TIDMWSP

RNS Number : 2242G

Wynnstay Properties PLC

19 November 2015

WYNNSTAY PROPERTIES PLC

INTERIM REPORT

SIX MONTHS ENDED 29TH SEPTEMBER 2015

WYNNSTAY PROPERTIES PLC

INTERIM RESULTS FOR THE SIX MONTHS ENDED 29TH SEPTEMBER 2015

CHAIRMAN'S STATEMENT

I am delighted to report on your company's performance for the

first half of the financial year to 29th September 2015, which can

be summarised as follows:

2015 2014

Operating income (2.0)% GBP555,000 GBP562,000

Income before Taxation (7.1)% GBP405,000 GBP436,000

Earnings per share (7.1)% 11.8p 12.7p

Net Asset value per share 14.8% 535p 466p

Interim Dividend per

share 11.1% 5.0p 4.5p

Property income for the half-year increased over the same period

last year to GBP860,000 (2014 - GBP808,000), reflecting the

contribution from the recent acquisitions as well as rent increases

from recently relet units. Operating income at

GBP555,000 (2014 - GBP562,000), and pre-tax profit of GBP405,000

(2013 - GBP436,000) were slightly lower, compared to the same

period last year, largely due to the costs incurred on our recent

acquisitions and in upgrading certain vacant properties within the

portfolio. The benefits of this expenditure should flow through to

rental income, profit and asset value later this financial year and

in the future.

The significant focus of the management and the Board over the

past six months has been on the completion of the acquisition of

the Beaver Industrial Estate, Liphook in Hampshire and on the

refurbishment and marketing of the two vacant units at Chessington,

both of which I mentioned in my statement accompanying last year's

annual report.

We completed the off-market acquisition of the Liphook estate in

late June following a period of negotiation with the

privately-owned vendor. It attracted us for a number of reasons. We

had been looking for some time to acquire another complete

industrial estate with opportunities for active management and

improvement similar to our estate at Aylesford and we consider the

Beaver Industrial Estate to be a very good fit for us in terms of

size, quality, tenant profile and location. The estate is very

close to Liphook town centre and adjacent to a substantial new

housing development. It was constructed in the 1980's and comprises

17 units of varying sizes. At the time of purchase it was let to 9

tenants on 12 separate leases with 3 units being vacant. Since June

we have let one of the vacant units and are continuing to market

the two other units. The rental income at the time of purchase was

just over GBP172,000 p.a. and is now almost GBP186,000 p.a.

following the recent letting, and with an anticipated rent roll

when fully let in the region of GBP225,000 p.a. As reported

previously the price paid was GBP2,600,000.

As mentioned in my statement at the end of last year the tenant

of two of the three units at our estate in Chessington vacated at

the year-end in March following the disposal of part of their

business. We negotiated a satisfactory cash settlement with them

regarding dilapidations and over the spring and summer have carried

out an extensive refurbishment funded by the settlement monies

received. These works were completed, within budget, by our

contractors at the end of September. There is a shortage of smaller

mixed-use flexible space of this nature in the area following a

change in planning policy permitting the conversion of offices to

residential use. This means that the remaining commercial space

potentially becomes more valuable. The two refurbished units which

now present well have been actively marketed over the summer as the

works progressed and the level of enquiries and viewings has been

encouraging. We have recently entered into negotiations with a

potential tenant for both units. I hope that we will have a

positive outcome before the year-end on which I can report to you

next June.

We have also enjoyed a busy period of management activity at our

estate at Aylesford. The largest tenant has renewed the lease of

its main premises, comprising four units, for a further five years

to 2020, whilst giving up a fifth unit, which it leased a couple of

years ago, that is now surplus to its current requirements. This

unit was immediately

relet, again for five years, to a new tenant requiring space to

operate as a sub-contractor to a larger distribution business

located nearby. The one unit at Aylesford that was vacant at the

year-end and to which I referred in June has now been relet, again

for five years, to another longstanding tenant of the estate who

required space to expand its business; and, at the same time, that

tenant has also agreed to extend the lease of its existing two

units to 2020. Finally, to complete the picture, another unit which

became vacant on the departure of the previous tenant has been

relet for ten years, at a higher rent than we previously received,

to a new tenant. Thus all the units on the Aylesford estate are

fully let and we have the benefit of an increased rental income for

a longer period.

Elsewhere in the portfolio, during the first-half of the year we

have negotiated new leases, lease extensions or lease variations

which should enhance investment value on units at Basingstoke,

Colchester, Norwich and St Neots. At the time of writing, we have

collected over 99% of the rental income due for the current quarter

commencing 29 September 2015.

During the second half of the year, we will concentrate on the

assimilation of the Liphook estate into the portfolio and on

continuing to explore opportunities to add value to the existing

portfolio, such as by change of use, by the acquisition of

neighbouring land or properties and by further development of

existing sites. We continue to seek suitable further acquisitions

although, in contrast to recent years, we have not made any firm

offers as those properties that were available did not meet our

criteria.

