TIDMBOD

RNS Number : 5344U

Botswana Diamonds PLC

29 March 2023

29(th) March 2023

Botswana Diamonds PLC ("Botswana Diamonds" or the "the

Company")

Unaudited Interim Statement and Financial Results for the Six

Months Ended 31 December 2022

Botswana Diamonds PLC (AIM:BOD) is a diamond explorer in

Sub-Saharan Africa with startup diamond production in South Africa.

We are one of the most active players in this field and offer one

of the few high-potential opportunities to invest in junior diamond

exploration in Africa, or elsewhere.

Highlights:

- The first diamonds have now been produced from the Marsfontein

dumps and gravels project in South Africa.

- Plans to begin production on the nearby Thorny River hard rock

kimberlite dyke system are well advanced.

- In Botswana, we expanded our additional stake in the prospective Maibwe concession.

Despite global political and economic turbulence, diamond prices

have been resilient. The United States stands-out with growing

diamond jewellery sales. Expected growth in Asian markets has been

disrupted, but long-term trends remain positive.

Supply disruptions support prices. Alrosa - the world's largest

diamond producer by volume - continues to supply - though more

smaller stones could hit the market. Diamonds from Botswana and

South Africa, where we operate, tend on average to be bigger and of

higher quality.

The industry is in a period of adjustment, as lab grown diamonds

find their market niche as an entry-level "value" diamond for those

not yet able to afford the real thing. But the re-sale value of

non-natural stones shows that they constitute a separate segment.

Consider the automotive industry, which offers excellent economy

and mid-priced cars but luxury car sales grow. There will be

(consumer) room for both.

Natural diamonds are more than compressed carbon. Owning them

represents a mix of human emotions, aspirations and feelings.

Diamonds are forever.

Operations: South Africa

Our recent focus has been bringing two operations into

production: Marsfontein dumps and gravels and the adjacent Thorny

River Dyke system. Diamonds are now being produced from

Marsfontein, which is a proof-of-concept trial project. We have

contracted out all production operations in return for a 15%

production royalty on Run-of-Mine goods, and 25% on special

diamonds. This plant, plus operational experience gained, will

facilitate operations this year on the larger Thorny River

project.

Teething issues at Marsfontein, along with plant delivery delays

and adverse weather delayed the first production by a month.

Current operations are processing 500 tons of dumps and gravels per

day. Diamonds are now being produced although as yet we do not have

a true representation of the average grade and quality.

Over the past two years we conducted drilling campaigns on the

Thorny River kimberlite dyke system and have identified several

areas where dykes have expanded, making mining more commercial. We

plan to mine these hot-spots using the same operational approach as

at Marsfontein - for a 15% production royalty agreement using the

same plant and equipment. These projects will thus deliver cash to

BOD with no further capital expenditure.

BOD is obtaining two full mining permits over the Thorny River

licences. Once the permits have been issued and the gravels mined

out at Marsfontein, the plant and equipment will move to Thorny

River. Production at Thorny River is expected to commence in the

second half of 2023.

Botswana:

Current Botswanan activities are in the under-explored Kalahari.

Negotiations with the receiver of BCL (a former Botswana copper

producer), allowed Siseko (of which BOD owns 51%) and our local

partner Future Minerals, to acquire 50% each of the ten Prospecting

Licenses in the central Kalahari. Diamonds were confirmed in

earlier drilling. Given the Kalahari's potential, we allowed

certain low potential licences to expire.

Prevailing circumstances during 2022 complicated our efforts to

secure a new joint venture partner to acquire the Ghaghoo mine,

which is close to our KX36 project. This fully equipped diamond

mine was placed on care and maintenance by the owner, Gem

Diamonds.

There now seems reviewed market interest in Ghaghoo, and we will

report as appropriate.

Outlook:

In January 2023, we raised GBP350,000 new capital via the

exercise of outstanding warrants. The cash came from a small group

of investors, including directors. Assuming operational success,

royalties from the Marsfontein /Thorny River operations are

expected to fully fund ongoing activities by end 2023.

Recent years have been difficult for junior diamond explorers

with little new cash available. But without exploration there can

be no new mines. And most new greenfield discoveries are made by

juniors.

