0001826470false00018264702024-09-102024-09-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 10, 2024 |

Petco Health and Wellness Company, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39878 |

81-1005932 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

10850 Via Frontera |

|

San Diego, California |

|

92127 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 453-7845 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A common stock, par value $0.001 per share |

|

WOOF |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On September 10, 2024, Petco Health and Wellness Company, Inc. (the “Company”) issued a press release disclosing its financial results for the quarter ended August 3, 2024. The full text of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

The Company has scheduled a webcast call at 5:00 p.m. Eastern Time on September 10, 2024 to discuss the Company’s financial results for the quarter ended August 3, 2024. In addition to the press release, an earnings presentation will be made available on the Company’s investor relations page at ir.petco.com. A replay of the webcast will also be made available on the Company’s investor relations page through September 24, 2024 at approximately 5:00 p.m. Eastern Time.

The information being furnished pursuant to Item 2.02, including Exhibit 99.1, and Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liability of that section, and shall not be incorporated by reference into any other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Petco Health and Wellness Company, Inc. |

|

|

|

|

Date: |

September 10, 2024 |

By: |

/s/ Giovanni Insana |

|

|

Name: Title: |

Giovanni Insana

Chief Legal Officer and Secretary |

Exhibit 99.1

|

|

Contacts: Investor Relations investorrelations@petco.com |

Media Relations Benjamin Thiele-Long benjamin.thiele-long@petco.com |

FOR IMMEDIATE RELEASE: September 10, 2024

Petco Health + Wellness Company, Inc. Reports Second Quarter 2024 Earnings Results

Q2 2024 Overview

•Net revenue of $1.52 billion decreased 0.5 percent year over year

•Comparable sales increased 0.3 percent year over year and increased 3.5 percent on a two-year basis

•GAAP net loss of $24.8 million, or $(0.09) per share, compared to GAAP net loss of $14.6 million, or $(0.05) per share in the prior year

•Adjusted EBITDA1 of $83.5 million compared to $112.6 million in the prior year

•Operating Cash Flow of $69.4 million compared to $96.6 million in the prior year

•Free Cash Flow 1 of $42.0 million compared to $44.6 million in the prior year

San Diego, September 10, 2024 – Petco Health and Wellness Company, Inc. (Nasdaq: WOOF), a complete partner in pet health and wellness, today announced its second quarter 2024 financial results.

In the second quarter of 2024, Petco delivered net revenue of $1.52 billion, down 0.5 percent versus prior year. On an as-reported basis, the company’s consumables business was up 1.5 percent versus prior year, and services and other business was up 3.1 percent versus prior year. Growth in the company's consumables and services and other business was offset by the company’s supplies and companion animal business, down 4.7 percent versus prior year. GAAP net loss in the second quarter of 2024 was $24.8 million or $(0.09) per share, compared to GAAP net loss of $14.6 million or $(0.05) per share in the prior year. Adjusted Net Income1 was $(5.9) million or $(0.02) per share, compared to $16.3 million or $0.06 per share in the prior year. Adjusted EBITDA1 was $83.5 million compared to $112.6 million in the prior year.

“Our second quarter results demonstrate the ongoing work of our teams to strengthen our retail fundamentals and accelerate the path to improved profitability," said Joel Anderson, Petco’s Chief Executive Officer. "I could not be more excited to lead Petco at this pivotal time. Looking ahead, I see tremendous opportunities for us to significantly improve our operating and financial performance and better leverage Petco’s strengths to capture greater share, deliver sustained profitability, and create value for shareholders.”

(1)Adjusted EBITDA, Adjusted Net Income, Adjusted Earnings Per Share (“Adjusted EPS”), and Free Cash Flow are non-GAAP financial measures. See “Non-GAAP Financial Measures” for additional information on non-GAAP financial measures and a reconciliation to the most comparable GAAP measures.

Fiscal Q3 2024 Outlook

The company is providing Q3 guidance for revenue, Adjusted EBITDA, and Adjusted EPS, in addition to reaffirming full year interest expense and capital expenditure expectations.

