TIDMMGNS

RNS Number : 2128T

Morgan Sindall Group PLC

24 March 2016

Morgan Sindall Group plc ('the Company')

Annual Financial Report

Further to the release of the Company's Preliminary Results

announcement on 23 February 2016, the Company announces that it has

today posted the following documents on its website at

www.corporate.morgansindall.comwww.investors.morgansindall.com:

-- 2015 Annual Report

-- Circular containing the notice of the 2016 annual general meeting

The Company will hold its annual general meeting at 10.00am on

Thursday 5 May 2016 at the offices of Jefferies Hoare Govett,

Vintners Place, 68 Upper Thames Street, London EC4V 3BJ.

A copy of each of the documents listed above has been submitted

to the Financial Conduct Authority's national storage mechanism

('NSM') and can be accessed via the NSM website at

www.hemscott.com/nsm.do.

In accordance with the requirements of Rules 4.1 and 6.3.5 of

the Disclosure and Transparency Rules, a description of the

principal risks and uncertainties affecting the Group is set out in

appendix 1 to this announcement. The Company's Preliminary Results

announcement released on 23 February 2016 contained all other

information required by DTR 6.3.5.

ENQUIRIES:

Morgan Sindall Group plc Tel: 020 7307 9200

Clare Sheridan, Company Secretary

End

24 March 2016

Appendix 1

The Board recognises the importance of risk in the running of

its business. It recognises that circumstances are continuously

changing and that the risks need to remain under regular review.

This review should be read in conjunction with the viability

statement below.

Overview

Operating in the construction industry, risk is at the heart of

everything we do. We therefore have well-embedded risk and control

processes in place to manage both material and day-to-day

circumstances.

The Group's risk and governance model is designed so that the

Board maintains overall responsibility for risk. Each division

identifies controls and mitigates threats within their operations.

The reporting structure ensures that once the risk appetite is

determined by the Board, risks are managed within acceptable

tolerance levels.

Senior managers within the divisions take ownership of specific

business risks. The likely causes and consequences of each risk are

recorded and each risk is evaluated (both before and after the

effect of mitigation) on its likelihood of occurrence and severity

of impact on strategy. This approach allows the identification and

consistent evaluation of principal risks, as well as consideration

of the effect of the current lines of defence in mitigation.

Process

Risk is managed across the Group in the following way:

-- The Group and its divisions undertake a comprehensive annual

business planning process to identify objectives and set strategies

to achieve their goals taking account of the risk appetite set by

the Board.

-- The executive directors meet with the divisions regularly

throughout the year and with an established agenda and reporting

format covering a range of matters. This allows the executive

directors to ensure that they maintain oversight and control over

the material aspects of strategic, financial, operational and risk

issues.

-- The risk environment is further underpinned by a clear set of

Group and divisional delegated authorities (DELAPS) that define

processes and procedures for approving material decisions,

particularly with regard to project selectivity, tender pricing,

risk, bid submissions and capital requirements. This ensures that

projects are approved at the appropriate level of management, with

the largest and most complex projects being approved at Board

level.

-- Twice yearly each division carries out a detailed risk review

which identifies mitigations or proposed actions for each

significant risk. Risk registers document these together with any

timescale by which actions are targeted for completion. In

conjunction with the divisional risk reviews the Group's executive

directors compile their own assessment thus ensuring that a top

down, bottom up approach is undertaken when considering the

Group-wide environment. These risks are then considered at the

monthly divisional board meetings, to ensure that they remain under

continuous review.

-- The Group risk committee meets three times a year. Its

purpose is to assist the Board in assessing and monitoring risk

management across the Group. The committee's role is to ensure that

inherent and emerging risks in the business are identified and

managed in a timely manner and at an appropriate level. The

committee reviews the response of the Group to specific areas of

risk, and approves standards and processes where weaknesses are

considered to exist.

