0001498372

--12-31

false

2022

FY

0001498372

2022-01-01

2022-12-31

0001498372

2022-12-31

0001498372

2022-06-30

0001498372

2023-07-07

0001498372

2021-12-31

0001498372

2021-01-01

2021-12-31

0001498372

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001498372

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001498372

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001498372

2020-12-31

0001498372

us-gaap:CommonStockMember

2020-12-31

0001498372

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001498372

us-gaap:RetainedEarningsMember

2020-12-31

0001498372

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001498372

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001498372

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001498372

us-gaap:CommonStockMember

2021-12-31

0001498372

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001498372

us-gaap:RetainedEarningsMember

2021-12-31

0001498372

us-gaap:CommonStockMember

2022-12-31

0001498372

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001498372

us-gaap:RetainedEarningsMember

2022-12-31

0001498372

us-gaap:ConvertibleDebtSecuritiesMember

2022-01-01

2022-12-31

0001498372

us-gaap:ConvertibleDebtSecuritiesMember

2021-01-01

2021-12-31

0001498372

us-gaap:PatentsMember

2022-12-31

0001498372

us-gaap:TrademarksMember

2022-12-31

0001498372

us-gaap:ComputerSoftwareIntangibleAssetMember

2022-12-31

0001498372

fil:WebsiteDevelopmentMember

2022-12-31

0001498372

fil:N2015ConvertibleDebenturesMember

2015-12-31

0001498372

fil:N2015ConvertibleDebenturesMember

2015-01-01

2015-12-31

0001498372

fil:N2015ConvertibleDebenturesMember

2022-12-31

0001498372

fil:N2015ConvertibleDebenturesMember

2021-12-31

0001498372

fil:N2018ConvertibleDebentureMember

2018-01-01

2018-12-31

0001498372

fil:N2018ConvertibleDebentureMember

2022-12-31

0001498372

fil:N2018ConvertibleDebentureMember

2021-12-31

xbrli:pure

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2022

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 000-56347

iWallet Corp

(Name of Small Business Issuer in its charter)

Nevada

|

| 27-1830013

|

(State of incorporation)

|

| (IRS Employer Identification No.)

|

401 Ryland St., Ste. 200A

Reno, NV

|

| 89502

|

(Address of principal executive office)

|

| (Zip Code)

|

Registrant’s telephone number, including area code: 858-610-2958

Securities registered pursuant to Section 12(b) of the Act:

Title of each class

| Trading Symbol(s)

| Name of each exchange

on which registered

|

Not applicable

| Not applicable

| Not applicable

|

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☐ No ☒

1

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

| ☐

| Accelerated filer

| ☐

|

Non-accelerated filer

| ☒

| Smaller reporting company

| ☒

|

| Emerging growth company

| ☐

|

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ☐ No ☒

On June 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $247,650, based upon the closing price on that date of the common stock of the registrant on the OTC Link alternative quotation system of $0.009. For purposes of this response, the registrant has assumed that its directors, executive officers and beneficial owners of 5% or more of its common stock are deemed to be affiliates of the registrant.

As of July 7, 2023, the Company had 52,819,419 outstanding shares of common stock.

Documents incorporated by reference: None.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which include but are not limited to, statements concerning our business strategy, plans and objectives, projected revenues, expenses, gross profit, income, and mix of revenue. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “hopes,” “estimates,” “should,” “may,” “will,” “with a view to” and variations of these words or similar expressions are intended to identify forward-looking statements. These statements do not guarantee future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements.

Item 1. Business

Overview

iWallet Corporation (the “Company” or “iWallet”) was incorporated on November 18, 2009, in the State of California as “Queensridge Mining Resources, Inc.” On or about July 21, 2014, iWallet Corporation, a private California corporation, merged with and into our wholly owned Nevada subsidiary, iWallet Acquisition Corp., and iWallet Acquisition Corp. then immediately merged with and into the Company, with the Company immediately changing its name to “iWallet Corporation.”

The Company is currently focused on designing and developing biometric locking wallets and related physical, personal security products, and providing consulting services in connection with protective wallets and other personal security products.

The Company’s fiscal year end is December 31, its telephone number is (858) 610-2958, and the address of its principal executive office is 401 Ryland St., Ste. 200A, Reno, Nevada.

The Company was previously a public company required to file reports with the United States Securities and Exchange Commission (the “SEC”) as a result of effectiveness of prior registration statements we filed with the SEC in 2010 and 2014, but our reporting obligations were automatically suspended as a result of having less than 300 shareholders of record, and we subsequently filed a Form 15 (a Notice of the suspension of our duty to file reports under the Securities Exchange Act) and discontinued reporting in 2016.

Description of Business

We are a designer and developer of innovative, physical, personal security products that incorporate security and communication technologies to protect against identity, personal and financial information theft. iWallet is a registered trademark in the United States. Our prior designs include a biometric locking luxury storage case, made from carbon fiber or aluminum, that protects cash, credit cards and personal information with a proprietary fingerprint security system from being read by many types of RF devices in public spaces, and a soft leather wallet that incorporates a GPS module allowing the customer to locate the wallet if misplaced. Using a free mobile application, the wallets were designed to allow owners to tether their wallets to a supported mobile smart device. A proximity alarm could then be configured to sound on the mobile device synced with our high-end version of the wallet when the wallet is separated by about five meters.

We are based in San Diego, California, and the iWallet business was originally founded in 2009. The initial version of the iWallet generated sales of over $700,000 in the first eighteen months following its launch. Established sales channels include Neiman Marcus in North America, Harrods in England, Highline Peak Group in Canada, and NeedItWantItGadgets in New Zealand. Our prospective sales channels include Dufry, Touch of Modern, Skymall, Travelsmith, Hammacher Schlemmer, and co-branding for Montblanc, Porsche Design, Ducati, Gucci, and Bugatti. We own the trademark “iWallet” for secure luxury storage cases connected to smartphones in the USA and have patents worldwide. We were previously licensed by Apple Inc. as an official Accessory Developer. That license is currently lapsed due to our current redesign of our product line and incorporation of updated technologies into our product line, but we anticipate being licensed as an official Accessory Developer

3

again within the next 12 months, subject to completion of our product redesign during that time period. We also currently provide consulting services to other companies in the industry.

We are currently improving our designs and seeking manufacturers to launch our products back into the market, and we are not currently engaged in any product sales. We are currently redesigning the original iWallet with current technology as follows:

a.Add facial recognition vs. the original fingerprint scanner in the original iWallet design.

b.Add GPS tracking vs. the original alarm going off when the iWallet was separated from the linked mobile device.

c.Use flexible case material vs. the original hard case to house wallet electronics.

d.Add ability to download credit card numbers to its built-in memory vs. the original non capability.

