape our digital future.

The Group's principal business activities involve recruiting,

training and deploying its own permanent IT and business

consultants ("Consultants") to clients, either on site or remotely.

FDM specialises in a range of technical and business disciplines

including Development, Testing, IT Service Management, Project

Management Office, Data Engineering, Cloud Computing, Risk,

Regulation and Compliance, Business Analysis, Business

Intelligence, Cyber Security, AI (Artificial Intelligence), Machine

Learning and Robotic Process Automation.

The FDM Careers Programme bridges the gap for graduates,

ex-Forces, returners to work, apprentices and others, providing the

training and experience required to make a success of launching or

relaunching their careers. We have FDM centres located in London,

Leeds, Glasgow, New York NY, Arlington VA, Charlotte NC, Austin TX,

Toronto, Frankfurt, Singapore, Hong Kong, Shanghai, Sydney and

Krakow. We also operate in Ireland, Luxembourg, the Netherlands,

Switzerland, Austria, Spain, South Africa and New Zealand.

FDM is a collective of many thousands of people from a multitude

of different backgrounds, life experiences and cultures. We are a

strong advocate of diversity and inclusion in the workplace and the

strength of our brand arises from the talent within.

Interim Management Review

Overview

FDM delivered a pleasing performance during the first half of

2022, experiencing strong levels of client demand across all our

operating regions.

During the first half of 2022 we consistently delivered high

average weekly deal volumes, resulting in Consultant headcount

growing to record numbers. The number of Consultants placed with

clients at week 26 was 4,703, up 22% against the first half of 2021

and up 17% since the 2021 year end. Revenue for the six-month

period ending 30 June 2022 was 16% higher (14% higher on a constant

currency basis) at GBP152.8 million (2021: GBP131.3 million). We

delivered a profit before tax for the first half of 2022 of GBP22.2

million, up 8% on the equivalent period in 2021.

At 30 June 2022, 59% of our Consultants were in their first

twelve months with the Group (2021: 40%), 27% in their second

twelve months with us (2021: 37%) and 14% post-24 months (2021:

23%).

We maintain our strong focus on cash management and cash

collection, ending the six-month period with GBP40.0 million of

cash and no debt (30 June 2021: GBP44.7 million of cash and no

debt).

We have continued to focus on developing and enhancing our

business model to ensure we attract the best candidates to our

business. We delivered 1,584 training completions in the first half

of the year (2021: 1,025), the highest number of training

completions for a six-month reporting period, and recruitment

activity is strong.

Strategy

FDM's strategy remains to deliver customer-led, sustainable,

profitable growth on a consistent basis through our

well-established business model. This model has enabled us to

deliver a positive performance in the half year and to continue to

deliver on our four key strategic objectives:

(i) Attract, train and develop high-calibre Consultants

Recruitment has continued to be a key area of focus during the

first half of 2022 in response to high levels of client demand

across all our regions.

We experienced a significant increase in the number of

applications across all our operating locations, most notably in

the UK. Our new global applicant tracking system was rolled out in

the first quarter of 2022; it has enabled us to process

applications more efficiently, whilst feedback confirms that it

also offers an improved user experience for applicants.

We are currently on track to deliver a record full year of

training completions. In total, there were 1,584 training

completions in the first half of the year, up 55% against the

equivalent period in 2021 (2021: 1,025).

As part of our investment in the growth of the business we

increased salary packages for Consultants across the Group, at an

increased cost of GBP2.4 million in the first half of 2022 over the

comparative period last year. Thus far, clients have proven

receptive to increased rates, given that the benefit flows to the

Consultants directly.

(ii) Invest in leading-edge training capabilities

Our Academy Transformation Programme, which we launched in June

2021 and which we detailed in our 2021 Annual Report, has continued

to make good progress during the first half of 2022. Working with

our accreditation partner, TechSkills, we achieved accreditation

for our TechOps course in the period, meeting our target of eight

accredited training programmes.

We are continuing with trials of our hybrid training model in

the UK as we work towards identifying the best training delivery

solution for the post-pandemic world of work. Whilst hybrid-remote

training is now firmly established as our preferred method of

delivery, our permanent Academies, of which we still have nine,

remain a key part of our training model as we continue to trial and

assess the benefits of bringing trainees into physical classrooms

for some elements of their training and collaboration days.

(iii) Grow and diversify our client base

We continued to deliver the highest level of service to our

clients and have worked closely with our clients to meet their

requirements as demand for Consultants reached record levels in the

first half of 2022.

We secured 30 new clients in the first half of 2022 (2021: 37 ),

of which 20 were from outside of the financial services sector; new

clients do not include a number of clients, which post-pandemic,

came back on stream to varying degrees, during the first half of

the year. We made progress in the government, pharmaceutical,

healthcare, life sciences and telecommunications sectors.

(iv) Expand and consolidate our geographic presence

The expansion and consolidation of our geographic presence is a

key growth driver for the Group. We delivered significant levels of

growth in the number of Consultants assigned to clients across all

of our operating regions compared with 30 June 2021, with the

exception of EMEA which saw a small decrease due to the anticipated

completion of a major Risk, Regulation and Compliance project for a

client in Luxembourg in the second half of 2021. The largest

absolute increase in the twelve months to 30 June 2022 came in the

UK, which saw Consultant headcount increase by 364, followed by

North America which increased Consultant headcount by 328. APAC

Consultant headcount increased by 207. Consultant numbers in all

our operating regions, including EMEA, have shown good growth since

31 December 2021.

An overview of the financial performance and development in each

of our markets is set out below.

