false

0000061004

0000061004

2024-05-15

2024-05-15

0000061004

lgl:CommonStockParValue001CustomMember

2024-05-15

2024-05-15

0000061004

lgl:WarrantsToPurchaseCommonStockParValue001CustomMember

2024-05-15

2024-05-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 15, 2024

|

THE LGL GROUP, INC.

|

|

(Exact Name of Registrant as Specified in Charter)

|

| |

|

|

|

Delaware

|

001-00106

|

38-1799862

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

| |

|

|

|

2525 Shader Road, Orlando, FL

|

32804

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (407) 298-2000

| |

|

(Former Name or Former Address, If Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01

|

|

LGL

|

|

NYSE American

|

|

Warrants to Purchase Common Stock, par value $0.01

|

|

LGL WS

|

|

NYSE American

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition |

The information contained in Item 7.01 is incorporated by reference into this Item 2.02.

|

Item 7.01.

|

Regulation FD Disclosure |

On May 15, 2024, The LGL Group, Inc. (the “Company”) issued a press release (the “Press Release”) announcing its financial results for the first quarter ended March 31, 2024. A copy of the Press Release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information furnished pursuant to this Item 7.01 of this Current Report on Form 8-K, including the exhibits hereto, shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any future filings by the Company under the Securities Act of 1933, as amended, or under the Exchange Act, unless the Company expressly sets forth in such future filing that such information is to be considered “filed” or incorporated by reference therein.

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

Exhibit No.

|

Description

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

THE LGL GROUP, INC.

|

| |

(Registrant) |

| |

|

| Date: May 15, 2024 |

By:

|

/s/ Christopher L. Nossokoff

|

| |

|

Name:

|

Christopher L. Nossokoff

|

| |

|

Title:

|

Vice President - Finance

|

Exhibit 99.1

THE LGL GROUP, INC. REPORTS First QUARTER 2024 RESULTS

ORLANDO, FL. – May 15, 2024 – The LGL Group, Inc. (NYSE American: LGL) ("LGL," "LGL Group," or the "Company") announced today its financial results for the first quarter ended March 31, 2024.

First Quarter 2024

Tim Foufas, Co-Chief Executive Officer, stated, "While our Electronics Instruments segment reported a decrease in revenue for the quarter compared to Q1 2023, we are pleased with the improvement in our order backlog and recent sales initiatives. With regard to our investments, we remain mindful of current U.S. Treasury yields as we continue to seek value add opportunities to grow shareholder value."

Consolidated Results

First quarter 2024 net income available to LGL Group common stockholders was $21,000, or $0.00 per diluted share, compared with $157,000, or $0.03 per diluted share, in the first quarter of 2023. The decrease was primarily due to:

| |

•

|

lower Net sales due to lower backlog as of Q4 2023;

|

| |

•

|

lower Net gains (losses) driven by mark-to-market losses and lower realized gains on Marketable securities; and

|

| |

•

|

higher Engineering, selling and administrative costs related to an increase in salaries and wages.

|

The decrease was partially offset by higher Net investment income on investments in U.S. Treasury money market funds due to the repositioning of the portfolio into U.S. Treasury money market funds that occurred during 2023.

Gross Margin

Gross margin declined to 48.0% for the three months ended March 31, 2024 compared to 56.5% for the three months ended March 31, 2023. The decrease in gross margins from the three months ended March 31, 2023 reflects lower margin product mix combined with higher labor costs.

Backlog

As of March 31, 2024, our order backlog was $341,000, an increase of $198,000 from $143,000 as of December 31, 2023. The backlog of unfilled orders includes amounts based on purchase orders, which we have determined are firm orders likely to be fulfilled primarily in the next 12 months but most of the backlog will ship in the next 90 days.

Liquidity

Our working capital metrics were as follows:

|

(in thousands)

|

|

March 31, 2024

|

|

December 31, 2023

|

|

Current assets

|

|

$ |

41,687 |

|

|

$ |

41,566 |

|

|

Less: Current liabilities

|

|

|

516 |

|

|

|

474 |

|

|

Working capital

|

|

$ |

41,171 |

|

|

$ |

41,092 |

|

As of March 31, 2024, LGL Group had investments (classified within Cash and cash equivalents and Marketable securities) with a fair value of $40.9 million, of which $23.8 million was held within the Merchant Investment business.

About The LGL Group, Inc.

The LGL Group, Inc. ("LGL," "LGL Group," or the "Company") is a holding company engaged in services, merchant investment and manufacturing business activities. Precise Time and Frequency, LLC ("PTF") is a globally positioned producer of industrial Electronic Instruments and commercial products and services. Founded in 2002, PTF operates from our design and manufacturing facility in Wakefield, Massachusetts. Lynch Capital International LLC is focused on the development of value through investments.

