TIDMMGNS

RNS Number : 9506U

Morgan Sindall Group PLC

04 August 2015

4 August 2015

MORGAN SINDALL GROUP PLC

('Morgan Sindall' or 'Group')

The Construction & Regeneration Group

RESULTS FOR THE HALF YEAR (HY) ENDED 30 JUNE 2015

HY 2015 HY 2014 % change

Revenue GBP1,152m GBP998m +15%

Profit before tax -

adjusted(1) GBP13.3m GBP14.2m -6%

Earnings per share

- adjusted(1) 24.5p 28.6p -14%

Period end net cash/(debt) (GBP8m) GBP34m

Average net debt (GBP35m) (GBP6m)

Interim dividend per

share 12.0p 12.0p -

(Loss)/profit before

tax - reported (GBP27.2m) GBP13.0m -309%

Basic (loss)/earnings

per share - reported (49.4p) 26.5p -286%

------------------------------ ------------ ---------- ----------

(1) 'Adjusted' is defined as before intangible

amortisation (GBP1.1m) and exceptional operating

items (GBP39.4m) (HY 2014: before intangible amortisation

(GBP1.2m))

Group highlights:

-- Group revenue up 15%, adjusted operating profit up 2%. Full

year expectations remain unchanged

-- Strong performance from Fit Out, with operating profit up 89%

to GBP10.4m (HY 2014: GBP5.5m) and good growth expected to continue

through the second half

-- Construction & Infrastructure adjusted operating profit

down to GBP0.3m (HY 2014: GBP5.9m), impacted by continued

challenges from older construction contracts in London and the

South. Completion taking longer than previously expected

-- Urban Regeneration operating profit up to GBP5.0m (HY 2014:

GBP3.5m) as a consequence of the ongoing and focused, long-term

investment in the development portfolio

-- Improved performance from response maintenance in Affordable

Housing, with loss reduced to GBP0.8m (HY 2014: loss GBP1.7m) and

further progress expected in the second half towards its target

break-even position by 2016

-- Further to the trading update on 7(th) May, an exceptional

charge of GBP39.4m taken as a write-down against amounts

recoverable on two old construction contracts. The charge is

non-cash in nature and commercial settlement 'in principle' reached

on one of the contracts

-- Average net debt of GBP35m reflecting the expected increase

in investment in Urban Regeneration and the regeneration activities

of Affordable Housing

-- Interim dividend held at 12.0p per share (HY 2014: 12.0p)

Commenting on today's results, Chief Executive, John Morgan

said:

"We've seen a strong performance from Fit Out in the first half

and Urban Regeneration continues to deliver good growth as a result

of our focused and long-term investment in the development

portfolio. Construction & Infrastructure continues to be

impacted by the poor performance of its older and lower margin

construction contracts in London and the South and, whilst these

are working through to completion, this is happening at a slower

rate than previously anticipated which will hold back the

divisional performance in the second half of the year. However, it

is expected that Fit Out will produce a further strong performance

in the second half, with Urban Regeneration and Affordable Housing

both making good progress.

Consequently, the Group remains on track to deliver results for

the full year in line with the Board's expectations and the outlook

for 2016 and beyond remains unchanged."

Enquiries

Morgan Sindall Group Tel: 020 7307

John Morgan 9200

Steve Crummett

Brunswick

Jonathan Glass Tel: 020 7404

Alison Kay 5959

Presentation

-- There will be an analyst and investor presentation today at

09.00 at Numis Securities Limited, The London Stock Exchange

Building, 10 Paternoster Square, London EC4M 7LT. Coffee and

registration will be from 08.45

-- A copy of these results is available at www.morgansindall.com

-- A recording of today's presentation of these results to

investors and analysts will be available at

www.morgansindall.com

Note to Editors

Morgan Sindall Group

Morgan Sindall Group plc is a leading UK Construction &

Regeneration group with a turnover of GBP2.2bn, employing around

5,700 employees and operating in the public, regulated and private

sectors. It reports through five divisions of Construction &

Infrastructure, Fit Out, Affordable Housing, Urban Regeneration and

Investments.

Group Strategy

Morgan Sindall Group's strategy is focused on two distinct but

complementary business activities: Construction and

Regeneration.

Construction activities comprise the following operations:

-- Construction & Infrastructure: Focused on the commercial,

defence, education, energy, healthcare, industrial, leisure,

retail, transport and water markets

-- Fit Out: Focused mainly on the fit out of office space with

opportunities in commercial, central and local government offices,

further education and retail banking

-- Construction and Services work within Affordable Housing:

Focused on new build house contracting and planned and response

maintenance

Regeneration activities comprise the following operations:

-- Regeneration mixed-tenure developments within Affordable

Housing: Focused on building and developing homes for open market

sale and for social/affordable rent

-- Urban Regeneration: Focused on transforming the urban

landscape through partnership working and the development of

multi-phase sites and mixed-use regeneration

-- Investments: Focused on strategic partnerships to develop

under-utilised property assets and provide the Group with

construction and regeneration opportunities

Basis of Preparation

The term 'adjusted' excludes the impact of intangible

amortisation of GBP1.1m and exceptional operating items of GBP39.4m

(HY 2014: intangible amortisation of GBP1.2m)

Group Operating Review

Revenue for the period was up 15% on the prior year at

GBP1,152m, driven by strong revenue growth in Fit Out (up 53%) and

supported by growth in Construction & Infrastructure (up 10%)

and Affordable Housing (up 5%).

The Group's total committed order book(*) as at 30 June 2015 was

GBP2.6bn, a decrease of 3% since the previous year end. Whilst

Affordable Housing grew its order book by 9% up to GBP732m, Fit Out

was down as expected from its high year end position of GBP241m, to

GBP201m. The Construction & Infrastructure order book was down

8% to GBP1,414m reflecting greater selectivity in tendering and the

transition towards more two-stage tendering work, where the

extended procurement process takes longer to convert into a signed

contract and therefore meet the strict criteria for inclusion as a

committed order. The regeneration & development pipeline(**)

remained broadly level with the year end position at GBP3.2bn.

Adjusted operating profit of GBP15.5m was 2% up on the prior

year, with adjusted operating margin of 1.3% (HY 2014: 1.5%).

There were strong profit performances from Fit Out, with an

increase in operating profit of 89% to GBP10.4m and an operating

margin of 3.5%, and Urban Regeneration which delivered an operating

profit of GBP5.0m compared to GBP3.5m in the prior year. Affordable

Housing performed in line with expectations delivering a profit of

GBP3.0m (HY 2014: GBP2.7m) and included an improved performance

from its response maintenance activities which reduced its losses

to GBP0.8m, from a GBP1.7m loss in the prior year.

Construction & Infrastructure was again impacted by lower

returns from its construction activities in London and the South,

as lower margin construction contracts procured during the more

difficult pricing environment of 2012-2013 continue being worked

through to delivery and completion. Completion of these

construction contracts has been more difficult and at a slower rate

than previously anticipated, with construction programmes now

extending into the second half. As a result, Construction &

Infrastructure delivered a significantly lower operating profit in

the period of GBP0.3m (HY 2014: GBP5.9m).

Net finance expense increased to GBP2.2m (HY 2014: GBP1.0m) due

mainly to higher net interest on a higher level of average net debt

and an increase in the amortisation of bank fees and

non-utilisation charges. This resulted in an adjusted profit before

tax of GBP13.3m (HY 2014: GBP14.2m).

It was announced in May that the Group result would include an

exceptional operating item of approximately GBP35m relating to the

impairment of trade and other receivables on two construction

contracts, both of which were transferred as part of the

acquisition of the design and project services division of Amec in

2007. Since then, commercial resolution 'in principle' has been

achieved on one of those contracts and based upon this and the

Board's best current assessment of the likely outcome on the other

contract, an exceptional item of GBP39.4m has been charged in the

period which is non-cash in nature.