Our Markets

UK(1)

Revenue for the six-month period to 30 June 2022 increased by

15% to GBP68.8 million (2021: GBP59.8 million). Consultants

deployed at week 26 were 2,045, an increase of 22% from 1,681 at

week 26 2021. Adjusted operating profit increased by 4% to GBP15.5

million (2021: GBP14.9 million). In July 2021 we standardised paid

training in the UK, bringing it into line with our operations

elsewhere in the world. The six-month period to 30 June 2022

includes GBP2.3 million of cost relating to this change, which was

not incurred in the comparative period in 2021.

Strong demand for our Consultants continued in the six months to

30 June 2022. To facilitate the demand, we trained a record 526

Consultants in the period (2021: 424). We have opened 21 new

clients in the period (2021: 14).

North America

Revenue for the six-month period to 30 June 2022 increased by

26% to GBP50.2 million (2021: GBP39.8 million). Consultants

deployed at week 26 were 1,405, an increase of 30% from 1,077 at

week 26 2021. Adjusted operating profit increased by 35 % to GBP6.6

million (2021: GBP4.9 million).

North America delivered strong Consultant growth in both Canada

and the US, with the initiatives we introduced to help us meet

growing demand proving successful. In the six months we trained 646

people (2021: 264), with record numbers in training at the period

end.

EMEA (Europe, Middle East and Africa, excluding UK)(1)

Revenue for the six-month period to 30 June 2022 decreased by

34% to GBP9.3 million (2021: GBP14.1 million). Consultants deployed

at week 26 were 295, a decrease of 11% from 332 at week 26 2021 and

an increase of 17% from 252 at week 52 2021. Adjusted operating

profit decreased by 43% to GBP1.2 million (2021: GBP2.1

million).

The decrease in Consultant headcount against week 26 2021

reflected the anticipated completion of a major Risk, Regulation

and Compliance project for a client in Luxembourg in the second

half of 2021; this was partially offset by growth in Poland, our

newest location in the region, where headcount is 88, achieved

within the first twelve months of operation.

APAC (Asia Pacific)

Revenue for the six-month period to 30 June 2022 increased by

39% to GBP24.5 million (2021: GBP17.6 million). Consultants

deployed at week 26 were 958, an increase of 28% from 751 at week

26 2021. Adjusted operating profit increased by 350 % to GBP1.8

million (2021: GBP0.4 million).

APAC headcount continues to grow at a rapid pace fuelled by

Australia, which in July surpassed 400 Consultants deployed.

Headcount in both Hong Kong and China remains broadly flat, despite

the territories being placed under strict lockdown measures. Our

newest location, New Zealand, is proving to be a useful source of

talent with Consultants being placed across the APAC region.

(1) Reflecting internal management and reporting, performance

and headcount results for Ireland, previously included within the

"UK and Ireland" region, are included within EMEA. The results to

June 2021 have been updated to reflect this change.

Financial Review

Summary income statement

Six months Six months % change

to to

30 June 30 June

2022 2021

Revenue GBP152.8m GBP131.3m +16%

Adjusted operating

profit (1) GBP25.1m GBP22.3m +13%

Operating profit GBP22.3m GBP20.8m +7%

Adjusted profit before

tax (1) GBP25.0m GBP22.0m +14%

Profit before tax GBP22.2m GBP20.5m +8%

Adjusted basic EPS(1) 17.6p 15.6p +13%

Basic EPS 15.6p 14.3p +9%

Overview

The Group delivered a solid first-half performance, with revenue

16 % higher at GBP152.8 million (2021: GBP131.3 million) (14%

higher on a constant currency basis), adjusted operating profit

increased by 13% to GBP25.1 million (2021: GBP22.3 million) and

with adjusted basic EPS up 13% to 17.6 pence (2021: 15.6

pence).

Consultants assigned to clients at week 26 2022 totalled 4,703,

an increase of 22% from 3,841 at week 26 2021 and an increase of

17% from 4,033 at week 52 2021. At week 26 our Ex-Forces Programme

accounted for 210 Consultants deployed worldwide (week 26 2021:

213; week 52 2021: 196). Our Returners Programme had 198 deployed

at week 26 2022 (week 26 2021: 146; week 52 2021: 156). The

Consultant utilisation rate increased to 97.6% (2021: 96.9%).

An analysis of revenue and Consultant headcount by region is set

out in the table below:

Six months Six months Year to 2022 2021 2021

to 30 June to 30 June 31 December Consultants Consultants Consultants

2022 2021 2021 assigned assigned assigned

Revenue Revenue Revenue to to to

GBPm GBPm GBPm clients clients clients

at week at week at week

26(2) 26(2) 52(2)

UK(3) 68.8 59.8 121.8 2,045 1,681 1,806

North America 50.2 39.8 81.4 1,405 1,077 1,095

EMEA(3) 9.3 14.1 25.0 295 332 252

APAC 24.5 17.6 39.2 958 751 880

------------ ------------ ------------- ------------- ------------- -------------

152.8 131.3 267.4 4,703 3,841 4,033

------------ ------------ ------------- ------------- ------------- -------------

Adjusted Group operating margin (1) has decreased to 16.5%

(2021: 17.0%), with overheads increasing to GBP51.3 million (2021:

GBP40.8 million). The decrease in adjusted operating margin results

from a range of items including our investment in people, systems

and the costs associated with record levels of paid training in the

period.

(1) The adjusted operating profit, adjusted group operating

margin and adjusted profit before tax are calculated before

Performance Share Plan expenses (including social security costs).

The adjusted basic earnings per share is calculated before the

impact of Performance Share Plan expenses (including social

security costs and associated deferred tax).

