Evolution Petroleum Corporation (NYSE American: EPM) (“Evolution”

or the “Company”) today announced its financial and operating

results for its fiscal first quarter ended September 30, 2023

(“Fiscal Q1” or the “current quarter”). Evolution also declared a

quarterly cash dividend of $0.12 per common share for the fiscal

2024 second quarter.

Key Highlights

- Entered into a participation

agreement with PEDEVCO Corp. (“PEDEVCO") to jointly develop

horizontal wells in the Chaveroo oilfield in the Permian Basin in

New Mexico.

- Spudded the first two wells of a

three well pad after the end of the current quarter.

- Reported sequential growth in

revenue of 13% to $20.6 million, net income of 788% to $1.5

million, and earnings per share from $0.00 to $0.04 per diluted

share.

- Generated Adjusted EBITDA1 of $6.7

million for the current quarter – an increase of 43% over the prior

quarter.

- Produced 6,457 net barrels of oil

equivalent per day ("BOEPD") in the first quarter of fiscal

2024.

- Paid quarterly dividends of $0.12

per common share.

- Maintained significant liquidity

and balance sheet strength:

- Fully funded operations, capital

expenditures, and dividends from operating cash flow and working

capital;

- Increased working capital from $8.9

million at June 30, 2023 to $9.0 million at September 30, 2023;

and

- Maintained $50

million available borrowing capacity under the senior secured

credit facility.

Kelly Loyd, President and Chief Executive

Officer, commented, “We are very pleased to have moved past many of

the operational issues that directly affected our production and

revenues during the previous quarter. Sequential production was up

at our Jonah Field, Williston Basin, and Delhi Field properties.

Current quarter versus prior quarter production at Hamilton Dome

was flat, and Barnett Shale production was down by approximately 4%

over the same time period. Overall, we achieved a net zero percent

decline rate, which allowed us to benefit significantly from

increased price realizations and grow revenue, net income, earnings

per share, and Adjusted EBITDA in the current quarter as compared

to the prior quarter. As we move forward throughout the fiscal

year, continued improving operational conditions and incremental

production from multiple capital projects should continue to

benefit our shareholders, including the successful completion of

two downdip producing wells in the Delhi Field. During the quarter,

we added another strategic property to our diverse portfolio of

non-operated assets, the Chaveroo Field. Redevelopment of the

Chaveroo Field horizontally has the potential to unlock significant

value for our shareholders as the Chaveroo Field has an estimated

original oil in place (OOIP) of over 700 million barrels with less

than 5% recovered vertically to date. Importantly, this adds an

economically advantaged, organic growth component with the

potential to meaningfully add to cash flow and production.”

Mr. Loyd concluded, “Once again, our continued

commitment to providing long-term total returns to our shareholders

was on display as we paid our 40th consecutive quarterly dividend

in September of $0.12 per share, marking our fifth consecutive

dividend paid at that level. Our strong cash flow generation from

low-decline reserves, zero outstanding debt, and significant

liquidity highlight our disciplined approach to maximizing total

shareholder returns as we continue to evaluate and execute on our

strategy of acquiring and developing accretive opportunities to

prudently grow the business for the long-term benefit of our

shareholders.”

_______________________________(1) Adjusted

EBITDA is Adjusted Earnings Before Interest, Taxes, Depreciation,

and Amortization and is a non-GAAP financial measure; see the

“Non-GAAP Reconciliation” tables later in this release for more

information on the most comparable GAAP measures.

Cash Dividend on Common

Stock

On November 6, 2023, Evolution’s Board of

Directors declared a cash dividend of $0.12 per share of common

stock, which will be paid on December 29, 2023, to common

stockholders of record on December 15, 2023. This will be the 41st

consecutive quarterly cash dividend on the Company’s common stock

since December 31, 2013. To date, Evolution has returned

approximately $106.4 million, or $3.21 per share, back to

stockholders in common stock dividends. Maintaining and ultimately

growing the common stock dividend remains a key Company

priority.

Financial and Operational Results for

the Quarter Ended September 30, 2023

| ($ in millions) |

1Q24 |

|

4Q23 |

|

% Change vs 4Q23 |

|

Average BOEPD |

|

6,457 |

|

|

|

6,484 |

|

|

- |

|

% |

| Revenues ($M) |

$ |

20,601 |

|

|

$ |

18,174 |

|

|

13 |

|

% |

| Net Income ($M) |

$ |

1,474 |

|

|

$ |

166 |

|

|

788 |

|

% |

| Adjusted Net Income(1)

($M) |

$ |

1,474 |

|

|

$ |

166 |

|

|

788 |

|

% |

| Adjusted EBITDA(2) ($M) |

$ |

6,703 |

|

|

$ |

4,672 |

|

|

43 |

|

% |

|

____________________ |

|

(1) |

Adjusted Net Income is a non-GAAP financial measure; see the

“Non-GAAP Information” section later in this release for more

information, including reconciliations to the most comparable GAAP

measures. |

|

(2) |

Adjusted EBITDA is Adjusted Earnings Before Interest, Taxes,

Depreciation, and Amortization and is a non-GAAP financial measure;

see the “Non-GAAP Information” section later in this release for

more information, including reconciliations to the most comparable

GAAP measures. |

|

|

|

Total production for the first quarter of fiscal

2024 was 6,457 net BOEPD, including 1,750 barrels per day (“BOPD”)

of crude oil; 22,011 thousand cubic feet per day (“MCFPD”), or

3,674 BOEPD, of natural gas; and 1,033 BOEPD of natural gas liquids

(“NGLs”).