After charging this exceptional operating item, the statutory

loss before tax was GBP27.2m, compared to a statutory profit before

tax in the prior year period of GBP13.0m. As a result, there is a

tax credit for the period of GBP5.5m, which is broadly in line with

the UK statutory rate.

Adjusted earnings per share of 24.5p and fully diluted adjusted

earnings per share of 24.2p were both down 14% on the prior

year.

There was an operating cash outflow of GBP53.3m in the period,

which resulted in a free cash outflow of GBP56.1m (HY 2014: outflow

of GBP39.8m). The main driver of this was the expected outflow of

working capital of GBP62.7m, which included an increase in

inventories of GBP54.2m in the regeneration activities of

Affordable Housing and in Urban Regeneration.

Consequently, the average daily net debt for the period

increased to GBP35m (HY 2014: GBP6m), of which GBP18m (HY 2014:

GBP14m) was non-recourse debt. This increase was as expected and in

line with the strategy of investing in the regeneration activities

of Urban Regeneration and Affordable Housing. The Group had net

debt of GBP8m as at 30 June 2015 (HY 2014: net cash GBP34m), which

included GBP19m of non-recourse debt (HY 2014: GBP18m).

Further continued investment is expected in the second half and

at a rate slightly higher than previously anticipated as schemes

accelerate ahead of previous plans. It is now expected that the

average daily net debt for the full year will be in the range of

GBP50m-GBP60m.

The interim dividend of 12.0p per share has been held level with

the prior year (HY 2014: 12.0p).

Outlook

There has been a strong performance from Fit Out in the first

half and Urban Regeneration continues to deliver good growth as a

result of the focused and long-term investment in the development

portfolio. Construction & Infrastructure continues to be

impacted by the poor performance of its older and lower margin

construction contracts in London and the South and, whilst these

are working through to completion, this is happening at a slower

rate than previously anticipated which will hold back the

divisional performance in the second half of the year. However, it

is expected that Fit Out will produce a further strong performance

in the second half, with Urban Regeneration and Affordable Housing

both making good progress.

Consequently, the Group remains on track to deliver results for

the full year in line with the Board's expectations and the outlook

for 2016 and beyond remains unchanged.

Business Review

The following Business Review is given on an adjusted basis,

unless otherwise stated.

Order book and regeneration & development pipeline

The Group's committed order book(*) at 30 June 2015 was

GBP2,572m, a decrease of 3% from the previous year end. The

divisional split is shown below.

Order book HY 2015 FY 2014 % change

GBPm GBPm

------------------------------- ------- ------- --------

Construction & Infrastructure 1,414 1,537 -8%

Fit Out 201 241 -17%

Affordable Housing -

construction & services 732 673 +9%

Urban Regeneration 212 197 +8%

Investments 17 19 -11%

Inter-divisional elims (4) (9)

------------------------------- ------- ------- --------

Group committed order

book 2,572 2,658 -3%

------------------------------- ------- ------- --------

(*) "Committed order book" comprises the secured order book and

framework order book. The secured order book represents the Group's

share of future revenue that will be derived from signed contracts

or letters of intent. The framework order book represents the

Group's expected share of revenue from the frameworks on which the

Group has been appointed. This excludes prospects where

confirmation has been received as preferred bidder only, with no

formal contract or letter of intent in place.

In addition, the Group's regeneration & development

pipeline(**) was GBP3,209m, a decrease of 1% on the previous year

end.

Regeneration & development HY 2015 FY 2014

pipeline GBPm GBPm % change

---------------------------- ------- ------- --------

Affordable Housing -

mixed-tenure 761 770 -1%

Urban Regeneration 2,245 2,215 +1%

Investments 203 242 -16%

---------------------------- ------- ------- --------

Group regeneration &

development pipeline 3,209 3,227 -1%

---------------------------- ------- ------- --------

(**) "Regeneration & development pipeline" represents the

Group's share of the gross development value of secured schemes

including the development value of open market housing schemes.

Construction & Infrastructure

HY 2015 HY 2014 % change

GBPm GBPm

------------------------------ ------- ------- --------

Revenue 623 567 +10%

Operating profit - adjusted 0.3 5.9 -95%

Operating margin - adjusted - 1.0% -100bps

------------------------------ ------- ------- --------

The Construction & Infrastructure result for the period was

down significantly on the prior year and was again adversely

impacted by the poor performance of the London and South

construction activities.

Divisional revenue of GBP623m was up 10% on the prior year (HY

2014: GBP567m). Split by type of activity, Construction accounted

for 56% of divisional revenue at GBP348m, which was up 20% compared

to the prior year, whilst Infrastructure was 44% of divisional

revenue at GBP275m, down 1% on the prior year.

Within Construction, Scotland and the North have both performed

well compared to prior year with the current higher quality work

starting to deliver margin improvements, whilst the East region has

maintained its already strong margin performance and is

experiencing similar increases in overall activity. The South West

region has also seen an upturn in activity, albeit from a

relatively low base, however London and the South East have

continued to significantly underperform.

London and the South East construction revenue in the period was

GBP48m, down 7% on prior year. At the full year results in

February, it was announced that delivery pressures during the

second half of 2014 had resulted in an escalation of costs and

increased forecast costs to complete which had adversely impacted

profitability and margin. These related mainly to a small number of

construction contracts which were due to complete within the first

half of 2015 and which had experienced programme slippage and

increases in costs. In addition, generally lower returns were

expected for at least the first half as the lower margin

construction contracts procured during the more difficult pricing

environment of 2012-2013 were being worked through to delivery and

completion.

Since then, although completion has been successfully achieved

on many of these contracts and particularly on some of the larger,

more difficult and complex projects, some final accounts still

require settlement and progress on others has been slower than

expected, with further delays now extending into the second half.

As a result, the continued low margin returns from these contracts

as they work through will more than off-set the benefit of improved

margins being produced elsewhere in the construction activities,

thereby impacting the overall divisional performance.

As a result of the ongoing poor performance, activities in the

London and the South East region have been reduced, with new

business activity being limited to mainly frameworks or bidding

opportunities involving either Investments or Urban Regeneration.

The combined order book for London and the South East at 30 June

was GBP58m, down 22% from the year end position and the regional

overhead has been reduced accordingly to match this level of

activity to improve performance and provide a competitive and

sustainable platform for the business going forward.

Due to the timing and localised nature of the issues in London

and the South East, together with the improving performance in the

other regional construction activities, confidence remains that

2016 and beyond will see a gradual reversion back to more

normalised construction margins.

In Infrastructure, activity levels on the division's existing

Utility Services frameworks in Water and Energy have increased and

at Sellafield, the provision of a range of new build and

decommissioning services through its joint venture Infrastructure

Strategic Alliance contract continues to progress. In other

activities, further progress has been made in pursuing

opportunities in Transport (Highways, Aviation and Rail) and

Tunnelling; in Transport, the division was appointed by Heathrow

Airport to work on the GBP16m improvement project on phase one of

the Sierra Taxiway, which runs just off the Southern Runway and

connects the cargo areas at Heathrow and the runway to Terminal 4;

in Highways, the division commenced work in joint venture on the

GBP290m A6 Manchester Airport Relief Road to provide c10km of dual

carriageway; and in Tunnelling, the division was awarded preferred

bidder status, in joint venture, on the GBP300m-GBP500m West

section of the Thames Tideway Tunnel.

The committed order book for the division at the period end was

GBP1,414m, down 8% since the start of the year. The movement

reflects the greater selectivity in tendering and the transition

towards more two-stage tendering work, where the extended

procurement process takes longer to convert into a signed contract

and therefore meet the strict criteria for inclusion as a committed

order. As at 30 June, 86% by value of the order book is derived

through negotiated/framework/two-stage bidding procurement

processes.

