UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 7)*

VNET Group, Inc.

(Name of Issuer)

Class A Ordinary Shares, Par Value US$0.00001

Per Share

(Title of Class of Securities)

G91458 102**

(CUSIP Number)

Mr. Sheng Chen

Guanjie Building, Southeast 1st Floor, 10# Jiuxianqiao East Road

Chaoyang District, Beijing 100016

People’s Republic of China

Phone: (+86) 10 8456-2121

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications)

February 2, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. x

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

*This statement on Schedule 13D constitutes Amendment No.7 to the initial

Schedule 13D (the “Original Schedule 13D”) filed on April 8, 2022 on behalf of each of Mr. Sheng Chen and GenTao Capital

Limited, as amended by the Amendment No.1 filed on September 14, 2022 (the “Amendment No.1”), Amendment No.2 filed

on February 17, 2023 (the “Amendment No.2”), Amendment No.3 filed on July 12, 2023 (the “Amendment No.3”)

Amendment No.4 filed on August 1, 2023 (the “Amendment No.4”), Amendment No. 5 filed on November 16, 2023 (the “Amendment

No. 5”), and Amendment No. 6 filed on December 28, 2023 (the “Amendment No. 6”, and together with the Original

Schedule 13D, Amendment No.1, Amendment No.2, Amendment No.3, Amendment No.4, Amendment No. 5 and Amendment No. 6, the “Original

13D Filings”), with respect to ordinary shares (“Ordinary Shares”), comprising Class A ordinary shares, par

value of $0.00001 per share (“Class A Ordinary Shares”), Class B ordinary shares, par value of $0.00001 per share (“Class

B Ordinary Shares”), and Class C ordinary shares, par value of $0.00001 per share (“Class C Ordinary Shares”)

of VNET Group, Inc., a Cayman Islands company (“Issuer”).

**This CUSIP number applies to the Issuer’s American Depositary

Shares (“ADSs”), each representing six Class A Ordinary Shares of the Issuer.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF

ABOVE PERSONS (ENTITIES ONLY)

Sheng Chen |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

PF, OO , SC |

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

People’s Republic of China |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

| |

|

|

| |

|

64,811,349 (1) |

| |

8. |

SHARED VOTING POWER |

| |

|

|

| |

|

0 |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

|

64,811,349 (1) |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

| |

64,811,349 (1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

4.1% (2) (representing 17.3% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

IN |

(1) Representing (i) one Class A Ordinary Share held

by GenTao Capital Limited (“GenTao”), (ii) 19,670,117 Class B Ordinary Shares held by Fast Horse Technology

Limited (“Fast Horse”), (iii) 8,087,875 Class B Ordinary Shares held by Sunrise Corporate Holding Ltd. (“Sunrise”),

(iv) four Class A Ordinary Shares, 769,486 Class B Ordinary Shares and 60,000 Class C Ordinary Shares held by Personal

Group Limited (“Personal Group”), (iv) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s

restricted share units at his election, and (v) 34,744,206 Class A Ordinary Shares acquired by Beacon Capital Group Inc. (“Beacon”)

from the vesting of performance-based restricted share units on February 2, 2024 (these units were granted to Mr. Sheng Chen and issued

to Beacon at his direction). Mr. Sheng Chen is the sole and direct shareholder of GenTao, Fast Horse, Sunrise, Personal Group and

Beacon and may be deemed to have beneficial ownership of the shares held by them.