Botswana Diamonds has raised money and prospected for ten years

with some limited success to date; most of our early-stage

investors continue to support new funding efforts and I hope that

their loyalty can be rewarded shortly.

John Teeling

Chairman

29(th) March 2023

_______________

This release has been approved by James Campbell, Managing

Director of Botswana Diamonds plc, a qualified geologist

(Pr.Sci.Nat), a Fellow of the Southern African Institute of Mining

and Metallurgy, the Institute of Materials, Metals and Mining (UK)

and the Geological Society of South Africa and who has over

35-years' experience in the diamond sector.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014. The person who arranged

for the release of this announcement on behalf of the Company was

James Campbell, Director

A copy of this announcement is available on the Company's

website, at www.botswanadiamonds.co.uk

S

Enquiries:

Botswana Diamonds PLC

John Teeling, Chairman +353 1 833 2833

James Campbell, Managing Director +27 83 457 3724

Jim Finn, Director +353 1 833 2833

Beaumont Cornish - Nominated Adviser

Michael Cornish

Roland Cornish +44 (0) 020 7628 3396

Beaumont Cornish Limited - Broker

Roland Cornish

Felicity Geidt +44 (0) 207 628 3396

First Equity Limited - Joint Broker

Jason Robertson +44 (0) 207 374 2212

+44 (0) 207 138 3206

BlytheRay - PR +44 (0) 207 138 3553

Megan Ray +44 (0) 207 138 3206

Said Izagaren +44 (0) 207 138 3206

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

www.botswanadiamonds.co.uk

Botswana Diamonds plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six Months Six Months Year

Ended Ended Ended

31 Dec 22 31 Dec 21 30 Jun 2022

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Administrative expenses (330) (228) (486)

Impairment of exploration and evaluation

assets - - (253)

---------------------- ------------------- --------------------

OPERATING LOSS (330) (228) (739)

LOSS BEFORE TAXATION (330) (228) (739)

Income tax expense - - -

---------------------- ------------------- --------------------

LOSS AFTER TAXATION (330) (228) (739)

Exchange difference on translation of foreign

operations (24) (159) 23

---------------------- ------------------- --------------------

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD (354) (387) (716)

====================== =================== ====================

LOSS PER SHARE - basic and diluted (0.04p) (0.03p) (0.09p)

====================== =================== ====================

CONDENSED CONSOLIDATED BALANCE SHEET 31 Dec 22 31 Dec 21 30 Jun 2022

unaudited unaudited audited

ASSETS: GBP'000 GBP'000 GBP'000

NON-CURRENT ASSETS

Intangible assets 8,764 8,126 8,185

Plant and equipment 207 207 207

---------------------- ------------------- --------------------

8,971 8,333 8,392

---------------------- ------------------- --------------------

CURRENT ASSETS

Other receivables 38 16 49

Cash and cash equivalents 95 318 159

---------------------- ------------------- --------------------

133 334 208

---------------------- ------------------- --------------------

TOTAL ASSETS 9,104 8,667 8,600

---------------------- ------------------- --------------------

LIABILITIES:

CURRENT LIABILITIES

Trade and other payables (1,041) (650) (734)

---------------------- ------------------- --------------------

TOTAL LIABILITIES (1,041) (650) (734)

NET ASSETS 8,063 8,017 7,866

====================== =================== ====================

EQUITY

Share capital - deferred shares 1,796 1,796 1,796

Share capital - ordinary shares 2,392 2,124 2,198

Share premium 11,844 11,383 11,487

Share based payments reserve 111 111 111

Retained Deficit (6,774) (5,933) (6,444)

Translation Reserve (323) (481) (299)

Other reserves (983) (983) (983)

---------------------- ------------------- --------------------

TOTAL EQUITY 8,063 8,017 7,866

====================== =================== ====================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share based

Share Share Payment Retained Translation Other Total

Capital Premium Reserves Deficit Reserve Reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 30 June

2021 3,778 10,984 111 (5,705) (322) (983) 7,863

Ordinary

shares issued 142 418 - - - - 560

Share issue

expenses - (19) - - - - (19)

Total

comprehensive

loss (228) (159) - (387)

------------------ ------------------ ------------------- ------------------ ------------------- ------------------- --------------------

