UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF FOREIGN PRIVATE

ISSUER PURSUANT TO RULE 13a-16

OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

| For the month of July, 2023 |

Commission File Number 000-56261 |

Glass House Brands Inc.

(Translation of registrant’s name into

English)

3645 Long Beach Blvd.

Long

Beach, California 90807

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨

Form 40-F x

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

Glass House Brands Inc. |

| |

|

| Date: July 5, 2023 |

/s/ Kyle Kazan |

| |

By: Kyle Kazan |

| |

Title: Chief Executive Officer |

EXHIBIT INDEX

Exhibit 99.1

FORM 51-102F3

MATERIAL CHANGE REPORT

| Item 1. |

Name and Address of Corporation |

Glass House Brands Inc. ("Glass House"

or the "Company")

3645 Long Beach Boulevard

Long Beach, California 90807

| Item 2. |

Date of Material Change |

June 23, 2023.

The news release disclosing the material change

was disseminated by the Company on June 28, 2023

through GlobeNewswire and is available on SEDAR (www.sedar.com) under the Company's issuer profile.

| Item 4. |

Summary of Material Change |

At the annual general and special meeting (the

"Meeting") of shareholders of the Company held on June 23, 2023, the shareholders passed a special resolution to

extend the "sunset" date for the Company's multiple voting shares (the "Multiple Voting Shares") from June

29, 2024 until June 29, 2027.

| Item 5. |

Full Description of Material Change |

| |

5.1 |

Full Description of Material Change |

On June 29, 2021, the Company (then known as Mercer Park

Brand Acquisition Corp.) and GH Group, Inc. completed a qualifying transaction under the rules of NEO Exchange Inc. (the

"Business Combination") that resulted in (a) the reverse take-over of the Company by the securityholders of GH

Group, Inc., (b) the Company changing its name to "Glass House Brands Inc." and (c) the Company

reorganizing its capital structure by creating multiple classes of shares, including restricted voting shares, limited voting

shares, subordinate voting shares and Multiple Voting Shares. The Multiple Voting Shares were issued to the founders of the Company

at the time of the Business Combination with the intention of giving the founders the opportunity to build the business of the

Company while the applicable U.S. legal regime developed at a state and federal level.

Initially, the articles of the Company provided that the Multiple

Voting Shares would automatically be redeemed on June 29, 2024, three years from the date of their initial issuance.

At the Meeting, shareholders of the Company approved, in accordance

with applicable laws, an amendment to the articles of the Company such that the Multiple Voting Shares would automatically be redeemed

on the sixth anniversary of the initial issuance of the Multiple Voting Shares, or June 29, 2027 (the "Amendment").

The Amendment did not otherwise affect the terms of the Multiple Voting Shares or the Company's other authorized capital.

Disclosure Required by MI 61-101

The Amendment may be a "related party transaction" under

paragraph (h) of the definition of "related party

transaction" in Multilateral Instrument 61-101 – Protection of Minority Security

Holders in Special Transactions ("MI 61-101") since the Amendment consists of amending the terms of the Multiple

Voting Shares, which is a security of the Company a majority of which is beneficially owned or over which control is exercised, directly

or indirectly, by the Founders (as defined below), each being a "related party" (as such term is defined in MI 61-101) of the

Company. The following supplementary information is provided in accordance with Section 5.2 of MI 61-101.

| |

a) |

A description of the transaction and its material terms: |

At the Meeting, shareholders of the Company passed a special resolution

to extend the "sunset" date for the Multiple Voting Shares from June 29, 2024 until June 29, 2027. The Multiple Voting

shares are held by the founders of the Company and entitle the founders to 50 votes per Multiple Voting Share on matters brought before

the shareholders of the Company. As of the record date for the Meeting, the Multiple Voting Shares represented approximately 80.5% of

the voting rights attached to outstanding voting securities of the Company.

| b) | The purpose and business reasons for the transaction: |

The Amendment will allow the founders of the Company to continue

to pursue their vision for the Company as the applicable legal and regulatory regime evolves. For more information on the reasons

for the Amendment, please see the Company's management information circular related to the Meeting, which was filed on SEDAR on

