RNS Number : 5056A

Morgan Sindall PLC

04 August 2008

04 August 2008

MORGAN SINDALL plc

('Morgan Sindall' or 'the Group')

Interim results for the six months to 30 June 2008

Morgan Sindall plc, the construction and regeneration group, today announces record interim results.

2008 2007

Revenue �1,239m �836m +48%

Adjusted profit before tax� �33.1m �25.2m +31%

Profit before tax �28.6m �25.2m +13%

Cash balance �98m �62m +58%

Adjusted earnings per share 60.9p 41.1p +48%

�

Earnings per share 50.1p 41.1p +22%

Interim dividend per share 12.0p 10.0p +20%

� Adjusted for amortisation of intangible assets

Group highlights

* Record set of interim results

* Continued progress with strategy of developing market leading positions across all chosen sectors

* Significant growth in Construction and Infrastructure Services divisions demonstrates success of acquisition

* Group well placed to deliver long-term sustainable growth

* Confidence reflected in strength of order book and robust net cash position

Divisional highlights

Fit Out

* Strong performance in mixed market conditions

* Operating profit of �11.5m (2007: �12.4m) on revenues of �205m (2007: �225m)

* Record margin of 5.6%, demonstrating benefits of 'Perfect Delivery' quality programme

* Order book increased both year-on-year and from the start of the year to �220m (2007: �206m)

* Focus on future growth from increased geographic and sector spread, and larger value contracts

Construction

* Strong public sector demand, particularly in education, while private sector demand remains robust apart from commercial property

* Operating profit up 86% to �4.1m (2007: �2.2m), after one-off costs of �1.0m relating to the acquisition, on revenues of �418m

(2007: �199m)

* Margin, after adjusting for one-off costs, up to 1.2% (2007: 1.1%)

* Performance improvement largely driven by acquisition impact

* Order book of �828m (2007: �891m)

* Encouraging outlook with division's enhanced capabilities, project range, and market and geographic coverage following

acquisition

Infrastructure Services

* Buoyant market conditions

* Operating profit up 90% to �7.6m (2007: �4.0m), after one-off IT costs of �1.4m relating to the acquisition, on revenues of �395m

(2007: �221m)

* Underlying revenue growth of 25%, plus a significant contribution from the acquisition

* Continued margin improvement to 2.3% (2007: 1.8%), after adjusting for one-off costs

* Strengthened market position with market leadership in tunnelling, transport, water and utilities

* Positive outlook backed up by record order book of �1.8bn (2007: �1.5bn)

Affordable Housing

* Strong performance in social new build and refurbishment sectors offset by impact of mortgage availability in open market housing

sector

* Operating profit of �8.8m (2007: �11.5m) on revenues of �176m (2007: �192m)

* Margin of 5.0% (2007: 6.0%)

* Order book maintained at �1.4bn (2007: �1.5bn)

* Outlook for social housing remains positive; division increasing focus on this area and selling units designated for open market

sales to housing associations

Urban Regeneration

* Solid performance in challenging market conditions

* Operating profit of �5.6m on revenues of �45m

* Share of forward development pipeline of �1.1bn, with a further four projects valued at �1.0bn at preferred bidder stage

* Mixed use development remains a major opportunity in the long-term

John Morgan, Executive Chairman, commented:

"Despite challenging market conditions, we have delivered a record set of interim results. We remain on track to deliver record results

for this year in line with our expectations.

"We are pleased with the acquisition we made last year. It brings an increasing balance to the Group and improves our market leading

positions in construction, infrastructure and regeneration.

"Our cash position remains strong, while our order book of �4.2bn gives us confidence for the future."

ENQUIRIES:

Morgan Sindall plc Tel: 020 7307 9200

John Morgan, Executive Chairman

Paul Smith, Chief Executive

David Mulligan, Finance Director

Blythe Weigh Communications Tel: 020 7138 3204

Tim Blythe Mobile: 07816 924626

Paul Weigh Mobile: 07989 129658

Interim Report

We are pleased to announce record results for the six months to 30 June 2008. Profit before tax and amortisation of intangible assets

rose by 31% to �33.1m (2007: �25.2m) on revenue that increased by 48% to �1.24bn (2007: �0.84bn). Adjusted earnings per share before

amortisation increased by 48% to 60.9p (2007: 41.1p).

Profit before tax for the period (after amortisation of intangible assets) was �28.6m (2007: �25.2m). The Board has declared an interim

dividend of 12.0p (2007: 10.0p), an increase of 20%.

