Interim Results

November 22 2006 - 4:43AM

UK Regulatory

RNS Number:4954M

Wynnstay Properties PLC

22 November 2006

Wynnstay Properties PLC ("Wynnstay" or "the Company")

Interim Results for the six months ended 29th September 2006

Chairman's Statement

I am pleased to report increased profits and earnings per share, despite lower

property income, compared with the interim results last year. Although we do

not carry out a revaluation at the interim stage, net asset value per share

reflects the property valuation conducted in March 2006 and is thus

substantially above the figure at this time last year.

The results may be summarised as follows:-

2006 2005

* Profit on Ordinary Activities before taxation: + 8.8% #283,000 #260,000

* Earnings per share: + 8.6% 6.3p 5.8p

* Interim dividend per share: + 6.5% 2.45p 2.3p

* Net asset value per share: + 14.6% 432p 377p

As anticipated, property income was lower in the first half, mainly as a

consequence of the Epsom property remaining vacant following the lease expiry in

September 2005. However, this was partially offset by a full contribution from

the letting of the vacant unit at Basingstoke and the letting of three recently

refurbished industrial units at St. Neots as well as from satisfactory rent

review settlements achieved elsewhere in the portfolio.

You will recall that we made an application for planning consent in relation to

the Epsom property, involving the construction of an additional fifth floor and

the conversion of the four upper floors for residential use, to comprise 15

apartments, with commercial use retained on the ground floor only. Those

Shareholders who were able to attend the Annual General Meeting in July were

able to see our plans for the property, which generated a considerable degree of

interest. I am pleased to report that permission for the scheme was granted

early in September. The Board reviewed the strategy and options for this

property at its meeting shortly thereafter.

We concluded that it would be in the best interests of Shareholders, having

regard to the continuing strength of the residential market and the considerable

interest expressed by a number of specialist developers for this type of

project, for the property to be sold with the benefit of the planning permission

we had obtained. Contracts were exchanged on 21st November 2006 for the sale of

this property for a cash consideration of #2,000,000. After taking account of

the settlement negotiated with the previous tenant and the design, planning and

selling costs involved, this disposal is expected to result in a net surplus

over book value of approximately #948,000, on which no tax liability should

arise. This surplus equates to 30 pence per share, which will be reflected in

the Company's financial statements for the year ending 25th March 2007. This

very profitable transaction was achieved as a result of the Company procuring a

skilfully and sensitively designed scheme for the conversion of the property to

satisfy stringent planning requirements, coupled with a professionally executed

marketing campaign.

During the first half, we examined numerous potential investment opportunities

and engaged in some detailed discussions with vendors, but no acquisitions took

place during the period. It remains difficult to acquire attractive investment

properties which provide opportunities for medium to long-term growth at prices

which can be justified. The intense competition in the market has driven prices

up to levels we consider will prove difficult to sustain. However, as I have

said before, this has the benefit that the value of your Company's properties at

the present time is being strongly sustained by these conditions which, should

they continue throughout the second half, are likely to have a positive impact

on the year end property revaluation. In the meantime, and especially with the

combination of low gearing, the unutilised element of our borrowing facilities

and the funds which will be generated from the disposal of the Epsom property,

the Company remains in a strong position to make significant investments as and

when opportunities arise or market conditions change.

Prospects for the full year appear satisfactory. Although property income is

likely to be somewhat lower than last year, we expect this to be countered by

lower overhead and interest costs. Profits will also be enhanced by the

disposal of the Epsom property.

In the light of these results, the Directors have decided to declare an interim

dividend of 2.45p per share, representing an increase of 6.5% over last year.

This will be paid on 14th December 2006 to those Shareholders on the register on

1st December 2006. Whilst we will, of course, decide on the appropriate amount

to recommend as a final dividend having regard to the results for the full year,

the Board is hopeful that this will reflect a similar percentage increase.