-

Oil increased 1% from 1,736 BOPD in the prior quarter, as a result

of the workover program at Williston Basin to restore oil

production.

-

Natural gas production decreased 2% from 22,462 MCFPD, or 3,748

BOEPD, in the prior quarter. The decrease was primarily related to

continued issues in the Barnett Shale, including compression

related issues from extreme heat experienced this summer, excessive

downtime within EnLink’s gathering and processing system, pipeline

rerouting and optimization, and the operator’s decision to

temporarily shut in low margin wells that were brought online to

take advantage of the high natural gas prices during the second

half of 2022. EnLink has finished a major overhaul of the Corvett

processing plant, the heat has abated, and the pipeline

optimization has been completed.

-

NGL production increased 3% from 1,000 BOEPD in the prior quarter,

primarily as a result of less downtime at Delhi Field and benefits

from the heat exchanger that was installed in May 2023.

Evolution reported $20.6 million of total

revenue for the current quarter, a 13% increase from the prior

quarter. Oil revenue increased 15% to $12.6 million from the

previous quarter, primarily due to a 13% increase in realized

commodity pricing coupled with 2% increase in sales volumes.

Natural gas revenue increased 11% from the prior quarter to $5.6

million due to a 12% increase in realized commodity pricing,

partially offset by a 1% decrease in sales volumes. Natural gas

revenue in the current quarter was negatively impacted by

approximately $0.5 million in estimated adjustments to prior

periods, dating back to September 2021, relating to updated

ownership interest calculations provided by the operator of the

Barnett properties. NGL revenue increased 10% to $2.4 million,

primarily due to a 6% increase in realized pricing together with a

4% increase in sales volumes. The average realized price per BOE

increased 13% to $34.68 compared to $30.80 in the prior

quarter.

Lease operating costs (“LOE”) remained

relatively flat at $11.9 million in the current quarter compared to

$11.8 million in the prior quarter. Although CO2 costs and

production taxes were higher due to increased commodity prices,

field level LOE declined from the prior quarter. On a per unit

basis, total LOE was $20.01 per BOE and $20.02 per BOE for the

current and prior quarters, respectively.

Depletion, depreciation, and accretion expense

was $4.3 million compared to $3.8 million in the prior quarter. On

a per BOE basis, the Company’s current quarter depletion rate of

$6.58 per BOE increased from $6.01 per BOE in the prior quarter due

to a reduction in proved reserves.

General and administrative expenses, including

stock-based compensation, increased slightly in the current quarter

to $2.6 million from $2.3 million in the prior quarter. The

increase was primarily attributable to salary expenses associated

with actual and estimated annual incentive compensation.

Net income for the current quarter was $1.5

million, or $0.04 per diluted share, compared to $0.2 million, or

$0.00 per diluted share, in the prior quarter. Net income and

diluted earnings per share in the current quarter were negatively

impacted by $0.4 million and $0.01, respectively, after income

taxes, due to the aforementioned prior period adjustments. Adjusted

EBITDA was $6.7 million for the current quarter compared to $4.7

million in the prior quarter. On a per BOE basis, Adjusted EBITDA

was $11.28 for the current quarter versus $7.92 for the preceding

quarter. Adjusted EBITDA was negatively impacted by approximately

$0.5 million due to the aforementioned prior period

adjustments.

Operations Update

On September 12, 2023, we entered into a

participation agreement (the “Participation Agreement”) with

PEDEVCO for the joint development of the Chaveroo oilfield, a

conventional oil-bearing San Andres field located in Chaves and

Roosevelt Counties, New Mexico (the “Chaveroo Field”).

Pursuant to the Participation Agreement, we have

the right, but not the obligation, to elect to participate in

drilling locations on approximately 16,000 gross leasehold acres

consisting of all leasehold rights from the surface to the base of

the San Andres formation, where PEDEVCO currently holds leasehold

interest. We have agreed to pay PEDEVCO $450 per acre for a 50%

working interest share in the leases in which we elect to

participate. We have entered into a standard operating agreement

with PEDEVCO serving as the operator with respect to the

development of the properties.

During the three months ended September 30,

2023, we paid total cash consideration of approximately $0.4

million, which includes less than $0.1 million of capitalized

transaction costs, in exchange for a 50% working interest share in

1,625 gross undeveloped leasehold acres associated with two initial

development blocks, or nine drilling locations. Following the

completion of the initial nine development wells, we will have the

right, but not the obligation, to elect to participate in the next

development block at the same cost per net acre. Our operator,

PEDEVCO, spud the initial well in October 2023 and has finished

drilling and casing. Drilling of the second well is currently

underway, and we expect all three wells from the first development

block to come online in the third quarter of fiscal year 2024.