-- The Group's audit committee is responsible for monitoring and

approving the work undertaken by the internal audit function and

for ensuring that the internal audit process remains efficient and

effective. The committee annually approves the internal audit which

covers both project and corporate level risks. The plan is

developed by focusing upon the principal risks identified from the

risk review process and feedback from current divisional

performance. The internal audit team reports regularly to the Board

and the audit committee on its findings. This process has been

strengthened by divisional audit committees established separately

for Construction & Infrastructure and Affordable Housing, which

have larger and more complex operations than other divisions.

Principal risks

The Board has carried out a robust assessment of the principal

risks that may threaten the Group's strategic priorities. The risks

represent a snapshot of the Company's current risk profile. This is

not an exhaustive list of all the risks the Company faces. As the

global economic environment changes and industry circumstances

evolve, new risks may arise or existing risks may recede or the

ranking of these risks may change.

Our principal risks are set out below:

Strategic Priority Principal risk

------------------------ ------------------------------

Win in targeted markets Macroeconomics - new

opportunities

------------------------ ------------------------------

Market capacity

------------------------ ------------------------------

Exposure to UK housing

market

------------------------------

Poor contract selection

------------------------ ------------------------------

Develop and retain Safety or environmental

talented people incident

------------------------ ------------------------------

Failing to attract and

retain talented people

------------------------ ------------------------------

Disciplined use of Insolvency of key client,

capital subcontractor or supplier

------------------------ ------------------------------

Treasury and funding

------------------------ ------------------------------

Management of working

capital

------------------------ ------------------------------

Maximise efficiency Misprice contracts

of resources

------------------------ ------------------------------

Managing changes to contracts

and disputes

------------------------ ------------------------------

Poor project delivery

------------------------ ------------------------------

Pursuing innovation Innovation

------------------------ ------------------------------

Information technology

------------------------ ------------------------------

In general terms there is a continuing decrease in the overall

risk perceived by the Group, due partly to the completion of a

small number of contracts in London and the South which had

experienced timetable slippages and increased costs. Other factors

reducing risk are the more favourable project procurement routes

that prevail and the sustained UK economy and housing market.

However global economic effects could impact UK investor confidence

and there remains some uncertainty ahead of the EU referendum and

the effect this may have on the market.

Construction: Contract terms, procurement routes and entry

margins are all more favourable,, which, added to improvements in

project controls, means the Group will operate in a more favourable

risk and opportunity environment than in recent years.

Regeneration: The Group's schemes are subject to economic

viability tests, are non-speculative and have robust risk and

capital controls, which allows us to take advantage of the current

prevailing UK economy but at the same time limiting any possible

negative fluctuations in the future markets.

Capital and cash: The Group has committed banking facilities

until 2018, which together with our robust cash and capital

controls allow us to confidently manage our investment portfolio

into the foreseeable future.

Resource: The People Promise initiated to address the Group's

future talent requirement is gathering momentum. This investment

has already begun to secure and develop the talent required to

enable our longer-term growth plans.

Viability statement

As required by provision C.2.2 of the Code, the directors have

assessed the prospects of the Group and have concluded that they

have a reasonable expectation that the Group will be able to

continue in operation and meet its liabilities as they fall due

over the period of the assessment. This assessment took account of

the Group's current position and principal risks and has been made

using a period of three years commencing on 1 January 2016, which

is consistent with the Group's budgeting cycle.

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 08:02 ET (12:02 GMT)

The directors have considered the Group's solvency and liquidity

using cash flow projections. These are compiled on a bottom up

basis incorporating each division's detailed business plans. At

Group level, the base case financial projections assume modest

revenue growth and an improvement in gross margin back to more

normal levels for the Group as the problem contracts that impacted

2015 do not recur and procurement routes become more favourable

with less single stage, competitive tendering. Overheads are

expected to increase ahead of inflation to support the expected

growth in volumes and activity. Operating cash flows are assumed to

broadly follow forecast profitability in the Group's construction

activities, but are much more independently variable in

regeneration, driven by the timing of construction spend and

programmed completions on schemes.

The Group's main committed facility matures in September 2018.

The directors draw attention to the key assumption that there is a

reasonable expectation that this will be renewed at the appropriate

time or the term extended and that there will not be a material

reduction in the level of facilities available to the Group or a

material change in the pricing.