It was announced in May that the results would include an

exceptional operating item of approximately GBP35m relating to the

impairment of trade and other receivables on two construction

contracts, both of which were transferred as part of the

acquisition of the design and project services division of Amec in

2007. Both contracts have the Secretary of State for Defence as the

overall employing party. One contract relates to the design and

construction of a floating jetty, the other to the design and

construction of living accommodation and infrastructure, both

around the Faslane Naval Base in West Scotland.

Since May, commercial resolution 'in principle' has been

achieved on one of those contracts, being the design and

construction of living accommodation and infrastructure. Based upon

this and the Board's best current assessment of the likely outcome

on the other contract, an exceptional item of GBP39.4m has been

charged in the period which is non-cash in nature.

Fit Out

HY 2015 HY 2014 % change

GBPm GBPm

----------------------------- ------- ------- --------

Revenue 299 195 +53%

Operating profit - adjusted 10.4 5.5 +89%

Operating margin - adjusted 3.5% 2.8% +70bps

----------------------------- ------- ------- --------

Fit Out delivered a very strong performance in the period, with

revenue of GBP299m (HY 2014: GBP195m) up 53%, with operating margin

increasing to 3.5%, resulting in operating profit of GBP10.4m (HY

2014: GBP5.5m), up 89%.

The fit out market has experienced significant activity during

the period and there remain attractive tendering opportunities

going into the second half, although bidding remains competitive.

The margin increase of 70bps, up to 3.5% in the period, has been

driven primarily by improved operational efficiency in project

delivery, however supported also by a general improvement in

negotiated terms on some projects.

The London region remains the most significant, accounting for

73% of revenue (HY 2014: 75%), with other regions at 27% (HY 2014:

25%). Split by type of work, 81% of revenue was traditional fit out

work (HY 2014: 79%), compared to 19% 'design and build' (HY 2014:

21%), whilst 76% of revenue related to fitting out of existing

space (34% refurbishment 'in occupation'), compared to 24% which

was new office fit out.

There have been no material changes to end market sectors

served, with commercial offices (82% of revenue) remaining the most

important market. Higher education at 8% of revenue is the second

largest, with retail banking, government and local authority work

and work for charitable organisations being the others. Examples of

projects delivered in the period are the Cat A and Cat B fit out

for Microsoft in Paddington, London and the 20 week fit out of

players' facilities and media areas for The All England Lawn Tennis

Club in Wimbledon, London, ahead of The Championships 2015.

The committed order book as at 30 June was GBP201m, 17% down

from the high year end position. Due to the relatively short term

nature of the order book, this decrease is not indicative of any

underlying trends and looking ahead to the second half, the overall

level of secured revenue together with the operational delivery

capability provides confidence of a continued strong

performance.

Affordable Housing

HY 2015 HY 2014 % change

GBPm GBPm

----------------------------- ------- ------- --------

Revenue 202 193 +5%

Operating profit - adjusted 3.0 2.7 +11%

Operating margin - adjusted 1.5% 1.4% +10bps

----------------------------- ------- ------- --------

Total divisional revenue of GBP202m was up 5% (HY 2014:

GBP193m), whilst operating profit of GBP3.0m was up 11% on the

prior year (HY 2014: GBP2.7m).

Affordable Housing's activities are divided into two main

categories: Regeneration (22% of revenue) which refers to the

division's mixed-tenure regeneration housing schemes; and

Construction & Services (78% of revenue) which includes new

build housing contracting and planned and response maintenance

services. Together, the division delivers a full range of housing

solutions for its partners and customers.

On the Regeneration side, revenue was down 8% to GBP44.0m (HY

2014: GBP47.8m) with an operating profit of GBP3.3m. 76% of this

revenue related to 195 (HY 2014: 233) open market sales completions

at an average sales price of GBP171k, whilst 24% of revenue related

to approximately 100 units through the social housing contracting

element of the mixed-tenure schemes. The lower level of open market

sales compared to the prior year was expected and is a result of

the current phases of the mixed-tenure developments. The second

half of the year is expected to see a significant increase in unit

sales, as construction completions accelerate through the third

quarter to deliver sales completions in the fourth quarter.

Capital employed in the Regeneration activities at the period

end was GBP150m, up from GBP123m at the year end, with GBP23m of

this increase being the investment in development schemes for

future open market sales in the second half of 2015 but also into

2016 and beyond. The regeneration and development pipeline at the

period end was GBP761m (FY 2014: GBP770m).

In Construction & Services, the increase in new-build

housing contracting revenue of GBP77.1m (HY 2014: GBP57.0m)

compared to prior year was driven by a full period of activity at

MOD Stafford, a GBP51m contract for 346 new homes for Army families

returning to the UK. Tender margins remain highly competitive in

contracting, whilst planned maintenance revenue of GBP49.8m (HY

2014: GBP55.1m) remains broadly steady and an important offering to

local authorities and housing associations.

Although response maintenance revenue was down 6% to GBP31.5m

(HY 2014: GBP33.5m), the operating losses have reduced

significantly to a loss of GBP0.8m (HY 2014: loss GBP1.7m).

Improvements have been based primarily on operational efficiency,

contract management and overhead management, supported by the

investment made in a new business system which is now live in the

market. The key focus for the second half of the year is on winning

new business at appropriate margins to build the critical mass and

the business remains on track to deliver its plan to achieve a

minimum of break-even by 2016.

The committed order book for Construction & Services at the

period end was GBP732m (FY 2014: GBP673m), an increase of 9%. Of

this, response maintenance accounted for GBP366m (FY 2014:

GBP355m). Notable wins include a GBP20m home improvement planned

maintenance programme for Chevin Housing Association in Yorkshire

and a GBP24m new-build contract for 221 new council homes for North

Lanarkshire Council.

Urban Regeneration

HY 2015 HY 2014 % change

GBPm GBPm

----------------------------- ------- ------- --------

Average capital employed(1)

(last 12 months) 58.3 51.0

Capital employed(1)

at period end 83.5 39.0

Revenue 26 42 -38%

Operating profit - adjusted 5.0 3.5 +43%

----------------------------- ------- ------- --------

Urban Regeneration has delivered a further strong performance in

the period, with operating profit up to GBP5.0m (HY 2014: GBP3.5m),

reflecting the benefit derived from the ongoing investment

programme in the development portfolio.

Capital employed(1) at the period end was GBP83.5m, up from

GBP49.4m at the year end. This is calculated after deducting

non-recourse debt of GBP18.5m and deferred consideration on the

purchase of interests in the ISIS Waterside Regeneration Joint

Venture (ISIS) of GBP13.8m. Average capital employed(1) for the

trailing twelve month period ('LTM') was GBP58.3m, with the overall

LTM Return On Average Capital Employed(2) of 16%.

Major contributors in the period include completions in the

first phase of the ISIS residential scheme Brentford Lock West (a

joint venture with the Canal and River Trust), further residential

sales from the Vimto Gardens development (part of English Cities

Fund's (ECf) Salford Central regeneration scheme - a joint venture

with Legal and General and the Homes and Communities Agency) and

the sale of remaining units in phase two of ECf's Rathbone Market

scheme in Canning Town.

The regeneration and development pipeline as at the period end

was GBP2,245m, up 1% from the year end and from this pipeline, the

division is expected to continue delivering strong profits as

schemes develop and as further working capital is invested through

the second half of 2015 and 2016

(1) Capital employed is calculated as total assets (excluding

goodwill, intangibles and cash) less total liabilities (excluding

corporation tax, deferred tax and inter-company financing). At the

period end, non-recourse debt was GBP18.5m (HY 2014: 18.3m) and

deferred consideration was GBP13.8m (HY 2014: GBP18.0m). LTM

average non-recourse debt was GBP18.2m (HY 2014: GBP10.9m) and LTM

average deferred consideration was GBP13.6m (HY 2014:

GBP18.0m).

