TIDMHOC

RNS Number : 2929U

Hochschild Mining PLC

22 November 2019

_____________________________________________________________________________________

22 November 2019

Hochschild announces 2020 guidance

Hochschild Mining PLC ("Hochschild" or "the Company") today

announces its 2020 guidance following completion of its mine

planning and budget process. The Company remains firmly on track to

meet its 2019 output guidance of 457,000 gold equivalent ounces or

37.0 million silver equivalent ounces.

Ignacio Bustamante, Chief Executive Officer said:

"Our ongoing strategy is expected to deliver consistent

production at competitive costs in 2020, with, once again, an

increase in output at Inmaculada. Following permitting delays at

Pallancata, we have decided to give our brownfield exploration team

more time to deliver additional resources and have therefore

reduced the operation's expected production to 7 million silver

equivalent ounces. However, we remain excited by the geological

potential surrounding all our operations. Finally, costs are

expected to rise moderately due to a one-off $22 million project to

increase tailings capacity at Inmaculada and the reduced production

at Pallancata."

2020 Production targets:

-- Overall attributable production target for 2020 of 432,000

gold equivalent ounces or 35.0 million silver equivalent

ounces.

-- Anticipated record output from Inmaculada of approximately

257,000 gold equivalent ounces;

-- Solid production of 14 million silver equivalent ounces

expected from the 51% owned San Jose mine in Argentina;

-- Pallancata expected to produce 7 million silver equivalent

ounces - output projections reduced to allow further time for

ongoing brownfield exploration owing to permitting delays

2020 Production split

Operation Gold production (oz approximate) Silver production (m oz

approximate)

Inmaculada 181,400 6.1

--------------------------------- ------------------------

Pallancata 19,300 5.5

--------------------------------- ------------------------

San Jose (100%) 93,300 6.5

--------------------------------- ------------------------

Total 294,000 18.1

--------------------------------- ------------------------

The all-in sustaining cost from operations in 2020 is expected

to be between $1,015 and $1,045 per gold equivalent ounce (or $12.5

and $12.9 per silver equivalent ounce) which includes a $22 million

project to expand the tailings storage facility at Inmaculada.

2020 AISC split

Operation AISC ($/oz) Au Eq AISC ($/oz) Ag Eq

------------------

Inmaculada 910-940 11.2-11.6

------------------

Pallancata 1,110-1,140 13.7-14.1

------------------

San Jose 1,130-1,160 13.9-14.3

------------------

Total from operations 1,015-1,045 12.5-12.9

------------------

The overall capital expenditure budget for 2020 is approximately

$115-130 million allocated to sustaining and development

expenditure. This includes a $22 million investment in the

above-mentioned tailings storage facility expansion at

Inmaculada.

2020 Capital expenditure split

Operation Sustaining & development capital expenditure

($m)

Inmaculada 80-85

---------------------------------------------

Pallancata 5-10

---------------------------------------------

San Jose 30-35

---------------------------------------------

Total 115-130

---------------------------------------------

The brownfield exploration budget for 2020 is approximately $36

million with the greenfield and advanced project budget set at

approximately $8 million and approximately $7 million for the

recently-acquired BioLantanidos deposit in Chile.

________________________________________________________________________________________

A conference call will be held at 12.00pm (London time) on

Friday 22 November 2019 for analysts and investors.

Dial in details as follows:

International Dial in: +44 333 300 0804

UK Toll-Free Number: 0800 358 9473

Pin: 30453450#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 333 300 0819

UK Toll Free: 0800 358 2049

Pin: 301305296#

________________________________________________________________________________________

Enquiries:

Hochschild Mining PLC

Charles Gordon

+44 (0)20 3709 3264

Head of Investor Relations

Hudson Sandler

Charlie Jack

+44 (0)20 7796 4133

Public Relations

________________________________________________________________________________________

About Hochschild Mining PLC

Hochschild Mining PLC is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates three underground epithermal vein mines, two located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

_____________________________________________________________________________________

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining PLC may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining PLC does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

This announcement contains information which prior to its

release could be considered inside information.

Note

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (Regulation (EU) No.596/2014). Upon the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

LEI: 549300JK10TVQ3CCJQ89

- ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCLFFLFLALLFIA

(END) Dow Jones Newswires

November 22, 2019 02:00 ET (07:00 GMT)

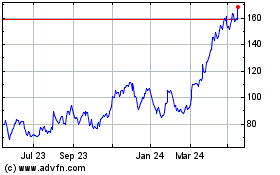

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Sep 2024 to Oct 2024

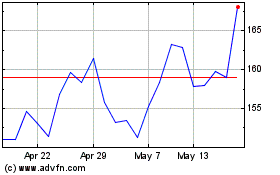

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Oct 2023 to Oct 2024