FlexShopper, Inc. (Nasdaq:FPAY) (“FlexShopper”), a leading national

online lease-to-own (“LTO”) retailer and LTO payment solution

provider, today announced its financial results for the quarter

ended June 30, 2022.

Results for Quarter Ended June 30, 2022

vs. Quarter Ended June 30, 2021:

- Total fundings increased 64.5% to

$32.8 million from $19.9 million consisting of gross lease

originations with no change of $19.9 million and loan

participations up ~16,490% from $78 thousand to $12.9 million

- Total net lease revenues and fees

decreased 0.6% to $30.5 million from $30.7 million

- Total net loan revenues and fees

increased 23,209% to $6.1 million from $26 thousand

- Gross profit increased 58.2% to

$17.5 million from $11.1 million

- Adjusted EBITDA1 increased to $6.4

million compared to $2.1 million

- Net income of $14.4 million

compared with net income of $942 thousand

- Net income attributable to common

stockholders of $13.8 million, or $0.51 per diluted share, compared

to net income attributable to common stockholders of $332 thousand,

or $0.01 per diluted share

Results for Six Months Ended June 30,

2022 vs. Six Months Ended June 30, 2021:

- Total fundings increased 31.9% to

$54.0 million from $40.9 million consisting of gross lease

originations decreasing from $40.8 to $36.1 million and loan

participations up ~10,090% from $175 thousand to $17.9 million

- Total net lease revenues and fees

decreased 8.2% to $58.2 million from $63.4 million

- Total net loan revenues and fees

increased 12,342% to $7.3 million from $58 thousand

- Gross profit increased 26.1% to

$26.9 million from $21.3 million

- Adjusted EBITDA1 increased to $6.3

million compared to $4.6 million

- Net income of $12.0 million

compared with net income of $943 thousand

- Net income attributable to common

stockholders of $10.8 million, or $0.42 per diluted share, compared

to net loss attributable to common stockholders of $(276) thousand,

or $(0.01) per diluted share

¹Adjusted EBITDA is a non-GAAP financial

measure. Refer to the definition and reconciliation of this measure

under “Non-GAAP Measures”.

“We are pleased with this quarter’s results in

the face of significant economic headwinds. The Company’s

historical omni-channel lease capabilities matched more recently

with a complementary loan product have enabled us to continue to

grow revenues while tightening underwriting standards. The

diversity of our platform coupled with new sales initiatives will

allow us to continue to grow in the current environment,” said

Richard House, CEO of FlexShopper.

FlexShopper CEO, Richard House, FlexShopper CFO,

Russ Heiser and FlexShopper COO, John Davis will discuss the

Company’s recent quarter, including financial and operating

results, and strategic outlook on the Company’s earnings conference

call and webcast.

Conference Call and Webcast Details

Conference call

Date: Thursday, August 11, 2022Time: 9:00 a.m. Eastern Time

Participant Dial-In Numbers:

Domestic callers: (877) 407-2988International callers: (412)

902-0038

Webcast

The call will also be simultaneously webcast

over the Internet via the “Investor” section of the Company’s

website at www.flexshopper.com or by clicking on the

conference call link:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=qo9OFRdT

An audio replay of the call will be archived on

the Company’s website.

FLEXSHOPPER,

INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited)

|

|

|

For the three months endedJune

30, |

|

|

For the six months endedJune

30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenues and fees, net |

|

$ |

30,468,476 |

|

|

$ |

30,662,470 |

|

|

$ |

58,234,788 |

|

|

$ |

63,413,801 |

|

| Loan revenues and fees, net of

changes in fair value |

|

|

6,079,675 |

|

|

|

26,083 |

|

|

|

7,268,599 |

|

|

|

58,422 |

|

| Total revenues |

|

|

36,548,151 |

|

|

|

30,688,553 |

|

|

|

65,503,387 |

|

|

|

63,472,223 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of lease revenues and