For Fiscal Q3 2024, the company expects:

|

|

Metric* |

FQ3 2024 Guidance |

Net Revenue |

~ $1.5 billion |

Adjusted EBITDA |

$76 million to $80 million |

Adjusted EPS |

$(0.03) to $(0.04) |

For Fiscal 2024 (a 52-week year), the company expects the following, both of which are unchanged:

|

|

Metric* |

2024 Guidance, YoY |

Net interest expense |

~$145 million |

Capital Expenditures |

~$140 million |

*Assumptions in the guidance include that economic conditions, currency rates and the tax and regulatory landscape remain generally consistent. For fiscal 2024, our guidance anticipates a 26 percent tax rate, and 272 million weighted average diluted share count. Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures and have not been reconciled to the most comparable GAAP outlook because it is not possible to do so without unreasonable efforts due to the uncertainty and potential variability of reconciling items, which are dependent on future events and often outside of management’s control and which could be significant. Because such items cannot be reasonably predicted with the level of precision required, we are unable to provide outlook for the comparable GAAP measures. Forward-looking estimates of Adjusted EBITDA and Adjusted EPS are made in a manner consistent with the relevant definitions and assumptions noted herein and in our filings with the Securities and Exchange Commission.

Earnings Conference Call Webcast Information:

Management will host an earnings conference call on September 10, 2024 at 5:00 PM Eastern Time to discuss the company’s financial results. The conference call will be accessible through a live webcast. Interested investors and other individuals can access the webcast, earnings release, and earnings presentation via the company’s investor relations page at ir.petco.com. A replay of the webcast will be archived on the company’s investor relations page through September 24, 2024 until approximately 5:00 PM Eastern Time.

About Petco, The Health + Wellness Co.:

Founded in 1965, Petco is a category-defining health and wellness company focused on improving the lives of pets, pet parents and our own Petco partners. We've consistently set new standards in pet care while delivering comprehensive pet wellness products, services and solutions, and creating communities that deepen the pet-pet parent bond. We operate more than 1,500 pet care centers across the U.S., Mexico and Puerto Rico, which offer merchandise, companion animals, grooming, training and a growing network of on-site veterinary hospitals and mobile veterinary clinics. Our complete pet health and wellness ecosystem is accessible through our pet care centers and digitally at petco.com and on the Petco app. In tandem with Petco Love, a life-changing independent nonprofit organization, we work with and support thousands of local animal welfare groups across the country and, through in-store adoption events, we've helped find homes for nearly 7 million animals.

Forward-Looking Statements:

This earnings release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, concerning expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are not statements of historical fact, including, but not limited to, statements regarding our Q3 and full year 2024 guidance, operational reset of our business, our competitive positioning, profitability, cost action plans and associated cost-savings. Such forward-looking statements can generally be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “intends,” “will,” “shall,” “should,” “anticipates,” “opportunity,” “illustrative,” or the negative thereof or other variations thereon or comparable terminology. Although Petco believes that the expectations and assumptions reflected in these statements are reasonable, there can be no assurance that these expectations will prove to be correct or that any forward-looking results will occur or be realized. Nothing contained in this earnings release is, or should be relied upon as, a promise or representation or warranty as to any future matter, including any matter in respect of the operations or business or financial condition of Petco. All forward-looking statements are based on current expectations and assumptions about future events that may or may not be correct or necessarily take place and that are by their nature subject to significant uncertainties and contingencies, many of which are outside the control of Petco. Forward-looking statements are subject to a number of risks, uncertainties and other factors that could cause actual results or events to differ materially from the potential results or events discussed in the forward-looking statements, including, without limitation, those identified in this earnings release as well as the following: (i) increased competition (including from multi-channel retailers, mass and grocery retailers, and e-Commerce providers); (ii) reduced consumer demand for our products and/or services; (iii) our reliance on key vendors; (iv) our ability to attract and retain qualified employees; (v) risks arising from statutory, regulatory and/or legal developments; (vi) macroeconomic pressures in the markets in which we operate, including inflation and prevailing interest rates; (vii) failure to effectively manage our costs; (viii) our reliance on our information technology systems; (ix) our ability to prevent or effectively respond to a data privacy or security breach; (x) our ability to effectively manage or integrate strategic ventures, alliances or acquisitions and realize the anticipated benefits of such transactions; (xi) economic or regulatory developments that might affect our ability to provide attractive promotional financing; (xii) business interruptions and other supply chain issues; (xiii) catastrophic events, political tensions, conflicts and wars (such as the ongoing conflicts in Ukraine and the Middle East), health crises, and pandemics; (xiv) our ability to maintain positive brand perception and recognition; (xv) product safety and quality concerns; (xvi) changes to labor or employment laws or regulations; (xvii) our ability to effectively manage our real estate portfolio; (xviii) constraints in the capital markets or our vendor credit terms; (xix) changes in our credit ratings; (xx) impairments of the carrying value of our goodwill and other intangible assets; (xxi) our ability to successfully implement our operational adjustments, achieve the expected benefits of our cost action plans and drive improved profitability; and (xxii) the other risks, uncertainties and other factors identified under “Risk Factors” and elsewhere in Petco’s Securities and Exchange Commission filings. The occurrence of any such factors could significantly alter the results set forth in these statements.