The impact of a number of downside scenarios on the Group's

headroom against its committed facilities and the financial

covenants thereon has been modelled based on the Group's principal

risks. The scenarios are focused on the risks that are scored as

most likely to occur or that would have the greatest potential

severity should they occur and include lower revenue growth,

failure to improve gross margin from current levels, a decline in

gross margin and deterioration in working capital, specifically

client receivables.

The Board has also considered a range of potential mitigating

actions that may be available if one or more of the scenarios

arose.

Strategic priority - Win in targeted markets

The markets in which we operate are affected to varying degrees

by general global economic conditions.

We welcome the sustained improvements in the UK economy and in

turn the quality of our related pipeline in Construction and

Regeneration markets. Unsettled world-wide conditions, such as the

impact of the EU referendum, interest rates and crude oil prices,

remain a concern in their ability to influence investor confidence

that could impact on the Group's longer-term strategy.

Principal Mitigation Key Risk change in

risk monitor reporting period(1)

/ metric

/

instrument

Frequency

-------------- ----------------------------------------------------------- ------------ -------------------------------------------------------------

Macroeconomic Business Decrease

- new * Strategic focus on market spread, geographical planning

opportunities capability and diversification offer measured process * We continue to enjoy sustained levels of opportunity

protection against the cyclical effect of individual Annual in our Construction and Regeneration markets and high

Failure to markets. levels of demand for its development schemes.

anticipate Board

and respond reporting

to global * Business planning processes focus on future markets Monthly * This is partially tempered by levels of competition

economic and those opportunities that are consistent with our in the Construction market, albeit procurement routes

changes risk appetite. Pipeline ,

could result and order margins and terms continue to be favourable.

in the book

inappropriate * Scale adds resilience by enabling the Group to reporting

allocation compete and work in areas with higher barriers to Weekly * Development schemes are sensitive to market and

of resources entry. consumer confidence. Our strategy continues to be

and capital. Sales and geared to commit only if schemes prove economically

This could marketing viable. This means we can maximise our residential

affect the * Added value can be offered to clients when our report portfolio whilst being able to respond quickly to any

Group's divisions work together. Weekly future negative market fluctuations.

profitability

and cash Controls

generation. * Regular monitoring and reporting of financial over * Construction & Infrastructure has been reshaped in

performance, work won, prospects and pipeline of delegated order to take advantage of the current UK economy, be

We have opportunities. authorities more selective to minimise risk and maximise

identified (DELAPS) opportunities for sustainable growth.

the markets Ongoing

and sectors * Market intelligence helps detect potential shifts in

in which we spending and allows us to adapt our strategy if * Group strategic reviews have been refocused by the

anticipate necessary. appointment of a group strategy director who is

future validating strategy and business planning in line

growth. with UK economic indicators and our growth

Within those aspirations

areas we

remain

focused on

selecting

opportunities

that will

provide

sustainable

margins and

repeat

business.

We seek to

anticipate

and

appropriately

respond to

changes in

the global

economic

environment

that may

negatively

impact on

these chosen

markets and

sectors.

-------------- ----------------------------------------------------------- ------------ -------------------------------------------------------------

Market Resource No Change

capacity * Rigorous DELAPS process requires teams at bid stage planning

to verify that appropriate levels of qualified reviews * The industry continues to experience skills and cost

Failure to resource are available. Weekly inflation pressures that we are managing through

rigorously disciplined bid and project selection processes.

review Supply

internal * Our operational resource levels are regularly chain

and third reviewed against anticipated workload. feedback * Construction & Infrastructure's supply chain

party reporting leadership team continues to drive initiatives, which

resource Ongoing/ include the promotion of supply chain partners and

levels * We monitor and report on supply chain utilisation Quarterly increasing engagement to align the business with the

against with a continued focus on initiatives within each 'Customer of Choice' strategy. Moving forward our

anticipated division. DELAPS reporting will include monitoring of progress and

workloads Ongoing improvements in performance throughout the year. This

as a result will help us secure the best supply chain partners to

of sustained * We seeks to differentiate ourselves by being the Tender meet our future needs whilst in return offering

levels of customer of choice to our partners through the review attractive terms.

activity. development and management of effective supply chain boards

Current relationships. Ongoing

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 08:02 ET (12:02 GMT)

positive * The People Promise initiative to help secure and

market develop talent has now been deployed into each of our

conditions * The business planning process identifies future divisions.

continue to resource requirements and supply chain strategies.

create a risk

of potential

overtrading

and, we,

together

with our

supply

chain, are

facing

increasing

pressure on

cost and

skills

availability.