The financial statements included in this report have been prepared in

accordance with accounting standard FRS 21 which requires that dividends

declared after the balance sheet date are not recognised as a liability. This

means they include the final dividend for the last financial year paid in August

2006, but not the interim dividend payable in December 2006. Further, they do

not reflect the release of deferred tax provisions no longer required, amounting

to #159,000, which will be reflected in the accounts for the full year.

I am extremely sorry to report that our Finance Director, Peter Kirkland, has

decided to retire at the age of 60. Peter has steered Wynnstay skilfully

through a period of great change over the last 12 years. We are indebted to him

for his commitment and loyalty and we will miss his breadth of experience and

wise counsel. I will include a fuller tribute to him in my annual statement.

We are in the course of recruiting his successor and an announcement will be

made in due course.

A record number of Shareholders were able to attend the Annual General Meeting

in July. The meeting provides a valuable opportunity for the Directors to talk

with Shareholders both formally and informally and to gauge interest in the

Company and its future. It also provides an occasion at which Shareholders can

discuss the Company's progress with each other. Our Annual General Meeting next

year will again be held at the Royal Automobile Club, 89 Pall Mall, London SW1

on Thursday 26th July 2007 and I hope that we will once again have an excellent

attendance.

Philip G.H. Collins

Chairman

22nd November 2006

Unaudited Consolidated Profit & Loss Account

Six Months ended 29th September 2006

Six Months ended Year ended

29th September 25th March

2006 2005 2006

(Unaudited) (Audited)

#'000 #'000 #'000

Turnover

Gross Rental Income 770 812 1,560

Fees and Commissions 8 8 17

-------------- -------------- --------------

778 820 1,577

Property Outgoings (30) (24) (62)

-------------- -------------- --------------

748 796 1,515

Administration and Other Costs (278) (341) (589)

-------------- -------------- --------------

Operating Profit 470 455 926

Finance Costs (Net) (187) (195) (373)

-------------- -------------- --------------

Profit on Ordinary Activities

before Taxation 283 260 553

Taxation (85) (78) (168)

-------------- -------------- --------------

Profit on Ordinary Activities

after Taxation 198 182 385

Dividends paid (see note 3) (189) (180) (253)

-------------- -------------- --------------

Profit Retained 9 2 132

-------------- -------------- --------------

Basic Earnings per share (see note 1) 6.3p 5.8p 12.2p

Unaudited Consolidated Balance Sheet

at 29th September 2006

29th September 2006 29th September 2005 25th March

(Unaudited) (Unaudited) 2006

(Audited)

#'000 #'000 #'000

Fixed Assets

Tangible Assets 20,360 18,750 20,357

Investments 1 1 1

-------------------- -------------------- --------------------

20,361 18,751 20,358

Current Assets

Debtors 98 85 35

Cash at Bank and in Hand 180 369 316

-------------------- -------------------- --------------------

278 454 351

Creditors: Amounts falling due

Within one year (679) (799) (758)

-------------------- -------------------- --------------------

Net Current Liabilities (401) (345) (407)

-------------------- -------------------- --------------------

Total Assets Less Current Liabilities 19,960 18,406 19,951

Creditors: Amounts falling due after more than

one year

(6,000) (6,200) (6,000)

-------------------- -------------------- --------------------

13,960 12,206 13,951

Provision for Liabilities and Charges (314) (304) (314)

-------------------- -------------------- --------------------

Net Assets 13,646 11,902 13,637

-------------------- -------------------- --------------------

Capital and Reserves

Share Capital 789 789 789

Capital Redemption Reserve 205 205 205

Share Premium Account 1,135 1,135 1,135

Capital Reserve 151 151 151

Revaluation Reserve 6,277 4,672 6,277

Distributable Reserves 5,089 4,950 5,080

-------------------- -------------------- --------------------

Equity Shareholders' Funds 13,646 11,902 13,637

-------------------- -------------------- --------------------

Unaudited Consolidated Cash Flow Statement

Six Months ended 29th September 2006

Six Months ended Year ended

29th September 25th March

2006 2005 2006

(Unaudited)