Petco cautions that the foregoing list of risks, uncertainties and other factors is not complete, and forward-looking statements speak only as of the date they are made. Petco undertakes no duty to update publicly any such forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law, regulation or other competent legal authority.

PETCO HEALTH AND WELLNESS COMPANY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

(Unaudited and subject to reclassification)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended |

|

|

|

August 3,

2024 |

|

|

July 29,

2023 |

|

|

Percent

Change |

|

Net sales: |

|

|

|

|

|

|

|

|

|

Products |

|

$ |

1,263,749 |

|

|

$ |

1,278,598 |

|

|

|

(1 |

%) |

Services and other |

|

|

260,006 |

|

|

|

252,136 |

|

|

|

3 |

% |

Total net sales |

|

|

1,523,755 |

|

|

|

1,530,734 |

|

|

|

(0 |

%) |

Cost of sales: |

|

|

|

|

|

|

|

|

|

Products |

|

|

787,103 |

|

|

|

789,091 |

|

|

|

(0 |

%) |

Services and other |

|

|

155,927 |

|

|

|

148,639 |

|

|

|

5 |

% |

Total cost of sales |

|

|

943,030 |

|

|

|

937,730 |

|

|

|

1 |

% |

Gross profit |

|

|

580,725 |

|

|

|

593,004 |

|

|

|

(2 |

%) |

Selling, general and administrative expenses |

|

|

578,257 |

|

|

|

568,967 |

|

|

|

2 |

% |

Operating income (loss) |

|

|

2,468 |

|

|

|

24,037 |

|

|

|

(90 |

%) |

Interest income |

|

|

(672 |

) |

|

|

(764 |

) |

|

|

(12 |

%) |

Interest expense |

|

|

36,805 |

|

|

|

37,493 |

|

|

|

(2 |

%) |

Loss on partial extinguishment of debt |

|

|

— |

|

|

|

305 |

|

|

|

(100 |

%) |

Other non-operating (income) loss |

|

|

— |

|

|

|

(1,795 |

) |

|

|

(100 |

%) |

Loss before income taxes and income from

equity method investees |

|

|

(33,665 |

) |

|

|

(11,202 |

) |

|

|

201 |

% |

Income tax (benefit) expense |

|

|

(4,651 |

) |

|

|

6,732 |

|

|

N/M |

|

Income from equity method investees |

|

|

(4,191 |

) |

|

|

(3,328 |

) |

|

|

26 |

% |

Net loss attributable to Class A and B-1 common

stockholders |

|

$ |

(24,823 |

) |

|

$ |

(14,606 |

) |

|

|

70 |

% |

|

|

|

|

|

|

|

|

|

|

Net loss per Class A and B-1 common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.09 |