As at 31

December 2021 3,920 11,383 111 (5,933) (481) (983) 8,017

Ordinary

shares issued 74 104 - - - - 178

Total

comprehensive

loss - (511) 182 - (329)

------------------ ------------------ ------------------- ------------------ ------------------- ------------------- --------------------

As at 30 June

2022 3,994 11,487 111 (6,444) (299) (983) 7,866

Ordinary

shares issued 194 357 - - - - 551

Share issue

expenses - - - - - - -

Total

comprehensive

loss - - (330) (24) - (354)

-------------------

As at 31

December 2022 4,188 11,844 111 (6,774) (323) (983) 8,063

================== ================== =================== ================== =================== =================== ====================

CONDENSED CONSOLIDATED CASH FLOW Six Months Six Months Year

Ended Ended Ended

31 Dec 22 31 Dec 21 30 Jun 2022

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the period (330) (228) (739)

Impairment of exploration and evaluation assets - - 253

Foreign exchange losses (2) 2 16

------------------- ------------------- ------------------

(332) (226) (470)

Movements in Working Capital 76 (69) (17)

------------------- ------------------- ------------------

NET CASH USED IN OPERATING ACTIVITIES (256) (295) (487)

------------------- ------------------- ------------------

CASH FLOWS FROM INVESTING ACTIVITIES

Additions to exploration and evaluation assets (105) (91) (222)

------------------- ------------------- ------------------

NET CASH USED IN INVESTING ACTIVITIES (105) (91) (222)

------------------- ------------------- ------------------

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from share issue 295 560 738

Share issue costs - (19) (19)

------------------- ------------------- ------------------

NET CASH GENERATED FROM FINANCING ACTIVITIES 295 541 719

------------------- ------------------- ------------------

NET (DECREASE)/INCREASE IN CASH AND CASH

EQUIVALENTS (66) 155 10

Cash and cash equivalents at beginning of the

period 159 165 165

Effect of foreign exchange rate changes 2 (2) (16)

CASH AND CASH EQUIVALENT AT THE OF THE PERIOD 95 318 159

=================== =================== ==================

Notes:

1. INFORMATION

The financial information for the six months ended 31 December

2022 and the comparative amounts for the six months ended 31

December 2021 are unaudited. The financial information above does

not constitute full statutory accounts within the meaning of

section 434 of the Companies Act 2006.

The Interim Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the European

Union.

The accounting policies and methods of computation used in the

preparation of the Interim Financial Report are consistent with

those used in the Group 2022 Annual Report, which is available at

www.botswanadiamonds.co.uk

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. DIVID

No dividend is proposed in respect of the period.

3. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the period available to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the period.

Diluted loss per share is computed by dividing the loss after

taxation for the period by the weighted average number of ordinary

shares in issue, adjusted for the effect of all dilutive potential

ordinary shares that were outstanding during the period.

The following table sets forth the computation for basic and

diluted earnings per share (EPS):

Six Months Six Months

Ended Ended Year Ended

31 Dec 31 Dec 30 Jun

22 21 22

GBP'000 GBP'000 GBP'000

Numerator

For basic and diluted EPS retained

loss (330) (228) (739)

============== ============== ==============

No. No. No.

Denominator

Weighted average number of ordinary

shares 924,921,167 813,171,948 844,141,491

============== ============== ==============

Loss per share - Basic and Diluted (0.04p) (0.03p) (0.09p)

============== ============== ==============

The following potential ordinary shares are anti-dilutive and

are therefore excluded from the weighted average number of shares

for the purposes of the diluted earnings per share:

No. No. No.