This new technology is currently being designed to be implemented with various portable containers like wallets, passport holders and hand bags. We are in the initial stages of product redesign, and we are currently conducting tests with electronic components from different suppliers to see which ones work more efficiently. Once we know which ones work to our satisfaction, we plan to make 3D prototypes to show to our consulting customers that already have relationships with for their feedback and approval. Due to the revamping of our line of products, we have discontinued manufacturing the original iWallet since we consider the prior iWallet technology outdated.

The Company is currently working with engineers regularly to reach the aforementioned four technology feature milestones described above, and the Company is also meeting regularly with potential clients that show interest in this new technology and might be willing to either purchase product or designs, including gauging interest in potential white (private) labeling for large name brands like Dunhill with which we have relationships.

We have accumulated a database of customers through tradeshows like the Consumer Electronics Show-CES, where iWallet won an innovation award that created a substantial interest in our products throughout many industries like automotive (General Motors, Mercedes Benz, Porsche each approached us previously), which could potentially sell iWallet products in their gift shops situated at their dealerships; duty-free shops situated at national borders, as well as in-flight catalogs, stores in cruise ships, etc. We also plan for our future products to be distributed through luggage retailers and manufacturers like we have in the past with Heys Luggage.

We anticipate that we will be ready to launch our redesigned products with updated technological features within the next 12 months, although the timeline may be delayed due to the continuing effects of the COVID-19 pandemic and the worldwide shortage in electronic components, resulting in part from Chinese supply chain interruptions and China’s continuing COVID-19 lockdowns. Accordingly, our projected product launch timeline is subject to normalization of the current computer chip and related component supply situation. We believe that with prototypes in hand, we will be able to secure purchase orders from small and large businesses and go into production, subject to electronic component availability, within the next year.

Products and Technology

We are redesigning our original product, which will be marketed as the “iWallet 2.0,” to have the following features:

·Sleek, compact industrial design with carbon fiber case

·Pairs with the owner’s cellular phone via bluetooth technology

·Patented, exclusive tamper resistant locking mechanism utilizes innovative fingerprint biometric reader for unlocking

·Unique latch control that only consumes power during latching hence providing extended battery life

·RFID blocking capability for enhanced wireless protection

·Speaker providing audible feedback

·GPS tracking capabilities

4

We also intend to bring the following additional products to market:

·Leather wallets with a GPS module built-in

·Storage devices with co-branding luxury partners

·A secure passport case called the iPassport

·A secure mobile personal safe to store pharmaceuticals in

·A smart “padlock” with a biometric reader for gym lockers and other personal areas that require security

We hold over twenty patents and patent applications filed in various countries around the world. Our products are manufactured under contract by a manufacturer based in Zhuhai, China, Apollo Electronics. The suppliers for our raw materials have been Future Electronics, Namiki Motors, Cotech Taiwan, Digital Persona, Avnet Electronics, Avnet Taiwan, and Apollo Electronics. Historically, our largest major customer has been Neiman Marcus, which was the source of approximately 60% of our gross revenues from our most recent product sales several years ago. We have not had any product sales for several years as we have been focused on updating our designs to use more cost-effective technologies and materials, and sourcing and updating our suppliers, tooling, and molds. We have now updated our designs and distribution plan, and we expect to relaunch product sales during 2023, and expand our distribution efforts. As we expand our sales and distribution channels, we expect that our customer base will diversify and that, in the future, our revenues will not be dependent upon one or a few major customers.

Services Offered

We are currently providing project management services to companies interested in the research, development (such as feasibility study, source codes, gerber files, apps, etc.), manufacturing (molds, PCB boards, etc.), materials (such as carbon fiber, fiber glass, aluminum, leather, polycarbonate, etc.), complex supply chain logistics, complex product cycle, and marketing (sales channels established throughout years of iWallet’s worldwide business relationships with high end brands, luxury department stores and duty free shops at worldwide airports, border crossings and cruise ships) of what we call “smart containers,” which are high-tech personal portable containers (such as wallets, purses, handbags and passport holders) that utilize the latest technologies in terms of GPS recovery for lost or stolen containers that can be tracked via an app on the owner’s smartphone or tablet; facial recognition and other biometrics such as fingerprint readers, voice recognition or remote opening through an app, in order to access its contents; various encrypted credit card numbers downloaded to the container that can be displayed on a LED/LCD screen to choose form of payment (Visa/MasterCard/American Express/Discover) at a touch of a button and pay the retailer with its NFC capability (the advantage of our system is that it is “off-the-grid” meaning that there is no third party carrier-such as the cellular phone carrier-that can be hacked into to steal personal information).

We consider ourselves to be at the forefront of the industry with the expertise, knowledge, resources and commitment to perform beyond our clients’ expectations with expertise in the field of portable containers that we dub “Techcessories,” and our commitment is to get their products out in the market as soon as possible to manage efficiently their product’s life cycles and replace their aging products with updated technology. We also plan to offer all of the aforementioned processes to companies on a partnership basis, whereby we would reduce the prices we charge to our customers (which reduction would reflect a portion of our cost of development, manufacturing, inventory and marketing) in exchange for being paid commissions by the customers in the future from new product sales or potentially receiving partial ownership in their new product offerings in the future, in order to provide a more affordable option to the client. We do not yet have any customers engaged on this basis, nor are we dependent on this structure.

Market and Competition Overview

Our primary target demographic is consumers who are in the market for high-end luxury storage cases and similar accessories. We do not believe that the $200+ approximate retail price to the customer for many of our planned products will be an obstacle for our initial target demographic.

We have previously competed with luxury brands such as Cartier, Salvatore Ferragamo, Louis Vuitton, and Gucci, all of which are better capitalized than we are, as well as the following smaller niche competitors (and product offerings):

5

·Ekster: Parliament Wallet - integrated RFID blocking technology. GPS tracking available as an addon.

·Nomad: Slim Wallet - provides GPS tracking in an inconspicuous fashion so thieves are not aware of the tracking capability.

·Zitahli: Mens Wallet with RFID Front for Men - includes RFID security technology.

We believe the security, high technology, slim design, and carbon fiber or leather construction of our anticipated storage device products can position the Company to compete for a share of the luxury secure accessories market.

Sales, Distribution and Growth Strategy

Our current sales strategy is focused on developing and introducing a new flexible wallet made out of leather instead of carbon fiber in order to be more competitive from a pricing standpoint with traditional leather containers and wallets.