merchandise sold |

|

|

18,207,305 |

|

|

|

19,490,864 |

|

|

|

37,367,916 |

|

|

|

41,954,420 |

|

| Loan origination costs and

fees |

|

|

804,228 |

|

|

|

111,787 |

|

|

|

1,229,741 |

|

|

|

175,184 |

|

| Marketing |

|

|

3,770,820 |

|

|

|

1,914,095 |

|

|

|

5,784,935 |

|

|

|

3,746,835 |

|

| Salaries and benefits |

|

|

3,014,920 |

|

|

|

2,747,005 |

|

|

|

5,979,362 |

|

|

|

5,656,324 |

|

| Operating expenses |

|

|

5,748,286 |

|

|

|

5,213,789 |

|

|

|

11,421,488 |

|

|

|

9,328,213 |

|

| Total costs and

expenses |

|

|

31,545,559 |

|

|

|

29,477,540 |

|

|

|

61,783,442 |

|

|

|

60,860,976 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

income |

|

|

5,002,592 |

|

|

|

1,211,013 |

|

|

|

3,719,945 |

|

|

|

2,611,247 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gain on extinguishment of

debt |

|

|

- |

|

|

|

1,931,825 |

|

|

|

- |

|

|

|

1,931,825 |

|

| Interest expense including

amortization of debt issuance costs |

|

|

(2,347,838 |

) |

|

|

(1,222,400 |

) |

|

|

(4,305,906 |

) |

|

|

(2,621,397 |

) |

| Income /(loss) before income

taxes |

|

|

2,654,754 |

|

|

|

1,920,438 |

|

|

|

(585,961 |

) |

|

|

1,921,675 |

|

| Benefit /(expense) from income

taxes |

|

|

11,734,467 |

|

|

|

(978,244 |

) |

|

|

12,594,247 |

|

|

|

(978,244 |

) |

| Net

income |

|

|

14,389,221 |

|

|

|

942,194 |

|

|

|

12,008,286 |

|

|

|

943,431 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends on Series 2

Convertible Preferred Shares |

|

|

(609,777 |

) |

|

|

(609,773 |

) |

|

|

(1,219,554 |

) |

|

|

(1,219,545 |

) |

| Net income/(loss)

