Ring Energy, Inc. Prices $20 Million Public Offering & Concurrent Registered Direct Offering at a 5.7% Premium to Prior Day C...

October 27 2020 - 8:30AM

Business Wire

Ring Energy, Inc. (NYSE American: REI) ("Ring Energy" or the

"Company"), today announced the pricing of an underwritten public

offering of (i) 8,343,000 Common Shares, (ii) 13,428,500 Pre-Funded

Warrants and (iii) 21,771,500 Common Warrants at a combined

purchase price of $0.70. The gross proceeds to Ring Energy from

this offering are expected to be approximately $15,240,000, before

deducting underwriting discounts and commissions and other

estimated offering expenses. Ring Energy has granted the

underwriters a 45-day option to purchase up to an additional

3,265,725 Common Shares and/or 3,265,725 Common Warrants to

purchase 3,265,725 Common Shares to cover over-allotments, if any.

The Common Warrants have a term of five years and an exercise price

of $0.80 per share. The offering is expected to close on or about

October 29, 2020, subject to customary closing conditions.

Ring Energy is concurrently announcing the pricing of a

registered direct of (i) 3,500,000 Common Shares, (ii) 3,300,000

Pre-Funded Warrants and (iii) 6,800,000 Common Warrants at a

combined purchase price of $0.70. The gross proceeds to Ring Energy

from this offering are expected to be approximately $4,760,000,

before deducting placement agent fees and other estimated offering

expenses. The Common Warrants have a term of five years and an

exercise price of $0.80 per share. The offering is expected to

close on or about October 29, 2020, subject to customary closing

conditions.

A.G.P./Alliance Group Partners is acting as sole book-running

manager for the underwritten public offering.

The underwritten public offering is being made pursuant to an

effective shelf registration statement on Form S-3 (No. 333-237988)

previously filed with the U.S. Securities and Exchange Commission

(the “SEC”) that was declared effective by the SEC on May 21, 2020.

A preliminary prospectus supplement and accompanying prospectus

describing the terms of the proposed offering was filed with the

SEC. Electronic copies of the preliminary prospectus supplement may

be obtained, when available, from A.G.P./Alliance Global Partners,

590 Madison Avenue, 28th Floor, New York, NY 10022 or via telephone

at 212-624-2006 or email: prospectus@allianceg.com. Before

investing in this offering, interested parties should read in their

entirety the prospectus supplement and the accompanying prospectus

and the other documents that Ring Energy has filed with the SEC

that are incorporated by reference in such prospectus supplement

and the accompanying prospectus, which provide more information

about Ring Energy and such offering. The final terms of the

proposed offering will be disclosed in a final prospectus

supplement to be filed with the SEC. The preliminary prospectus

supplement and accompanying prospectus is also available, and the

final prospectus supplement and accompanying prospectus will be

available, on the SEC’s website at http://www.sec.gov.

A.G.P./Alliance Global Partners is acting as sole placement

agent for the registered direct offering.

The registered direct offering is being made pursuant to an

effective shelf registration statement on Form S-3 (File No.

333-237988) previously filed with the U.S. Securities and Exchange

Commission (the “SEC”). A prospectus supplement describing the

terms of the proposed offering will be filed with the SEC and will

be available on the SEC’s website located at http://www.sec.gov.

Electronic copies of the prospectus supplement may be obtained,

when available, from A.G.P./Alliance Global Partners, 590 Madison

Avenue, 28th Floor, New York, NY 10022, or by telephone at (212)

624-2060, or by email at prospectus@allianceg.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Ring Energy, Inc.

Ring Energy, Inc. is an oil and gas exploration, development and

production company with current operations in Texas and New

Mexico.

www.ringenergy.com

Safe Harbor Statement

This press release contains forward-looking statements related

to Ring Energy and its subsidiaries under the safe harbor

provisions of Section 21E of the Private Securities Litigation

Reform Act of 1995 and subject to risks and uncertainties that

could cause actual results to differ materially from those

projected. Forward-looking statements include statements regarding

the proposed underwritten public offering, the proposed registered

direct offering, expected proceeds of the offerings, and other

matters that are described in Ring Energy’s most recent periodic

reports filed with the SEC, including Ring Energy’s Annual Report

on Form 10-K for the year ended December 31, 2019, as amended,

subsequent Quarterly Reports on Form 10-Q and the preliminary

prospectus supplement related to the proposed public underwritten

offering filed with the SEC on or about the date hereof, including

risks and uncertainties associated with general economic and market

conditions and the satisfaction of customary closing conditions and

the other risk factors set forth in those filings. Investors are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this release and we

undertake no obligation to update any forward-looking statement in

this press release except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201027005482/en/

K M Financial, Inc. Bill Parsons, 702-489-4447

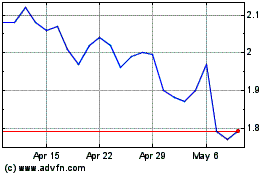

Ring Energy (AMEX:REI)

Historical Stock Chart

From Feb 2025 to Mar 2025

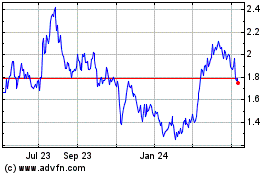

Ring Energy (AMEX:REI)

Historical Stock Chart

From Mar 2024 to Mar 2025