During the current quarter, we participated in

the drilling and completion of two new down dip wells at Delhi

Field. Production of the first well began in August 2023 while the

second well came online in September 2023. We and the operator have

been pleased with the early results of these two wells.

Balance Sheet, Liquidity, and Capital

Spending

On September 30, 2023, cash and cash equivalents

totaled $9.4 million, and working capital was $9.0 million.

Evolution’s $50 million revolving credit facility remained undrawn.

As a result, total liquidity on September 30, 2023, was $59.4

million, including cash and cash equivalents.

During the first quarter of fiscal 2024, the

Company fully funded operations, development capital expenditures,

and cash dividends through cash generated from operations and

working capital. For the quarter ended September 30, 2023,

Evolution paid $4.0 million in common stock dividends and incurred

$1.8 million in capital expenditures, which includes cash paid for

undeveloped acreage at Chaveroo Field. For fiscal year 2024, the

Company expects capital expenditures to be in the range of $10.0

million to $14.0 million, which excludes any potential

acquisitions. Our expected capital expenditures for fiscal year

2024 include the two down dip wells at Delhi Field, previously

discussed, and the drilling of two sidetrack locations targeting

the Birdbear formation in the Williston Basin. It also includes the

drilling and completion of three horizontal wells associated with

the first development block at Chaveroo Field, which are currently

underway. Towards the end of the fiscal year, we also expect to

start incurring capital expenditures for the second development

block at Chaveroo Field, consisting of six horizontal wells.

Evolution believes its near-term capital spending requirements will

be met from cash flows from operations and current working

capital.

Conference Call

As previously announced, Evolution Petroleum

will host a conference call on Wednesday, November 8, 2023, at

10:00 a.m. Central Time to review its first quarter fiscal 2024

financial and operating results. To join by phone, please dial

(844) 481-2813 (Toll-free) or (412) 317-0677 (International) and

ask to join the Evolution Petroleum Corporation call.

To join online via webcast, click the following

link:https://event.choruscall.com/mediaframe/webcast.html?webcastid=HcYXfROg.

A webcast replay will be available through

November 8, 2024, via the webcast link above and on Evolution's

website at www.ir.evolutionpetroleum.com.

About Evolution Petroleum

Evolution Petroleum Corporation is an

independent energy company focused on maximizing total shareholder

returns through the ownership of and investment in onshore oil and

natural gas properties in the U.S. The Company aims to build and

maintain a diversified portfolio of long-life oil and natural gas

properties through acquisitions, selective development

opportunities, production enhancements, and other exploitation

efforts. Properties include non-operated interests in the following

areas: the Jonah Field in Sublette County, Wyoming; the Williston

Basin in North Dakota; the Barnett Shale located in North Texas;

the Hamilton Dome Field located in Hot Springs County, Wyoming; the

Delhi Holt-Bryant Unit in the Delhi Field in Northeast Louisiana;

the Chaveroo oilfield located in Chaves and Roosevelt Counties, New

Mexico; as well as small overriding royalty interests in four

onshore Texas wells. Visit www.evolutionpetroleum.com for

more information.

Cautionary Statement

All forward-looking statements contained in this

press release regarding the Company's current expectations,

potential results, and future plans and objectives involve a wide

range of risks and uncertainties. Statements herein using words

such as “believe,” “expect,” “plans,” “outlook,” “should,” “will,”

and words of similar meaning are forward-looking statements.

Although the Company’s expectations are based on business,

engineering, geological, financial, and operating assumptions that

it believes to be reasonable, many factors could cause actual

results to differ materially from its expectations and can give no

assurance that its goals will be achieved. These factors and others

are detailed under the heading "Risk Factors" and elsewhere in our

periodic documents filed with the Securities and Exchange

Commission. The Company undertakes no obligation to update any

forward-looking statement.

Investor Relations (713) 935-0122

info@evolutionpetroleum.com

| |

| |

|

Evolution Petroleum Corporation |

|

Condensed Consolidated Statements of Operations

(Unaudited) |

|

(In thousands, except per share amounts) |

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

| |

2023 |

|

2022 |

|

2023 |

| Revenues |

|

|

|

|

|

|

|

|

|

Crude oil |

$ |

12,616 |

|

|

$ |

15,163 |

|

|

$ |

10,982 |

|

|

Natural gas |

|

5,552 |

|

|

|

19,848 |

|

|

|

4,984 |

|

|

Natural gas liquids |

|

2,433 |

|

|

|

4,786 |

|

|

|

2,208 |

|

|

Total revenues |

|

20,601 |

|

|

|

39,797 |

|

|

|

18,174 |

|

| Operating costs |

|

|

|

|

|

|

|

|

|

Lease operating costs |

|

11,883 |

|

|

|

19,116 |

|

|

|

11,818 |

|

|

Depletion, depreciation, and accretion |

|

4,262 |

|

|

|

3,598 |

|

|

|

3,834 |

|

|

General and administrative expenses |

|

2,603 |

|

|

|

2,472 |

|

|

|

2,263 |

|

|

Total operating costs |

|

18,748 |

|

|

|

25,186 |

|

|

|

17,915 |

|

| Income (loss) from

operations |

|

1,853 |

|

|

|

14,611 |

|

|

|

259 |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

Net gain (loss) on derivative contracts |

|

— |

|

|

|

(603 |

) |

|

|

— |

|

|

Interest and other income |

|

116 |

|

|

|

6 |

|

|

|

95 |

|

|

Interest expense |

|

(32 |

) |

|

|

(243 |

) |

|

|

(54 |

) |

| Income (loss) before income

taxes |

|

1,937 |

|

|

|

13,771 |

|

|

|

300 |

|

| Income tax (expense)