Our strategy remains the same, to develop market leading positions within our chosen sectors in the construction and regeneration

markets. The Group has made excellent progress in this strategy over the past year. Fit Out has increased its market share in the commercial

office fit out sector. Construction and Infrastructure Services have both significantly extended their capabilities and geographic coverage

as a result of the businesses acquired from Amec plc in July 2007. Affordable Housing has strengthened its position in the social housing

sector, partly compensating for the decline in affordable open market housing. And finally, the Group has added a leading mixed use

regeneration capability through its Urban Regeneration division, which was also acquired in July 2007.

The overall growth in profitability of the Group for the first six months of 2008 was driven primarily by contributions from the

businesses acquired in July 2007. These contributions are seen in improved performances from Construction and Infrastructure Services

compared with the six months to 30 June 2007, as well as in profit from Urban Regeneration. Construction and Infrastructure Services also

expanded organically, benefitting from the buoyant market conditions in their respective markets. Conversely, Fit Out and Affordable Housing

have both faced more challenging market conditions than those experienced in 2007. Consequently the underlying profitability of the Group

achieved in the first half of 2008 was broadly similar to that achieved in the corresponding period in 2007.

Net cash at 30 June 2008 was �98m (2007: �62m) with average cash during the six months to the end of June of �95m compared with �39m for

the same period last year.

The performance of each of the operating divisions for the six months to 30 June 2008 is set out below. Divisional operating profits

are stated before the amortisation of intangible assets.

Fit Out

Fit Out produced another excellent performance during the first half of 2008, generating an operating profit of �11.5m (2007: �12.4m) on

revenue of �205m (2007: �225m). The operating margin of 5.6% (2007: 5.5%) was another record for the division demonstrating the benefits of

its 'Perfect Delivery' quality programme. Overall demand in the commercial office fit out market has been reasonably robust, and the

division's performance was driven by a strengthening of its market share and its broad sector spread, which helped it offset some softening

of demand from the financial services sector.

The division continues to focus on growth from increased geographic spread; expansion into the retail, leisure, entertainment and

education sectors; and larger value contracts. Notable projects undertaken or secured during the period include new open plan offices,

restaurant and meeting rooms for Guardian Media Group valued at �16m, the �19m fit out of two buildings for London Borough of Newham

comprising offices and a new business centre, and a �9m fit out to create new headquarters for the Intercontinental Hotel Group in

Buckinghamshire.

The order book has increased both year-on-year and since the start of the year from �179m to �220m (2007: �206m) and revenue for the

second half of the year is therefore expected to be ahead of that for the first half. As previously announced, we continue to expect some

softening of demand in 2009 albeit current signs are very encouraging with the order book for 2009 ahead of where the 2008 order book was at

this time last year.

Construction

The Construction division delivered an operating profit of �4.1m (2007: �2.2m) on revenue of �418m (2007: �199m). This revenue level

reflects year-on-year growth of around 5% in the underlying business complemented by growth from last year's acquisition. The operating

profit is stated after one-off costs of �1.0m relating to the acquisition. Adjusting the operating profit for these costs gives an operating

margin for the period of 1.2% (2007: 1.1%).

As has been well documented, demand in commercial property has weakened. However, demand from the rest of the private sector is

reasonably robust while demand from the public sector, which now accounts for approximately 70% of the division's revenue, is strong,

particularly in education where we have recently won some major new contracts. The division significantly expanded its capabilities, project

range, market coverage and geographic coverage through last year's acquisition and this is reflected in many of the new contracts secured

during the period. These include the division's appointment as a construction partner in the delivery of a seven year, �200m building

programme for Cambridgeshire County Council and as prime contractor on the �44m Bideford College for Devon County Council a School

Pathfinder Project under the Government's Building Schools for the Future ('BSF') programme.

The order book at the end of June was �828m (2007: �891m) with the overall outlook for the construction market remaining encouraging.

Infrastructure Services

Infrastructure Services enjoyed buoyant market conditions during the first half of 2008, driven in particular by investment in the

transport and utilities sectors. We expect these favourable conditions to continue for the foreseeable future. The division achieved an

operating profit of �7.6m (2007: �4.0m) on revenue of �395m (2007: �221m). This increase in revenue of 79% reflects growth in the underlying

business of approximately 25%, with the remainder from last year's acquisition. The operating profit is also stated after one-off IT costs

relating to the acquisition of �1.4m. Adjusting the operating profit for these costs gives an improved operating margin of 2.3% (2007:

1.8%).