May 24, 2023.

| c) | The anticipated effect of the transaction on Glass House's

business and affairs: |

The Amendment will allow the Company to preserve its existing

share structure until June 29, 2027, by delaying the automatic redemption of the Multiple Voting Shares, and will not otherwise

affect the terms of the Multiple Voting Shares or the Company's other authorized capital. See also See "The purpose and

business reasons for the transaction" above.

| i. | The interest in the transaction of every interested party

and of the related parties and associated entities of the interested parties: |

Each of Mr. Kyle Kazan, Mr. Graham Farrar,

Ms. Jocelyn Rosenwald, Mr. Jamie Rosenwald and Mr. Kris Hulgreen (each, a "Founder") may be an "

interested party" (within the meaning of MI 61-101) with respect to the Amendment. The Founders are the only holders of the

Multiple Voting Shares.

| ii. | The anticipated effect of the transaction on the percentage

of securities of Glass House, or of an affiliated entity of Glass House, beneficially owned or controlled by each person referred to

in subparagraph (i) for which there would be a material change in that percentage: |

Not applicable.

| e) | A discussion of the review and approval process adopted by

the board of directors and the special committee, if any, of Glass House for the transaction, including a discussion of any materially

contrary view or abstention by a director and any material disagreement between the board and the special committee: |

Having undertaken a thorough review of, and carefully considered the

Amendment, including consulting with legal counsel, the directors of the Company who do not beneficially own any Multiple Voting Shares

(a) unanimously concluded that the Amendment is in the best interest of the Company, and (b) unanimously recommended that the board

of directors approve the Amendment and recommend that the shareholders vote in favour of the Amendment at the Meeting.

| f) | A summary in accordance with section 6.5 of MI 61-101, of

the formal valuation, if any, obtained for the transaction, unless the formal valuation is included in its entirety in the material change

report or will be included in its entirety in another disclosure document for the transaction: |

Not applicable.

| g) | Disclosure, in accordance with section 6.8 of MI 61-101,

of every prior valuation in respect of the issuer that relates to the subject matter of or is otherwise relevant to the transaction |

| i. | That has been made in the 24 months before the date of the

material change report: |

Not applicable.

| ii. | The existence of which is known, after reasonable enquiry

to Glass House or to any director or officer of Glass House: |

Not applicable.

| h) | The general nature and material terms of any agreement entered

into by Glass House, or a related party of Glass House, with an interested party or a joint actor with an interested party, in connection

with the transaction: |

Not applicable.

| i) | Disclosure of the formal valuation and minority approval

exemptions, if any, on which Glass House is relying under sections 5.5 and 5.7 of MI 61-101 respectively, and the facts supporting reliance

on the exemptions: |

No exemptions were relied upon.

The Amendment is not subject to the formal valuation requirements

of Section 5.4 of MI 61-101 as it is not a transaction described in paragraphs (a) through (g) of the definition of

"related party transaction" in MI 61-101.

The Company obtained "minority approval" (as defined in

MI 61-101) of the Amendment.

Section 5.2(2) of MI 61-101

The Company did not file a material change report 21 days before

the Meeting, because the decision to implement the Amendment was subject to the prior approval of the shareholders of the Company at

the Meeting.

| |

5.2 |

Disclosure of Restructuring Transactions |

Not applicable.

| Item 6. |

Reliance on Subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7. |

Omitted Information |

Not applicable.

| Item 8. |

Executive Officer |

Benjamin Vega

General Counsel and Corporate Secretary

Tel: (562) 264-5078

July 4, 2023

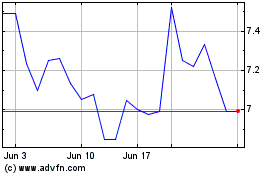

Glass House Brands (QX) (USOTC:GLASF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Glass House Brands (QX) (USOTC:GLASF)

Historical Stock Chart

From Apr 2023 to Apr 2024