Catena Group PLC Equity Subscription & Issue of Conv Loan Notes (9210E)

March 04 2020 - 2:00AM

UK Regulatory

TIDMCTNA

RNS Number : 9210E

Catena Group PLC

04 March 2020

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

4 March 2020

Catena Group PLC

("Catena" or the "Company")

Result of Equity Subscription and Issue of Convertible Loan

Notes

Further to the announcement made on 3 March 2020, Catena Group

plc is pleased to announce that it has raised gross proceeds of

GBP1.5 million before expenses by way of a subscription of

4,000,000 new Ordinary Shares (the "Subscription Shares") at a

price of 25 pence per share ("Issue Price") (the "Subscription")

and the issue of GBP0.5 million convertible loan notes ("Loan

Notes"). The net proceeds will be used to finance the proposed

investment in Insight Capital Partners Ltd.

The Issue Price represents a discount of 9.1 per cent. to the

closing price of 27.50 pence on 2 March 2020. The Subscription and

the issue of the Loan Notes are both conditional on admission of

the Subscription Shares to trading on AIM. The Subscription Shares

represent approximately 10.1 per cent. of the Company's issued

share capital as enlarged by the Subscription. If the Loan Notes

were to be converted in full, this would then result in the issue

and allotment of a further 2,000,000 new Ordinary Shares.

Related Party Transactions

Matthew Farnum-Schneider, Chief Executive of the Company, has

subscribed for Subscription Shares as outlined below:

Shareholder Number of Number of Shareholding % of Enlarged

Existing Ordinary Subscription following Issued Share

Shares Shares subscribed the Subscription Capital

for

Matthew Farnum-Schneider 0 100,000 100,000 0.25%

------------------- ------------------- ------------------ --------------

Matthew Farnum-Schneider is a director of the Company and

therefore classified as a related party under the AIM Rules.

Matthew has participated in the Subscription in respect of 100,000

Subscription Shares at the Issue Price and his participation is

considered a related party transaction for the purposes of the AIM

Rules. The Directors, excluding Matthew Farnum-Schneider, having

consulted with the Company's nominated advisor, Cantor Fitzgerald

Europe, consider the terms of Matthew's participation in the

Subscription to be fair and reasonable insofar as the Company's

shareholders are concerned.

Richard Bernstein, a significant shareholder, has subscribed for

Subscription Shares as outlined below:

Shareholder Number of Number of Shareholding % of Enlarged

Existing Ordinary Subscription following Issued Share

Shares Shares subscribed the Subscription Capital

for

Richard Bernstein 10,606,000 140,000 10,746,000 27.16%

------------------- ------------------- ------------------ --------------

Richard Bernstein is a significant shareholder in the Company

and therefore classified as a related party under the AIM Rules.

Richard has participated in the Subscription in respect of 140,000

Subscription Shares at the Issue Price and his participation is

considered a related party transaction for the purposes of the AIM

Rules. The Directors, having consulted with the Company's nominated

advisor, Cantor Fitzgerald Europe, consider the terms of Richard's

participation in the Subscription to be fair and reasonable insofar

as the Company's shareholders are concerned.

Admission

Application has been made to the London Stock Exchange for the

Subscription Shares to be admitted to trading on AIM ("Admission")

and it is expected that Admission will occur at 8.00 a.m. on 9

March 2020.

Total Voting Rights

Following Admission, the Company will have 39,561,638 Ordinary

Shares in issue, none of which will be held in treasury.

Accordingly, the total number of voting rights in the Company will

be 39,561,638 and shareholders may use this figure as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Definitions

Other than where defined, capitalised terms used in this

announcement shall have the same meaning as those set out in the

"Equity subscription and convertible loan note" announcement

released at 7:01 a.m. on 3 March 2020.

* ENDS *

This announcement has been released by Matthew Farnum-Schneider,

Chief Executive, on behalf of the Group.

For further information, please visit www.catenagroup.co.uk or

contact:

Catena Group PLC

Matthew Farnum-Schneider +44 (0)20 3743 2543

Cantor Fitzgerald Europe (Nomad and Broker)

David Foreman/Michael Boot/Adam Dawes +44 (0)20 7894 7000

St Brides (Financial PR)

Catherine Leftley/Beth Melluish +44 (0)20 7236 1177

Notification of Dealing Forms

1 Details of the person discharging managerial responsibilities/person closely associated

a) Name Matthew Farnum-Schneider

2 Reason for the notification

a) Position/status Chief Executive

b) Initial notification/ Amendment Initial

3 Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

a) Name Catena Group PLC

b) LEI 21380098CKBAG1NWCD98

4 Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

a) Description of the financial instrument, type of instrument Ordinary Shares of 1p each

Identification code GB00BYV31355

b) Nature of the transactions Subscription for Ordinary Shares

c) Price(s) and volume(s) Price(s) Volume(s)

25p 100,000

d) Aggregated information N/A

- Aggregated volume

- Price

e) Date of the transaction 3 March 2020

f) Place of the transaction London Stock Exchange

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKKNBNBBKBPNK

(END) Dow Jones Newswires

March 04, 2020 02:00 ET (07:00 GMT)

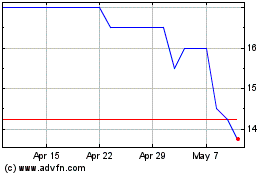

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jun 2024 to Jul 2024

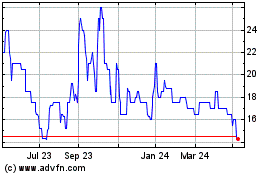

Insig Ai (LSE:INSG)

Historical Stock Chart

From Jul 2023 to Jul 2024