Infrastructure Services also strengthened its market position through last year's acquisition and it is now a market leader in the

water, tunnelling, transport and utilities sectors. This leadership has contributed to its success in securing, as part of the Interlink

joint venture, a share of the �445m M74 completion project, Scotland's largest ever road construction scheme, and delivering the BAA

infrastructure and pavement works at Heathrow in the first half of 2008.

The order book at the end of June was �1.8bn (2007: �1.5bn) with the outlook for the infrastructure market remaining positive.

Affordable Housing

The refurbishment and new build social housing sectors, which now account for 90% of the division's revenue for the first half of this

year, remain healthy underpinned by the Government's Decent Homes programme and funding to the Housing Corporation. The division

strengthened its position in these sectors in the first half of the year, in particular securing Decent Homes contracts at Dudley, West

Midlands valued at �11m, and in North Warwickshire valued at �12m as well as being appointed development partner by Hounslow Homes for a

�53m contract to build 350 new homes for rent and shared ownership.

In recent months, however, the division's open market house sales have been increasingly impacted by the availability of mortgages.

Therefore, despite the growth of its revenue from social housing, overall the division delivered a reduced operating profit of �8.8m (2007:

�11.5m) on revenue of �176m (2007: �192m) achieving an operating margin of 5.0% (2007: 6.0%).

The order book at the end of June was �1.4bn (2007: �1.5bn). The outlook for social housing in the UK remains positive albeit, as

previously announced, we expect the division to continue to be impacted during the remainder of 2008 and in 2009 by the downturn in open

market house sales. To mitigate the effects of this downturn the division is successfully increasing its focus on refurbishment and new

build social housing, reducing production costs and selling units designated for open market sale to housing associations.

Urban Regeneration

Urban Regeneration performed in line with management's expectations over the first six months of 2008 delivering operating profit,

including share of joint ventures, of �5.6m on revenue of �45m. The division, which was acquired last year, gives the Group a leading mixed

use property development and urban regeneration business with interests in 30 long-term regeneration projects. Its share of the project

pipeline is valued at �1.1bn and it has a share in four further projects currently at preferred bidder stage, valued at an additional

�1.0bn.

The division is responding to the recent slowdown of the commercial property market by revisiting existing plans and rephasing

developments to ensure it is best placed to take full advantage when the market improves. Although the recent softening of the commercial

and residential property sectors means the short-term outlook for the division is subdued, the Group remains of the view that mixed use

development is central to the regeneration of urban communities in areas of social and economic deprivation and will be a major opportunity

in the long-term.

Financial review and principal risks

Revenue for the six months to 30 June 2008 increased by 48% to �1.24bn (2007: �0.84bn). This increase is due to the impact of the

acquisition in July 2007 as well as organic growth at Infrastructure Services and Construction offset by a fall in revenue from Fit Out and

Affordable Housing. Overall underlying revenue increased by 4% with the remaining growth contributed by the businesses acquired.

Group profit from operations prior to the amortisation of intangible assets increased by 30% to �30.8m (2007: �23.7m). The operating

margin was 2.5% (2007: 2.8%) reflecting the change in the mix of the business with a shift in revenue away from our higher margin divisions.

The increase in the profit from operations was driven by the acquisition with underlying profitability being broadly flat year-on-year;

increased profit as a result of organic growth at Construction and Infrastructure Services being offset by a decline in profit from Fit Out

and Affordable Housing. The cost of Group Activities was broadly similar to that for the same period last year.

Net finance income was �2.3m (2007: �1.5m) reflecting the higher level of average cash over the period of �95m (2007: �39m). Profit

before tax and amortisation of intangible assets of �33.1m was 31% ahead of last year's �25.2m. The income tax expense was �7.5m (2007:

�7.9m), lower than the same period last year, reflecting the lower headline rate and an increase in the operating profit derived from joint

ventures, which is stated after tax. Profit after tax was �21.1m (2007: �17.3m). Shareholders' equity increased to �176.8m (2007: �154.1m).

The average cash for the period was �95m (2007: �39m) and the cash at 30 June 2008 was �98m (2007: �62m). This reflects operating

profitability and corresponding strength in operating cash flow over the past twelve months. During the period the Group renewed the �25m,

364-day revolving facility for a further twelve months to June 2009. In addition to its cash resources the Group has in total �75m of

committed bank facilities and a �10m overdraft facility.