(2) Return On Average Capital Employed = (Adjusted operating

profit less interest on non-recourse debt less unwind of discount

on deferred consideration) divided by (average capital employed).

LTM interest on non-recourse debt was GBP1.5m (HY 2014: LTM

GBP0.5m) and the unwind of discount on deferred consideration was

LTM GBP0.5m (HY 2014: LTM GBP0.5m).

Investments

HY 2015 HY 2014 % change

GBPm GBPm

----------------------------- ------- ------- --------

Average capital employed(1)

(last 12 months) 19.0 18.9

Capital employed(1)

at period end 15.4 14.8

Operating profit - adjusted 0.4 1.3 -69%

----------------------------- ------- ------- --------

The strategic rationale for Investments is to unlock prime

long-term construction and regeneration opportunities for other

divisions and create value from investments for the Group. For

2015, approximately GBP150m of construction work is targeted to be

secured for Group divisions, primarily for Construction &

Infrastructure but also opportunities for Affordable Housing.

During the period, Investments made a small profit of GBP0.4m

generated principally from its interests in joint ventures and

Local Asset Backed Vehicle (LABV) schemes. This included achieving

legal completion on c60 residential units in the Bournemouth Town

Centre LABV and reaching financial close on a number of sites in

the division's HB Villages 'supported living' joint venture. The

second half is expected to show an operating loss due to the

phasing of schemes, with the overall result for the year expected

to be an operating loss of between GBP1m-GBP2m.

Capital employed at the period end was GBP15.4m, slightly up on

the prior year position, however down from GBP20.2m at the year

end. The reduction in the period was primarily due to achieving

practical completion on the Towcester mixed-use Regeneration and

Civic Accommodation project. LTM average capital employed was

GBP19.0m.

(1) Capital employed = total assets (excluding goodwill,

intangibles, corporation tax credit and cash) less total

liabilities.

Note: Capital is invested in a number of schemes including

GBP5.6m in HB Villages (a joint venture focused on care and

supported living), GBP4.4m in regeneration projects (including

GBP2.2m in LABVs), GBP3.0m in PFI-type investments and GBP2.2m in

the Wellspring Partnership, which is delivering public sector

healthcare and education projects in Scotland.

Directors' valuation of investments can only be made in

circumstances where future cash flows are near certain. The

Investments division holds a number of interests in developments,

arrangements and schemes which are included in "capital employed".

Where directors' valuation is appropriate, current valuation is

GBP3.0m relating to 2 investments with carrying value of

GBP3.0m.

Other Financial Information

Net finance expense. Net finance expense was GBP2.2m, a GBP1.2m

increase versus HY 2014 which is broken down as follows:

HY 2015 HY 2014 % change

GBPm GBPm

--------------------------- ------- ------- --------

Net interest charge

on net debt (1.2) (0.7) -71%

Amortisation of bank

fees & non-utilisation

fees (1.0) (0.6) -67%

Interest from JVs 0.4 0.3 +33%

Other (0.4) - -

Total net finance expense (2.2) (1.0) -120%

--------------------------- ------- ------- --------

Tax. A tax credit of GBP5.5m is shown for the six month period

(HY 2014: charge of GBP1.8m).

HY 2015 HY 2014

GBPm GBPm

-------------------------------- -------- -------

(Loss)/profit before

tax (27.2) 13.0

Less: share of net profit

in taxed joint ventures(#) (0.5) (0.5)

Less: gains on disposal

of joint ventures - (1.7)

(Loss)/profit subject

to tax (27.7) 10.8

Statutory tax rate 20.25% 21.5%

Current tax credit/(charge)

at statutory rate 5.6 (2.3)

Other adjustments (0.1) 0.5

Tax credit/(charge) 5.5 (1.8)

-------------------------------- -------- -------

(#) certain of the Group's joint ventures

are reported net of tax. Other joint ventures

are partnerships where profits are taxed

within the Group rather than the joint

venture

Net working capital. 'Net Working Capital' is defined as

'Inventories plus Trade & Other Receivables, less Trade &

Other Payables, adjusted to exclude deferred consideration payable,

accrued interest and capitalised arrangement fees.

HY 2015 HY 2014

GBPm GBPm

-------------------------------- ------- -------

Inventories 256.4 182.6

Trade & Other Receivables 455.0 422.3

Trade & Other Payables (703.9) (630.9)

Net working capital - adjusted 7.5 (26.0)

Exceptional operating items (39.4) -

Net working capital - reported (31.9) (26.0)

-------------------------------- ------- -------

Cash flow. Operating cash flow was an outflow of GBP53.3m, with

a free cash outflow of GBP56.1m.

HY 2015 HY 2014

GBPm GBPm

------------------------------------------ ------- -------

Operating profit - adjusted 15.5 15.2

Depreciation 2.6 2.3

Share option expense 0.8 0.8

Movement in fair value of shared

equity loans (0.6) (0.6)

Gains on disposal of joint ventures - (1.7)

Share of net profit of joint

ventures (5.1) (2.5)

Gain on disposal of PPE - (0.2)

Other operating items* (0.6) (5.8)

Change in working capital (62.7) (41.2)

Net capital expenditure (including

repayment of finance leases) (4.1) (4.3)

Dividends and interest received

from joint ventures 0.9 0.9

Operating cash flow (53.3) (37.1)

Income taxes paid (1.3) (1.8)

Net interest paid (non-joint

venture) (1.5) (0.9)

Free cash flow (56.1) (39.8)

------------------------------------------ ------- -------

*Other operating items in 2014 includes property dilapidation

provisions released to the income statement within the

Construction

& Infrastructure division

Net debt. Net debt at the end of the period was GBP7.6m, as a

result of a net cash outflow of GBP63.3m from 1 January 2015.

GBPm

-------------------------- ------

Net cash as at 1 January

2015 55.7

Free cash flow (56.1)

Dividends (6.6)

Other (0.6)

Net debt as at 30

June 2015 (7.6)

-------------------------- ------

Capital employed by strategic activity.

An analysis of the negative capital employed in the Construction

activities shows a decrease of GBP27.1m since the year end, split

as follows:

Capital employed(1) HY 2015 FY 2014 Change

in Construction GBPm GBPm GBPm

------------------------------- -------- -------- ---------

Construction & Infrastructure (132.9) (102.7) -30.2(2)

Fit Out (39.6) (41.6) +2.0

Affordable Housing -

Construction & Services (30.6) (31.7) +1.1

------------------------------- -------- -------- ---------

(203.1) (176.0) -27.1

------------------------------- -------- -------- ---------

An analysis of capital employed in the Regeneration activities

shows an increase of GBP56.5m since the year end, split as

follows:

Capital employed HY 2015 FY 2014 Change

in Regeneration GBPm GBPm GBPm

----------------------- -------- -------- -------

Affordable Housing

- mixed tenure(1) 149.9 122.7 +27.2

Urban Regeneration(3) 83.5 49.4 +34.1

Investments(1) 15.4 20.2 -4.8

----------------------- -------- -------- -------

248.8 192.3 +56.5

----------------------- -------- -------- -------

1 Definition as per the Investments section in the Business

Review

2 includes the impact of the exceptional operating item of

GBP39.4m

3 Definition as per the Urban Regeneration section in the

Business Review

Dividends. The Board of Directors has approved an interim

dividend of 12.0p per share (HY 2014: 12.0p), level with the prior

year.

Principal risks and uncertainties.

The Group has a clear and established risk framework in place

for managing its risks. The framework is designed and operated to

identify, control and mitigate any threat to the Group achieving

its goals. The framework and the risks including details of the

mitigations taken to manage them are set out more fully in the risk

review in the Group's 2014 annual report and have not changed since

then. A summary of the principal risks and uncertainties that the

directors consider may have a material impact on the Group's

performance are:

-- Markets: The markets in which the Group operates are affected to varying degrees by general macro-economic conditions. The Group is therefore focused on capitalising on the improving economic conditions and shaping the business to take account of future growth indicators. However, there is a risk that business opportunities within the Group's strategy may be delayed.