Share options 11,410,000 11,410,000 11,410,000

============== ============== ==============

4. INTANGIBLE ASSETS

31 Dec 31 Dec 30 June

22 21 22

Exploration and evaluation assets: GBP'000 GBP'000 GBP'000

Cost:

Opening balance 9,807 9,563 9,563

Additions 603 91 222

Exchange variance (24) (159) 22

10,386 9,495 9,807

======== ======== ========

Impairment:

Opening balance 1,622 1,369 1,369

Provision for impairment - - 253

-------- -------- --------

1,622 1,369 1,622

======== ======== ========

Carrying Value:

Opening balance 8,185 8,194 8,194

======== ======== ========

Closing balance 8,764 8,126 8,185

======== ======== ========

Regional Analysis 31 Dec 31 Dec 30 Jun

22 21 22

GBP'000 GBP'000 GBP'000

Botswana 6,638 6,925 6,636

South Africa 2,126 1,201 1,549

Zimbabwe - - -

8,764 8,126 8,185

========= ========= =========

Exploration and evaluation assets relate to expenditure incurred

in exploration for diamonds in Botswana and South Africa. The

directors are aware that by its nature there is an inherent

uncertainty in exploration and evaluation assets and therefore

inherent uncertainty in relation to the carrying value of

capitalized exploration and evaluation assets.

During the prior year, the Group recorded an impairment charge

of GBP253,380 on expenditure incurred exploring for new licences in

Botswana and South Africa and expenditure incurred on the Ghaghoo

diamond mine as the Group was unsuccessful in securing a joint

venture partner to complete the acquisition.

On 11 November 2014 the Brightstone block was farmed out to BCL

Investments (Proprietary) Limited, a Botswana Company, who assumed

responsibility for the work programme. Botswana Diamonds will

retain a 15% equity interest in the project.

On 6 February 2017 the Group entered into an Option and Earn-In

Agreement with Vutomi Mining Pty Ltd and Razorbill Properties 12

Pty Ltd (collectively known as 'Vutomi'), a private diamond

exploration and development firm in South Africa. Pursuant to the

terms of the Agreement, Botswana Diamonds earned a 40% equity

interest in the project. A separate agreement for funding of

exploration resulted in the Company's interest in Vutomi increasing

from 40% to 45.94%.

On 28 September 2022 the Group increased its' interest from

45.94% to 74%. The consideration for Vutomi comprised 56,989,330

new ordinary shares of GBP0.0025 each in the Company. There are no

lock-in arrangements, but the Consideration Shares were issued in

two equal tranches (three months apart) following Completion.

Accordingly, 28,464,665 Consideration Shares ("First Tranche

Consideration Shares") were issued to the vendors of Vutomi on 28

September 2022. The Company also agreed that immediately on

completion of the Acquisition, the Company would sell 26% of Vutomi

for a deferred consideration of US$316,333 to the Company's local

South African Empowerment partner, Baroville Trade and Investments

02 Proprietary Limited, in order to comply with South African

requirements on empowerment ownership, which was to be funded by a

loan from Botswana Diamonds. On completion, the Company therefore

owns 74% of Vutomi.

The realisation of these intangible assets is dependent on the

successful discovery and development of economic diamond resources

and the ability of the Group to raise sufficient finance to develop

the projects. It is subject to a number of significant potential

risks, as set out below:

-- licence obligations;

-- exchange rate risks;

-- uncertainties over development and operational costs;

-- political and legal risks, including arrangements with

governments for licenses, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- title to assets;

-- financial risk management;

-- going concern; and

-- operational and environmental risks.

Included in additions for the period are GBP35,854 (June 2022:

GBP71,768) of directors' remuneration which has been capitalized.

This is for time spent directly on the operations rather than on

corporate activities.

5. PLANT AND EQUIPMENT

31 Dec 31 Dec 30 Jun

22 21 22

GBP'000 GBP'000 GBP'000

Opening balance 207 207 207

Additions - - -

Closing 207 207 207

========= ========= =========

On 18 July 2020 the Group entered into an agreement to acquire

the KX36 Diamond discovery in Botswana, along with two adjacent

Prospecting Licences and a diamond processing plant. These

interests are part of a package held by Sekaka Diamond Exploration

(Pty) Ltd. The acquisition was completed on 20 November 2020. The

diamond processing plant is a recently constructed, fit-for-purpose

bulk sampling plant on site. The sampling plant includes crushing,

scrubbing, dense media separation circuits and x-ray recovery

modules within a secured area.

