TIDMSTCM

RNS Number : 2006C

Steppe Cement Limited

09 June 2023

9 June 2023

Steppe Cement Ltd

CEO STATEMENT

Overall, the cement market in Kazakhstan remained stable in 2022

compared with the historical high achieved during 2021 and on a per

capital level, the consumption for the 2022 year of 630 kg per

capita is consistent with that which should be expected based on

actual GDP and the anticipated GDP growth rate.

The Kazak cement market remained stable at 11.6 million tonnes ,

with sales volume by Steppe Cement decreasing by 1% year on year,

due mostly to logistical problems in the railway system in the

third and fourth quarters. The blend of this was that domesticl

sales increased by 4% and exports reduced to virtually zero .

Imports into Kazakshtan decreased by 25% to 0.6 million tonnes,

being equivalent to 5% of the total market, with these coming

mostly from Russia. Exports from local producers decreased again by

33% to 1.1 million tonnes, with these being mostly to Uzbekistan

and Kyrgystan as new capacity has been commisioned in Uzbekistan.

Exports remain concentrated to the Tashkent and Bishkek areas.

The market demand in 2023 has shown a decrease in the first

quarter due to weather conditions, logistics and persistant high

inflation and we expect the market to improve in the coming

quarters. High interest rates will slow down the mortgage market

but the economy remains strong driven by commodities.

During 2021 and 2022 the government implemented incentives which

helped the construction industry, particularly the ability to

withdraw part of the individual pension funds and use them for real

estate acquisitions. The development of the main cities continues,

and the rate of urbanization is estimated to grow from the current

59% to 69% in the next 25 years. The banks are actively promoting

long term mortgages and the program has been very successful.

The political unrest at the beginning of 2022 as well as the

conflict in Ukraine have brought higher inflation and more populist

policies. After a phase of salary increases to compensate for

inflation, the government seems to be committed to lowering

inflation.

In 2022, Steppe Cement posted a net profit of USD17.9 million

while EBITDA remained stable at USD31 million. Higher pricing

compensated for the increase in costs and slightly lower volumes.

Steppe Cement's average cement selling prices increased by 12% in

KZT and 4% in USD, to USD52 per tonne delivered.

Steppe Cement operated both lines at 86% of their current

combined capacity (which is 1.1 million tonnes for line 5 and 0.85

million tonnes for line 6).

Shareholders' funds remained stable at USD65.1 million after the

dividend distribution USD12.6 million to shareholders (5 UK pence

per share).

Key financials Year ended Year ended Inc/(Dec)%

31- Dec-22 31- Dec-21

Sales (tonnes of cement) 1,670,174 1,688,544 (1%)

------------ ------------ -----------

Consolidated turnover (KZT million) 40,023 36,020 11%

------------ ------------ -----------

Consolidated turnover (USD million) 86.7 84.6 3%

------------ ------------ -----------

Consolidated profit before tax

(USD million) 21.7 21.4 1%

------------ ------------ -----------

Consolidated profit after tax

(USD million) 17.9 17.1 5%

------------ ------------ -----------

Profit per share (US cents) 8.2 7.8 5%

------------ ------------ -----------

Shareholders' funds (USD million) 65.1 65.6 (1%)

------------ ------------ -----------

Average exchange rate (KZT/USD) 461 426 (8%)

------------ ------------ -----------

Exchange rate as at year end

(KZT/USD) 462 434 (6%)

------------ ------------ -----------

Production and costs

Line 5 produced 60% 995,933 tonnes of cement while Line 6

produced 663,955 tonnes.

Line 5 performed at 90% capacity as it was limited by roller

maintenance while Line 6 was limited by reliability. In 2023 we

expect higher production from Line 6 and similar in Line 5.

Cost per tonne increased by 20% in KZT at slightly higher pace

than inflation. The average cash production cost of clinker

increased from USD20/tonne to USD23/tonne while cement cash cost

increased from USD23/tonne to USD26/tonne in 2022. The cost of

production increased by 20% in local currency in line with

inflation of 18.8% year on year. The devaluation of the currency

was limited to 8%.

Despite the increase of transportation costs, selling expenses,

reflecting mostly cement delivery costs, were reduced to

USD6.6/tonne as we focused in markets closer to the factory.

General and administrative expenses we reduced to USD6.4 million

from USD6.7 million in 2021 due to cost control measures.

On 31 March 2023 the company had 799 employees a similar level

to 2022.