-- People: The Group's performance and business conduct affects

employees, subcontractors and the public and, in turn, can affect

its reputation and commercial performance. The Group prides itself

on its industry-leading practices and works in some high profile

and technically challenging environments. As markets emerge from

recession employee turnover has increased. If the Group does not

succeed in attracting and retaining the right talent for its future

needs it will not be able to develop the business as

anticipated.

-- Winning in our markets: The Group undertakes several hundred

contracts each year and it is important that contractual terms

reflect risks arising from the nature and complexity of the works

and the duration of the contracts and that these risks are

effectively managed.

-- Maximise efficiency: If employees are not properly engaged

with the culture of the business, clients are less likely to

receive exceptional levels of service.

-- Disciplined use of capital: Without sufficient liquidity, the

Group's ability to meet its liabilities as they fall due would be

compromised, which could ultimately lead to its failure to continue

as a going concern. In a rising market there is an increased risk

that the Group's counterparties overtrade which could affect their

liquidity.

-- Pursue innovation: The Group is committed to offering

customers innovative and cost-effective solutions. If it fails to

encourage an innovative approach across the Group it will lose its

competitive edge and suffer reputational damage. This is coupled

with the risk that the Group's systems will not provide appropriate

security levels or resilience needed to ensure reliable levels of

business continuity.

Cautionary forward-looking statement

These results contain forward-looking statements based on

current expectations and assumptions. Various known and unknown

risks, uncertainties and other factors may cause actual results to

differ from any future results or developments expressed or implied

from the forward-looking statements. Each forward-looking statement

speaks only as of the date of this document. The Group accepts no

obligation to publicly revise or update these forward-looking

statements or adjust them to future events or developments, whether

as a result of new information, future events or otherwise, except

to the extent legally required.

Condensed consolidated income statement

For the six months ended 30 June 2015

Six months

Six months to to Year ended

30 June 31 Dec

30 June 2015 (unaudited) 2014 2014

Before Exceptional (unaudited) (audited)

exceptional operating

items items Total Total Total

Notes GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

Revenue 1,152.0 - 1,152.0 998.5 2,219.8

Cost of sales (1,056.1) (39.4) (1,095.5) (914.9) (2,038.8)

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

Gross profit 95.9 (39.4) 56.5 83.6 181.0

Administrative expenses (85.5) - (85.5) (72.6) (160.3)

Share of net profit of

joint ventures 5.1 - 5.1 2.5 6.3

Other gains and losses - - - 1.7 1.9

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

Operating (loss)/profit

before intangible amortisation 15.5 (39.4) (23.9) 15.2 28.9

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

Intangible amortisation (1.1) - (1.1) (1.2) (2.4)

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

Operating (loss)/profit 14.4 (39.4) (25.0) 14.0 26.5

Finance income 0.5 - 0.5 0.8 1.0

Finance costs (2.7) - (2.7) (1.8) (4.7)

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

(Loss)/profit before

tax 12.2 (39.4) (27.2) 13.0 22.8

Tax 1 (2.5) 8.0 5.5 (1.8) (4.8)

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

(Loss)/profit for the

period 9.7 (31.4) (21.7) 11.2 18.0

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

Attributable to:

Owners of the Company 9.8 (31.4) (21.6) 11.3 18.1

Non-controlling interests (0.1) - (0.1) (0.1) (0.1)

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

(Loss)/profit for the

period 9.7 (31.4) (21.7) 11.2 18.0

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

(Loss)/earnings per share

Basic 5 (49.4p) 26.5p 42.3p

Diluted 5 (48.9p) 26.0p 41.6p

-------------------------------- ----- ----------- ----------- --------- ----------- ----------

There were no discontinued operations in either the current or

comparative periods.

Condensed consolidated statement of comprehensive income

For the six months ended 30 June 2015

Six months Six months

to to Year ended

30 June 30 June 31 Dec

2015 2014 2014

(unaudited) (unaudited) (audited)

GBPm GBPm GBPm

----------------------------------------- ----------- ----------- ----------

(Loss)/profit for the period (21.7) 11.2 18.0

Items that will not be reclassified

subsequently to profit or loss:

Actuarial gain arising on defined

benefit obligation 0.1 - 0.1

Income tax relating to items not

reclassified - - (0.2)

Items that may be reclassified

subsequently to profit or loss:

Movement on cash flow hedges in

equity accounted joint ventures - (0.1) (0.2)

Foreign exchange movement on translation

of overseas operation 0.1 (0.1) (0.2)

0.1 (0.2) (0.4)

----------------------------------------- ----------- ----------- ----------

Other comprehensive income/(expense) 0.2 (0.2) (0.5)

----------------------------------------- ----------- ----------- ----------

Total comprehensive (expense)/income (21.5) 11.0 17.5

----------------------------------------- ----------- ----------- ----------

Attributable to:

Owners of the Company (21.4) 11.1 17.6

Non-controlling interests (0.1) (0.1) (0.1)

----------------------------------------- ----------- ----------- ----------

Total comprehensive (expense)/income (21.5) 11.0 17.5

----------------------------------------- ----------- ----------- ----------

Condensed consolidated balance sheet

At 30 June 2015

30 June 30 June 31 Dec

2015 2014 2014

(unaudited) (unaudited) (audited)

Notes GBPm GBPm GBPm

------------------------------- ----- ----------- ----------- ---------

Assets

Goodwill and other intangible

assets 217.7 219.3 218.1

Property, plant and equipment 19.8 19.8 19.2

Investment property 9.5 9.8 9.5

Investments in joint ventures 61.5 47.2 55.0

Other investments - 0.4 0.3

Shared equity loan receivables 6 20.6 20.1 20.4

Retirement benefit asset 1.2 0.3 0.8

------------------------------- ----- ----------- ----------- ---------

Non-current assets 330.3 316.9 323.3

Inventories 256.4 182.6 202.2

Trade and other receivables 7 416.8 422.4 442.4

Cash and cash equivalents 8 84.9 72.4 87.6

Current assets 758.1 677.4 732.2

------------------------------- ----- ----------- ----------- ---------

Total assets 1,088.4 994.3 1,055.5

------------------------------- ----- ----------- ----------- ---------

Liabilities

Trade and other payables 9 (696.0) (628.2) (690.1)

Current tax liabilities (3.9) (5.6) (5.2)

Finance lease liabilities (1.7) (1.5) (1.6)

Borrowings 8 (18.5) - -

Provisions (0.7) (1.5) (1.2)

Current liabilities (720.8) (636.8) (698.1)

------------------------------- ----- ----------- ----------- ---------

Trade and other payables (22.3) (20.8) (22.0)

Finance lease liabilities (2.2) (3.2) (2.5)

Borrowings 8 (74.0) (38.3) (31.9)

Deferred tax liabilities (11.0) (15.7) (16.5)

Provisions (16.4) (17.0) (16.6)

------------------------------- ----- ----------- ----------- ---------

Non-current liabilities (125.9) (95.0) (89.5)

------------------------------- ----- ----------- ----------- ---------

Total liabilities (846.7) (731.8) (787.6)

------------------------------- ----- ----------- ----------- ---------

Net assets 241.7 262.5 267.9

------------------------------- ----- ----------- ----------- ---------

Equity

Share capital 2.2 2.2 2.2

Share premium account 31.9 27.0 30.9

Other reserves (0.7) (0.6) (0.8)

Retained earnings 209.0 234.5 236.2

------------------------------- ----- ----------- ----------- ---------

Equity attributable to owners

of the Company 242.4 263.1 268.5

Non-controlling interests (0.7) (0.6) (0.6)