We plan to private label our product designs for well-established global brands that we already have a business relationship with (described below) through our first and second generation wallets, unlike our competitors that only promote their brands.

As funds permit, we plan to attend domestic consumer electronics trade shows, personal accessories trade shows, vacation trade shows, and luggage related trade shows to promote our line of unique products that we call “Techcessories.” The Company has been working with Global Marketing Strategies in order to explore creative strategies, advertising concepts, consumer opinions, existing distribution and sales channels to determine the best path for sales and distribution of the Company’s product and services offerings.

Our established distribution channels for the original iWallet products include the following, which we believe will be available for the Company’s future product offerings.

·Neiman Marcus in North America

·Harrods in England

Employees

We have no employees except for our CEO, Steven Cabouli.

Environmental Laws

We have not incurred and do not anticipate incurring any expenses associated with environmental laws.

Item 1A. Risk Factors.

As a smaller reporting company as defined by Rule 12b2 of the Securities Exchange Act of 1934, the Company is not required to provide the information under this item.

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties.

The Company does not currently lease or own any real property.

Item 3. Legal Proceedings.

From time to time, we may be involved in litigation relating to claims arising out of our operations in the normal course of business. As of December 31, 2022, there were no pending or threatened lawsuits that could reasonably be expected to have a material effect on the Company’s results of operations.

6

Item 4. Mine Safety Disclosures

None.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

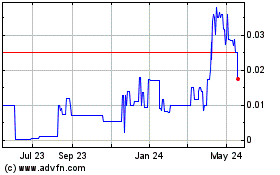

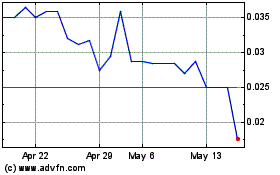

The Company’s common stock is not listed on any national securities exchange, the Company’s common stock are quoted for trading on the “OTC Pink” tier of the over-the-counter alternative trading system operated by OTC Markets Group, Inc. (OTC Link ATS) under the symbol “IWAL.”

The following table summarizes the high and low historic trading prices of the Company’s common stock for the periods indicated as reported by otcmarkets.com (as historic high and low bid prices are not reported by otcmarkets.com).

Fiscal Year Ended December 31, 2022

|

| High

|

| Low

|

First Quarter

|

| $

| 0.0490

|

| $

| 0.0040

|

Second Quarter

|

| $

| 0.0180

|

| $

| 0.0090

|

Third Quarter

|

| $

| 0.0200

|

| $

| 0.0080

|

Fourth Quarter

|

| $

| 0.0150

|

| $

| 0.0010

|

Fiscal Year Ended December 31, 2021

|

| High

|

| Low

|

First Quarter

|

| $

| 0.0474

|

| $

| 0.0010

|

Second Quarter

|

| $

| 0.0399

|

| $

| 0.0010

|

Third Quarter

|

| $

| 0.1103

|

| $

| 0.0091

|

Fourth Quarter

|

| $

| 0.0358

|

| $

| 0.0141

|

Holders of our common stock are entitled to receive dividends as may be declared by the Board of Directors. The Company’s Board of Directors is not restricted from paying any dividends but is not obligated to declare a dividend. No cash dividends have ever been declared and it is not anticipated that cash dividends will ever be paid.

As of December 31, 2022, the Company had authorized 75,000,000 shares of common stock, and no shares of preferred stock authorized. As of December 31, 2022, the Company had 52,819,419 outstanding shares of common stock which were owned by approximately 52 shareholders of record.

Common Stock

At any meeting of the shareholders, every shareholder of common stock is entitled to vote and may vote in person or by proxy authorized by an instrument in writing filed in accordance with the procedure established for the meeting.

Each shareholder shall have one vote for every share of stock entitled to vote, which is registered in his name on the record date for the meeting, except as otherwise required by law or the Articles of Incorporation.

All elections of directors shall be determined by a plurality of the votes cast by the holders of shares entitled to vote in the election of directors at a meeting of shareholders at which a quorum is present. Except as otherwise required by law or the Articles of Incorporation, all matters other than the election of directors shall be determined by the affirmative vote of the holders of a majority of the shares entitled to vote on that matter and represented in person or by proxy at a meeting of shareholders at which a quorum is present.

The Company’s Articles of Incorporation do not provide for cumulative voting or preemptive rights.

Dividend Rights. Holders of common stock are entitled to receive ratably those dividends, if any, as may be declared from time to time by the board of directors out of legally available funds.

7

Liquidation Rights. In the event of our liquidation, dissolution or winding up, holders of common stock will be entitled to share ratably in the net assets legally available for distribution to shareholders after the payment of all of our debts and other liabilities.

Other Rights. Holders of common stock have no preemptive, conversion or subscription rights, and there are no redemption or sinking fund provisions, nor are there any restrictions on alienability, applicable to the common stock.

Preferred Stock

Our Articles of Incorporation do not authorize the issuance of any preferred stock.

Convertible Instruments

The following is a description of the material terms of our convertible instruments which remain outstanding as of December 31, 2022:

In fiscal 2015, the Company issued two tranches, one in April and one in September, of secured convertible debentures with identical terms and maturity dates (together, “the Debentures”) for gross proceeds of $492,500. The Company incurred $39,400 in broker’s commissions resulting in net proceeds of $453,100. The Debentures bear interest at a rate of 8% per annum, with interest payments due semi-annually. The Debentures originally matured on April 30, 2017, and became immediately due and payable at the request of the holders. Subsequently, the holders agreed to extend the maturity date in the Debentures to April 30, 2022. The Company is currently negotiating with the note holders to extend the notes, which is expected to be completed during the 3rd quarter of 2023. The Debentures are convertible at any time, in whole, to shares of common stock at a conversion price of $0.15 per share. At December 31, 2022 and 2021, the accrued interest on the Debentures was $402,848 and $333,762, respectively.

On August 13, 2018, the Company entered into a secured convertible debenture agreement (the “Convertible Debenture”) with a service provider amounting to $12,000. The Convertible Debenture bears interest at 10% per annum calculated monthly and payable on maturity and had a maturity date of August 13, 2021. The Convertible Debenture became immediately due and payable in default at the request of the holder, although the holder has not made any request for immediate payment. The Convertible Debenture is currently in default, and the Company is currently working with the holder on extending the due date of the Convertible Debenture, which is expected to be completed during the 3rd quarter of 2023. The conversion price is $0.06 per share. At December 31, 2022 and 2021, the accrued interest was $5,264 and $4,064, respectively.

