SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2018

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

The securities mentioned herein will not be or have not been registered under the Securities

Act

of 1933 and may not be offered or sold in the

United States

absent registration or an applicable exemption from registration requirements.

AMBEV S.A.

CNPJ/MF [National Corporate Taxpayers Register of the Ministry of Finance] No. 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

MANAGEMENT PROPOSAL

GENERAL MEETING OF DEBENTURE HOLDERS OF THE FIRST (1

st

) ISSUE OF DEBENTURES, NOT CONVERTIBLE INTO SHARES, IN SINGLE SERIES, UNSECURED, FOR PUBLIC DISTRIBUTION, WITH RESTRICTED PLACEMENT EFFORTS, OF AMBEV S.A.

AMBEV S.A.

CNPJ/MF [National Corporate Taxpayers Register of the Ministry of Finance] No. 07.526.557/0001-00

NIRE [Corporate Registration Identification Number] 35.300.368.941

(“

Company

”)

To the Debenture Holders,

We hereby present the following Management Proposal regarding the matters set forth in the agenda for the General Meeting of the Debenture Holders of the First (1

st

) Issue of Debentures, Not Convertible into Shares, in Single Series, Unsecured, for Public Distribution, with Restricted Placement Efforts, of the Company (“

GMDH

”, “

Issue

” and “

Debentures

”, respectively), to be held, on first call, on December 17, 2018, at 11:00 AM, at the Company’s headquarters (“

Proposal

”):

1.

Amend the investment projects that will benefit from the net proceeds resulting from the Issue described in Annex I of the Deed of Issue.

We propose that Annex I to the “

Private Instrument of Deed of First (1

st

) Issue of Debentures, Not Convertible into Shares, in Single Series, Unsecured, for Public Distribution, with Restricted Placement Efforts, of Ambev S.A.

”, entered into on September 9, 2015 by Ambev S.A. (“

Issuer

”) and Simplific Pavarini Distribuidora de Títulos e Valores Mobiliários Ltda., in the capacity of trustee (“

Trustee

”), and amended on October 29, 2015 (“

Deed of Issue

”) be entirely replaced by the document attached hereto as

Exhibit A

.

2.

Authorize the Trustee to execute with the Issuer an amendment to the Deed of Issue, as well as to take any necessary measures to comply with the resolutions taken in the GMDH.

In case the matter referred to in item 1 above is approved, we propose that the Trustee be authorized to execute with the Company an amendment to the Deed of Issue, as well as to take any necessary measures to comply with the resolutions taken in the GMDH.

This Proposal may be supplemented and/or modified by the Company’s management up to the GMDH, if necessary. Any changes in the conditions of the Debentures will depend on the approval of the Debenture Holders, at the GMDH.

This Proposal will be available at the Company’s headquarters and at the Trustee’s headquarters, as well as on the websites of the Brazilian Securities and Exchange Commission (CVM), B3 SA - Brasil, Bolsa, Balcão and the Company’s investor relations department (

ri.ambev.com.br

).

AMBEV S.A.

EXHIBIT A

PROPOSAL – Annex I to the Private Instrument of Deed of First (1

st

) Issue of Debentures, Not Convertible into Shares, in Single Series, Unsecured, for Public Distribution, with Restricted Placement Efforts, of Ambev S.A.

“

EXHIBIT I – INVESTMENT PROJECTS AND SIMPLIFIED PROCEDURE

A. General Information

Under the terms of article 1 of Law 12,431, the net resources obtained by the Company with the gain shall be exclusively allocated in the Investment Projects described below (including reimbursements, pursuant to Law 12,431).

B. Information on Each Investment Project

|

Investment Project 1

|

Itapissuma-PE

|

|

Purpose of the Project

|

Expansion of the new Itapissuma-PE plant to produce special beers (including Budweiser and Stella Artois), Skol Senses and alcohol.