In 2022, finance costs remained stable at USD 1 million. Without

operating lease interest of USD0.2 million under IFRS 16, the

finance cost was USD0.8 million, mostly interest on loans.

Other income of USD2.4 million reflects the write-back of

receivables previously written down and the write-back of deferred

income from the government subsidied loans.

The factory receives an allocation CO(2) emissions from the

government and does not trade them as they are at a level similar

to historical production. There is a very limited market for

alternative fuels and the increase in additives in the cement is

not yet accepted beyond certain levels.

Capital investment increased significantly in 2022 but it will

be limited going forward

Capital investment was accelerated to USD10 million to complete

the work started in 2021 and to compensate for the slow down in

investment during 2019 and 2020 due to COVID19. Apart from the

traditional maintenance capex and purchase of key spares for USD3

million per year, we managed to complete a significant number of

projects in 2022:

- New FL Smith close circuit separator for cement mill number 1

with an investment of USD3.6 million. The mill capacity was

increased by 30%, slag content can be increased to 25%, power

consumption has been reduced and the quality and stability has

improved

- A similar separator for cement mill number 2,. The project was

started and USD1.5 million was spent in 2022. Commissioning will be

done between the winter 2023 and spring 2024.

- Replacement of one reducer for one cement mill at a cost of USD 0.9 million

- Bucket crane revamping to support summer sales USD 0.3 million

- Online monitoring of main stack emissions to comply with

ecological requirements USD0.15 million

- Coal dosing system to improve feeding reliability

- High tension drive motors to maintain key spares

- Additional gas analyzer for kiln system to maintain clinker stability

Those projects were financed by USD4.3 million in subsidized

loans and USD 3.5 million from internal cash flow.

We have plans for a further USD4 million investment in 2023 and

the first quarter of 2024 including:

- Complete the new separator for cement mill 2 for USD 2 million

- Preheater raiser duct extension by 24 meters to improve the preheater calcination in line 6

- Software upgrades to the ABB control system at a cost of

USD0.7 million to allow further automatisation of the factory and

prevent obsolescence

- Engineering of raw mill 3 separator conversion to dynamic

separator to support the increase in production of line 6 by 10%

when completed

- Upgrades to bag filters to improve maintenance and future enviroment requirements

The government has announced that the subsidized credit lines

will be limited as the focus shifts to the control of inflation. We

will try to complete the remaining capex planned with our cash flow

to avoid borrowings at commercial KZT rates as much as

possible.

Financial position: New debt will be limited as interest rates

in Kazakhstan have increased to 20% per annum in 2023

During the year, our total loans outstanding were stable at

USD6.7 million versus USD5.6 million in 2021. The loans had good

subsidized rates in KZT but the renewal will be most likely made at

near commercial rates and the company has an incentive to reduce

the borrowing in 2023. The company ended the year with net debt of

USD2.6 million, excluding IFRS 16 leases.

Long-term loans were increased from USD3.2million to

USD5.4million while short term loans were reduced from USD 2.3 to

USD 1.3million.

Despite the politically unstable environment in Kazakhstan at

the beginning of the year, the unpredictable situation in the

region and the surge in inflation, the KZT had only an 8%

devaluation against the USD and an average exchange rate of 461 vs

426 in 2021.

We maintain short term credit lines available as stand by:

- KZT 1 billion short term in a government subsidized program in

KZT at 6% per annum, but it will difficult to renew

- KZT 2 billion from Halyk Bank at 6% p.a. in USD or 20% in KZT.

Depreciation of property, plant and equipment decreased to

USD6.1 million in 2022 due to devaluation

Steppe Cement's effective income tax rate was 20% consistent

with last year.

Javier del Ser Perez

Chief Executive Officer

Annual Report 2022 and Annual General Meeting

Steppe Cement will release its Annual Report 2022 on its web

site at www.steppecement.com during the week commencing 20th June

2023. The Company's Annual General Meeting is expected to take

place at its Malaysian Office at Suite 10.1, 10th Floor, West Wing,

Rohas Perkasa, 8 Jalan Perak, Kuala Lumpur Malaysia on Wednesday,

12th July 2023 at 4 p.m.

Steppe Cement's AIM nominated adviser and broker is RFC Ambrian

Limited.

Nominated Adviser contact: Stephen Allen or Andrew Thomson on

+61 8 9480 2500.