) |

|

$ |

(0.05 |

) |

|

|

66 |

% |

Diluted |

|

$ |

(0.09 |

) |

|

$ |

(0.05 |

) |

|

|

66 |

% |

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing net loss per Class A

and B-1 common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

273,074 |

|

|

|

267,163 |

|

|

|

2 |

% |

Diluted |

|

|

273,074 |

|

|

|

267,163 |

|

|

|

2 |

% |

PETCO HEALTH AND WELLNESS COMPANY, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except per share amounts)

(Unaudited and subject to reclassification)

|

|

|

|

|

|

|

|

|

|

|

August 3,

2024 |

|

|

February 3,

2024 |

|

ASSETS |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

127,620 |

|

|

$ |

125,428 |

|

Receivables, less allowance for credit losses1 |

|

|

47,035 |

|

|

|

44,369 |

|

Merchandise inventories, net |

|

|

672,328 |

|

|

|

684,502 |

|

Prepaid expenses |

|

|

59,758 |

|

|

|

58,615 |

|

Other current assets |

|

|

35,152 |

|

|

|

38,830 |

|

Total current assets |

|

|

941,893 |

|

|

|

951,744 |

|

Fixed assets |

|

|

2,206,885 |

|

|

|

2,173,015 |

|

Less accumulated depreciation |

|

|

(1,447,180 |

) |

|

|

(1,356,648 |

) |

Fixed assets, net |

|

|

759,705 |

|

|

|

816,367 |

|

Operating lease right-of-use assets |

|

|

1,368,740 |

|

|

|

1,384,050 |

|

Goodwill |

|

|

980,064 |

|

|

|

980,297 |

|

Trade name |

|

|

1,025,000 |

|

|

|

1,025,000 |

|

Other long-term assets |

|

|

201,245 |

|

|

|

205,694 |

|

Total assets |

|

$ |

5,276,647 |

|

|

$ |

5,363,152 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and book overdrafts |

|

$ |

474,496 |

|

|

$ |

485,131 |

|

Accrued salaries and employee benefits |

|

|

135,235 |

|

|

|

101,265 |

|

Accrued expenses and other liabilities |

|

|

196,518 |

|

|

|

200,278 |

|

Current portion of operating lease liabilities |

|

|

306,507 |

|

|

|

310,507 |

|

Current portion of long-term debt and other lease liabilities |

|

|

5,095 |

|

|

|

15,962 |

|

Total current liabilities |

|

|

1,117,851 |

|

|

|

1,113,143 |

|

Senior secured credit facilities, net, excluding current portion |

|

|

1,575,630 |

|

|

|

1,576,223 |

|

Operating lease liabilities, excluding current portion |

|

|

1,104,709 |

|

|

|

1,116,615 |

|

Deferred taxes, net |

|

|

219,574 |

|

|

|

251,629 |

|

Other long-term liabilities |

|

|

127,400 |

|

|

|

121,113 |

|

Total liabilities |

|

|

4,145,164 |

|

|

|

4,178,723 |

|

Commitments and contingencies |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Class A common stock2 |

|

|

236 |

|

|

|

231 |

|

Class B-1 common stock3 |

|

|

38 |

|

|

|

38 |

|

Class B-2 common stock4 |

|

|

— |

|

|

|

— |

|

Preferred stock5 |

|

|

— |

|

|

|

— |

|

Additional paid-in-capital |

|

|

2,260,381 |

|

|

|

2,229,582 |

|

Accumulated deficit |

|

|

(1,118,549 |

) |

|

|

(1,047,243 |

) |

Accumulated other comprehensive (loss) income |

|

|

(10,623 |

) |

|

|

1,821 |

|

Total stockholders’ equity |

|

|

1,131,483 |

|

|

|

1,184,429 |

|

Total liabilities and stockholders’ equity |

|

$ |

5,276,647 |

|

|

$ |

5,363,152 |

|

(1)Allowances for credit losses are $1,859 and $1,806, respectively

(2)Class A common stock, $0.001 par value: Authorized - 1.0 billion shares; Issued and outstanding - 235.8 million and 231.2 million shares, respectively

(3)Class B-1 common stock, $0.001 par value: Authorized - 75.0 million shares; Issued and outstanding - 37.8 million shares

(4)Class B-2 common stock, $0.000001 par value: Authorized - 75.0 million shares; Issued and outstanding - 37.8 million shares

