Core Molding Technologies, Inc. (NYSE American:

CMT) (“Core Molding”, “Core” or the “Company”), a leading

engineered materials company specializing in molded structural

products, principally in building products, industrial and

utilities, medium and heavy-duty truck and powersports industries

across the United States, Canada and Mexico today reports financial

and operating results for the fiscal periods ended June 30,

2024.

Second Quarter

2024 Highlights

- Total net sales of $88.7 million

decreased 9.2% compared to the prior year second quarter.

- Gross margin of $17.7 million, or

20.0% of net sales, compared to 21.0% of net sales in the prior

year second quarter.

- Selling, general, and

administrative expenses of $10.2 million, or 11.5% of net sales,

compared to $10.5 million, or 10.7% of net sales for the prior year

second quarter.

- Operating income of $7.5 million,

or 8.4% of net sales, compared to operating income of $10.1

million, or 10.3% of net sales for the prior year second

quarter.

- Net income of $6.4 million, or

$0.73 per diluted share, compared to net income of $7.9 million, or

$0.91 per diluted share for the prior year second quarter.

- Adjusted EBITDA1 of $11.6 million,

or 13.0% of net sales, compared to $13.7 million, or 14.1% for the

prior year second quarter.

Six Month 2024 Highlights

- Total net sales of $166.9 million

decreased 15.4% compared to the prior year six month period .

- Gross margin of $31.0 million, or

18.6% of net sales, compared to 19.4% of net sales in the prior

year six-month period.

- Selling, general, and

administrative expenses of $18.8 million, or 11.3% of net sales,

compared to $20.2 million, or 10.2% of net sales for the prior year

six-month period.

- Operating income of $12.2 million,

or 7.3% of net sales, compared to operating income of $18.1

million, or 9.2% of net sales for the prior year six-month

period.

- Net income of $10.2 million, or

$1.15 per diluted share, compared to net income of $13.8 million,

or $1.59 per diluted share for the prior year six-month

period.

- Adjusted EBITDA1 of $20.3 million,

or 12.2% of net sales, compared to $26.0 million, or 13.2% for the

prior year six-month period.

1Adjusted EBITDA is a non-GAAP financial measure as defined and

reconciled below.

David Duvall, the Company’s President

and Chief Executive Officer, said, “Our second quarter

performance reflects our focus on investing for growth, operational

performance and cash flow generation. Because we design and

manufacture engineered solutions using innovative processes, the

Company’s 2024 sales transformation is imperative to our next phase

which is focused on growth and leveraging the significant

improvements we have made in our operations and engineering

functions. Our Must Win Battle this year of Invest For Growth

involves streamlining the Sales execution processes, increasing

resources in our Account Management team, deeper data-driven market

analyses, and increasing customer engagement events. Our structural

sales and operational workstreams include 1) new leadership and

specialized teams to ‘own’ growth in each vertical, 2)

comprehensive sales engagement and cross-selling our portfolio into

every relationship, and 3) a robust lead generation process with

active participation and follow-up of industry trade shows and

customer lunch & learn events.

“Halfway through fiscal 2024, our opportunity

pipeline is a robust $250 million, and new business wins total $42

million. These new wins are diversified across our end markets,

with over half comprising new business and the remainder of wins

being replacements of current business. Because of the technical

requirements and validation required with most of our solutions,

our quote-to-cash cycle is 12 to 18 months, and therefore, the

benefits of these wins will be realized starting in 2025 and 2026.

We have shown that we can execute and have a strong performance

track record. As we execute our Invest For Growth initiatives, we

are confident we will increase sales wins, unlock significant

earnings potential, and generate long-term shareholder value.”

John Zimmer, the Company’s EVP and Chief

Financial Officer, commented, “Our first half results

reflect our ability to maintain gross margins within our full-year

goal range of 17% to 19% even with lower sales in a challenging

sales environment driven by economic conditions. As expected, first

half sales declined 15.4%, primarily due to economic headwinds,

tough comparisons, and customer inventory rationalization. In the

second quarter, we sustained a strong 20% gross margin, which

pushed the first-half gross margin to 18.6%. We anticipate

second-half of the year gross margin percentages to be lower than

first-half gross margin percentages due to normal seasonality and

less leverage of fixed costs, but we still expect full-year gross

margin percentages to be within our yearly gross margin goal

range.