------------------------------- ----- ----------- ----------- ---------

Total equity 241.7 262.5 267.9

------------------------------- ----- ----------- ----------- ---------

Condensed consolidated cash flow statement

For the six months ended 30 June 2015

Six months Six months

to to Year ended

30 June 30 June 31 Dec

2015 2014 2014

(unaudited) (unaudited) (audited)

Notes GBPm GBPm GBPm

-------------------------------------- ------ ----------- ----------- ----------

Operating activities

Operating (loss)/profit (25.0) 14.0 26.5

Adjusted for:

Amortisation of intangible assets 1.1 1.2 2.4

Share of net profit of equity

accounted joint ventures (5.1) (2.5) (6.3)

Depreciation 2.6 2.3 4.8

Share option expense 0.8 0.8 0.7

Profit on disposal of interests

in joint ventures - (1.7) (1.9)

Gain on disposal of property,

plant and equipment - (0.2) (0.2)

Movement in fair value of shared

equity loan receivables (0.6) (0.6) (1.8)

Non-cash impairment of investments - - 1.0

Non-cash exceptional operating

items 39.4 - -

Additional pension contributions (0.3) (0.3) (0.7)

Disposals of investment properties - 0.2 0.5

Disposal of shared equity loan

receivables 0.4 0.2 1.1

Decrease in provisions (0.7) (5.9) (6.6)

---------------------------------------------- ----------- ----------- ----------

Operating cash flows before

movements in working capital 12.6 7.5 19.5

Increase in inventories (54.2) (21.6) (41.2)

Increase in receivables (14.1) (37.3) (55.7)

Increase in payables 5.6 17.7 85.1

---------------------------------------------- ----------- ----------- ----------

Movements in working capital (62.7) (41.2) (11.8)

---------------------------------------------- ----------- ----------- ----------

Cash (outflow)/inflow from operations (50.1) (33.7) 7.7

---------------------------------------------- ----------- ----------- ----------

Income taxes paid (1.3) (1.8) (4.4)

---------------------------------------------- ----------- ----------- ----------

Net cash (outflow)/inflow from

operating activities (51.4) (35.5) 3.3

---------------------------------------------- ----------- ----------- ----------

Investing activities

Interest received 0.5 0.8 0.9

Dividend from joint ventures 0.5 0.6 0.8

Proceeds on disposal of property,

plant and equipment - 0.3 0.4

Purchases of property, plant

and equipment (3.5) (3.8) (5.7)

Net payments to acquire or increase

interests in joint ventures (2.0) - (6.0)

Proceeds on disposal of interests

in joint ventures - 4.6 5.9

Proceeds on disposal of other

investments - 5.9 0.3

Net cash (outflow)/inflow from

investing activities (4.5) 8.4 (3.4)

------------------------------------ ----- ------ ------

Financing activities

Interest paid (1.6) (1.4) (4.9)

Dividends paid 4(6.6) (6.4) (11.5)

Repayments of obligations under

finance leases (0.6) (0.8) (1.5)

Proceeds from long-term borrowings 8 60.6 15.2 8.8

Proceeds on issue of share capital 1.0 0.1 4.0

Proceeds on exercise of share

options 0.4 - -

------------------------------------ ----- ------ ------

Net cash inflow/(outflow) from

financing activities 53.2 6.7 (5.1)

------------------------------------ ----- ------ ------

Net decrease in cash and cash

equivalents (2.7) (20.4) (5.2)

Cash and cash equivalents at

the beginning of the period 87.6 92.8 92.8

------------------------------------ ----- ------ ------

Cash and cash equivalents at

the end of the period 8 84.9 72.4 87.6

------------------------------------ ----- ------ ------

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2015

Share

Share premium Other Retained Non-controlling Total

capital account reserves earnings Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------- -------- -------- --------- --------- ------ --------------- -------

1 January 2015 2.2 30.9 (0.8) 236.2 268.5 (0.6) 267.9

Total comprehensive expense - - 0.1 (21.5) (21.4) (0.1) (21.5)

Share option expense - - - 0.8 0.8 - 0.8

Issue of shares at a premium - 1.0 - - 1.0 - 1.0

Exercise of share options - - - 0.1 0.1 - 0.1

Dividends paid - - - (6.6) (6.6) - (6.6)

30 June 2015 (unaudited) 2.2 31.9 (0.7) 209.0 242.4 (0.7) 241.7

------------------------------- -------- -------- --------- --------- ------ --------------- -------

Share

Share premium Other Retained Non-controlling Total

capital account reserves earnings Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------- -------- -------- --------- --------- ----- --------------- -------

1 January 2014 2.2 26.9 (0.4) 228.8 257.5 (0.5) 257.0

Total comprehensive income - - (0.2) 11.3 11.1 (0.1) 11.0

Share option expense - - - 0.8 0.8 - 0.8

Issue of shares at a premium - 0.1 - - 0.1 - 0.1

Dividends paid - - - (6.4) (6.4) - (6.4)

------------------------------- -------- -------- --------- --------- ----- --------------- -------

30 June 2014 (unaudited) 2.2 27.0 (0.6) 234.5 263.1 (0.6) 262.5

------------------------------- -------- -------- --------- --------- ----- --------------- -------

Share

Share premium Other Retained Non-controlling Total

capital account reserves earnings Total interests equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------- -------- -------- --------- --------- ------ --------------- -------

1 January 2014 2.2 26.9 (0.4) 228.8 257.5 (0.5) 257.0

Total comprehensive income - - (0.4) 18.0 17.6 (0.1) 17.5

Share option expense - - - 0.7 0.7 - 0.7

Tax relating to share option - - - 0.2 0.2 - 0.2

Issue of shares at a premium - 4.0 - - 4.0 - 4.0

Dividends paid - - - (11.5) (11.5) - (11.5)

------------------------------- -------- -------- --------- --------- ------ --------------- -------

31 December 2014 (audited) 2.2 30.9 (0.8) 236.2 268.5 (0.6) 267.9

------------------------------- -------- -------- --------- --------- ------ --------------- -------

Other reserves

Other reserves include:

-- Capital redemption reserve of GBP0.6m (30 June 2014: GBP0.6m,

31 December 2014: GBP0.6m) which was created on the redemption of

preference shares in 2003.

-- Hedging reserve of (GBP0.8m) (30 June 2014: (GBP0.7m), 31

December 2014: (GBP0.8m)) arising under cash flow hedge accounting.

Movements on the effective portion of hedges are recognised through

the hedging reserve, whilst any ineffectiveness is taken to the

income statement. Cumulative movements recognised through the

hedging reserve are recycled through the income statement on

disposal of the associated joint ventures.

-- Translation reserve of (GBP0.5m) (30 June 2014: (GBP0.5m), 31

December 2014: (GBP0.6m)) arising on the translation of overseas

operations into the Group's functional currency.

Retained earnings

Retained earnings include shares that are held as 'treasury

shares' and represent the cost to Morgan Sindall Group plc of

shares purchased in the market and held by the Morgan Sindall

Employee Benefit Trust (the 'Trust') to satisfy options under the

Group's share incentive schemes. The number of shares held by the

Trust at 30 June 2015 was 487,668 (30 June 2014: 545,767, 31

December 2014: 545,767) with a cost of GBP3.7m (30 June 2014:

GBP4.1m, 31 December 2014: GBP4.1m).

Notes to the condensed consolidated financial statements

For the six months ended 30 June 2015

1 Basis of preparation

General information

The financial information set out in this half year report does

not constitute the Company's statutory accounts for the year ended

31 December 2014 as defined in section 434 of the Companies Act

2006. A copy of the statutory accounts for that year was delivered

to the Registrar of Companies. The auditor reported on those

accounts: their report was unqualified, did not draw attention to

any matters by way of emphasis without qualifying their report and

did not contain a statement under section 498(2) or (3) of the

Companies Act 2006. This half year report has not been audited or

reviewed by the auditor pursuant to the Auditing Practices Board

guidance on the Review of Interim Financial Information. Figures as

at 30 June 2015 and 2014 and for the six months ended 30 June 2015

and 2014 are therefore unaudited.