(2) Week 26 in 2022 commenced on 27 June 2022 (2021: week 26

commenced on 28 June 2021 and week 52 commenced on 20 December

2021).

(3) Reflecting internal management and reporting, performance

and headcount results for Ireland, previously included within the

"UK and Ireland" region, are included within EMEA. The results to

June 2021 have been updated to reflect this change.

Adjusting items

The Group presents adjusted results, in addition to the

statutory results, as the Directors consider that they provide a

useful indication of underlying trading performance and cash

generation. The adjusted results are stated before Performance

Share Plan expenses including associated taxes and social security

costs. An expense of GBP2.8 million was recognised in the six

months to 30 June 2022 relating to Performance Share Plan expenses

including social security costs (2021: GBP1.5 million). The

increase in the charge reflects the rapid recovery of the business

post-pandemic, which has moved the expectations on the achievement

of the necessary targets that trigger award of the Performance

Share Plan. Details of the Performance Share Plan are set out in

note 13 to the Condensed Consolidated Interim Financial

Statements.

Net finance costs

Finance costs include lease liability interest of GBP0.2 million

(2021: GBP0.3 million). The Group continues to have no

borrowings.

Taxation

The Group's total tax charge for the half year was GBP5.2

million, equivalent to an effective tax rate of 23.2%, on profit

before tax of GBP22.2 million (2021: effective rate of 23.5% based

on a tax charge of GBP4.8 million and a profit before tax of

GBP20.5 million). The effective rate is higher than the underlying

UK tax rate of 19% primarily due to Group profits earned in higher

tax jurisdictions. The effective rate reflects the Group's

geographical mix of profits and the impact of items considered to

be non-deductible for tax purposes.

Earnings per share

Basic earnings per share increased in the period to 15.6 pence

(2021: 14.3 pence), whilst adjusted basic earnings per share was

17.6 pence (2021: 15.6 pence). Diluted earnings per share was 15.3

pence (2021: 14.3 pence).

Dividend

The Group continues with its dividend policy of retaining

sufficient capital to fund ongoing operating requirements and

maintaining an appropriate level of free cash, dividend cover and

sufficient funds to invest in the Group's longer-term growth. On 27

July 2022, the Directors declared an interim dividend of 17.0 pence

per ordinary share (2021: 15.0 pence) which will be payable on 30

September 2022 to shareholders on the register on 26 August

2022.

Cash flow and Statement of Financial Position

The Group's cash balance decreased to GBP40.0 million as at 30

June 2022 (2021: GBP44.7 million) reflecting increasing revenues

throughout the period creating greater working capital

requirements. Debtor days at period end were 45 days (2021: 47

).

Dividends paid in the half year totalled GBP19.6 million (2021:

GBP30.5 million, including the 2020 final dividend which was

temporarily delayed as the impact of COVID-19 was unfolding). Net

capital expenditure was GBP0.5 million (2021: GBP0.1 million) and

tax paid was GBP7.7 million (2021: GBP5.3 million).

Cash conversion for the period was 75.3% (2021: 93.3%) and

adjusted cash conversion was 66.9% (2021: 86.9%), the decrease

occurring as a result of increased levels of activity and revenue

in the final months of the half year, which is included in the

receivables balance and therefore not converted to cash as at 30

June 2022.

Related party transactions

Details of related party transactions are included in note 15 of

the Condensed Interim Financial Statements.

Principal risks facing the business

The Group faces a number of risks and uncertainties which could

have a material impact upon its long-term performance. The

principal risks and uncertainties faced by the Group are set out in

the Annual Report and Accounts for the year ended 31 December 2021

on pages 32 to 39.

Changes in the macro-economic and global geopolitical

environment

Macro-economic uncertainty, arising largely from the current

instabilities in the global geopolitical environment, remains the

Group's principal risk. The Russian invasion of Ukraine has

contributed to global inflationary and supply-chain pressures,

which coincide with wage inflation and increased national interest

rates. There is a risk of recession occurring in some territories

over the next twelve months.

The Board recognises that these conditions may affect the

spending decisions of some clients. Whilst certain scenarios are

outside the Group's control, we believe that FDM's business model

is flexible, and the agile resource represented by our Consultants

can be attractive to clients during times of economic, political

and social uncertainty. There is therefore the potential for an

increase in demand for our services during such times. Whilst the

Board will continue to review the measures which it has in place to

identify and react to changes in macro-economic conditions, these

factors, together with FDM's strong cash and financial position,

give the Board confidence that FDM can continue to respond

appropriately to ameliorate the effect of any adverse economic

conditions which may arise.

In February 2022, the UK Government and the UK's National Cyber

Security Centre warned of a heightened cyber security threat to the

UK's infrastructure and UK companies, arising from the increased

geopolitical tensions in Eastern Europe. We consider that this risk

remains high, and we continue to strengthen our cyber security and

information safeguarding capabilities.

Climate change and other Environmental, Social and Governance

("ESG") risks

The Board considers that the risk of the direct physical effects

of climate change impairing the Group's ability to continue its

business activities is relatively low. The Group's operating model

is agile and adaptable, and measures which we have put in place

over the past year in response to the COVID-19 pandemic and the

challenges of remote working and training give the Board confidence

that the Group is able to recruit, train and deploy Consultants

efficiently from any of our locations. We are conscious that some

of our current office locations are in cities which could be

vulnerable to the longer-term risk of rising sea levels and extreme

weather. The Board's policy is to consider these factors in the

round as our portfolio of physical premises changes with the needs

of the Group's business, which are evolving in line with our

Academy transformation strategy and beyond. For some years we have

been committed to considering the carbon footprint of premises when

opening new locations (for example, we opened our most recent major

Academy location in 2019, in the cutting-edge sustainable

development at Barangaroo in Sydney, Australia).