Broker contact: Charlie Cryer at +44 20 3440 680

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF PROFIT OR LOSS

FOR THE YEARED 31 DECEMBER 2022

The Group The Company

Note 2022 2021 2022 2021

USD USD USD USD

Revenue 4 86,732,039 84,578,739 14,641,442 1,469,264

Cost of sales (49,107,243) (44,834,182) - -

------------- ------------- ------------ -----------

Gross profit 37,624,796 39,744,557 14,641,442 1,469,264

Selling expenses (10,997,920) (12,264,221) - -

General and

administrative

expenses (6,393,080) (6,761,722) (369,812) (324,207)

Interest income 573,913 401,619 - -

Finance costs 5 (1,048,888) (1,090,949) - -

Net foreign exchange

loss 6 (435,204) (227,951) (330,675) (825)

Other income, net 2,367,459 1,616,216 - 112,940

Profit before income

tax 7 21,691,076 21,417,549 13,940,955 1,257,172

Income tax expense 8 (3,807,706) (4,352,182) - -

------------- ------------- ------------ -----------

Profit for the

year 17,883,370 17,065,367 13,940,955 1,257,172

============= ============= ============ ===========

Attributable to

shareholders of

the

Company 17,883,370 17,065,367 13,940,955 1,257,172

============= ============= ============ ===========

Earnings per share:

Basic and diluted

(cents) 9 8.2 7.8

============= =============

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

The Group The Company

2022 2021 2022 2021

USD USD USD USD

Profit for the year 17,883,370 17,065,367 13,940,955 1,257,172

------------- ------------- ------------ -----------

Other comprehensive

(loss)/income:

Items that may not

be

reclassified subsequently

to

profit or loss:

Revaluation gain on

property,

plant and equipment, - - - -

net of

tax

Gain on recovery of

impaired - 15,373 - -

assets

Increase in provision

for

site restoration - (23,611) - -

Items that may be

reclassified

subsequently to profit

or

loss:

Exchange differences

arising from translation

of

foreign operations (5,829,119) (1,923,738) - -

------------- ------------- ------------ -----------

Total other comprehensive

loss (5,829,119) (1,931,976) - -

------------- ------------- ------------ -----------

Total comprehensive

income for the year 12,054,251 15,133,391 13,940,955 1,257,172

============= ============= ============ ===========

Attributable to the

shareholders of the

Company 12,054,251 15,133,391 13,940,955 1,257,172

============= ============= ============ ===========

.

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF FINANCIAL POSITION

AS OF 31 DECEMBER 2022

The Group The Company

Note 2022 2021 2022 2021

USD USD USD USD

Assets

Non-Current Assets

Property, plant

and

equipment 10 49,361,749 48,437,801 - -

Right-of-use assets 11 5,525 1,700,510 - -

Investment in subsidiary

companies 12 - - 36,199,599 36,199,599

Loans to subsidiary

company 27 - - 30,050,000 30,080,000

Other assets 13 1,530,916 155,132 - -

Total Non-Current

Assets 50,898,190 50,293,443 66,249,599 66,279,599

------------ ------------ ------------ ------------

Current Assets

Inventories 14 20,646,156 16,023,541 - -

Trade and other

receivables 15 2,045,004 1,751,720 2,372,114 1,724,364

Other assets 13 1,081,719 2,258,501 - -

Income tax recoverable 602,734 911,395 - -

Loans and advances

to

subsidiary companies 27 - - 60,352 49,536

Advances and prepaid

expenses 16 8,577,714 5,233,894 7,305 4,971

Cash and cash

equivalents 17 4,143,953 10,136,022 1,239,827 614,225

Total Current Assets 37,097,280 36,315,073 3,679,598 2,393,096

Total Assets 87,995,470 86,608,516 69,929,197 68,672,695

============ ============ ============ ============

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF FINANCIAL POSITION

AS OF 31 DECEMBER 2022 (CONTINUED)

The Group The Company

Note 2022 2021 2022 2021

USD USD USD USD

Equity and Liabilities

Capital and Reserves

Share capital 18 73,760,924 73,760,924 73,760,924 73,760,924

Revaluation reserve 19 1,795,426 2,068,114 - -

Translation reserve 19 (126,267,201) (120,438,082) - -

Retained earnings/

(Accumulated losses) 19 115,791,111 110,190,323 (4,220,191) (5,605,876)