Related party transactions for the period are disclosed in note 11 to the financial statements following this report.

The directors consider that the key risks which may have a material impact on the Group's performance in the remaining six months of the

financial year are unchanged from those detailed in the 2007 annual report and accounts. these include but are not limited to; the ability

to attract, develop and retain talented employess, safe operation as a construction business, market related risks, contract related risks

and acquisition related risks.

Outlook

As previously announced, for the remainder of 2008 and 2009 we expect the strength in the infrastructure sector and the weakness in the

commercial property and open market housing sectors to continue.

Against this market backdrop, the Group remains firmly on course to achieve its targets for 2008 and beyond. Strategically it is better

placed than ever, with all of its businesses having further developed their market positions and with the addition of a leading mixed use

regeneration business during the past year. Our confidence is reflected in our forward order book, which now stands at �4.2bn (2007: �4.1bn)

and in our strong net cash position of �98m (2007: �62m).

Forward-looking statements

This interim report has been prepared solely to assist shareholders to assess the Board's strategies and their potential to succeed. It

should not be relied on by any other party for other purposes. Forward-looking statements have been made by the directors in good faith

using information available up until the date on which they approved the interim report. Forward-looking statements should be regarded

with caution because of the inherent uncertainties in economic trends and business risks.

Morgan Sindall plc

Interim financial statements for the six months to 30 June 2008

Consolidated income statement

for the six months to 30 June 2008 (unaudited)

Unaudited Unaudited Year ended

six six 31

months to months to December

30 June 2007

2008 30 June �m

�m 2007

�m

Continuing operations

Revenue (note 4) 1,238.5 836.1 2,114.6

Cost of sales (1,115.3) (744.1) (1,892.9)

Gross profit 123.2 92.0 221.7

Other administrative expenses (95.9) (67.9) (168.4)

Amortisation of intangible assets (4.5) - (4.5)

Total administrative expenses (100.4) (67.9) (172.9)

Share of net profit/(loss) of equity 3.5 (0.4) 4.7

accounted joint ventures

Profit from operations 26.3 23.7 53.5

Finance income 4.5 3.0 8.5

Finance expense (2.2) (1.5) (4.4)

Net finance income 2.3 1.5 4.1

Profit before income tax expense 28.6 25.2 57.6

Income tax expense (note 5) (7.5) (7.9) (18.2)

Profit for the period attributable to equity 21.1 17.3 39.4

holders of the parent company

There are no discontinued activities in either the current or comparative periods.

Earnings per share

From continuing operations

Basic (note 7) 50.1p 41.1p 93.8p

Diluted (note 7) 49.4p 40.1p 91.7p

Morgan Sindall plc

Interim financial statements for the six months to 30 June 2008

Consolidated balance sheet

at 30 June 2008 (unaudited)

Unaudited Unaudited Restated

30 June 30 June 31

2008 2007 December

�m �m 2007

�m

Non current assets

Property, plant and equipment 26.4 18.8 23.8

Goodwill 183.3 72.7 183.3

Other intangible assets 28.0 - 32.5

Investments in equity accounted joint ventures 46.7 10.8 38.1

Investments 0.1 0.1 0.1

Deferred tax assets 5.5 3.6 5.0

290.0 106.0 282.8

Current assets

Inventories 176.4 92.5 128.8

Amounts recoverable on construction contracts 277.3 210.8 209.1

Trade and other receivables 267.2 150.1 238.3

Cash and cash equivalents 98.3 62.4 218.9

819.2 515.8 795.1

Total assets 1,109.2 621.8 1,077.9

Current liabilities

Trade and other payables (839.8) (417.4) (814.1)

Amounts received in advance on (66.7) (36.3) (67.4)

construction contracts

Current tax liabilities (7.4) (6.6) (10.6)

Finance lease liabilities (3.6) (1.5) (1.4)

(917.5) (461.8) (893.5)

Net current (liabilities)/assets (98.3) 54.0 (98.4)

Non current liabilities

Trade and other payables (10.9) - (12.2)

Retirement benefit obligation (2.6) (2.8) (3.3)

Finance lease liabilities (1.4) (3.1) (3.2)

(14.9) (5.9) (18.7)

Total liabilities (932.4) (467.7) (912.2)