We are committed to reducing our carbon footprint in all areas

and building carbon efficiencies into our ways of working. We have

committed to:

-- reduce our absolute Scope 1 and 2 greenhouse emissions by 50%

by 2030 from a 2020 base year; and

-- reduce Scope 3 greenhouse emissions by 62% per full time

employee within the same timeframe.

In June 2022, the Science Based Targets initiative ("SBTi")

validated that these targets are in conformance with the SBTi

Criteria and Recommendations (version 4.2). The SBTi's Target

Validation Team has determined that our targets are in line with

helping to keep a rise in global temperature to below 1.5(o) C.

We are developing our reporting in line with the recommendations

from the Task Force on Climate-Related Financial Disclosures

("TCFD") and we will report on these efforts in more detail in our

annual report for 2022.

We are aware that our clients in some sectors could be adversely

affected by future climate change and there is a risk that this

affects our own business indirectly as clients' spending decisions

are constrained by challenges associated with climate change. We

look to mitigate this risk by diversifying the sectors and

geographies in which we operate. We believe that there is

opportunity for the Group as we train and deploy Consultants with

the skills to help our clients find and apply the optimal technical

and business solutions to the challenges which climate change

brings. For example, some of our clients in the energy sector are

deploying Consultants on projects to help them move towards

sourcing energy from renewable sources.

The ESG credentials of global businesses like FDM are

increasingly under scrutiny from investors, customers and employees

and those businesses that do not stand up to that scrutiny are at

risk of losing their share of the market. FDM is a leader in the

field of corporate social responsibility and good governance; our

competitive edge lies in the fact that diversity, inclusion and

social mobility are the DNA of our business model. Further

information about our work in this area is on pages 40 to 47 of our

Annual Report and Accounts for the year ended 31 December 2021.

The Board

There have been no changes to the composition of the Board or

its Committees during the period.

Summary and outlook

FDM has performed well in the first half of 2022, continuing to

deliver a strong operational and financial performance while

further accelerating and enhancing investment to support

anticipated levels of growth.

While mindful of wider macro-economic uncertainties, the Board

is confident that the Group is well placed to achieve its

expectations for the full year and to deliver sustainable,

long-term growth.

By order of the Board

Rod Flavell Mike McLaren

Chief Executive Officer Chief Financial Officer

27 July 2022

Condensed Consolidated Income Statement

for the six months ended 30 June 2022

Six months Six months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Note GBP000 GBP000 GBP000

Revenue 152,805 131,289 267,356

Cost of sales (79,148) (69,708) (140,641)

Gross profit 73,657 61,581 126,715

( 84,700

Administrative expenses (51,320) (40,809) )

Operating profit 22,337 20,772 42,015

Finance income 148 43 58

Finance costs (287) (343) ( 650 )

Net finance costs (139) ( 300) (592)

Profit before income tax 22,198 20,472 41,423

Taxation 7 (5,150) (4,810) (9,594)

Profit for the period 17,048 15,662 31,829

E arnings per ordinary share

pence pence pence

Basic 9 15.6 14.3 29.1

Diluted 9 15.3 14.3 28.8

Condensed Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2022

Six months Six months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

Profit for the period 17,048 15,662 31,829

Other comprehensive income/ (expense)

Items that may be subsequently reclassified

to profit or loss

Exchange differences on retranslation

of foreign operations

(net of tax) 1,478 (315) (47)

Total other comprehensive income/

(expense) 1,478 (315) (47)

Total comprehensive income for the

period 18,526 15,347 31,782

Condensed Consolidated Statement of Financial Position

as at 30 June 2022

30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Note GBP000 GBP000 GBP000

Non-current assets

Right-of-use assets 10,107 12,608 11,631

Property, plant and equipment 3,944 4,669 4,069

Intangible assets 19,629 19,673 19,597

Deferred income tax assets 2,437 1,334 2,484

36,117 38,284 37,781

Current assets

Trade and other receivables 10 50,306 43,871 35,841

Cash and cash equivalents 11 39,978 44,707 53,120

90,284 88,578 88,961

Total assets 126,401 126,862 126,742

Current liabilities

Trade and other payables 12 32,048 34,649 31,235

Lease liabilities 5,114 5,046 5,413

Current income tax liabilities 1,422 1,756 2,147

38,584 41,451 38,795

Non-current liabilities

Lease liabilities 8,306 11,657 9,817

Total liabilities 46,890 53,108 48,612

Net assets 79,511 73,754 78,130

Equity attributable to owners

of the parent

Share capital 1,092 1,092 1,092

Share premium 9,705 9,705 9,705

Capital redemption reserve 52 52 52

Own shares reserve (1,859) (2,727) ( 2,355)

Translation reserve 1,721 (25) 243

Other reserves 9,170 3,291 7,186

Retained earnings 59,630 62,366 62,207

Total equity 79,511 73,754 78,130

Condensed Consolidated Statement of Cash Flows

for the six months ended 30 June 2022

Six months Six months Year ended

to 30 to 30 31 December

June June 2021 2021

2022

(Unaudited) (Unaudited) (Audited)

Note GBP000 GBP000 GBP000

Cash flows from operating activities

Profit before income tax for

the period 22,198 20,472 41,423

Adjustments for:

Depreciation and amortisation 3,372 3,066 6,160

Loss on disposal of non-current

assets 6 3 2

Finance income (148) (43) (58)