Warrants

The following is a schedule of the Company’s outstanding common stock purchase warrants:

| Warrants

|

| Exercise Price

|

Outstanding and exercisable, December 31, 2020

| 650,000

|

| $

| 0.10

|

Expired

| (650,000)

|

| $

| 0.10

|

Outstanding and exercisable, December 31, 2021

| -

|

| $

| -

|

Expired

| -

|

| $

| -

|

Outstanding and exercisable, December 31, 2022

| -

|

| $

| -

|

Item 6. Selected Financial Data

Not applicable.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The statements contained in the following MD&A and elsewhere throughout this Annual Report on Form 10-K, including any documents incorporated by reference, that are not historical facts, including statements about our beliefs and expectations, are “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements preceded by, followed by or that

8

include the words “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “intend” and similar words or expressions. In addition, any statements that refer to expectations, projections, or other characterizations of future events or circumstances are forward-looking statements.

These forward-looking statements, which reflect our management’s beliefs, objectives, and expectations as of the date hereof, are based on the best judgement of our management. All forward-looking statements speak only as of the date on which they are made. Such forward-looking statements are subject to certain risks, uncertainties and assumptions relating to factors that could cause actual results to differ materially from those anticipated in such statements, including, without limitation, the following: economic, social and political conditions, global economic downturns resulting from extraordinary events such as the COVID-19 pandemic and other securities industry risks; interest rate risks; liquidity risks; credit risk with clients and counterparties; risk of liability for errors in clearing functions; systemic risk; systems failures, delays and capacity constraints; network security risks; competition; reliance on external service providers; new laws and regulations affecting our business; net capital requirements; extensive regulation, regulatory uncertainties and legal matters; failure to maintain relationships with employees, customers, business partners or governmental entities; the inability to achieve synergies or to implement integration plans and other consequences associated with risks and uncertainties detailed in our filings with the SEC, including our most recent filings on Forms 10 and 10-Q.

We caution that the foregoing list of factors is not exclusive, and new factors may emerge, or changes to the foregoing factors may occur, that could impact our business. We undertake no obligation to publicly update or revise these statements, whether as a result of new information, future events or otherwise, except to the extent required by the federal securities laws.

Certain information contained in this discussion and elsewhere in this report may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and is subject to the safe harbor created by that act. The safe harbor created by the Private Securities Litigation Reform Act will not apply to certain “forward looking statements” because we issued “penny stock” (as defined in Section 3(a)(51) of the Securities Exchange Act of 1934 and Rule 3(a)(51-1) under the Exchange Act) during the three year period preceding the date(s) on which those forward looking statements were first made, except to the extent otherwise specifically provided by rule, regulation or order of the Securities and Exchange Commission. We caution readers that certain important factors may affect our actual results and could cause such results to differ materially from any forward-looking statements which may be deemed to have been made in this Report or which are otherwise made by or on our behalf. For this purpose, any statements contained in this report that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,” “explore,” “consider,” “anticipate,” “intend,” “could,” “estimate,” “plan,” or “propose” or the negative variations of those words or comparable terminology are intended to identify forward-looking statements. Factors that may affect our results include, but are not limited to, the risks and uncertainties associated with:

·Our ability to raise capital necessary to sustain our anticipated operations and implement our business plan,

·Our ability to implement our business plan,

·Our ability to generate sufficient cash to survive,

·The degree and nature of our competition,

·The lack of diversification of our business plan,

·The general volatility of the capital markets and the establishment of a market for our shares, and

·Disruption in the economic and financial conditions primarily from the impact of past terrorist attacks in the United States, threats of future attacks, police and military activities overseas and other disruptive worldwide political and economic events and environmental weather conditions.

We are also subject to other risks detailed from time to time in our other filings with Securities and Exchange Commission and elsewhere in this report. Any one or more of these uncertainties, risks and other influences could materially affect our results of operations and whether forward-looking statements made by us ultimately prove to be accurate. Our actual results, performance and achievements could differ materially from those expressed or implied in these forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether from new information, future events or otherwise.

9

Plan of Operation

The Company is currently focused on designing and developing biometric locking wallets and related physical, personal security products, and providing consulting services in connection with protective wallets and other personal security products.

Results of Operations

For the year ended December 31, 2022, compared to the period ended December 31, 2021

Revenues

We had $10,050 and $69,400 of revenue for the years ended December 31, 2022 and 2021, respectively.

Cost of Sales

We had $0 and $27,450 of cost of sales for the years ended December 31, 2022 and 2021, respectively. For the years ended December 31, 2022 and 2021, as a percentage of revenue, it was 0.0% and 39.6%, respectively.

Operating Expenses

Operating expenses for the years ended December 31, 2022 and 2021, were $46,495 and $245,731, respectively. The decrease in expenses for 2022 compared to 2021 was comprised primarily of no stock-based compensation during 2022 as compared to $212,500 in the prior year.

Other Income (Expenses)

Other expenses for the years ended December 31, 2022 and 2021, were $70,285 and $143,045, respectively. The loss on settlement of accounts payable of $78,050 during 2021 was the difference between the years ended December 31, 2022 and 2021.

Net Loss

Net loss for the years ended December 31, 2022 and 2021 was $106,730 and $346,826, respectively, due to the aforementioned factors.

Liquidity and Capital Resources

We had a cash balance of $13,049 and negative working capital of $908,544 at December 31, 2022.

The Company’s anticipated capital requirements for the next 12 months will consist of expenses of being a public company and general and administrative expenses all of which we currently estimate will cost $250,000, excluding revenue related expenses and salaries. In the event there are unanticipated expenses and we need additional funds, we may seek to raise additional funding that we require in the form of equity financing from the sale of our common stock. However, we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund such additional expenses. We currently do not have any agreements, arrangements or understandings with any person or entity to obtain funds through bank loans, lines of credit or any other sources.

Sources and Uses of Cash

Operating activities during the period ended December 31, 2022 used $36,609 of net cash. Net cash used in investing activities was $0 for the period ended December 31, 2022. Net cash provided by financing activities was $0 for the period ended December 31, 2022. Operating activities during the year ended December 31, 2021 provided $37,668 of net cash. Net cash used in investing activities was $0 for the year ended December 31, 2021. Net cash provided by financing activities was $0 for the year ended December 31, 2021.

The Company has been impacted by the COVID-19 pandemic, and some of its earlier plans to further diversify its operations and expand its operating subsidiaries have been paused due to the economic uncertainty.