#'000 #'000 #'000

Cash Flow from Operating Activities (Note A) 398 521 1,004

--------------- --------------- ---------------

Returns on Investment and Servicing

of Finance

Interest Received 4 6 10

Interest Paid (258) (195) (388)

--------------- --------------- ---------------

Net Cash (Outflow) from Returns on

Investment and Servicing of Finance (254) (189) (378)

--------------- --------------- ---------------

Taxation Paid (86) (55) (127)

--------------- --------------- ---------------

Capital Expenditure and Financial

Investment

Purchase of Tangible Fixed Assets (5) (1) (3)

Disposal of Tangible Fixed Assets - 1 1

--------------- --------------- ---------------

Net Cash (Outflow) from

Investing Activities (5) - (2)

--------------- --------------- ---------------

Equity Dividends Paid (189) (180) (253)

--------------- --------------- ---------------

Net Cash (Outflow)/Inflow before Financing (136) 97 244

Financing

Repayment of Bank Loan - - (200)

--------------- --------------- ---------------

(Decrease)/Increase in Cash in the Period (136) 97 44

--------------- --------------- ---------------

Reconciliation of Net Cash Flow to

Movement in Net Debt

(Decrease)/Increase in Cash in the Period (136) 97 44

Cash Inflow from Debt Financing - - 200

--------------- --------------- ---------------

Movement in Net Debt in the Period (136) 97 244

Net Debt at 25th March 2006 (5,684) (5,928) (5,928)

--------------- --------------- ---------------

Net Debt at 29th September 2006 (Note B) (5,820) (5,831) (5,684)

--------------- --------------- ---------------

Notes To Cash Flow Statement

A. Reconciliation of Operating Profit to Net Cash Inflow from Operating

Activities

Six Months ended Year ended

29th September 25th March

2006 2005 2006

#'000 #'000 #'000

Operating Profit 470 455 926

Depreciation and Amortisation 2 1 2

(Increase)/Decrease in Debtors (63) (1) 49

(Decrease)/Increase in Creditors (11) 66 27

-------------- -------------- --------------

Net Cash Inflow from Operating Activities 398 521 1,004

-------------- -------------- --------------

B. Analysis of Net Debt

29th September

2006 Cash Movement 25th March 2006

#'000 #'000 #'000

Cash at Bank and in Hand 180 (136) 316

Debt due after more than one year (6,000) - (6,000)

--------------- --------------- ---------------

Net Debt (5,820) (136) (5,684)

--------------- --------------- ---------------

Notes

1. Basic earnings per share have been calculated on profits after taxation

attributable to Ordinary Shareholders of #198,000 (2005: #182,000) and on

3,155,267 ordinary shares, being the weighted average number in issue during

both periods.

2. The figures in these statements do not constitute statutory accounts;

those for the year ended 25th March 2006 are extracted from the Group Accounts

which have been filed with the Registrar of Companies and which received an

unqualified report from the Auditors and did not contain a statement under

Section 237(2) or (3) of the Companies Act 1985 as amended.

3. An interim dividend of 2.45p per share, amounting to #77,000, will be

paid on 14th December 2006 to those Shareholders on the register at 1st December

2006. A final dividend of 6.0p per share in respect of the year ended 25th

March 2006, was paid to Shareholders on 3rd August 2006 and the cost amounting

to #189,000 has been included in the Profit and Loss Account for the half year

ended 29th September 2006.

4. This interim report is being posted to all Shareholders and will be

available free of charge until 31st December 2006 on application to the

Company's registered office at Cleary Court, 21 St. Swithin's Lane, London EC4N

8AD.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR IIFVALSLFFIR

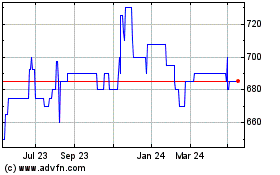

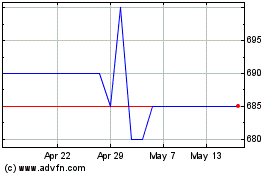

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2024 to Jul 2024

Wynnstay Properties (LSE:WSP)

Historical Stock Chart

From Jul 2023 to Jul 2024