(5)Preferred stock, $0.001 par value: Authorized - 25.0 million shares; Issued and outstanding - none

PETCO HEALTH AND WELLNESS COMPANY, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited and subject to reclassification)

|

|

|

|

|

|

|

|

|

|

|

26 Weeks Ended |

|

|

|

August 3,

2024 |

|

|

July 29,

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(71,306 |

) |

|

$ |

(16,498 |

) |

Adjustments to reconcile net loss to net cash provided by

operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

99,305 |

|

|

|

97,919 |

|

Amortization of debt discounts and issuance costs |

|

|

2,435 |

|

|

|

2,446 |

|

Provision for deferred taxes |

|

|

(27,782 |

) |

|

|

(11,002 |

) |

Equity-based compensation |

|

|

29,348 |

|

|

|

46,248 |

|

Impairments, write-offs and losses on sale of fixed and other assets |

|

|

7,069 |

|

|

|

1,035 |

|

Loss on partial extinguishment of debt |

|

|

— |

|

|

|

746 |

|

Income from equity method investees |

|

|

(9,077 |

) |

|

|

(6,458 |

) |

Amounts reclassified out of accumulated other comprehensive (loss) income |

|

|

(2,274 |

) |

|

|

1,055 |

|

Non-cash operating lease costs |

|

|

207,605 |

|

|

|

211,576 |

|

Other non-operating (income) loss |

|

|

2,665 |

|

|

|

(4,614 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Receivables |

|

|

(2,083 |

) |

|

|

(16,679 |

) |

Merchandise inventories |

|

|

11,769 |

|

|

|

(23,011 |

) |

Prepaid expenses and other assets |

|

|

(7,166 |

) |

|

|

(14,237 |

) |

Accounts payable and book overdrafts |

|

|

(9,644 |

) |

|

|

97,062 |

|

Accrued salaries and employee benefits |

|

|

34,591 |

|

|

|

1,221 |

|

Accrued expenses and other liabilities |

|

|

3,015 |

|

|

|

(1,238 |

) |

Operating lease liabilities |

|

|

(209,738 |

) |

|

|

(232,518 |

) |

Other long-term liabilities |

|

|

2,224 |

|

|

|

1,212 |

|

Net cash provided by operating activities |

|

|

60,956 |

|

|

|

134,265 |

|

Cash flows from investing activities: |

|

|

|

|

|

|

Cash paid for fixed assets |

|

|

(60,029 |

) |

|

|

(114,023 |

) |

Cash paid for acquisitions, net of cash acquired |

|

|

(259 |

) |

|

|

(2,040 |

) |

Proceeds from investment |

|

|

998 |

|

|

|

10,248 |

|

Proceeds from sale of assets |

|

|

1,019 |

|

|

|

— |

|

Cash received from partial surrender of officers' life insurance |

|

|

206 |

|

|

|

— |

|

Net cash used in investing activities |

|

|

(58,065 |

) |

|

|

(105,815 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Borrowings under long-term debt agreements |