10

Off Balance Sheet Arrangements

We have no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues, or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Critical Accounting Policies

The preparation of financial statements and related disclosures in conformity with U.S. generally accepted accounting principles (“GAAP”) and the Company’s discussion and analysis of its financial condition and operating results require the Company’s management to make judgments, assumptions and estimates that affect the amounts reported in its financial statements and accompanying notes. Note 2, “Significant Accounting Policies,” of the Notes to Financial Statements for the years ended December 31, 2022 and 2021 included in this Form 10-K, describes the significant accounting policies and methods used in the preparation of the Company’s financial statements. Management bases its estimates on historical experience and on various other assumptions it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities. Actual results may differ from these estimates, and such differences may be material.

Critical accounting estimates are those estimates made in accordance with GAAP that involve a significant level of estimation uncertainty and have had or are reasonably likely to have a material impact on the financial condition or results of operations of the Company. Management believes the Company’s critical accounting policies and estimates are those related to revenue recognition, intangible assets, and income taxes. Management considers these policies critical because they are both important to the portrayal of the Company’s financial condition and operating results, and they require management to make judgments and estimates about inherently uncertain matters. The Company’s management has reviewed these critical accounting policies and related disclosures.

Revenue Recognition

The Company plans to derive revenue primarily from the sale of its wallets. The Company also will derive an insignificant amount of revenue from providing engraving of the wallets. Engraving revenues will be recognized concurrent with the revenues for the related wallet. The Company also will earn revenue from consulting contracts with others desiring to operate in the smart wallet sector. Revenue is recognized in accordance with ASC 606. The Company performs the following five steps: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract, and (v) recognize revenue when (or as) the entity satisfies a performance obligation. The Company applies the five-step model to arrangements that meet the definition of a contract under Topic 606, including when it is probable that the entity will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer. At contract inception, once the contract is determined to be within the scope of Topic 606, the Company evaluates the goods or services promised within each contract related performance obligation and assesses whether each promised good or service is distinct. The Company recognizes as revenue, the amount of the transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied.

Intangible Assets

Patents and trademarks are measured at cost. Legal fees associated with patents and trademarks, which are expected to be issued, are recorded as patents and trademarks on the balance sheets. Upon approval by the relevant patent office, the patents and trademarks are amortized over their respective expected lives. Patent and trademark costs associated with patents or trademarks which are not approved or are abandoned, are expensed in the period in which such patents are not approved.

The Company expects to maintain patents for up to 20 years from the effective date and the trademark registrations for as long as the trademarks remain in use and the required filings are made to keep them in use. However, based on the Company’s assessment of potential innovation or other competing technological developments a useful life of ten years has been assessed for both the patents and the trademarks.

11

Software consists of costs relating to the development of the software behind the biometric scanning and the other security programs involved in the wallets. Costs relating to the development of this software are capitalized and amortized over its estimated useful life of ten years.

Website development costs relating to website and mobile application and software development are also capitalized and amortized over its estimated useful life of three years.

Topic 350-20, Goodwill, and 350-30, General Intangibles Other than Goodwill, in the Accounting Standards Codification (“ASC”) requires intangible assets with a finite life be tested for impairment whenever events or circumstances indicate that the carrying amount of an asset (or asset group) may not be recoverable. An impairment loss would be recognized when the carrying amount of an asset exceeds the estimated discounted cash flow used in determining the fair value of the asset.

Income Taxes

Income taxes are computed in accordance with the provisions of ASC Topic 740, which requires, among other things, a liability approach to calculating deferred income taxes. The Company recognizes deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in its financial statements or tax returns. Under this method, deferred tax liabilities and assets are determined based on the difference between the financial statement carrying amounts and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. The Company is required to make certain estimates and judgments about the application of tax law, the expected resolution of uncertain tax positions and other matters. In the event that uncertain tax positions are resolved for amounts different than the Company’s estimates, or the related statutes of limitations expire without the assessment of additional income taxes, the Company will be required to adjust the amounts of the related assets and liabilities in the period in which such events occur. Such adjustments may have a material impact on the Company’s income tax provision and results of operations.

Recently Issued Accounting Pronouncements

We do not expect the adoption of any recently issued accounting pronouncements to have a significant impact on our net results of operations, financial position, or cash flows.

Seasonality

We do not expect our sales to be impacted by seasonal demands for our products and services.

Item 7A. Quantitative and Qualitative Disclosure about Market Risk

Not applicable.

Item 8. Financial Statements

iWallet Corp.

Contents

12

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Pinnacle Accountancy Group of Utah

(a dba of Heaton & Company, PLLC)

Farmington, Utah

Opinion on the Financial Statements

We have audited the accompanying balance sheets of iWallet Corporation (the Company) as of December 31, 2022 and 2021, and the related statements of operations, changes in stockholders’ deficit, and cash flows for the years then ended, and the related notes (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Going Concern Considerations

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. The Company has suffered recurring losses since inception and has not achieved profitable operations, which raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matter

The critical audit matter communicated below is a matter arising from the current period audit of the financial statements that was communicated or required to be communicated to the audit committee and that: (1) relates to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the financial statements, taken as a whole, and we are not, by communicating the critical audit matter below, providing a separate opinion on the critical audit matter or on the accounts or disclosures to which it relates.

F-1

Going Concern - Disclosure

The financial statements of the Company are prepared on a going concern basis, which assumes that the Company will continue in operation for the foreseeable future and, accordingly, will be able to realize its assets and discharge its liabilities in the normal course of operations. As noted in “Going Concern Considerations” above, the Company has a history of recurring net losses, a significant accumulated deficit and currently has net working capital deficit. The Company has contractual obligations, such as commitments for repayments of interest payable, due to related party, and convertible debentures (collectively “obligations”). Currently, management’s forecasts and related assumptions illustrate their intent to meet the obligations through management of expenditures, resumption of its planned business operations, obtaining additional debt financing, and issuance of capital stock for additional funding to meet its operating needs. Should there be constraints on the ability to resume its planned business operations or access financing through stock issuances, the Company will continue to manage cash outflows and meet the obligations through debt financing.

We identified management’s assessment of the Company’s ability to continue as a going concern as a critical audit matter. Management made judgments to assess the Company’s intent and ability to effectively implement its plans and provide the necessary cash flows to fund the Company’s obligations as they become due. Specifically, the judgments with the highest degree of impact and subjectivity in assessing the Company’s intent and ability to effectively implement its plans include its ability to manage expenditures, access funding from the capital market, obtain debt financing, and successfully resume its planned business operations. Auditing the judgments made by management required a high degree of auditor judgment and an increased extent of audit effort.

Addressing the matter involved performing procedures and evaluating audit evidence in connection with forming our overall opinion on the financial statements. These procedures included the following, among others: evaluating the Company’s intent and ability to (i) access funding from the capital market; (ii) manage expenditures (iii) obtain debt financing, and (iv) resume its planned business operations.