benefit |

|

(463 |

) |

|

|

(3,064 |

) |

|

|

(134 |

) |

| Net income (loss) |

$ |

1,474 |

|

|

$ |

10,707 |

|

|

$ |

166 |

|

| Net income (loss) per common

share: |

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.04 |

|

|

$ |

0.32 |

|

|

$ |

— |

|

|

Diluted |

$ |

0.04 |

|

|

$ |

0.32 |

|

|

$ |

— |

|

| Weighted average number of

common shares outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

32,663 |

|

|

|

33,134 |

|

|

|

32,618 |

|

|

Diluted |

|

32,984 |

|

|

|

33,319 |

|

|

|

32,891 |

|

| |

|

Evolution Petroleum Corporation |

|

Condensed Consolidated Balance Sheets

(Unaudited) |

|

(In thousands, except share and per share

amounts) |

|

|

|

|

|

|

|

|

|

| |

September 30, 2023 |

|

June 30, 2023 |

|

Assets |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

9,413 |

|

|

$ |

11,034 |

|

|

Receivables from crude oil, natural gas, and natural gas liquids

revenues |

|

10,555 |

|

|

|

7,884 |

|

|

Prepaid expenses and other current assets |

|

2,122 |

|

|

|

2,277 |

|

|

Total current assets |

|

22,090 |

|

|

|

21,195 |

|

| Property and equipment, net of

depletion, depreciation, and impairment |

|

|

|

|

|

|

|

|

Oil and natural gas properties—full-cost method of accounting: |

|

|

|

|

|

|

|

|

Oil and natural gas properties, subject to amortization, net |

|

103,384 |

|

|

|

105,781 |

|

|

Oil and natural gas properties, not subject to amortization |

|

398 |

|

|

|

— |

|

|

Total property and equipment, net |

|

103,782 |

|

|

|

105,781 |

|

|

|

|

|

|

|

|

|

|

| Other assets |

|

1,328 |

|

|

|

1,341 |

|

| Total assets |

$ |

127,200 |

|

|

$ |

128,317 |

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

7,117 |

|

|

$ |

5,891 |

|

|

Accrued liabilities and other |

|

5,204 |

|

|

|

6,027 |

|

|

State and federal taxes payable |

|

753 |

|

|

|

365 |

|

|

Total current liabilities |

|

13,074 |

|

|

|

12,283 |

|

| Long term liabilities |

|

|

|

|

|

|

|

|

Deferred income taxes |

|

6,728 |

|

|

|

6,803 |

|

|

Asset retirement obligations |

|

17,364 |

|

|

|

17,012 |

|

|

Operating lease liability |

|

112 |

|

|

|

125 |

|

|

Total liabilities |

|

37,278 |

|

|

|

36,223 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

|

|

|

Common stock; par value $0.001; 100,000,000 shares authorized:

issued and outstanding 33,440,195 and 33,247,523 shares as of

September 30, 2023 and June 30, 2023,

respectively |

|

33 |

|

|

|

33 |

|

|

Additional paid-in capital |

|

40,465 |

|

|

|

40,098 |

|

|

Retained earnings |

|

49,424 |

|

|

|

51,963 |

|

|

Total stockholders' equity |

|

89,922 |

|

|

|

92,094 |

|

|

Total liabilities and stockholders' equity |

$ |

127,200 |

|

|

$ |

128,317 |

|

| |

|

Evolution Petroleum Corporation |

|

Condensed Consolidated Statements of Cash Flows

(Unaudited) |

|

(In thousands) |

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

| |

2023 |

|

2022 |

|

2023 |

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

1,474 |

|

|

$ |

10,707 |

|

|

$ |

166 |

|

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

Depletion, depreciation, and accretion |

|

4,262 |

|

|

|

3,598 |

|

|

|

3,834 |

|

|

Stock-based compensation |

|

472 |

|

|

|

208 |

|

|

|

484 |

|

|

Settlement of asset retirement obligations |

|

— |

|

|

|

(7 |

) |

|

|

(55 |

) |

|

Deferred income taxes |

|

(75 |

) |

|

|

(36 |

) |

|

|

(196 |

) |

|

Unrealized (gain) loss on derivative contracts |

|

— |

|

|

|

(1,119 |

) |

|

|

— |

|

|

Accrued settlements on derivative contracts |

|

— |

|

|

|

(220 |

) |

|

|

211 |

|

|

Other |

|

— |

|

|

|

(8 |

) |

|

|

(1 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Receivables from crude oil, natural gas, and natural gas liquids