You will recall that last year we were able to increase both the

interim and the final dividends, with the total dividend for the

year increasing by 4.2%. The larger proportion of the increase was

paid on the interim dividend with a view to aligning further the

overall balance between the interim and final payments. In the

light of the satisfactory performance reported above, I am pleased

to say that the Directors have decided to pay an increased interim

dividend of 5.00p per share (2014 - 4.5p). The interim dividend

will be paid on 18th December 2015 to those Shareholders on the

register on 27th November 2015. However, this increase should not

be taken as any indication that the final dividend will also be

increased.

Advances in communications and technology bring great benefits.

But they also provide opportunities for unscrupulous criminals to

seek access to personal information in order to steal an

individual's financial assets. There have been several recent cases

reported in the press. One form of this fraud is unsolicited

telephone approaches to shareholders about their investments in

which the caller mentions individual holdings, such as Wynnstay

Properties. There is nothing that we can do to deter or stop these

approaches and I would urge all shareholders to be vigilant. On

Wynnstay's website (www.wynnstayproperties.co.uk), shareholders

will also find a warning and a link to other information about

unsolicited approaches regarding shares on the Financial Conduct

Authority's website.

Our Annual General Meeting next year will again be held at the

Royal Automobile Club, 89 Pall Mall, London SW1 on Wednesday 13th

July 2016 at 12 noon. I encourage shareholders to make plans to

attend the meeting and meet the Board and fellow shareholders. The

meeting provides an important forum to learn more about Wynnstay's

activities and plans, its performance and its future, formally and

informally, as well as to socialise with other shareholders. We

benefit consistently from high levels of participation in formal

voting at our meeting through proxies lodged by shareholders who

are unable to attend, but it is always encouraging to have the

opportunity to meet and talk to shareholders in person.

Finally, on behalf of the Board, I wish all shareholders a very

Happy Christmas and good health and happiness in 2016.

19th November 2015 Philip G.H. Collins

Chairman

1. ACCOUNTING POLICIES

Wynnstay Properties PLC is a public limited company incorporated

and domiciled in England and Wales. The principal activity of the

Company is property investment, development and management. The

Company's ordinary shares are traded on the Alternative Investment

Market.

Basis of Preparation

These unaudited condensed interim financial statements have been

prepared in accordance with International Financial Reporting

Standard (IFRS) IAS 34 Interim Financial Reporting. They do not

constitute statutory accounts within the meaning of section 435 of

the Companies Act 2006.

The unaudited condensed interim financial statements should be

read in conjunction with the financial statements of the Company as

at and for the year ended 25th March 2015 which were prepared in

accordance with IFRS as adopted by the European Union and those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS, and have been reported on by the Company's auditors.

The financial information for the interim periods ended 29th

September 2015 and 29th September 2014 has not been audited and the

auditors have not reported on or reviewed these interim financial

statements. The information for the year ended 25th March 2014 has

been extracted from the latest published audited financial

statements.

Key Sources of Estimation Uncertainty

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

The preparation of the financial statements requires management

to make judgements, estimates and assumptions that may affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses.

Revisions to accounting estimates are recognised in the period

in which the estimate is revised if the revision affects only that

period. The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are those relating to the fair value of investment properties.

Investment Properties

All the Company's investment properties are revalued annually

and stated at fair value at 25th March. The aggregate of any

resulting surpluses or deficits are recognised through the

statement of comprehensive income.

Depreciation

In accordance with IAS 40, freehold and leasehold investment

properties are included at the reporting date at fair value, and

are not depreciated.

Depreciation of other plant and equipment is on a straight line

basis calculated at annual rates estimated to write off each asset

over its useful life of 5 years.

Disposal of Investments

The gains and losses on the disposal of investment properties

and other investments are included in the statement of

comprehensive income in the year of disposal.

Property Income

Property income represents the value of accrued charges under

operating leases for rental of the Company's properties. Revenue is

measured at the fair value of the consideration received. All

income is derived in the United Kingdom.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax. Current tax is the expected tax payable on the

taxable income for the year based on the tax rate enacted or

substantially enacted at the reporting date, and any adjustment to

tax payable in respect of prior years. Taxable profit differs from

income before tax as reported in the income statement because it

excludes items of income or expense that are deductible in other

years, and it further excludes items that are never taxable or

deductible.

Deferred taxation is the tax expected to be payable or

recoverable on differences between the carrying amounts of assets

and liabilities in the financial statements and the corresponding

tax bases used in the computation of taxable profits, and is

accounted for using the financial position liability method.

Deferred tax liabilities are recognised for all taxable temporary

differences (including unrealised gains on revaluation of

investment properties) and deferred tax assets are recognised to

the extent that it is probable that taxable profits will be

available against which deductible temporary differences can be

utilised. The Company provides for deferred tax on investment

properties by reference to the tax that would be due on the sale of

the investment properties.