-------------- ----------------------------------------------------------- ------------ ------------------------------------------------------------

Exposure to Business No Change

UK housing * Key UK statistics are monitored, including planning

market unemployment, lending and affordability. process * The industry continues to experience skills and cost

Annually inflation pressures that we are managing through

The UK disciplined bid and project selection processes.

housing * Commitments to development schemes are carefully Board

sector is controlled via a rigorous three-stage development reporting

strongly approval process. Monthly * Construction & Infrastructure's supply chain

influenced leadership team continues to drive initiatives, which

by Government Sales and include the promotion of supply chain partners and

stimulus and * Development structures limit speculative development marketing increasing engagement to align the business with the

consumer to minimise the impact of negative market report 'Customer of Choice' strategy. Moving forward our

confidence. fluctuations. Weekly reporting will include monitoring of progress and

If mortgage improvements in performance throughout the year. This

availability Development will help us secure the best supply chain partners to

and * Where possible, the forward purchase of land is forecasting meet our future needs whilst in return offering

affordability subject to economic viability prior to commitment. Monthly/ attractive terms.

become less quarterly

favourable

this could * When feasible sections of large scale residential * The People Promise initiative to help secure and

make existing schemes are forward sold to institutional investors. develop talent has now been deployed into each of our

schemes divisions.

difficult

to sell and

future

developments

unviable,

reducing

profitability

and tying

up capital.

-------------- ----------------------------------------------------------- ------------ ------------------------------------------------------------

Poor contract Pipeline Decrease

selection * Business planning identifies the markets, sectors and order

and book reporting * The majority of our material projects continue to be

There is a clients that we will target. Weekly secured with repeat clients with strong

risk that relationships.

a division Tender review

would accept * Plans for specific types of work, contract size an boards

a contract d Ongoing * The current market allows the divisions to be more

outside its risk profile are agreed by individual divisions. selective in respect of which contracts to bid for.

core Board reporting

competencies Monthly

or for which * A system of DELAPS governs bid selectivity and the * The development within Construction & Infrastructure

it has acceptance of work. DELAPS of enhanced pipeline and opportunity selectivity

insufficient Ongoing tools means we can identify work that has a higher

resources. probability of success.

This can * Staff planning ensures appropriate levels of Sales and

become qualified resource. marketing

a greater report * Greater visibility of medium-term pipeline quality

risk in a Weekly and the ability to give an early indication of longer

rising market * Initiatives are in place to select supply chain term trends mean we are better able to reshape the

when there partners that match our expectations in terms of Supply chain business in response.

are more quality, sustainability and availability. feedback

opportunities reporting

but of Ongoing/quarterly * As market conditions continue to be favourable we

varying have experienced a greater use of more attractive

quality, procurement routes (negotiated and two-stage) and in

coupled addition have been able to negotiate more favourable

with a limit terms.

on the

availability

of the

appropriate

skills and

resources.

Failure to

understand

project risks

may lead to

poor project

delivery and

ultimately

result in

contract

losses

and

reputational

damage.

-------------- --------------------------------------------------------- ------------------ ------------------------------------------------------------

Strategic priority - Develop and retain talented people

Our performance and business conduct affects employees,

subcontractors and the public and, in turn, can affect our

reputation and commercial performance. We pride ourselves on our

industry-leading practices and our work in some high profile and

technically challenging markets.

Increased market activity has resulted in higher levels of

employee turnover across the sector. If we do not succeed in

attracting and retaining the right talent for our future needs we

will not be able to develop the business as anticipated.

