Goldman Sachs Reports Surprise Profit Increase -- Update

July 18 2017 - 8:27AM

Dow Jones News

By Liz Hoffman

Goldman Sachs Group Inc. reported a surprise increase in

second-quarter profit despite tough conditions in its core trading

businesses.

The Wall Street firm reported earnings of $3.95 a share.

Analysts had expected $3.39, on average, down from $3.72 a year

ago. Revenue of $7.89 billion fell from $7.93 billion in the second

quarter of last year, and beat analyst expectations of $7.52

billion.

Rivals including J.P. Morgan Chase & Co. and Citigroup Inc.

reported declines in trading businesses last week, and Bank of

America Corp. followed Tuesday morning. Those banks offset trading

slumps with gains in other businesses such as commercial

lending.

Goldman's boon came from a segment it calls "Investing and

Lending," which isn't a distinct operating unit but rather

encompasses loans and equity investments that Goldman makes in

various parts of its business. Revenue increased 42%

year-over-year, mostly from higher valuations for Goldman's stakes

in private companies, many of them technology startups.

For all Goldman's changes since the financial crisis, the firm

run by Chief Executive Lloyd Blankfein is still heavily dependent

on arranging big, complex trades and deals for corporate and

institutional clients. Demand for those services has flagged as

placid markets have churned higher and companies have delayed some

deals, awaiting signs from Washington on tax and regulatory

reform.

Banks rely on idiosyncratic events like the U.K.'s Brexit vote

or the U.S. presidential election to spur trading. There have been

fewer of those kind of events so far this year.

Goldman reported a 17% decrease in trading revenues, the

steepest of any big bank to report second-quarter earnings yet.

Trading revenue fell 14% at J.P. Morgan, 9% at Bank of America and

7% at Citigroup.

Revenue from trading bonds and other fixed-income products

dropped 40%. That business stumbled badly in the first quarter and

has generally struggled to find its footing as volatility remains

low and credit spreads -- the gap between bids and offers where

banks make their money -- have narrowed.

The story was better in equities, which posted its best quarter

in two years. Revenues of $1.89 billion jumped 17% from a year

ago.

Goldman was once the stock-trading king of Wall Street -- it

virtually invented the large institutional "block trade" in the

1960s -- but lost the crown to Morgan Stanley in 2014 and has

fallen further behind since.

Executives say the firm has invested in technology that will

take time to bear fruit, like the 2015 purchase of a Swedish firm

that specializes in ultrafast exchange hookups.

Investment-banking, the business of arranging mergers and

helping companies raise money, reported a 3% decline in revenue

from a year ago. Goldman has leaned hard on that unit in recent

years, though there are signs that it also may be slowing. A record

deal boom in 2015 and 2016 is cooling, and some companies have been

postponing deals as they wait to see if the Trump administration

can achieve promised tax and regulatory changes.

Goldman's return on equity, a key measure of how profitably it

invests shareholders' money, stood at 8.7% in the quarter. Goldman

is one of few banks that has reliably exceeded 10% -- a level

typically demanded by investors -- since the crisis.

Shares of Goldman fell 0.6% to $227.82 in premarket trading. The

stock, before Tuesday, had fallen 4% this year after surging more

than 30% following the election.

Write to Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

July 18, 2017 08:12 ET (12:12 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

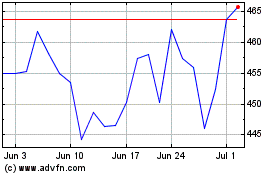

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Aug 2024 to Sep 2024

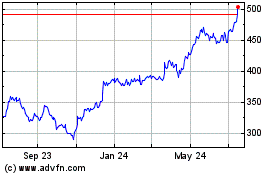

Goldman Sachs (NYSE:GS)

Historical Stock Chart

From Sep 2023 to Sep 2024