Current Report Filing (8-k)

May 12 2021 - 4:13PM

Edgar (US Regulatory)

0000091767false00000917672021-05-102021-05-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 10, 2021

SONOCO PRODUCTS COMPANY

Commission File No. 001-11261

|

|

|

|

|

|

|

|

|

|

|

Incorporated under the laws

|

|

I.R.S. Employer Identification

|

|

of South Carolina

|

|

No. 57-0248420

|

1 N. Second St.

Hartsville, South Carolina 29550

Telephone: 843/383-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

No par value common stock

|

SON

|

New York Stock Exchange, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On May 10, 2021, Sonoco Products Company (the "Company") entered into an accelerated share repurchase agreement (the "ASR Agreement") with Wells Fargo Bank, N.A. (the "Bank") to repurchase approximately $150 million of its common stock with available cash on hand.

The Company is repurchasing shares of its common stock as part of its $350 million share repurchase program previously announced in its quarterly report on Form 10-Q filed on May 4, 2021.

Pursuant to the terms of the ASR Agreement, the Company will pay the Bank $150 million in exchange for an initial delivery of approximately 1.75 million shares. The final number of shares to be repurchased will be based on the Company's volume-weighted average share price during the repurchase period, less a discount and subject to adjustments. At final settlement, under certain circumstances, the Bank may be required to deliver to the Company additional shares of the Company's common stock or the Company may be required to deliver to the Bank additional shares of the Company's common stock (or, at the Company's election, to make a cash payment to the Bank). The final settlement is expected to occur no later than the third quarter of 2021.

The description of the ASR Agreement contained herein is qualified in its entirety by reference to the ASR Agreement that is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information in Item 1.01 is incorporated herein by reference.

Item 8.01 Other Events.

On May 11, 2021, the Company issued a press release announcing its entry into the ASR Agreement. A copy of this press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit

|

|

|

|

No.

|

|

Description of Exhibits

|

|

|

|

|

|

10.1

|

*

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* Certain portions of this exhibit have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K. The Company agrees to furnish supplementally an unredacted copy of the exhibit to the Securities and Exchange Commission upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SONOCO PRODUCTS COMPANY

|

|

|

|

|

|

|

Date: May 12, 2021

|

|

|

|

By:

|

|

/s/ Julie C. Albrecht

|

|

|

|

|

|

|

|

Julie C. Albrecht

|

|

|

|

|

|

|

|

Vice President and Chief Financial Officer

|

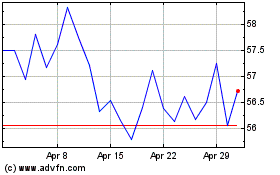

Sonoco Products (NYSE:SON)

Historical Stock Chart

From Aug 2024 to Sep 2024

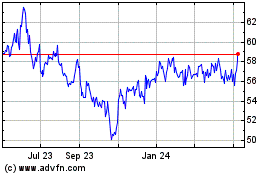

Sonoco Products (NYSE:SON)

Historical Stock Chart

From Sep 2023 to Sep 2024