|

|

201,000 |

|

|

|

— |

|

Repayments of long-term debt |

|

|

(201,000 |

) |

|

|

(60,000 |

) |

Debt refinancing costs |

|

|

(3,028 |

) |

|

|

— |

|

Payments for finance lease liabilities |

|

|

(3,528 |

) |

|

|

(3,349 |

) |

Proceeds from employee stock purchase plan and stock option exercises |

|

|

1,630 |

|

|

|

2,454 |

|

Tax withholdings on stock-based awards |

|

|

(3,468 |

) |

|

|

(4,873 |

) |

Proceeds from issuance of common stock |

|

|

2,500 |

|

|

|

— |

|

Net cash used in financing activities |

|

|

(5,894 |

) |

|

|

(65,768 |

) |

|

|

|

|

|

|

|

Net decrease in cash, cash equivalents and restricted cash |

|

|

(3,003 |

) |

|

|

(37,318 |

) |

Cash, cash equivalents and restricted cash at beginning of period |

|

|

136,649 |

|

|

|

213,727 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

133,646 |

|

|

$ |

176,409 |

|

NON-GAAP FINANCIAL MEASURES

The following information provides definitions and reconciliations of the non-GAAP financial measures presented in this earnings release to the most directly comparable financial measures calculated and presented in accordance with generally accepted accounting principles (GAAP). The company has provided this non-GAAP financial information, which is not calculated or presented in accordance with GAAP, as information supplemental and in addition to the financial measures presented in this earnings release that are calculated and presented in accordance with GAAP. Such non-GAAP financial measures should not be considered superior to, as a substitute for or alternative to, and should be considered in conjunction with, the GAAP financial measures presented in this earnings release. The non-GAAP financial measures in this earnings release may differ from similarly titled measures used by other companies.

The tables below reflect the calculation of Adjusted EBITDA, Adjusted Net Income, and Adjusted EPS, as applicable, for the thirteen weeks ended August 3, 2024 compared to the thirteen weeks ended July 29, 2023, respectively.

Adjusted EBITDA and Trailing Twelve Month Adjusted EBITDA

Adjusted EBITDA, including Trailing Twelve Month Adjusted EBITDA, is considered a non-GAAP financial measure under the Securities and Exchange Commission’s (SEC) rules because it excludes certain amounts included in net income calculated in accordance with GAAP. Management believes that Adjusted EBITDA is a meaningful measure to share with investors because it facilitates comparison of the current period performance with that of the comparable prior period. In addition, Adjusted EBITDA affords investors a view of what management considers to be Petco’s core operating performance as well as the ability to make a more informed assessment of such operating performance as compared with that of the prior period. Please see the company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024 filed with the SEC on April 3, 2024 for additional information on Adjusted EBITDA.