revenues |

|

(2,686 |

) |

|

|

6,804 |

|

|

|

1,958 |

|

|

Prepaid expenses and other current assets |

|

169 |

|

|

|

33 |

|

|

|

288 |

|

|

Accounts payable and accrued liabilities |

|

320 |

|

|

|

(5,173 |

) |

|

|

(5,343 |

) |

|

State and federal income taxes payable |

|

388 |

|

|

|

2,578 |

|

|

|

(1,793 |

) |

|

Net cash provided by operating activities |

|

4,324 |

|

|

|

17,365 |

|

|

|

(447 |

) |

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

Acquisition of oil and natural gas properties |

|

— |

|

|

|

(31 |

) |

|

|

— |

|

|

Capital expenditures for oil and natural gas properties |

|

(1,827 |

) |

|

|

(1,848 |

) |

|

|

(2,727 |

) |

|

Net cash used in investing activities |

|

(1,827 |

) |

|

|

(1,879 |

) |

|

|

(2,727 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

Common stock dividends paid |

|

(4,013 |

) |

|

|

(4,026 |

) |

|

|

(3,992 |

) |

|

Common stock repurchases, including stock surrendered for tax

withholding |

|

(105 |

) |

|

|

(26 |

) |

|

|

(187 |

) |

|

Repayments of senior secured credit facility |

|

— |

|

|

|

(9,000 |

) |

|

|

— |

|

|

Net cash (used in) provided by financing activities |

|

(4,118 |

) |

|

|

(13,052 |

) |

|

|

(4,179 |

) |

|

Net increase (decrease) in cash and cash equivalents |

|

(1,621 |

) |

|

|

2,434 |

|

|

|

(7,353 |

) |

|

Cash and cash equivalents, beginning of period |

|

11,034 |

|

|

|

8,280 |

|

|

|

18,387 |

|

|

Cash and cash equivalents, end of period |

$ |

9,413 |

|

|

$ |

10,714 |

|

|

$ |

11,034 |

|

| |

|

Evolution Petroleum Corporation |

|

Non-GAAP Reconciliation – Adjusted EBITDA

(Unaudited) |

|

(In thousands) |

| |

Adjusted EBITDA and Net income (loss) and

earnings per share excluding selected items are non-GAAP financial

measures that are used as supplemental financial measures by our

management and by external users of our financial statements, such

as investors, commercial banks, and others, to assess our operating

performance as compared to that of other companies in our industry,

without regard to financing methods, capital structure, or

historical costs basis. We use these measures to assess our ability

to incur and service debt and fund capital expenditures. Our

Adjusted EBITDA and Net income (loss) and earnings per share,

excluding selected items, should not be considered alternatives to

net income (loss), operating income (loss), cash flows provided by

(used in) operating activities, or any other measure of financial

performance or liquidity presented in accordance with U.S. GAAP.

Our Adjusted EBITDA and Net income (loss) and earnings per share

excluding selected items may not be comparable to similarly titled

measures of another company because all companies may not calculate

Adjusted EBITDA and Net income (loss) and earnings per share

excluding selected items in the same manner.

We define Adjusted EBITDA as net income (loss)

plus interest expense, income tax expense (benefit), depreciation,

depletion, and accretion (DD&A), stock-based compensation,

ceiling test impairment, and other impairments, unrealized loss

(gain) on change in fair value of derivatives, and other

non-recurring or non-cash expense (income) items.