Principal Mitigation Key monitor Risk change in

risk / metric reporting period(1)

/ instrument

Frequency

-------------- ------------------------------------------------------------ ---------------- ------------------------------------------------------------

Safety or HSE Board No Change

environmental * Key executives with specific responsibility for HSE report

incident are identified in each division and on the Board. Monthly * We monitor comparable industry-leading statistics. A

significant proportion of work is carried out in

With Group HSE highly complex and public environments which require

increased * HSE policy frameworks are widely communicated and forum strict observation of the highest levels of Health

pressure on senior managers appointed to manage them in each Quarterly and Safety Executive standards.

employees division and at project level.

and the HSE project

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 08:02 ET (12:02 GMT)

supply audit and * Safety innovations in Construction & Infrastructure

chain there * A Group-wide HSE forum operates to share learning, HSE training this year have included: i) a 'human performance'

is an best practice and emerging risks. schedules approach to leadership, supporting focus on

increasing and ratios influential and current HSE trends and themes; ii) a

risk that Ongoing/monthly cultural development programme and the development of

an accident * Established safety systems, site visits, monitoring a behavioural model for supervisors; iii)

or incident and reporting, procedures including near miss and HSE incident improvements in our engagement with the supply chain;

occurs potential hazard reporting, are in place across the investigation iv) the introduction of High Potential Incident

causing Group. report measures to improve intelligence; v) safety

harm to an Ongoing/monthly improvement plans in place for each business unit.

individual

or community. * Investigation and root cause analysis of accidents or

This could incidents and near misses are undertaken. * A Board HSE committee was established in 2015 to

result in oversee health and safety performance.

legal

proceedings, * Regular HSE training includes behavioural training

financial and update courses are provided.

penalties,

insurance

claims, * Major incident management plans and business

reputational continuity plans are in place and periodically

damage and reviewed and tested.

project

delays.

Consequently

we fail to

pre-qualify

in our

markets

due to a poor

HSE track

record and

ultimately

fails to

deliver

our targets.

-------------- ------------------------------------------------------------ ---------------- ------------------------------------------------------------

Failing to Divisional No Change

attract and * The People Promise has been deployed in all divisions 'people

retain aiming to build the Group's talent pool, identify boards' * Although the industry continues to suffer from a lack

talented people with high potential for future leadership, to review of skilled talent that will remain an issue for the

people offer exciting career opportunities and recognise talent foreseeable future, our investment in the People

achievement. Twice a Promise and associated initiatives is helping us to

In the year retain our talented teams.

current

economic * Future skills and capability requirements are HR Board

environment, monitored. reporting * Continued investment is made in graduate, trainee and

it has Monthly apprenticeship schemes to secure an annual inflow of

become new talent.

increasingly * An annual employee appraisal process is in place, Employee

difficult providing a two-way feedback on performance. joiners

to attract and leavers * A new leadership development programme was launched

and retain report in 2016 with the aim of training 400 leaders over the

the best * Training and development plans seek to maximise Weekly/monthly next two years.

people. relevant skills and experience.

Without Recruitment

talent, monitoring

it becomes * Succession plans are in place across the Group. Weekly/monthly

very

difficult Annual

to maintain * Staff leaver and joining feedback is obtained to appraisal

the highest understand reasons for change. process

levels of Annually

customer

service * Remuneration packages are benchmarked where possible.

and

technical

excellence

that we

strive

for.

------------- ------------------------------------------------------------ --------------- ------------------------------------------------------------

Strategic priority - Disciplined use of capital

Without sufficient liquidity, our ability to meet our

liabilities as they fall due would be compromised, which could

ultimately lead to our failure to continue as a going concern. In a

rising market there is an increased risk that the Group's

counterparties overtrade, which could affect their liquidity. The

heightened market that prevails could mean that a client or supply

chain partner inadvertently over stresses their -finances, so we

need to remain vigilant.