Net assets 176.8 154.1 165.7

Equity

Share capital 2.2 2.1 2.1

Share premium account 26.5 26.2 26.3

Capital redemption reserve 0.6 0.6 0.6

Own shares (7.2) (4.7) (5.5)

Hedging reserve 0.1 2.9 (2.2)

Retained earnings 154.6 127.0 144.4

Total equity 176.8 154.1 165.7

Morgan Sindall plc

Interim financial statements for the six months to 30 June 2008

Consolidated cash flow statement

for the six months to 30 June 2008 (unaudited)

Unaudited Unaudited Year ended

six six months to 30 31

months to June 2007 December

30 June �m 2007

2008 �m

�m

Net cash (outflow)/inflow from (103.3) (19.2) 158.1

operating activities (note 9)

Cash flows from investing activities

Interest received 4.6 2.9 8.4

Proceeds on disposal of property, 0.2 0.1 0.6

plant and equipment

Purchases of property, plant and (4.1) (3.6) (8.0)

equipment

Payments to acquire interests in (2.8) (2.4) (5.0)

joint ventures

Payments for the acquisition of a - - (25.5)

subsidiary

Net cash acquired on acquisition of a - - 14.2

subsidiary

Net cash outflow from investing (2.1) (3.0) (15.3)

activities

Cash flows from financing activities

Payments to acquire own shares (1.7) (1.3) (2.1)

Dividends paid (11.9) (8.4) (12.6)

Repayment of obligations under (1.9) (1.1) (4.7)

finance leases

Proceeds on issue of share capital 0.3 - 0.1

Net cash outflow from financing (15.2) (10.8) (19.3)

activities

Net (decrease)/increase in cash and (120.6) (33.0) 123.5

cash equivalents during the period

Cash and cash equivalents at 218.9 95.4 95.4

beginning of period

Cash and cash equivalents at end of 98.3 62.4 218.9

period

Morgan Sindall plc

Interim financial statements for the six months to 30 June 2008

Consolidated statement of recognised income and expense

for the six months to 30 June 2008 (unaudited)

Unaudited Unaudited Year ended

six six 31

months to months to December

30 June 2007

2008 30 June �m

�m 2007

�m

Actuarial gains/(losses) arising on defined 0.5 (0.3) (0.9)

benefit plan

Deferred tax on defined benefit plan (0.1) - 0.3

liabilities recognised directly in equity

Movement in cash flow hedges in equity 2.3 3.7 (1.4)

accounted joint ventures

Net income/(expense) recognised directly in 2.7 3.4 (2.0)

equity

Profit for the period 21.1 17.3 39.4

Total recognised income and expense 23.8 20.7 37.4

attributable to equity holders of the parent

company

Morgan Sindall plc

Interim financial statements for the six months to 30 June 2008

Notes to the interim financial statements (unaudited)

1 Basis of preparation and significant accounting policies

General information

The results for the half years ended 30 June 2008 and 2007 and the balance sheets as at those dates have not been audited and do not

constitute statutory accounts. The financial information for the year ended 31 December 2007 does not constitute statutory accounts as

defined in section 240 of the Companies Act 1985. A copy of the statutory accounts for that year has been delivered to the Registrar of

Companies. The auditor*s report on those accounts was not qualified and did not contain statements under section 237(2) or (3) of the

Companies Act 1985.

Statement of compliance

The condensed set of financial statements included in this interim report has been prepared in accordance with International Accounting

Standard 34 *Interim Financial Reporting*, as adopted by the European Union and the Disclosure and Transparency Rules of the Financial

Services Authority.

Accounting policies

The same accounting policies and methods of computation are followed in these condensed set of financial statements as applied in the

Group*s latest annual report and accounts for the year ended 31 December 2007.

At the date of authorisation of these financial statements, IFRS 8 *Operating Segments* was in issue but not yet effective and has not been

applied in these interim financial statements. The directors anticipate that the adoption of this standard in future periods will have no

material impact on the financial statements of the Group except for additional disclosures in relation to IFRS 8.

2 Restatement of comparative balances

As was stated in note 23 on page 76 of the 2007 annual Rreport and accounts, the fair value adjustments arising on the acquisition of Amec

Developments Limited and certain assets and business carried on by Amec Investments Limited and the assets, liabilities and contracts

relating to the Design and Project Services division of Amec plc were provisional and subject to finalisation in accordance with IFRS 3

*Business Combinations*.