LGL was incorporated in 1928 under the laws of the State of Indiana, and in 2007, the Company was reincorporated under the laws of the State of Delaware as The LGL Group, Inc. We maintain our executive offices at 2525 Shader Road, Orlando, Florida 32804. Our telephone number is (407) 298-2000. Our Internet address is www.lglgroup.com. LGL common stock and warrants are traded on the NYSE American ("NYSE") under the symbols "LGL" and "LGL WS", respectively.

LGL Group's business strategy is primarily focused on growth through expanding new and existing operations across diversified industries. The Company's engineering and design origins date back to the early 1900s. In 1917, Lynch Glass Machinery Company ("Lynch Glass"), the predecessor of LGL Group, was formed and emerged in the late 1920s as a successful manufacturer of glass-forming machinery. Lynch Glass was then renamed Lynch Corporation ("Lynch") and was incorporated in 1928 under the laws of the State of Indiana. In 1946, Lynch was listed on the "New York Curb Exchange," the predecessor to the NYSE American. The Company has a had a long history of owning and operating various business in the precision engineering, manufacturing, and services sectors.

Cautionary Note Concerning Forward-Looking Statements

This press release may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as "may," "will," "expect," "project," "estimate," "anticipate," "plan," "believe," "potential," "should," "continue" or the negative versions of those words or other comparable words. These forward-looking statements are not guarantees of future actions or performance. These forward-looking statements are based on information currently available to us and our current plans or expectations and are subject to a number of uncertainties and risks that could significantly affect current plans, anticipated actions and our future financial condition and results. Certain of these risks and uncertainties are described in greater detail in our filings with the Securities and Exchange Commission. We are under no obligation to (and expressly disclaim any such obligation to) update or alter our forward-looking statements, whether as a result of new information, future events or otherwise.

###

Contact:

The LGL Group, Inc.

Christopher Nossokoff

(407) 298-2000

info@lglgroup.com

The LGL Group, Inc.

Consolidated Statements of Operations

(Unaudited)

| |

|

Three Months Ended March 31,

|

|

(in thousands, except share data)

|

|

2024

|

|

2023

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

392 |

|

|

$ |

441 |

|

|

Net investment income

|

|

|

499 |

|

|

|

198 |

|

|

Net (losses) gains

|

|

|

(3 |

) |

|

|

345 |

|

|

Total revenues

|

|

|

888 |

|

|

|

984 |

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

Manufacturing cost of sales

|

|

|

204 |

|

|

|

192 |

|

|

Engineering, selling and administrative

|

|

|

605 |

|

|

|

542 |

|

|

Total expenses

|

|

|

809 |

|

|

|

734 |

|

|

Income from continuing operations before income taxes

|

|

|

79 |

|

|

|

250 |

|

|

Income tax expense

|

|

|

36 |

|

|

|

65 |

|

|

Net income from continuing operations

|

|

|

43 |

|

|

|

185 |

|

|

Income (loss) from discontinued operations, net of tax

|

|

|

— |

|

|

|

(28 |

) |

|

Net income

|

|

|

43 |

|

|

|

157 |

|

|

Less: Net income attributable to non-controlling interests

|

|

|

22 |

|

|

|

— |

|

|

Net income attributable to LGL Group common stockholders

|

|

$ |

21 |

|

|

$ |

157 |

|

| |

|

|

|

|

|

|

|

|

|

Income (loss) per common share attributable to LGL Group common stockholders:

|

|

|

|

|

|

|

|

|

|

Basic (a):

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

Income (loss) from discontinued operations

|

|

|

— |

|

|

|

(0.01 |

) |

|

Net income attributable to LGL Group common stockholders

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

Diluted (a):

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

Income (loss) from discontinued operations

|

|

|

— |

|

|

|

(0.01 |

) |

|

Net income attributable to LGL Group common stockholders

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

5,352,937 |

|

|

|

5,352,937 |

|

|

Diluted

|

|

|

5,604,430 |

|

|

|

5,352,937 |

|

|

(a)

|

Basic and diluted earnings per share are calculated using actual, unrounded amounts. Therefore, the components of earnings per share may not sum to its corresponding total.

|

The LGL Group, Inc.

