Pre-close trading update (7529J)

July 05 2011 - 2:00AM

UK Regulatory

TIDMMGNS

RNS Number : 7529J

Morgan Sindall Group PLC

05 July 2011

Morgan Sindall Group plc

5 July 2011

PRE-CLOSE TRADING UPDATE

The Board of Morgan Sindall Group today announces its trading

update for the six months to 30 June 2011. The Group's interim

results will be announced on Monday 8 August 2011.

The Group's positive start to the year has continued and we

remain on track to meet our expectations for the current year. The

financial position of the Group remains strong with the forward

order book in line with the start of the year.

Construction & Infrastructure

Construction & Infrastructure is trading in line with

expectations, with revenue consistent with the corresponding period

in 2010. However, as anticipated, operating margins are lower as a

result of the competitive environment. During the period the

division was successful in securing positions on a number of major

construction frameworks including places on two lots of the GBP500m

Smarte East Alliance framework and on the GBP400m, four-year South

East Wales Schools Capital Working Group framework. The division

also secured major civil engineering projects including the GBP50m

Pudding Mill Lane station works for Crossrail and, in joint

venture, the GBP235m Crossrail Whitechapel and Liverpool Street

Station Tunnels contract.

The division remains well positioned to exploit opportunities in

expanding sectors of the market which include power distribution,

airports and rail where growth is being driven by investment in

economic infrastructure, as well as the improving commercial

sector, particularly in London.

Affordable Housing

Affordable Housing has traded well in the first half of the year

demonstrating its full service capabilities by securing major

opportunities across mixed tenure, new build social housing and

planned and response maintenance. Contracts secured include two

mixed tenure development schemes in Doncaster worth GBP20m, a mixed

tenure scheme in Skipton worth GBP30m, a GBP40m programme of

improvements for Cartrefi Cymunedol Gwynedd, and a place on two

major Scottish frameworks valued at up to GBP210m in total for Port

of Leith and West of Scotland housing associations. In addition,

Lovell's joint venture, Compendium, was selected as preferred

bidder for Derby's GBP100m Castleward Urban Village

development.

The slight improvement in market conditions for open market

housing continues despite sales remaining constrained by the lack

of available mortgage finance. Alternative financing options remain

important in supporting house sales. Social housing maintenance,

refurbishment and carbon reduction projects remain resilient and

the division's combined planned and response maintenance offering

means we are well placed to address these opportunities. The

division secured its first photo voltaic (PV) installation

contracts for Flintshire CC and Clwyd Alyn Housing Association, an

important milestone in this emerging sector, and is pursuing a

number of major PV opportunities which may also harness the

Investments division's financing expertise. The maintenance

contracts acquired from Connaught continue to perform as expected

and the collection of debts acquired from the administrator is, to

date, in line with our expectations.

Fit Out

Fit Out has seen increased levels of activity, with revenue

ahead of that in the corresponding period last year albeit

operating margins, as expected, are lower due to the highly

competitive market. Due to the absence of major new commercial

properties being completed, there are few large fit out contracts

available at present. We expect a gradual improvement in the fit

out market next year as new developments are completed. The

division has recently established a technology business to broaden

its offering by delivering data centre and technology-led projects.

As a consequence of the revenue growth we believe the division

continues to take market share, leaving it well placed for the

expected recovery in the market from 2012.

Urban Regeneration

Urban Regeneration remains on track to make further progress

this year. During the period the division was selected by

Warrington Borough Council as its development partner to deliver

the Council's GBP130m Bridge Street regeneration plan. It has also

commenced activity on a number of its projects reflecting an

improving outlook for the commercial sector.

Investments

The Investments division has had a successful six months. It

secured the GBP350m Bournemouth regeneration contract using an

innovative Local Asset Backed Vehicle ('LABV') model, reached

financial close on the next tranche of schools under the Hull BSF

programme and was appointed preferred developer on the GBP450m

Southampton Waterfront scheme. Whilst the pipeline of PFI

opportunities has reduced in the near term, the division is

progressing a number of complex land swap development opportunities

in which it has a strong track record.

The Group's order book remains in line with the start of the

year at GBP3.6bn with the Group's development pipeline increasing

by GBP0.4bn to GBP1.8bn, with a further GBP0.8bn of developments at

preferred bidder. The Group's financial position remains strong,

with average cash for the six months to 30 June 2011 at GBP44m

being above our expectations although lower than that for the

corresponding period in 2010.

Overall we have had a positive first half of 2011 and, with our

track record in growth sectors, broad sector spread and depth of

capabilities, we remain well positioned to face the challenges

ahead and to benefit from opportunities as they arise.

- Ends -

Morgan Sindall Group plc Tel: 020 7307 9200

Paul Smith, Chief Executive

David Mulligan, Finance Director

Blythe Weigh Communications Tel: 020 7138 3204

Paul Weigh Mobile: 07989 129658

Tim Blythe Mobile: 07816 924626

Notes to Editors:

Morgan Sindall Group plc is a leading UK construction and

regeneration group operating through five divisions of construction

& infrastructure, affordable housing, fit out, urban

regeneration and investments.

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTDKQDQABKDOOK

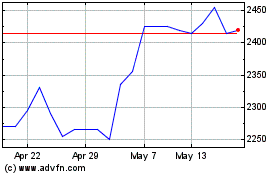

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

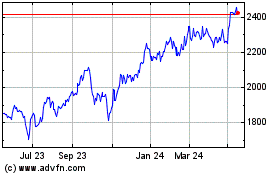

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024