/s/ Pinnacle Accountancy Group of Utah

We have served as the Company’s auditor since 2021.

Pinnacle Accountancy Group of Utah

(a dba of Heaton & Company, PLLC)

PCAOB ID 6117

Farmington, Utah

July 7, 2023

F-2

iWallet Corp.

Balance Sheets

| December 31, 2022

|

| December 31, 2021

|

Assets

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

Cash

| $

| 13,049

|

| $

| 49,658

|

Total Current Assets

|

| 13,049

|

|

| 49,658

|

|

|

|

|

|

|

Total Assets

| $

| 13,049

|

| $

| 49,658

|

|

|

|

|

|

|

Liabilities and Stockholders’ Deficit

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

Account Payable

| $

| 7,332

|

| $

| 4,499

|

Accrued Interest Payable

|

| 408,112

|

|

| 337,826

|

Due to Related Party

|

| 1,649

|

|

| 4,647

|

Convertible Debentures

|

| 504,500

|

|

| 504,500

|

Total Current Liabilities

|

| 921,593

|

|

| 851,472

|

|

|

|

|

|

|

Total Liabilities

|

| 921,593

|

|

| 851,472

|

|

|

|

|

|

|

Stockholders’ Deficit

|

|

|

|

|

|

Common stock; par value $0.001, 75,000,000

shares authorized; 52,819,419 shares issued

and outstanding

|

| 52,819

|

|

| 52,819

|

Additional Paid-in Capital

|

| 4,252,563

|

|

| 4,252,563

|

Accumulated Deficit

|

| (5,213,926)

|

|

| (5,107,196)

|

Total Stockholders’ Deficit

|

| (908,544)

|

|

| (801,814)

|

Total Liabilities and Stockholders’ Deficit

| $

| 13,049

|

| $

| 49,658

|

The accompanying notes are an integral part of these audited financial statements.

F-3

iWallet Corp.

Statements of Operations

| For the Years Ended

December 31,

|

| 2022

|

| 2021

|

Revenues

| $

| 10,050

|

| $

| 69,400

|

Cost of Sales

|

| -

|

|

| 27,450

|

Gross Profit

|

| 10,050

|

|

| 41,950

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

General and Administrative Expenses

|

| 46,495

|

|

| 245,731

|

Total Operating Expenses

|

| 46,495

|

|

| 245,731

|

Operating Loss

|

| (36,445)

|

|

| (203,781)

|

|

|

|

|

|

|

Other Income (Expense)

|

|

|

|

|

|

Loss on Settlement of Accounts Payable

|

| -

|

|

| (78,050)

|

Interest Expense

|

| (70,285)

|

|

| (64,995)

|

Total Other Income (Expense)

|

| (70,285)

|

|

| (143,045)

|

Net Loss

| $

| (106,730)

|

| $

| (346,826)

|

|

|

|

|

|

|

Basic and Diluted Earnings per Share

| $

| (0.00)

|

| $

| (0.01)

|

|

|

|

|

|

|

Weighted Average Common Shares - Basic and Diluted

|

| 52,819,419

|

|

| 43,908,460

|

The accompanying notes are an integral part of these audited financial statements.

F-4

iWallet Corp.

Statement of Changes in Stockholders’ Deficit

Years Ended December 31, 2022 and 2021

| Common Shares

|

|

|

|

|

|

|

| Shares

|

| Amount

|

| Additional

Paid-in

Capital

|

| Accumulated

Deficit

|

| Total

Stockholders’

Deficit

|

Balance at December 31, 2020

| 37,819,419

|

| $

| 37,819

|

| $

| 3,952,563

|

| $

| (4,760,370)

|

| $

| (769,988)

|

Issuance of Common Stock for Settlement of Debt

| 2,500,000

|

|

| 2,500

|

|

| 100,000

|

|

| -

|

|

| 102,500

|

Issuance of Common Stock for Services

| 12,500,000

|

|

| 12,500

|

|

| 200,000

|

|

| -

|

|

| 212,500

|

Net Loss for the Year

| -

|

|

| -

|

|

| -

|

|

| (346,826)

|

|

| (346,826)

|

Balance at December 31, 2021

| 52,819,419

|

|

| 52,819

|

|

| 4,252,563

|

|

| (5,107,196)

|

|

| (801,814)

|

Net Loss for the Year

| -

|

|

| -

|

|

| -

|

|

| (106,730)

|

|

| (106,730)

|

Balance at December 31, 2022

| 52,819,419

|

| $

| 52,819

|

| $

| 4,252,563

|

| $

| (5,213,926)

|

| $

| (908,544)

|

The accompanying notes are an integral part of these audited financial statements.

F-5

iWallet Corp.

Statements of Cash Flows

| For the Years Ended

December 31,

|

| 2022

|

| 2021

|

Cash Flows from Operating Activities:

|

|

|

|

|

|

Net Loss for the Year

| $

| (106,730)

|

| $

| (346,826)

|

Adjustments to Reconcile Net Loss to Net Cash Used in Operating Activities

|

|

|

|

|

|

Stock Issued for Services

|

| -

|

|

| 212,500

|

Loss on Settlement of Accounts Payable

|

| -

|

|

| 78,050

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Changes in Accounts Payable

|

| 2,833

|

|

| 28,949

|

Changes in Due to Related Party

|

| (2,998)

|

|

| -

|

Changes in Accrued Interest Payable

|

| 70,286

|

|

| 64,995

|

Net Cash Provided by (Used in) Operating Activities

|

| (36,609)

|

|

| 37,668

|

|

|

|

|

|

|

Cash Flows from Investing Activities:

|

|

|

|

|

|

Net Cash Provided by Investing Activities

|

| -

|

|

| -

|

|

|

|

|

|

|

Cash Flows from Financing Activities:

|

|

|

|

|

|

Net Cash Provided by Financing Activities

|

| -

|

|

| -

|

|

|

|

|

|

|

Net Increase in Cash

|

| (36,609)

|

|

| 37,668

|

Cash at Beginning of Year

|

| 49,658

|

|

| 11,990

|

Cash at End of Year

| $

| 13,049

|

| $

| 49,658

|

|

|

|

|

|

|

Supplemental Disclosure Information:

|

|

|

|

|

|

Interest Paid in Cash

| $

| -

|

| $

| -

|

Income Taxes paid in Cash

| $

| -

|

| $

| -

|

|

|

|

|

|

|

Schedule of Non-Cash Investing and Financing Activities:

|

|

|

|

|

|

Accounts payable settled via the issuance of common stock

| $

| -

|

| $

| 24,450

|

The accompanying notes are an integral part of these audited financial statements.