Consolidated Balance Sheets

(Unaudited)

|

(in thousands)

|

|

March 31, 2024

|

|

December 31, 2023

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

40,871 |

|

|

$ |

40,711 |

|

|

Marketable securities

|

|

|

19 |

|

|

|

22 |

|

|

Accounts receivable, net of reserves of $53 and $58, respectively

|

|

|

269 |

|

|

|

356 |

|

|

Inventories, net

|

|

|

213 |

|

|

|

204 |

|

|

Prepaid expenses and other current assets

|

|

|

315 |

|

|

|

273 |

|

|

Total current assets

|

|

|

41,687 |

|

|

|

41,566 |

|

|

Right-of-use lease assets

|

|

|

61 |

|

|

|

75 |

|

|

Intangible assets, net

|

|

|

52 |

|

|

|

57 |

|

|

Deferred income tax assets

|

|

|

151 |

|

|

|

152 |

|

|

Total assets

|

|

$ |

41,951 |

|

|

$ |

41,850 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

516 |

|

|

|

474 |

|

|

Non-current liabilities

|

|

|

701 |

|

|

|

694 |

|

|

Total liabilities

|

|

|

1,217 |

|

|

|

1,168 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Total LGL Group stockholders' equity

|

|

|

38,792 |

|

|

|

38,762 |

|

|

Non-controlling interests

|

|

|

1,942 |

|

|

|

1,920 |

|

|

Total stockholders' equity

|

|

|

40,734 |

|

|

|

40,682 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

41,951 |

|

|

$ |

41,850 |

|

The LGL Group, Inc.

Segment Results

(Unaudited)

| |

|

Three Months Ended March 31,

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

|

2024

|

|

2023

|

|

$ Change

|

|

% Change

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

$ |

392 |

|

|

$ |

441 |

|

|

$ |

(49 |

) |

|

|

-11.1 |

% |

|

Merchant Investment

|

|

|

289 |

|

|

|

— |

|

|

|

289 |

|

|

n/m

|

|

|

Corporate

|

|

|

207 |

|

|

|

543 |

|

|

|

(336 |

) |

|

|

-61.9 |

% |

|

Total revenues

|

|

|

888 |

|

|

|

984 |

|

|

|

(96 |

) |

|

|

-9.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

|

390 |

|

|

|

369 |

|

|

|

21 |

|

|

|

5.7 |

% |

|

Merchant Investment

|

|

|

49 |

|

|

|

— |

|

|

|

49 |

|

|

n/m

|

|

|

Corporate

|

|

|

370 |

|

|

|

365 |

|

|

|

5 |

|

|

|

1.4 |

% |

|

Total expenses

|

|

|

809 |

|

|

|

734 |

|

|

|

75 |

|

|

|

10.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations before income taxes

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Instruments

|

|

|

2 |

|

|

|

72 |

|

|

|

(70 |

) |

|

|

-97.2 |

% |

|

Merchant Investment

|

|

|

240 |

|

|

|

— |

|

|

|

240 |

|

|

n/m

|

|

|

Corporate

|

|

|

(163 |

) |

|

|

178 |

|

|

|

(341 |

) |

|

|

-191.6 |

% |

|

Income from continuing operations before income taxes

|

|

|

79 |

|

|

|

250 |

|

|

|

(171 |

) |

|

|

-68.4 |

% |

|

Income tax expense

|

|

|

36 |

|

|

|

65 |

|

|

|

(29 |

) |

|

|

-44.6 |

% |

|

Net income (loss) from continuing operations

|

|

|

43 |

|

|

|

185 |

|

|

|

(142 |

) |

|

|

-76.8 |

% |

|

Income (loss) from discontinued operations, net of tax

|

|

|

— |

|

|

|

(28 |

) |

|

|

28 |

|

|

|

-100.0 |

% |

|

Net income

|

|

|

43 |

|

|

|

157 |

|

|

|

(114 |

) |

|

|

-72.6 |

% |

|

Less: Net income attributable to non-controlling interests

|

|

|

22 |

|

|

|

— |

|

|

|

22 |

|

|

n/m

|

|

|

Net income attributable to LGL Group common stockholders

|

|

$ |

21 |

|

|

$ |

157 |

|

|

$ |

(136 |

) |

|

|

-86.6 |

% |

v3.24.1.1.u2

Document And Entity Information

|

May 15, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

THE LGL GROUP, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 15, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-00106

|

| Entity, Tax Identification Number |

38-1799862

|

| Entity, Address, Address Line One |

2525 Shader Road

|

| Entity, Address, City or Town |

Orlando

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

32804

|

| City Area Code |

407

|

| Local Phone Number |

298-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000061004

|

| CommonStockParValue001 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

LGL

|

| Security Exchange Name |

NYSE

|

| WarrantsToPurchaseCommonStockParValue001 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to Purchase Common Stock, par value $0.01

|

| Trading Symbol |

LGL WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lgl_CommonStockParValue001CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=lgl_WarrantsToPurchaseCommonStockParValue001CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

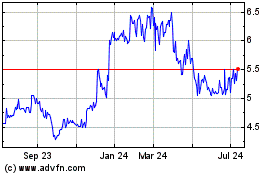

LGL (AMEX:LGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

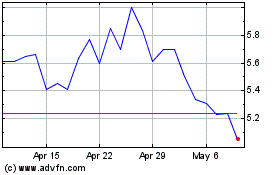

LGL (AMEX:LGL)

Historical Stock Chart

From Feb 2024 to Feb 2025