Finance costs 287 343 650

Share-based payment charge (including

associated social security costs) 2,805 1,535 5,622

Increase in trade and other

receivables (12,837) (13,567) (5,123)

Increase in trade and other

payables 1,142 7,575 3,471

Cash flows generated from operations 16,825 19,384 52,147

Interest received 148 43 58

Income tax paid (7,723) (5,339) (10,606)

Net cash flow from operating

activities 9,250 14,088 41,599

Cash flows from investing activities

Acquisition of property, plant

and equipment (542) (107) (368)

Net cash used in investing

activities (542) (107) (368)

Cash flows from financing activities

Proceeds from sale of shares

from EBT 264 190 450

Principal elements of lease

payments (2,739) (2,624) (5,294)

Interest elements of lease payments (232) (301) (564)

Proceeds from sale of own shares 20 51 50

Finance costs paid (55) (43) (85)

Dividends paid 8 (19,620) (30,482) (46,820)

Net cash used in financing

activities (22,362) (33,209) (52,263)

Exchange gains/ (losses) on

cash and cash equivalents 512 (790) (573)

Net decrease in cash and cash

equivalents (13,142) (20,018) (11,605)

Cash and cash equivalents at

beginning of period 53,120 64,725 64,725

Cash and cash equivalents at

end of period 11 39,978 44,707 53,120

Condensed Consolidated Statement of Changes in Equity

for the six months ended 30 June 2022

Capital Own

Share Share redemption shares Translation Other Retained Total

capital premium reserve reserve reserve reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2022 1,092 9,705 52 (2,355) 243 7,186 62,207 78,130

(Audited)

Profit for the

period - - - - - - 17,048 17,048

Other comprehensive

income for the

period - - - - 1,478 - - 1,478

Total comprehensive

income for the

period - - - - 1,478 - 17,048 18,526

Share-based payments

(note 13 ) - - - - - 2,354 - 2,354

Transfer to retained

earnings - - - - - (370) 370 -

Own shares sold

(note 14 ) - - - 496 - - (213) 283

Recharge of net

settled share

options - - - - - - (162) (162)

Dividends (note

8 ) - - - - - - (19,620) (19,620)

Total transactions

with owners,

recognised

directly in equity - - - 496 - 1,984 (19,625) (17,145)

Balance at 30

June 2022

(Unaudited) 1,092 9,705 52 (1,859) 1,721 9,170 59,630 79,511

Condensed Consolidated Statement of Changes in Equity

(continued)

for the six months ended 30 June 2021

Capital Own

Share Share redemption shares Translation Other Retained Total

capital premium reserve reserve reserve reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2021 1,092 9,705 52 (3,795) 290 3,396 77,224 87,964

(Audited)

Profit for the period - - - - - - 15,662 15,662

Other comprehensive

expense for the

period - - - - (315) - - (315)

Total comprehensive

(expense)/ income

for the period - - - - (315) - 15,662 15,347

Share-based payments

(note 13 ) - - - - - 1,330 (645) 685

Transfer to retained

earnings - - - - - (1,435) 1,435 -

Own shares sold (note

14 ) - - - 1,068 - - (828) 240

Dividends (note 8

) - - - - - - (30,482) (30,482)

Total transactions

with owners,

recognised

directly in equity - - - 1,068 - (105) (30,520) (29,557)

Balance at 30 June

2021 1,092 9,705 52 (2,727) (25) 3,291 62,366 73,754

(Unaudited)

Condensed Consolidated Statement of Changes in Equity

(continued)

for the year ended 31 December 2021

Capital Own

Share Share redemption shares Translation Other Retained Total

capital premium reserve reserve reserve reserves earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance at 1 January

2021 1,092 9,705 52 (3,795) 290 3,396 77,224 87,964

(Audited)

Profit for the year - - - - - - 31,829 31,829

Other comprehensive

expense for the

year - - - - (47) - - (47)

Total comprehensive

(expense)/ income

for the year - - - - (47) - 31,829 31,782

Share-based payments

(note 13 ) - - - - - 5,320 - 5,320

Transfer to retained

earnings - - - - - (1,530) 1,530 -

Own shares sold - - - 1,440 - - (938) 502

Recharge of net

settled share options - - - - - - (618) (618)

Dividends (note

8 ) - - - - - - (46,820) (46,820)

Total transactions

with owners, recognised

directly in equity - - - 1,440 - 3,790 (46,846) (41,616)

Balance at 31 December

2021 1,092 9,705 52 (2,355) 243 7,186 62,207 78,130

(Audited)

Notes to the Condensed Consolidated Interim Financial

Statements

1 General information

The Group is an international professional services provider

focussing principally on IT, specialising in the recruitment,

training and deployment of its own permanent IT and business

Consultants.

The Company is a public limited company incorporated and

domiciled in the UK and registered as a public limited company in

England and Wales with a Premium Listing on the London Stock

Exchange. The Company's registered office is 3rd Floor, Cottons

Centre, Cottons Lane, London SE1 2QG and its registered number is

07078823.

These Condensed Interim Financial Statements were approved for

issue by the Board of Directors of the Group on 27 July 2022. They

have not been audited, but have been subject to an independent

review by PricewaterhouseCoopers LLP, whose independent report is

included on pages 28 and 29 .

These Condensed Interim Financial Statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006. The Annual Report and Accounts for the year

ended 31 December 2021 was approved by the Board of Directors of

the Group on 16 March 2022 and delivered to the Registrar of

Companies. The report of the auditors on those accounts was

unqualified, did not contain an emphasis of matter paragraph and

did not contain any statement under section 498 of the Companies

Act 2006.