(2) Calculation based on 1,580,410,776 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,513,405,187 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723

outstanding Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D Ordinary

Share, par value of $0.00001 per share (“Class D Ordinary Shares”) of the Issuer, (v) 1,479,660 Class A Ordinary

Shares issuable under Mr. Sheng Chen’s restricted share units at his election, and (vi) 34,744,206 Class A Ordinary Shares acquired

by Beacon from the vesting of performance-based restricted share units on February 2, 2024 (these units were granted to Mr. Sheng Chen

and issued to Beacon at his direction), assuming conversion of all outstanding Class B Ordinary Shares and Class C Ordinary

Shares into Class A Ordinary Share. Each Class B Ordinary Share or each Class C Ordinary Share is convertible into one

Class A Ordinary Share at any time by the holder thereof. Class A Ordinary Shares are not convertible into Class B Ordinary

Shares or Class C Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes, except that the Issuer shall only proceed with certain corporate matters with the written consent

of the holders holding a majority of the issued and outstanding Class C Ordinary Shares or with the sanction of a special resolution

passed at a separate meeting of the holders of the issued and outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF

ABOVE PERSONS (ENTITIES ONLY)

GenTao Capital Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

| |

|

|

| |

|

1(1) |

| |

8. |

SHARED VOTING POWER |

| |

|

|

| |

|

0 |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

|

1(1) |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

| |

1(1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

0.0%(2) (representing 0.0% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing one Class A Ordinary Share held by GenTao.

(2) Calculation based on 1,580,410,776 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,513,405,187 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723 outstanding

Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D Ordinary Share,

(v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units at his election, and

(vi) 34,744,206 Class A Ordinary Shares acquired by Beacon from the vesting of performance-based restricted share units on February 2,

2024 (these units were granted to Mr. Sheng Chen and issued to Beacon at his direction), assuming conversion of all outstanding Class B

Ordinary Shares and Class C Ordinary Shares into Class A Ordinary Share. Each Class B Ordinary Share or each Class C

Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A Ordinary Shares are

not convertible into Class B Ordinary Shares or Class C Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes, except that the Issuer shall only proceed with certain corporate matters with the written consent

of the holders holding a majority of the issued and outstanding Class C Ordinary Shares or with the sanction of a special resolution

passed at a separate meeting of the holders of the issued and outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF

ABOVE PERSONS (ENTITIES ONLY)

Fast Horse Technology Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

| |

|

|

| |

|

19,670,117 (1) |

| |

8. |

SHARED VOTING POWER |

| |

|

|

| |

|

0 |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

|

19,670,117 (1) |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

| |

19,670,117 (1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

1.2%(2) (representing 10.6% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing 19,670,117 Class B Ordinary Shares held

by Fast Horse.

(2) Calculation based on 1,580,410,776 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,513,405,187 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723 outstanding

Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D Ordinary Share,

(v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units at his election, and (vi)

34,744,206 Class A Ordinary Shares acquired by Beacon from the vesting of performance-based restricted share units on February 2, 2024

(these units were granted to Mr. Sheng Chen and issued to Beacon at his direction), assuming conversion of all outstanding Class B

Ordinary Shares and Class C Ordinary Shares into Class A Ordinary Share. Each Class B Ordinary Share or each Class C

Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A Ordinary Shares are

not convertible into Class B Ordinary Shares or Class C Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes, except that the Issuer shall only proceed with certain corporate matters with the written consent

of the holders holding a majority of the issued and outstanding Class C Ordinary Shares or with the sanction of a special resolution

passed at a separate meeting of the holders of the issued and outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF

ABOVE PERSONS (ENTITIES ONLY)

Sunrise Corporate Holding Ltd. |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

| |

|

|

| |

|

8,087,875(1) |

| |

8. |

SHARED VOTING POWER |

| |

|

|

| |

|

0 |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

|

8,087,875(1) |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

| |

8,087,875(1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

0.5%(2) (representing 4.4% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing 8,087,875 Class B Ordinary Shares.

