0001396440false00013964402024-09-102024-09-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________

FORM 8-K

__________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) September 10, 2024

__________________________________________________________________________

Main Street Capital Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 001-33723 | 41-2230745 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

1300 Post Oak Boulevard, 8th Floor, Houston, Texas | 77056 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant's telephone number, including area code: 713-350-6000

Not Applicable

___________________________________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | MAIN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

On September 10, 2024, the Registrant posted a presentation on its corporate website regarding the special meeting of stockholders of MSC Income Fund, Inc. (the “MSC Income Special Meeting”), which is managed by MSC Adviser I LLC, a wholly-owned subsidiary of the Registrant. The MSC Income Special Meeting is scheduled to be held on December 2, 2024 and relates to MSC Income Fund, Inc.’s potential listing and related transactions (collectively, the “MSIF Listing”). The presentation may be accessed at https://www.mainstcapital.com/investors/presentations.

On September 10, 2024, the Registrant issued a press release related to the MSIF Listing. A copy of such press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information disclosed under this Item 7.01, including Exhibit 99.1 hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference into any filing made under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Main Street Capital Corporation |

| | |

| Date: September 10, 2024 | By: | /s/ Jason B. Beauvais |

| | Name: Jason B. Beauvais |

| | Title: General Counsel |

Exhibit 99.1

| | | | | |

| NEWS RELEASE |

| Contacts: Main Street Capital Corporation Dwayne L. Hyzak, CEO, dhyzak@mainstcapital.com Ryan R. Nelson, CFO, rnelson@mainstcapital.com 713-350-6000 Dennard Lascar Investor Relations Ken Dennard / ken@dennardlascar.com Zach Vaughan / zvaughan@dennardlascar.com 713-529-6600 |

MSC Income Fund, Inc. Files Definitive Proxy Statement in Connection with Potential Listing of its Shares on a National Securities Exchange

HOUSTON – September 10, 2024 – Main Street Capital Corporation (NYSE: MAIN) (“Main Street”) is pleased to announce that MSC Income Fund, Inc. (“MSC Income”), a non-listed business development company (“BDC”) for which Main Street’s wholly owned registered investment adviser, MSC Adviser I, LLC (“MSC Adviser”), serves as the investment adviser and administrator, recently filed a Definitive Proxy Statement (the “Definitive Special Proxy Statement”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with an upcoming Special Meeting of MSC Income shareholders (the “MSC Income Special Meeting”). The Definitive Special Proxy Statement details a series of proposals which Main Street and MSC Income believe will position MSC Income to effectuate a listing of its shares of common stock on a national securities exchange (such as the New York Stock Exchange or NASDAQ Stock Market) (a “Listing”), which may be accompanied by a follow-on public offering of MSC Income’s shares, in each case if and when market conditions make it desirable to do so and if it is otherwise in MSC Income’s and its shareholders’ best interest.

In commenting on the Definitive Special Proxy Statement, Dwayne L. Hyzak, Main Street’s Chief Executive Officer, stated, “We continue to be very excited about the potential changes at MSC Income Fund that are detailed in its recent Definitive Special Proxy Statement filing, which are the result of our continued efforts to find the best long-term outcome for all MSC Income Fund stakeholders. We believe that the planned activities and changes represent significant catalysts to the future growth of MSC Income Fund and strengthen its ability to continue to

provide its shareholders with an attractive recurring and growing quarterly dividend and favorable total shareholder returns through a transition of MSC Income Fund’s investment strategy and investment portfolio to be solely focused on its private loan investment strategy. We also understand that an option for liquidity is a valuable feature of any investment, so we are pleased that the Definitive Special Proxy Statement is a significant step in providing all MSC Income Fund shareholders the benefits of an equity security that is listed on a national securities exchange.”

Mr. Hyzak continued, “At the same time, we believe these planned activities and changes provide significant future benefits to Main Street’s asset management business through the opportunity to grow the management fees that our wholly owned adviser receives from MSC Income Fund as it executes its growth plans. The changes also increase the future growth potential of our lower middle market investment portfolio as a result of MSC Income Fund’s planned transition to a private loan only investment strategy. We look forward to sharing additional details of the expected future benefits to the shareholders of both Main Street and MSC Income Fund and the potential timing of a Listing and to executing on the plans detailed in MSC Income Fund’s Definitive Special Proxy Statement.”

Main Street believes that a Listing, and actions taken in connection therewith, would provide several benefits to MSC Income stakeholders, including, but not limited to the following:

•an opportunity for the significant growth of MSC Income through near-term access to additional capital through the public capital markets;

•significant benefits for MSC Income’s shareholders associated with an investment strategy intended to generate an attractive recurring and growing quarterly dividend through an intentional transition of MSC Income’s investment strategy and investment portfolio to be solely focused on its private loan investment strategy, rather than its current focus primarily on its private loan investment strategy and secondarily on its lower middle market investment strategy; and

•a path to an option for full liquidity for those existing MSC Income shareholders who desire such an option.

A Listing would also provide MSC Income with the longer-term opportunity to access additional leverage capacity through a potential future reduction in its minimum asset coverage ratio from 200% to 150%, subject to future approval of the MSC Income board of directors or MSC Income’s shareholders, which would allow MSC Income to further optimize its leverage profile and shareholder returns and support the future growth of its investment portfolio. Effective upon a Listing, MSC Income and MSC Adviser would amend their existing investment advisory agreement to better align with MSC Income’s transition to focus on its private loan investment strategy, including changes to the base management fee and incentive fee structures. The transactions and changes contemplated in the Definitive Special Proxy Statement, including the proposed amendment of MSC Income’s investment advisory agreement with MSC Adviser, have been approved by MSC Income’s board of directors, but remain subject to approval of MSC Income’s shareholders.