“Our total available liquidity was $87.8 million

at the end of the second quarter, which is available to grow the

business organically and through acquisitions as well as to

repurchase shares of the Company. We generated $16.1 million of

free cash flows1 for the first six months of 2024 compared to $14.4

million in the same period of 2023, as the Company remains in a

solid cash-generating position due to past operational improvements

we implemented. Consistent with our capital allocation strategy, we

repurchased approximately 24 thousand shares during the second

quarter at an average stock price of $16.41 under our previously

announced share repurchase program.”

“Despite easing second-half sales comparisons,

we are lowering sales guidance to the bottom of our full-year

guidance, down approximately 15%, compared to 2023 sales due to

continued softness in customer demand driven by macro-economic

conditions. We continue to evaluate the Company’s fixed cost

structure and will adjust costs prudently. We will provide ongoing

updates this year on our ‘Invest for Growth’ initiatives and

progress to drive topline revenue.”

1Free Cash Flow is a non-GAAP financial measure as defined and

reconciled below.

2024 Capital Expenditures

The Company’s capital expenditures for the first

six months of 2024 were $4.8 million. The Company anticipates

spending approximately $13 million during 2024 on property, plant

and equipment purchases for all of the Company's operations.

Financial Position at

June 30, 2024

The Company’s total liquidity at June 30,

2024 was $87.8 million, with $37.8 million in cash, $25.0 million

of undrawn capacity under the Company’s revolving credit facility

and $25.0 million of undrawn capacity under the Company's capex

credit facility. The Company’s term debt was $22.4 million at

June 30, 2024. The term debt-to-trailing twelve months

Adjusted EBITDA1 was less than one times trailing twelve months

Adjusted EBITDA1 as of June 30, 2024. The Company had a

trailing twelve months return on capital employed1 of 12.1% as of

June 30, 2024.

1 Adjusted EBITDA and return on capital employed

are non-GAAP financial measures as defined and reconciled

below.

Conference Call

The Company will conduct a conference call today

at 10:00 a.m. Eastern Time to discuss financial and operating

results for the periods ended June 30, 2024. To access the call

live by phone, dial (844) 881-0134 and ask for the Core Molding

Technologies call at least 10 minutes prior to the start time. A

telephonic replay will be available through August 13, 2024, by

calling (877) 344-7529 and using passcode ID: 3909303#. A webcast

of the call will also be available live and for later replay on the

Company’s Investor Relations website at

www.coremt.com/investor-relations/events-presentations/.

About Core Molding Technologies, Inc.

Core Molding Technologies is a leading

engineered materials company specializing in molded structural

products, principally in building products, utilities,

transportation and powersports industries across North America. The

Company operates in one operating segment as a molder of

thermoplastic and thermoset structural products. The Company’s

operating segment consists of one reporting unit, Core Molding

Technologies. The Company offers customers a wide range of

manufacturing processes to fit various program volume and

investment requirements. These processes include compression

molding of sheet molding compound (“SMC”), resin transfer molding

(“RTM”), liquid molding of dicyclopentadiene (“DCPD”), spray-up and

hand-lay-up, direct long-fiber thermoplastics (“DLFT”) and

structural foam and structural web injection molding (“SIM”). Core

Molding Technologies serves a wide variety of markets, including

the medium and heavy-duty truck, marine, automotive, agriculture,

construction, and other commercial products. The demand for Core

Molding Technologies’ products is affected by economic conditions

in the United States, Mexico, and Canada. Core Molding

Technologies’ operations may change proportionately more than

revenues from operations.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the federal securities laws that

are subject to risks and uncertainties. These statements often

include words such as “believe”, “anticipate”, “plan”, “expect”,

“intend”, “will”, “should”, “could”, “would”, “project”,

“continue”, “likely”, and similar expressions. In particular, this

press release may contain forward-looking statements about the

Company’s expectations for future periods with respect to its plans

to improve financial results, the future of the Company’s end

markets. Factors that could cause actual results to differ from

those reflected in forward-looking statements relating to our

operations and business include: dependence on certain major

customers, and potential loss of any major customer due to

completion of existing production programs or otherwise; general

macroeconomic, social, regulatory and political conditions,

including uncertainties surrounding volatility in financial

markets; changes in the plastics, transportation, marine and

commercial product industries (including changes in demand for

production), efforts of the Company to expand its customer base and

develop new products to diversify markets, materials and processes

and increase operational enhancements; the Company’s initiatives to

quote and execute manufacturing processes for new business, acquire

raw materials, address inflationary pressures, regulatory matters

and labor relations; the Company’s financial position or other

financial information; and other risks and uncertainties described

in the Company’s Annual Report on Form 10-K for the year ended

December 31, 2023, and our subsequent quarterly reports, all of

which are available on the SEC and Company website. These

statements are based on certain assumptions that the Company has

made in light of its experience as well as its perspective on

historical trends, current conditions, expected future developments

and other factors it believes are appropriate under the

circumstances. Actual results may differ materially from the

anticipated results because of certain risks and uncertainties,

including those included in the Company’s filings with the SEC.