2 Basis of preparation

This Condensed Consolidated Interim Financial Report for the

half-year reporting period ended 30 June 2022 has been prepared in

accordance with the UK-adopted International Accounting Standard

34, "Interim Financial Reporting" and the Disclosure Guidance and

Transparency Rules sourcebook of the United Kingdom's Financial

Conduct Authority.

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting period,

except for the estimation of income tax, which is determined in the

Interim Financial Statements using the estimated average annual

effective income tax rate applied to the pre-tax income of the

interim period.

The following amendments to accounting standards, that became

applicable for annual reporting periods commencing on or after 1

January 2022, have been considered and did not have a material

impact on the Group:

(a) Property, Plant and Equipment: Proceeds before Intended Use

- Amendments to IAS 16

(b) Onerous Contracts - Cost of Fulfilling a Contract -

Amendments to IAS 37

(c) Annual Improvements to IFRS Standards 2018-2020

(d) Reference to the Conceptual Framework - Amendments to IFRS

3

Going concern basis

The Group's continued and forecast global growth, positive

operating cash flow and liquidity position, together with its

distinctive business model and training facilities, have enabled it

to manage its business risks. The Group's forecasts and projections

show that it will continue to operate with adequate cash resources

and within the current working capital facilities.

Having reassessed the principal risks, the Directors consider it

appropriate to adopt the going concern basis of accounting in

preparing the interim financial information.

3 Significant accounting policies

These Condensed Interim Financial Statements have been prepared

in accordance with the accounting policies, methods of computation

and presentation adopted in the financial statements for the year

ended 31 December 2021.

4 Significant accounting estimate

The preparation of the Group's Condensed Interim Financial

Statements requires management to make estimates and assumptions

that affect the reported amounts of revenues, expenses, assets and

liabilities, and the disclosure of contingent liabilities, at the

end of the reporting period. Uncertainty about these assumptions

and estimates could result in outcomes that require a material

adjustment to the carrying amount of the asset and liability

affected in future periods. The following is considered to be the

Group's significant estimate:

Share-based payment charge

A share-based payment charge is recognised in respect of share

awards based on the Directors' best estimate of the number of

shares that will vest based on the performance conditions of the

awards, which comprise adjusted earnings per share growth and the

number of employees that will leave before vesting. The charge is

calculated based on the fair value on the grant date using the

Black-Scholes model and is expensed over the vesting period.

The estimates and assumptions applied in the Condensed Interim

Financial Statements, including the key sources of estimation

uncertainty, were the same as those applied in the Group's Annual

Report for the year ended 31 December 2021, with the exception of

changes in estimates that are required in determining the provision

for income taxes.

No individual judgements have been made that have a significant

impact on the financial statements.

5 Seasonality

The Group is not significantly impacted by seasonality trends. A

lower number of working days in the first half of the year is

approximately offset by increased annual leave in the second half

of the year, our lowest number of billable days occurs in December

each year.

6 Segmental reporting

Management has determined the operating segments based on the

operating reports reviewed by the Board of Directors that are used

to assess both performance and strategic decisions. Management has

identified that the Executive Directors are the chief operating

decision maker in accordance with the requirements of IFRS 8

'Operating segments'.

At 30 June 2022, the Board of Directors consider that the Group

is organised into four core geographical operating segments:

(1) UK;

(2) North America;

(3) Europe, Middle East and Africa, excluding UK ("EMEA"); and

(4) Asia Pacific ("APAC").

Each geographical segment is engaged in providing services

within a particular economic environment and is subject to risks

and returns that are different from those of segments operating in

other economic environments.

All segment revenue, profit before income tax, assets and

liabilities are attributable to the Group's sole revenue-generating

stream, being a global professional services provider with a focus

on IT.

6 Segmental reporting (continued)

Segmental reporting for the six months ended 30 June 2022

(Unaudited)

North

UK(1) America EMEA(1) APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 68,787 50,246 9,297 24,475 152,805

Depreciation and amortisation 1,413 927 137 895 3,372

Segment operating profit 13,413 6,108 1,155 1,661 22,337

Finance income(2) 197 75 1 2 275

Finance costs(2) (89) (20) (54) (251) (414)

Profit before income tax 13,521 6,163 1,102 1,412 22,198

Total assets 72,488 23,103 11,994 18,816 126,401

Total liabilities (10,346) (9,584) (5,161) (21,799) (46,890)

(1) Reflecting internal management and reporting changes, the

results for FDM Astra Ireland Limited ("Ireland") are now included

within the EMEA segment. The results for the period ending 30 June

2021 were included within the segment "UK & Ireland" which is

now presented as "UK".

(2) Finance income and finance costs include intercompany

interest which is eliminated upon consolidation.

Included in total assets above are non-current assets (excluding

deferred tax) as follows:

North

UK(1) America EMEA(1) APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

30 June 2022 23,925 1,806 1,118 6,831 33,680

Segmental reporting for the six months ended 30 June 2021

(Unaudited)

North

UK(1) America EMEA(1) APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 59,846 39,750 14,113 17,580 131,289

Depreciation and amortisation (1,248) (841) (118) (859) (3,066)

Segment operating profit 13,897 4,613 2,045 217 20,772

Finance income(2) 95 86 - - 181

Finance costs(2) (126) (32) (42) (281) (481)

Profit / (loss) before

income tax 13,866 4,667 2,003 (64) 20,472

Total assets 73,865 21,799 11,985 19,213 126,862

Total liabilities (16,171) (7,356) (6,027) (23,554) (53,108)

6 Segmental reporting (continued)

Included in total assets above are non-current assets (excluding

deferred tax) as follows:

North

UK(1) America EMEA(1) APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

30 June 2021 26,063 2,042 698 8,147 36,950

Segmental reporting for the year ended 31 December 2021

(Audited)

North

UK(1) America EMEA(1) APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

Revenue 121,846 81,387 24,963 39,160 267,356

Depreciation and amortisation (2,489) (1,714) (241) (1,716) (6,160)

Segment operating profit 24,570 12,215 3,237 1,993 42,015

Finance income(2) 159 174 - 4 337

Finance costs (231) (60) (88) (550) (929)

Profit before income tax 24,498 12,329 3,149 1,447 41,423

Total assets 75,995 21,038 11,937 17,772 126,742

Total liabilities (13,053) (8,669) (6,193) (20,697) (48,612)

Included in total assets above are non-current assets (excluding

deferred tax) as follows:

North

UK(1) America EMEA(1) APAC Total

GBP000 GBP000 GBP000 GBP000 GBP000

31 December 2021 24,839 2,144 1,030 7,284 35,297

7 Taxation

Income tax expense is recognised based on management's estimate

of the weighted average annual income tax rate expected for the

full financial year. The estimated average annual tax rate used for

the six months ended 30 June 2022 is 23.2 % (the estimated tax rate

for the six months ended 30 June 2021 was 23.5 %).

8 Dividends

2022

An interim dividend of 17.0 pence per ordinary share was

declared by the Directors on 27 July 2022 and will be paid on 30

September 2022 to holders of record on 26 August 2022, the amount

payable will be GBP18.5 million.

A final dividend of 18.0 pence per share in respect of the year

to 31 December 2021 was approved by shareholders at the AGM on 24

May 2022 and paid on 10 June 2022 to shareholders of record on 20

May 2022, the total amount paid was GBP19.6 million.

2021

An interim dividend of 15.0 pence per ordinary share was

declared by the Directors on 27 July 2021 and was paid on 3

September 2021 to holders of record on 6 August 2021, the amount

paid was GBP16.3 million.

8 Dividends (continued)

2020

On 27 January 2021, the Board declared a second interim dividend

of 13.0 pence per ordinary share, which was paid to shareholders on

26 February 2021, the total amount payable was GBP14.2 million. The

Board proposed a final dividend of 15.0 pence per ordinary share,

approved by shareholders at the AGM held on 28 April 2021, which

was paid on 4 June 2021, the amount paid was GBP16.3 million.

9 Earnings per ordinary share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary equity holders of the parent company by

the weighted average number of ordinary shares in issue during the

period.

Six months Six months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Profit for the period GBP000 17,048 15,662 31,829

Average number of ordinary shares

in issue (thousands) Number 109,192 109,192 109,192

Basic earnings per share Pence 15.6 14.3 29.1

Adjusted basic earnings per share is calculated by dividing the

profit attributable to ordinary equity holders of the parent

company, excluding Performance Share Plan expense (including social

security costs and associated deferred tax), by the weighted

average number of ordinary shares in issue during the period.

Six months Six months Year ended

to to 30 June 31 December

30 June 2021 2021

2022

(Unaudited) (Unaudited) (Audited)

Profit for the period (basic

earnings) GBP000 17,048 15,662 31,829

Share-based payment expense

(including social security

costs) (see note 13 ) GBP000 2,810 1,536 5,261

Tax effect of share-based

payment expense GBP000 (599) (162) (837)

Adjusted profit for the

period GBP000 19,259 17,036 36,253

Average number of ordinary shares

in issue (thousands) Number 109,192 109,192 109,192

Adjusted basic earnings per

share Pence 17.6 15.6 33.2

9 Earnings per ordinary share (continued)

Diluted earnings per share

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares. The Company

has one type of dilutive potential ordinary shares in the form of

share options; the number of shares in issue has been adjusted to

include the number of shares that would have been issued assuming

the exercise of the share options.

Six months Six months Year ended

to 30 June to 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

Profit for the period (basic

earnings) GBP000 17,048 15,662 31,829

Average number of ordinary

shares in issue (thousands) Number 109,192 109,192 109,192

Adjustment for share options

(thousands) Number 2,083 56 1,386

Diluted number of ordinary

shares in issue (thousands) Number 111,275 109,248 110,578

Diluted earnings per share Pence 15.3 14.3 28.8

10 Trade and other receivables

30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

Trade receivables 37,206 35,362 26,727

Other receivables 4,648 2,478 3,464

Prepayments and accrued income 8,452 6,031 5,650

50,306 43,871 35,841

Trade receivables and accrued income have increased as at 30

June due to high levels of activity in the last two months of the

period. Debtor days at period end were 45 days (June 2021: 47).

Included within prepayments and accrued income is GBP4,756,000

of accrued income (June 2021: GBP2,516,000; December 2021:

GBP2,883,000). The value of accrued income varies with the day of

the week that closes the period.

11 Cash and cash equivalents

30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

Cash and cash equivalents 39,978 44,707 53,120

12 Trade and other payables

30 June 30 June 31 December

2022 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

Trade payables 1,369 2,095 1,113

Other payables 1,198 1,994 1,725

Other taxes and social security 8,699 8,462 8,444

Accruals and deferred income 20,782 22,098 19,953

32,048 34,649 31,235

13 Share-based payments

During the six-month period ended 30 June 2022, the Group

recognised a share-based payment expense of GBP2,797,000 (2021:

GBP1,392,000) and associated social security costs of GBP13,000

(2021: GBP144,000). The social security costs for the period to 30

June 2022 are lower than the comparative period for 2021 due to

movements in the Company's share price.