(2) Calculation based on 1,580,410,776 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,513,405,187 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723 outstanding

Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D Ordinary Share,

(v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units at his election, and (vi)

34,744,206 Class A Ordinary Shares acquired by Beacon from the vesting of performance-based restricted share units on February 2, 2024

(these units were granted to Mr. Sheng Chen and issued to Beacon at his direction), assuming conversion of all outstanding Class B

Ordinary Shares and Class C Ordinary Shares into Class A Ordinary Share. Each Class B Ordinary Share or each Class C

Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A Ordinary Shares are

not convertible into Class B Ordinary Shares or Class C Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote, each

Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D Ordinary

Share is entitled to 500 votes, except that the Issuer shall only proceed with certain corporate matters with the written consent of the

holders holding a majority of the issued and outstanding Class C Ordinary Shares or with the sanction of a special resolution passed

at a separate meeting of the holders of the issued and outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF

ABOVE PERSONS (ENTITIES ONLY)

Personal Group Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

| |

|

|

| |

|

829,490(1) |

| |

8. |

SHARED VOTING POWER |

| |

|

|

| |

|

0 |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

|

829,490(1) |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

| |

829,490(1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

0.1%(2) (representing 0.4% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing four Class A Ordinary Shares, 769,486 Class B

Ordinary Shares, and 60,000 Class C Ordinary Shares held by Personal Group.

(2) Calculation based on 1,580,410,776 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,513,405,187 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723 outstanding

Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D Ordinary Share,

(v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units at his election, and (vi)

34,744,206 Class A Ordinary Shares acquired by Beacon from the vesting of performance-based restricted share units on February 2, 2024

(these units were granted to Mr. Sheng Chen and issued to Beacon at his direction), assuming conversion of all outstanding Class B

Ordinary Shares and Class C Ordinary Shares into Class A Ordinary Share. Each Class B Ordinary Share or each Class C

Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A Ordinary Shares are

not convertible into Class B Ordinary Shares or Class C Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes, except that the Issuer shall only proceed with certain corporate matters with the written consent

of the holders holding a majority of the issued and outstanding Class C Ordinary Shares or with the sanction of a special resolution

passed at a separate meeting of the holders of the issued and outstanding Class C Ordinary Shares.

| 1. |

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF

ABOVE PERSONS (ENTITIES ONLY)

Beacon Capital Group Inc. |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS (see instructions)

AF, OO |

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨

|

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

British Virgin Islands |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7. |

SOLE VOTING POWER |

| |

|

|

| |

|

34,744,206 (1) |

| |

8. |

SHARED VOTING POWER |

| |

|

|

| |

|

0 |

| |

9. |

SOLE DISPOSITIVE POWER |

| |

|

|

| |

|

34,744,206 (1) |

| |

10. |

SHARED DISPOSITIVE POWER |

| |

|

|

| |

|

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

| |

|

| |

34,744,206 (1) |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions) ¨ |

| |

|

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

| |

|

| |

2.2%(2) (representing 1.9% of the total outstanding voting power (3)) |

| 14. |

TYPE OF REPORTING PERSON (see instructions) |

| |

|

| |

CO |

(1) Representing 34,744,206 Class A Ordinary Shares acquired by

Beacon.

(2) Calculation based on 1,580,410,776 outstanding Ordinary Shares

as a single class, being the sum of (i) 1,513,405,187 outstanding Class A Ordinary Shares (excluding treasury shares and Class A

Ordinary Shares in the form of ADSs that are reserved for issuance upon the exercise of share incentive awards), (ii) 30,721,723 outstanding

Class B Ordinary Shares, (iii) 60,000 outstanding Class C Ordinary Shares, (iv) no outstanding Class D Ordinary Share,

(v) 1,479,660 Class A Ordinary Shares issuable under Mr. Sheng Chen’s restricted share units at his election, and (vi)

34,744,206 Class A Ordinary Shares acquired by Beacon from the vesting of performance-based restricted share units on February 2, 2024

(these units were granted to Mr. Sheng Chen and issued to Beacon at his direction), assuming conversion of all outstanding Class B

Ordinary Shares and Class C Ordinary Shares into Class A Ordinary Share. Each Class B Ordinary Share or each Class C

Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A Ordinary Shares are

not convertible into Class B Ordinary Shares or Class C Ordinary Shares under any circumstances.