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

13 Weeks Ended |

|

Reconciliation of Net Loss Attributable to Class A and B-1

Common Stockholders to Adjusted EBITDA |

|

August 3,

2024 |

|

|

July 29,

2023 |

|

Net loss attributable to Class A and B-1 common stockholders |

|

$ |

(24,823 |

) |

|

$ |

(14,606 |

) |

Add (deduct): |

|

|

|

|

|

|

Interest expense, net |

|

|

36,133 |

|

|

|

36,729 |

|

Income tax (benefit) expense |

|

|

(4,651 |

) |

|

|

6,732 |

|

Depreciation and amortization |

|

|

49,718 |

|

|

|

48,664 |

|

Income from equity method investees |

|

|

(4,191 |

) |

|

|

(3,328 |

) |

Loss on partial extinguishment of debt |

|

|

— |

|

|

|

305 |

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

Asset impairments and write offs |

|

|

3,561 |

|

|

|

1,031 |

|

Equity-based compensation |

|

|

11,914 |

|

|

|

24,119 |

|

Other non-operating (income) loss |

|

|

— |

|

|

|

(1,795 |

) |

Mexico joint venture EBITDA (1) |

|

|

9,902 |

|

|

|

8,544 |

|

Acquisition and divestiture-related costs (2) |

|

|

— |

|

|

|

— |

|

Other costs (3) |

|

|

5,960 |

|

|

|

6,183 |

|

Adjusted EBITDA |

|

$ |

83,523 |

|

|

$ |

112,578 |

|

Net sales |

|

$ |

1,523,755 |

|

|

$ |

1,530,734 |

|

Net margin (4) |

|

|

(1.6 |

%) |

|

|

(1.0 |

%) |

Adjusted EBITDA Margin |

|

|

5.5 |

% |

|

|

7.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

(dollars in thousands) |

|

Trailing Twelve Months |

|

Reconciliation of Net (Loss) Income Attributable to Class A and B-1

Common Stockholders to Adjusted EBITDA |

|

August 3,

2024 |

|

|

February 3,

2024 |

|

|

July 29,

2023 |

|

Net (loss) income attributable to Class A and B-1 common stockholders |

|

$ |

(1,335,018 |

) |

|

$ |

(1,280,210 |

) |

|

$ |

36,154 |

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

147,282 |

|

|

|

147,504 |

|

|

|

132,068 |

|

Income tax (benefit) expense |

|

|

(42,465 |

) |

|

|

(27,613 |

) |

|

|

24,433 |

|

Depreciation and amortization |

|

|

202,168 |

|

|

|

200,782 |

|

|

|

196,177 |

|

Income from equity method investees |

|

|

(18,807 |

) |

|

|

(16,188 |

) |

|

|

(14,240 |

) |

Loss on partial extinguishment of debt |

|

|

174 |

|

|

|

920 |

|

|

|

746 |

|

Goodwill impairment |

|

|

1,222,524 |

|

|

|

1,222,524 |

|

|

|

— |

|

Asset impairments and write offs |

|

|

8,867 |

|

|

|

2,833 |

|

|

|

1,658 |

|

Equity-based compensation |

|

|

64,959 |

|

|

|

81,859 |

|

|

|

81,915 |

|

Other non-operating loss (income) |

|

|

2,552 |

|

|

|

(4,727 |

) |

|

|

(1,892 |

) |

Mexico joint venture EBITDA (1) |

|

|

41,346 |

|

|

|

38,226 |

|

|

|

33,583 |

|

Acquisition and divestiture-related costs (2) |

|

|

3,719 |

|

|

|

— |

|

|

|

2,219 |

|

Other costs (3) |

|

|

39,365 |

|

|

|

35,193 |

|

|

|

8,860 |

|

Adjusted EBITDA |

|

$ |

336,666 |

|

|

$ |

401,103 |

|

|

$ |

501,681 |

|

Net sales |

|

$ |

6,221,537 |

|

|

$ |

6,255,284 |

|

|

$ |

6,165,821 |

|

Net margin (4) |

|

|

(21.5 |

%) |

|

|

(20.5 |

%) |

|

|

0.6 |

% |

Adjusted EBITDA Margin |

|

|

5.4 |

% |

|

|

6.4 |

% |

|

|

8.1 |

% |

Adjusted Net Income and Adjusted EPS

Adjusted Net Income and Adjusted diluted Earnings Per Share attributable to Petco common stockholders (Adjusted EPS) are considered non-GAAP financial measures under the SEC’s rules because they exclude certain amounts included in the net income attributable to Petco common stockholders and diluted earnings per share attributable to Petco common stockholders calculated in accordance with GAAP. Management believes that Adjusted Net Income and Adjusted EPS are meaningful measures to share with investors because they facilitate comparison of the current period performance with that of the comparable prior period. In addition, Adjusted Net Income and Adjusted EPS afford investors a view of what management considers to be Petco’s core earnings performance as well as the ability to make a more informed assessment of such earnings performance with that of the prior period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands, except per share amounts) |

|

13 Weeks Ended |

|

Reconciliation of Diluted EPS to Adjusted EPS |

|

August 3, 2024 |

|

|

July 29, 2023 |

|

|

|

Amount |

|

|

Per share |

|

|

Amount |

|

|

Per share |

|

Net loss attributable to common stockholders / diluted

EPS |

|

$ |

(24,823 |

) |

|

$ |

(0.09 |

) |

|

$ |

(14,606 |

) |

|

$ |

(0.05 |

) |

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefit) expense |

|

|

(4,651 |

) |

|

|

(0.01 |

) |

|

|

6,732 |

|

|

|

0.02 |

|

Loss on partial extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

305 |

|

|

|

0.00 |

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Asset impairments and write offs |