Principal Mitigation Key monitor Risk change in

risk / metric reporting period(1)

/ instrument

Frequency

-------------- ------------------------------------------------------------ ------------------- --------------------------------------------------------------

Insolvency Pipeline No Change

of key * Work is only carried out for financially sound and order

client, clients, established through rigorous due diligence book reporting * Increasing emphasis on project selectivity ensures

subcontractor and credit checks. Weekly that we optimise our focus on sectors and clients

or supplier that have secure covenants.

Insolvency Tender review

of a client * Financial security is sought and obtained where boards

may result required including specific commercial terms and Ongoing * Construction & Infrastructure have a greater focus on

in payment terms, with escrow accounts used as securing long-term supply chain relationships with

significant appropriate. WIP/debt/retention financially sound subcontractors.

financial monitoring

loss due to Daily/weekly

a bad debt, * Contracts with clients, subcontractors or suppliers

whilst are only entered into after review at the appropriate Supply chain

insolvency level of delegated authority. feedback

of a reporting

subcontractor Ongoing/quarterly

or supplier * Work with approved suppliers wherever possible

may disrupt Supply chain

a contract's prequalification

programme * Regular meetings are held with key supply chain Ongoing

of work and members to give and receive feedback and maintain the

lead to quality of the relationship. DELAPS

increased Ongoing

costs in

finding * Business strategy is largely focused on public and

replacements commercial clients based in sound market sectors,

for their reducing the risk of failure.

services.

There is also

a risk that,

given the

wider global

economic

climate,

historical

credit checks

are relied

upon that

have

subsequently

been

overtaken

by events.

-------------- ------------------------------------------------------------ ------------------- --------------------------------------------------------------

Treasury and Management Decrease

funding * We have committed banking facilities of GBP140m accounts

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 08:02 ET (12:02 GMT)

maturing in 2018, (of total facilities GBP175m). Monthly * Debt availability and terms continue to improve for

A lack of These will enable us to fund our planned investment the Group, our clients and our supply chain.

liquidity portfolio. Monitoring

could impact of cash

our ability levels

to continue * A three-stage process for approving development and Daily

to trade or investment-related schemes gives an early indication

restrict our of potential long-term balance sheet commitments. DELAPS

ability to Ongoing

invest in

regeneration * We have a disciplined allocation process for Cash forecast

schemes or significant project related capital which considers report

growth all future requirements and return on investment. Weekly/monthly

markets.

* Daily monitoring of cash levels and regular

forecasting of future cash balances and facility

headroom are conducted.

* Long-term cash forecasts are regularly stress tested

.

* Group DELAPS ensure prior approval is sought for

significant project related capital.

------------- ----------------------------------------------------------- --------------- ------------------------------------------------------------

Management Monitoring Decrease

of working * Working capital is monitored and managed as of cash

capital appropriate, with acute focus on any overdue work in levels * Working capital continues to improve as aged projects

progress, debtors or retentions. Daily unwind and general market terms improve.

Poor

management Cash forecast

of working * Ongoing cash management focus continues to improve. report * Continued cash optimisation focus and controls are

capital Weekly realising benefits.

leads

to * Cash profiling of key opportunities is undertaken at

inadequate an early stage to ensure they meet the Group's

liquidity expectations.

and funding

problems.

------------- ----------------------------------------------------------- --------------- ------------------------------------------------------------

Strategic priority - Maximise efficiency of resources

The Group undertakes several hundred contracts each year. It is

important that contractual terms reflect risks arising from the

nature and complexity of the works and the duration of the

contracts and that these risks are effectively managed.

Having identified the markets in which we will operate, we must

ensure that we select opportunities which we can successfully

deliver by employing capable and available resources. We must

actively manage these resources to ensure our clients receive

exceptional levels of service.