There can be no assurance that statements made in this press

release relating to future events will be achieved. The Company

undertakes no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time. All subsequent written and oral forward-looking statements

attributable to the Company or persons acting on behalf of the

Company are expressly qualified in their entirety by such

cautionary statements.

Company Contact:Core Molding

Technologies, Inc.John ZimmerExecutive Vice President & Chief

Financial Officerjzimmer@coremt.com

Investor Relations

Contact:Three Part Advisors, LLCSandy Martin or Steven

Hooser214-616-2207

- Financial Statements Follow –

|

Core Molding Technologies,

Inc.Consolidated Statements of

Operations(unaudited, in thousands, except share

and per share data) |

|

|

|

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net sales: |

|

|

|

|

|

|

|

|

Products |

$ |

83,956 |

|

|

$ |

95,703 |

|

|

$ |

159,787 |

|

|

$ |

194,040 |

|

|

Tooling |

|

4,787 |

|

|

|

2,022 |

|

|

|

7,101 |

|

|

|

3,192 |

|

|

Total net sales |

|

88,743 |

|

|

|

97,725 |

|

|

|

166,888 |

|

|

|

197,232 |

|

|

|

|

|

|

|

|

|

|

|

Total cost of sales |

|

71,018 |

|

|

|

77,163 |

|

|

|

135,858 |

|

|

|

158,927 |

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

17,725 |

|

|

|

20,562 |

|

|

|

31,030 |

|

|

|

38,305 |

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expense |

|

10,236 |

|

|

|

10,492 |

|

|

|

18,810 |

|

|

|

20,161 |

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

7,489 |

|

|

|

10,070 |

|

|

|

12,220 |

|

|

|

18,144 |

|

|

|

|

|

|

|

|

|

|

|

Other income and expense |

|

|

|

|

|

|

|

|

Net interest expense |

|

(38 |

) |

|

|

293 |

|

|

|

45 |

|

|

|

649 |

|

|

Net periodic post-retirement benefit |

|

(138 |

) |

|

|

(52 |

) |

|

|

(276 |

) |

|

|

(105 |

) |

|

Total other (income) and expense |

|

(176 |

) |

|

|

241 |

|

|

|

(231 |

) |

|

|

544 |

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

7,665 |

|

|

|

9,829 |

|

|

|

12,451 |

|

|

|

17,600 |

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

1,246 |

|

|

|

1,893 |

|

|

|

2,273 |

|

|

|

3,812 |

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

6,419 |

|

|

$ |

7,936 |

|

|

$ |

10,178 |

|

|

$ |

13,788 |

|

|

|

|

|

|

|

|

|

|

|

Net income per common share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.74 |

|

|

$ |

0.93 |

|

|

$ |

1.17 |

|

|

$ |

1.62 |

|

|

Diluted |

$ |

0.73 |

|

|

$ |

0.91 |

|

|

$ |

1.15 |

|

|

$ |

1.59 |

|

|

Core Molding Technologies, Inc.Product

Sales by Market(unaudited, in

thousands) |

|

|

|

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Medium and heavy-duty truck |