|

|

3,561 |

|

|

|

0.01 |

|

|

|

1,031 |

|

|

|

0.01 |

|

Equity-based compensation |

|

|

11,914 |

|

|

|

0.04 |

|

|

|

24,119 |

|

|

|

0.09 |

|

Other non-operating income |

|

|

— |

|

|

|

— |

|

|

|

(1,795 |

) |

|

|

(0.01 |

) |

Other costs (3) |

|

|

5,960 |

|

|

|

0.02 |

|

|

|

6,183 |

|

|

|

0.02 |

|

Adjusted pre-tax (loss) income / diluted (loss) earnings per

share |

|

$ |

(8,039 |

) |

|

$ |

(0.03 |

) |

|

$ |

21,969 |

|

|

$ |

0.08 |

|

Income tax (benefit) expense at 26% normalized tax rate |

|

|

(2,090 |

) |

|

|

(0.01 |

) |

|

|

5,712 |

|

|

|

0.02 |

|

Adjusted Net (Loss) Income / Adjusted EPS |

|

$ |

(5,949 |

) |

|

$ |

(0.02 |

) |

|

$ |

16,257 |

|

|

$ |

0.06 |

|

Free Cash Flow

Free Cash Flow is a non-GAAP financial measure that is calculated as net cash provided by operating activities less cash paid for fixed assets. Management believes that Free Cash Flow, which measures the ability to generate additional cash from business operations, is an important financial measure for use in evaluating the company’s financial performance.

The table below reflects the calculation of Free Cash Flow for the thirteen and twenty-six weeks ended August 3, 2024 compared to the thirteen and twenty-six weeks ended July 29, 2023, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

|

13 Weeks Ended |

|

|

26 Weeks Ended |

|

|

|

August 3,

2024 |

|

|

July 29,

2023 |

|

|

August 3,

2024 |

|

|

July 29,

2023 |

|

Net cash provided by operating activities |

|

$ |

69,370 |

|

|

$ |

96,614 |

|

|

$ |

60,956 |

|

|

$ |

134,265 |

|

Cash paid for fixed assets |

|

|

(27,388 |

) |

|

|

(51,973 |

) |

|

|

(60,029 |

) |

|

|

(114,023 |

) |

Free Cash Flow |

|

$ |

41,982 |

|

|

$ |

44,641 |

|

|

$ |

927 |

|

|

$ |

20,242 |

|

Non-GAAP Financial Measures Footnotes

(1)Mexico Joint Venture EBITDA represents 50 percent of the entity’s operating results for all periods, as adjusted to reflect the results on a basis comparable to Adjusted EBITDA. In the financial statements, this joint venture is accounted for as an equity method investment and reported net of depreciation and income taxes because such a presentation would not reflect the adjustments made in the calculation of Adjusted EBITDA, we include the 50 percent interest in the company’s Mexico joint venture on an Adjusted EBITDA basis to ensure consistency. The table below presents a reconciliation of Mexico joint venture net income to Mexico joint venture EBITDA.

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended |

|

(in thousands) |

|

August 3,

2024 |

|

|

July 29,

2023 |

|

Net income |

|

$ |

8,822 |

|

|

$ |

6,656 |

|

Depreciation |

|

|

6,996 |

|

|

|

6,443 |

|

Income tax expense |

|

|

3,903 |

|

|

|

2,364 |

|

Foreign currency (gain) loss |

|

|

(380 |

) |

|

|

395 |

|

Interest expense, net |

|

|

463 |

|

|

|

1,230 |

|

EBITDA |

|

$ |

19,804 |

|

|

$ |

17,088 |

|

50% of EBITDA |

|

$ |

9,902 |

|

|

$ |

8,544 |

|

(2)Acquisition and divestiture-related costs include direct costs resulting from acquiring, integrating, or divesting businesses. These include third-party professional and legal fees, losses on sales of divestitures, and other integration-related costs that would not have otherwise been incurred as part of the company’s operations.

(3)Other costs include, as incurred: restructuring costs and restructuring-related severance costs; legal reserves associated with significant, non-ordinary course legal or regulatory matters; and costs related to certain significant strategic transactions.

(4)We define net margin as net income attributable to Class A and B-1 common stockholders divided by net sales and Adjusted EBITDA margin as Adjusted EBITDA divided by net sales.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

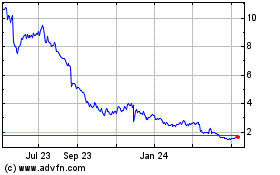

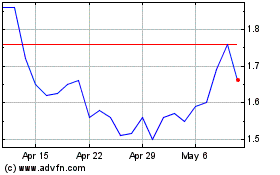

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Petco Health and Wellness (NASDAQ:WOOF)

Historical Stock Chart

From Nov 2023 to Nov 2024