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

Net income (loss) |

$ |

1,474 |

|

|

$ |

10,707 |

|

|

$ |

166 |

|

| Adjusted by: |

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

32 |

|

|

|

243 |

|

|

|

54 |

|

| Income tax expense

(benefit) |

|

463 |

|

|

|

3,064 |

|

|

|

134 |

|

| Depletion, depreciation, and

accretion |

|

4,262 |

|

|

|

3,598 |

|

|

|

3,834 |

|

| Stock-based compensation |

|

472 |

|

|

|

208 |

|

|

|

484 |

|

| Unrealized loss (gain) on

derivative contracts |

|

— |

|

|

|

(1,119 |

) |

|

|

— |

|

| Severance |

|

— |

|

|

|

74 |

|

|

|

— |

|

| Transaction costs |

|

— |

|

|

|

230 |

|

|

|

— |

|

| Adjusted

EBITDA |

$ |

6,703 |

|

|

$ |

17,005 |

|

|

$ |

4,672 |

|

| |

|

Evolution Petroleum Corporation |

|

Non-GAAP Reconciliation – Adjusted Net Income

(Unaudited) |

|

(In thousands, except per share amounts) |

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

| |

2023 |

|

2022 |

|

2023 |

| As

Reported: |

|

|

|

|

|

|

|

|

|

Net income (loss), as reported |

$ |

1,474 |

|

|

$ |

10,707 |

|

|

$ |

166 |

|

| |

|

|

|

|

|

|

|

|

| Impact of Selected

Items: |

|

|

|

|

|

|

|

|

| Unrealized loss (gain) on

commodity contracts |

|

— |

|

|

|

(1,119 |

) |

|

|

— |

|

| Severance |

|

— |

|

|

|

74 |

|

|

|

— |

|

| Transaction costs |

|

— |

|

|

|

230 |

|

|

|

— |

|

| Selected items, before income

taxes |

$ |

— |

|

|

$ |

(815 |

) |

|

$ |

— |

|

| Income tax effect of selected

items(1) |

|

— |

|

|

|

(183 |

) |

|

|

— |

|

| Selected items, net of

tax |

$ |

— |

|

|

$ |

(632 |

) |

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

| As Adjusted: |

|

|

|

|

|

|

|

|

| Net income (loss), excluding

selected items(2) |

$ |

1,474 |

|

|

$ |

10,075 |

|

|

$ |

166 |

|

| |

|

|

|

|

|

|

|

|

| Undistributed earnings

allocated to unvested restricted stock |

|

(26 |

) |

|

|

(104 |

) |

|

|

(3 |

) |

| Net income (loss), excluding

selected items for earnings per share calculation |

$ |

1,448 |

|

|

$ |

9,971 |

|

|

$ |

163 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) per common

share — Basic, as reported |

$ |

0.04 |

|

|

$ |

0.32 |

|

|

$ |

— |

|

| Impact of selected items |

|

— |

|

|

|

(0.02 |

) |

|

|

— |

|

| Net income (loss) per common

share — Basic, excluding selected items(2) |

$ |

0.04 |

|

|

$ |

0.30 |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) per common

share — Diluted, as reported |

$ |

0.04 |

|

|

$ |

0.32 |

|

|

$ |

— |

|

| Impact of selected items |

|

— |

|

|

|

(0.02 |

) |

|

|

— |

|

| Net income (loss) per common

share — Diluted, excluding selected items(2)(3) |

$ |

0.04 |

|

|

$ |

0.30 |

|

|

$ |

— |

|

|

____________________ |

|

(1) |

For the three months ended September 30, 2022, represents the tax

impact using an estimated tax rate of 22.5%. |

|

(2) |

Net income (loss) and earnings per share excluding selected items

are non-GAAP financial measures presented as supplemental financial

measures to enable a user of the financial information to

understand the impact of these items on reported results. These

financial measures should not be considered an alternative to net

income (loss), operating income (loss), cash flows provided by

(used in) operating activities, or any other measure of financial

performance or liquidity presented in accordance with U.S. GAAP.

Our Adjusted Net Income (Loss) and earnings per share may not be

comparable to similarly titled measures of another company because

all companies may not calculate Adjusted Net Income (Loss) and

earnings per share in the same manner. |

|

(3) |

The impact of selected items for the three months ended September

30, 2023 and 2022 was calculated based upon weighted average

diluted shares of 33.0 million and 33.3 million, respectively, due

to the net income (loss), excluding selected items. The impact of

selected items for the three months ended June 30, 2023 was

calculated based upon weighted average diluted shares of 32.9

million, due to the net income (loss), excluding selected

items. |

| |

|

Evolution Petroleum Corporation |

|

Supplemental Information on Oil and Natural Gas Operations

(Unaudited) |

|

(In thousands, except per unit and per BOE

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, |

|

June 30, |

| |

2023 |

|

2022 |

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

| Crude oil |

$ |

12,616 |

|

|

$ |

15,163 |

|

|

$ |

10,982 |

|

| Natural gas |

|

5,552 |

|

|

|

19,848 |

|

|

|

4,984 |

|

| Natural gas liquids |

|

2,433 |

|

|

|

4,786 |

|

|

|

2,208 |

|

| Total revenues |

$ |

20,601 |

|

|

$ |

39,797 |

|

|

$ |

18,174 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Lease operating

costs: |

|

|

|

|

|

|

|

|

|

|

|

| CO2 costs |

$ |

1,578 |

|

|

$ |

2,199 |

|

|

$ |

1,348 |

|

| Ad valorem and production

taxes |

|

1,278 |

|

|

|

3,263 |

|

|

|

1,157 |

|

| Other lease operating

costs |

|

9,027 |

|

|

|

13,654 |

|

|

|

9,313 |

|

| Total lease operating

costs |

$ |

11,883 |

|

|

$ |

19,116 |

|

|

$ |

11,818 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Depletion of full cost proved