$ |

46,841 |

|

$ |

45,193 |

|

$ |

88,350 |

|

$ |

94,709 |

|

Power sports |

|

20,902 |

|

|

23,878 |

|

|

39,761 |

|

|

45,914 |

|

Building products |

|

5,429 |

|

|

10,691 |

|

|

11,974 |

|

|

22,478 |

|

Industrial and utilities |

|

4,175 |

|

|

6,622 |

|

|

7,521 |

|

|

13,052 |

| All

other |

|

6,609 |

|

|

9,319 |

|

|

12,181 |

|

|

17,887 |

| Net

product revenue |

$ |

83,956 |

|

$ |

95,703 |

|

$ |

159,787 |

|

$ |

194,040 |

|

Core Molding Technologies,

Inc.Consolidated Balance

Sheets(in thousands) |

|

|

|

|

|

|

|

As of |

|

|

|

|

June 30, |

|

As of |

|

|

|

2024 |

|

|

December 31, |

|

|

(unaudited) |

|

|

2023 |

|

|

Assets: |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

37,787 |

|

|

$ |

24,104 |

|

|

Accounts receivable, net |

|

46,988 |

|

|

|

41,711 |

|

|

Inventories, net |

|

21,764 |

|

|

|

22,063 |

|

|

Prepaid expenses and other current assets |

|

12,164 |

|

|

|

15,001 |

|

|

Total current assets |

|

118,703 |

|

|

|

102,879 |

|

|

|

|

|

|

|

Right of use asset |

|

2,812 |

|

|

|

3,802 |

|

|

Property, plant and equipment, net |

|

79,725 |

|

|

|

81,185 |

|

|

Goodwill |

|

17,376 |

|

|

|

17,376 |

|

|

Intangibles, net |

|

5,224 |

|

|

|

6,017 |

|

|

Other non-current assets |

|

1,857 |

|

|

|

2,118 |

|

|

Total Assets |

$ |

225,697 |

|

|

$ |

213,377 |

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity: |

|

|

|

|

Liabilities: |

|

|

|

|

Current liabilities: |

|

|

|

|

Current portion of long-term debt |

$ |

1,780 |

|

|

$ |

1,468 |

|

|

Accounts payable |

|

29,458 |

|

|

|

23,958 |

|

|

Contract liabilities |

|

5,886 |

|

|

|

5,204 |

|

|

Compensation and related benefits |

|

8,153 |

|

|

|

10,498 |

|

|

Accrued other liabilities |

|

6,749 |

|

|

|

5,058 |

|

|

Total current liabilities |

|

52,026 |

|

|

|

46,186 |

|

|

|

|

|

|

|

Other non-current liabilities |

|

2,812 |

|

|

|

3,759 |

|

|

Long-term debt |

|

20,603 |

|

|

|

21,519 |

|

|

Post retirement benefits liability |

|

2,753 |

|

|

|

2,960 |

|

|

Total Liabilities |

|

78,194 |

|

|

|

74,424 |

|

|

|

|

|

|

|

Stockholders' Equity: |

|

|

|

|

Common stock |

|

88 |

|

|

|

86 |

|

|

Paid in capital |

|

44,770 |

|

|

|

43,265 |

|

|

Accumulated other comprehensive income, net of income taxes |

|

3,976 |

|

|

|

5,301 |

|

|

Treasury stock |

|

(33,578 |

) |

|

|

(31,768 |

) |

|

Retained earnings |

|

132,247 |

|

|

|

122,069 |

|

|

Total Stockholders' Equity |

|

147,503 |

|

|

|

138,953 |

|

|

Total Liabilities and Stockholders' Equity |

$ |

225,697 |

|

|

$ |

213,377 |

|

|

Core Molding Technologies,

Inc.Consolidated Statements of Cash

Flows(unaudited, in thousands) |

|

|

|

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

| Net

income |

$ |

10,178 |

|

|

$ |

13,788 |

|

|

Adjustments to reconcile net income to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