The fair value exercise has now been completed and the final acquisition balance sheet and related fair value adjustments are disclosed in

note 10 of these interim financial statements.

In accordance with IFRS 3 *Business Combinations* the affected financial statement balances have been restated. None of the restatements

have had an impact on gross profit, profit from operations or net assets. There was no impact on recognised income or expense as stated.

3 Seasonality

The Group*s Fit Out, Construction, Infrastructure Services, Affordable Housing and Urban Regeneration activities are generally not subject

to significant seasonal variation.

4 Analysis of revenue and profit from business segments

For management purposes, the Group is organised into five operating divisions: Fit Out, Construction, Infrastructure Services, Affordable

Housing and Urban Regeneration. The divisions are the basis on which the Group reports its primary segment information. Segment information

about the Group*s continuing operations is presented below:

Unaudited for the six months to 30 June

2008

Fit Out Construction Infrastructure Affordable Housing Urban Regeneration Group Activities

Total

�m �m Services �m �m �m

�m

�m

Revenue 204.5 417.7 394.8 175.8 45.1 0.6

1,238.5

Operating profit before 11.5 4.1 7.6 8.8 2.7 (7.4)

27.3

amortisation

Share of results of associates - - - - 2.9 0.6

3.5

and joint ventures after tax

Profit from operations 11.5 4.1 7.6 8.8 5.6 (6.8)

30.8

before amortisation

Amortisation of intangible - (1.0) (0.4) - (3.1) -

(4.5)

assets

Profit from operations 11.5 3.1 7.2 8.8 2.5 (6.8)

26.3

Net finance income

2.3

Profit before tax

28.6

Unaudited for the six months to 30 June 2007

Fit Out Construction Infrastructure Affordable Housing Urban Regeneration Group Activities

Total

�m �m Services �m �m �m

�m

�m

Revenue 225.0 199.0 220.5 191.6 - -

836.1

Operating profit 12.4 2.2 4.0 11.5 - (6.0)

24.1

before amortisation

Share of results of associates - - - - - (0.4)

(0.4)

and joint ventures after tax

Profit from operations 12.4 2.2 4.0 11.5 - (6.4)

23.7

before amortisation

Amortisation of intangible - - - - - -

-

assets

Profit from operations 12.4 2.2 4.0 11.5 - (6.4)

23.7

Net finance income

1.5

Profit before tax

25.2

4 Analysis of revenue and profit from business segments (continued)

Year ended 31 December

2007

Fit Out Construction Infrastructure Affordable Housing Urban Regeneration Group Activities

Total

�m �m Services �m �m �m

�m

�m

Revenue 491.7 621.4 575.4 398.0 25.9 2.2

2,114.6

Operating profit 25.9 4.9 10.6 25.5 0.9 (14.5)

53.3

before amortisation

Share of results of associates - - - - 3.3 1.4

4.7

and joint ventures after tax

Profit from operations 25.9 4.9 10.6 25.5 4.2 (13.1)

58.0

before amortisation

Amortisation of intangible - (1.0) (0.3) - (3.2) -

(4.5)

assets

Profit from operations 25.9 3.9 10.3 25.5 1.0 (13.1)

53.5

Net finance income

4.1

Profit before tax

57.6

5 Income tax expense

Unaudited Year ended

six months

to 30 June

2008 2007 31 December 2007

�m �m �m

Current tax expense

UKcorporation tax 7.6 7.8 19.7

Adjustment in respect of prior years 0.2 - 0.3

7.8 7.8 20.0

Deferred tax expense

Current year (0.3) 0.1 (0.1)

Adjustment in respect of prior years - - (1.7)

(0.3) 0.1 (1.8)

Total income tax expense 7.5 7.9 18.2

Income tax for the six month period is charged at 30% (2007: 31%), being the estimated annual effective tax rate expected for the full

financial year, applied to the profit before income tax expense excluding the share of net profit/loss of equity accounted joint ventures

for the six month period (which are stated net of income tax).

6 Dividends

Unaudited Year ended

Six months

to 30 June

2008 2007 31 December 2007

�m �m �m

Final dividend for the year ended 31 December 11.9 8.4 8.4

2007 of 28.0p (2006: 20.0p) per share

Proposed interim dividend for the period to 5.2 4.2 4.2

30 June 2008

of 12.0p (2007: 10.0p) per share

The interim dividend was approved by the Board on 4 August 2008 and has not been included as a liability at 30 June 2008.