(3) Each Class A Ordinary Share is entitled to one vote,

each Class B Ordinary Share is entitled to ten votes, each Class C Ordinary Shares is entitled to one vote and each Class D

Ordinary Share is entitled to 500 votes, except that the Issuer shall only proceed with certain corporate matters with the written consent

of the holders holding a majority of the issued and outstanding Class C Ordinary Shares or with the sanction of a special resolution

passed at a separate meeting of the holders of the issued and outstanding Class C Ordinary Shares.

CUSIP No. G91458 102

Pursuant to Rule 13d-2 promulgated under the Act, this amendment to

Schedule 13D (this “Amendment No.7”) amends and supplements the Original 13D Filings. Except as specifically provided

herein, this Amendment No.7 does not modify any of the information previously reported in the Original 13D Filings. All capitalized terms

used herein which are not defined herein have the meanings given to such terms in the Original 13D Filings.

| Item 2. |

Identity and Background. |

Item 2(a) of the Original 13D Filings is amended

and restated as follows:

(a)

Each of the following is hereinafter individually

referred to as a “Reporting Person” and collectively as the “Reporting Persons”. This statement

is filed on behalf of:

This Schedule 13D is being filed jointly by the

Reporting Persons pursuant to Rule 13d-1(k) promulgated by the SEC under Section 13 of the Act. The agreement among the Reporting Persons

relating to the joint filing is attached hereto as Exhibit 99.21. Information with respect to each of the Reporting Persons is given solely

by such Reporting Person, and no Reporting Person assumes responsibility for the accuracy or completeness of the information concerning

the other Reporting Persons, except as otherwise provided in Rule 13d-1(k).

Items 2(b), (c) and (f) are supplemented as follows:

(b)

| (vi) | The principal business address of Beacon is Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British

Virgin Islands. |

(c), (f)

| (iii) | Beacon is a business company organized in the British Virgin Islands, solely engaged in holding, distributing or effecting any sale

of securities held by it. Mr. Sheng Chen wholly owns and controls all the outstanding securities of Beacon, and is the sole director of

Beacon. Beacon has no executive officer. |

| Item 3. |

Source and Amount of Funds or Other Consideration. |

Item 3 is supplemented by

adding the following:

On or around February 2, 2024, Beacon acquired

34,744,206 Class A Ordinary Shares from the vesting of an equal number of restricted share units (the “PSU”) granted

to Mr. Sheng Chen under the 2020 Share Incentive Plan of the Issuer and pursuant to an award agreement between the Issuer and Mr. Sheng

Chen. When the Class A Ordinary Shares were released to Beacon at Mr. Sheng Chen’s instruction in payment for the PSU, par value

shall be deemed paid by Mr. Sheng Chen for each PSU by past services rendered by Mr. Sheng Chen. Beacon, to which the PSU were issued,

is a company wholly owned by him.

The PSUs are subject to a number of post-vesting

conditions applicable to all grantees in the same round. Among others, at the Issuer’s request, Mr. Sheng Chen must return all Class

A Ordinary Shares acquired from the vesting of such PSU to the Issuer at no cost if there is a termination of his service due to cause

or voluntary leave (other than disability or retirement) prior to January 26, 2028 and at fair market value if there is a termination

of his service without cause, in each case, subject to the discretion of the Compensation Committee otherwise. Further, prior to February

2, 2028, Mr. Sheng Chen may not transfer, sell or otherwise dispose of any vested PSUs or any Class A Ordinary Shares that he acquires

upon the vesting of the PSUs without obtaining a written consent of the Compensation Committee. Mr. Sheng Chen has obtained a consent

from the Compensation Committee to pledge these PSUs from time to time, if any, in the future.

| Item 4. |

Purpose of Transaction. |

The information set forth

in Item 3 is hereby incorporated by reference in its entirety. Item 4 is supplemented by adding the following:

Mr. Sheng Chen acquired the Class A Ordinary Shares

as partial consideration for his continuing services to the Issuer as co-chairperson. Other Reporting Persons also hold Shares of the

Issuer. Depending on overall market conditions, performance and prospects of the Issuer, subsequent developments affecting the Issuer,

other opportunities available to the Reporting Persons and other considerations, the Reporting Persons may hold, vote, acquire or dispose

of or otherwise deal with securities (including Class A Ordinary Shares and the ADSs) of the Issuer. Any of the foregoing actions may

be effected at any time or from time to time, subject to applicable law.