6,728 |

|

|

|

6,346 |

|

|

Loss on disposal of property, plant and equipment |

|

231 |

|

|

|

80 |

|

|

Share-based compensation |

|

1,505 |

|

|

|

1,487 |

|

|

Losses (gain) on foreign currency |

|

404 |

|

|

|

296 |

|

|

Change in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(5,277 |

) |

|

|

(6,107 |

) |

|

Inventories |

|

299 |

|

|

|

(523 |

) |

|

Prepaid and other assets |

|

613 |

|

|

|

(190 |

) |

|

Accounts payable |

|

5,159 |

|

|

|

700 |

|

|

Accrued and other liabilities |

|

1,631 |

|

|

|

3,492 |

|

|

Post retirement benefits liability |

|

(528 |

) |

|

|

(465 |

) |

|

Net cash provided by operating activities |

|

20,943 |

|

|

|

18,904 |

|

|

Cash flows from investing activities: |

|

|

|

|

Purchase of property, plant and equipment |

|

(4,805 |

) |

|

|

(4,511 |

) |

|

Net cash used in investing activities |

|

(4,805 |

) |

|

|

(4,511 |

) |

|

Cash flows from financing activities: |

|

|

|

|

Gross borrowings on revolving loans |

|

— |

|

|

|

(38,962 |

) |

|

Gross repayment on revolving loans |

|

— |

|

|

|

37,098 |

|

|

Payments for taxes related to net share settlement of equity

awards |

|

(1,417 |

) |

|

|

(1,907 |

) |

|

Purchase of treasury shares |

|

(393 |

) |

|

|

— |

|

|

Payment on principal on term loans |

|

(645 |

) |

|

|

(643 |

) |

|

Net cash used in financing activities |

|

(2,455 |

) |

|

|

(4,414 |

) |

|

Net change in cash and cash equivalents |

|

13,683 |

|

|

|

9,979 |

|

|

Cash and cash equivalents at beginning of

period |

|

24,104 |

|

|

|

4,183 |

|

|

Cash and cash equivalents at end of period |

$ |

37,787 |

|

|

$ |

14,162 |

|

|

Cash paid for: |

|

|

|

|

Interest |

$ |

538 |

|

|

$ |

653 |

|

|

Income taxes |

$ |

1,230 |

|

|

$ |

3,347 |

|

|

Non cash investing activities: |

|

|

|

|

Fixed asset purchases in accounts payable |

$ |

157 |

|

|

$ |

848 |

|

Non-GAAP Financial Measures

This press release contains financial

information determined by methods other than in accordance with

accounting principles generally accepted in the United States of

America ("GAAP"). Core Molding management uses non-GAAP measures in

its analysis of the Company's performance. Investors are encouraged

to review the reconciliation of non-GAAP financial measures to the

comparable GAAP results available in the accompanying tables.

Reconciliation of Non-GAAP Financial

Measures

Adjusted EBITDA represents net income before, as

applicable from time to time, (i) interest expense, net, (ii)

provision (benefit) for income taxes, (iii) depreciation and

amortization of long-lived assets, (iv) share based compensation

expense, (v) plant closure costs, and (vi) nonrecurring legal

settlement costs and associated legal expenses unrelated to the

Company's core operations. Debt-to-trailing twelve months adjusted

EBITDA represents total outstanding debt divided by trailing twelve

months Adjusted EBITDA. Free Cash Flow represents net cash (used

in) provided by operating activities less purchase of property,

plant and equipment. Trailing twelve months return on capital

employed represents the trailing twelve months earnings before (i)

interest expense, net and (ii) provision (benefit) for income taxes

divided by (i) stockholders' equity and (ii) current and long-term

debt.

We present Adjusted EBITDA, Adjusted EBITDA as a

percent of net sales, debt-to-trailing twelve months adjusted

EBITDA, Free Cash Flow and trailing twelve months Return on Capital

Employed because management uses these measures as key performance

indicators, and we believe that securities analysts, investors and

others use these measures to evaluate companies in our industry.

These measures have limitations as analytical tools and should not

be considered in isolation or as an alternative to performance

measure derived in accordance with GAAP as an indicator of our

operating performance. Our calculation of these measures may not be

comparable to similarly named measures reported by other companies.

The following tables present reconciliations of net income to

Adjusted EBITDA, and Cash Flow from Operating Activities to Free

Cash Flow, the most directly comparable GAAP measures, and Debt to

trailing twelve months adjusted EBITDA and trailing twelve months

Return on Capital Employed, for the periods presented:

|

Core Molding Technologies, Inc. Net Income

to Adjusted EBITDA Reconciliation(unaudited, in

thousands) |

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

income |

$ |

6,419 |

|

|

$ |

7,936 |

|

|

$ |

10,178 |

|

|

$ |

13,788 |

|

|

Provision for income taxes |

|

1,246 |

|

|

|

1,893 |

|

|

|

2,273 |

|

|

|

3,812 |

|

|

Total other expenses(1) |

|

(176 |

) |

|

|

241 |

|

|

|

(231 |

) |

|

|

544 |

|

|

Depreciation and amortization |

|

3,308 |

|

|

|

2,918 |

|

|

|

6,581 |

|

|

|

6,388 |

|

|

Share-based compensation |

|

766 |

|

|

|

756 |

|

|

|

1,505 |

|

|

|

1,487 |

|

|

Adjusted EBITDA |

$ |

11,563 |

|

|

$ |

13,744 |

|

|

$ |

20,306 |

|

|

$ |

26,019 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA as a percent of net sales |

|

13.0 |

% |

|

|

14.1 |

% |

|

|

12.2 |

% |

|

|

13.2 |

% |

|

|

|

|

|

|

|

|

|

|

(1)Includes net interest expense and non-cash periodic

post-retirement benefit cost. |

|

Core Molding Technologies, Inc.

