With the global economy sputtering, some key commodities have

been hard hit. Oil has been especially victimized, thanks to its

high correlation with economic activity, and increasing dependence

on emerging markets to generate more demand for the important

product.

Thanks to these trends, the past few months have been a pretty

rough time for both crude oil and oil stocks/ETFs that target the

space. In fact, the price of WTI crude fell from about $108/bbl. at

the beginning of May to a low of just under $80/bbl. in late June,

although it has managed to rebound just a bit since then.

This collapse in oil prices hit a number of companies in the oil

producing segment quite hard in the end of the second quarter of

the year. In one six week stretch in the time period, the

Energy Select Sector SPDR (XLE) was actually down over

10.5%, underscoring just how rough trading had become for the

segment.

Yet while many investors were quite disappointed with these

returns, those who were in other corners of the oil market saw even

bigger losses in the time frame. Funds and stocks targeting oil

services, drilling, and exploration were down more than 15% in a

similar period, suggesting that the rough trading in oil hit the

more volatile corners of the hydrocarbon equity market pretty

hard.

Prices have come back in recent weeks across the oil market

though, as more worries over the Middle East are plaguing the space

while there is more hope for the domestic market too. End of year

spending looks to be decent while consumer confidence is high,

suggesting that more could be bullish about the economy leading to

more economic activity—and oil use—heading into 2013.

Given this, for oil bulls, it could be time to consider cycling

back into the equity side of the space in hopes of solid run up to

close out the year. Arguably the best way to do this could be via

some of the hardest hit segments in recent weeks, namely the oil

services space.

This corner has—in my opinion—been unfairly beaten down despite

the solid fundamentals underlying the space. After all, it should

be noted that drilling volume is on the rise and more production is

taking place across the world, giving oil service firms plenty of

opportunities to cash in on the boom (Read Three ETFs for the

Unconventional Oil Revolution).

However, it should be noted that many of the funds in this

space, and even the broad energy sector at large, don’t really have

favorable Zacks ETF Ranks at this time. In fact, XLE has a Rank of

3, or ‘Hold’ suggesting a neutral outlook for the broad space.

With that being said, it is important to remember that the Zacks

ETF Rank is designed for a relatively long time period and not just

the next few months. Thanks to this, some investors might want to

consider temporarily cycling into oil services, at least in the

short term, before pushing back out of the segment if oil fails to

hold strong above $85 (read Time to Buy Oil and Gas Services

ETFs?).

Clearly, the segment is one of the more volatile in the oil

industry and can be hard hit when prices are slumping, suggesting

that caution must be taken when looking at the sector. Yet for

those with a short time horizon and a belief that

oil can continue to rebound in the next few months, any of the

following four ETFs could be interesting picks to close out the

quarter:

Market Vectors Oil Services ETF (OIH)

OIH is by far the most popular and liquid choice in the oil

service space, tracking the Market Vectors US Listed Oil Services

25 Index. With this focus, the fund has just over 4.7 million

shares in volume a day and AUM of just over $1.25 billion.

The fund holds about 25 securities in its basket, giving heavy

weights to Schlumberger (SLB), National Oilwell Varco (NOV), and

Halliburton (HAL). This gives the fund a roughly 70% allocation to

the U.S., but decent international exposure of 13% to Switzerland,

and then another 15% combined to the United Kingdom and the

Netherlands (read Three ETFs for an Iranian Crisis).

Over the past month, OIH has lost about 10.2%, falling much

further than oil or the broad energy space, suggesting an oversold

situation. The fund currently has a Zacks ETF Rank of 3, or ‘Hold’

suggesting a performance in line with broader markets over the next

year.

iShares Dow Jones US Oil Equipment & Services ETF

(IEZ)

For another pretty popular way to target the space, investors

have iShares’ IEZ which follows the Dow Jones US Select Oil

Equipment & Services index. This benchmark tracks the US

segment of the market including firms that provide equipment or

services to oil fields and offshore platforms, such as drilling,

exploration, and a variety of other related segments

Top holdings in this fund include a nearly 20% weighting to SLB,

and then an 8.79% allocation to NOV and an 8.3% weight to HAL. IEZ

is pretty much entirely focused on the North American market,

although large caps account for just 55% of the total exposure in

the fund.

In terms of performance, IEZ has lost about 7.1% in the past

month, giving it a roughly 16.8% loss YTD, suggesting once more

that it could be oversold. Investors should note that the fund

currently has a Zacks ETF Rank of 3 or ‘Hold’ so it could continue

have an uncertain outlook once we get into 2013.

SPDR S&P Oil & Gas Equipment & Services ETF

(XES)

State Street’s entrant in the space tracks the S&P Oil &

Gas Equipment & Services Select Industry Index. This benchmark

is a modified equal weight index, ensuring that no one firm

dominates the fund’s risk/return profile (see Oil Bull Market is No

Place for MLP ETF Investors).

With this focus, the fund holds about 40 securities in its

basket putting a heavy focus on American stocks. In terms of

capitalization levels, large caps account for just 20% of assets

leaving more than 50% of the ETF for small and micro caps.

This ETF is also a low cost fund, charging investors just 35

basis points a year in fees. Furthermore, the performance has been

relatively decent in the trailing one month period, as it is down

about 6.4%, although the YTD look has the fund at a roughly 18.8%

loss. Due in part to this, the fund has a Zacks Rank of 3

suggesting it could perform in line with others in the space over

the next 12 months.

PowerShares Dynamic Oil & Gas Services

(PXJ)

The last choice investors have in the space targets a slightly

more ‘active’ index, the Dynamic Oil Services Intellidex Benchmark.

This index evaluates companies on a host of investment criteria

including growth, valuation, timeliness, and risk factors.

This produces a fund that has roughly 30 securities in its

basket although costs are somewhat higher at 63 basis points a year

in fees. The approach also ensures that a few companies do not

dominate the fund as large caps account for just over one-quarter

of the total, and small/micro caps make up roughly half of the fund

(see Invest Like Warren Buffett with These ETFs).

Meanwhile, top holdings include an interesting mix, as

Oceaneering takes the top spot at 5.3% of assets, while it is

closely trailed by Diamond Offshore Drilling and Cameron

International each make up about 5.1% of assets as well. In fact,

no one company makes up less than 2% of the portfolio suggesting a

very well spread out risk return profile.

In terms of performance, had lost a more respectable 6%% in the

past one month period, although it is down in line with the others

in the space from a year-to-date look. Still, the Zacks ETF Rank is

a little more bearish as the fund has a rank of 4 or ‘Sell’,

meaning that it could be rough going in this fund when compared to

others in the space over longer time periods.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

HALLIBURTON CO (HAL): Free Stock Analysis Report

ISHARS-DJ OIL E (IEZ): ETF Research Reports

MKT VEC-OIL SVC (OIH): ETF Research Reports

PWRSH-DYN OIL&G (PXJ): ETF Research Reports

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

SPDR-SP O&G EQP (XES): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

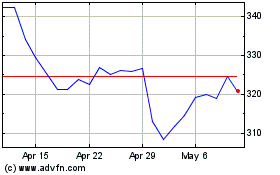

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Nov 2024 to Dec 2024

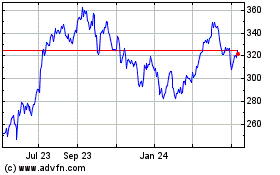

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Dec 2023 to Dec 2024