------------- ------------- ------------- -------------

Net Equity 65,080,260 65,581,279 69,540,733 68,155,048

------------- ------------- ------------- -------------

Non-Current Liabilities

Borrowings 20 3,913,689 1,941,383 - -

Lease liabilities 21 - 8,571 - -

Deferred taxes 22 3,266,775 4,318,652 - -

Deferred income 23 2,572,552 1,588,098 - -

Provision for site

restoration 178,420 180,314 - -

Total Non-Current

Liabilities 9,931,436 8,037,018 - -

------------- ------------- ------------- -------------

Current Liabilities

Trade and other

payables 24 7,348,587 5,061,705 - -

Accrued and other

liabilities 25 2,250,689 1,552,778 143,808 227,897

Amount owing to

a

subsidiary company 27 - - 244,656 289,750

Borrowings 20 2,814,525 3,614,801 - -

Lease liabilities 21 58,960 2,017,879 - -

Deferred income 23 140,259 103,720 - -

Taxes payable 26 370,754 639,336 - -

Total Current Liabilities 12,983,774 12,990,219 388,464 517,647

------------- ------------- ------------- -------------

Total Liabilities 22,915,210 21,027,237 388,464 517,647

------------- -------------

Total Equity and

Liabilities 87,995,470 86,608,516 69,929,197 68,672,695

============= ============= ============= =============

Company No. LL04433

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Non-distributable

Distributable

Share Revaluation Translation Retained

The Group capital reserve reserve earnings Net*

USD USD USD USD USD

As of 1 January

2022 73,760,924 2,068,114 (120,438,082) 110,190,323 65,581,279

Profit for the

year - - - 17,883,370 17,883,370

Other

comprehensive

loss - - (5,829,119) - (5,829,119)

----------------------- --------------------------------------------------

Total

comprehensive

income for the

year - - (5,829,119) 17,883,370 12,054,251

Other

transactions

impacting

equity:

Dividends paid

(Note 19) - - - (12,555,270) (12,555,270)

Transfer of

revaluation

reserve

relating to

property,

plant and

equipment

through

use - (272,688) - 272,688 -

As of 31

December 2022 73,760,924 1,795,426 (126,267,201) 115,791,111 65,080,260

=========== ======================= ================================================== ============== =============

* Attributable to the shareholders of the Company

Company No. LL04433

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022 (CONTINUED)

Non-distributable

Distributable

Share Revaluation Translation Retained

The Group capital reserve reserve earnings Net*

USD USD USD USD USD

As of 1

January 2021 73,760,924 2,370,706 (118,514,344) 100,325,002 57,942,288

Profit for the

year - - - 17,065,367 17,065,367

Other

comprehensive

loss - (8,238) (1,923,738) - (1,931,976)

----------------------- --------------------------------------------------

Total

comprehensive

income for

the

year - (8,238) (1,923,738) 17,065,367 15,133,391

Other

transactions

impacting

equity:

Dividends

paid (Note

19) - - - (7,494,400) (7,494,400)

Transfer of

revaluation

reserve

relating to

property,

plant and

equipment

through

use - (294,354) - 294,354 -

As of 31

December 2021 73,760,924 2,068,114 (120,438,082) 110,190,323 65,581,279

=========== ======================= ================================================== ============== ============

* Attributable to the shareholders of the Company

Company No. LL04433

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

(Accumulated

losses)/

Distributable

Share Retained

The Company Capital earnings Net

USD USD USD

As of 1 January 2022 73,760,924 (5,605,876) 68,155,048

Total comprehensive income

for the year - 13,940,955 13,940,955

Dividends paid (Note 19) - (12,555,270) (12,555,270)

As of 31 December 2022 73,760,924 (4,220,191) 69,540,733

=========== =============== =============

As of 1 January 2021 73,760,924 631,352 74,392,276

Total comprehensive income

for the year - 1,257,172 1,257,172

Dividends paid (Note 19) - (7,494,400) (7,494,400)

As of 31 December 2021 73,760,924 (5,605,876) 68,155,048

=========== =============== =============

Company No. LL04433

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022

The Group The Company

2022 2021 2022 2021

USD USD USD USD

CASH FLOWS FROM/ (USED

IN) OPERATING ACTIVITIES

Profit before income

tax 21,691,076 21,417,549 13,940,955 1,257,172

Adjustments for:

Depreciation of property,

plant and equipment 6,135,236 7,039,116 - -

Depreciation of right-of-use

assets 1,587,293 1,716,748 - -

Dividend income - - (13,309,140) -

Gain on disposal of

property, plant (27,725) - - -

and equipment

Interest income (573,913) (401,619) (1,332,302) (1,469,264)