Scope:

- One Long Neck bottle line with capacity for 60,000 bottles per hour (350 ml), with additional capacity in the packaging line equal to 116,000 hl / month;

- New beer production process area to add 64,000 hl / m to the current plant capacity;

- New alcohol grinding plant that will add 50,000 hl / m to serve beverages with added alcohol, such as Skol Senses.

|

|

Date of commencement or estimated date to commence the Investment Project, as the case may be

|

January 1

st

, 2015

|

|

Current phase of the Investment Project

|

97%

|

|

Date of conclusion or estimated term to conclude the Investment Project, as the case may be

|

June 30, 2019

|

|

Estimated volume of financial resources necessary to implement the Investment Project

|

R$426,623,347.99

|

|

Amount of the Debentures intended to the Investment Project

|

R$331,472,389.28

|

|

Estimated percentage to be gained with the issue of Debentures, in view of the needs of financial resources of the Investment Project

|

78

%

|

|

Allocation of resources to be gained by means of Debentures

|

33%

|

***

|

Investment Project 2

|

Starck C2C - Rio de Janeiro

|

|

Purpose of the Project

|

To meet the growing demand for aluminum bottle sales through the verticalization of production, with the installation of a new plant in the city of Rio de Janeiro, to produce C2C aluminum bottles in two sizes: 11.5 ounces and 16 ounces.

|

|

Date of commencement or estimated date to commence the Investment Project, as the case may be

|

June 1

st

, 2015

|

|

Current phase of the Investment Project

|

100%

|

|

Date of conclusion or estimated term to conclude the Investment Project, as the case may be

|

December 31, 2018

|

|

Estimated volume of financial resources necessary to implement the Investment Project

|

R$115,817,928.68

|

|

Amount of the Debentures intended to the Investment Project

|

R$72,427,417.49

|

|

Estimated percentage to be gained with the issue of Debentures, in view of the needs of financial resources of the Investment Project

|

63%

|

|

Allocation of resources to be gained by means of Debentures

|

7%

|

***

|

Investment Project 3

|

Ponta Grossa

|

|

Purpose of the Project

|

Greenfield project that involves the construction of a plant comprising a line of bottles (300ml and 600ml) and a line of cans (269ml, 350ml, 473ml and 550ml) as well as the entire infrastructure (earth, water and effluents treatment sub-station, warehouses for logistics and processing etc.) necessary for the full operation of the plant.

|

|

Date of commencement or estimated date to commence the Investment Project, as the case may be

|

January 1

st

, 2014

|

|

Current phase of the Investment Project

|

99%

|

|

Date of conclusion or estimated term to conclude the Investment Project, as the case may be

|

April 30, 2019

|

|

Estimated volume of financial resources necessary to implement the Investment Project

|

R$875,306,638.21

|

|

Amount of the Debentures intended to the Investment Project

|

R$430,626,288.72

|

|

Estimated percentage to be gained with the issue of Debentures, in view of the needs of financial resources of the Investment Project

|

49%

|

|

Allocation of resources to be gained by means of Debentures

|

43%

|

***

|

Investment Project 4

|

Piraí

|

|

Purpose of the Project

|

Investment (i) in new line of beer cans in aluminum cans; and (ii) the adequacy of beer container lines in aluminum cans and long neck glass bottles, to increase the company's packing capacity of beers. Investment in a desalcoholization plant and in all the necessary infrastructure for such process, with a view to the production of Skol Beats.

|

|

Date of commencement or estimated date to commence the Investment Project, as the case may be

|

June 1

st

, 2015

|

|

Current phase of the Investment Project

|

100%

|

|

Date of conclusion or estimated term to conclude the Investment Project, as the case may be

|

December 31, 2018

|

|

Estimated volume of financial resources necessary to implement the Investment Project

|

R$284,893,774.73

|

|

Amount of the Debentures intended to the Investment Project

|

R$165,473,904.51

|

|

Estimated percentage to be gained with the issue of Debentures, in view of the needs of financial resources of the Investment Project

|

58%

|

|

Allocation of resources to be gained by means of Debentures

|

17%”

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 3, 2018

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/

Fernando Mommensohn Tennenbaum

|

|

|

Fernando Mommensohn Tennenbaum

Chief Financial and Investor Relations Officer

|

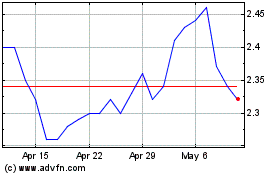

Ambev (NYSE:ABEV)

Historical Stock Chart

From Aug 2024 to Sep 2024

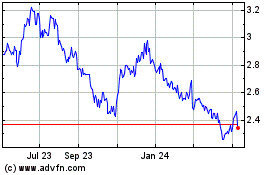

Ambev (NYSE:ABEV)

Historical Stock Chart

From Sep 2023 to Sep 2024