Time to Buy Treasury Bond ETFs? - ETF News And Commentary

September 26 2013 - 10:00AM

Zacks

These are trying times for the fixed income world, in particular

the U.S. Treasury market, as investors are pouring money into the

rising equity markets since the start of the year. Plus, market

apprehensions relating to the Fed’s possible announcement of

scaling back some of its asset purchases in the September FOMC

meeting took a toll on the bond markets for a couple of months.

This resulted in soaring yields and a huge sell-off in the global

bond markets. Yields on 10-year Treasury notes climbed to 3% in

early September from a low of 1.6% in May.

According to Trim Tabs Investment Research, total bond funds shed

$20.3 billion in the first part of the half of September, compared

to total outflows of $37.4 billion in August, $14.8 billion in July

and record $68.6 billion in June (read: Bond ETFs Experience

Massive Outflows).

This trend is likely to rebound in the coming weeks as the Fed

finally refrained from withdrawing the stimulus, keeping the

current bond buying program intact.

No Taper: Life to Treasury Bonds

In the latest FOMC meeting, Ben Bernanke put QE3 tapering on hold

until pronounced growth is seen in the economy. Instead, it lowered

the GDP growth outlook to 2%–2.3% from 2.3%–2.6% for this year,

citing concerns of tight fiscal policy and higher mortgage rates.

Further, the Fed reiterated that the interest rates would stay near

zero level and would not be increased until the unemployment rate

falls below 6.5% and inflation exceeds their target.

This surprising move cheered the market and breathed life into the

depressed bond world. Following the no taper announcement, bond

yields fell sharply and Treasury bonds climbed. This was especially

true in the yields on 10-year Treasury notes that fell sharply by

10 bps to 2.75% while the 5-year note dropped 12 bps to 1.49% on

the day (read: 'No Taper' and the Impact on Broad Market ETFs).

The bull market in bonds seems to have a little bit of life left

based on the Fed decision. As such, investors seeking to play on

the fixed income space may find it difficult to ignore this

opportunity to tap into the space.

How to Play?

We have highlighted three Treasury bond ETFs that could continue to

offer price appreciation to investors as long as the Fed does not

taper. The trio have a decent Zacks Rank of 3 or ‘Hold’ rating as

well, suggesting that these could be a good picks at present (see:

all the Government Bonds ETFs here).

iShares 3-7 Year Treasury Bond ETF

(IEI)

This ETF targets the intermediate part of the yield curve having

maturity of at least 3 years and less than 7 years by tracking the

Barclays U.S. 3-7 Year Treasury Bond Index. It is one of the most

popular and liquid ETFs in the Treasury space with AUM of over $5.2

billion and average daily volume of nearly 1.1 million

shares.

With holdings of 66 securities in its basket, effective duration

comes in at 4.42 years while average maturity is 4.64 years. The

product charges 15 bps in expense ratio, while the fund lost nearly

1.6% in the year-to-date period and pays 1.32% in 30-day SEC

yield.

Schwab Intermediate-Term U.S. Treasury ETF

(SCHR)

This fund follows the Barclays U.S. 3-10 Year Treasury Bond Index,

holding 59 securities in the basket. It has amassed $302.3 million

in its asset base while sees moderate volume of more than 53,000

shares per day.

The product has effective duration of 5.11 years and average

maturity of 5.53 years. The ETF is the low cost choice, charging

only 10 bps in fees per year from investors (read: Medium Term

Treasury Bond ETF Investing 101). In terms of performance, the fund

is down 2.4% year-to-date while pays 1.42% in 30-day SEC yield.

iShares U.S. Treasury Bond ETF

(GOVT)

This product provides diversified exposure to U.S. Treasuries and

tracks the Barclays U.S. Treasury Bond Index. The fund is unpopular

with AUM of under $100 million while trades in moderate volume of

above 70,000 shares per day. The ETF has expense ratio of

0.15%.

In total, the fund holds 58 securities in the portfolio. About

three-fifths of these have a maturity of less than 5 years while

30% have a maturity in between 5–10 years. This gives average

maturity of 6.16 years and effective duration of 4.82 years.

Further, GOVT yields 1.28% in 30-day SEC and lost around 2.4% in

the year-to-date time frame (see more in the Zacks ETF Center).

Bottom Line

Bottom Line

Treasury bond ETFs were the worst hit by tapering talks this year

as the rise in interest rates might cause big losses in these

products. However, the surprising move by Ben Bernanke has fueled

new hopes into this corner of investing and investors could enjoy a

nice bounce back in the coming weeks.

Still, investors should take some caution, as the next round of

taper talk is seemingly under way soon, suggesting that these may

just be short-term picks, but ones that look to rise if the Fed

fails to taper once again.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-US TB (GOVT): ETF Research Reports

ISHARS-3-7YTB (IEI): ETF Research Reports

SCHWAB-US IT TR (SCHR): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

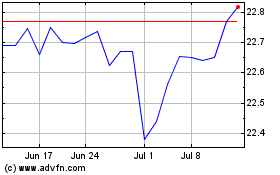

iShares US Treasury Bond... (AMEX:GOVT)

Historical Stock Chart

From Nov 2024 to Dec 2024

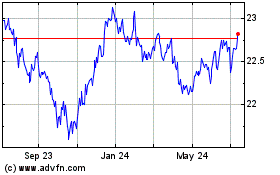

iShares US Treasury Bond... (AMEX:GOVT)

Historical Stock Chart

From Dec 2023 to Dec 2024