Finance costs 1,048,888 1,090,949 - -

Net unrealised foreign

exchange

loss 538,663 227,951 - -

Provision for obsolete

inventories 167,628 142,387 - -

Credit loss allowance

for

doubtful receivables 174,650 594,901 - -

Allowance for advances

paid

to third parties 157,723 11,676 - -

Deferred income (140,259) (105,947) - -

Reversal of allowance

for trade receivable

no longer required (172,464) (769,654) - -

------------- ------------- ------------ -----------

Operating cash flows

before

movements in working

capital 30,586,796 30,964,057 (700,487) (212,092)

Movement in working capital:

(Increase)/Decrease in:

Inventories (8,501,824) (6,054,197) - -

Trade and other receivables (427,760) 302,194 (865,000) (90,000)

Loans and advances to

subsidiary companies - - 19,184 20,176

Advances, prepaid expenses

and

other assets (5,608,461) (2,820,912) (2,334) 877

Company No. LL04433

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022 (CONTINUED)

The Group The Company

2022 2021 2022 2021

USD USD USD USD

Increase/(Decrease) in:

Trade and other payables 2,097,417 659,458 - -

Accrued and other liabilities 786,440 54,890 (84,089) 41,149

Cash Generated From/(Used

In)

Operations 18,932,608 23,105,490 (1,632,726) (239,890)

Income tax paid (4,599,594) (3,985,384) - -

Net Cash From/(Used In)

Operating

Activities 14,333,014 19,120,106 (1,632,726) (239,890)

-------------- -------------- -------------- -------------

CASH FLOWS (USED IN)/

FROM INVESTING ACTIVITIES

Purchase of property,

plant and

equipment (7,768,695) (6,215,744) - -

Contribution to site

restoration

fund (334) (18,414) - -

Proceeds from disposal

of

property, plant and

equipment 85,599 118,234 - -

Dividends received from

subsidiary - - 13,309,140 6,610,895

Interest received 573,913 401,619 1,549,552 -

-------------- -------------- -------------- -------------

Net Cash (Used In)/From

Investing Activities (7,109,517) (5,714,305) 14,858,692 6,610,895

-------------- -------------- -------------- -------------

CASH FLOWS FROM/

(USED IN) FINANCING

ACTIVITIES

(Repayment to)/Advance

from a subsidiary company - - (45,094) 289,750

Return of net investment

from a

subsidiary company - - - 94,920

Proceeds from borrowings* 7,299,722 5,502,753 - -

Repayment of borrowings* (4,472,018) (6,345,979) - -

Repayment of lease liabilities* (1,838,949) (1,805,362) - -

Dividends paid (12,555,270) (7,494,400) (12,555,270) (7,494,400)

Interest paid (1,038,335) (1,081,123) - -

-------------- -------------- -------------- -------------

Net Cash Used In Financing

Activities (12,604,850) (11,224,111) (12,600,364) (7,109,730)

-------------- -------------- -------------- -------------

Company No. LL04433

STEPPE CEMENT LTD

(Incorported in Labuan FT, Malaysia under Labuan Companies Act,

1990)

STATEMENTS OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2022 (CONTINUED)

The Group The Company

2022 2021 2022 2021

USD USD USD USD

NET (DECREASE)/INCREASE

IN CASH AND CASH

EQUIVALENTS (5,381,353) 2,181,690 625,602 (738,725)

EFFECTS OF FOREIGN

EXCHANGE RATE

CHANGES (610,716) (259,348) - -

CASH AND CASH

EQUIVALENTS AT

BEGINNING OF YEAR 10,136,022 8,213,680 614,225 1,352,950

CASH AND CASH

EQUIVALENTS AT

END OF YEAR (Note 17) 4,143,953 10,136,022 1,239,827 614,225

============= ============ =========== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FLMJTMTBMMFJ

(END) Dow Jones Newswires

June 09, 2023 02:00 ET (06:00 GMT)

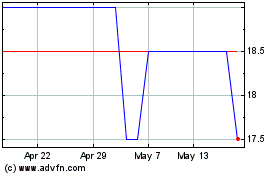

Steppe Cement (LSE:STCM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Steppe Cement (LSE:STCM)

Historical Stock Chart

From Mar 2024 to Mar 2025