Thanks to election fever, Indian markets are hitting fresh highs.

The BSE Sensex breached the 22,000 threshold while the National

Stock Exchange index – Nifty – is hovering close to 6,600.

The strong rally is mainly driven by consistent incredible foreign

fund inflows on optimism over the new government to turnaround the

beleaguered economy that outweighs the negative global sentiments

stemming from the continued Fed taper, soft economic data in China

and geopolitical tensions in Europe.

Notably, foreign investors have pumped in around 73,235 crore

rupees ($2.6 billion) in the stock market so far this year, making

it the fourth highest inflow after injecting 1.4 lakh crore rupees

in 2013 and 1.1 lakh crore rupees in 2010 and 2011 each.

Further, overall fundamentals are improving for the Indian economy.

Current account deficit is narrowing, fiscal deficit is under

control, inflation has been trending down, and rupee has stabilized

(read: India ETFs Surging: Can This Trend Continue?).

The Indian currency has shown strong resilience to the emerging

market turmoil this year and has appreciated nearly 12% from the

record low reached in late August. Rupee is currently hovering

around 60.50 against the greenback, representing the highest level

in eight months. Moreover, the geopolitical tensions in Russia,

slowdown in China and turmoil in other emerging nations are

boosting investor confidence and encouraging them to invest in the

recovering Indian economy.

The bullish trend in Indian market and its currency is likely to

continue until the election results on the expectation of a strong

growth-oriented government post elections and the domestic factors,

which are stimulating growth in Asia’s third-largest economy.

Investors seeking to ride out this optimism could play with the

Indian ETFs with a lower risk. While there are several options in

the space, the following four ETFs are leading the space higher,

gaining double-digits over the past one month. Any of these

products could be an intriguing choice for investors at least for

the near term (see: all the emerging Asia Pacific ETFs here):

EGShares Indxx India Small Cap Fund (SCIN)

This fund provides exposure to the small cap segment of the broad

Indian equity market by tracking the Indxx India Small Cap Index.

Holding 56 securities, the product is widely spread out across each

security as none of these holds more than 3.3% of assets. From a

sector look, financials make up for one-third of the portfolio

while industrials and consumer discretionary get double-digit

allocation in the basket.

The ETF is unpopular and illiquid with AUM of $15.6 million and

average daily volume of about 14,000 shares. The fund charges 85

bps in fees per year and added nearly 10% in the past one month.

SCIN has a Zacks ETF Rank of 2 or ‘Buy’ rating (read: 3 Small Cap

ETFs Surging in the Past Month).

WisdomTree India Earnings Fund (EPI)

This product tracks the WisdomTree India Earnings Index and is

tilted toward large cap stocks. In total, the fund holds 169

securities with the largest allocation going to Reliance Industries

and Infosys that account for 8.67% and 7.21% share, respectively.

The ETF is heavy on financials with one-fourth share, followed by

energy (19.27%), information technology (14.76%) and industrials

(10.43%).

EPI is the largest and most popular ETF targeting India with AUM of

$884.3 million and average trading volume of more than 4.1 million

shares. Expense ratio came in at 0.83%. The fund gained nearly 11%

over the past month and has a decent Zacks ETF Rank of 3 or ‘Hold’

rating.

iShares India 50 ETF (INDY)

This ETF is also a large cap centric fund and follows the CNX Nifty

Index, which seeks to track the performance of the largest 50

Indian stocks. ITC, Infosys and Reliance Industries occupy the top

three positions in the basket with a combined 23% of assets. With

respect to sector holdings, banks and software take the top two

spots at 20.8% and 15.7%, respectively, while others make up for

single-digit allocations (read: 3 Financial ETFs to Play the Bank

Stress Tests).

The ETF has amassed $477.6 million and trades in volume of nearly

160,000 million shares a day, suggesting some extra cost in the

form of tight bid/ask spread beyond the expense ratio of 0.93%.

INDY is up over 10.5% in the trailing one-month period and has a

Zacks ETF Rank of 3 or ‘Hold’ rating.

EGShares India Infrastructure Index Fund

(INXX)

This fund provides exposure to the growing infrastructure corner of

the broad Indian market by tracking the Indxx India Infrastructure

Index. Holding 30 stocks in its basket, the fund allocates higher

to Bharat Heavy Electrical, Larsen & Tubro and Tata Steel with

a combined 20% share. From a sector look, industrials take the top

spot with 38%, closely followed by utilities (26%), basic materials

(17%) and telecom (11%).

The fund has accumulated just $16.6 million in its asset base and

trades in small volume of 10,0000 shares a day on average. Expense

ratio came in at 0.85%. Though INXX is unpopular, illiquid and

expensive, it is leading the space higher gaining about 15% in the

past one month. The ETF has a Zacks ETF Rank of 3 or ‘Hold’

rating.

Bottom Line

These products are clearly outpacing the broad U.S. market fund

(SPY), emerging Asia Pacific fund (GMF) and the broad emerging

market fund (VWO) by wide margins. This outperformance will

continue based on post-election boom and improving domestic

fundamentals. Investors should not miss this opportunity of

grabbing the surging sentiments with any of the above-mentioned

products.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

SPDR-SP EM ASIA (GMF): ETF Research Reports

ISHARS-SP INDIA (INDY): ETF Research Reports

EMERG-GS IIIIF (INXX): ETF Research Reports

EMERG-GS INDIA (SCIN): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

VANGD-FTSE EM (VWO): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

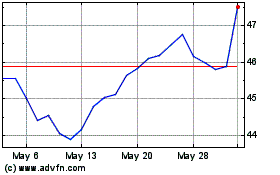

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Oct 2024 to Nov 2024

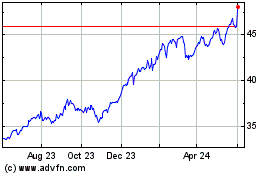

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Nov 2023 to Nov 2024