Basis of preparation

The annual financial statements of Morgan Sindall Group plc are

prepared in accordance with IFRSs as adopted by the European Union.

The condensed consolidated financial statements included in this

half year report were prepared in accordance with IAS 34 'Interim

Financial Reporting'. While the financial information included in

this half year report was prepared in accordance with the

recognition and measurement criteria of International Financial

Reporting Standards ('IFRS'), this half year report does not itself

contain sufficient information to comply with IFRS.

Going concern

The directors are satisfied that the Group has sufficient

resources to continue in operation for the foreseeable future, a

period of not less than 12 months from the date of this report.

Accordingly, they continue to adopt the going concern basis in

preparing the condensed consolidated financial statements.

Changes in accounting policies

In the current year, the Group has adopted Annual Improvements

2011 - 2013 Cycle which has not had a material impact on the

Group's results. Otherwise, the same accounting policies,

presentation and methods of computation are followed in the

condensed consolidated financial statements as applied in the

Group's latest annual audited financial statements.

Tax

A tax credit of GBP5.5m is shown for the six month period (six

months to 30 June 2014: charge of GBP1.8m, year ended 31 December

2014: charge of GBP4.8m). This tax credit is recognised based upon

the best estimate of the average income tax rate on profit/(loss)

before tax expected for the full financial year.

Seasonality

The Group's activities are generally not subject to significant

seasonal variation.

2 Business segments

For management purposes, the Group is organised into five

operating divisions: Construction & Infrastructure, Fit Out,

Affordable Housing, Urban Regeneration and Investments. The

divisions' activities are as follows:

-- Construction & Infrastructure: offers national design,

construction and infrastructure services to private and public

sector clients. The division works on projects, and in frameworks

and strategic alliances of all sizes across a broad range of

markets including commercial, defence, education, energy,

healthcare, industrial, leisure, retail, transport and water.

-- Fit Out: specialises in fit out and refurbishment projects in

the commercial, central and local government office, further

education and retail banking markets. Overbury operates as a

national fit out company through multiple procurement routes and

Morgan Lovell offers a turnkey design and build service in office

interior design, fit out and refurbishment.

-- Affordable Housing: specialises in the design and build,

planned and response maintenance of homes and the regeneration of

communities across the UK. The division operates a full

mixed-tenure model creating homes for rent, shared ownership and

open market sale.

-- Urban Regeneration: works with landowners and public sector

partners to unlock value from under-developed assets to bring about

sustainable regeneration and urban renewal through the delivery of

mixed-use and residential-led projects. Typically creates

commercial, retail, residential, leisure and public realm

facilities.

-- Investments: realises the potential for under-utilised

property assets and promotes economic growth, primarily through

strategic partnerships with the public sector, by providing

flexible structuring and funding solutions and development

expertise. The division covers a wide range of markets including

asset backed, education, health and social care, residential,

student accommodation, leisure and infrastructure.

Group Activities represents costs and income arising from

corporate activities which cannot be meaningfully allocated to the

operating segments. These include costs such as treasury

management, corporate tax coordination, insurance management and

company secretarial services. The divisions are the basis on which

the Group reports its segmental information as presented below:

Six months

to 30 June

2015

----------------- ---------------- ----- ---------- ------------- ----------- ----------- ------------ -------

Construction Fit Affordable Urban Group

& Infrastructure Out Housing Regeneration Investments Activities Eliminations Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

----------------- ---------------- ----- ---------- ------------- ----------- ----------- ------------ -------

External revenue 621.4 293.4 202.4 25.8 9.0 - - 1,152.0

Inter-segment

revenue 1.8 5.2 - - - - (7.0) -

----------------- ---------------- ----- ---------- ------------- ----------- ----------- ------------ -------

Total revenue 623.2 298.6 202.4 25.8 9.0 - (7.0) 1,152.0

Operating

profit/(loss)

before

amortisation

of intangible

assets and

exceptional

operating

items 0.3 10.4 3.0 5.0 0.4 (3.6) - 15.5

----------------- ---------------- ----- ---------- ------------- ----------- ----------- ------------ -------

Amortisation

of intangible

assets - - (0.3) (0.8) - - - (1.1)

Exceptional

operating

items (39.4) - - - - - - (39.4)

----------------- ---------------- ----- ---------- ------------- ----------- ----------- ------------ -------

Operating

(loss)/profit (39.1) 10.4 2.7 4.2 0.4 (3.6) - (25.0)

----------------- ---------------- ----- ---------- ------------- ----------- ----------- ------------ -------

Six months

to 30 June

2014

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ -------

Construction

& Fit Affordable Urban Group

Infrastructure Out Housing Regeneration Investments Activities Eliminations Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ -------

External

revenue 562.5 193.7 191.7 41.8 8.8 - - 998.5

Inter-segment

revenue 4.5 1.7 1.7 - - - (7.9) -

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ -------

Total revenue 567.0 195.4 193.4 41.8 8.8 - (7.9) 998.5

Operating

profit/(loss)

before

amortisation

of intangible

assets and

exceptional

operating

items 5.9 5.5 2.7 3.5 1.3 (3.7) - 15.2

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ -------

Amortisation

of intangible

assets - - (0.3) (0.9) - - - (1.2)

Exceptional

operating

items - - - - - - - -

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ -------

Operating

profit/(loss) 5.9 5.5 2.4 2.6 1.3 (3.7) - 14.0

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ -------

Year ended

31 December

2014

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ ---------

Construction

& Fit Affordable Urban Group

Infrastructure Out Housing Regeneration Investments Activities Eliminations Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ ---------

External

revenue 1,159.0 503.6 419.6 112.7 24.9 - - 2,219.8

Inter-segment

revenue 12.7 3.3 3.0 - - - (19.0) -

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ ---------

Total revenue 1,171.7 506.9 422.6 112.7 24.9 - (19.0) 2,219.8

Operating

profit/(loss)

before

amortisation

of intangible

assets and

exceptional

operating

items 3.5 15.0 6.0 10.0 0.9 (6.5) - 28.9

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ ---------

Amortisation

of intangible

assets - - (0.6) (1.8) - - - (2.4)

Operating

profit/(loss) 3.5 15.0 5.4 8.2 0.9 (6.5) - 26.5

-------------- -------------- ----- ---------- ------------ ----------- ---------- ------------ ---------

During the six months to 30 June 2015, six months to 30 June

2014 and the year ended 31 December 2014, inter-segment sales were

charged at prevailing market prices and significantly all of the

Group's operations were carried out in the UK.

3 Exceptional operating items

Six months Six months

to to Year ended

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

------------------------------------------ ---------- ---------- ----------

Impairment of trade and other receivables 39.4 - -

------------------------------------------ ---------- ---------- ----------

The exceptional operating item of GBP39.4m relates to the

impairment of trade and other receivables on two construction

contracts, both of which were transferred as part of the

acquisition of the design and project services division of Amec plc

in 2007. Both contracts have the Secretary of State for Defence as

the overall employing party. One contract relates to the design and

construction of a floating jetty, the other to the design and

construction of living accommodation and infrastructure, both

around the Faslane Naval Base in West Scotland.

Commercial resolution 'in principle' has been achieved on the

contract for the design and construction of living accommodation

and infrastructure during the period. Based upon this and the

Board's best current assessment of the likely outcome on the other

contract, an exceptional item has been charged, which is non-cash

in nature.