Computation of Debt to Trailing Twelve Months Adjusted

EBITDA(unaudited, in thousands) |

|

|

|

|

Q3 2023 |

|

Q4 2023 |

|

Q1 2024 |

|

Q2 2024 |

|

Trailing Twelve Months |

|

Net income |

$ |

4,354 |

|

$ |

2,182 |

|

$ |

3,759 |

|

|

$ |

6,419 |

|

|

$ |

16,714 |

|

Provision for income taxes |

|

1,386 |

|

|

223 |

|

|

1,029 |

|

|

|

1,246 |

|

|

|

3,884 |

|

Total other expenses(1) |

|

135 |

|

|

112 |

|

|

(56 |

) |

|

|

(176 |

) |

|

|

15 |

|

Depreciation and amortization |

|

3,208 |

|

|

3,315 |

|

|

3,272 |

|

|

|

3,308 |

|

|

|

13,103 |

|

Share-based compensation |

|

736 |

|

|

700 |

|

|

739 |

|

|

|

766 |

|

|

|

2,941 |

|

Adjusted EBITDA |

$ |

9,819 |

|

$ |

6,532 |

|

$ |

8,743 |

|

|

$ |

11,563 |

|

|

$ |

36,657 |

|

|

|

|

|

|

|

|

|

|

|

|

Total Outstanding Term Debt as of June 30, 2024 |

|

$ |

22,383 |

|

|

|

|

|

|

|

|

|

|

|

|

Debt to Trailing Twelve Months Adjusted EBITDA |

|

|

0.61 |

|

|

|

|

|

|

|

|

|

|

|

|

(1)Includes net interest expense and non-cash periodic

post-retirement benefit cost. |

|

Core Molding Technologies, Inc.Computation

of Trailing Twelve Months Return on Capital

Employed(unaudited, in thousands) |

|

|

|

|

Q3 2023 |

|

Q4 2023 |

|

Q1 2024 |

|

Q2 2024 |

|

Trailing Twelve Months |

|

Operating Income |

$ |

5,875 |

|

$ |

2,517 |

|

$ |

4,732 |

|

$ |

7,489 |

|

$ |

20,613 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

$ |

147,503 |

|

|

Structured Debt |

|

$ |

22,383 |

|

|

Total Capital Employed |

|

$ |

169,886 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Capital Employed |

|

|

12.1 |

% |

|

Core Molding Technologies, Inc.Computation

of Trailing Twelve Months Return on Capital Employed Excluding

Cash(unaudited, in thousands) |

|

|

|

|

Q3 2023 |

|

Q4 2023 |

|

Q1 2024 |

|

Q2 2024 |

|

Trailing Twelve Months |

|

Operating Income |

$ |

5,875 |

|

$ |

2,517 |

|

$ |

4,732 |

|

$ |

7,489 |

|

$ |

20,613 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

$ |

147,503 |

|

|

Structured Debt |

|

$ |

22,383 |

|

|

Less Cash |

|

$ |

(37,787 |

) |

|

Total Capital Employed, Excluding Cash |

|

$ |

132,099 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on Capital Employed, Excluding Cash |

|

|

15.6 |

% |

|

Core Molding Technologies, Inc.Free Cash

FlowSix Months Ended

June 30, 2024 and

2023 (unaudited, in

thousands) |

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flow provided by operations |

$ |

20,943 |

|

|

$ |

18,904 |

|

|

Purchase of property, plant and equipment |

|

(4,805 |

) |

|

|

(4,511 |

) |

|

Free cash flow |

$ |

16,138 |

|

|

$ |

14,393 |

|

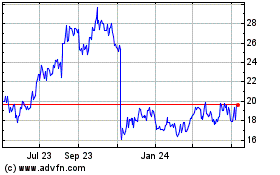

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

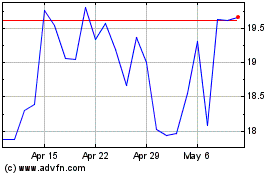

Core Molding Technologies (AMEX:CMT)

Historical Stock Chart

From Nov 2023 to Nov 2024