Beacon previously filed a Schedule 13G on December

31, 2020 (the “Schedule 13G”) and is filing this Schedule 13D to supersede its previously filed Schedule 13G.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

The information set forth in Item 3 is hereby

incorporated by reference in its entirety.

| Item 7. |

Material to Be Filed as Exhibits. |

Item 7 is supplemented by adding the following:

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 6, 2024

| Sheng Chen |

By |

/s/ Sheng Chen |

| |

|

Sheng Chen |

| |

|

|

| GenTao Capital Limited |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| |

|

|

| Fast Horse Technology Limited |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| Sunrise Corporate Holding Ltd. |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| |

|

|

| Personal Group Limited |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

| |

|

|

| Beacon Capital Group Inc. |

By |

/s/ Sheng Chen |

| |

|

Name: Sheng Chen |

| |

|

Title: Director |

Exhibit 99.21

JOINT FILING AGREEMENT

Pursuant to and in accordance

with the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder (the “Exchange Act”),

the undersigned hereby agree to the joint filing on behalf of each of them of any filing required by such party under Section 13

of the Exchange Act or any rule or regulation thereunder (including any amendment, restatement, supplement, and/or exhibit thereto)

with respect to securities of VNET Group, Inc., a company organized under the laws of the Cayman Islands, and further agree to the

filing, furnishing, and/or incorporation by reference of this Agreement as an exhibit thereto. Each of them is responsible for the timely

filing of such filings and any amendments thereto, and for the completeness and accuracy of the information concerning such person contained

therein; but none of them is responsible for the completeness or accuracy of the information concerning the other persons making the filing,

unless such person knows or has reason to believe that such information is inaccurate. This Agreement shall remain in full force and effect

until revoked by any party hereto in a signed writing provided to each other party hereto, and then only with respect to such revoking

party. This Agreement may be executed in any number of counterparts all of which taken together shall constitute one and the same instrument.

Dated: February 6, 2024

[Signature

Page Follows]

| |

Sheng Chen |

| |

|

| |

|

| |

/s/ Sheng Chen |

| |

|

| |

|

| |

GenTao Capital Limited |

| |

|

| |

|

| |

/s/ Sheng Chen |

| |

By: Sheng Chen |

| |

Title: Authorized Signatory |

| |

|

| |

|

| |

Fast Horse Technology Limited |

| |

|

| |

|

| |

/s/ Sheng Chen |

| |

By: Sheng Chen |

| |

Title: Authorized Signatory |

| |

|

| |

|

| |

Sunrise Corporate Holding Ltd. |

| |

|

| |

|

| |

/s/ Sheng Chen |

| |

By: Sheng Chen |

| |

Title: Authorized Signatory |

| |

|

| |

|

| |

Personal Group Limited |

| |

|

| |

|

| |

/s/ Sheng Chen |

| |

By: Sheng Chen |

| |

Title: Authorized Signatory |

| |

|

| |

|

| |

Beacon Capital Group Inc. |

| |

|

| |

|

| |

/s/ Sheng Chen |

| |

By: Sheng Chen |

| |

Title: Authorized Signatory |

Signature Page to the

Joint Filing Agreement

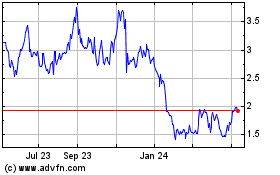

VNET (NASDAQ:VNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

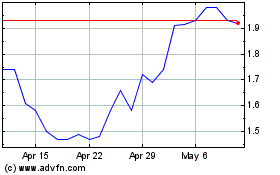

VNET (NASDAQ:VNET)

Historical Stock Chart

From Apr 2023 to Apr 2024