0001777393false00017773932024-01-072024-01-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date Earliest Event Reported): January 7, 2024

ChargePoint Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39004 | | 84-1747686 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

240 East Hacienda Avenue Campbell, CA | | 95008 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(408) 841-4500(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 | | CHPT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 10, 2024, ChargePoint Holdings, Inc. (the "Company") implemented a reorganization of its operations including a reduction of the Company's current global workforce by approximately 12% (the “Reorganization”). The Reorganization is expected to lead to approximately $14 million in restructuring charges, consisting of approximately $10 million in severance and related expenses and approximately $4 million in facility-related expenses. The Company expects to recognize these charges primarily during its fourth quarter of fiscal year 2024, with a majority of the cash expenditures occurring in the first quarter of fiscal year 2025. The Reorganization is expected to result in annual operating expense savings of approximately $33 million.

The estimates of the charges and expenditures that the Company expects to incur in connection with the Reorganization, and the timing thereof, are subject to a number of assumptions, including local law requirements in various jurisdictions, and actual amounts may differ materially from estimates. In addition, the Company may incur other charges or cash expenditures not currently contemplated due to unanticipated events that may occur, including in connection with the implementation of the Reorganization.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 7, 2024, Michael Hughes notified the Company of his intention to resign from his position as Chief Commercial and Revenue Officer, effective as of February 29, 2024. In connection with Mr. Hughes’ resignation, on January 9, 2024, Mr. Hughes, the Company and its wholly owned subsidiary, ChargePoint, Inc., entered into a Transition and Separation Agreement and General Release (the “Hughes Agreement”). Under the terms of the Hughes Agreement, Mr. Hughes will continue to provide transition services through May 1, 2024 (the “Transition Period”) and, during the Transition Period, will continue to receive payment of his base salary as in effect on his resignation date and participate in the Company’s welfare and retirement benefit plans, subject to the terms and conditions of those plans. Mr. Hughes’ equity incentive awards will remain outstanding and continue to vest in accordance with their terms during the Transition Period.

Following the conclusion of the Transition Period, Mr. Hughes’ employment with the Company will terminate and he will be eligible to receive severance benefits in accordance with the terms of his existing Severance and Change in Control Agreement, as described in the Company’s Definitive Proxy Statement, filed with the Securities and Exchange Commission (the “SEC”) on May 25, 2023, as well as reimbursement for the employer portion of monthly COBRA premiums.

Item 7.01. Regulation FD Disclosure.

On January 10, 2024, the Company issued a press release announcing the Reorganization and in connection with the Reorganization, Rick Wilmer, the Company’s Chief Executive Officer, sent a communication to the Company’s employees. A copy of the press release is attached as Exhibit 99.1 and a copy of the communication to the Company's employees is attached as Exhibit 99.2 to this Current Report on Form 8-K (this “Current Report”).

The information contained in this Item 7.01 and in the accompanying Exhibit 99.1 and Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Forward-Looking Statements

This Current Report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, including statements regarding the Reorganization, the final size of the workforce reduction, the total charges the Company expects to recognize in connection therewith and the timing of such recognition, and the total annual operating expense savings expected from the Reorganization. The Company cautions you that these forward-looking statements are subject to numerous risk and uncertainties, most of which are difficult to predict and many of which are beyond the control of the Company. Additional risks and uncertainties that could affect the Company and its financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Quarterly Report on Form 10-Q filed with the SEC on December 8, 2023, which is available on the Company’s website at investors.chargepoint.com and on the SEC’s website at www.sec.gov. All forward-looking statements in this report are based on information available to the Company as of the date hereof, and the Company assumes no obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by applicable law.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | |

| 99.1 | | |

| 99.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| CHARGEPOINT HOLDINGS, INC. |

| |

| By: | | /s/ Mansi Khetani |

| | Name: Mansi Khetani |

| | Title: Interim Chief Financial Officer |

Date: January 10, 2024

Exhibit 99.1

ChargePoint Announces Reorganization to Position Itself for Long-Term,

Sustainable Growth

Campbell, Calif. – January 10, 2024 – ChargePoint (NYSE:CHPT), a leading provider of networked charging solutions for electric vehicles (EVs), today announced a strategic reorganization designed to improve financial performance and position itself for long-term, sustainable growth. The reorganization includes an approximately 12% reduction of the ChargePoint global workforce.

The reorganization is expected to lead to approximately $14 million in restructuring charges, consisting of approximately $10 million in severance and related expenses and approximately $4 million in facility-related expenses. ChargePoint expects the action to result in annual operating expense savings of approximately $33 million. As previously announced, additional components of the strategic plan under new President and Chief Executive Officer, Rick Wilmer, will be discussed in ChargePoint’s fourth quarter of fiscal 2024 investor call expected to be held in March of this year.

“As part of a comprehensive business evaluation in my new position as CEO, today we have taken the difficult decision to reorganize our global workforce,” said Rick Wilmer, President and CEO of ChargePoint. “After a thorough review of our business strategy and product roadmap, we are heightening our focus on execution, operational excellence, and improved efficiencies while we continue with our industry-leading innovation.”

As previously announced, ChargePoint maintains a strong financial position with approximately $397 million in cash, cash equivalents and restricted cash on the Company’s balance sheet at the end of the third quarter of fiscal year 2024, with access to an additional $150 million through a revolving credit facility, which remains undrawn. The Company remains committed to its plan for achieving positive non-GAAP adjusted EBITDA in the fourth quarter of calendar year 2024.

About ChargePoint Holdings, Inc.