The interim dividend of 12.0p (2007: 10.0p) per share will be paid on 12 September 2008 to shareholders on the register at 15 August 2008.

The ex-dividend date will be 13 August 2008.

7 Earnings per share

There are no discontinued operations in either the current or comparative periods.

The calculation of the basic and diluted earnings per share is based on the following data:

Unaudited Year ended

six months

to 30 June

Earnings 2008 2007 31 December 2007

�m �m �m

Earnings before taxation 28.6 25.2 57.6

Deduct: taxation expense per income statement (7.5) (7.9) (18.2)

Earnings for the purpose of basic and 21.1 17.3 39.4

dilutive earnings per share being net profit

attributable to equity holders of the parent

company

Add back: amortisation expense 4.5 - 4.5

Earnings for the purposes of basic and 25.6 17.3 43.9

dilutive earnings per share adjusted for

amortisation expense

Unaudited Year ended

six months to 30

June

Number of shares 2008 2007 31 December 2007

No.* No. No. *000s

000s *000s

Weighted average number of ordinary 42,095 42,003 41,989

shares for the purposes of basic earnings

per share

Effect of dilutive potential ordinary

shares:

Share options 355 867 720

Conditional shares not vested 196 179 239

Weighted average number of ordinary 42,646 43,049 42,948

shares for the purposes of diluted

earnings per share

Unaudited Year ended

six months

to 30 June

2008 2007 31 December 2007

pence pence pence

Basic and diluted earnings per share

Basic earnings per share 50.1p 41.1p 93.8p

Diluted earnings per share 49.4p 40.1p 91.7p

Basic and diluted earnings per share adjusted

for amortisation

Basic earnings per share 60.9p 41.1p 104.5p

Diluted earnings per share 60.1p 40.1p 102.2p

8 Statement of changes in total equity

Unaudited Year ended

six months to

30 June

2008 2007 31 December 2007

�m �m �m

Balance at beginning of the period 165.7 141.9 141.9

Total recognised income and expense 23.8 20.7 37.4

Final dividend for 2007 (11.9) (8.4) (8.4)

Interim dividend - - (4.2)

Share-based payments 1.1 1.2 1.7

Issue of shares at a premium 0.3 - 0.1

Exercise of share options 0.4 - -

Deferred tax on share based payments 0.3 - (0.7)

Own shares acquired (1.7) (1.3) (2.1)

Share award under long term incentive plan (1.2) - -

Balance at end of the period 176.8 154.1 165.7

9 Reconciliation of profit from operations to net cash from operating activities

Unaudited Year ended

six months to

30 June

2008 2007 31 December 2007

�m �m �m

Cash flows from operating activities

Profit from operations for the period 26.3 23.7 53.5

Adjusted for:

Amortisation of intangible assets 4.5 - 4.5

Share of results of joint ventures (3.5) 0.4 (4.7)

Depreciation of property, plant and 3.5 2.8 6.3

equipment

Expense in respect of share options 0.3 1.2 1.7

Defined benefit pension payment (0.3) (0.1) (0.2)

Defined benefit pension charge 0.1 0.1 0.1

(Gain)/loss on disposal of property, plant (0.1) 0.4 1.2

and equipment

Operating cash flows before movements in 30.8 28.5 62.4

working capital

Increase in inventories (47.6) (5.7) (10.4)

Increase in receivables (97.2) (79.8) (33.3)

Increase in payables 23.7 46.8 159.2

Cash (absorbed by)/generated by operations (90.3) (10.2) 177.9

Income taxes paid (11.0) (7.6) (15.8)

Interest paid (2.0) (1.4) (4.0)

Net cash (outflow)/inflow from operating (103.3) (19.2) 158.1

activities

During the period, the Group acquired property, plant and equipment with an aggregate cost of �5.3m of which �1.2m was acquired by means of

finance leases. Cash payments of �4.1m were made to purchase property, plant and equipment.

Cash and cash equivalents (which are presented as a single class of assets on the face of the balance sheet) comprise cash at bank and other

short-term highly liquid investments with a maturity of three months or less.

10 Final acquisition balance sheet

On 27 July 2007 the Group acquired Amec Developments Limited and certain assets and business carried on by Amec Investments Limited and the

assets, liabilities and contracts relating to the Design and Project Services (*DPS*) division of Amec plc, save for certain excluded assets

and liabilities.