F-6

iWallet Corp.

Notes to Financial Statements

December 31, 2022 and 2021

1. Nature of Business and Going Concern

iWallet Corp (“the Company”) has been engaged in the design, development, manufacturing and sales of bio-metric locking wallets, which operate by scanning a user’s fingerprint to open the wallet.

iWallet Corporation (“iWallet”) was incorporated on November 18, 2009 in the State of California and is located at 7394 Trade Street, San Diego, California 92121. On July 21, 2014 the Company merged with iWallet Acquisition Corporation (the “Acquisition Sub”) (“the Merger”), a subsidiary formed by Queensridge Mining Resources, Inc. (“Queensridge”) for purposes of the Merger, which resulted in the Company becoming a wholly-owned subsidiary of Queensridge. Immediately following the merger, the Acquisition Sub merged with and into Queensridge. Queensridge immediately changed its name to iWallet Corp and is continuing the business of iWallet as its only line of business.

The Company began trading on July 21, 2014 on the OTCQB Exchange under the ticker symbol IWAL. The Company’s functional currency is the U.S. Dollar.

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (‘U.S. GAAP’), which contemplates continuation of the Company as a going concern.

As of December 31, 2022 and 2021, the Company had a deficit of $5,213,926 and $5,107,196, respectively, and had significant losses and negative cash flows from operations for the year ended December 31, 2022. The Company completed a public listing transaction, which raised additional funds and included warrant agreements that expired in 2021. However, there is no certainty that the Company will be successful in generating sufficient cash flow from operations or achieving and maintaining profitable operations in the near future to enable it to meet its obligations as they come due. As a result, there is substantial doubt regarding the Company’s ability to continue as a going concern. The future of the Company is dependent upon its ability to obtain financing and upon achieving profitable operations.

Management has raised additional capital through private placement offerings and has plans to raise funds through public offering of its capital stock. While the Company has been successful in securing such financing in the past, there is no assurance that it will be able to do so in the future. Accordingly, these financial statements do not give effect to adjustments, relating to the recoverability and classification of recorded assets, or the amounts of and classifications of liabilities that might be necessary in the event the Company cannot continue in existence.

These financial statements do not include any adjustments relating to the recoverability and classification of the recorded asset amounts or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

2. Significant Accounting Policies

Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expense during the reporting period. Actual results could differ from those estimates. Significant estimates include amounts for useful lives of patents, trademarks, software and website development costs (note 4).

Intangible assets

Patents and trademarks are measured at cost. Legal fees associated with patents and trademarks, which are expected to be issued, are recorded as patents and trademarks on the balance sheets. Upon approval by the relevant patent office, the patents and trademarks are amortized over their respective expected lives. Patent and trademark costs associated with patents or trademarks which are not approved or are abandoned, are expensed in the period in which such patents are not approved.

F-7

The Company expects to maintain patents for up to 20 years from the effective date and the trademark registrations for as long as the trademarks remain in use and the required filings are made to keep them in use. However, based on the Company’s assessment of potential innovation or other competing technological developments a useful life of ten years has been assessed for both the patents and the trademarks.

Software consists of costs relating to the development of the software behind the biometric scanning and the other security programs involved in the wallets. Costs relating to the development of this software are capitalized and amortized over its estimated useful life of ten years.

Website development costs relating to website and mobile application and software development are also capitalized and amortized over its estimated useful life of three years.

Topic 350-20, Goodwill, and 350-30, General Intangibles Other than Goodwill, in the Accounting Standards Codification (“ASC”) requires intangible assets with a finite life be tested for impairment whenever events or circumstances indicate that the carrying amount of an asset (or asset group) may not be recoverable. An impairment loss would be recognized when the carrying amount of an asset exceeds the estimated discounted cash flow used in determining the fair value of the asset.

Fair value of financial instruments

ASC Topic 820 defines fair value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. Included in the ASC Topic 820 framework is a three level valuation inputs hierarchy with Level 1 being inputs and transactions that can be effectively fully observed by market participants spanning to Level 3 where estimates are unobservable by market participants outside of the Company and must be estimated using assumptions developed by the Company. The Company discloses the lowest level input significant to each category of asset or liability valued within the scope of ASC Topic 820 and the valuation method as exchange, income or use. The Company uses inputs which are as observable as possible and the methods most applicable to the specific situation of each company or valued item.

The carrying amounts of cash, accounts payable, accrued liabilities, due to related party, and convertible debentures approximate fair value because of their short-term nature.

Revenue recognition

The Company plans to derive revenue primarily from the sale of its wallets. The Company also will derive an insignificant amount of revenue from providing engraving of the wallets. Engraving revenues will be recognized concurrent with the revenues for the related wallet. The Company also will earn revenue from consulting contracts with others desiring to operate in the smart wallet sector.

Revenue is recognized in accordance with ASC 606. The Company performs the following five steps: (i) identify the contract(s) with a customer, (ii) identify the performance obligations in the contract, (iii) determine the transaction price, (iv) allocate the transaction price to the performance obligations in the contract, and (v) recognize revenue when (or as) the entity satisfies a performance obligation. The Company applies the five-step model to arrangements that meet the definition of a contract under ASC 606, Revenue from Contracts with Customers, including when it is probable that the entity will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer. At contract inception, once the contract is determined to be within the scope of ASC 606, the Company evaluates the goods or services promised within each contract related performance obligation and assesses whether each promised good or service is distinct. The Company recognizes as revenue, the amount of the transaction price that is allocated to the respective performance obligation when (or as) the performance obligation is satisfied.

The Company earned $10,050 and $69,400 in consulting revenue during the years ended December 31, 2022 and 2021, respectively, along with cost of sales of $0 and $27,450, respectively, from outside services providing technology for our consulting services.

F-8

Concentrations of credit risk

The Company’s cash balances are maintained in bank accounts in the United States. Deposits held in banks in the United States are insured up to $250,000 per depositor for each bank by the Federal Deposit Insurance Corporation. Actual balances at times may exceed these limits.

Loss per share of common stock

Loss per common share (basic and diluted) is computed by dividing the net loss by the weighted average number of shares of common stock outstanding during the period. Common stock equivalents are excluded from the computation of diluted loss per share when their effect is anti-dilutive. Diluted loss per share and the weighted average number of shares of common stock exclude 6,256,720 and 5,776,146 potentially convertible debenture shares (note 6) for the years ended December 31, 2022 and 2021, respectively, since their effect is anti-dilutive.