oil and natural gas properties |

$ |

3,910 |

|

|

$ |

3,322 |

|

|

$ |

3,544 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Production: |

|

|

|

|

|

|

|

|

|

|

|

| Crude oil (MBBL) |

|

161 |

|

|

|

168 |

|

|

|

158 |

|

| Natural gas (MMCF) |

|

2,025 |

|

|

|

2,494 |

|

|

|

2,044 |

|

| Natural gas liquids

(MBBL) |

|

95 |

|

|

|

115 |

|

|

|

91 |

|

| Equivalent (MBOE)(1) |

|

594 |

|

|

|

699 |

|

|

|

590 |

|

| Average daily production

(BOEPD)(1) |

|

6,457 |

|

|

|

7,598 |

|

|

|

6,484 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Average price per

unit(2): |

|

|

|

|

|

|

|

|

|

|

|

| Crude oil (BBL) |

$ |

78.36 |

|

|

$ |

90.26 |

|

|

$ |

69.51 |

|

| Natural gas (MCF) |

|

2.74 |

|

|

|

7.96 |

|

|

|

2.44 |

|

| Natural Gas Liquids (BBL) |

|

25.61 |

|

|

|

41.62 |

|

|

|

24.26 |

|

| Equivalent (BOE)(1) |

$ |

34.68 |

|

|

$ |

56.93 |

|

|

$ |

30.80 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Average cost per

unit: |

|

|

|

|

|

|

|

|

|

|

|

| CO2 costs |

$ |

2.66 |

|

|

$ |

3.15 |

|

|

$ |

2.28 |

|

| Ad valorem and production

taxes |

|

2.15 |

|

|

|

4.67 |

|

|

|

1.96 |

|

| Other lease operating

costs |

|

15.20 |

|

|

|

19.53 |

|

|

|

15.78 |

|

| Total lease operating

costs |

$ |

20.01 |

|

|

$ |

27.35 |

|

|

$ |

20.02 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Depletion of full cost proved

oil and natural gas properties |

$ |

6.58 |

|

|

$ |

4.75 |

|

|

$ |

6.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| CO2 costs per MCF |

$ |

0.99 |

|

|

$ |

1.11 |

|

|

$ |

0.91 |

|

| CO2 volumes (MMCF per day,

gross) |

|

72.4 |

|

|

|

90.0 |

|

|

|

68.2 |

|

|

____________________ |

|

(1) |

Equivalent oil reserves are defined as six MCF of natural gas and

42 gallons of NGLs to one barrel of oil conversion ratio which

reflects energy equivalence and not price equivalence. Natural gas

prices per MCF and NGL prices per barrel often differ significantly

from the equivalent amount of oil. |

|

(2) |

Amounts exclude the impact of cash paid or received on the

settlement of derivative contracts since we did not elect to apply

hedge accounting. |

| |

|

Evolution Petroleum Corporation |

|

Summary of Production Volumes, Average Sales Price, and

Average Production Costs (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

| |

|

September 30, |

|

June 30, |

| |

|

2023 |

|

2022 |

|

2023 |

| |

|

Volume |

|

Price |

|

Volume |

|

Price |

|

Volume |

|

Price |

|

Production: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil (MBBL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonah Field |

|

|

9 |

|

|

$ |

88.41 |

|

|

|

9 |

|

|

$ |

94.00 |

|

|

|

9 |

|

|

$ |

77.87 |

|

|

Williston Basin |

|

|

40 |

|

|

|

78.94 |

|

|

|

37 |

|

|

|

90.76 |

|

|

|

34 |

|

|

|

70.31 |

|

|

Barnett Shale |

|

|

1 |

|

|

|

74.96 |

|

|

|

1 |

|

|

|

141.00 |

|

|

|

3 |

|

|

|

69.37 |

|

|

Hamilton Dome Field |

|

|

37 |

|

|

|

69.46 |

|

|

|

38 |

|

|

|

78.37 |

|

|

|

37 |

|

|

|

60.53 |

|

|

Delhi Field |

|

|

73 |

|

|

|

81.54 |

|

|

|

83 |

|

|

|

94.46 |

|

|

|

74 |

|

|

|

73.01 |

|

|

Other |

|

|

1 |

|

|

|

81.80 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

75.07 |

|

|

Total |

|

|

161 |

|

|

$ |

78.36 |

|

|

|

168 |

|

|

$ |

90.26 |

|

|

|

158 |

|

|

$ |

69.51 |

|

| Natural gas (MMCF) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonah Field |

|

|

904 |

|

|

$ |

3.69 |

|

|

|

958 |

|

|

$ |

8.21 |

|

|

|

881 |

|

|

$ |

3.16 |

|

|

Williston Basin |

|

|

21 |

|

|

|

2.04 |

|

|

|

18 |

|

|

|

7.33 |

|

|

|

23 |

|

|

|

2.99 |

|

|

Barnett Shale |

|

|

1,100 |

|

|

|

1.98 |

|

|

|

1,518 |

|

|

|

7.81 |

|

|

|

1,140 |

|

|

|

1.87 |

|

|

Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total |

|

|

2,025 |

|

|

$ |

2.74 |

|

|

|

2,494 |

|

|

$ |

7.96 |

|

|

|

2,044 |

|

|

$ |

2.44 |

|

| Natural gas liquids

(MBBL) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonah Field |

|

|

10 |

|

|

$ |

27.06 |

|

|

|

12 |

|

|

$ |

42.00 |

|

|

|

9 |

|

|

$ |

25.80 |

|

|

Williston Basin |

|

|

4 |

|

|

|

17.66 |

|

|

|

5 |

|

|

|

42.60 |

|

|

|

5 |

|

|

|

15.00 |

|

|

Barnett Shale |

|

|

59 |

|

|

|

26.45 |

|

|

|

75 |

|

|

|

41.71 |

|

|

|

61 |

|

|

|

24.52 |

|

|

Delhi Field |

|

|

22 |

|

|

|

23.64 |

|

|

|

23 |

|

|

|

40.91 |

|

|

|

16 |

|

|

|

24.65 |

|

|

Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total |

|

|

95 |

|

|

$ |

25.61 |

|

|

|

115 |

|

|

$ |

41.62 |

|

|

|

91 |

|

|

$ |

24.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equivalent (MBOE)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonah Field |