4 Dividends

Amounts recognised as distributions

to equity holders in the period:

------------------------------------- ---------- ---------- ----------

Six months Six months

to to Year ended

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

------------------------------------- ---------- ---------- ----------

Final dividend for the year ended

31 December 2014 of 15.0p per share 6.6 - -

Interim dividend for the year ended

31 December 2014 of 12.0p per share - - 5.1

Final dividend for the year ended

31 December 2013 of 15.0p per share - 6.4 6.4

------------------------------------- ---------- ---------- ----------

6.6 6.4 11.5

------------------------------------- ---------- ---------- ----------

Proposed dividends:

------------------------------------- ---------- ---------- ----------

Six months Six months

to to Year ended

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

------------------------------------- ---------- ---------- ----------

Interim dividend for the year ending

31 December 2015 of 12.0p per share 5.3

Final dividend for the year ended

31 December 2014 of 15.0p per share - - 6.6

Interim dividend for the year ending

31 December 2014 of 12.0p per share - 5.1 -

------------------------------------- ---------- ---------- ----------

The proposed interim dividend of 12.0p per share was approved by

the Board on 4 August 2015 and will be paid on 23 October 2015 to

shareholders on the register at 2 October 2015. The ex-dividend

date will be 1 October 2015.

5 (Loss)/earnings per share

Six months Six months

to to Year end

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

----------------------------------- ---------- ---------- --------

(Loss)/earnings attributable to

the owners of the Company (21.6) 11.3 18.1

Adjustments:

Exceptional operating items net

of tax 31.4 - -

Intangible amortisation net of

tax 0.9 0.9 1.9

Adjusted Earnings 10.7 12.2 20.0

------------------------------------ ---------- ---------- --------

Basic weighted average ordinary

shares (m) 43.7 42.7 42.8

Dilutive effect of share options

and conditional shares not vested

(m) 0.5 0.8 0.7

------------------------------------ ---------- ---------- --------

Diluted weighted average ordinary

shares (m) 44.2 43.5 43.5

------------------------------------ ---------- ---------- --------

Basic (loss)/earnings per share (49.4p) 26.5p 42.3p

Diluted (loss)/earnings per share (48.9p) 26.0p 41.6p

Adjusted earnings per share 24.5p 28.6p 46.7p

Diluted adjusted earnings per

share 24.2p 28.0p 46.0p

----------------------------------- ------- ----- -----

The average market value of the Company's shares for the purpose

of calculating the dilutive effect of share options and long-term

incentive plan shares was based on quoted market prices for the

period that the options were outstanding. The average share price

for the period was GBP7.56 (30 June 2014: GBP7.89, 31 December

2014: GBP7.70).

A total of 917,350 share options that could potentially dilute

earnings per share in the future were excluded from the above

calculations because they were anti-dilutive at 30 June 2015 (30

June 2014: 276,056, 31 December 2014: 268,056).

6 Shared equity loan receivables

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

------------------------------------ ------- ------- ------

1 January 20.4 19.7 19.7

Net change in fair value recognised

in the income statement 0.6 0.6 1.8

Repayments (0.4) (0.2) (1.1)

------------------------------------- ------- ------- ------

End of period 20.6 20.1 20.4

------------------------------------- ------- ------- ------

Basis of valuation and assumptions made

There is no directly observable fair value for individual loans

arising from the sale of specific properties under the scheme, and

therefore the Group has developed a model for determining the fair

value of the portfolio of loans based on national property prices,

expected property price increases, expected loan defaults and a

discount factor which reflects the interest rate expected on an

instrument of similar risk and duration in the market. Details of

the key assumptions made in this valuation are as follows:

30 June 30 June 31 Dec

2015 2014 2014

--------------------------------------- -------- -------- --------

Assumption

Period over which shared equity

loan receivables are discounted:

First Buy and Home Buy schemes 20 years 20 years 20 years

Other schemes 9 years 8 years 9 years

Nominal discount rate 6.7% 7.0% 6.7%

Weighted average nominal annual

property price increase 3.2% 2.2% 3.2%

Forecast default rate 2.0% 2.0% 2.0%

Number of properties sold under

the shared equity scheme for which

a loan was outstanding at the

year end 705 743 709

Weighted average shared equity

loan contribution (being the Group's

weighted average loan as a proportion

of the selling price of a property) 24% 24% 24%

---------------------------------------- -------- -------- --------

Sensitivity analysis

At 30 June 2015, if the nominal discount rate had been 100bps

higher at 7.7% and all other variables were held constant, the fair

value of the shared equity loan receivables would decrease by

GBP0.7m with a corresponding reduction in both the result for the

period and equity (excluding the effects of tax).

At 30 June 2015, if the period over which the shared equity loan

receivables (excluding those relating to the First Buy and Home Buy

schemes) are discounted had been 10 years and all other variables

were held constant, the fair value of the shared equity loan

receivables would decrease by GBP0.8m with a corresponding

reduction in both the result for the period and equity (excluding

the effects of tax).

7 Trade and other receivables

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

------------------------------- ------- ------- ------

Amounts due from construction

contract customers 246.9 256.8 241.5

Trade receivables 147.0 141.1 176.7

Amounts owed by joint ventures 0.6 7.6 3.3

Prepayments 13.0 9.0 11.9

Other receivables 9.3 7.9 9.0

-------------------------------- ------- ------- ------

416.8 422.4 442.4

------------------------------- ------- ------- ------

8 Net (debt)/cash

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

------------------------------- ------- ------- ------

Cash and cash equivalents 84.9 72.4 87.6

Non-recourse project financing

due in less than one year (18.5) - -

Borrowings due after one year (74.0) (20.0) (15.0)

Non-recourse project financing

due after one year - (18.3) (16.9)

-------------------------------- ------- ------- ------

Net (debt)/cash (7.6) 34.1 55.7

-------------------------------- ------- ------- ------

Borrowings of GBP74.0m were drawn down under the Group's

committed bank loan facilities. Additional project finance

borrowings of GBP18.5m (30 June 2014: GBP18.3m, 31 December 2014:

GBP16.9m) were drawn from separate facilities to fund specific

projects. These project finance borrowings are without recourse to

the remainder of the Group's assets.

9 Trade and other payables

30 June 30 June 31 Dec

2015 2014 2014

GBPm GBPm GBPm

------------------------------------- ------- ------- ------

Trade payables 209.7 187.6 167.7

Amounts due to construction contract

customers 43.3 49.1 48.9

Amounts owed to joint ventures 0.2 0.2 0.2

Other tax and social security 17.7 12.5 17.0

Accrued expenses 396.9 348.2 429.2

Deferred income 8.9 7.4 8.6

Other payables 19.3 23.2 18.5

-------------------------------------- ------- ------- ------

696.0 628.2 690.1

------------------------------------- ------- ------- ------

Current and non-current other payables include nil and GBP13.8m

respectively (30 June 2014: GBP4.7m and GBP13.3m, 31 December 2014

nil and GBP13.6m) related to the discounted deferred consideration

due on the acquisition of an additional interest in ISIS Waterside

Regeneration Partnership.

10 Contingent liabilities

Group banking facilities and surety bond facilities are

supported by cross guarantees given by the Company and

participating companies in the Group. There are contingent

liabilities in respect of surety bond facilities, guarantees and

claims under contracting and other arrangements, including joint

arrangements and joint ventures entered into in the normal course

of business.

11 Subsequent events

There were no subsequent events that affected the financial

statements of the Group.

The directors confirm that to the best of their knowledge:

-- the unaudited condensed consolidated financial statements

have been prepared in accordance with IAS 34 'Interim Financial

Reporting' as adopted by the European Union required by DTR

4.2.4R;

-- the half year report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

-- the half year report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein)

By order of the Board

John Morgan Steve Crummett

Chief Executive Finance Director

4 August 2015

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PKNDBABKDFFK

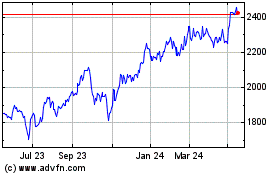

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

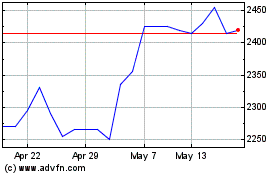

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024