Income taxes

Income taxes are computed in accordance with the provisions of ASC 740, Income Taxes, which requires, among other things, a liability approach to calculating deferred income taxes. The Company recognizes deferred tax liabilities and assets for the expected future tax consequences of events that have been recognized in its financial statements or tax returns. Under this method, deferred tax liabilities and assets are determined based on the difference between the financial statement carrying amounts and tax bases of assets and liabilities using enacted tax rates in effect in the years in which the differences are expected to reverse. The Company is required to make certain estimates and judgments about the application of tax law, the expected resolution of uncertain tax positions and other matters. In the event that uncertain tax positions are resolved for amounts different than the Company’s estimates, or the related statutes of limitations expire without the assessment of additional income taxes, the Company will be required to adjust the amounts of the related assets and liabilities in the period in which such events occur. Such adjustments may have a material impact on the Company’s income tax provision and results of operations.

3. Recently Issued Accounting Standards and Recently Adopted Accounting Pronouncement

Management does not believe that any recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the accompanying financial statements.

4. Intangible Assets

| December 31, 2022 and 2021

|

| Cost

|

| Accumulated

Amortization

|

| Net

Book Value

|

Patents

| $

| 78,619

|

| $

| 78,619

|

| $

| -

|

Trademarks

|

| 16,909

|

|

| 16,909

|

|

| -

|

Software

|

| 51,680

|

|

| 51,680

|

|

| -

|

Website Development

|

| 16,000

|

|

| 16,000

|

|

| -

|

| $

| 163,208

|

| $

| 163,208

|

| $

| -

|

Amortization for the years ended December 31, 2022 and 2021 was $0 and $0 respectively.

5. Related Party Transactions and Balances

| December 31, 2022

|

| December 31, 2021

|

Current Liabilities

|

|

|

|

|

|

Due to Related Party

| $

| 1,649

|

| $

| 4,647

|

The above balances are non-interest bearing, unsecured and due on demand. The related party is affiliated by virtue of common ownership.

F-9

6. Convertible Debentures

In fiscal 2015, the Company issued two tranches, one in April and one in September, of secured convertible debentures with identical terms and maturity dates (together, “the Debentures”) for gross proceeds of $492,500. The Company incurred $39,400 in broker’s commissions resulting in net proceeds of $453,100. The Debentures bear interest at a rate of 8% per annum, with interest payments due semi-annually. The Debentures matured originally on April 30, 2017. On July 13, 2021, the Company re-negotiated these debentures and extended the maturity date to April 30, 2022. The Company is currently negotiating with the note holders to extend the notes, which is expected to be completed during the 3rd quarter of 2023. The Debentures are convertible at any time, in whole, to shares of common stock at a conversion price of $0.15 per share. At December 31, 2022 and 2021, the accrued interest was $402,848 and $333,762, respectively.

The conversion feature was determined to be an embedded derivative; however, since the instrument is a conventional convertible debenture the conversion feature was not bifurcated. Additionally, the conversion feature was determined not to be beneficial in both tranches as the fair value of the Company’s share price at the date of issuance was less than the conversion price. Accordingly, no proceeds were allocated to the value of the conversion feature on initial recognition.

As previously noted, the Company has adopted ASU 2015-03 “Imputation of Interest” and as a result has recognized the convertible debentures net of the related issuance costs of $39,400. These costs were realized using an effective interest rate of 13.06%, for the April tranche and 13.83% for the September tranche. Imputed interest expense has been fully recognized prior to the years ended December 31, 2022 and 2021.

On August 13, 2018, the Company entered into a secured convertible debenture agreement (the “convertible debenture”) with a service provider amounting to $12,000. The convertible debentures bear interest at 10% per annum calculated monthly and payable on maturity and had a maturity date of August 13, 2021. The debentures become immediately due and payable in default at the request of the note holders. The Company is currently negotiating with the note holders to extend the notes, which is expected to be completed during the 3rd quarter of 2023. The conversion price is $0.06 per share. At December 31, 2022 and 2021, the accrued interest was $5,264 and $4,064, respectively.

7. Share Capital

The Company is authorized to issue 75,000,000 shares of Common Stock with a par value of $0.001 and had 52,819,419 shares of Common Stock issued and outstanding as of December 31, 2022 and 2021.

On June 30, 2021, the Company issued 2,500,000 shares of Common Stock to a vendor for settlement of $24,450 in accounts payable. The stock price was $0.041 for a total value of $102,500 and the Company recognized a loss on settlement of accounts payable of $78,050.

On August 12, 2021, the Company issued 12,500,000 shares of Common Stock to its CEO for services rendered to the Company. The stock price was $0.017 for a total value of $212,500 and the Company recognized an expense of $212,500.

8. Warrants

The following is a continuity schedule of the Company’s common stock purchase warrants:

| Warrants

|

| Exercise Price

|

Outstanding and exercisable, December 31, 2020

| 650,000

|

| $

| 0.10

|

Expired

| (650,000)

|

| $

| 0.10

|

Outstanding and exercisable, December 31, 2021

| -

|

| $

| -

|

Expired

| -

|

| $

| -

|

Outstanding and exercisable, December 31, 2022

| -

|

| $

| -

|

F-10

9. Income Taxes

Components of loss before income taxes consists of the following:

| 2022

|

| 2021

|

U.S.

| $

| (106,730)

|

| $

| (346,826)

|

The provision (recovery) for income taxes consists of the following:

| 2022

|

| 2021

|

Current

|

|

|

|

|

|

Federal

| $

| -

|

| $

| -

|

State

|

| -

|

|

| -

|

|

| -

|

|

| -

|

Deferred

| $

| -

|

| $

| -

|

The reconciliation of the provision (recovery) for income taxes based on the combined U.S. statutory federal and state tax rate of 26.75% (Federal - 21%; State - 5.75%, net of Federal benefit) to the effective tax rates:

| 2022

|

| 2021

|

Net loss before recovery of income taxes

| $

| (106,730)

|

| $

| (346,826)

|

Statutory rate

|

| 26.75%

|

|

| 26.75%

|

Expected income tax recovery

| $

| (28,550)

|

| $

| (92,776)

|

Change in valuation allowance

|

| 28,550

|

|

| 92,776

|

Recovery of income taxes

| $

| -

|

| $

| -

|

The components of deferred taxes are as follows:

| 2022

|

| 2021

|

Deferred tax assets

|

|

|

|

|

|

Net operating losses

| $

| 1,394,725

|

| $

| 1,366,175

|

Valuation allowance

|

| (1,394,725)

|

|

| (1,366,175)

|

| $

| -

|

| $

| -

|

The Company has non-capital income tax losses that will begin to expire in 2033 through 2040.