Pre-close Trading Update

March 27 2009 - 8:31AM

UK Regulatory

TIDMWSP

RNS Number : 6172P

Wynnstay Properties PLC

27 March 2009

WYNNSTAY PROPERTIES PLC

("Wynnstay" or "the Company")

Pre-close Trading Update

Further to the announcement of the Company's interim results for the six months

ended 30 September 2008 and in advance of the announcement of its results for

the year ended 25 March 2009, Wynnstay provides the following pre-close trading

update:

* The Company's Independent Valuers, Sanderson Weatherall, have revalued the

Company's investment properties at 25 March 2009 in the sum of GBP20.745m. This

compares to the interim revaluation of the entire portfolio by Sanderson

Weatherall as at 29 September 2008 in the sum of GBP24.1m.

* Under UK Generally Accepted Accounting Principles (UKGAAP) any revaluation

adjustment, would be reflected in the balance sheet, rather than in the income

statement. However, since the Company is now required to prepare its financial

statements under International Financial Reporting Standards (IFRS) it is

obliged to reflect any revaluation adjustment in full in its income statements

which thus impacts on profits and earnings rather than only on net asset value

per share.

* It should be stressed that the revaluation reflects changes in market conditions

and does not reflect the underlying performance of Wynnstay's core business of

managing and securing rental income from its portfolio.

* Wynnstay's property portfolio remains fully let and income producing and no

material rental income remains outstanding at the year end. Property and

administrative costs have been rigorously controlled and are expected to be

significantly lower than last year. Finance costs, while benefiting from lower

prevailing interest rates, will be higher than last year reflecting the

increased borrowings to acquire the Aylesford industrial estate in June 2008.

* Wynnstay has entered into a new five year GBP8.5m facility with one of

Scandinavia's leading banking groups, Svenska Handelsbanken AB, to replace the

previous facility for the same amount with N.M. Rothschild & Sons which was due

to expire in 2011. Taken overall, the principal terms of the new arrangement

are not materially different from those under the previous facility. The Company

did not incur any significant costs in negotiating and entering into the new

arrangement and now has the benefit of a borrowing facility which runs through

until 2013.

* Properties charged to Handelsbanken are valued as at 25 March 2009 by Sanderson

Weatherall at GBP13.27m and thus the Company has uncharged properties valued as

at that date of GBP7.475m.

* As at 25 March 2009, the amount drawn down under the new facility was GBP7.9m

and the Company had net cash balances of GBP0.8m which could be used, together

with the undrawn balance of GBP0.6m under the new facility and the uncharged

properties valued at GBP7.475m, to provide and secure finance for future

property purchases, if and when suitable opportunities arise.

* The Company's current rental income covers current interest payments by a

multiple of almost four and a half times and its current operating income,

excluding revaluation adjustment, covers current interest payments by more than

three times.

The Company's final results will be announced on or about 18 June 2009 and the

Annual Report and Financial Statements will be posted to Shareholders shortly

thereafter.

Enquiries:

Wynnstay Properties PLC

Toby Parker - Finance Director: 0207 745 7160

Nominated Adviser & Broker

Charles Stanley Securities

Rick Thompson / Carl Holmes: 0207 149 6000

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTSEMFEWSUSEED

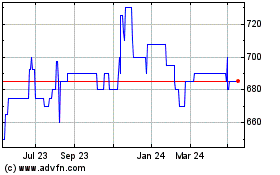

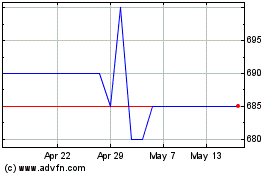

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2024 to Jul 2024

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2023 to Jul 2024