14 Investment in own shares

During 2018 the FDM Group Employee Benefit Trust was established

to purchase shares sold by option holders upon exercise of options

under the FDM Performance Share Plan. The Group accounts for its

own shares held by the Trustee of the FDM Group Employee Benefit

Trust as a deduction from shareholders' funds. During the period

own shares held were used to satisfy the requirements of the

Group's share plans.

15 Related party transactions

A number of the Directors' family members are employed by the

Group. The employment relationships are at market rate and are

carried out on an arm's length basis.

16 Key management personnel

The key management personnel comprise the Directors of the

Group. The compensation of key management is set out below:

Six months Six months Year ended

to to 31 December

30 June 30 June 2021

2022 2021

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

Short-term employee benefits 1,827 1,688 3,475

Post-employment benefits 46 17 47

Share-based payments expense 468 218 711

2,341 1,923 4,233

17 Financial instruments

There are no material differences between the fair value of the

financial assets and liabilities included within the following

categories in the Condensed Consolidated Statement of Financial

Position and their carrying value:

-- Trade and other receivables

-- Cash and cash equivalents

-- Trade and other payables

Statement of Directors' Responsibilities

The Directors confirm that these Condensed Interim Financial

Statements have been prepared in accordance with UK adopted

International Accounting Standard 34 "Interim Financial Reporting"

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority and that the

interim management report includes a fair review of the information

required by DTR 4.2.7R and DTR 4.2.8R, namely:

-- An indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- Material related party transactions in the first six months

and any material changes in the related party transactions

described in the last Annual Report.

Directors who held office during the period:

Rod Flavell Chief Executive Officer

Sheila Flavell Chief Operating Officer

Mike McLaren Chief Financial Officer

Andy Brown Chief Commercial Officer

David Lister Non-Executive Chairman

Alan Kinnear Non-Executive Director

Jacqueline de Rojas Non-Executive Director

Michelle Senecal de Fonseca Non-Executive Director

Peter Whiting Non-Executive Director

The Executive Directors of FDM were listed in the Annual Report

and Accounts of the Company for the year ended 31 December 2021 and

remained the same in the six months to 30 June 2022.

By order of the Board

Rod Flavell Mike McLaren

Chief Executive Officer Chief Financial Officer

27 July 2022

Independent review report to FDM Group (Holdings) plc

Report on the Condensed Consolidated Interim Financial

Statements

Our conclusion

We have reviewed FDM Group (Holdings) plc's Condensed

Consolidated Interim Financial Statements (the "interim financial

statements") in the Interim Report of FDM Group (Holdings) plc for

the six month period ended 30 June 2022 (the "period").

Based on our review, nothing has come to our attention that

causes us to believe that the interim financial statements are not

prepared, in all material respects, in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority.

The interim financial statements comprise:

-- the Condensed Consolidated Statement of Financial Position as at 30 June 2022;

-- the Condensed Consolidated Income Statement for the period then ended;

-- the Condensed Consolidated Statement of Comprehensive Income for the period then ended;

-- the Condensed Consolidated Statement of Cash Flows for the period then ended;

-- the Condensed Consolidated Statement of Changes in Equity for the period then ended; and

-- the explanatory notes to the interim financial statements.

The interim financial statements included in the Interim Report

of FDM Group (Holdings) plc have been prepared in accordance with

UK adopted International Accounting Standard 34, 'Interim Financial

Reporting' and the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, 'Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity' issued by the Financial Reporting Council for use in the

United Kingdom. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and,

consequently, does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

We have read the other information contained in the Interim

Report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the interim financial statements.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed. This conclusion is based on

the review procedures performed in accordance with this ISRE.

However, future events or conditions may cause the group to cease

to continue as a going concern.

Responsibilities for the interim financial statements and the

review

Our responsibilities and those of the directors

The Interim Report, including the interim financial statements,

is the responsibility of, and has been approved by, the directors.

The directors are responsible for preparing the Interim Report in

accordance with the Disclosure Guidance and Transparency Rules

sourcebook of the United Kingdom's Financial Conduct Authority. In

preparing the Interim Report, including the interim financial

statements, the directors are responsible for assessing the group's

ability to continue as a going concern, disclosing, as applicable,

matters related to going concern and using the going concern basis

of accounting unless the directors either intend to liquidate the

group or to cease operations, or have no realistic alternative but

to do so.

Our responsibility is to express a conclusion on the interim

financial statements in the Interim Report based on our review. Our

conclusion, including our Conclusions relating to going concern, is

based on procedures that are less extensive than audit procedures,

as described in the Basis for conclusion paragraph of this report.

This report, including the conclusion, has been prepared for and

only for the company for the purpose of complying with the

Disclosure Guidance and Transparency Rules sourcebook of the United

Kingdom's Financial Conduct Authority and for no other purpose. We

do not, in giving this conclusion, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

PricewaterhouseCoopers LLP

Chartered Accountants

London

27 July 2022

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAEXXASAAEAA

(END) Dow Jones Newswires

July 28, 2022 02:00 ET (06:00 GMT)

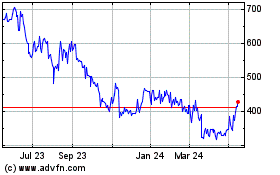

FDM (AQSE:FDM.GB)

Historical Stock Chart

From Oct 2024 to Nov 2024

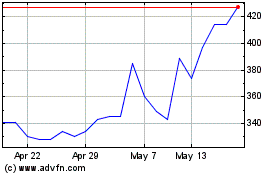

FDM (AQSE:FDM.GB)

Historical Stock Chart

From Nov 2023 to Nov 2024