On page 76 of the 2007 annual report and accounts, the provisional fair values of the net assets and goodwill acquired were reported. The

Group has since completed the fair value exercise as announced on 1 July 2008. This has lead to further adjustments of �60.5m. The final

fair values are as follows:

�m

Purchase consideration:

Cash paid 23.7

Costs directly attributable to the acquisition 1.8

Total purchase consideration 25.5

Net liabilities acquired (85.1)

Goodwill 110.6

Acquiree's carrying Provisional fair Final fair value Fair value

amount value adjustments adjustments made 30 30 June

�m made 31 December June 2008 2008

2007�m �m �m

Cash and cash equivalents 14.2 - - 14.2

Intangible fixed assets:

Secured customer contracts - 3.1 1.1 4.2

Other contracts and related - 30.7 (3.8) 26.9

relationships

Software - 0.9 - 0.9

Non-compete agreement - 5.0 - 5.0

Tangible fixed assets 2.0 0.2 (0.2) 2.0

Investments in joint ventures 28.7 (4.2) - 24.5

and associates

Working capital (68.2) (37.0) (57.6) (162.8)

Net liabilities acquired (23.3) (1.3) (60.5) (85.1)

Purchase consideration settled 23.7

in cash

Directly attributable 1.8

acquisition costs

Cash and cash equivalents (14.2)

acquired

Cash outflow on acquisition 11.3

11 Related party transactions

Transactions between the Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between the Group and its joint ventures are disclosed below and are unsecured and will be paid in

cash. Other than construction related performance guarantees given in the ordinary course of business, no guarantees have been given or

received and there is no provision for impairment in respect of the amounts owed by related parties.

Trading transactions

During the period, Group companies entered into the following significant transactions with related parties. Transactions and amounts owed

in the period are as follows:

Six months to 30 June 2008 Provision of goods Amounts owed by/(owing to) related

and services parties

�m �m

Community Solutions for 26.3 5.4

Primary Care (Holdings)

Limited

Lingley Mere Business Park 13.6 (4.5)

Development Company Limited

Ician Developments Limited 13.2 -

PFF Dorset Limited 12.3 1.4

Six months to 30 June 2007 Provision of goods Amounts owed by/(owing to) related

and services parties

�m �m

Community Solutions for 5.0 0.5

Primary Care (Holdings)

Limited

Morgan Sindall Investments 1.7 0.1

(3PD) Limited

Year ended 31 December 2007 Provision of goods Amounts owed by/(owing to) related

and services parties

�m �m

Community Solutions for 7.7 0.8

Primary Care (Holdings)

Limited

The Compendium Group Limited 2.2 -

Eurocentral Partnership 11.3 -

Limited

Lingley Mere Business Park 2.6 (6.5)

Development Company Limited

Bromley Park Limited 8.2 (5.9)

PFF Dorset Limited 9.5 2.4

12 Contingent liabilities

Group banking facilities and surety bond facilities are supported by cross guarantees given by the Company and participating companies in

the Group. There are contingent liabilities in respect of bonds, guarantees and claims under contracting and other arrangements, including

joint arrangements and joint ventures entered into in the normal course of business.

On 17 April 2008 the Office of Fair Trading (OFT) issued a Statement of Objections to the Company together with a number of construction

companies in England in connection with its investigation into alleged infringements of UK Competition law in the sector. The Company has

co-operated with the OFT's investigation under the OFT's leniency policy and, as a result, has been provisionally granted a reduction in any

penalty which the OFT might ultimately impose, however, the directors remain unable to estimate the size of any potential liability and as a

result no provision has been made in these interim financial statements.

Responsibility statement

The directors confirm that the interim report includes a fair review of the information required by FSA Disclosure and Transparency Rules

4.2.7 and 4.2.8.

The directors also confirm that the condensed set of financial statements for the six months to 30 June 2008 have been prepared in

accordance with IAS 34 *Interim Financial Reporting* as adopted by the European Union.

By order of the Board

Paul Smith

David Mulligan

Chief Executive

Finance Director

4 August 2008

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZGGGRKMVGRZM

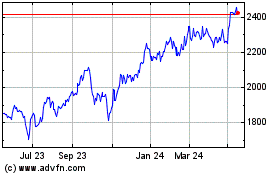

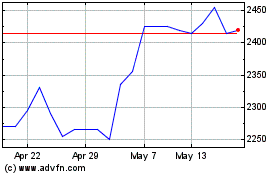

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024