|

|

170 |

|

|

$ |

25.91 |

|

|

|

181 |

|

|

$ |

50.89 |

|

|

|

165 |

|

|

$ |

22.60 |

|

|

Williston Basin |

|

|

48 |

|

|

|

68.56 |

|

|

|

45 |

|

|

|

82.29 |

|

|

|

43 |

|

|

|

59.57 |

|

|

Barnett Shale |

|

|

243 |

|

|

|

15.77 |

|

|

|

329 |

|

|

|

45.96 |

|

|

|

254 |

|

|

|

15.15 |

|

|

Hamilton Dome Field |

|

|

37 |

|

|

|

69.46 |

|

|

|

38 |

|

|

|

78.37 |

|

|

|

37 |

|

|

|

60.53 |

|

|

Delhi Field |

|

|

95 |

|

|

|

68.24 |

|

|

|

106 |

|

|

|

82.87 |

|

|

|

90 |

|

|

|

64.69 |

|

|

Other |

|

|

1 |

|

|

|

81.80 |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

75.07 |

|

|

Total |

|

|

594 |

|

|

$ |

34.68 |

|

|

|

699 |

|

|

$ |

56.93 |

|

|

|

590 |

|

|

$ |

30.80 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average daily

production (BOEPD)(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonah Field |

|

|

1,848 |

|

|

|

|

|

|

|

1,967 |

|

|

|

|

|

|

|

1,813 |

|

|

|

|

|

|

Williston Basin |

|

|

522 |

|

|

|

|

|

|

|

489 |

|

|

|

|

|

|

|

473 |

|

|

|

|

|

|

Barnett Shale |

|

|

2,641 |

|

|

|

|

|

|

|

3,576 |

|

|

|

|

|

|

|

2,791 |

|

|

|

|

|

|

Hamilton Dome Field |

|

|

402 |

|

|

|

|

|

|

|

413 |

|

|

|

|

|

|

|

407 |

|

|

|

|

|

|

Delhi Field |

|

|

1,033 |

|

|

|

|

|

|

|

1,153 |

|

|

|

|

|

|

|

989 |

|

|

|

|

|

|

Other |

|

|

11 |

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

Total |

|

|

6,457 |

|

|

|

|

|

|

|

7,598 |

|

|

|

|

|

|

|

6,484 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Production costs (in thousands, except per

BOE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lease operating costs |

|

Amount |

|

per BOE |

|

Amount |

|

per BOE |

|

Amount |

|

per BOE |

|

Jonah Field |

|

$ |

2,562 |

|

|

$ |

15.07 |

|

|

$ |

2,864 |

|

|

$ |

15.82 |

|

|

$ |

2,218 |

|

|

$ |

13.45 |

|

|

Williston Basin |

|

|

1,390 |

|

|

|

28.96 |

|

|

|

1,490 |

|

|

|

33.11 |

|

|

|

1,149 |

|

|

|

26.83 |

|

|

Barnett Shale |

|

|

3,192 |

|

|

|

13.09 |

|

|

|

8,853 |

|

|

|

26.91 |

|

|

|

3,902 |

|

|

|

15.28 |

|

|

Hamilton Dome Field |

|

|

1,337 |

|

|

|

36.55 |

|

|

|

1,463 |

|

|

|

38.50 |

|

|

|

1,417 |

|

|

|

38.76 |

|

|

Delhi Field |

|

|

3,402 |

|

|

|

35.83 |

|

|

|

4,446 |

|

|

|

41.94 |

|

|

|

3,132 |

|

|

|

35.06 |

|

|

Total |

|

$ |

11,883 |

|

|

$ |

20.01 |

|

|

$ |

19,116 |

|

|

$ |

27.35 |

|

|

$ |

11,818 |

|

|

$ |

20.02 |

|

|

____________________ |

|

(1) |

Equivalent oil reserves are defined as six MCF of natural gas and

42 gallons of NGLs to one barrel of oil conversion ratio which

reflects energy equivalence and not price equivalence. Natural gas

prices per MCF and NGL prices per barrel often differ significantly

from the equivalent amount of oil. |

|

|

|

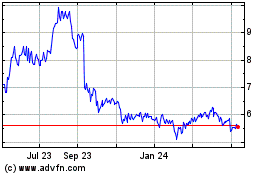

Evolution Petroleum (AMEX:EPM)

Historical Stock Chart

From Oct 2024 to Nov 2024

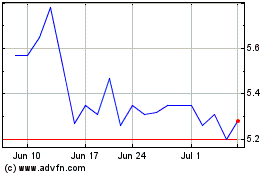

Evolution Petroleum (AMEX:EPM)

Historical Stock Chart

From Nov 2023 to Nov 2024