Key monitor

Principal Mitigation / metric Risk change in

risk / reporting period(1)

instrument

Frequency

-------------- ------------------------------------------------------------ ------------ ------------------------------------------------------------

Mispricing Tender No Change

a contract * Robust DELAPS govern the selection of all bids and review

the acceptance of work at key stages. boards * We continue to secure improved contract procurement

If contracts Ongoing routes and terms.

are not

costed * We have a well-established bidding process and Board

correctly experienced bidding teams. reporting * The development within Construction & Infrastructure

this could Monthly of enhanced pipeline and opportunity selectivity

lead to loss tools means we can identify work that has a higher

of * Robust pre-selection, due diligence and risk DELAPS probability of success. Greater visibility of

profitability assessment of individual bids take place. Ongoing medium-term pipeline quality and the ability to give

on a contract an early indication of longer term trends better

that reduces enable us to reshape the business in response.

overall gross * Contract tender reviews are conducted at three key

margin. It stages: pre-qualification, pre-tender and final

may also tender submission. Each stage is approved by an

result appropriate level of senior management via tender

in damaged review boards.

client and

project team

relationships

.

-------------- ------------------------------------------------------------ ------------ ------------------------------------------------------------

Managing Project Decrease

changes * Work is carried out under standard terms wherever financial

to contracts possible. performance * Contract procurement routes and terms are improved

and contract Monthly with an increasing two-stage and negotiated approach.

disputes

* Contract terms are reviewed at tender stage and any Project

Changes to variations approved by the appropriate level of operational * Further enhancements have been made to contract early

contracts management. performance warning techniques.

and contract Monthly

disputes

could * We have well-established systems of measuring and Electronic * The BIM strategy has been fully developed to provide

lead to costs reporting project progress and estimated outturns, project more efficient asset management across the whole

being including contract variations. management lifecycle.

incurred tool

that are not dashboard

recovered * Enhanced project management systems have lead Ongoing

and loss of indicators that assist in the early identification of

profitability potential issues.

on a contract

and delayed

cash. * Increasing building information management ('BIM')

Ultimately adoption is helping us overcome potential design and

we may need constructability issues before they become too costly

to resort or time consuming.

to legal

action

to resolve * Regularised project review process including peer

disputes reviews ensures rigour is applied in core processes

which to facilitate early warning and subsequent mitigation

can prove strategies.

costly with

uncertain

outcomes, * A decision to take legal action is based on

and can appropriate legal advice and suitable provision made

adversely for legal costs.

affect our

client

relationships

.

-------------- ------------------------------------------------------------ ------------ ------------------------------------------------------------

Poor project Electronic Decrease

delivery * A project review process facilitates early warning project

and subsequent mitigation strategies. management * New enhanced project related electronic early warning

The quality tool 'Lead Indicator' tool monitors programme, margin,

of Ongoing change and cash, allowing early identification of

workmanship * Electronic project management workbooks enhance issues.

or poor functionality, client experience and efficiency with CSQ and

commercial the ability for 'live' reporting of key project Perfect

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 08:02 ET (12:02 GMT)

and aspects such as programme and change control. Delivery * The improving market and terms under which we

operational performance contract reduce the probability of disputes. However

delivery of monitoring the upward pressure on skills and commodities needs

a contract, * An escalation process ensures senior management Ongoing/monthly careful management to avoid surprises.

whether by intervention at early stage.

the Group Project

or a joint financial * The development within Construction & Infrastructure

venture * Formal internal peer reviews highlight areas of performance of an enhanced opportunity selectivity process

partner improvement, risk and/or best practice. Monthly affords greater visibility of both project and

or portfolio risk. This means we select projects that

subcontractor Project have a higher probability of success.

does not meet * Client feedback is collated and reviewed using operational

the customer satisfaction questionnaires ('CSQs') and the performance

expectations Perfect Delivery process. Monthly * A significant BIM capability means we are ready to

of clients. meet the government's 2016 mandate and overcome

Project potential design and constructability issues before

failures * Lessons learned exercises are carried out on they become too costly or time consuming.

could incur projects.

additional

costs that * The Perfect Delivery philosophy and culture is

erode profit * Teams are incentivised on Perfect Delivery outcomes embedded in each division and differentiates the

margins and to achieve high levels of client satisfaction. Group's offering.

lead to the

withholding

of Interim * Strategic supply chain trading arrangements are in * Advanced client experience developments are under way

cash payments place to help ensure consistent quality. in the Fit Out division.

impacting

on working

capital. It

is also

possible

that client

experiences

will fall

short of the

standards

we set by

the Group,

potentially

leading to

a reduction

in repeat

business or

in client

referrals.