Deferred tax is calculated at the rates that are expected to

apply in the period when the liability is settled, or the asset is

realised. Deferred tax is charged or credited in the statement of

comprehensive income, including deferred tax on the revaluation of

the asset.

Investments

Quoted investments are recognised as held at fair value, and are

measured at subsequent reporting dates at fair value, which is

either at the bid price, or the latest traded price, depending on

the convention of the exchange on which the investment is quoted.

Changes in fair value are recognised in profit or loss.

Trade and other accounts receivable

Trade and other receivables are initially measured at fair value

as reduced by appropriate allowances for estimated irrecoverable

amounts. All receivables do not carry any interest and are short

term in nature.

Cash and cash equivalents

Cash comprises cash at bank and on demand deposits. Cash

equivalents are short term (less than three months from inception),

repayable on demand and which are subject to an insignificant risk

of change in value.

Trade and other accounts payable

Trade and other payables are initially measured at fair value.

All trade and other accounts payable are not interest bearing.

Comparative information

The information for the year ended 25 March 2015 has been

extracted from the latest published audited financial

statements.

Pensions

Pension contribution towards employees' pension plans are

charged to the statement of comprehensive income as incurred. The

pension scheme is a defined contribution scheme.

2. DIVIDENDS

Payment Per share Amount absorbed

Period Date (pence) GBP'000

6 months to 29th

September 2015 18th Dec 2015 5.00 137

6 months to 29th

September 2014 19th Dec 2014 4.50 122

Year ended 25th 17th July

March 2015 2015 7.8 211

3. EARNINGS PER

SHARE

Basic earnings per share are calculated by dividing income after

taxation attributable to Ordinary Shareholders of GBP321,000

(2014:

GBP345,000) by the weighted average number of 2,711,617 ordinary

shares in issue during the period (2014: 2,711,617). There are no

instruments in issue that would have the effect of diluting

earnings per share.

4. UNAUDITED STATEMENT OF FINANCIAL POSITION

Six months ended Year ended

29th September 29th September 25th March

2015 2014 2015

GBP'000 GBP'000 GBP'000

Property Income 860 808 1,663

Property Costs (84) (31) (87)

Administrative Costs (221) (214) (414)

-------------- -------------- ------------------------

555 562 1,162

Movement in fair value of:

Investment Properties 1,530

Profit on Sale of Investment

Property

-------------- -------------- ------------------------

Operating Income 555 562 2,692

Investment Income 2 2

Finance Costs (152) (126) (265)

-------------- -------------- ------------------------

Income before Taxation 405 436 2,429

-------------- -------------- ------------------------

Taxation (84) (91) (210)

-------------- -------------- ------------------------

Income after Taxation 321 345 2,219

-------------- -------------- ------------------------

The company has no other

items of comprehensive income

5. UNAUDITED STATEMENT OF COMPREHENSIVE INCOME

29th September 29th September 25th March

2015 2014 2015

GBP'000 GBP'000 GBP'000

Non Current Assets

Investment Properties 24,495 19,595 21,780

Investments 3 3 3

-------------- -------------- ----------

24,498 19,598 21,783

Current Assets

Accounts Receivable 273 226 489

Cash and Cash Equivalents 920 683 1,050

-------------- -------------- ----------

1,192 909 1,539

Current Liabilities

Accounts Payable (902) (503)

Income Taxes Payable (309) (330) (223)

-------------- -------------- ----------

(1,212) (833) (1,309)

-------------- -------------- ----------

Net Current Liabilities (19) 75 230

Total Assets Less

Current Liabilities 24,479 19,672 22,013

Non-Current Liabilities

Bank Loans Payable (9,967) (7,034) (7,621)

-------------- -------------- ----------

Net Assets 14,511 12,639 14,392

-------------- -------------- ----------

Capital and Reserves

Share Capital 789 789 789

Treasury Shares (1,570) (1,570) (1,570)

Share Premium Account 1,135 1,135 1,135

Capital Redemption

Reserve 205 205 205

Retained Earnings 13,952 12,080 13,833

-------------- -------------- ----------

14,511 12,639 14,392

-------------- -------------- ----------

6. UNAUDITED STATEMENT OF CASHFLOW

Six months ended Year ended

29th September 29th September 25 March

2015 2014 2015

(MORE TO FOLLOW) Dow Jones Newswires

November 19, 2015 02:00 ET (07:00 GMT)

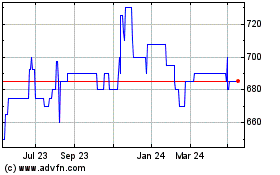

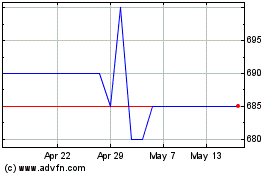

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2023 to Jul 2024