For more information on the Definitive Special Proxy Statement and the related MSC Income activities, including a supplemental presentation outlining the details of MSC Income’s potential Listing and the potential impacts to Main Street, we encourage our investors to visit the Presentations section of the Main Street website at https://www.mainstcapital.com/investors/news-events/presentations.

IMPORTANT NOTICE

This press release is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any securities of Main Street or MSC Income. The full details of the MSC Income proposals to be considered at the MSC Income Special Meeting (the “Proposals”) are included in the Definitive Special Proxy Statement, which MSC Income filed with the SEC on September 3, 2024. You should carefully read the Definitive Special Proxy Statement because it contains important information about the MSC Income Special Meeting and the Proposals.

ABOUT MAIN STREET CAPITAL CORPORATION

Main Street (www.mainstcapital.com) is a principal investment firm that primarily provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street’s portfolio investments are typically made to support

management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. Main Street seeks to partner with entrepreneurs, business owners and management teams and generally provides “one-stop” financing alternatives within its lower middle market investment strategy. Main Street’s lower middle market portfolio companies generally have annual revenues between $10 million and $150 million. Main Street’s middle market portfolio companies are generally larger in size than its lower middle market portfolio companies.

Main Street, through its wholly owned portfolio company MSC Adviser, also maintains an asset management business through which it manages investments for external parties, the largest of which is MSC Income. MSC Adviser is registered as an investment adviser under the Investment Advisers Act of 1940, as amended.

ABOUT MSC INCOME FUND, INC.

MSC Income (www.mscincomefund.com) is a principal investment firm primarily focused on providing debt capital to middle market companies and customized debt and equity financing to lower middle market companies. MSC Income’s lower middle market portfolio companies generally have annual revenues between $10 million and $150 million. MSC Income’s middle market portfolio companies are generally larger in size than its lower middle market portfolio companies.

FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements, which are based upon Main Street and MSC Income management’s current expectations and are inherently uncertain and which involve substantial risks and uncertainties. These forward-looking statements include, without limitation, statements relating to the following: the completion of certain proposed transactions by MSC Income, including a Listing, any potential follow-on public equity offering and the completion of certain other transactions; MSC Income’s planned transition to focus on its private loan investment strategy; MSC Income’s potential to access additional leverage and to reduce the minimum asset coverage requirement applicable to it under the Investment Company Act of 1940, as amended; the declaration and payment of future dividends; MSC Income providing a

path to an option for full liquidity for its shareholders; MSC Income, Main Street or their respective shareholders achieving any benefits from any of the foregoing; and anticipated approvals relating to the MSC Income Special Meeting. The use of words such as “anticipates,” “believes,” “intends,” “plans,” “expects,” “projects,” “estimates,” “will,” “should,” “may” and similar expressions identify any such forward-looking statements. Any such statements other than statements of historical fact are likely to be affected by other unknowable future events and conditions, including elements of the future that are or are not under Main Street’s or MSC Income’s control, and that Main Street and MSC Income may or may not have considered; accordingly, such forward-looking statements are not guarantees or assurances of future performance or events and are subject to various risks and uncertainties. Certain factors could cause actual results, conditions and events to differ materially from those projected or anticipated, including the risks and uncertainties associated with (i) the timing or likelihood of the completion of the proposed transactions by MSC Income described in the Definitive Special Proxy Statement, (ii) the timing or likelihood of the commencement and/or completion of any Listing and/or any potential follow-on public equity offering and uncertainty with respect to the trading levels of shares of MSC Income’s common stock following any Listing, (iii) the possibility that MSC Income may fail to obtain the requisite shareholder approval for one or more of the Proposals, (iv) regulatory factors and general economic, political and market conditions at the time of any potential future transaction or event referenced in this communication, as well as other external factors, (v) changes in laws or regulations or interpretations of current laws and regulations that could impact implementation of one or more of the Proposals or the transactions contemplated thereby, (vi) MSC Income’s or Main Street’s plans, expectations, objectives and intentions, as a result of any potential future transaction or event referenced in this communication, and (vii) other factors enumerated in Main Street’s and MSC Income’s filings with the SEC. You should not place undue reliance on such forward-looking statements, which speak only as of the date of this communication. None of Main Street, MSC Income or any of their affiliates undertakes any obligation to update any forward-looking statements made herein, unless required by law. Therefore, you should not rely on these forward-looking statements as representing the views of Main Street, MSC Adviser, MSC Income or any of their affiliates as of any date subsequent to the date of this communication. You should read this communication and the documents referenced in this communication completely and with

the understanding that actual future events and results may be materially different from expectations. All forward-looking statements included in this communication are qualified by these cautionary statements.

NO OFFER OR SOLICITATION

This communication is not, and under no circumstances is it to be construed as, a prospectus or an advertisement. Nothing in this communication shall constitute an offer to sell, or a solicitation of an offer to buy, any securities and this communication should not be interpreted or construed as such. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the registration requirements of the Securities Act of 1933, as amended, or an exemption therefrom.

Information contained on our website or MSC Income’s website is not incorporated by reference into this communication.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

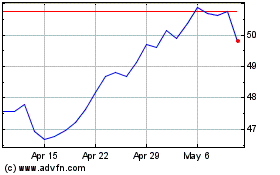

Main Street Capital (NYSE:MAIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

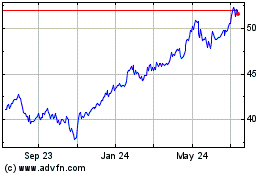

Main Street Capital (NYSE:MAIN)

Historical Stock Chart

From Nov 2023 to Nov 2024