attributable to common and Series 1 Convertible Preferred

shareholders |

|

$ |

13,779,444 |

|

|

|

332,421 |

|

|

|

10,788,732 |

|

|

|

(276,114 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted

income/(loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.63 |

|

|

|

0.02 |

|

|

|

0.49 |

|

|

|

(0.01 |

) |

|

Diluted |

|

|

0.51 |

|

|

$ |

0.01 |

|

|

|

0.42 |

|

|

|

(0.01 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE COMMON

SHARES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

21,605,234 |

|

|

|

21,605,461 |

|

|

|

21,576,312 |

|

|

|

21,375,096 |

|

|

Diluted |

|

|

27,898,824 |

|

|

|

23,603,477 |

|

|

|

28,193,268 |

|

|

|

21,375,096 |

|

FLEXSHOPPER,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS

| |

|

June 30, |

|

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

(unaudited) |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

Cash |

|

$ |

4,988,308 |

|

|

$ |

4,986,559 |

|

| Restricted cash |

|

|

461,649 |

|

|

|

108,083 |

|

| Accounts receivable, net |

|

|

33,050,840 |

|

|

|

26,338,883 |

|

| Loans receivable at fair

value |

|

|

22,534,033 |

|

|

|

3,560,108 |

|

| Prepaid expenses |

|

|

1,113,554 |

|

|

|

957,527 |

|

| Lease merchandise, net |

|

|

36,136,995 |

|

|

|

40,942,112 |

|

| Total current assets |

|

|

98,285,379 |

|

|

|

76,893,272 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

9,399,753 |

|

|

|

7,841,206 |

|

| Other assets, net |

|

|

76,040 |

|

|

|

77,578 |

|

| Deferred tax asset, net |

|

|

12,244,068 |

|

|

|

- |

|

| Total assets |

|

$ |

120,005,240 |

|

|

$ |

84,812,056 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

5,242,163 |

|

|

$ |

7,982,180 |

|

| Accrued payroll and related

taxes |

|

|

416,734 |

|

|

|

391,078 |

|

| Promissory notes to related

parties, net of $0 at 2022 and $1,274 at 2021 of unamortized

issuance costs, including accrued interest |

|

|

1,167,871 |

|

|

|

1,053,088 |

|

| Accrued expenses |

|

|

4,777,278 |

|

|

|

2,987,646 |

|

| Lease liability - current

portion |

|

|

189,804 |

|

|

|

172,732 |

|

| Total current liabilities |

|

|

11,793,850 |

|

|

|

12,586,724 |

|

| |

|

|

|

|

|

|

|

|

| Loan payable under credit

agreement to beneficial shareholder, net of $394,396 at 2022 and

$413,076 at 2021 of unamortized issuance costs |

|

|

66,755,604 |

|

|

|

50,061,924 |

|

| Promissory notes to related

parties, net of current portion |

|

|

10,750,000 |

|

|

|

3,750,000 |

|

| Deferred income tax

liability |

|

|

178,160 |

|

|

|

495,166 |

|

| Lease liabilities net of

current portion |

|

|

1,675,959 |

|

|

|

1,774,623 |

|

| Total liabilities |

|

|

91,153,573 |

|

|

|

68,668,437 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Series 1 Convertible Preferred

Stock, $0.001 par value - authorized 250,000 shares, issued and

outstanding 170,332 shares at $5.00 stated value |

|

|

851,660 |

|

|

|

851,660 |

|

| Series 2 Convertible Preferred

Stock, $0.001 par value - authorized 25,000 shares, issued and

outstanding 21,952 shares at $1,000 stated value |

|

|

21,952,000 |

|

|

|

21,952,000 |

|

| Common stock, $0.0001 par

value- authorized 40,000,000 shares, issued and outstanding

21,605,234 shares at June 30, 2022 and 21,442,278 shares at

December 31, 2021 |

|

|

2,161 |

|

|

|

2,144 |

|

| Additional paid in

capital |

|

|

39,259,862 |

|

|

|

38,560,117 |

|

| Accumulated deficit |

|

|

(33,214,016 |

) |

|

|

(45,222,302 |

) |

| Total stockholders’

equity |

|

|

28,851,667 |

|

|

|

16,143,619 |

|

|

|

|

$ |

120,005,240 |

|

|

$ |

84,812,056 |

|

FLEXSHOPPER,

INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWSFor the six months ended June 30, 2022 and

2021(unaudited)