ChargePoint is creating a new fueling network to move people and goods on electricity. Since 2007, ChargePoint has been committed to making it easy for businesses and drivers to go electric with one of the largest EV charging networks and a comprehensive portfolio of charging solutions. The ChargePoint cloud subscription platform and software-defined charging hardware are designed to include options for every charging scenario from home and multifamily to workplace, parking, hospitality, retail and transport fleets of all types. Today, one ChargePoint account provides access to hundreds of thousands of places to charge in North America and Europe. For more information, visit the ChargePoint pressroom, the ChargePoint Investor Relations site, or contact the ChargePoint North American or European press offices or Investor Relations.

Forward-Looking Statements

This press release contains forward-looking statements that involve risks, uncertainties, and assumptions including statements regarding our ability to improve execution and operations and capitalize on efficiencies while continuing with our industry leading innovation, our ability to generate positive non-GAAP adjusted EBITDA in the fourth quarter of calendar year 2024, our ability to achieve operating expense savings as a result of the reorganization and the expected amount of such expense savings. There are a significant number of factors that could cause actual results to differ materially from the statements made in this press release, including: macroeconomic trends including changes in or sustained inflation, prolonged and sustained increases in interest rates, or other events beyond our control on the overall economy which may reduce demand for our products and services, geopolitical events and conflicts, adverse impacts to our business and those of our customers and suppliers, including due to supply chain disruptions, component shortages, and associated logistics expense increases; our limited operating history as a public company; risks associated with our quarter-end closing procedures, including management’s judgments; our ability as an organization to successfully acquire and integrate other companies, products or technologies in a successful manner; our dependence on widespread acceptance and adoption of EVs and increased demand for installation of charging stations; our current dependence on sales of charging stations for most of our revenues; overall demand for EV charging and the potential for reduced demand for EVs if governmental rebates, tax credits and other financial incentives are reduced, modified or eliminated or governmental mandates to increase the use of EVs or decrease the use of vehicles powered by fossil fuels, either directly or indirectly through mandated limits on carbon emissions, are reduced, modified or eliminated; our reliance on contract manufacturers, including those located outside the United States, may result in

supply chain interruptions, delays and expense increases which may adversely affect our sales, revenue and gross margins; our ability to expand our operations and market share in Europe; the need to attract additional fleet operators as customers; potential adverse effects on our revenue and gross margins due to delays and costs associated with new product introductions, inventory obsolescence, component shortages and related expense increases; adverse impact to our revenues and gross margins if customers increasingly claim clean energy credits and, as a result, they are no longer available to be claimed by us; the effects of competition; risks related to our dependence on our intellectual property; and the risk that our technology could have undetected defects or errors. Additional risks and uncertainties that could affect our financial results are included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on December 8, 2023, which is available on our website at investors.chargepoint.com and on the SEC’s website at www.sec.gov. Additional information will also be set forth in other filings that we make with the SEC from time to time. All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by applicable law.

CHPT-IR

ChargePoint

AJ Gosselin

Director, Corporate Communications

AJ.Gosselin@chargepoint.com

media@chargepoint.com

Patrick Hamer

Vice President, Capital Markets and Investor Relations

Patrick.Hamer@chargepoint.com

investors@chargepoint.com

Exhibit 99.2

Dear ChargePointers,

As we prepare for a new fiscal year which will see us achieve many important milestones, I write this to explain my most difficult decision since becoming our CEO. Today we are announcing an approximately 12% reduction in our global workforce. This is a duty I carry with a heavy heart. This decision was guided by my responsibility to you, our shareholders, and our Board of Directors to build a thriving - and sustainable - business with the goal of having positive adjusted EBITDA in the fourth quarter of calendar 2024.

As hard as this is, I expect this decision to be a turning point. Other changes we are making are quite exciting, but reducing our workforce is by far the most difficult and unpleasant. I want to explain the logic behind the decision, and to let you know that care and consideration were taken when making it. I want to answer the three questions which are likely top of mind for you: The first being “why?”, the second being “is this it?”, and the third being “how will we do all of the work?”.

Regarding “why”, it was balanced against our business strategy, sales forecast, product roadmap, and the work we need to get done. We have also identified improvements in efficiency that can be realized through organizational clarity combined with an operating cadence that is both well understood and well executed. Some of the impacted positions within the company relate to these changes. I fully realize these explanations may not ease the pain for those who are directly affected, but I can assure you this was evaluated thoughtfully.

To answer the question “is this it”, the answer is that there are no other current plans, and I do not expect so if we are able to hit our financial and operational targets.

Addressing our ability to get our work done, we will actively examine everything we do. We will stop doing work that doesn’t directly align with our strategy or help us serve our customers better. You will not have to absorb all the work our departing colleagues are leaving behind.

Despite this difficult decision, I remain encouraged by what I have seen in the business, our market-leading technology, and our talented team. This change may feel like it’s out of your control. What we can control is our performance, our execution, and our perspective going forward. That's what we're going to focus on. If we keep our heads up, keep moving forward, and stay positive, together we can do this. I am honored to serve you by making the goals clear, then rolling my sleeves up and doing whatever it takes to help us all win, both collectively and personally.

I look forward to speaking with you all in tomorrow’s town hall.

-Rick

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

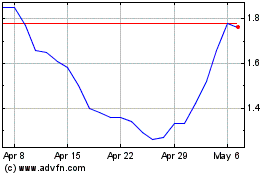

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

ChargePoint (NYSE:CHPT)

Historical Stock Chart

From Apr 2023 to Apr 2024