-------------- ------------------------------------------------------------ ---------------- -------------------------------------------------------------

Strategic priority - Pursuing innovation

We are committed to offering clients innovative and

cost-effective solutions. If we fail to encourage an innovative

approach across the Group we will lose our competitive edge and

suffer reputational damage.

This is coupled with the risk that our systems will not provide

appropriate security levels or resilience needed to ensure reliable

levels of business continuity.

The ever evolving technology environment and persistent cyber

security threat will remain a challenge for the foreseeable

future.

Principal Mitigation Key monitor Risk change in

risk / metric reporting period(1)

/ instrument

Frequency

------------- ------------------------------------------------------------ ---------------- ------------------------------------------------------------

Innovation IT budget Decrease

* A culture of innovation is encouraged and relevant forecasting

A failure ideas, sourced via employees, supply chain, clients Annual/monthly * We are progressively adopting new technologies in

to adopt and external sources, are promoted into the business order to work more efficiently and sustainability,

appropriate environment. Annual business attract and retain talent, and ultimately attain

innovations planning greater returns.

in new Annual

products * Reviews are undertaken to promote elimination of

or waste of both resources and processes, adopting lean Work winning * Recent innovation examples include Lync, BIM, a

techniques methodology where appropriate. Ongoing careers website, upgraded electronic site management

could result tools, smart device facilitation, cost value

in the Group Project reconciliation online recruitment and applicant

being less * Business improvement and IT forum structures are in operational tracking system metrics, management information

effective place to review, sponsor and promote new innovations performance systems, enhanced enterprise finance tools and a

than our into the business. monitoring web-enabled housing stock system.

competitors Ongoing

and unable

to secure * In the near future our largest division, Constructio

best value n

for, or & Infrastructure, plans to introduce a new electroni

offer c

the best work winning tool designed to provide workflow

solutions management of our tender pipeline and enhanced live

to, our business information tools.

clients.

If new

technologies

and

innovation

are not

promoted

into the

business

environment

we may

become

a less

attractive

proposition

to new and

existing

talent.

------------- ------------------------------------------------------------ ---------------- ------------------------------------------------------------

Information Group and No Change

technology * Our Group-wide IT strategy has been remodelled to divisional

encompass an optimised shared services approach, IT forums * Our progressive investment and focus on our IT

If we fail direction and investment. Monthly strategy and programme is maturing, but at the same

to manage time needs to remain focused.

and invest IT monitoring

in our IT * A co-ordinated services approach drives optimisation, and performance

environment efficiency and performance across the whole reporting * We continue to make significant headway in the

we will not technology environment. Ongoing/monthly centralisation of our IT capability and as a result

meet the have enhanced levels of resilience across the network

future that include our data and security environments.

needs of the * A Group-wide IT forum structure is in place ensuring

business in focused strategic development and day-to-day running

terms of of our technology environment.

expected

growth,

security * Progressive IT investment continues to yield

and Infrastructure, application and service delivery

innovation, improvements.

ultimately

meaning that

we will fail * Group-wide risk and security strategies are enacted,

to maintain creating awareness, threat alert, risk and

a vulnerability prioritisation and response.

sustainable

business

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 08:02 ET (12:02 GMT)

------------- ------------------------------------------------------------ ---------------- ------------------------------------------------------------

1 Risk change in reporting period - signifies the Board's

opinion of pre-mitigation risk movement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSUSVARNKAOUAR

(END) Dow Jones Newswires

March 24, 2016 08:02 ET (12:02 GMT)

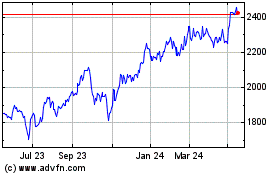

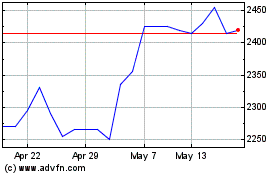

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024