| |

|

2022 |

|

|

2021 |

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

|

|

|

Net income |

|

$ |

12,008,286 |

|

|

$ |

943,431 |

|

| Adjustments to reconcile net

income to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and impairment of

lease merchandise |

|

|

37,367,916 |

|

|

|

39,064,981 |

|

| Other depreciation and

amortization |

|

|

2,059,323 |

|

|

|

1,324,049 |

|

| Amortization of debt issuance

costs |

|

|

106,886 |

|

|

|

134,580 |

|

| Compensation expense related

to stock-based compensation and warrants |

|

|

562,705 |

|

|

|

1,034,334 |

|

| Provision for doubtful

accounts |

|

|

27,563,993 |

|

|

|

18,778,392 |

|

| Proceeds from sale of lease

receivables |

|

|

6,604,507 |

|

|

|

- |

|

| Interest in kind added to

promissory notes balance |

|

|

113,509 |

|

|

|

9,461 |

|

| Deferred income tax |

|

|

(12,561,074 |

) |

|

|

378,859 |

|

| Gain on debt

extinguishment |

|

|

- |

|

|

|

(1,931,825 |

) |

| Net changes in the fair value

of loans receivable at fair value |

|

|

(2,457,851 |

) |

|

|

58,575 |

|

| Changes in operating assets

and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(40,880,457 |

) |

|

|

(21,775,777 |

) |

|

Loans receivable at fair value |

|

|

(16,516,074 |

) |

|

|

(179,141 |

) |

|

Prepaid expenses and other |

|

|

(155,773 |

) |

|

|

(174,222 |

) |

|

Lease merchandise |

|

|

(32,562,799 |

) |

|

|

(33,875,960 |

) |

|

Security deposits |

|

|

- |

|

|

|

4,280 |

|

|

Lease liabilities |

|

|

(5,091 |

) |

|

|

(2,598 |

) |

|

Accounts payable |

|

|

(2,740,017 |

) |

|

|

(4,105,547 |

) |

|

Accrued payroll and related taxes |

|

|

25,656 |

|

|

|

438,010 |

|

|

Accrued expenses |

|

|

1,794,983 |

|

|

|

(158,248 |

) |

| Net cash used in operating

activities |

|

|

(19,671,372 |

) |

|

|

(34,366 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES |

|

|

|

|

|

|

|

|

| Purchases of property and

equipment, including capitalized software costs and data costs |

|

|

(3,687,241 |

) |

|

|

(1,367,154 |

) |

| Net cash used in investing

activities |

|

|

(3,687,241 |

) |

|

|

(1,367,154 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

|

|

|

|

|

| Proceeds from loan payable

under credit agreement |

|

|

17,800,000 |

|

|

|

3,500,000 |

|

| Repayment of loan payable

under credit agreement |

|

|

(1,125,000 |

) |

|

|

(4,975,000 |

) |

| Debt issuance related

costs |

|

|

(86,932 |

) |

|

|

(526,565 |

) |

| Proceeds from exercise of

stock options |

|

|

137,057 |

|

|

|

17,126 |

|

| Proceeds from promissory

notes, net of fees |

|

|

7,000,000 |

|

|

|

- |

|

| Principal payment under

finance lease obligation |

|

|

(5,592 |

) |

|

|

(2,457 |

) |

| Repayment of installment

loan |

|

|

(5,605 |

) |

|

|

(5,603 |

) |

| Net cash provided by/(used in)

financing activities |

|

|

23,713,928 |

|

|

|

(1,992,499 |

) |

| |

|

|

|

|

|

|

|

|

| INCREASE / (DECREASE) IN CASH

and RESTRICTED CASH |

|

|

355,315 |

|

|

|

(3,394,019 |

) |

| |

|

|

|

|

|

|

|

|

| CASH and RESTRICTED CASH,

beginning of period |

|

|

5,094,642 |

|

|

|

8,541,232 |

|

| |

|

|

|

|

|

|

|

|

| CASH and RESTRICTED CASH, end

of period |

|

$ |

5,449,957 |

|

|

$ |

5,147,213 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

| Interest paid |

|

$ |

3,953,765 |

|

|

$ |

2,506,589 |

|

Non-GAAP Measures

We regularly review a number of metrics,

including the following key metrics, to evaluate our business,

measure our performance, identify trends affecting our business,

formulate financial projections and make strategic decisions.

Adjusted EBITDA represents net income before

interest, stock-based compensation, taxes, depreciation (other than

depreciation of leased inventory), amortization, and one-time or

non-recurring items. We believe that Adjusted EBITDA provides us

with an understanding of one aspect of earnings before the impact

of investing and financing charges and income taxes.

Key performance metrics for the three and six months ended June

30, 2022 and 2021 were as follows:

| |

|

Three months ended June 30, |

|

|

|

|

|

|

|

| |

|

2022 |

|

|

2021 |

|

|

$ Change |

|

|

% Change |

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

14,389,221 |

|

|

$ |

942,194 |

|

|

$ |

13,447,027 |

|

|

|

1,427.2 |

|

| Income taxes |

|

|

(11,734,467 |

) |

|

|

978,244 |

|

|

|

(12,712,711 |

) |

|

|

(1,299.5 |

) |

| Amortization of debt issuance

costs |

|

|

56,283 |

|

|

|

42,877 |

|

|

|

13,406 |

|

|

|

31.3 |

|

| Other amortization and

depreciation |

|

|

1,122,263 |

|

|

|

672,656 |

|

|

|

449,607 |

|

|

|

66.8 |

|

| Interest expense |

|

|

2,291,555 |

|

|

|

1,179,523 |

|

|

|

1,112,032 |

|

|

|

94.3 |

|

| Stock-based compensation |

|

|

257,476 |

|

|

|

249,222 |

|

|

|

8,254 |

|

|

|

3.3 |

|

| Gain on debt

extinguishment |

|

|

- |

|

|

|

(1,931,825 |

) |

|

|

1,931,825 |

|

|

|

- |

|

| Adjusted EBITDA |

|

$ |

6,382,331 |

|

|

$ |

2,132,891 |

|

|

$ |

4,249,440 |

|

|

|

199.2 |

|

| |

|

Six months ended June 30, |

|

|

|

|

|

|

|

| |

|

2022 |

|

|

2021 |

|

|

$ Change |

|

|

% Change |

|

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

12,008,286 |

|

|

$ |

943,431 |

|

|

$ |

11,064,855 |

|

|

|

1,172.8 |

|

| Income taxes |

|

|

(12,594,247 |

) |

|

|

978,244 |

|

|

|

(13,572,491 |

) |

|

|

(1,387.4 |

) |

| Amortization of debt issuance

costs |

|

|

106,886 |

|

|

|

134,580 |

|

|

|

(27,694 |

) |

|

|

(20.6 |

) |

| Other amortization and

depreciation |

|

|

2,059,323 |

|

|

|

1,324,049 |

|

|

|

735,274 |

|

|

|

55.5 |

|

| Interest expense |

|

|

4,199,020 |

|

|

|

2,486,817 |

|

|

|

1,712,203 |

|

|

|

68.9 |

|

| Stock-based compensation |

|

|

562,705 |

|

|

|

629,486 |

|

|

|

(66,781 |

) |

|

|

(10.6 |

) |

| Product/ infrastructure

expenses |

|

|

- |

|

|

|

10,000 |

|

|

|

(10,000 |

) |

|

|

|

|

| Gain on debt

extinguishment |

|

|

- |

|

|

|

(1,931,825 |

) |

|

|

1,931,825 |

|

|

|

- |

|

| Adjusted EBITDA |

|

$ |

6,341,973 |

|

|

$ |

4,574,782 |

|

|

$ |

1,767,191 |

|

|

|

38.6 |

|

The Company refers to Adjusted EBITDA in the

above table as the Company uses this measure to evaluate operating

performance and to make strategic decisions about the Company.

Management believes that Adjusted EBITDA provides relevant and

useful information which is widely used by analysts, investors and

competitors in its industry in assessing performance.

About FlexShopper

FlexShopper, LLC, a wholly owned subsidiary of

FlexShopper, Inc. (FPAY), is a financial and technology company

that provides brand name electronics, home furnishings and other

durable goods to consumers on a lease-to-own (LTO) basis through

its e-commerce marketplace (www.FlexShopper.com) as well as its

patented systems. FlexShopper also provides LTO technology

platforms to retailers and e-retailers to facilitate transactions

with consumers that want to acquire their products, but do not have

sufficient cash or credit. FlexShopper approves consumers utilizing

its proprietary consumer screening model, collects from consumers

under an LTO contract and funds the LTO transactions by paying

merchants for the goods.

Forward-Looking Statements

All statements in this release that are not

based on historical fact are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements, which are based on certain assumptions and describe our

future plans, strategies and expectations, can generally be

identified by the use of forward-looking terms such as “believe,”

“expect,” “may,” “will,” “should,” “could,” “seek,” “intend,”

“plan,” “goal,” “estimate,” “anticipate,” or other comparable

terms. Examples of forward-looking statements include, among

others, statements we make regarding expectations of lease

originations during the holiday season, the expansion of our

lease-to-own program; expectations concerning our partnerships with

retail partners; investments in, and the success of, our

underwriting technology and risk analytics platform; our ability to

collect payments due from customers; expected future operating

results and; expectations concerning our business strategy.

Forward-looking statements involve inherent risks and uncertainties

which could cause actual results to differ materially from those in

the forward-looking statements, as a result of various factors

including, among others, the following: our limited operating

history, limited cash and history of losses; our ability to obtain

adequate financing to fund our business operations in the future;

the failure to successfully manage and grow our FlexShopper.com

e-commerce platform; our ability to maintain compliance with

financial covenants under our credit agreement; our dependence on

the success of our third-party retail partners and our continued

relationships with them; our compliance with various federal, state

and local laws and regulations, including those related to consumer

protection; the failure to protect the integrity and security of

customer and employee information; and the other risks and

uncertainties described in the Risk Factors and in Management’s

Discussion and Analysis of Financial Condition and Results of

Operations sections of our Annual Report on Form 10-K and

subsequently filed Quarterly Reports on Form 10-Q. The

forward-looking statements made in this release speak only as of

the date of this release, and FlexShopper assumes no obligation to

update any such forward-looking statements to reflect actual

results or changes in expectations, except as otherwise required by

law.

Contact:

FlexShopper, Inc.Investor

Relationsir@flexshopper.com

FlexShopper, Inc.

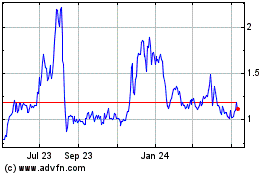

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

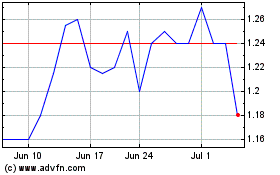

FlexShopper (NASDAQ:FPAY)

Historical Stock Chart

From Dec 2023 to Dec 2024