6. SHARE CAPITAL

Deferred Shares - nominal value of 0.75p per share Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2021 and 1 July 2022 239,487,648 1,796,157 -

At 30 June 2022 and 31 December 2022 239,487,648 1,796,157 -

============ ============== ==============

Ordinary Shares - nominal value of 0.25p per share Number Share Capital Share Premium

GBP'000 GBP'000

At 1 July 2021 792,721,902 1,982 10,984

Issued during the period 56,683,333 142 418

Share issue expenses - - (19)

At 31 December 2021 849,405,235 2,124 11,383

------------ -------------- --------------

Issued during the period 29,666,667 74 104

Share issue expenses - - -

At 30 June 2022 879,071,902 2,198 11,487

------------ -------------- --------------

Issued during the period 77,543,877 194 357

Share issue expenses - - -

At 31 December 2022 956,615,779 2,392 11,844

============ ============== ==============

Movements in share capital

On 4 July 2022, a total of 1,666,667 warrants were exercised at

a price of 0.60p per warrant for GBP10,000.

On 8 September 2022, a total of 47,000,000 warrants were

exercised at a price of 0.60p per warrant for GBP282,000.

On 28 September 2022, a total of 28,464,665 shares were issued

at a price of 0.90p per share totalling GBP256,182 to Vutomi Mining

Pty Ltd and Razorbill Properties 12 Pty Ltd (collectively known as

'Vutomi'), as part consideration for the acquisition of the

company. Further information is detailed in Note 4 above.

On 6 October 2022, a total of 412,545 warrants were exercised at

a price of 0.60p per warrant for GBP2,475.

7. TRADE AND OTHER PAYABLES

31 Dec 31 Dec 30 Jun

22 21 22

GBP'000 GBP'000 GBP'000

Trade payables 82 25 48

Petra Diamonds creditor 123 104 123

Accruals 594 521 563

Consideration due - Vutomi acquisition 242 - -

1,041 650 734

========= ========= =========

It is the Company's normal practice to agree terms of

transactions, including payment terms, with suppliers and provided

suppliers perform in accordance with the agreed terms, payment is

made accordingly. In the absence of agreed terms it is the

Company's policy that the majority of payments are made between 30

- 40 days. The carrying value of trade and other payables

approximates to their fair value.

The Company was due to issue a total of 28,524,665 ordinary

shares of GBP0.0025 each in the Company at a price of 0.85p per

share as part consideration of the acquisition of Vutomi. These

shares were issued after the period end on 27 January 2023. Further

information is detailed in Notes 4 and 9.

8. SHARE BASED PAYMENTS

WARRANTS

Dec 2022 Jun 2022 Dec 2021

Number of Warrants Weighted average Number of Warrants Weighted average Number of Warrants Weighted average

exercise price in exercise price in exercise price in

pence pence pence

Outstanding

at

beginning

of the

period 162,816,667 1.07 192,483,334 1.07 139,166,667 0.60

Issued - - 0.60 55,000,000 2.00

Exercised (49,079,212) 0.60 (29,666,667) 0.60 (1,683,333) 0.60

Expired - - - - - -

Outstanding

at end of

the period 113,737,455 1.28 162,816,667 1.07 192,483,334 1.07

Further information of the warrants are detailed in Note 6

above.

9. POST BALANCE SHEET EVENTS

On 27 January 2023, the Company issued 28,524,665 ordinary

shares of GBP0.0025 each in the Company in respect of the second

tranche of consideration shares due following completion of the

acquisition of Vutomi. Further information is detailed in Notes 4

and 7 above.

On 27 January 2023 the Company announced that it had raised

GBP352,425 pursuant to the receipt of conversion notices from

holders of 58,737,455 warrants exercisable at 0.60 pence each.

10. APPROVAL

The Interim Report for the period to 31(st) December 2022 was

approved by the Directors on 28(th) March 2023.

11. AVAILABILITY OF REPORT

The Interim Statement will be available on the website at

www.botswanadiamonds.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR MZGZFNRLGFZM

(END) Dow Jones Newswires

March 29, 2023 02:00 ET (06:00 GMT)

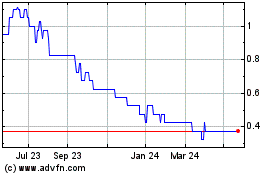

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

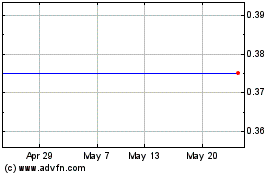

Botswana Diamond (AQSE:BOD.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025